- Home

- »

- Plastics, Polymers & Resins

- »

-

North America Amber Glass Packaging Market Size, 2028GVR Report cover

![North America Amber Glass Packaging Market Size, Share & Trends Report]()

North America Amber Glass Packaging Market Size, Share & Trends Analysis Report By Application (Dietary Supplements, Pharmaceuticals), By Product (Bottles, Containers & Jars), By Region, And Segment Forecasts, 2020 - 2028

- Report ID: GVR-4-68039-666-6

- Number of Report Pages: 92

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Bulk Chemicals

Report Overview

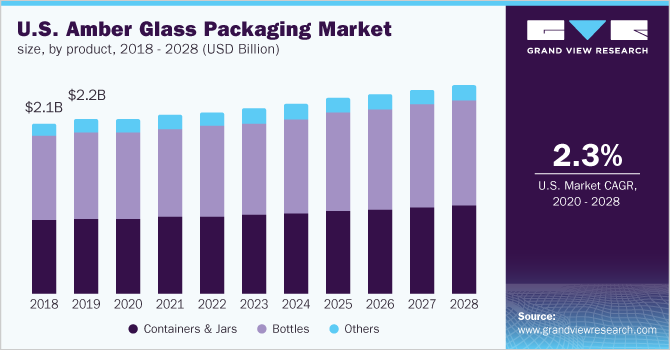

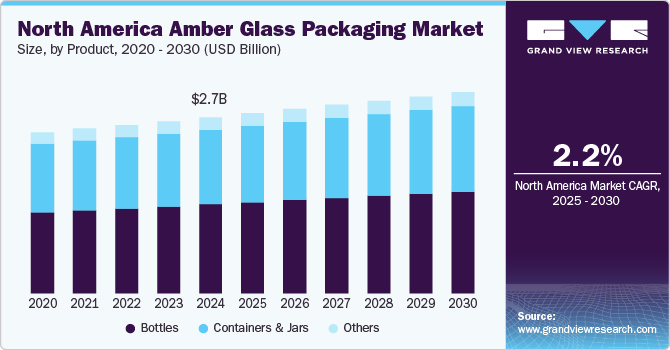

The North America amber glass packaging market size was estimated at USD 2,520.2 million in 2020 and is expected to grow at a compounded annual growth rate (CAGR) of 2.3% from 2020 to 2028. The demand for glass packaging in North America is projected to grow over the forecast period owing to the rising governmental and industrial initiatives towards sustainable packaging options. Amber glass is used for packaging syrups, drinks, capsules, and tablets to protect these contents from sunlight exposure and, thereby extend their shelf life. Amber glass offers greater protection to light-sensitive products compared to other available colored glasses, such as green and blue, and is thereby expected to gain traction in the coming years. The consumption of wine, beer, and liquor is increasing in the U.S., which is expected to fuel the demand for amber glass bottles.

Wine Institute reported that the shipment of sparkling wine or champagne increased from 24,443 thousand 9-liter cases in 2016 to 28,485 thousand 9-liter cases in 2020 in the U.S. The primary raw materials used in glassmaking include minerals, such as silica or silicon dioxide, soda ash, and limestone. As per the National Industrial Sand Association, silica accounts for about 70% of the final weight of glass products. Iron oxide (Fe2O3) powder is commonly used as a coloring agent for the manufacturing of amber glass.

The raw materials are required to be heated at about 1,500°C for the melting process. A high amount of fuel is required to increase the furnace temperature. The burning of fuel leads to the emission of toxic gases. Thus, new technologies and renewable energy resources are being adopted by players, such as O-l’s MAGMA melting technology, wherein the melting process can utilize biofuels or hydrogen instead of fossil fuels. Players are further taking efforts to reduce melt temperature using more recycled glass or cullet.

Manufacturers of glass packaging are constantly striving to develop a wide range of technologies to gain a competitive advantage. For instance, Gerresheimer AG started its new glass technology center in New Jersey, the U.S. in October 2019. This innovation center was aimed to further boost innovation and new product developments. The emergence of Ultraviolet (UV) glass is expected to restrain the market growth. Players, such as Premium Vials, MIRON Violetglass USA, Inc., and Infinity Jars, offer UV glass jars and bottles designed for the storage of spices, coffee, cooking oil, and perfumes.

