- Home

- »

- Advanced Interior Materials

- »

-

Copper Scrap Market Size, Share & Trends Report, 2030GVR Report cover

![Copper Scrap Market Size, Share & Trends Report]()

Copper Scrap Market (2024 - 2030) Size, Share & Trends Analysis Report By Feed Material (Old Scrap, New Scrap), By Grade (Bare Bright, #1 Copper, #2 Copper Scrap), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-233-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Copper Scrap Market Summary

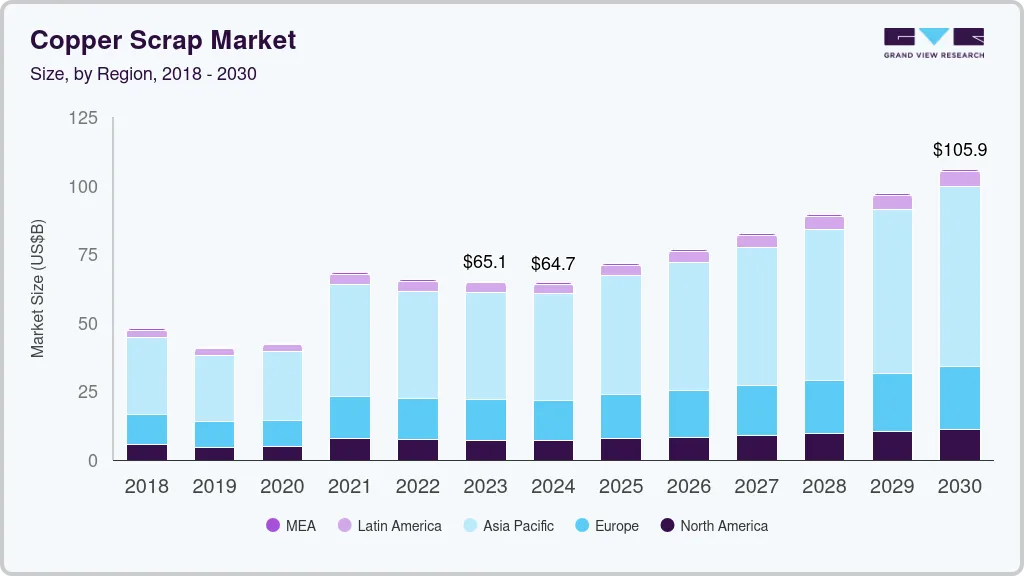

The global copper scrap market size was estimated at USD 65.09 billion in 2023 and is projected to reach USD 105.90 billion by 2030, growing at a CAGR of 8.6% from 2024 to 2030. The market is expected to be driven by increasing emphasis on sustainability and clean energy, leading to rising electrification of vehicles and power generation through renewable sources.

Key Market Trends & Insights

- Asia Pacific dominated the market with the revenue share of 59.9% in 2023.

- The copper scrap industry in India is anticipated to grow at the significant CAGR during the forecast period.

- Based on feed material, the old scrap segment led the market with the largest revenue share of 51.6% in 2023.

- Based on grade, the copper scrap segment led the market with the largest revenue share of 31.6% in 2023.

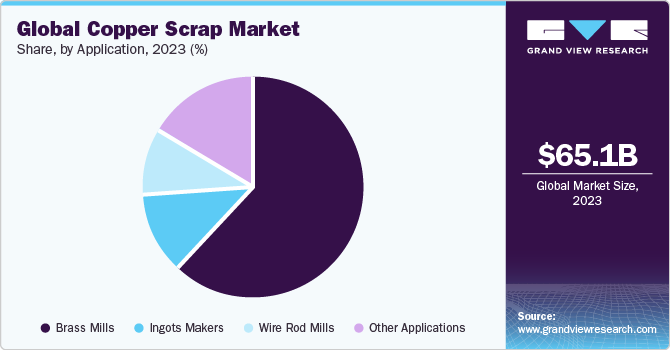

- Based on application, the brass mills segment led the market with the largest revenue share of 62.4% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 65.09 Billion

- 2030 Projected Market Size: USD 105.90 Billion

- CAGR (2024-2030): 8.6%

- Asia Pacific: Largest market in 2023

- Middle East & Africa: Fastest growing market

According to the International Copper Study Group, copper scrap accounted for a share of 25%-30% of global refined copper production over the past two years. Slow mining of copper due to political and operational hurdles in key producing nations in South America has also impacted global supply during 2022.The U.S. is one of the largest copper scrap suppliers worldwide, and the country exported nearly USD 4.59 billion of copper scrap in 2023. Key export destinations were China, Germany, South Korea, Belgium, and Japan. The buyers in China prefer overseas scrap on account of its consistent quality and benefit of tax rebates.

