- Home

- »

- Automotive & Transportation

- »

-

Buses Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Buses Market Size, Share & Trends Report]()

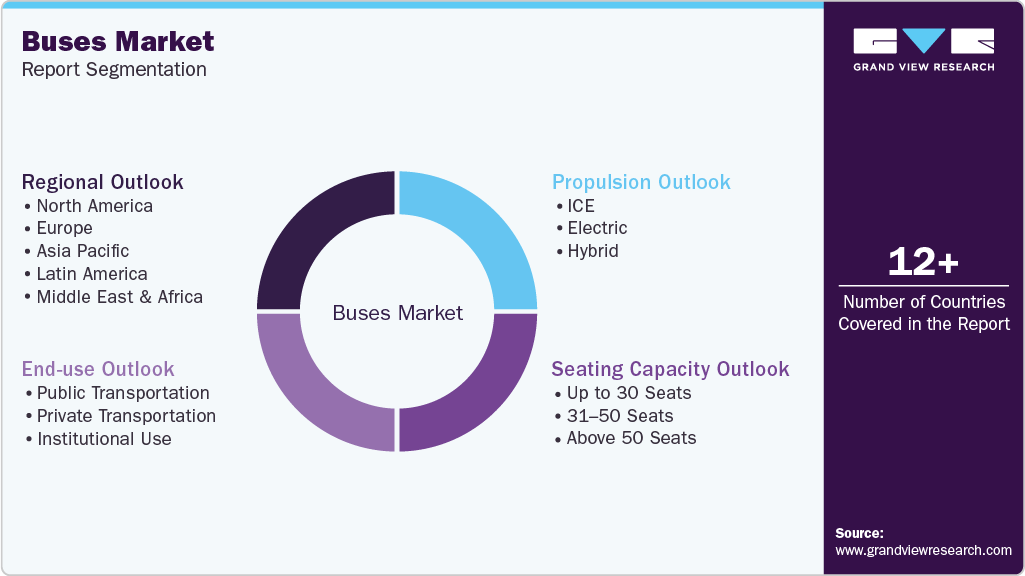

Buses Market (2026 - 2033) Size, Share & Trends Analysis Report By Propulsion (ICE, Electric, Hybrid), By Seating Capacity (Up To 30 Seats, 31-50 Seats, Above 50 Seats), By End Use (Public Transportation, Private Transportation), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-930-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Buses Market Summary

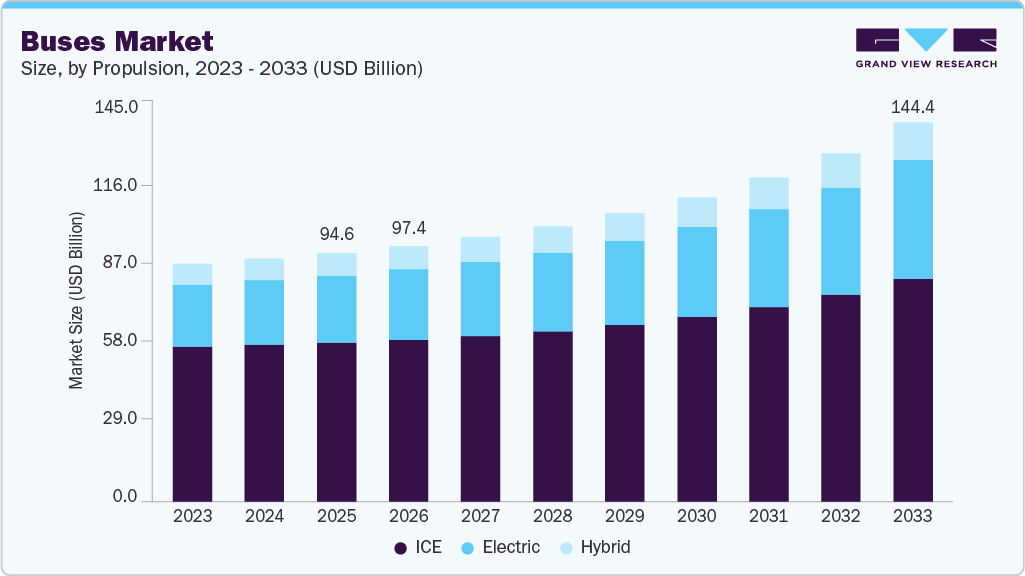

The global buses market size was estimated at USD 94.62 billion in 2025, and is projected to reach USD 144.42 billion by 2033, growing at a CAGR of 5.8% from 2026 to 2033. The buses industry is experiencing steady growth driven by rapid urbanization, rising population density in cities, and increasing demand for efficient mass transportation systems.

