- Home

- »

- Advanced Interior Materials

- »

-

Non-ferrous Scrap Recycling Market Size, Share Report 2030GVR Report cover

![Non-ferrous Scrap Recycling Market Size, Share & Trends Report]()

Non-ferrous Scrap Recycling Market (2024 - 2030) Size, Share & Trends Analysis Report By Sector (Construction, Automotive), By Metal (Aluminum, Copper), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68038-828-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Non-ferrous Scrap Recycling Market Summary

The global non-ferrous scrap recycling market size was estimated at USD 623.1 billion in 2023 and is projected to reach USD 816.8 billion by 2030, growing at a CAGR of 3.9% from 2024 to 2030. Increasing demand for non-ferrous scrap in secondary production and end-use industries is anticipated to propel market growth over the forecast period.

Key Market Trends & Insights

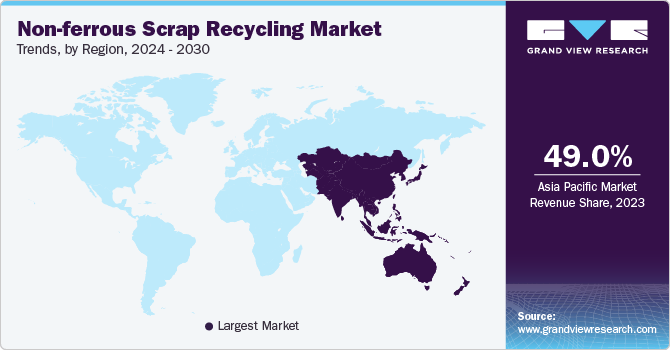

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, U.S. is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, lead accounted for a revenue of USD 476.2 billion in 2023.

- Lead is the most lucrative metal segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 623.1 Million

- 2030 Projected Market Size: USD 816.8 Million

- CAGR (2024-2030): 3.9%

- Asia Pacific: Largest market in 2023

Growing consumer demand has propelled manufacturers to increase their production of electronics, vehicles, and other products. In addition, rapid industrialization across the world has led to increasing demand for non-ferrous scrap. As a result, more emphasis is drawn on its collection and recycling. For example, European Aluminum released its “Circular Aluminum Action Plan”, which aims at achieving the full potential of aluminum for a circular economy by the year 2030.

Recycling of aluminum gives rise to various industrial and environmental opportunities in Europe. Circular Aluminum Action Plan forecasts that 50.0% of Europe’s aluminum demand can be supplied through post-consumer recycling if correct policy framework is put in place. High recycling rate of aluminum in Europe, which is over 90.0% in automotive and building sectors and over 75.0% in beverage cans, is a positive aspect of the plan to become successful.

Non-ferrous metals, including aluminum, copper, lead, nickel, and zinc, have the ability to be recycled over and over without losing their chemical or physical properties. This ability further augments the demand for non-ferrous scrap, which is collected from various end-use industries and processed at recycling centers for further use. Rising society awareness of environment, economy, and energy saving in terms of recycling these metals is a growth driver for the market.

Non-ferrous metals account for a small volume share compared to ferrous in the industry, however, in terms of value, they have a higher share. Large revenue share is due to a higher market price compared to ferrous, which is another reason to emphasize recycling in order to reduce manufacturing costs. High price of these metals is a motivator for consumers pushing them towards recycling, as they find a fair price from non-ferrous scrap dealers in exchange for their old products, which becomes a source for extracting metals like aluminum and copper.

Non-ferrous Scrap Price Trends

The non-ferrous scrap prices have been witnessing fluctuations for the past few years. After over a decade, the aluminum scrap prices peaked in 2021, matching 2011 levels. The surge is attributed to post-pandemic era, which propelled demand for home cooking, thus an increase in demand for packaging materials, which led to an increase in price for aluminum scrap. Further, the shifting inclination towards renewable energy has augmented the demand for copper and eventually its scrap. This has led to a surge in their prices.

