- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Floor Coatings Market Size, Share & Growth Report, 2030GVR Report cover

![Floor Coatings Market Size, Share & Trends Report]()

Floor Coatings Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Epoxy, Polyaspartic), By Application (Concrete, Wood), By Component, By End-use (Residential, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-348-5

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Floor Coatings Market Size & Trends

The global floor coatings market size was estimated at USD 3.42 billion in 2024 and is projected to grow at a CAGR of 6.9% from 2025 to 2030. The market is expected to witness substantial growth over the forecast period owing to the rising construction industry and increasing use of coatings in commercial, industrial, and residential applications. The product is applied to wood, terrazzo, concrete, and other types of floors to protect them from corrosion, thermal shock, moisture, and chemicals. They are majorly used to enhance the shelf life of the floor and provide decorative aspects, low maintenance, and protection.

The growing construction industry, especially in emerging economies such as China and India, is enormously contributing to the growth of the product market. Properties such as excellent abrasion resistance, fast drying and curing, chemical resistance, and low cost are fueling the product demand in end use applications. The global construction industry is one of the major consumers of coatings worldwide, accounting for over 40% of the global demand for coatings in 2023.

The value chain of the product market comprises raw material suppliers, manufacturers, third-party distribution channels, and end use industries. The initial stage of the value chain focuses on procuring the necessary raw materials to produce the product. Critical raw materials for synthesizing the product include pigments, resins, solvents, extenders, and additives.

Resins, pigments, solvents, and additives are among the major raw materials used to manufacture the product. As per the American Coating Association, the raw materials used in the manufacturing of coatings represented a relatively small (~5%) but essential component of the USD 4.5 trillion global chemicals industry in 2022.

Companies such as Akzo Nobel N.V., PPG Industries, Inc., and The Sherwin-Williams Company benefit from their integration across the value chain. This allows them to adapt quickly to changes in consumer demand and competitor movements. Their backward integration helps lower operational costs by providing in-house access to raw materials.

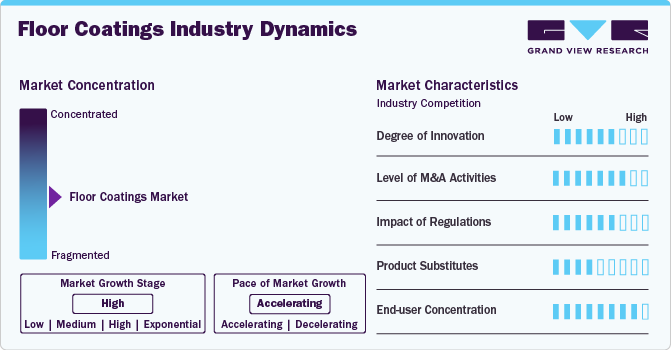

Market Concentration & Characteristics

The market is moderately fragmented, with players aiming to achieve optimum business growth and strong market positioning through production capacity expansions, new product development, acquisition, collaboration, partnership, and investments in research and development. For instance, in 2023, Arkema acquired ARC Building Products. This acquisition is intended to strengthen Arkema’s position in the building materials sector and expand its product portfolio. The deal aligns with Arkema’s strategic focus on growth and innovation in key markets.

PPG Industries, Inc., The Sherwin-Williams Company, Axalta Coating Systems, LLC, and Akzo Nobel N.V. are among the top manufacturers in the product market. These companies have a stronghold in the emerging markets of Asia Pacific, Africa, and the Middle East while exporting their products to various end-use applications such as architectural, decorative, protective, and marine applications in these regions.

These companies are continuously engaged in research & development activities and focus on new product development to meet the growing demand from various end use industries. For instance, in 2023, Jotun, a significant player in coatings, significantly expanded its research and development facilities for fire protection coatings. This expansion, taking place in Norway, is set to enhance the company's capabilities in developing advanced fire protection solutions.

Product Insights

The epoxy coatings segment dominated the market with a revenue share of 40.7% in 2023 owing to their widespread use on concrete floors in several industrial and commercial applications, such as warehouses, commercial and retail stores, showrooms, garages, manufacturing plants, hospitals, airplane hangars, and others.