Key Market Trends & Insights

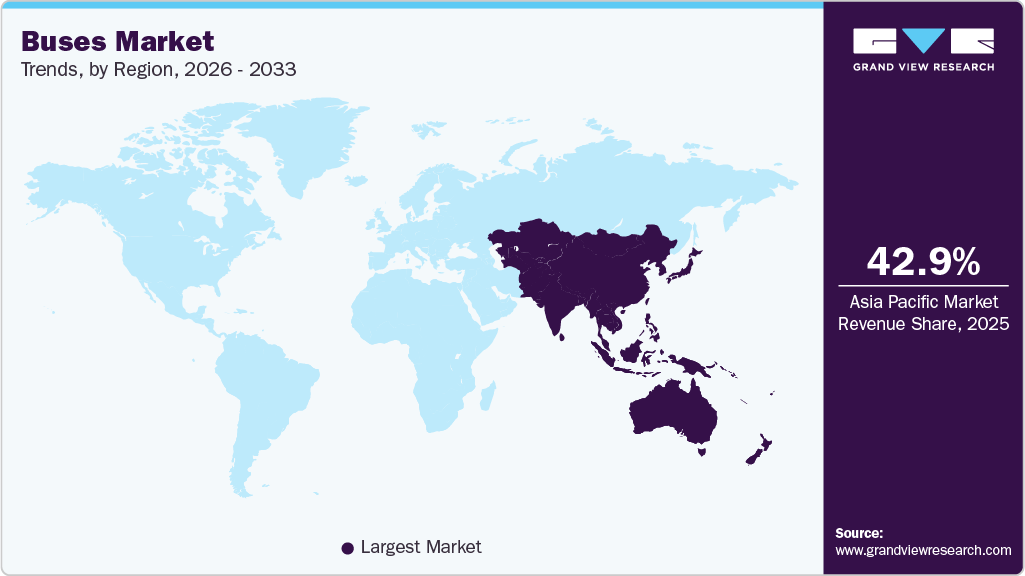

- Asia Pacific dominated the global buses market with the largest revenue share of 42.9% in 2025.

- The buses industry in the China accounted for the largest market revenue share in 2025.

- By propulsion, the ICE segment led the market with the largest revenue share of 63.8% in 2025.

- By seating capacity, the 31-50 seats segment accounted for the largest market revenue share in 2025.

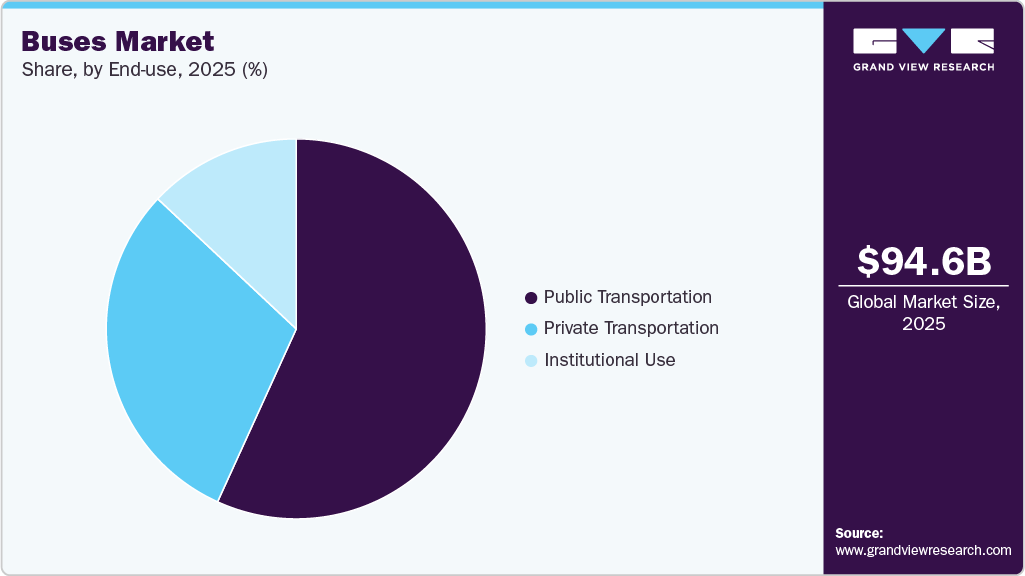

- By end use, the public transportation accounted for the largest market revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 94.62 Billion

