- Home

- »

- Advanced Interior Materials

- »

-

North America Air Purifier Market Size & Share Report, 2030GVR Report cover

![North America Air Purifier Market Size, Share & Trends Report]()

North America Air Purifier Market (2023 - 2030) Size, Share & Trends Analysis Report By Technology (HEPA, Activated Carbon, Ionic Filters), By Application (Residential, Industrial), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-066-3

- Number of Report Pages: 169

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

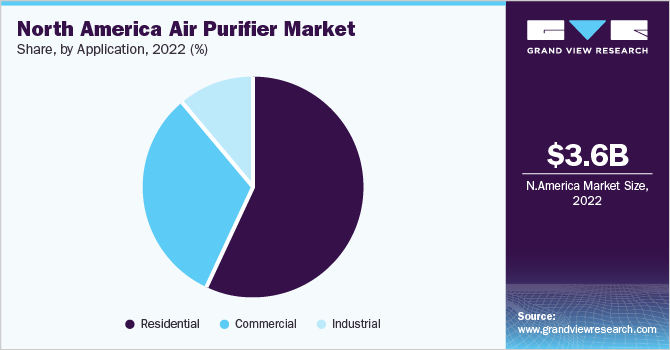

The North America air purifier market size was valued at USD 3.6 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.2% from 2023 to 2030. The growth of the market in this region can be attributed to the rising usage of air purifiers to control air quality and minimize the impact of increasing air pollution levels in metro areas. Moreover, improving the standard of living, growing health consciousness and rising disposable income of consumers are expected to lead to the growth of the air purifier industry in North America in the coming years. The air purifiers are tested for quality control, wherein the efficiency of the filters is a vital test for determining the air purifier quality. The filters need to meet the quality control test standards specified by the American Society for Testing and Materials (ASTM). In the case of HEPA filters, additional standards such as ASTM-F50 must be met before sending the product to distributors or end-users.

Rising pollution levels and the increasing prevalence of airborne diseases in Canada have resulted in creating awareness among consumers about air pollution and devices protecting polluted air, thereby augmenting the product demand. Health Canada, the Department of the Government of Canada has published guidelines for indoor air quality stating the short-term exposure limits and long-term exposure limits for various substances.

Air pollution can be classified into two main categories, namely outdoor or ambient air pollution, and indoor air pollution. Outdoor air pollution refers to the pollution that occurs outside of the built environment. Some examples of outdoor air pollution include fine particles produced due to the burning of fossil fuels, ground-level ozone, and noxious gases such as nitrogen oxide, sulfur dioxide, carbon monoxide, and chemical vapors.

In contrast to outdoor pollution, indoor pollution involves particulates, carbon oxides, and other pollutants that are carried by indoor air and dust. Examples of indoor pollutants include particulate matter, pesticides, second-hand tobacco smoke, asbestos, VOCs, radon, carbon monoxide, and outdoor-indoor allergens. Indoor pollutants too have a severe impact on human health and can cause diseases such as stroke, COPD, and lung cancer. Thus, growing awareness about both outdoor and indoor air pollution and the health problems associated with it is expected to be one of the major drivers for the adoption of air purifiers.

Increasing levels of air pollution have given rise to increased worries over the state of public health due to the widespread and negative consequences. Therefore, the research and development of technology for air filtration has garnered considerable attention as a viable and potentially fruitful alternative. Up to this point, several efforts have been made to enhance air filtration technologies to circumvent the trade-off connection that exists between the level of filtration efficiency and the pressure drop.

The major players in the market are launching new products to expand their product portfolio and customer base. For instance, in November 2022, IQAir launched the smart slim bionic air purifier Atem X. This is the high-performance air purifier launched in the company's product line. It also removes ultra-fine particles, allergens, smoke, bacteria, and others.