These coatings provide a decorative and high-gloss finish and are available in a variety of colors. For decorative purposes, epoxy product type is applied on color aggregate flooring, terrazzo flooring, and chip flooring. These coatings offer an easy to clean and chemically-resistant flooring solutions, which can be applied directly over old and new concrete floors.

The polyaspartic product type is a polyurea, a group of elastomeric materials derived from a reaction between an isocyanate and a synthetic resin blend component. One of the most significant advantages of polyaspartic products is their fast-curing time and resistance to abrasion and chemical spills. Moreover, these coatings can be applied in a wide range of temperature and humidity conditions, which extends their usability in various climates.

Polyurethane product is a popular choice for both residential and industrial settings. These coatings provide a durable, versatile, and aesthetically pleasing solution for protecting and enhancing floors. Polyurethanes are highly resistant to chemicals, making them less likely to stain or fade and maintain their true color for a longer period.

Component Insights

The single-component segment dominated the market with a revenue share of 48.2% in 2023. The single-component product offers a convenient and effective solution for protecting and enhancing the durability and appearance of floors in various settings. They offer excellent adhesion to concrete floors and impart a semi-glossy finish. They are also economical, easy to apply, and impervious. Therefore, these coatings are suitable for use in parking areas, industrial facilities, warehouses, basement areas, and aircraft hangers, among others. Advancements in residential development, such as indoor playgrounds, walkways, and others, are anticipated to fuel the demand for single-component coatings.

Double-component products are advanced systems used to protect and enhance the durability of floors in various industrial, commercial, and residential applications. Unlike single-component coatings that come pre-mixed and ready to use, two-component coatings require mixing a resin (base) with a hardener (catalyst) before application. This chemical reaction initiates curing, which leads to a durable and resilient floor finish.

Triple-component products have high compression, high tensile strength, and resistance to water and chemicals. Moreover, surfaces coated with these coatings are not prone to bacterial growth, do not attract dust, and are easy to clean. The coatings are used for seamless and self-leveling floors for areas with pedestrian and light-wheeled traffic. With the growing demand for packaged foods, pharmaceuticals, and the automobile industry, coupled with the necessary infrastructure for these sectors, there is an expected increase in the demand for three-component products.

Application Insights

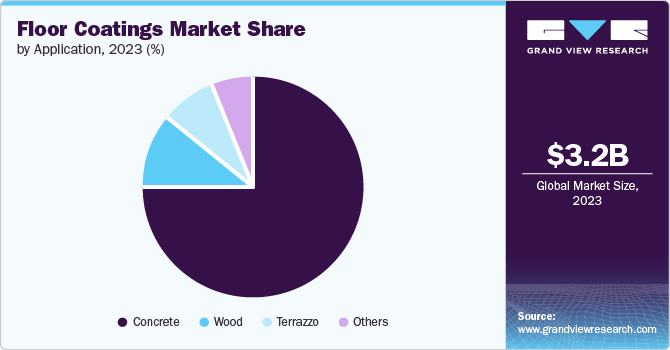

The concrete application segment dominated the market with a revenue share of 48.2% in 2023. Concrete floor coatings are specialized products applied to concrete surfaces to enhance their durability, aesthetics, and performance in various residential, commercial, and industrial settings. These coatings provide a protective layer that improves resistance to wear, abrasion, chemicals, moisture, and UV exposure, thereby extending the lifespan of concrete floors and reducing maintenance requirements.

Various coatings are designed for specific uses, such as concrete sealers, which demand minimal preparation prior to application. These sealers safeguard concrete surfaces from stains caused by food and chemicals and also simplify the cleaning process.

End Use Insights

The industrial segment dominated the market with a revenue share of 44.5% in 2023. The product is used in various industries. They are in demand from the food, chemical processing, and manufacturing industries. The demand for floor coatings from these industries is expected to grow during the forecast period owing to wear and temperature resistance, anti-slip properties, etc. offered by them.

