- Home

- »

- Plastics, Polymers & Resins

- »

-

North America Automotive Plastics Market, Industry Report, 2030GVR Report cover

![North America Automotive Plastics Market Size, Share & Trends Report]()

North America Automotive Plastics Market Size, Share & Trends Analysis Report By Product (PP, PU), By Application (Interior Furnishings, Power Trains), By Process, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-054-5

- Number of Report Pages: 128

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

The North America automotive plastics market size was valued at USD 5.04 billion in 2023 and is anticipated to grow at a CAGR of 4.6% from 2024 to 2030. This growth is attributed to the wide use of automotive plastics to enhance fuel efficiency, reduce vehicle weight, and improve driving safety. The stringent regulations imposed by the government to curb vehicular emissions have prompted manufacturers to incorporate plastics in their vehicles, thereby reducing weight and fuel consumption. This trend is expected to stimulate market growth in North America in the coming years.

High-strength nylon fabrics are typically used to manufacture airbags, while advanced automotive plastics are used for seatbelts and child safety seats. The presence of major automobile and OEM manufacturers in the region, coupled with the increasing use of plastics to enhance vehicle performance and safety, is likely to propel the North American market. For example, in March 2023, the American Chemistry Council (ACC) published a report titled "Chemistry and Automobiles", which emphasized the significant role of chemistry and plastics in the automotive industry.

Several North American companies have chosen to invest in the production of electric vehicles due to increasing demand and government subsidies. For instance, General Motors has committed to investing USD 35 billion in the development of Electric Vehicles (EV) and Autonomous Vehicles (AV) by 2025. The company also plans to install 3,500 new EV charging plugs across Canada and the U.S., to triple the number of charging locations. This investment is anticipated to accelerate EV production, which in turn is expected to increase the demand for automotive plastics over the forecast period.

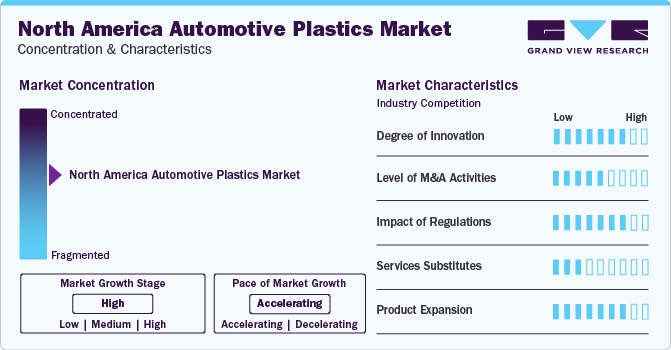

Market Characteristics & Concentration

The North America Automotive market is marked by a high level of innovation. This innovation is driven by ongoing advancements in engineering techniques and material science. Producers are persistently creating new types of automotive plastics with enhanced characteristics such as recyclability, durability, and light weighting to cater to the changing needs of the automotive industry in terms of sustainability, safety, and fuel efficiency.

The market experiences a moderate level of merger and acquisition activities. There have been cases of consolidation among leading players aiming to broaden their range of products or acquire new technologies. However, the market is still relatively dispersed with a multitude of suppliers serving various segments of the automotive industry.

Regulatory measures significantly influence the market. Regulations on fuel efficiency, emissions standards, and vehicle safety stimulate the demand for certain automotive plastics and affect the selection of materials and manufacturing processes. Adherence to regulatory norms is crucial for gaining market entry and sustaining competitiveness in the automotive sector.

The market offers limited substitutes for automotive plastics, particularly for applications that demand cost-effective, durable, and lightweight materials. While some automotive components may use alternative materials such as composite materials or metals, plastics provide unique benefits in terms of cost-efficiency, weight reduction, and design flexibility, making them essential in contemporary vehicle production.

The market witnesses a high level of product expansion. Producers are constantly creating new variants of automotive plastics designed to fulfill the distinct requirements of various vehicle components and applications. These include recyclable thermoplastics, bio-based materials, and high-performance engineering plastics, among others, broadening the scope for automotive engineers and designers.