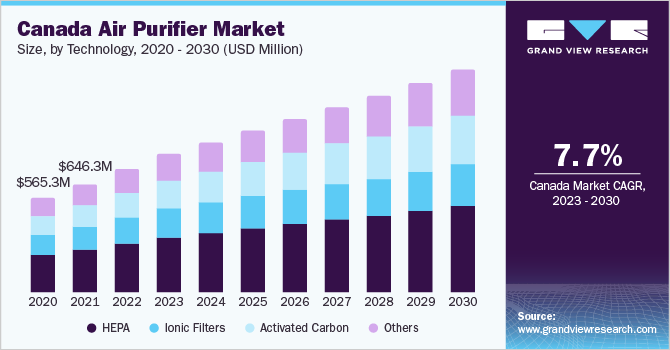

Technology Insights

HEPA segment led the market and accounted for 40.2% of the North America revenue share in 2022. HEPA (High-Efficiency Particulate Air) filters are a type of extended surface mechanical filter, majorly manufactured using submicron glass fibers. The texture of these filters is similar to blotter paper. HEPA filters' enormous surface areas aid in the removal of 99.7% of particles larger than or equal to 0.3 microns. It is also highly effective at filtering both minute and large particles.

Activated carbon is expected to be the fastest-growing market with a CAGR of 8.1% during the forecast period. Activated carbon or activated charcoal filters are comprised of small pieces of carbon in granular form or powdered blocks, specially treated with oxygen, to initiate the pores of carbon atoms. This aids in increasing the carbon surface area and making it porous, thereby increasing its capability to absorb airborne particles. These filters are used for odors from cooking and absorbing gases, smoke mold, pets, and chemicals.

Ionic filters, also known as air ionizers or ion generators, use anions (negative ions) to collect airborne particles. Ionic filters emit a cloud of anions with the help of electricity, which, when charged, attracts airborne particles so that they fall on the mechanical air filter, ceiling, nearest wall, or a charged collector plate.

Ionic filters can reduce the particulate size to around 0.1 microns. Only the filters having ozone emission concentration less than 0.05 ppm (parts per million) as per the standard of the California Air Resources Board (CARB) are to be used in air purifiers. Filters not conforming to the established standards are considered dangerous to human health.

Application Insights

The commercial application segment led the market and accounted for 57.2% of the revenue in 2022. The segment is expected to be the fastest growing at a CAGR of 9.0% during the 2023-2030 period. The product has commercial uses in various places including offices, hospitals, schools, hotels, conference centers, movie theatres, malls, and other leisure facilities. Because poor indoor air quality can reduce employee productivity, air purifiers are installed in offices to preserve the purity of the air there.

Air purifiers are used in dental & medical laboratories, veterinary hospitals, boarding kennels, clinics, animal kennels, and hospitals for removing allergens, airborne pathogens, and odor from the air as well as for maintaining indoor air quality for patients as well as employees working in these facilities. The purifiers are used in patient care rooms in hospitals for controlling infectious and communicable diseases as well as to remove airborne pathogens, bacteria, and allergens to maintain a clean environment.

Residential applications include small- and large homes and residential properties. Ambient air quality has been deteriorating over the past decades owing to the growing population and urbanization. This, in turn, has affected the indoor air quality owing to dust, gases, and other contaminants entering the indoor premises. The growing demand for clean air has resulted in increased adoption of air purifiers.

Air purifiers are used in pharmaceutical industries for the containment of chemical compounds formed during the production and development of pharmaceutical drugs. In the food & beverage industry, air purifiers with HEPA filters are responsible for maintaining cleanroom conditions for the processing and packaging of food-grade products as well as during the bottling process of various alcoholic and non-alcoholic beverages.

Regional Insights

The U.S. led the market and accounted for over 76.4% of North America revenue in 2022. According to the U.S. EPA 2020 report, due to the high exposure to air pollution, there were approximately 110,000 deaths in the U.S. The increasing death counts escalated the adoption of air purifiers, as it purifies particles such as bio-contaminants, pollen, smoke, and dust.

