- Home

- »

- Plastics, Polymers & Resins

- »

-

North America Food Service Disposable Market, Industry Report 2030GVR Report cover

![North America Food Service Disposable Market Size, Share & Trends Report]()

North America Food Service Disposable Market Size, Share & Trends Analysis Report By Material (Plastic, Fiber-based), By Product, By Application, By Distribution Channel, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-702-8

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

The North America food service disposable market size was estimated at USD 27.07 billion in 2023 and is expected to grow at a CAGR of 3.1% from 2024 to 2030. The rising penetration of online food delivery services, coupled with the growing popularity of food trucks in the U.S., is fueling the demand for food service disposable in North America. An increasing demand for convenience and on-the-go dining has been a significant driving factor for the market. Fast-paced lifestyles in North America have led consumers to seek efficient and convenient food options, which often involve the use of disposable packaging and utensils. This trend has been particularly prominent in urban areas, where people have less time to prepare meals at home and rely more heavily on takeout and delivery services.

The advent of online food delivery platforms and the growing popularity of food delivery services fueled the demand for food service disposables. Restaurants and food establishments adapted their packaging solutions to ensure the safe and hygienic transportation of food. This adaptation increased the demand for disposable containers, boxes, cutlery, and utensils designed specifically for delivery purposes. Hence, the rise of the food delivery industry played a crucial role in driving this demand. Furthermore, the expansion of the food service industry, including the growth of quick-service restaurants (QSRs), cafeterias, and catering services, has contributed to the increased product demand. As these establishments seek efficient and cost-effective solutions for serving and packaging food, the use of disposable products has become increasingly prevalent across the world.

Moreover, the growing trend towards sustainability and eco-friendliness has influenced the market growth. Many manufacturers have started producing disposable products from biodegradable or compostable materials, such as plant-based plastics or paper products. This has appealed to environmentally conscious consumers and businesses alike, as it helps reduce the environmental impact of disposable products. For instance, in November 2023, SOFi Products introduced a 100% plastic-free, biodegradable cup for hot beverages which features three flaps that can be folded together to create fill-proof lid. This eliminates the requirement of a separate lid to seal the cups, which would help counter the packaging waste problem.

Market Concentration & Characteristics

Major players operating in North America food service disposable industry include Graphic Packaging International LLC, Sonoco Products Company, Sabert Corporation, Genpak LLC, Pactiv LLC, Inteplast Group, Anchor Packaging Inc., Carlisle FoodService Products, GreenGood USA, Georgia-Pacific LLC, Amhil, Huhtamaki Oyj, Printpack, Dart Container Corporation, Mondi, Airlite Plastics, Reynolds Consumer Products, Material Motion, Inc., CMG Plastics, Berry Global Inc.

Companies are using eco-friendly materials and innovative packaging to reduce their environmental impact. New materials and design techniques are enhancing the functionality and appeal of disposable food service products. Together, these developments are transforming the landscape of the food service disposable sector in North America. For instance, in March 2024, AptarGroup, Inc. launched Halopack's paperboard tray packaging in the U.S. This innovative solution, known as Aptar Halopack, is designed for dry and high-moisture foods, offering a wide range of configurations. The packaging is produced with recycled cardboard and a minimal amount of easily removable film, making it recyclable and environmentally friendly. This partnership between Aptar and Halopack aims to introduce a sustainable fiber-based tray system to North America, providing a greener packaging option for various food products.

In November 2023, Eco Products Inc. introduced two new sets of lids for paper hot cups and molded fiber bowls. The new lids are made from renewable molded fiber that is certified as compostable by the Biodegradable Products Institute (BPI), which would help the company position its products as a sustainable option to plastic lids.

Material Insights

On the basis of materials, the market is further segmented into plastics, paper & paperboard, metal, fiber-based, and other materials. The plastics segment dominated the overall market with a revenue share of over 52.0% in 2023. Plastic disposables, such as plates, cups, and utensils, are sturdy, lightweight, and resistant to moisture and leaks. They can hold hot and cold foods/beverages without compromising their integrity, making them ideal for takeout and delivery services.