In 2022, 891.8 kilotons of copper were consumed in the U.S., in the form of refined metal and its alloys produced. Despite the rise in product prices since 2020 and prices peaking in 2022, demand for copper scrap has been rising due to clean energy, electrification, and gradual regularization of recycling value chain. As a result of the rising demand for copper scrap and usage of copper products in various applications, many market players are adopting strategic initiatives to stay ahead in a competitive market.

For instance, in March 2023, Sims Metal, an Australian-origin metal recycling company, acquired Northeast Metal Traders (NEMT) in Pennsylvania to expand its regional operating and commercial assets. NEMT is among the largest copper recyclers in the country, with extensive supply connections across the eastern states.

Market Concentration & Characteristics

Market growth stage is moderate, and pace of market growth is accelerating. The market is characterized by rising demand for clean renewable energy through power generation, electrification and their growing adoption of copper scrap in diverse applications. The experiences a high level of merger and acquisition activities by copper scrap recycling companies owing to fragmented nature of market.

Emerging players are entering into partnerships and collaborations with a shared commitment to work together toward common objectives, often leveraging each other's strengths, resources, and expertise for mutually beneficial goals. This is due to several factors, including desire to maintain market share and need in a fragmented, competitive, and growing market.

The market is impacted by government regulations about copper scrap collection and recycling. For instance, the Occupational Safety and Health Administration (OSHA) provides standards for metal recycling and scrap processing of various materials, including copper, zinc, aluminum, and others.

Scrap constitutes an important component of charge mix in copper smelters and there are no substitutes for use of scrap in copper production. The end-user concentration is low in industry owing to its wide applications in end-use industries such as automotive & transportation, construction & building, electrical & electronics, machinery & equipment, and consumer appliances.

Feed Material Insights

Based on feed material, the old scrap segment led the market with the largest revenue share of 51.6% in 2023. When a product reaches end of its life and is disposed of, it creates what is known as end-of-life scrap. This scrap is also referred to as consumer scrap or old scrap. Since metal is a valuable resource, it is often reclaimed or recovered to be recycled into new products. Therefore, old scrap is also anticipated to grow at the fastest CAGR over the forecast period.

Although, this scrap is typically referred to as dirty scrap because it has a significant amount of insulation, sheathing, and covering that must be shredded out. This dirty scrap must be further cleaned before it is considered clean scrap. It is sorted, baled, and stored at this stage for further processing or sales. The most common sources of old scrap are C&D, ELVs, WEE, IEW, and INEW.

On the other hand, new scrap is generated in smaller quantities compared to old scrap, but it is still a valuable source of copper. Direct scrap is purest form of copper scrap that is generated during manufacturing processes and has a high intrinsic value owing to its purity content and price. It is always reused in refining process.

Grade Insights

Based on grade, the #2 copper scrap segment led the market with the largest revenue share of 31.6% in 2023. It comprises unalloyed wire, pipe or solid metal that contains paint and coating, or solder on it. It has a minimum copper content of 94-96% and is used in manufacturing wire, fittings, pipes, and tubes. To be classified as this scrap type, wires should be bare (free of insulation), and may be <1/16th inch in diameter. However, very low-diameter wires can reduce the scrap value.

It further requires cleaning, grading, and sorting before being used in secondary smelting furnace. It is most commonly traded scrap type in the global market. As it is more commonly available as compared to #1. However, many countries such as China and Malaysia have placed restrictions on import from the global market, by classifying many shipments as waste. Hence, for trade, this grade needs to be clearly sorted, graded, and labelled.

