- Home

- »

- Advanced Interior Materials

- »

-

Recycled Lead Market Size & Share, Industry Report, 2027GVR Report cover

![Recycled Lead Market Size, Share & Trends Report]()

Recycled Lead Market (2020 - 2027) Size, Share & Trends Analysis Report By Application (Battery, Rolls & Extruded Products, Pigments), By Region (NA, Europe, APAC, CSA, MEA), And Segment Forecasts

- Report ID: GVR-4-68038-687-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global recycled lead market size was valued at USD 15.61 billion in 2019 and is expected to register a compound annual growth rate (CAGR) of 2.4% from 2020 to 2027. The increasing demand for batteries from electric vehicles and energy storage systems is anticipated to augment market growth. Lead is the only metal that can be recycled several times without having any diminishing impact on its quality. As a result, the production of secondary (recycled) lead is increasing over primary, which is anticipated to have a positive impact on market growth. Several products including battery, sheets, pipe, cable sheathing, electrical and electronic products, and cathode-ray tubes are used for recycling.

The growth of the electric vehicles industry is the major driver for the market. By the end of 2018, the U.S. had touched the milestone of 1 million electric vehicles on the roads and this figure is expected to reach 18.7 million by 2030. The rising number of electric vehicles will require more batteries, which is anticipated to augment the demand for recycled lead. According to the United States Geological Survey, as of 2019, the lead-acid battery industry held a share of 93% of the U.S. lead consumption and secondary accounted for a share of over 80% of the total lead production in the country.

The major restraint for the market growth is the increasing demand for lithium-ion batteries. Factors like efficiency and environment-friendliness are compelling lead-acid batteries to lose the market share to lithium-ion batteries. Lithium-ion batteries are inviting more funds and investments for their development. For instance, in December 2017, funds from a USD 108 million government-funded battery research facility in the U.K. were directed toward the development of lithium batteries.

The demand for lead-acid batteries is likely to prevail on account of their ability to be recycled. The recycling technology and supply chain for lithium-ion batteries is not fully in place when compared to lead-acid. In addition, the amount of energy required for producing the latter is three times less than lithium-ion. Hence, with these merits and further research and development, the demand for lead-acid batteries is expected to sustain, thus, a positive sign for the recycled lead market growth over the forecast period.

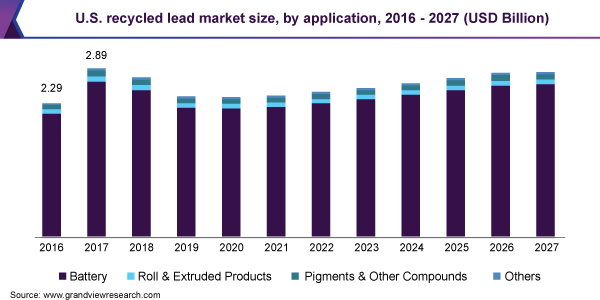

Application Insights

The battery was the largest segment with a revenue share of around 85% in 2019 and this trend is expected to continue over the forecast period. Despite certain disadvantages over its alternatives, the demand for lead-acid batteries is anticipated to prevail over the forecast period owing to its number of advantages. Cost-efficient, easy to manufacture, low self-discharge rate, low maintenance requirements, and mature, reliable, and well-understood technology are a few of its advantages, which are expected to boost production during the forecast period.

The increasing demand for batteries is propelling manufacturers to expand their production capacity and integrate across the value chain. For example, in October 2019, Henan Yuguang Gold & Lead Co., Ltd announced its plan for setting up a lead-acid battery as part of a downstream expansion. In July 2018, Balance of Storage Systems announced about expanding its hybrid lead and lithium battery units to reach 20,000. Such expansions indicate the growing demand for batteries, thus, driving the market growth.

Rolls and extruded products were the second-largest application segment of the market, as of 2019. Considering the softness of the metal, lead can be extruded in any shape including wire, rod, anode, burning bar, weights, ballast, and others. These are further used in various end-use industries, for example, wires find application in the semiconductor industry, and sheets are used in the building and construction industry for flashings or weathering in order to prevent water penetration. Sheets are also useful for sound insulation owing to their high density.

