Report Overview

The North American amines market size was estimated at 976.1 kilotons in 2016. Rapidly increasing awareness regarding health and health safety, increasing population, the necessity for higher crop yield, and reduced arable land are expected to drive market demand over the forecast period.

Increased demand for surfactants, including heavy-duty laundry liquids, is expected to fuel product demand over the coming years. The positive outlook of the personal care industry in Mexico, coupled with surging demand for cosmetic products in emerging markets of China and India, is expected to fuel market growth through 2025.

Amines include a diverse group of chemical intermediates with broad applications in numerous sectors. As a result, the total demand follows global economic trends. Rising per capita incomes, coupled with increasing consumer spending, motor vehicle ownership, and modernizing agricultural industries in developing nations, is expected to have a strong impact on the consumption of amines.

Amines are used as intermediates, chelating agents, formulators, neutralizing agents, corrosion inhibitors, and activators in various end-use applications such as personal care products, agricultural chemicals, wood treatment, petroleum, gas treatment, water treatment, cement, pharmaceuticals, paints and coatings, textiles, and cleaning products. Growth in end-use industries such as agriculture, personal care, petroleum, and water treatment has been driving product demand over the past few years and this trend is expected to continue over the forecast period.

Amines including ethanolamines and fatty amines are widely employed in the manufacturing of surfactants. The growing use of surfactants in various end-use industries is expected to have a positive impact on the market over the forecast period. Growth of the detergents industry, particularly in the U.S. and Canada, owing to increasing disposable income, is expected to drive the global surfactants market over the forecast period. Besides, increasing oilfield chemicals owing to rapidly rising exploration and production (E&P) activities in North America is expected to have a positive impact on growth.

The largest portion of produced amines goes into manufacturing crop protection chemicals. They help control weed growth through enhanced uptake and absorption. Besides, amines in crop protection chemicals have good fertilizer compatibility as well as display good performance in hard water.

Additionally, these products are employed in the production of personal care products. Evolving the personal care products segment, which offers various products and developing formulations for varied consumer groups, is expected to create new growth opportunities for industry players over the forecast period. Growing preference for the product in light of its multi-functionality is expected to augment industry demand over the coming years.

Product Insights

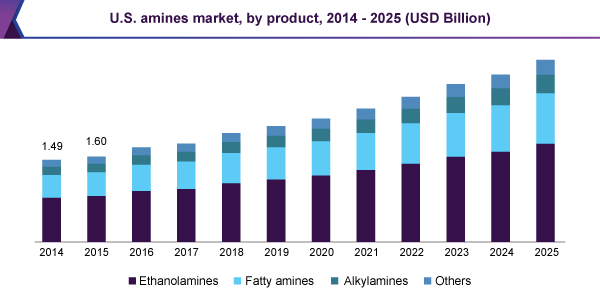

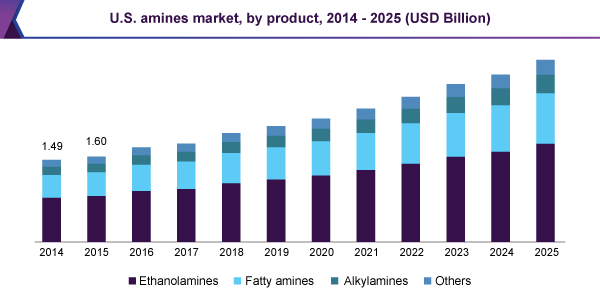

Based on the product, the industry is segmented into ethanolamines, fatty amines, alkylamines, and others. Ethanolamines are employed in the manufacturing of mascara, eyeliners, shaving products, foundations, and hair care products. Growing consumption on account of superior foaming properties will increase demand for amines in the personal care sector over the forecast period.

Ethanolamines have been significantly gaining share over the past few years and this trend is expected to continue over the forecast period. The segment held a share of 54.7% in the total revenue in North America in 2016. The product is employed in gas sweetening, where it is used as a lubricant as well as a scouring agent. Growth in the lubricants industry, on account of high demand from the automotive, construction, and industrial machinery industries, is expected to fuel demand for ethanolamine over the forecast period.

Fatty amines are expected to gain a significant market share over the forecast period in North America. Increasing application in power generation, water treatment, construction, refining, and mining industries are expected to stimulate product demand over the forecast period. These products are further employed as corrosion inhibitors primarily in water treatment, metalworking fluids, and refineries. Furthermore, the growing use of corrosion inhibitors to reduce maintenance costs of equipment is expected to create immense growth potential.