Application Insights

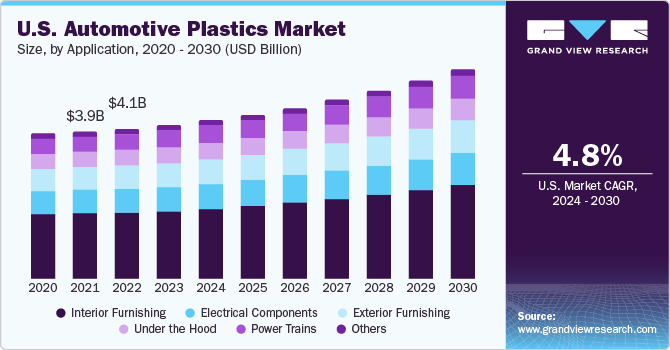

The interior furnishings segment led the industry and accounted for the largest market share of 51.5% in 2023. The growth is linked to the escalating demand for plastic materials in the automotive industry, used in components such as seat covers, steering wheels, body & light panels, seat bases, rear package shelves, fascia systems, load floors, and headliners. Techniques such as In-mold decoration (IMD) and in-mold labeling process (IML) are gaining prominence due to the increasing production of auto parts coated with decorative films, soft-touch materials, or textiles for aesthetic appeal. The surface finishes of IMD or IML not only enhance the look but also serve protective functions and help reduce vehicle noise levels.

The Exterior furnishing segment held a substantial market share in 2023. Automotive engineers are constantly pushing the boundaries to increase optimization rates and precision in blow and extrusion molding operations, all while aiming to lower the total production costs. These factors are fueling innovations in car assembly processes, leading to the replacement of traditionally heavy and costly materials with plastic compounds.

Product Insights

The Polypropylene (PP) segment led the market and accounted for the maximum revenue share of 33.03% in 2023. Polypropylene (PP) is a material that has found widespread application in various sectors such as packaging, electrical & electronics, construction, consumer goods, and automotive due to its versatile properties. It exhibits excellent resistance to chemicals and electricity, even at extremely high temperatures. PP is semi-rigid, translucent, and has inherent hinge properties. Compared to other plastic materials, PP is relatively lighter and is extensively utilized in the automotive industry. It contributes to reducing the total weight of vehicles, which subsequently leads to a decrease in fuel consumption and CO2 emissions. Moreover, LGF20, LGF30, and LGF40, which contain 20%, 30%, and 40% long glass fibers respectively, are reinforced with homopolymer-PP thermoplastic composites. These are produced using a pultrusion process where the fiber is melt-impregnated to enhance performance.

The Polyurethane (PU) segment accounted for a significant portion of the market in 2023. This growth is attributed to its unique ability to combine the properties of both plastics and rubber while being lighter than metal and other plastic materials. The demand for PU has been on the rise in the automotive industry for applications such as refrigeration insulation, interior trims, and seat cushioning. This trend has significantly influenced the growth of this segment in recent years and is expected to persist in the forecast period.

The Polyvinyl chloride (PVC) segment experienced considerable growth in 2023. PVC, a thermoplastic polymer, has been a staple in the automotive industry for many years. It is typically used to manufacture various automotive parts, including interior and exterior trims, instrument panels, door panels, and dashboards. The numerous benefits of PVC make it a preferred material choice for automobile manufacturers.

Process Insights

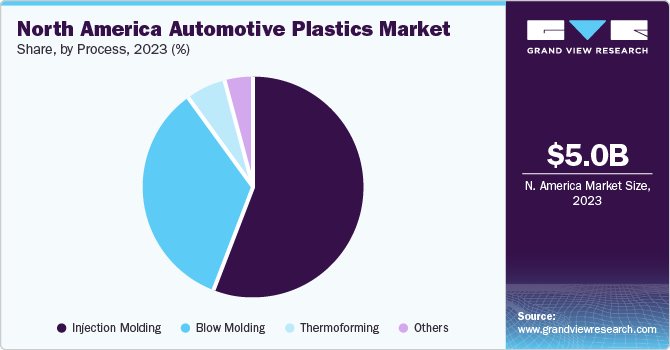

The Injection Molding segment led the market and accounted for the largest market share of 56.3% in 2023. The growth in the automotive plastics market can be attributed to the numerous benefits of Injection Molding in the production of plastic parts for vehicles. Injection molding, a common plastic molding technique, is employed to create plastic components such as housing covers, light covers & lenses, engine & lighting clips, wiring harnesses, and connectors.

