- Home

- »

- Automotive & Transportation

- »

-

North America Bus Market Size, Share, Industry Report 2030GVR Report cover

![North America Bus Market Size, Share & Trends Report]()

North America Bus Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Single Deck, Double Deck), By Fuel (Diesel, Electric and Hybrid), By Seat Capacity, By Application, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-080-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

North America Bus Market Size & Trends

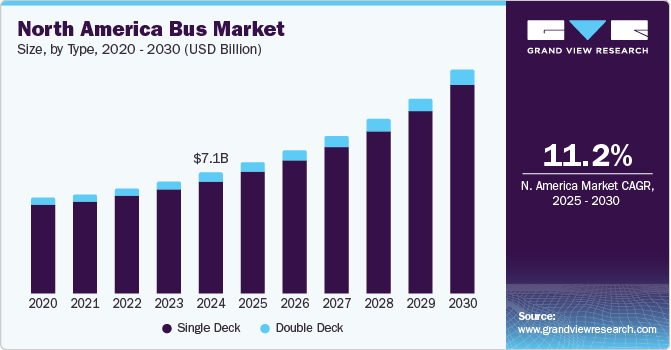

The North America bus market size was estimated at USD 7.13 billion in 2024 and is projected to grow at a CAGR of 11.2% from 2025 to 2030. Factors such as advancement in the public transportation industry and the expansion & revamping of American and Canadian road networks are driving market growth. The use of electric buses for long-distance intercity travel and school commuting is expected to increase, which has resulted in fueling the demand for buses in North America. To address the problem of rising environmental pollution brought on by travel and transportation, the federal government is offering funding & incentives to replace fossil fuel-based buses with electric ones. The support from the government in the form of incentives is also encouraging OEMs to manufacture and launch electric buses in the market.

Growing concerns regarding the increasing concentration of greenhouse gases and pollution levels are encouraging American and Canadian government organizations to undertake several initiatives to reduce carbon emission levels. One such initiative includes electrifying the public transport fleet by procuring electric buses through bus manufacturers. For instance, in May 2023, the Canadian government announced procurement of 1,299 electric buses to enhance the electric public transportation network in the Eastern Province of Quebec, Canada. In addition, Canada's Federal and provincial governments are said to invest USD 585 million and USD 823.2 million, respectively, to purchase 1,229 electric buses for Quebec.

Moreover, the ongoing transition from conventional buses to battery-powered and hydrogen fuel-powered buses is driving the demand for the North America bus industry. The U.S. Federal government, schools, automobile manufacturers & suppliers, and regional public transport providers that install efficient charging infrastructure are partnering to reduce the challenge faced by the fleet operators in the electric bus industry. They are working on the development of battery charging infrastructure and hydrogen fuel stations in the region. For instance, in April 2023, BorgWarner Inc., an automotive supplier, announced its partnership with Pontiac City School District, Michigan, for providing proprietary charging with direct current fast chargers, enabling vehicle-to-grid charging for 25 IC electric buses.

Companies in the market are enhancing their offerings with features such as Wi-Fi, communication systems, and Advanced Driver Assistance Systems (ADAS) to elevate the travel experience and ensure passenger safety. For instance, in April 2023, Scania AB introduced an electric bus in Mexico equipped with ten batteries totaling 330 kWh, providing a range of 300 km. It also features a 2-speed transmission for efficient battery management, regenerative braking, power output of 230 kW, and 1,800 Nm of torque. Furthermore, the bus incorporates an ADAS system for alerting the driver to nearby people and objects, along with an Acoustic Vehicle Alerting System (AVAS) to further enhance safety and comfort for passengers.

Moreover, prominent players in the North America bus industry are investing in developing low-emission diesel engines. These engines are integrated with clean diesel technology, require less fuel, and have lower operating costs, thereby buses integrated with clean diesel engine technology are widely used for transit buses. For instance, in April 2023, New Flyer, a subsidiary of NFI Group Inc., announced that they had received the order for an additional 116 Xcelsior heavy-duty transit buses on behalf of the New York City Transit Authority. The Xcelsior buses equipped with a diesel engine comply with the Heavy-Duty National Program standards set by the United States Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA). This engine, when used with ultra-low-sulfur diesel fuel, emits 95% fewer nitrogen oxides compared to regular emissions.

Type Insights

The single deck segment held the largest share of 92.8% in 2024. The aggressive investments being made across the U.S. and Canada to enhance the road transportation network have increased the accessibility of single-deck buses for interstate travel for passengers. Several city administrations are pursuing plans to convert their entire bus fleets to all-electric vehicles. For instance, the Metropolitan Transportation Authority (MTA) is contemplating replacing its entire bus fleet with zero-emission vehicles by 2040.