Canada is expected to register lucrative growth over the forecast period with a 7.7% CAGR. The country has shown progress in its air pollution control through compliance with industry standards and vehicle emission levels. Standards set by the Environment Protection Agency and initiatives taken by the Canadian Council of Ministers of the Environment (CCME) to improve air quality and control industrial emissions are expected to stimulate the demand for air purifiers in the country over the forecast period.

Rising installation of comprehensive ambient air quality monitoring systems, regular emissions inventory, and organization of air quality management programs to improve public health are expected to surge the demand for air purifiers over the coming years. In addition, strengthening vehicular emissions control with surveillance programs and advanced technologies along with remote sensors and green inspectors are projected to propel the market growth over the forecast period.

Growing consumer awareness regarding air pollution along with the increasing death rate have forced manufacturers to invest in green technologies to restrict the pollution levels in Mexico. As a result, innovations such as artificial trees, which use algae to clean CO2 and other contaminants in the air, and billboards made up of specialized resins that attract nearby air pollutants and convert them into oxygen, are promising alternatives that can restrict the market growth over the forecast period.

Key Companies & Market Share Insights

Manufacturers of air purifiers use a variety of strategies, such as joint ventures, mergers, acquisitions, new product developments, and geographic expansions, to increase their market share and meet the shifting technological demands for equipment from various end-use sectors, including residential, commercial, and industrial.

For instance, in January 2023, Levoit introduced the Vital 200S Smart True HEPA Air Purifier, a brand-new smart air purifier with a 99.97% particle removal rate that aims to support a better lifestyle and provide the purest air possible. The Vital 200S purifies a typical bedroom (400 square feet) in just 12 minutes, a typical living room (950 square feet or more) in just 30 minutes, and rooms up to 1900 square feet in 60 minutes. It does this by utilizing high-performance technology, powerful purification, and smart customizations. Some prominent players in the North America air purifier market include:

-

Beyond by Aerus

-

Arovast Corporation (Levoit)

-

KOIOS

-

Rabbit Air

-

WYND TECHNOLOGIES, INC

-

Oransi

-

Pure Enrichment

-

Amaircare

-

Blueair

-

Airpura Industries

-

IQAir

-

Honeywell International Inc.

-

LG Electronics

North America Air Purifier Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.0 billion

Revenue forecast in 2030

USD 6.3 billion

Growth Rate

CAGR of 7.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion, CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, trends

Segments Covered

Technology, application, country

Country Scope

U.S., Canada, Mexico

Key companies profiled

Beyond by Aerus; Arovast Corporation (Levoit); KOIOS; Rabbit Air; WYND TECHNOLOGIES, INC; Oransi; Pure Enrichment; Amaircare; Blueair; Airpura Industries; IQAir; Honeywell International Inc.; LG Electronics

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Air Purifier Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the North America air purifier market based on technology, application, and country:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

HEPA

-

Activated Carbon

-

Ionic Filters

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Industrial

-

Commercial

-

Retail Shops (Mercantile)

-

Offices

-

Healthcare Facilities

-

Hospitality

-

Schools & Educational Institutions

-

Laboratories

-

Transport (Railway Stations, Metros, Bus Stops, Airports)

-

Others

-

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. North America air purifier market size was estimated at USD 3.6 billion in 2022 and is expected to reach USD 4.0 billion in 2023.

b. North America air purifier market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.2% from 2023 to 2030 to reach USD 6.3 billion by 2030.

b. U.S. dominated the North America air purifier market with a revenue share of 76.4% in 2022, on account of several factors including rapid industrialization, growing urban population and technological innovation in air purifiers.

b. Some of the key players operating in North America air purifier market include Beyond by Aerus, Arovast Corporation (Levoit), KOIOS, Rabbit Air, WYND TECHNOLOGIES, INC, Oransi, Pure Enrichment, Amaircare, Blueair, Airpura Industries, IQAir, Honeywell International Inc., LG Electronics.

b. The key factors that are driving North America air purifier market include the rising usage of air purifiers to control air quality and minimize the impact of increasing air pollution levels in metro areas.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.