Ongoing industrialization, along with an increasing number of infrastructure development projects and the flourishing manufacturing sector, is projected to positively impact the growth of the industrial segment of the product market over the forecast period. According to the United Nations Industrial Development Organizations, there was a 2.3% growth in industrial sectors, including manufacturing, mining, electricity generation, water supply, waste management, etc., in December 2023, thereby signaling a post-pandemic recovery worldwide.

Regional Insights

The floor coatings market in North America is expected to witness significant growth over the coming years, owing to the high demand for non-residential construction projects, such as hospitals, commercial buildings, and colleges. National policies promoting the housing sector's recovery are expected to positively impact future construction trends. Reconstruction activities in the U.S., coupled with infrastructure development in Canada and Mexico as a result of rapid industrialization, are expected to provide immense market potential in North America over the forecast period, thus increasing the demand for the product in the region.

U.S. Floor Coatings Market Trends

The floor coatings market in the U.S. is experiencing significant growth driven by the construction sector in the U.S., which is growing at a significant rate owing to positive market fundamentals for commercial real estate and a strong economy, along with rising state and federal funding for institutional buildings and public works. For instance, in March 2023, the U.S. government announced an investment worth USD 2 trillion for the development of infrastructure, including hospital buildings, roads, and other infrastructure.

Asia Pacific Floor Coatings Market Trends

The Asia Pacific floor coatings market dominated the segment with a revenue share of 41.9% in 2023, which is attributed to rising construction activities and growing demand from the construction sector in emerging countries such as India, Japan, and South Korea.

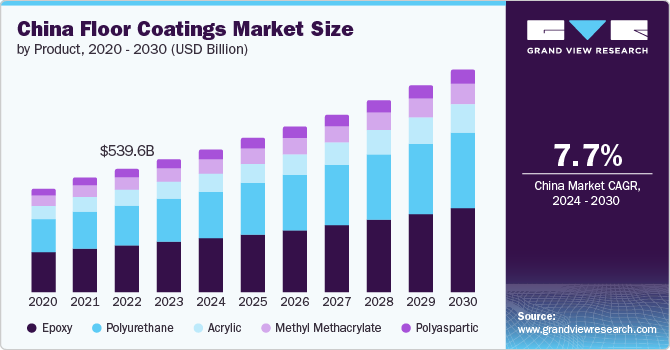

The floor coatings market in China is expected to be one of the promising markets in the Asia Pacific in the coming years due to the support of the government for promoting investments in the manufacturing sector. Several companies are expanding their existing manufacturing facilities or setting up new ones owing to low labor costs and ease of raw material procurement in China. The growing manufacturing sector is expected to contribute to the demand for the product in the country owing to the increasing construction of manufacturing units in China.

According to the ITA, China was the largest construction market in the world in 2023. The country's 14th Five-Year Plan focuses on developing new infrastructure related to transportation, energy, water systems, etc. According to the same organization, an estimated USD 4.2 trillion investment is expected in new infrastructure developments in the country between 2021 and 2025. Thus, the ongoing urbanization and the increasing infrastructure development projects are expected to boost the demand for the product in the country in the coming years.

Europe Floor Coatings Market Trends

The floor coatings market in Europe is expected to grow significantly over the forecast period due to the expanding construction sector in various countries, including the UK, Germany, France, Italy, and Spain. Moreover, the construction sector in the region is expected to grow due to increased funding from the European Union (EU), offered by governments of various countries of the region.

According to the European Parliament report, over 90% of buildings in the region were built before 1990 and over 40% before 1960. Thus, several buildings require renovations and reconstruction in Europe. The product plays a crucial role in various construction applications, such as floor insulation and waterproofing. Thus, the flourishing construction sector boosts the demand for products in the region.

The floor coatings market in Germany is expected to grow significantly over the forecast period. According to Autobei Consulting Group, Germany dominates the automotive market in Europe with 41 engine production plants reported in 2023 that contribute one-third to the total automobile production in the country. The sales of new vehicles are constantly increasing in Germany with improvements in the economy of the country. This is expected to increase the number of vehicle production units in Germany in the coming years. Thus, the expected rise in demand for industrial construction in the country in the coming years is further anticipated to fuel the growth of the market for the product in Germany over the forecast period.

