- Home

- »

- Advanced Interior Materials

- »

-

North America And Europe PPE Distribution Market ReportGVR Report cover

![North America And Europe PPE Distribution Market Size, Share & Trends Report]()

North America And Europe PPE Distribution Market Size, Share & Trends Analysis Report By Product (Head Protection, Eye Protection, Face Protection), By End-use (Chemical, Healthcare), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-594-6

- Number of Report Pages: 137

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Report Overview

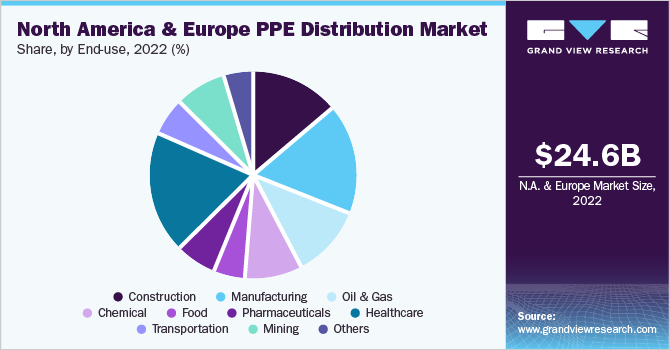

The North America and Europe PPE distribution market size was valued at USD 24.56 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.7% from 2023 to 2030. The growing concerns for ensuring employee health and safety, combined with stringent occupational regulations, are likely to drive the market over the forecast period. The growing adoption of e-commerce platforms among distributors is anticipated to further drive the growth of the personal protective equipment (PPE) distribution market over the forecast period.

Distributors play a significant role in the PPE industry. Product manufacturers are dependent on distributors to supply their products to consumers. Consolidation and globalization of PPE manufacturers have a significant impact on distributors and force them to look beyond their traditional business models of supply and distribution. To sustain the business, PPE distributors are adopting various strategies including alliances with overseas suppliers and setting up operations in different countries, which gives them easier access to tap into new markets and expand their product portfolio and service offerings.

Primary factors driving the construction industry in the U.S. include population growth, increased government spending, and private investments. Moreover, the rising demand for floor space expansion in various industries has led to the growth in new construction and renovation projects in the region. Thus, the aforementioned factors are likely to drive the demand for PPE over the forecast period and facilitate the growth of the PPE distribution market in the country.

The aftermath of the COVID-19 pandemic outbreak is likely to act as a major driver for healthcare PPE in the country. The U.S. was one of the most severely affected countries in the world by the coronavirus. In addition, several PPE manufacturing companies in the country are working closely with the government to reduce the demand-supply gap of PPE.

In the U.S., the Families First Coronavirus Response Act was implemented for protecting public health workers to curb the spread of the COVID-19 pandemic. The surge in personal protective equipment in 2020 and restrictions on imports from foreign countries boosted domestic production and distribution in the U.S. PPE market.

Moreover, according to Occupational Safety and Health Administration (OSHA), the use of personal protective equipment is expected to grow in end-use industries including chemical, construction, pharmaceutical, and healthcare. In addition, the increasing number of blue-collar workforces across numerous industrial sectors is expected to fuel PPE distribution demand.

Constant innovations, such as the introduction of comfortable, lighter, high-quality fabric industrial protective equipment are expected to bolster market growth. Market expansion is expected to be facilitated by demand for protective gears that combine safety with aesthetics and advanced technology. The increasing awareness among industry experts and players regarding the importance of the safety of employees and secure workplaces on account of the stringent regulations along with the high cost associated with workplace dangers is anticipated to boost personal protective equipment distribution demand in the market.

Product Insights

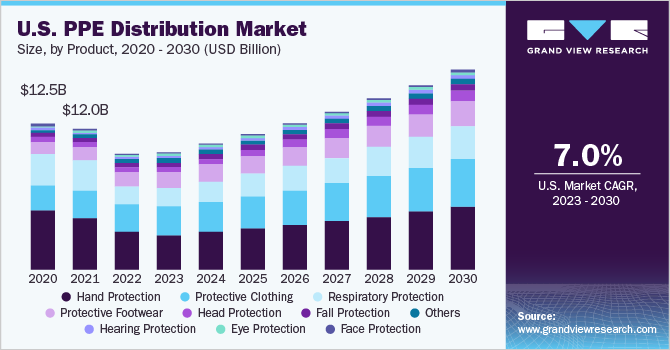

Hand protection emerged as the leading product segment, accounting for over 31.4% of the total revenue share in 2022. Workers must wear hand protection or protective gloves to prevent frequent hand injuries that occur in various industries, including metal fabrication, food processing, oil & gas, and construction. In addition, a growing number of activities in cold environments and handling of sharp tools & hazardous chemicals are expected to drive the growth of the hand protection market in the long term.

Fall protection equipment is used in various industries, including power generation, construction, and oil & gas. Fall protection equipment includes a chest harness, safety nets, body belts, and suspension belts. These products are mainly used in the construction industry to protect workers from injuries that are caused due to free falls. Increasing awareness about employee safety norms across the aforementioned industries is expected to fuel product demand.

Protective clothing is used to protect employees against various hazards, including sharp object injuries. The growing construction and manufacturing industry is anticipated to drive the product market over the forecast period. Furthermore, an increase in executive management concerns toward employee health & safety coupled with the growing number of on-site fatalities on account of the absence of protective kits is likely to drive product demand.