The fiber-based material segment is expected to grow at the fastest CAGR of 4.7% during the forecast period. There is a growing demand for eco-friendly and sustainable disposable products in the food service industry. Fiber-based materials, like paper and molded fiber, are biodegradable and compostable, making them more environmentally friendly than plastic-based alternatives.

Application Insights

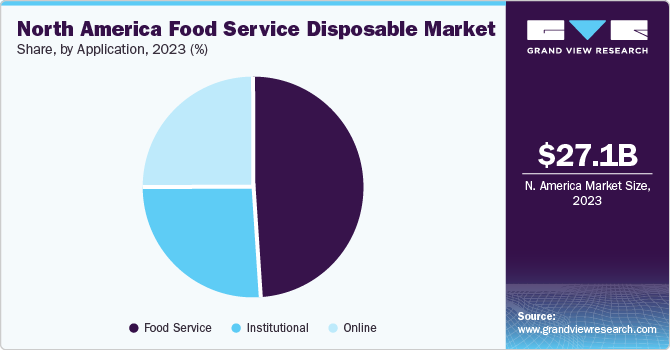

Based on the applications, the market has been further divided into food service, online, and institutional. The food service application segment dominated the market and accounted for the largest revenue share of over 49.0% in 2023. The food service industry, which includes restaurants, cafes, fast-food chains, and catering services, is a major consumer of disposable products, such as plates, cups, utensils, and containers. Hence, the growing food service sector, driven by factors like convenience, changing lifestyles, and urbanization, is augmenting the product demand.

The online application segment is projected to progress at the fastest CAGR of 5.0% over the forecast period. Online ordering and delivery platforms offer a convenient way for consumers to access food service disposables, such as takeout containers, cups, utensils, and packaging materials, without physically visiting stores or restaurants. Moreover, the growth of food delivery services, such as DoorDash, Uber Eats, and GrubHub, has increased the demand for disposable food packaging materials to ensure the safe and efficient delivery of food items to customers.

Product Insights

Based on products, the market is further categorized into plates, cups & lids, trays & containers, bowls, bags, boxes & cartons, cutlery, and other products. The trays & containers product segment dominated the market and accounted for the largest revenue share of over 30.0% in 2023. Disposable trays and containers offer immense convenience for food service establishments and consumers. They allow easy transportation, distribution, and consumption of meals, especially in the growing takeout and delivery segments.

On the other hand, the cups & lids product segment is expected to grow at the fastest CAGR of 3.8% during the forecast period. Cups and lids are used across various food service channels, including QSRs, cafes, convenience stores, and other retail outlets. The ubiquitous nature of beverages consumed on the go drives the demand for disposable cups and lids.

Distribution Channel Insights

On the basis of materials, the market has been further segmented into corporate distributors, direct distributors, individual distributors, GPO, and other distribution channels. The direct distributors segment dominated the overall market with a revenue share of over 45.0% in 2023. Direct distributors can offer more cost-effective solutions by eliminating mediators and purchasing directly from manufacturers.

This allows them to pass on the cost savings to food service establishments, making their products more attractive, especially for businesses operating on tight margins. The GPO segment is expected to grow at the fastest CAGR of 4.3% during the forecast period. GPOs act as centralized purchasing entities, simplifying the procurement process for their members. Instead of each individual organization negotiating with multiple suppliers, the GPO handles contracting, ordering, and distribution logistics.

Country Insights

U.S. Food Service Disposable Market Trends

The food service disposable market in U.S. accounted for the largest revenue share of over 84.0% in 2023 due to increased meat production, high per capita consumption of all dairy products, and the presence of prominent producers of dairy products, such as cheese and yogurt. The U.S. has a large population pool and consumer market, which translates into a high product demand from restaurants, cafeterias, catering services, and other food service establishments. In addition, the U.S. has a well-developed and extensive food service industry, including numerous fast-food chains, casual dining restaurants, and institutional food services, all of which rely heavily on disposable products for food serving and packaging.

Canada Food Service Disposable Market Trends

The food service disposable market in Canada is expected to witness significant growth from 2024 to 2030. Several leading manufacturers of food service disposables, such as Dart Container Corp., Huhtamaki, and Cascades, have substantial operations and production facilities in Canada. This local presence allows for efficient distribution and better catering to the domestic market, thus positively influencing the country’s market growth.