Central & South America Floor Coatings Market Trends

The Central & South America floor coatings market is expected to grow substantially over the forecast period due to economic and industrial growth. Rising GDP, especially in countries such as Argentina, Brazil, and Chile, coupled with increasing disposable income, is fueling the growth of the construction sector in the region, which is anticipated to create lucrative opportunities for the product during the forecast period. The availability of cheap labor, proximity to raw material suppliers, and low production costs attract investors in the region, which is also a factor that favors market growth.

The Colombia floor coatings market is expected to grow significantly over the forecast period. Significant new investments in housing and public works are expected to boost infrastructure growth in Colombia, thereby augmenting the demand for the product over the next seven years. The Bogota Urban Renewal project consists of 50 skyscrapers, 500 high rises, a subway system, and a smart city, which are meant to establish Bogota as the technological, financial, and industrial capital of the region. Thus, the increasing number of infrastructure development projects is expected to drive the demand for the product in the region.

Brazil floor coatings market is a prominent consumer in Central & South America, and the trend will likely continue over the forecast period. Revival of the economy, coupled with the growing interest of investors in the manufacturing industries, is expected to propel the growth of the construction industry, which, in turn, is anticipated to create demand for the product in the country. In addition, the presence of various players, including BASF, AkzoNobel N.V., and Sika AG, is expected to propel market growth over the forecast period.

Middle East & Africa Floor Coatings Market Trends

The Middle East & Africa floor coatings market is expected to witness significant growth over the forecast period, due to the building & construction industry increase. The building & construction growth is majorly supplemented by economies in the Middle East, such as the UAE, Saudi Arabia, Egypt, Kuwait, and others. Rapid investment in non-oil-based sectors, such as improving manufacturing industry infrastructure in the region, is expected to fuel the growth of the construction industry, which, in turn, is anticipated to drive the product market.

The floor coatings market in Saudi Arabia is expected to witness significant growth over the forecast period due to the demand for the product in Saudi Arabia has been experiencing a significant rise, owing to several factors. First, the country's construction and architectural sector has witnessed substantial growth, driven by mega projects such as the Red Sea Project and the Qiddiya Entertainment City. These developments have increased the need for the product in various applications.

In addition, Saudi Arabia, the largest national market in the Middle East, plays a crucial role in the region's consumption and production volume of the product. The country's comprehensive reform strategy, Vision 2030, is expected to further drive growth in the medium term once fundamental improvements are completed. Overall, the combination of construction projects and mega-developments has fueled the demand for the product in Saudi Arabia.

Key Floor Coatings Company Insights

Some of the key players operating in the market include BASF SE, AKZO NOBEL N.V., Asian Paints Limited, 3M, AXALTA COATING SYSTEMS LTD., Hempel A/S, Kansai Paint Co., Ltd., Nippon Paint Holdings Co., Ltd., The Jotun Group, Arkema, PPG Industries, Inc., The Sherwin-Willams Company, The Dow Chemical Company, The Lubrizol Corporation, and Sika Group among others.

-

AKZO NOBEL N.V. is involved in manufacturing and marketing paints & performance coatings. It operates through three business segments: specialty chemicals, performance coatings, and decorative paints. Key products offered by the company include functional chemicals, industrial chemicals, pulp & performance chemicals, powder coatings, and automotive & aerospace coatings. It caters to aerospace, automotive, chemicals, household appliances, safety, furniture & flooring, marine, mining, oil & gas, packaging, and energy. The company has a global presence in 150 countries.

-

The Jotun Group formulates, produces, and distributes decorative paints and performance coatings for residential, commercial, and industrial purposes, as well as for marine, energy, and oil and gas industries. It operates through four business segments: decorative paints, protective coatings, marine coatings, and powder coatings. The company has established R&D laboratories in Norway, the UK, Türkiye, Dubai, South Korea, India, Thailand, Malaysia, China, and the U.S.