UV glass selectively allows passage of UV-A light, unlike amber glass, and thereby helps protect the packaged contents. The COVID-19 outbreak negatively affected the market at the beginning of the year 2020 due to lower sales of non-essential products, such as beer and wine bottles, and cosmetics. For instance, as per the O-I’s Annual Report 2020, the revenue of the company’s Americas segment declined by 8% in 2020 compared to 2019 due to the pandemic. This sales decrease was attributed to lower glass container shipments to alcoholic beverage manufacturers in the U.S.

Product Insights

The bottles segment dominated the market with a revenue share of over 50% in 2020. Alcoholic beverages are one of the major application areas of amber glass bottles. Beer and wine have their characteristic flavors developed during their brewing and fermentation processes, respectively. Light exposure can cause photo-oxidation of these beverages, thereby resulting in the loss of their tastes. Amber glass bottles are thus widely used for beer and wine packaging to retain their original flavors.

Scented products are often stored in amber-colored glass bottles to prevent the loss of fragrance and product potency due to UV light exposure. For instance, in July 2020, APC Packaging launched a new range of Boston round amber (CRAM) glass bottles that can be used for oils, serums, and Cannabidiol (CBD) products. Amber glass containers and jars are expected to witness significant demand owing to their wide applicability in various end-use industries.

Jars are used for the packaging of cosmetics, such as face creams and bath salts, and medicines and health supplements in tablet or capsule forms. In September 2021, Prose, a U.S.-based hair care products company, launched its new Root Source personalized hair growth supplements packaged in amber-colored glass jars to protect plant-based ingredients in the product from UV rays. Pharmaceutical vials and cartridges are included in the other products segment.

Pharmaceutical injection and infusion vials are made of amber glass to protect Active Pharmaceutical Ingredients (APIs). Factors, such as safe transportation of drugs and their accurate drug delivery have contributed to the increased demand for glass cartridges for storing drugs. For instance, Gerresheimer AG produces more than one billion glass cartridges annually.

Application Insights

The pharmaceuticals application segment accounted for the largest revenue share of over 45% in 2020. Drugs are formulated with APIs, which can degrade or lose potency on exposure to sunlight. In April 2021, SGD Pharma launched their new 50 ml amber-molded glass vials in a tray to expand its Ready-to-Use (RTU) Sterinity molded glass vial platform. These vials are compliant with the U.S. Pharmacopoeia and can be used to store high-value light-sensitive parenteral drugs. As per the Office of Pharmaceutical Quality (OPQ) of the U.S. Food and Drug Administration, OPQ enabled the FDA approval of 942 generic and 3 bio-similar drug products in 2020. The rising development of pharmaceutical products in North America is thereby expected to boost the growth of the pharmaceuticals segment.

Nutritional supplements containing ingredients, such as vitamins, proteins, omega-3, probiotics, and herbal extracts, are sensitive to changes in environmental parameters. Solgar Inc., a U.S.-based nutraceutical company, specifically makes use of recyclable amber glass bottles to store omega 3 concentrates and liquid calcium & magnesium citrate to protect the packaged supplements from heat, light, and moisture.

The rising adoption of amber glass for packaging products other than alcoholic beverages is expected to fuel the segment growth. For instance, Oberweis Dairy replaced its traditionally used clear glass milk bottles with amber glass bottles. The move was taken by the company as the company observed loss of milk taste, which was caused by bright lighting present in grocery stores that were selling the product.

Anti-aging serums and creams containing ingredients, such as retinol and hyaluronic acid that are sensitive to light, are commonly packaged in amber glass jars or bottles. Cosmetic brands, such as L’Oréal, DECIEM’s The Ordinary, Cliganic, Clarins, and others, make use of amber glass containers for storing their anti-aging skincare products, which help in increasing the product shelf life.

Country Insights

The market in North America is expected to witness significant growth over the coming years on account of the rapid growth of end-use industries, such as pharmaceuticals and food & beverages. North American countries have been capturing nearly half of the global pharmaceutical market in the recent past.