The process entails the melting of plastic pellets and the injection of the molten substance into a mold of the desired shape. The material is then cooled and solidified, and upon opening the mold, the formed part is emitted.

Blow Molding also accounted for a significant portion of the market in 2023. This technique is used to produce thin-walled, hollow, and custom plastic components for the automotive industry. It is primarily used to create products with a uniform wall thickness, which is crucial when the shape of the final product is important. The process is similar to glassblowing, where the plastic is heated and then air is injected, causing the hot plastic to expand, akin to a balloon.

Country Insights

U.S. Automotive Plastics Market Trends

The Automotive Plastics market in the U.S. accounted for the largest market share of 82.3% in 2023. This growth is attributed to the escalating automobile production in the nation, which is fueling a massive demand for automotive plastics. The U.S., a notable market in North America, is characterized by advancements in plastic formulation techniques and growing consumer consciousness about the health and environmental impacts of plastics. Moreover, the surge in metal prices, curbing fuel consumption, decreasing vehicle weight for fuel efficiency, and mitigating greenhouse gas emissions are the primary factors propelling the automotive plastics demand in the country.

Canada Automotive Plastics Market Trends

Canada Automotive Plastics market held a substantial market share in 2023, due to the strong Canadian dollar enhancing consumer purchasing power. Additionally, the low loan interest rates and moderate gas prices have spurred automotive acquisitions in the country. These elements, combined with the rising government incentive schemes, are anticipated to favorably influence the demand for electric vehicle plastics over the projected period.

Mexico Automotive Plastics Market Trends

The Automotive Plastics market in Mexico experienced considerable growth in 2023. This growth is due to burgeoning automobile production. Moreover, aspects such as the low tax rate, and OEM training programs in the nation are expected to be instrumental in enticing key automobile manufacturers to set up their manufacturing plants in Mexico. Consequently, the increasing automotive manufacturing plants and automobile production in Mexico are projected to create a vast demand for automotive plastics in the forthcoming years.phrase

Key North America Automotive Plastics Company Insights

The North America Automotive Plastics Market is characterized by the existence of numerous suppliers providing a broad array of solutions and materials. While a few large multinational corporations serve the automotive industry, the market remains distributed, with several specialized suppliers catering to different applications and segments within the automotive supply chain.

Key players in the market include Dow, Inc.; Owens Corning, and Hanwha Azdel Inc.

-

Dow, Inc. provides its plastic products to a variety of industries including consumer goods, healthcare, food & beverage, personal care, construction, life sciences, paints & coatings, and paper. The company's materials science division offers a range of products such as performance materials & coatings, industrial intermediates & infrastructure, and packaging & specialty plastics.

-

Owens Corning delivers its products to a diverse range of industries such as automotive, construction, consumer goods, energy, and industrial manufacturing. The company's composites product line includes mats, carbon fiber-reinforced polymer laminates, fiberglass, thermoplastics, and fabrics. These are utilized in a variety of automotive interior applications such as panels, door trims, dashboards, and cockpit components.

Magna International, Inc.; and Lear Corporation are some other participants in the North America Automotive Plastics market

- Lear Corporation is a manufacturer and distributor of seating and electrical systems for the automotive industry. It operates via two business segments: seating and electrical. The seating business segment encompasses seat structure & mechanisms, seat covers, foams, safety, heat & cool systems, complete seat designing, and manufacturing. The electrical business segment includes electrical distribution systems, software, cybersecurity, and other electronics & instrumental panels in the automotive sector.