Application Insights

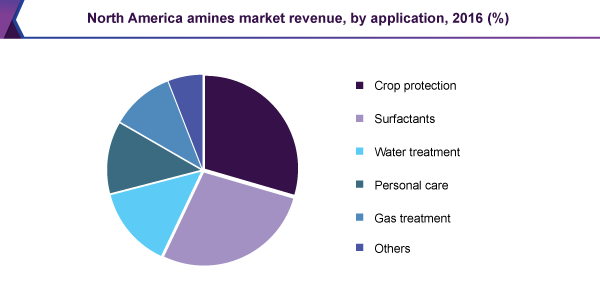

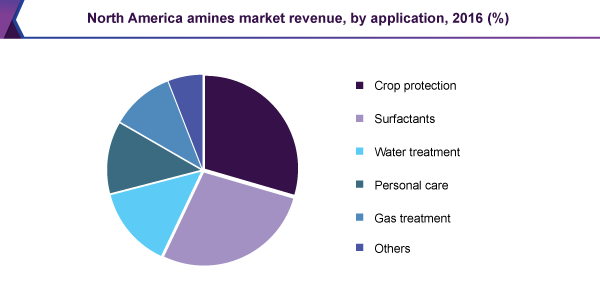

Crop protection, surfactants, water treatment, personal care, and gas treatment are key application areas of the product. The personal care segment is expected to gain a significant share over the forecast period in North America on account of its rising product demand, particularly in the U.S.

In 2015, the crop protection segment dominated the North American amines market and held close to 30.0% of the overall revenue. Amines help control weed growth through enhanced uptake and absorption. Also, amines in crop protection chemicals have good fertilizer compatibility as well as display good performance in hard water. This, in turn, is expected to have a positive impact on the market over the forecast period

Stringent regulations against the use of synthetic pesticides owing to adverse environmental impacts are expected to hamper demand growth. The majority of the amine products used in the manufacturing of crop protection chemicals are closely governed by regulatory bodies such as U.S. EPA as well as the European Commission.

Country Insights

The U.S. was the leading segment in 2015 and is expected to continue its dominance over the forecast period. Being an industry leader and having high disposable income levels, the segment is likely to drive overall industry growth over the next few years. Also, rising demand from various application industries in the country is expected to drive product demand.

Increasing demand for detergents, personal care products, cleaning products, and crop protection chemicals is expected to fuel amine demand over the forecast period. The export market is highly important for amine manufacturers in the country as industry participants aim to expand globally owing to the relative maturity of the domestic economy.

Rising expenditure on research and development programs, incentives offered by the federal government, and growing consumer awareness are key factors augmenting demand for bio-based amines. Growing bio-based amine demand is expected to have a positive impact on the industry in North America. However, it will negatively affect the market for synthetic amines over the coming years. Increasing demand for high quality and effective drug formulations is predicted to contribute to industry growth over the forecast period.

Key Companies & Market Share Insights

The North American market for amines is characterized by the presence of numerous key manufacturers and distributors. Companies in the domain operate their businesses through high production volumes and vast geographical reach. Market participants follow an integrated approach from the manufacturing of the product and its derivatives to the production of the final amine. Companies are involved in research and development activities for product innovation and expansion of the application scope. Also, they opt for technological collaborations to increment efforts in R&D.

Some of the key companies present in the industry are Arkema S.A., AkzoNobel N.V., BASF SE, SABIC, Dow Chemical Company., Huntsman Corporation, Mitsubishi Gas Chemical Co., Taminco Corporation, Celanese Corporation., and Sinopec Corp.

North America Amines Market Report Scope

|

Report Attribute

|

Details

|

|

The market size value in 2019

|

USD.2.57 billion

|

|

The revenue forecast in 2025

|

USD 4.02 billion

|

|

Growth Rate

|

CAGR of 7.7% from 2019 to 2025

|

|

The base year for estimation

|

2016

|

|

Historical data

|

2014 - 2015

|

|

Forecast period

|

2017 - 2025

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2019 to 2025

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, application, region

|

|

Regional scope

|

North America

|

|

Country scope

|

U.S., Canada, Mexico

|

|

Key companies profiled

|

Arkema S.A., AkzoNobel N.V., BASF SE, SABIC, Dow Chemical Company., Huntsman Corporation, Mitsubishi Gas Chemical Co., Taminco Corporation, Celanese Corporation., and Sinopec Corp.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Segments Covered in the Report

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the North America amines market report based on the product, application, and country:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Ethanolamines

-

Fatty amines

-

Alkylamines

-

Others

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Crop protection

-

Surfactants

-

Water treatment

-

Personal care

-

Gas treatment

-

Others

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)