- Home

- »

- Paints, Coatings & Printing Inks

- »

-

North America Concrete Floor Coatings Market, Industry Report, 2030GVR Report cover

![North America Concrete Floor Coatings Market Size, Share & Trends Report]()

North America Concrete Floor Coatings Market Size, Share & Trends Analysis Report By Product (Acrylic, Epoxy, Polyurethane, Polyaspartic), By Application (Outdoor, Indoor), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-401-7

- Number of Report Pages: 200

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

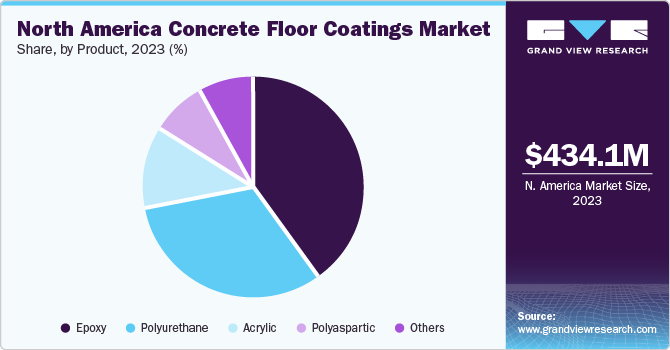

The North America concrete floor coatings market size was estimated at USD 434.06 million in 2023 and is projected to grow at a CAGR of 4.8% from 2024 to 2030. This is attributable to the rising infrastructure developments, business firms, and educational institutions majorly in the U.S. The country contributed the maximum share of the product market owing to abundant resources and buying power, which, in turn, is expected to drive the market growth.

Floor coatings are widely used in residential, industrial, and commercial applications owing to properties, such as corrosion & thermal shock resistance, moisture, and chemicals. They are used to increase the shelf life of the floor reducing the maintenance requirements along with providing decorative aspects and protection.

Various rules are applicable for the manufacturing of coatings, due to the carcinogenic and flammable nature of solvents. However, powder-based products are eco-friendly as they contain no solvents and hence do not lead to volatile organic compounds (VOCs), emissions of which cause air pollution. Moreover, powder-based products are gaining popularity as they have an advantage over other products, in terms of environmental regulations, given their solvent-free and VOC-free nature. This is likely to propel the market growth over the coming years.

In addition, the increasing consumer spending across end-use industries is expected to support market growth. These products are used in indoor and outdoor applications of residential, commercial, and industrial structures, such as waste disposable systems, stadiums, and religious monuments. Indoor applications include basements, garages, and interiors of residential and commercial buildings. Outdoor applications comprise pavements, sports stadiums, floors of waste disposable systems, and religious monuments.

Epoxy, polyurethane (PU), and polyaspartic are the majorly used products as concrete floor coatings in North America. Epoxy-based products include solids, solvent-borne, and water-based products. Furthermore, PU-based products cover moisture cure, solvent-borne, solids, and water-based products. Other product types include polyuria-based coatings.

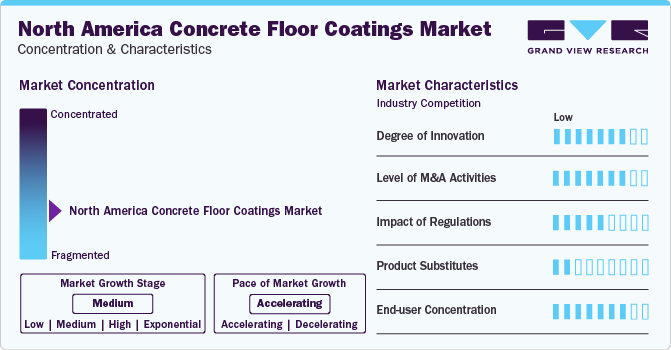

Market Concentration & Characteristics

The North America concrete floor coatings market demonstrates characteristics akin to a fragmented landscape. with the presence of various key players, such as Henkel AG & Co. KGaA, The Tennant Company, BASF SE, The Sherwin-Williams Company, PPG Industries, Inc. Axalta Coatings Systems, and Jotun, with some other small and medium regional players from all over the world.

Market growth stage is medium, and the pace of its growth is accelerating. The product market is characterized by a high degree of innovation. Ongoing research and development activities in the field of nanocoatings, powder coatings, and concrete coatings installation, among others, drive innovations in production and application.

The manufacturing and utilization of concrete floor coatings are subject to a myriad of regulations and standards aimed at safeguarding the safety and quality of these products. These regulations are designed to uphold human safety and environmental safety. While regulatory specifics may diverge depending on country or region, there exist overarching regulatory frameworks governing the industry. Key regulatory bodies and organizations overseeing the market include the U.S. Federal Regulations, OSHA, EU, REACH, U.S. Coatings Association, and U.S. EPA, among others.