Key Floor Coatings Companies:

The following are the leading companies in the floor coatings market. These companies collectively hold the largest market share and dictate industry trends.

- Flowcrete Group Ltd.

- BASF SE

- Stonhard

- AKZO NOBEL N.V.

- Asian Paints Limited

- Terrazzo & Marble Supply

- Maris Polymers

- 3M

- Koninklijke DSM N.V.

- Michelman, Inc.

- AXALTA COATING SYSTEMS LTD.

- Chugoku Marine Paints, Ltd.

- Hempel A/S

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- Grand Polycoats

- Florock Polymer Flooring

- CPC Floor Coatings

- Tikkurila Oyj

- Teknos Group

- Mapei S.p.A.

- LATICRETE International, Inc.

- The Jotun Group

- ArmorPoxy

- Arkema

- PPG Industries, Inc.

- The Sherwin-Willams Company

- Tambour

- The Dow Chemical Company

- The Lubrizol Corporation

- Sika Group

Recent Developments

-

In July 2024, Sherwin-Williams introduced a new line of high-performance flooring systems designed for giga factories producing electric vehicle (EV) batteries. These flooring solutions offer chemical resistance, electrostatic discharge protection, moisture vapor control, and enhanced slip resistance. They are engineered to meet the specific demands of EV battery manufacturing, ensuring safety and efficiency. The systems also allow for quicker installation by reducing substrate cure time and supporting faster production ramp-up.

-

In April 2023, Dur-A-Flex launched Vent-E-A, a breathable epoxy flooring system. This new product is designed to improve floor durability and performance by allowing moisture to escape, which helps prevent damage and prolongs the lifespan of the flooring. The system addresses specific needs in various industrial and commercial applications.

Floor Coatings Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.65 billion

Revenue forecast in 2030

USD 5.11 billion

Growth rate

CAGR of 6.9% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, component, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; China; India; Japan, Australia; Brazil; Argentina; Saudi Arabia, UAE

Key companies profiled

Flowcrete Group Ltd., BASF SE, Stonhard, AKZO NOBEL N.V., Asian Paints Limited, Terrazzo & Marble Supply, Maris Polymers, 3M, Koninklijke DSM N.V.; Michelman, Inc., AXALTA COATING SYSTEMS LTD.; Chugoku Marine Paints, Ltd., Hempel A/S, Kansai Paint Co., Ltd., Nippon Paint Holdings Co., Ltd.; Grand Polycoats, Florock Polymer Flooring, CPC Floor Coatings, Tikkurila Oyj, Teknos Group; Mapei S.p.A., LATICRETE International, Inc., The Jotun Group, ArmorPoxy, Arkema, PPG Industries, Inc., The Sherwin-Willams Company, Tambour, The Dow Chemical Company, The Lubrizol Corporation, Sika Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Floor Coatings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global floor coatings market report based on product, component, application, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Epoxy

-

Polyaspartic

-

Polyurethane

-

Acrylic

-

Methyl Methacrylate

-

-

Component Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Single Component

-

Double Component

-

Triple Component

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Concrete

-

Wood

-

Terrazzo

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Industrial

-

Commercial

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global floor coatings market size was estimated at USD 3.2 billion in 2023 and is expected to reach USD 3.42 billion in 2024.

b. The global floor coatings market is expected to grow at a compound annual growth rate of 6.9% from 2024 to 2030 to reach USD 5.11 billion by 2030.

b. Epoxy product segment dominated the floor coatings market with a share of 40.7% in 2023. This is attributed to the rising product demand from various application such as commercial & retail stores, warehouses, showrooms, manufacturing plants, garages, and others.

b. Some key players operating in the floor coatings market include RPM International, Inc., Sika Group, Flowcrete Group Ltd., BASF SE, Stonhard, Akzo Nobel N.V., Asian Paints Limited, Axalta Coating Systems Ltd., Chugoku Marine Paints, Ltd., and Kansai Paint Co., Ltd.

b. Key factors that are driving the market growth include rising demand for green building, growing smart cities initiatives, and rising infrastructure development activities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.