- 2033 Projected Market Size: USD 144.42 Billion

- CAGR (2026-2033): 5.8%

- Asia Pacific: Largest market in 2025

Governments across developed and emerging economies are prioritizing the expansion of public transport to reduce traffic congestion, lower carbon emissions, and improve access to mobility. Growth in intercity and long-distance travel, supported by tourism and regional connectivity initiatives, is also contributing to higher demand for coaches and luxury buses. In addition, replacement demand for aging bus fleets, particularly in Europe and North America, continues to support market expansion.Technological advancements are reshaping the buses industry, with a strong shift toward electrification, automation, and digital integration. Electric and hybrid buses are gaining traction due to improvements in battery energy density, charging infrastructure, and total cost of ownership. Manufacturers such as BYD Auto and Yutong Bus are leading innovation in zero-emission buses, while European players are focusing on hydrogen fuel-cell and connected bus technologies. Advanced driver-assistance systems (ADAS), telematics, fleet management software, and predictive maintenance solutions are increasingly being integrated to enhance safety, operational efficiency, and uptime.

Investments in the bus market are being driven by large-scale public procurement programs, private operator fleet expansion, and strategic partnerships between OEMs and technology providers. Governments and municipal transportation authorities are allocating substantial budgets toward the adoption of electric buses and the development of charging infrastructure. Private investments and funding are also increasing in areas such as battery manufacturing, hydrogen ecosystems, and digital mobility platforms. In emerging markets, investments are focused on expanding production capacity and localization, with companies such as Tata Motors and Ashok Leyland strengthening their domestic and export-oriented bus portfolios.

Despite positive growth prospects, the bus market faces several restraints. High upfront costs associated with electric and hydrogen buses, along with the need for charging or refueling infrastructure, can limit adoption, especially in cost-sensitive markets. Budget constraints faced by public transport authorities often delay procurement cycles. Supply chain disruptions, volatility in raw material prices, and dependence on battery supply further impact manufacturing costs and margins.

Propulsion Insights

The ICE segment led the market with the largest revenue share of 63.8% in 2025. The ICE segment continues to witness growth in the buses industry due to its cost-effectiveness, operational reliability, and widespread fueling infrastructure. Diesel and CNG buses remain the preferred choice in many emerging economies where budget constraints, long route distances, and limited charging infrastructure make large-scale electrification challenging. Transit authorities and private fleet operators favor ICE buses for intercity and long-haul applications, where refueling speed and extended driving range are critical.

The electric segment is expected to grow at the fastest CAGR during the forecast period. The electric bus segment is witnessing rapid growth driven by global decarbonization goals, supportive government policies, and declining battery costs. Urban transport authorities are increasingly adopting electric buses to reduce greenhouse gas emissions, improve air quality, and lower long-term operating expenses. Subsidies, grants, and favorable procurement policies are accelerating adoption, particularly in China, Europe, and parts of North America. Technological advancements in battery energy density, fast-charging systems, and fleet management software are improving vehicle range and operational efficiency, making electric buses viable for daily urban routes.

Seating Capacity Insights

The 31-50 seats segment led the market with the largest revenue share of 55.4% in 2025. The 31-50 seats segment is growing steadily due to its optimal balance between passenger capacity, operational efficiency, and route versatility. Mid-size buses are widely deployed for city transit, intercity routes, airport shuttles, and tourism, where moderate passenger volumes and comfort requirements are critical. Public transport authorities favor this segment for replacing aging standard buses while improving fuel efficiency and service frequency. The segment is also benefiting from increased adoption of electric and alternative-fuel powertrains, which are more economically viable in mid-capacity buses.