End-user concentration plays a pivotal role in shaping the dynamics of this market. With a multitude of product manufacturers increasingly incorporating these products into their formulations, there's a tendency towards larger volume purchases. This trend can engender economies of scale for suppliers of the product, potentially yielding cost efficiencies in both production and distribution processes. Moreover, heightened end-user concentration often fosters enduring relationships between suppliers of the product and major players in the end-use industries. This stability lays the groundwork for collaborative ventures, mutual comprehension, and the establishment of enduring business partnerships.

Application Insights

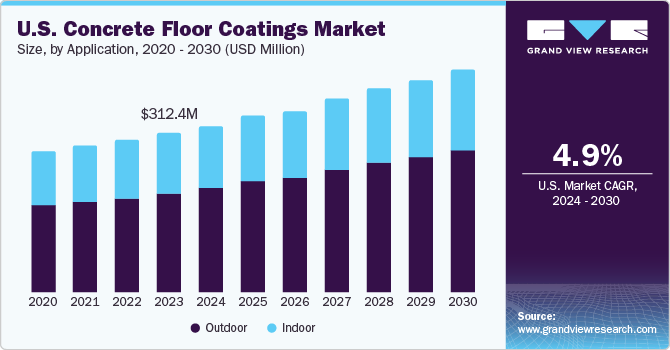

The outdoor applications segment dominated the market with a revenue share of 61.41% in 2023. The rising establishments of sports stadiums on account of the growing popularity of sports, such as football, rugby, ice hockey, and tennis, in the U.S. and Canada is anticipated to promote the role of flooring solutions. In addition, a change in urban lifestyle, increasing preference for concrete floors, and rising awareness regarding safety in commercial parking areas are creating product demand.

The indoor applications segment includes basements, garages, and interiors of residential and commercial buildings. The increasing application scope of floor coatings in sectors, such as industrial and commercial applications, on account of excellent heat and wear resistance is projected to boost product demand in indoor applications over the next seven years.

Product Insights

The epoxy product segment dominated the market and accounted for a share of approximately 40.03% in 2023. Epoxy-based products exhibit properties, such as excellent adhesion, heat and chemical resistance, and favorable electrical insulation, which have led to their increased popularity in formulations of these products. In addition, lower costs of epoxy-based products compared to their counterparts are expected to have a favorable impact on the market growth. Polyurethane concrete floor coatings are available in both solvent- and water-based formulations. These products offer high flexibility and abrasion, corrosion, & wear resistance, thus, paving their way for use as flooring solutions in residential, commercial, and industrial sectors.

In addition, PU coatings have high UV stability, which is anticipated to fuel their demand over the forecast period. However, the growing application scope of PU in adhesives & sealants for the automotive and construction industries across the region is anticipated to impact raw material availability for the production of PU-based products. Polyaspartic concrete floor coatings can perform at a wide range of temperatures. In addition, they exhibit properties, such as fast curing and high UV stability, which have helped increase their popularity. The aforementioned properties of polyaspartic-based products are anticipated to play a pivotal role in segment growth.

Country Insights

U.S. Concrete Floor Coatings Market Trends

The U.S. concrete floor coatings marketdominated the overall regional market and accounted for a share of 71.98% share in 2023. This high share is attributable to increased demand for green buildings, and subsequent rise in construction activities, owing to the rising awareness about the benefits associated with it coupled with increasing concern over sustainability. This, in turn, is projected to create a high demand for concrete floor coatings.

Canada Concrete Floor Coatings Market Trends

The concrete floor coatings market in Canadaisexpected to witness significant growth from 2024 to 2030. Positive economic outlook and growth in the residential as well as non-residential construction sectors are expected to create an opportunity for concrete floor coating manufacturers as well as contractors and service providers across Canada. However, uncertainty around the trade relationships with the United States is the biggest threat to the Canadian economy and, consequently to the construction sector. Another potential risk is the Canadian high household debt, making households more vulnerable to an economic or interest rate shock.

Mexico Concrete Floor Coatings Market Trends

The Mexico concrete floor coatings market isprojected to have steady growth over the forecast period. The product consumption in Mexico is primarily dependent upon the growth of the residential as well as non-residential construction sectors. The construction industry in Mexico has witnessed variable growth over the past few years, and a low growth, owing to several internal as well as external factors. These factors primarily include a decline in crude oil prices, global economic conditions, etc.

Key North America Concrete Floor Coatings Company Insights

The market is fragmented in nature with the presence of several key players, such as Henkel AG & Co. KGaA, The Sherwin-Williams Company, BASF SE, and PPG Industries, Inc. The players face intense competition from each other as well as from regional players, who have strong distribution networks and good knowledge about suppliers and regulations.