Market Concentration & Characteristics

Non-ferrous scrap recycling market is at a moderate stage of growth, with an accelerated pace. The market is relatively consolidated, characterized by presence of major players who operate integrated recycling units across various regions. These entities cater to global demand, contributing to a high level of competition within the industry.

The market is characterized by a moderate level of innovation aimed at enhancing the manufacturing process to produce high-quality recycled non-ferrous metals. Companies have significantly increased their investment in research and development (R&D) to improve the efficiency of non-ferrous scrap recycling through adoption of advanced technologies.

The market observed moderately high levels of merger and acquisition (M&A) activity owing to heavy competition. Major players in this industry are investing in small companies that have adopted advanced technologies and have efficient processes in place, along with a strong presence in regional markets.

The market is also subject to high levels of regulatory scrutiny. Non-ferrous scrap recycling consists of a few regulatory norms and standards that are accepted by metal and scrap recycling industry. The regulatory norm provides benefits and safety to the production and workers’ safety in facility.

Sector Insights

Construction segment dominated the market and accounted for the largest share of 39.0% in 2023, in terms of revenue. A huge amount of non-ferrous scrap is collected from construction industry, for example, copper from pipes and tubing, aluminum from window frames, shop fronts, curtain walling, door handles, and other structures, and zinc from roofing and galvanized steel products.

Despite the largest share, construction is anticipated to witness a low growth rate compared to other sectors owing to durability of non-ferrous materials and long-life span of structures before they can be used for scrap. However, construction segment is anticipated to dominate the market on account of rapid industrialization and infrastructural developments with more use of non-ferrous metals across the forecast period.

Automotive held second-largest revenue share in 2023 and is anticipated to witness the fastest growth rate over the forecast period. After the decline in automotive production in 2020 and 2021, production has been moving in an upward trajectory. Millions of vehicles are discarded annually across the globe. Automotive is a reliable source for recycling as over 25 million tons of materials are recycled from automobiles every year. Cars are the most recycled item in the U.S. The country recycles over 12 million cars annually and the figure is around 8 million for Europe.

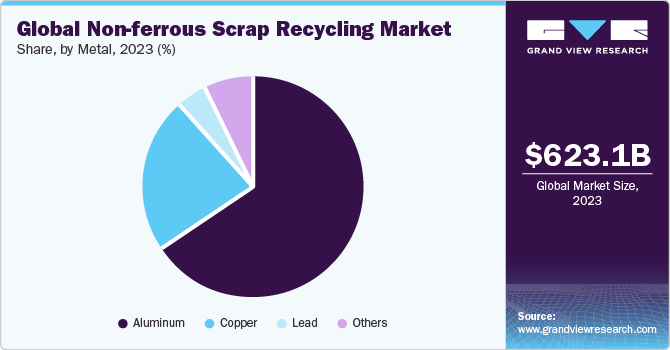

Metal Insights

Aluminum dominated the market and held the largest revenue share of 76.0% in 2023. Increasing demand for recycled aluminum from construction, automotive, and packaging industries has augmented demand for its scrap. According to International Aluminium Institute, industry leaders at COP 28 announced that they aim to achieve a target of nearly 100% recycling for the world's aluminum beverage cans by 2050. The industry is also working towards a target of 80% recycling rates by 2030. This initiative by aluminum beverage can value chain industry players will help to accelerate recycling of aluminum cans and boost growth of the market.

Copper is one of the most expensive non-ferrous metals. It is extensively used in construction and consumer goods industry owing to its property of conducting electricity. It is used in pipes, electric cables, and electrical components. Copper can be found in most electronic and household appliances. For instance, a computer contains about 1.5 kilograms of copper. Around 90% of copper used in civil infrastructure is recycled.

Lead is among the most recycled non-ferrous metals. Recycled lead is a major raw material in production of new lead products. Batteries are major application of lead, and their recovery rate is 100.0%. According to Battery Council International and EUROBAT, lead-acid battery is known to be most recycled consumer product across the globe. Lead scrap is mostly obtained from automotive batteries, but it is also obtained from construction industry owing to its application as lead sheets.