The double deck segment is expected to grow at a significant CAGR during the forecast period. The growth of the double-deck bus segment in the market is driven by increasing demand for high-capacity public transportation solutions in urban areas. With rising urbanization and population density in cities such as New York, San Francisco, and Toronto, transit authorities are focusing on maximizing passenger capacity without expanding road infrastructure. Double-deck buses offer a space-efficient alternative, allowing transportation agencies to move more passengers per trip compared to standard single-deck buses.

Fuel Insights

The diesel segment held the largest market share in 2024. Diesel tends to be cheaper as compared to other vehicle fuels. Hence, diesel-fired buses are preferred owing to their lower operating costs. Diesel engines are also considered rigid and safe. Hence, diesel engines power 95% of all school buses in North America. Among these, the cleanest, emission-free diesel engine technology is used by 58% of consumers. While most schools are being encouraged to utilize blends of high-quality biodiesel and renewable fuel to power their school buses, and several schemes are also being launched to encourage the electrification of buses, the high initial costs and investments are compelling local agencies to continue using diesel buses.

The electric and hybrid segment is expected to register the fastest CAGR during the forecast period. The segment growth can be attributed to the continued electrification of public fleets and the aggressive adoption of hybrid buses by public fleet operators in the U.S. A myriad of incentives, subsidiaries, and rebates are being offered to electrify the existing bus fleet. For instance, the City of Jonesboro in the U.S. state of Arkansas received funding worth USD 878,584 to buy hybrid buses. These buses are a replacement for older diesel buses and subsequently would help in improving air quality throughout the city.

Seat Capacity Insights

The 31-50 seats segment dominated the market in 2024. Buses with a capacity of 30-50 seats are utilized for scheduled travel, tourism, and student transportation. Traffic congestion particularly makes these buses an ideal alternative for public transport. Electrification is also emerging as a popular trend, particularly when it comes to buses with a capacity of 30-50 seats. Several initiatives are being pursued to curb pollution and protect school-going children from vehicular pollution. For instance, the U.S. government’s Clean School Bus program envisages the U.S. Environmental Protection Agency (EPA) covering up to 100% of the cost of replacing incumbent school buses with zero-emission school buses, including the cost of vehicles and the charging infrastructure. OEMs are particularly focusing on the 30-50-seater variants, typically by integrating low-emission technologies or improving the range of electric buses by adding extra battery packs.

The more than 50 seats segment is projected to grow at a significant CAGR over the forecast period. The growing preference for bus rapid transit systems in line with the unabated increase in urban population is expected to drive the growth of the segment. Bus rapid transit systems combine the speed and capacity of metro services to offer affordable and flexible commutes. Buses with more than 50 seats are used for tourism purposes, especially for long travels as well as for sightseeing and pick-and-drop schedules during long-distance travel.

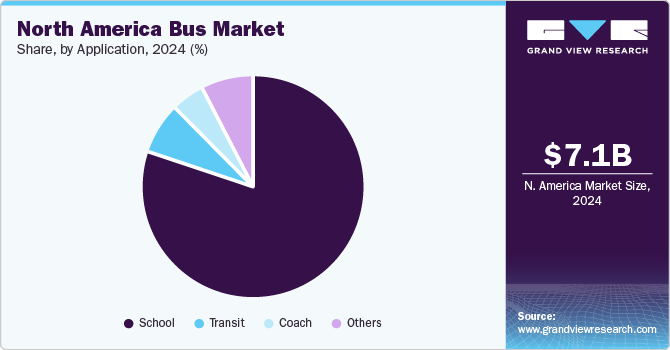

Application Insights

The school segment dominated the market in 2024. Factors such as refurbishment and replacing existing fossil fuel-powered bus fleets with electric ones are expected to support segmental growth over the forecast period. Schools in various U.S. states, including Illinois, New York, Virginia, Florida, and California, are committed to increasing the use of electric school buses. California is already leading the way in the adoption by deploying over 1,000 electric school buses across the state. Similarly, in April 2022, New York Governor Kathy Hochul reached an agreement on a USD 220 billion state budget with legislators, which includes the goal of having around 50,000 of the state's school buses run on electricity by 2035.

The transit segment is projected to grow at a significant CAGR over the forecast period. Transit buses are emerging as the preferred choice for long-distance commuters, who are increasingly relying on these buses to meet their transportation needs. The bus ridership is typically growing in the U.S., especially in the federal district of Washington DC and the state of New York, among other areas.

Country Insights

U.S. Bus Market Trends

The U.S. bus market held a dominant position in the North America region in 2024. The growing traction of buses in the U.S. is attributed to the revamping of highway infrastructure throughout the country, the electrification of public transit bus fleet by the different state governments, growing investment towards bus charging infrastructure, the development of electric bus fleet by private transit service operators and aggressive investment by the school and federal government to electrify school buses fleet with the country. The electrification efforts, coupled with technological development in diesel engines, electric motors, and hydrogen fuel cell technology, are expected to augment the market growth.