Bare bright is most valuable and expensive grade available in the market. It is also referred to as “bright and shiny copper” or millberry scrap and is most sought-after type. Bare bright copper scrap refers solely to copper wire, and can also include cable, but excludes copper piping. As it has a minimum copper content of 99% (typically 99.9% purity). This type of scrap is generally found in electrical wires and is accepted as imports by many countries.

Application Insights

Based on application, the brass mills segment led the market with the largest revenue share of 62.4% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. Brass is commonly produced in secondary smelters, where scrap is a predominant material in charge mix.

Brass is an alloy of copper and zinc. Brass mills melt and use copper & alloy scrap materials to produce tubes, sheets, strips, bars, rods, extrusions, forgings, and mechanical wires. Nearly half of the copper input in these mills is obtained from copper scrap. Fabrication processes including hot rolling, cold rolling, drawing, and extrusion are used to convert melted & cast feedstock into final products.

Wire rod mills primarily manufacture wires that are used in electrical applications. Copper wire rods produced at these mills are used in diverse applications, such as connectors & gaskets, bus bars, electrical connectors, general household usage, and industrial applications. Investments in new mills are projected to benefit the market. For instance, in December 2022, Southwire Company, LLC and Primetals Technologies announced a partnership to expand existing Southwire Continuous Rod (SCR) in order to produce cables, wires, and related products. Installed a copper wire rod mill at its Carrollton plant in U.S.

End-use Insights

Based on end-use, the electrical & electronics segment dominated the market with the revenue share in 2023 and is anticipated to grow at the fastest CAGR over the forecast period.Copper primarily finds use in electrical wiring, transformers, cables, electrical components, and motors owing to its unique conductive properties. Rising demand for electronic devices across the globe and increasing awareness regarding energy efficiency are growing consumption of copper scrap in various end-use industries, especially electrical & electronics sectors.

Various industries such as aerospace, automotive, consumer goods, and electronics are investing billions into existing and new production capacities. Rising investments in electric vehicle production are expected to increase the demand for copper scrap from automotive & transportation sector.

For instance, Mexican government aims to increase production of clean energy from 25% to 35% by 2024. Hence, rising automotive production in the country is aligned in this direction. In September 2023, Tesla along with its supplier partners announced that it plans to invest about USD 15.00 billion in a new factory over next two years. The facility is currently under construction in Neuvo Leon.

Regional Insights

The copper scrap market in North America held a significant revenue share in 2023. Copper scrap recycling in North America is vital for addressing high copper demand for the redevelopment of aging infrastructure. Recycled copper scrapes are widely used in electric vehicles and constructions. The demand for copper scrap in the region is further driven by the inclination to develop a green economy. The sustainable nature of copper scraps is crucial for minimizing the carbon footprint, making it a substitute for primary metal production.

U.S. Copper Scrap Market Trends

The copper scrap market in U.S. is expected to be driven by the rising clean energy, electrification, and gradual regularization of recycling value chain. As a result of growing demand for copper scrap and usage of their products in various applications, many market players are adopting strategic initiatives to stay ahead in a competitive market. Amongst them are Ames Copper Group, Aurubis, Igneo, and Wieland.

The Canada copper scrap market is expected to grow at the fastest CAGR during the forecast period, as copper manufacturing and recycling metal forms a key contributor to the country’s economy. According to the government of Canada, in 2022 over 510,782 tonnes of copper was produced from the Canadian mines, more than half of it originated from British Columbia. In 2022, Canada’s exports of copper and copper-based products were estimated at USD 9.4 billion. Canada has a robust copper recycling industry, with significant amounts recovered in the Quebec-based (Rouyn-Noranda and Montréal) smelter and refineries. High exports and domestic recycling refineries are paving landscape for the market expansion.

Asia Pacific Copper Scrap Market Trends

Asia Pacific dominated the market with the revenue share of 59.9% in 2023. According to UNCTAD’s World Investment Report 2023, FDI inflow in Asia remained at USD 662 billion in 2022, which accounted for almost 50% of global inflows. Several countries in the region are focusing on reducing their carbon emissions by shifting their attention toward renewable energy.

For instance, Taiwan plans to generate 20% of its energy requirement from renewables by 2025. The country is expected to add 5.7 GW of offshore wind energy between 2021 and 2025. These investments are resulting in a rise in demand for copper scrap. Hence, such policy decisions and investments across Asia Pacific region are expected to positively increase copper scrap demand during the forecast period.