The European Federation of Pharmaceutical Industries and Associations (EFPIA) reported that the U.S. and Canada combinedly accounted for 49.0% of the sales share of the global pharmaceutical market in 2020. This is expected to boost the demand for amber glass injection vials, ampoules, cartridges, and bottles in the region.

The market in the U.S. was the largest with a revenue share of over 87% in 2020. The presence of big multinational players in the U.S. including Gerresheimer AG and O-I, Ardagh Group, has led to the adoption of expansion strategies to maintain a strong foothold in the market. In March 2021, O-I announced to expand its Zipaquirá, Colombia facility by 2022. This is expected to increase the glass bottle production capacity by 2%, thus, benefiting the company’s offerings in the amber glass packaging range.

The rising consumption of beer in Canada is further expected to fuel the product demand. Beer Canada reported that the number of brewing facilities in Canada increased from about 1,120 in 2019 to 1,210 in 2020. It also reported that bottled beer accounted for a revenue share of 21% among all packaging types sold in Canada.

Key Companies & Market Share Insights

Prominent manufacturers in the market have been adopting various strategies including investments, capacity expansions, and new product developments to strengthen their presence. For instance, in August 2019, Ardagh Group introduced a new 12oz amber glass bottle design for the kombucha drink of the company, Mountain Culture Kombucha. This amber bottle will offer protection to live microorganisms present in kombucha drinks and help retain the product taste.

Strategies, such as product portfolio expansion and constant improvements in technologies, have also been adopted by players to gain a strong foothold in the market. For instance, in March 2019, a new division named ‘Lifestyle Packaging’ was formed by Origin Pharma Packaging. It is engaged in offering glass and plastic packaging solutions including amber glass packaging. It offers bottles, jars, and droppers, for the packaging of cosmetics, essential oils, diffusers, and fragrances. Some prominent players in the North America amber glass packaging market include:

-

Ardagh Group S.A.

-

Piramal Enterprises Ltd.

-

Gerresheimer AG

-

O-I

-

J.G. Finneran Associates, Inc.

-

Pacific Vial

-

Origin Pharma Packaging

-

Silver Spur Corp.

-

Kaufman Container

-

Anchor Glass Container Corp.

North America Amber Glass Packaging Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 2.57 billion

Revenue forecast in 2028

USD 3.01 billion

Growth rate

CAGR of 2.3% from 2020 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2020 - 2028

Quantitative units

Volume in million units, revenue in USD million/billion, and CAGR from 2020 to 2028

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

Ardagh Group S.A.; Piramal Enterprises Ltd.; Gerresheimer AG; O-I; J.G. Finneran Associates, Inc.; Pacific Vial; Origin Pharma Packaging; Silver Spur Corp.; Kaufman Container; Anchor Glass Container Corp.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the North America amber glass packaging market report on the basis of product, application, and country:

-

Product Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2028)

-

Containers & Jars

-

Bottles

-

Others

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2028)

-

Pharmaceuticals

-

Dietary Supplements

-

Food & Beverages

-

Personal Care & Cosmetics

-

Others

-

-

Country Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2028)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The North America amber glass packaging market size was estimated at USD 2,520.2 million in 2020 and is expected to reach USD 2.57 billion in 2021

b. The North American amber glass packaging market is expected to grow at a compound annual growth rate of 2.3% from 2020 to 2028 to reach USD 3.01 billion by 2028.

b. Bottles dominated the North American amber glass packaging market with a share of nearly 50.3% in 2020 owing to rising demand for amber glass bottles from beverage and pharmaceutical manufactures.

b. Some of the key players operating in the North America amber glass packaging market include Ardagh Group S.A., Piramal Enterprises Ltd., Gerresheimer AG, O-I, J.G. Finneran Associates, Inc., Pacific Vial, Origin Pharma Packaging, Silver Spur Corporation, Kaufman Container, Anchor Glass Container Corporation

b. The key factors that are driving the North America amber glass packaging market include protection provided by the amber-colored glass from UV rays to light-sensitive products and increased inclination of consumers, government authorities, and market players toward green packaging

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."