Regional Insights

North America held a significant revenue share in the global market, owing to presence of the U.S., a major non-ferrous scrap recycler in the region. According to Copper Development Association Inc., approximately 830 kilotons of copper scrap was recycled in the U.S. in 2022, which accounted for around 32% of total copper supply in the country.

U.S. Non-ferrous Scrap Recycling Market Trends

U.S. is one of the largest consumers of non-ferrous scrap recycling metals in North America. It is in line with consumption of aluminum and copper from various end-use industries, as they majorly contribute to generation of non-ferrous scrap.

Europe Non-ferrous Scrap Recycling Market Trends

Europe accounted for the second-largest share of global revenue in 2023 and is projected to witness steady growth from 2024 to 2030. The market's growth in Europe can be attributed to the region's increasing focus on energy efficiency and reduction of carbon emissions.

Germany non-ferrous scrap recycling market heldover 32.0% revenue share in Europe in 2023.Its commitment to circular economy principles incentivizes businesses to recycle non-ferrous metals, such as aluminum, copper, and zinc, which are significant contributors to the market.

Asia Pacific Non-ferrous Scrap Recycling Market Trends

Asia Pacific dominated the market and accounted for the largest revenue share of 49.0% in 2023. Governments across the region are implementing regulations and policies to promote recycling and sustainable practices. Increasing awareness among industries and consumers about environmental impact of waste disposal is further encouraging adoption of recycling practices.

China non-ferrous scrap recycling market held a revenue share of 47.0% in 2023. High demand for aluminum and copper in the country, along with a rising emphasis on decarbonization of the economy and promoting a circular economy, has propelled the growth of recycling industry.

Central & South America Non-ferrous Scrap Recycling Market Trends

Countries across the region are trying to propel their recycling rate of aluminum and reduce carbon footprints, which is expected to positively affect demand for non-ferrous metals. For instance, in May 2023, Brazil achieved a remarkable feat by recycling 100% of 390.2 kilotons of aluminum cans sold in 2022.

Key Non-ferrous Scrap Recycling Company Insights

Some of the key players operating in the market include Hindalco Industries Ltd., Aurubis, and TSR Recycling GmbH & Co. KG among others.

-

Hindalco Industries Ltd. recycles processed scrap from customers and the market, along with their own processed scrap. Furthermore, it is involved in recycling copper scrap and recovering copper from discarded slag. It is engaged in it as a part of its approach to sustainability. It covers areas such as sustainable mining, energy conservation, recycling, eco-friendly disposal of industrial waste, safety, socio-economic development of communities surrounding the plant, and employee empowerment.

-

Aurubis is a global non-ferrous metal company that is significantly engaged in recycling and processing organic and inorganic metal-bearing recycling raw materials, scrap metals, complex metal concentrates, and industrial residue into metals with high purity. Its business is divided into two segments, namely multi-metal recycling (MMR) and custom smelting & products (CSP).

-

TSR Recycling GmbH & Co. KG handles all jobs requiring scrap metal and recycled raw materials. Along with buying, recycling, and selling materials, it also offers a comprehensive array of services for both ferrous and non-ferrous metals. It can recycle 500 kilotons of non-ferrous metal and 7,900 kilotons of ferrous metal each year.

Key Non-ferrous Scrap Recycling Companies:

The following are the leading companies in the non-ferrous scrap recycling market. These companies collectively hold the largest market share and dictate industry trends.

- Aurubis

- Chiho Environmental Group Limited.

- Hindalco Industries Ltd.

- Kuusakoski

- Matalco Inc.

- OmniSource Corp.

- Recyclex

- SA Recycling LLC

- Sims Metal Management Inc.