The China copper scrap market is largest owing to country being world's largest copper producer and consumer, accounting for over one-third of world's consumption. China's copper consumption is primarily dependent on domestic production, imports, and scrap reuse. To meet the demand-supply gap, it relies on secondary copper industry. Therefore, China has introduced a scrap import inspection procedure, which has resulted in lower scrap exports from other regions, and increased imports from within the region.

The copper scrap industry in India is anticipated to grow at the significant CAGR during the forecast period, owing to growth potential in automotive industry, leading to long-term expansion strategies by leading manufacturers in the country. According to Invest India, automotive industry is projected to reach USD 300.2 billion by 2026. This industry accounted for a share of 7.1% of the GDP of India in 2022 and contributed a share of 4.7% to total exports from the country in same year.

Europe Copper Scrap Market Trends

The copper scrap market in Europe directly contributes to the EU economic growth as the metal supply in the region primarily depends on the recycling of copper scrap. According to the European Recycling Industries' Confederation (EuRIC), 44% of EU copper demand is met by recycling scrap copper. Furthermore, since recycling metals is highly labor intensive, it has created a wide variety of job opportunities in Europe, which includes the collection and sorting of end-of-life products that contain metals.

The Spain copper scrap market is anticipated to witness the fastest CAGR during the forecast period, owing to more inclination towards recyclability, EVs, and renewable energy. Recovery resilience program (RRP) is anticipated to be implemented as a priority, and the scrap sector is hoping to address its challenges of increasing prices and availability, which is currently met primarily through imports. It is a significant importer of copper scrap, primarily from France, Portugal, UK, Italy, and Germany.

The copper scrap market in UK exports increased by 1.62% between November 2022 and November 2023, which is a key contributor to the country’s economy, according to Other Eligible Communities (OEC). Despite the moderate fragmentation of the UK market, EMR and Sims Group UK account for a major revenue share. Furthermore, the strong manufacturing presence, particularly in the West Midlands is driving the profitability of the marketgrowth.

Central & South America Copper Scrap Market Trends

The copper scrap market in Central & South America is anticipated to witness the significant CAGR from 2024 to 2030. The growth can be attributed to the efforts undertaken by the International Copper Association (ICA) to copper mining, smelting, refining, and recycling in this region by 2050.

The Brazil copper scrap market growth can be attributed to the flourishing energy generation industry and surging investments by automobile manufacturers in Brazil. It is a predominant producer of copper ore and is home to many important mines. In terms of the closed-loop model for metal, Brazil is a front-runner in terms of recycling policy and initiatives. Implementation of government initiatives and policies will fuel the adoption of a circular economy for waste management in the country. This has encouraged key end-use industries of copper, primarily automotive companies, to set up a base in the country.

Middle East & Africa Copper Scrap Market Trends

The copper scrap market in Middle East & Africa is projected to grow at the fastest CAGR of 5.9% during the forecast period, owing to the growing investments of the Gulf countries in setting up smelting refineries. The four major copper scrap markets in the region include the UAE, Saudi Arabia, Iran, and Turkey. Recycled copper is used in solar panels, electric vehicles, wind turbines, and other electronic appliances, which will aid in the transition toward a green economy.

The Saudi Arabia copper scrap market is expected to grow at a lucrative CAGR during the forecast period, due to the increasing use of recycled copper in various industrial applications. The country's contribution to the Middle East & Africa market highlights its influence on the regional market dynamics.

Key Copper Scrap Company Insights

Some of the key players operating in the market include Glencore, Aurubis, CMC and OmniSource LLC.

-

Glencore plc is a global producer of primary metals, copper, energy products, and recycling. Copper ore is extracted and processed in South Africa, the Democratic Republic of Congo, and Australia. It has copper scrap facilities in North America. Its business is divided into two segments, namely metals & minerals and energy products. It has a global presence, buying and selling scrap on a large scale across geographies

-

Aurubis is amongst the leading market players and is a global supplier of non-ferrous metals, with copper being its predominant product. It is also an established recycler. Its business is divided into two segments: multimetal recycling (MMR) and custom smelting & products (CSP). The company has a strong presence across Europe and a plant in the U.S. It caters to diverse industries such as construction, electrical, machinery production and plant engineering, transport, chemical and others

Global Metals & Iron Inc., Pascha GmbH., and Perniagaan Logam Panchavarnam Sdn Bhd are some of the emerging market participants.