Mexico Food Service Disposable Market Trends

The food service disposable market in Mexico is expected to witness significant growth owing to the presence of a well-established food service industry and rise in the number of QSRs. In addition, Mexico’s geographic proximity to the U.S. market gives Mexican manufacturers easier access to export their products to the U.S., which is a major product consumer.

Key North America Food Service Disposable Company Insights

The market is fragmented with the presence of a substantial number of companies. The industry has been observing a substantial number of new product launches and expansions over the past few years.

-

In November 2023, CMG Plastics launched a set of new round lids made from linear low-density polyethylene (LLDPE). These lids include the 307CE composite can lid, 401CE composite can lid, and the 307SS paperboard container lid. These round lids are specifically designed to complement composite and paperboard containers and are ideal for packaging breadcrumbs, drink mixes, and snacks

-

In October 2023, Georgia-Pacific LLC finalized a USD 175.0 billion investment in its Dixie tableware facility located in Darlington, South Carolina, U.S. This expansion aims to enhance production operations for plates, bowls, cups, and lids, addressing the growing demand from both customers and consumers for these widely used disposable household products. The company aims to solidify its position as a preferred partner for suppliers, customers, and the local Darlington community through this investment

Key North America Food Service Disposable Companies:

- Graphic Packaging International LLC

- Sonoco Products Company

- Sabert Corporation

- Genpak LLC

- Pactiv LLC

- Inteplast Group

- Anchor Packaging Inc.

- Carlisle FoodService Products

- GreenGood USA

- Georgia-Pacific LLC

- Amhil

- Huhtamaki Oyj

- Printpack

- Dart Container Corporation

- Mondi

- Airlite Plastics

- Reynolds Consumer Products

- Material Motion, Inc.

- CMG Plastics

- Berry Global Inc.

North America Food Service Disposable Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 27.81 billion

Revenue forecast in 2030

USD 33.35 billion

Growth rate

CAGR of 3.1% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors and trends

Segments covered

Material, product, application, distribution channel, country

Regional scope

North America

Country Scope

U.S.; Canada; Mexico

Key companies profiled

Graphic Packaging International LLC; Sonoco Products Company; Sabert Corp.; Genpak LLC; Pactiv LLC; Inteplast Group; Anchor Packaging Inc.; Carlisle FoodService Products; GreenGood USA; Georgia-Pacific LLC; Amhil; Huhtamaki Oyj; Printpack; Dart Container Corp.; Mondi; Airlite Plastics; Reynolds Consumer Products; Material Motion, Inc.; CMG Plastics; Berry Global Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Food Service Disposable Market Report Segmentation

This report forecasts volume and revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America food service disposable market report based on material, product, application, distribution channel, and country.

-

Material Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Plastic

-

Polypropylene (PP)

-

Polyethylene (PE)

-

Expanded Polystyrene (EPS)

-

Others

-

-

Paper & Paperboard

-

Metal

-

Fiber-based

-

Others

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Platers

-

Cups & Lids

-

Trays & Containers

-

Bowls

-

Bags

-

Boxes & Cartons

-

Cutlery

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Food Service

-

Full Service

-

Quick Service

-

Others

-

-

Online

-

Institutional

-

-

Distribution Channel Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Corporate Distributors

-

Direct Distributors

-

Individual Distributors

-

GPO

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America food service disposable market was estimated at USD 27.07 billion in the year 2023 and is expected to reach USD 27.81 billion in 2024

b. The North America food service disposable market is expected to grow at a compound annual growth rate of 3.1% from 2024 to 2030 to reach USD 33.35 billion by 2030.

b. The U.S. had the largest revenue share, 84.4%, in the North American food service disposable market in 2023.

b. The key market players in the North America food service disposables market include Graphic Packaging International LLC, Sonoco Products Company, Sabert Corp., Genpak LLC, Pactiv LLC, and Interplast Group among others.

b. Increasing penetration of online food delivery services, the growing popularity of food trucks in the U.S., and the increasing digitization of the food service industry are the factors driving the North America food service disposable market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."