Canada Bus Market Trends

Canada bus industry is expected to grow at the fastest CAGR over the forecast period. Canada is also undertaking initiatives for the deployment of electric buses in the country. For instance, in January 2023, the mayor of Ottawa announced USD 350 million in federal funding to purchase 350 electric buses and install the charging infrastructure for the bus fleet in Ottawa. The region is also witnessing a trend of private transit entities in Canada electrifying their vehicle fleets in association with major bus manufacturers present in Canada, which is further driving the market growth.

Key North America Bus Company Insights

Some of the key companies in the North America bus industry include Blue Bird Corporation, NFI Group, Daimler AG, Navistar Inc., AB Volvo, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies. For instance, leading manufacturers are expanding their product portfolios by integrating advanced electric and autonomous technologies to cater to the growing demand for sustainable and efficient transportation solutions.

-

NFI Group operates through its subsidiaries, which have an exhaustive line of electric and ICE fuel-based buses. In North America, the company operates in the U.S. and Canada, supplying buses to transit authorities across the region. The company follows an electrification trend like other manufacturers; however, it collaborates with prominent bus manufacturers, such as BYD, to leverage their expertise and technologies. The company is actively undertaking product enhancements and conducting trials for autonomous buses.

-

Navistar Inc. has a strong presence in North America and Canada and has established a strong distribution and services network in the region. To maintain a strong presence in the local community, the manufacturer actively organizes training programs for its dealers and provides scholarships for education. IC Bus, the company’s subsidiary, launched electric buses and collaborated with charging service and infrastructure providers.

Key North America Bus Companies:

- AB Volvo

- Anhui Ankai Automobile Co., Ltd.

- Blue Bird Corporation

- BYD Company Limited

- Daimler AG (Mercedes-Benz Group AG)

- Iveco SpA

- Man Se

- NAVISTAR (Traton Group)

- NFI Group

- Proterra Inc.

Recent Developments

-

In January 2024, BLUE BIRD CORPORATION delivered twenty-three electric school buses to Carter County Schools (CCS) in Kentucky. This marks a new era for the school district, replacing traditional diesel buses with zero-emission alternatives. These buses produce zero tailpipe emissions, significantly contributing to cleaner air for students, communities, and the environment.

-

In January 2024, Group Keolis S.A.S. announced two major contracts to operate and maintain bus networks in Phoenix (Arizona) and Austin (Texas). These contracts solidify Keolis's position as a major player in the US public transportation market. They will expand access to reliable and efficient public transportation in both Phoenix and Austin. The use of natural gas and electric buses in these networks demonstrates Keolis's commitment to sustainability.

North America Bus Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.73 billion

Revenue forecast in 2030

USD 13.16 billion

Growth Rate

CAGR of 11.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in units, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, fuel, seat capacity, application, country

Country scope

U.S.; Canada; Mexico

Key companies profiled

AB Volvo; Anhui Ankai Automobile Co., Ltd.; Blue Bird Corporation; BYD Company Limited; Daimler AG (Mercedes-Benz Group AG); Iveco SpA; Man Se; NAVISTAR (Traton Group); NFI Group; Proterra Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Bus Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America bus market report based on type, fuel, seat capacity, and country.

-

Type Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Single Deck

-

Double Deck

-

-

Fuel Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Diesel

-

Electric and Hybrid

-

Other Fuel

-

-

Seat Capacity Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

15-30 Seats

-

31-50 Seats

-

More Than 50 Seats

-

-

Application Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Transit

-

School

-

Coach

-

Others

-

-

Country Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America bus market size was valued at USD 7.13 billion in 2024 and is expected to reach USD 7.73 billion in 2025.

b. The North America bus market is expected to grow at a compound annual growth rate of 11.2% from 2025 to 2030 to reach USD 13.16 billion by 2030.

b. The single deck segment accounted for the largest market share of 92.8% in 2024. The segmental growth is attributed to investment by the American and Canadian governments to improve road transportation networks for interstate and intercity travel through single-deck buses.

b. The key players operating in the North America bus market include: AB Volvo, Anhui Ankai Automobile Co., Ltd., Blue Bird Corporation, BYD Company Limited , Daimler AG (Mercedes-Benz Group AG ), Iveco SpA, NAVISTAR (Traton Group), NFI Group, Proterra Inc., and REV Group, Proterra Inc.

b. Factors such as the replacement and revamping of American and Canadian public transit fleets are driving the North America bus market growth. The growing popularity of electric buses for intracity travel and school commuting is expected to fuel the expansion of the North America bus market. The usage of buses in airports, government facilities, and luxury tourism is further anticipated to support the North America bus market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.