-

Global Metals & Iron Inc. is a privately owned family business and a provider of metal scrap. It has recycling facilities for ferrous and non-ferrous metals across the country. It mainly caters to the Canadian market, with exports to Canada and other regions when business conditions such as currency valuation is attractive. It also processes all grades of copper, bronze/ brass alloys to foundries, smelters, mills, and refiners

-

Pascha GmbH is a non-ferrous scrap dealer that aims at providing high-quality processed scrap at cost-effective prices. It mainly provides services in Germany, and to other European markets and is a supplier of aluminum scrap, iron scrap, and copper scrap

Key Copper Scrap Companies:

The following are the leading companies in the copper scrap market. These companies collectively hold the largest market share and dictate industry trends.

- Ames Copper Group

- Aurubis AG

- CMC

- Glencore

- Global Metals & Iron Inc.

- JAIN RESOURCE RECYCLING PVT LTD.

- KGHM METRACO S.A.

- OmniSource, LLC.

- Pascha GmbH.

- Perniagaan Logam Panchavarnam Sdn Bhd

- S.I.C. Recycling, Inc.

Recent Developments

-

In August 2023, Hindalco Industries, an Indian aluminum and copper manufacturer, announced an investment of INR 2,000 crore (~USD 240.2 million) to set up a copper and e-waste recycling unit in India. This will give Hindalco Industries access to secure feedstock for its copper cathode plant. The plan will also be in alignment with government’s Waste to Wealth Initiative - i.e., it would help in value-adding to the economy by helping retain and process its e-waste, which is currently exported

-

In July 2023, Marex, a UK-based financial services company, acquired Global Metals Network (GMN), a recycled metals producer based in Hong Kong, for an undisclosed amount. This transaction is expected to benefit Marex by increasing customer reach, expanding its supplier network, and increasing revenue

-

In June 2023, Elemental Holding Group, a Luxembourg-based mining company and e-waste recycler, acquired Colt Recycling LLC, a UK-based e-waste recycler having facilities in New Hampshire, UK, and North Carolina, U.S. for an undisclosed amount. This will help the former in expanding its geographical footprint

Copper Scrap Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 64.67 billion

Revenue forecast in 2030

USD 105.90 billion

Growth rate

CAGR of 8.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Feed material, grade, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Belgium; UK; Italy; Spain; China; Japan; India; Brazil; South Africa

Key companies profiled

Ames Copper Group; Aurubis AG; CMC; Glencore; Global Metals & Iron Inc.; JAIN RESOURCE RECYCLING PVT LTD.; KGHM METRACO S.A.; OmniSource; LLC.; Pascha GmbH.; Perniagaan Logam Panchavarnam Sdn Bhd; S.I.C. Recycling, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Copper Scrap Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the copper scrap market report based on feed material, grade, application, end-use, and region:

-

Feed Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Old Scrap

-

New Scrap

-

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Bare Bright

-

#1 Copper Scrap

-

#2 Copper Scrap

-

Other Grades

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Wire Rod Mills

-

Brass Mills

-

Ingots Makers

-

Other Applications

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Electrical & Electronics

-

Industrial Machinery & Equipment

-

Transportation Equipment

-

Consumer and General Products

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Belgium

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global copper scrap market size was estimated at USD 65.09 billion in 2023 and is expected to drop to USD 64.67 billion in 2024.

b. The global copper scrap market is expected to grow at a compound annual growth rate of 8.6% from 2024 to 2030 to reach USD 105.90 billion by 2030.

b. Based on application, the brass mills segment accounted for a revenue share of over 62.0% of the overall market in 2023, owing to high demand from applications such as hardware & plumbing, valves, casings, and decorative items.

b. Some of the key vendors of the global copper scrap market include Glencore, Aurubis, Omnisource LLC, and CMC among others.

b. Shifting inclination toward cleaner energy and electric vehicles, along with rising demand for greener buildings are the major driving factors behind the growth of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.