- TSR Recycling GmbH & Co. KG

Recent Developments

-

In November 2023, Norsk Hydro ASA initiated operations at its latest Cassopolis facility situated in Michigan, U.S. The facility has been established with an investment of USD 150 million and is expected to have an annual output of 120 kilotons of recycled aluminum. The plant was planned to leverage post-consumer aluminum scrap generated from transport, automotive, and building & construction sectors. The primary aim of this aluminum recycling plant is to revitalize metal scrap and curtail waste.

-

In August 2023, Hindalco Industries, an Indian aluminum and copper manufacturer, announced an investment of INR 2,000 crore (~USD 240.2 million) to set up a copper and e-waste recycling unit in India. This initiative was planned to give Hindalco Industries access to secure feedstock for its copper cathode plant. The plan is also in alignment with government’s Waste to Wealth Initiative to help in value-adding to the economy by helping retain and process its e-waste, which is currently exported.

-

In June 2022, Aurubis, the largest copper producer and recycler in Europe announced an investment of USD 320 million for construction of a multimetal recycling plant in Georgia. The plant was aimed at reducing waste while supplying essential metals to businesses that design batteries for electric cars, other products, and alternative energy sources like solar and wind.

-

In May 2022, Sims Metal Management Inc., a global recycling giant, invested USD 88 million for a plot of property in Brisbane's portside suburb of Pinkenba to secure one of the few remaining locations with deep water access. It planned to create a metals processing and resource renewal facility for non-ferrous and ferrous metals.

Non-ferrous Scrap Recycling Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 663.84 billion

Revenue forecast in 2030

USD 816.78 billion

Growth Rate

CAGR of 3.5% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, Volume in million tons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Metal, sector, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Russia; Turkey; China; India; Japan; Brazil

Key companies profiled

Sims Metal Management Inc.; OmniSource Corp.; TSR Recycling GmbH & Co. KG; Aurubis; Kuusakoski; Hindalco Industries Ltd.; Matalco Inc.; SA Recycling LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

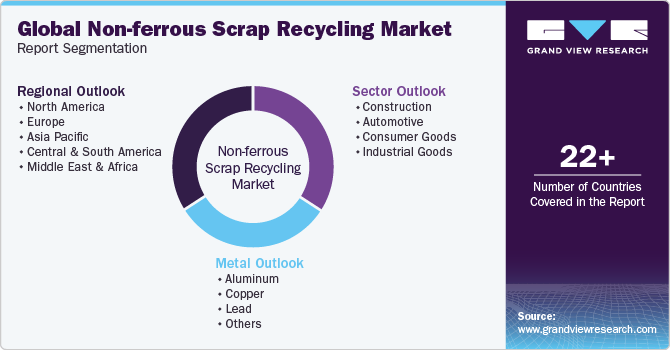

Global Non-ferrous Scrap Recycling Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global non-ferrous scrap recycling market report based on sector, metal, and region:

-

Sector Outlook (Volume, Million Tons; Revenue, USD Billion, 2018 - 2030)

-

Construction

-

Automotive

-

Consumer Goods

-

Industrial Goods

-

-

Metal Outlook (Volume, Million Tons; Revenue, USD Billion, 2018 - 2030)

-

Aluminum

-

Copper

-

Lead

-

Others

-

-

Regional Outlook (Volume, Million Tons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global non-ferrous scrap recycling market size was estimated at USD 623.15 million in 2023 and is expected to increase to USD 663.84 million in 2024.

b. The non-ferrous scrap recycling market is expected to grow at a compound annual growth rate of 3.5% from 2024 to 2030 to reach USD 816.78 million by 2030.

b. Construction dominated the non-ferrous scrap recycling market with a share of over 38.0% in 2023, owing to extensive use of materials like aluminum and copper in the industry, which leads to a huge amount of scrap generation.

b. Some of the key players operating in the non-ferrous scrap recycling market include Sims Metal Management Inc., OmniSource, SA Recycling, Hindalco Industries Inc., Kuusakoski, and Chiho Environmental Group.

b. The high cost of producing primary metals coupled with increasing consumer awareness pertaining to recycling is anticipated to drive the non-ferrous scrap recycling market over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.