The up to 30 seats segment is expected to grow at the fastest CAGR during the forecast period. The up to 30-seat segment is witnessing strong growth driven by rising demand for flexible and cost-efficient mobility solutions across urban, suburban, and rural areas. Minibuses and microbuses are increasingly used for feeder services, last-mile connectivity, employee transportation, school transport, and tourism applications due to their ability to operate efficiently on narrow roads and low-demand routes. Lower acquisition and operating costs compared to larger buses make this segment attractive for private operators and small fleet owners.

End Use Insights

The public transportation segment accounted for the largest market revenue share in 2025. The public transportation segment is experiencing sustained growth, driven by rapid urbanization, increasing daily commuter volumes, and government initiatives aimed at strengthening mass transit systems. Municipal and state transport authorities are expanding and modernizing bus fleets to reduce traffic congestion, improve last-mile connectivity, and offer affordable mobility solutions. Increased investments in bus rapid transit (BRT) corridors and smart city programs are further accelerating demand for city and mid-size buses. Strong policy support in the form of subsidies, low-interest financing, and incentives for electric and CNG buses is encouraging large-scale procurement.

The private transportation segment is projected to grow at the fastest CAGR of 7.1% over the forecast period. The private transportation segment is growing steadily due to increasing demand for flexible, reliable, and service-oriented mobility solutions. Expansion of corporate employee transportation, school and college transport services, tourism, and intercity travel is driving fleet additions by private operators. Rising disposable incomes and growth in domestic tourism are supporting higher demand for premium and luxury coaches, particularly on long-distance routes. Private operators are also investing in technologically advanced buses to enhance passenger comfort, safety, and operational efficiency.

Regional Insights

The buses market in North America held a significant share in 2025. The North America bus market is characterized by steady replacement demand, fleet modernization programs, and increasing adoption of low- and zero-emission buses. Public transit agencies are prioritizing electric and hybrid buses to meet emission reduction targets and enhance urban air quality.

U.S. Buses Market Trends

The buses market in the U.S. held a dominant position in North America in 2025, driven by federal and state funding for public transportation infrastructure. Programs supporting the deployment of electric buses and charging infrastructure are accelerating the electrification of fleets across major cities. Demand remains strong for transit buses, school buses, and intercity coaches, driven by the need to replace aging fleets.

Europe Buses Market Trends

The buses industry in Europe was identified as a lucrative region in 2025. The Europe bus industry is driven by stringent emission regulations, strong public transport usage, and aggressive decarbonization targets. Governments across the region are actively transitioning city bus fleets toward electric and hydrogen-powered models.

The UK buses market is expected to grow at a rapid CAGR during the forecast period, amid government-backed funding programs aimed at zero-emission public transport. Local transport authorities are increasingly procuring electric buses to meet net-zero targets and improve service reliability. Strong demand is observed in urban and regional transit, supported by investments in fleet renewal and enhancements to the passenger experience.

The buses industry in German held a substantial market share in 2025. Germany plays a pivotal role in the European market, supported by advanced manufacturing capabilities and strong policy support for clean mobility. The country is witnessing rising adoption of electric and hydrogen fuel-cell buses, particularly in city transit applications.

Asia Pacific Buses Market Trends

Asia Pacific dominated the global buses market with the largest revenue share of 42.9% in 2025 and is e. The growth in the region is driven by rapid urbanization, expanding public transport networks, and rising population density. Governments across the region are investing heavily in city bus fleets to address congestion and mobility challenges.

The buses industry in India is expected to grow at a rapid CAGR in the coming years, fueled by increasing urban transit demand, government-led public transport initiatives, and the replacement of aging fleets. State transport undertakings are investing in electric and CNG buses to reduce operating costs and emissions. Growth in intercity travel, employee transportation, and school bus services is further supporting demand.

The China bus market held a substantial market share in Asia Pacific in 2025. Large-scale urban transit systems and extensive deployment of electric buses drive the growth in the region. Strong government support, subsidies, and domestic manufacturing capabilities have enabled the rapid electrification of city bus fleets. The country also serves as a major exporter of buses and related technologies to global markets.

Key Buses Company Insights

Some of the key companies in the buses industry include Yutong Bus Co., Ltd., Tata Motors Limited, ASHOK LEYLAND, AB Volvo, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Yutong Bus Co., Ltd., headquartered in Zhengzhou, China, traces its origins to 1963 as the Zhengzhou Bus Repair Factory and was formally established in 1993. It has since evolved into the bus manufacturer, holding a dominant position in China's market. The company produces a wide range of vehicles, including city buses, coaches, electric and hybrid models, and special-purpose buses, achieving annual production capacities exceeding 35,000 units and exporting to over 40 countries across Europe, Africa, Latin America, and beyond.