End-use Insights

Personal Protective Equipment (PPE) distribution in the healthcare sector accounted for the largest share of 18.4% in 2022. However, the growth of the manufacturing sector is also significant owing to stringent occupational safety regulations coupled with the enhanced workforce strength in manufacturing sectors across Germany, France, and Italy especially from sectors like fabricated metal products, automotive, rubber, and plastics have contributed toward PPE demand over the past few years.

Construction is anticipated to witness a growth of 8.1% over the forecast period. Personal protective equipment in the construction industry is used to protect employees from cuts, abrasions, and hot splashes. Although the construction of civil engineering projects has witnessed a decline in Europe, residential and non-residential building projects have witnessed moderate growth over the past few years.

PPE distribution in the pharmaceuticals sector accounted for 6.1% of the market revenue share in 2022. The U.S., Germany, and Switzerland cumulatively account for a significant share of global pharmaceutical exports. Ongoing investment in drug R&D across various countries including Switzerland, Netherlands, and Belgium is expected to steer demand for PPE such as protective clothing, gloves, respirators, and footwear over the next eight years.

Regional Insights

North America is anticipated to emerge as the fastest-growing regional market with a CAGR of 6.9% from 2023-2030. PPE demand in North America is characterized by rapid growth in segments such as heat and fire-retardant protective clothing. This growth is attributed to various revisions in the industry standards by regulatory agencies such as OSHA, National Fire Protection Association (NFPA).

Europe accounted for 52.9% of the revenue share in 2022. The personal protection equipment manufacturing and distribution markets are governed by the European Union PPE Directive 89/686/EEC. This directive has issued legal obligations to ensure that safety equipment provides the highest level of protection against workplace hazards.

Key Companies & Market Share Insights

The North America and Europe PPE distribution industry is highly competitive in nature as the mortar and brick stores compete with e-commerce-based multinationals for sustaining their market share. Shifting consumer preference toward online shopping has resulted in financial loss for retail stores in the U.S., Canada, and European countries.

This is expected to steer consolidation among domestic safety wear suppliers, to enhance their logistics capabilities and subsequently the market share. While companies such as Protek, Vanzeebroeck NV, A3 Safety, and Domeyer are involved in B2B clientele, companies such as J&K Ross, GenXtreme, AB Safety, Kellner & Kunz, and Safety Management Italy are utilizing e-commerce platforms for managing PPE distribution in Europe.

Leading e-commerce companies in the industrial safety supplies industry include Grainger and Amazon. Other key players in North America include Total Safety, Mallory, J.J. Keller, DXP Enterprises, and ORR. Key players in Europe include Kellner & Kunz, Haberkorn Group, Alsico Laucuba, AB Safety NV, GCE Group, and Etra Oy.

For instance, in March 2023, Mallory Safety & Supply acquired JG Tucker & Son, a distributor of safety products in Los Angeles, to serve customers better in Southern California. Some prominent players in the North America and Europe PPE distribution market include:

-

Grainger

-

Protek PPE

-

J&K Ross

-

GenXtreme

-

AB Safety

-

Kellner & Kunz

-

Safety Management Italy s.r.l

-

Total Safety

-

Mallory Safety

-

J.J. Keller & Associates

North America And Europe PPE Distribution Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 24.94 billion

Revenue forecast in 2030

USD 41.14 billion

Growth Rate

CAGR of 6.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe

Country Scope

U.S.; Canada; Mexico; Austria; Belgium; Denmark; Finland; France; Germany; Italy; Netherlands; Norway; Poland; Spain; Sweden; Switzerland; UK

Key companies profiled

Grainger, Protek PPE; J&K Ross; GenXtreme; AB Safet; Kellner & Kunz; Safety Management Italy s.r.l; Total Safety; Mallory Safety; J.J. Keller & Associates

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America And Europe PPE Distribution Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018to 2030. For this study, Grand View Research has segmented the North America and Europe PPE distribution market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Head protection

-

Eye protection

-

Face protection

-

Hearing protection

-

Protective clothing

-

Respiratory protection

-

Protective footwear

-

Fall protection

-

Hand protection

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Construction

-

Manufacturing

-

Oil & gas

-

Chemical

-

Healthcare

-

Food & beverage

-

Pharmaceuticals

-

Transportation

-

Mining

- Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Austria

-

Belgium

-

Denmark

-

Finland

-

France

-

Germany

-

Italy

-

Netherlands

-

Norway

-

Poland

-

Spain

-

Sweden

-

Switzerland

-

UK

-

-

Frequently Asked Questions About This Report

b. The North America and Europe PPE market size was estimated at USD 24.56 billion in 2022 and is expected to reach USD 24.94 billion in 2023.

b. The North America and Europe PPE market is expected to grow at a compound annual growth rate of 6.7% from 2023 to 2030 to reach USD 41.14 billion by 2030.

b. Hand protection was the major product segment in 2022 and accounted for 30.4% of the overall revenue share owing to growing demand for the product in chemical production, industrial manufacturing, and building and construction industries.

b. Hand protection was the major product segment in 2022 and accounted for 30.4% of the overall revenue share owing to growing demand for the product in chemical production, industrial manufacturing, and building and construction industries.

b. The key factors that are driving the North America and Europe PPE market include the increasing product demand from numerous end-use industries including power generation, chemicals, food & beverage, and petrochemical.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."