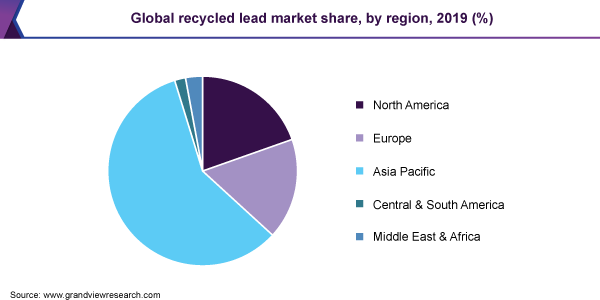

Regional Insights

Asia Pacific was the largest regional market with a revenue share of more than 55% in 2019 and this growth can be attributed to China, which is the largest producer and consumer of recycled lead in the world. The country is putting more emphasis on increasing its secondary production as the environmental issues are restricting new capacity releases for lead concentrates, thus, lower capacity for the primary market.

Considering the growing proportion of secondary over primary, it can be said that the former will soon be listed on Shanghai Futures Exchange. However, the production has been limited as of March 2020, owing to the Covid-19 pandemic across the globe. Since the country is immobilized it is difficult to transport scrap batteries to the recyclers, which is the main raw material, thus restricting production.

In terms of consumption, China accounts for a share of over 40% of the global market. The country is the largest battery producer in the world and also suffers from overcapacity. As a result, the manufacturers are moving out to South East Asia. Factors such as low labor cost, proper infrastructure, close proximity to end markets, rapid growth in the domestic market, and ease of doing business are propelling manufacturers to set up their plants in South East Asia. However, as of April 2020, amidst the coronavirus outbreak, the demand for batteries is anticipated to decline especially for the automotive market, as the manufacturing operations are at a halt.

The Middle East and Africa are expected to register a CAGR of 1.3% in terms of volume, over the forecast period. The growth is attributed to the rapidly rising production of batteries in Africa. However, the increasing production is giving rise to serious lead poisoning issues in the region. As per researchers, countries including Senegal, Kenya, Nigeria, and others are facing major health issues and even death owing to lack of regulation and inadequate pollution controls in the facilities. The lead wastes are contaminating the environment and affecting the health of the workers and their facilities who are working in close proximity to the facility. This is anticipated to hinder the market growth in the region.

Key Companies & Market Share Insights

Capacity expansion is one of the key strategic initiatives adopted by key industry players. For instance, in April 2019, Gravita Tanzania Limited began production of lead with an annual production capacity of 3,000 tons per annum. The plant is worth an investment of ₹9.5 crores (~USD 1.2 million). The long-term initiatives by the market players have been deeply impacted owing to the COVID-19 pandemic. The intensity of the pandemic is extremely high for countries like Italy. Amidst this situation where several lives are lost and manufacturing and transportation are restricted, Italian lead-acid battery firms suspended their production in March 2020. Some of the prominent players operating in the recycled lead market are:

-

Gravita India Ltd.

-

Eco-bat Technologies Ltd.

-

KOREAZINC

-

Recyclex

-

Yuguang Gold & Lead Co., Ltd.

Recycled Lead Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 15.54 billion

Market size volume in 2020

7,089.3 kilotons

Revenue forecast in 2027

USD 18.81 billion

Volume forecast in 2027

8,195.3 kilotons

Growth Rate

CAGR of 2.4% (revenue-based) from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in kilotons, Revenue in USD million &

CAGR from 2020 to 2027Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Asia Pacific; Europe; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; Italy; U.K.; China; India; South Korea

Key companies profiled

Gravita India Ltd.; Eco-bat Technologies Ltd.; KOREAZINC; Recyclex; Yuguang Gold & Lead Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global recycled lead market report on the basis of application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Battery

-

Rolls & Extruded Products

-

Pigments & Other Compounds

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

Italy

-

The U.K.

-

-

Asia Pacific

-

China

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global recycled lead market size was estimated at USD 15.61 billion in 2019 and is expected to reach USD 15.5 billion in 2020.

b. The global recycled lead market size is expected to grow at a compound annual growth rate of 2.4% from 2020 to 2027 to reach USD 18.8 billion by 2027.

b. Battery dominated the recycled lead market with a share of 85% in 2019. This is attributable to rising demand for lead acid batteries owing to cost efficient, easy to manufacture, low self-discharge rate, low maintenance requirements, and mature, reliable, & well-understood technology.

b. Some key players operating in the recycled lead market include Gravita India Ltd., Eco-bat Technologies Ltd., KOREAZINC, Recyclex, and Yuguang Gold & Lead Co., Ltd.

b. Key factors that are driving the market growth include increasing demand for batteries from electric vehicles and energy storage systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.