Key North America Automotive Plastics Companies:

- Dow, Inc.

- Hanwha Azdel Inc.

- Lear Corporation

- Owens Corning

- Magna International, Inc.

- Momentive Performance Materials, Inc.

- DuPont de Nemours, Inc.

- Industrias Cazel

- Axiom Group Inc.

- Amra Plastic Moulders Inc.

Recent Developments

-

In February 2024, Owens Corning, a global frontrunner in the building and construction materials sector, and Masonite International Corporation, a worldwide supplier of interior and exterior doors and door systems, announced a definitive agreement. Under this agreement, Owens Corning will purchase all outstanding shares of Masonite at $133.00 per share in cash. This represents an approximate 38% premium to Masonite’s closing share price on February 8, 2024, and an approximate 46% premium to Masonite’s 20-day volume-weighted average price. The estimated transaction value is around $3.9 billion, implying a purchase multiple of approximately 8.6x 2023E adjusted EBITDA2 or 6.8x when including synergies of $125 million.

-

In May 2023, Dow and New Energy Blue announced a long-term supply agreement in North America. Under this agreement, New Energy Blue will produce bio-based ethylene from renewable agricultural residues. Dow plans to buy this bio-based ethylene, which will reduce carbon emissions from plastic production, and use it in recyclable applications across transportation, footwear, and packaging. Dow's agreement with New Energy Blue, a team of experts with extensive experience in bio-conversion ventures, marks the first agreement in North America to produce plastic source materials from corn stover (stalks and leaves). This is also Dow's first agreement to use agricultural residues for plastic production in North America.

North America Automotive Plastics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.2 billion

Revenue forecast in 2030

USD 6.8 billion

Growth rate

CAGR of 4.6% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, process, application, region

Regional Coverage

North America

Country Coverage

U.S.; Canada; Mexico

Key companies profiled

Dow, Inc.; Hanwha Azdel Inc.; Lear Corporation; Owens Corning; Magna International, Inc.; Momentive Performance Materials, Inc.; DuPont de Nemours, Inc.; Industrias Cazel; Axiom Group Inc.; Amra Plastic Moulders Inc.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Automotive Plastics Market Report Segmentation

This report forecasts revenue growth at regional levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America Automotive Plastics market report based on Product, process, application, and country:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

ABS

-

PP

-

PP LGF 20

-

PP LGF 30

-

PP LGF 40

-

-

Others

-

PU

-

PVC

-

PE

-

PC

-

PMMA

-

PA (Nylon 6 & 66)

-

Others

-

-

Process Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Injection Molding

-

Blow Molding

-

Thermoforming

-

Other

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Power Trains

-

Electrical Components

-

Interior Furnishing

-

IMD or IML

-

Others

-

-

Exterior Furnishing

-

Under the Hood

-

Chassis

-

-

Country Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America automotive plastics market was valued at USD 5.04 billion in the year 2023 and is expected to reach USD 5.20 billion in 2024.

b. The North America automotive plastics market is expected to grow at a compound annual growth rate of 4.6% from 2024 to 2030 to reach USD 6.80 billion by 2030.

b. The Injection Molding segment led the market and accounted for the largest market share of 56.3% in 2023. The growth in the automotive plastics market can be attributed to the numerous benefits of Injection Molding in the production of plastic parts for vehicles.

b. The key market player in the North America automotive plastics market includes Dow, Inc.; Hanwha Azdel Inc.; Lear Corporation; Owens Corning; Magna International, Inc.; Momentive Performance Materials, Inc.; DuPont de Nemours, Inc.; Industrias Cazel; Axiom Group Inc.; Amra Plastic Moulders Inc.

b. The key factors that are driving the North America automotive plastics market include the wide use of automotive plastics to enhance fuel efficiency, reduce vehicle weight, and improve driving safety. The stringent regulations imposed by the government to curb vehicular emissions have prompted manufacturers to incorporate plastics in their vehicles, thereby reducing weight and fuel consumption.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."