-

The Sherwin-Williams Company was formed in 1866 and is headquartered in Cleveland, Ohio the U.S. It is engaged in the manufacturing and distribution of paints, stains, and coatings for professionals, and industrial, commercial, retail, and marine industries. The company has categorized its business into three segments, namely the Americas Group, Consumer Brands Group, and Performance Coatings Group

-

North American Coating Solution was established in 1997 and is headquartered in Michigan, U.S. The company provides installation services for epoxy floors and concrete polishing services. It also provides services like repairing of the concrete floors, epoxy floor removal, industrial painting, and garage floor coating. In addition, it offers epoxy floor coatings, which have good chemical-resistant properties and are used to fill the cracks in floors. The company is an installer and does not have any products of its own

Vanguard Concrete Coatings, Tennant Coatings, Jotun, and Elite Crete Systems are some of the emerging companies in the North America concrete floor coatings market.

-

Headquartered in Michigan, U.S., Vanguard Concrete Coating was established in 2000. The company offers services for resinous floor coating, concrete floor polishing, decorative floor coating, and epoxy floor coating. It is a certified installer of major coating manufacturers, including Sherwin-Williams, Tennant, Akzo Noble, DuPont, BASF, and Key Resin Company. Resinous floor coatings offered by the company provide excellent chemical resistance and are used in places that require waterproofing and safety from chemical or physical damage. The company also offers decorative concrete flooring, which enhances finishing along with protection

-

Headquartered in Indiana, U.S., Elite Crete Systems was founded in 1986. The company develops and manufactures products for engineered surfaces and flooring. It provides flooring solutions to automotive, aviation & aerospace, education, healthcare & medical, hospitality & entertainment, residential, retail, and warehousing industries. Some of the clients of the company are Bend Distillery, Nissan Dealership, and Mermaid Winery

Key North America Concrete Floor Coatings Companies:

- TruCrete Surfacing Systems

- The Sherwin-Williams Company

- North American Coating Solution

- Henkel AG & Co. KGaA

- BASF SE

- Vanguard Concrete Coating

- Tennant Coatings

- Jotun

- Axalta Coating Systems

- Elite Crete Systems

- Stonhard

- PPG Pittsburgh Paints

- Key Resin Company

- BEHR Process Corporation

- EPMAR Corporation

- Pratt & Lambert

- Dex-O-Tex

- Florock

- Garland Industries, Inc.

- Tnemec

- Cornerstone Coatings

- Westcoat Specialty Coating Systems

- Versatile Building Products

Recent Developments

-

In December 2023, United Floor Coatings launched its novel product line of polyaspartic and epoxy-based coating products. These innovative coatings are designed to provide high quality, durability, and protection for industrial, commercial, and residential floors

-

In January 2023, Sika launched MB EZ Rapid, a single component rapid drying moisture barrier, adhesion promoter, and substrate consolidator for all floors

-

In June 2023, MaxHome, one of the leading providers of advanced floor coatings, launched its novel garage floor coating and concrete floor coating products. These products are specifically developed to offer extraordinary durability and protection to the floors of residential spaces

North America Concrete Floor Coatings Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 453.43 million

Revenue forecast in 2030

USD 602.40 million

Growth rate

CAGR of 4.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

May 2024

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, country

Country scope

U.S.; Canada; Mexico

Key companies profiled

TruCrete Surfacing Systems; The Sherwin-Williams Company; North American Coating Solution; Henkel AG & Co. KGaA; BASF SE; Vanguard Concrete Coating; Tennant Coatings; Jotun; Axalta Coating Systems; Elite Crete Systems; Stonhard; PPG Pittsburgh Paints; Key Resin Company; BEHR Process Corp.; EPMAR Corp.; Pratt & Lambert; Dex-O-Tex; Florock; Garland Industries, Inc.; Tnemec; Cornerstone Coatings; Westcoat Specialty Coating Systems

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Concrete Floor Coatings Market Report Segmentation

This report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America concrete floor coatings market report based on product, application, and country:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Epoxy

-

Polyurethane

-

Polyaspartic

-

Acrylic

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Indoor

-

Outdoor

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America concrete floor coatings market size was estimated at USD 434.06 million in 2023 and is expected to reach USD 453.43 million in 2024.

b. The North America concrete floor coatings market is expected to grow at a compound annual growth rate of 4.8% from 2024 to 2030 to reach USD 602.40 million by 2030.

b. The U.S. dominated the North America concrete floor coatings market with a share of 71.98% in 2023. This is attributable to the robust infrastructure of commercial and residential structures and high penetration of manufacturing facilities of automotive, FMCG, pharmaceutical, food & beverage, and oil & gas sectors in the country.

b. Some key players operating in the North America concrete floor coatings market include Henkel AG & Co. KGaA, The Sherwin-Williams Company, BASF SE, Jotun, The Tennant Company, Axalta Coating Systems, Stonhard, Inc., Behr Paint Company, and PPG Industries, Inc.

b. Key factors that are driving the North America concrete floor coatings market growth include North America concrete floor coatings application for resilient floorings and soft coverings, and its rising application in residential and commercial buildings.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."