-

AB Volvo, through its Volvo Buses subsidiary, offers a comprehensive portfolio of heavy-duty city buses, coaches, chassis, and electric models for public transportation across Europe, North and South America, Asia, and Australia. The division emphasizes sustainability with advanced electric and hybrid buses, such as the Volvo 7900 Electric and BZL series, which incorporate autonomous features such as sensors, navigation, and AI-driven operations for enhanced safety and efficiency. Production facilities are located in India (Bangalore) and include legacy plants, including the former Irvine, Scotland location. Volvo Buses supports global operators with services, I-Shift gearboxes, ESP stability systems, and fuel-efficient D8K engines, as seen in platforms such as the Volvo 9600 launched in India for luxury inter-city travel, aligning with Volvo Group's broader commitment to zero-emission public mobility.

Key Buses Companies:

The following are the leading companies in the buses market. These companies collectively hold the largest market share and dictate industry trends.

- Yutong Bus Co., Ltd.

- Tata Motors Limited

- ASHOK LEYLAND

- AB Volvo

- BYD Company Limited

- Scania

- MAN

- Xiamen King Long International Trading Co., Ltd.

- New Flyer

- Daimler Truck AG

Recent Developments

-

In October 2025, Volvo Buses formed a strategic partnership with Marcopolo to bolster its European coach portfolio by offering complete premium coaches, combining Volvo's B13R chassis from Sweden with Marcopolo's Paradiso G8 1200 body from Brazil. These coaches are available in 4x2 and 6x2 configurations through Volvo's dealer networks in France and Italy. This collaboration enhances flexibility for local operators by integrating Volvo's chassis technology, known for its quality, safety, and comfort, with Marcopolo's modern design, while undergoing homologation for European standards on safety, durability, and cybersecurity.

-

In October 2024, Ashok Leyland, a commercial vehicle manufacturer and Hinduja Group flagship, has signed a Memorandum of Understanding (MoU) with FlixBus India, a travel-tech firm focused on affordable and sustainable mobility, to revolutionize inter-city bus travel through advanced chassis access, after-sales services, and technology integration for FlixBus partners. The partnership emphasizes high-capacity vehicles that prioritize safety, performance, low total cost of ownership, and eco-friendly innovations to support FlixBus's rapid expansion, which has already served over 300,000 passengers, achieving sixfold revenue growth since its launch, across regions such as South India (Bangalore, Hyderabad, Chennai) and beyond.

Buses Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 97.41 billion

Revenue forecast in 2033

USD 144.42 billion

Growth Rate

CAGR of 5.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report seating capacity

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Propulsion, seating capacity, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Yutong Bus Co., Ltd.; Tata Motors Limited; ASHOK LEYLAND; AB Volvo; BYD Company Limited; Scania; MAN; Xiamen King Long International Trading Co.,Ltd.; New Flyer; Daimler Truck AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Buses Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global buses market report based on propulsion, seating capacity, end use, and region:

-

Propulsion Outlook (Revenue, USD Million, 2021 - 2033)

-

ICE

-

Electric

-

Hybrid

-

-

Seating Capacity Outlook (Revenue, USD Million, 2021 - 2033)

-

Up to 30 Seats

-

31-50 Seats

-

Above 50 Seats

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Public Transportation

-

Private Transportation

-

Institutional Use

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global buses market size was estimated at USD 94.62 billion in 2025 and is expected to reach USD 97.41 billion in 2026.

b. The global buses market is expected to grow at a compound annual growth rate of 5.8% from 2026 to 2033 to reach USD 144.42 billion by 2033.

b. Asia Pacific dominated the buses market with a share of 42.9% in 2025. This is significantly attributed to the higher population, and consumer preference for public transportation.

b. Some key players operating in the buses market include Yutong Bus Co., Ltd.; Tata Motors Limited; ASHOK LEYLAND; AB Volvo; BYD Company Limited; Scania; MAN; Xiamen King Long International Trading Co.,Ltd.; New Flyer; Daimler Truck AG.

b. Key factors that are driving the buses market growth include improving the public transportation sector and expanding of the road network.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.