- Home

- »

- Advanced Interior Materials

- »

-

North America Iron Casting Market Size, Share Report, 2030GVR Report cover

![North America Iron Casting Market Size, Share & Trends Report]()

North America Iron Casting Market Size, Share & Trends Analysis Report By Product (Gray Cast Iron, Ductile Cast Iron), By Application (Automotive, Railways), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-023-7

- Number of Report Pages: 92

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

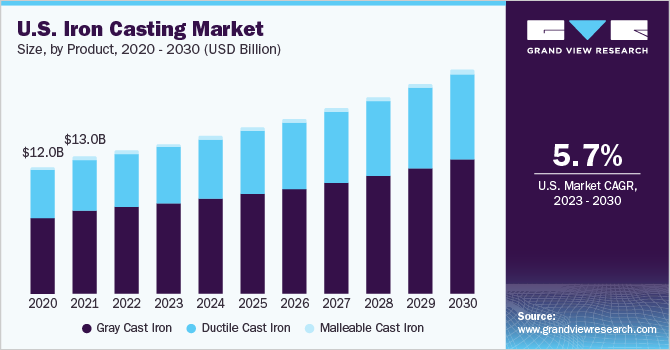

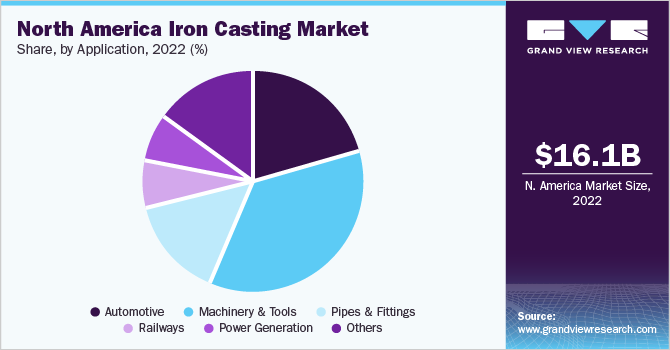

The North America iron casting market size was valued at USD 16.05 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. Growing investments in the railway sector toward economic development across various countries are anticipated to drive market growth over the coming years. Due to their high strength and low wear characteristics, iron castings are used in the production of components for railroads & their infrastructure. Thus, rising investment in the railway sector is anticipated to propel product demand over the forecast period. For instance, in March 2022, the Government of Mexico unveiled its USD 2.4 billion metro modernization plan. The upgradation of the infrastructure is expected to be completed by 2030.

The U.S. is a significant market for iron castings owing to the widespread presence of end-use industries. The product demand in the country is being driven by large-scale auto plants, manufacturers of machinery & tools, and increasing demand for pipes and fittings due to the development of the petrochemical industry and infrastructure improvements.

Growing investments in setting up new plants for water and sewage treatment are further anticipated to augment market growth in the coming years. For instance, in November 2021, Haskell was selected to design and build a new water treatment plant worth USD 150 million in Riviera Beach, U.S. The plant is expected to be functional by 2023.

Furthermore, growing infrastructural developments are expected to fuel the need for iron castings. For instance, a USD 1 trillion bipartisan plan to upgrade the nation's infrastructure, including its roads, bridges, airports, rail networks, and power systems, was approved by the U.S. government in November 2021. This infrastructure upgrade is expected to be finished by 2025.

Iron castings have been widely used by the automotive industry. However, the consistent decline in global vehicle production over the past few years has been a challenge for the market. Also, the growing inclination towards lightweight vehicles is propelling the penetration of aluminum castings in the automotive industry, which is restraining the market growth.

Product Insights

Based on product, gray cast iron accounted for the largest revenue share of over 60.0% in 2022 of the overall market. It is largely used due to its high compressive strength, good damping capacity, high thermal conductivity, good machinability, low-cost production, and good wear resistance. These properties make the product applicable in a variety of applications including pipes, machinery & tools, and automobiles.

Increasing demand for machines & tooling is pushing key manufacturers to set up new plants, which are expected to boost segment growth over the forecast period. For instance, in September 2022, Seco Tools opened a new tool manufacturing unit in Ramos Arizpe, Mexico. The plant spans over 2,500 square meters.

Ductile cast iron is expected to register the fastest CAGR of 5.9% in terms of revenue over the forecast period. Due to its lower density and exceptional reliability, even at extremely low temperatures, the product is chosen by manufacturers of wind energy power plants and various machine & tooling parts. Furthermore, owing to its microstructure, it finds application in water & sewage pipes.

Malleable cast iron is another vital segment of the market. It produces stronger castings, which makes it suitable for applications requiring high machinability and toughness. It finds wide usage in a variety of sectors, including agriculture, machinery, automotive, and mining.

Application Insights

The machinery & tools segment held the largest revenue share of over 35.0% in the year 2022 in the overall market, and it is expected to continue its dominance across the forecast period. Iron castings are widely used in machinery & tools owing to their good wear resistance, high strength, and good machinability. These are used for producing machinery and tools used in industrial, construction, and agriculture/farming applications.

Rising demand for machine tools for increasing productivity is expected to fuel segment growth over the coming years. For instance, according to the U.S. Manufacturing Technology Orders Report, the new orders of manufacturing technology reached USD 467.8 million in February 2023, which is 33% more than the previous month. This value for February 2023 is 50% above the average value for all February orders. The rise in demand for machine tools is fueled by increased spending on manufacturing technologies.

The railway sector is anticipated to register the fastest CAGR in terms of revenue over the forecast period. Increasing investments by several governments to modernize their rail infrastructure is expected to propel the demand for iron castings. For instance, in March 2021, the U.S. proposed a plan to invest USD 80 billion in passenger and freight rail services. The investment intends to modernize the Northeast corridor.

Iron castings are used in water and sewage pipes owing to their good compression strength and long life. They are more energy efficient than other alternatives such as polyvinyl chloride (PVC), cross-linked polyethylene (PEX), and copper, owing to their oversized inside diameter. Large diameter enables cast iron pipes to reduce the force required to push water through the pipes.

Regional Insights

Canada is a vital market in North America and is anticipated to achieve a CAGR of 4.7%, in terms of revenue, from 2023 to 2030. Increasing investment toward the upgradation of water infrastructure is expected to help propel market growth. For instance, in August 2021, the Canadian government announced an investment of CAD 22 million (~USD 17.53 million) in water infrastructure projects. The investment included the construction of a new water treatment plant in Petit Rocher, New Brunswick, coupled with six other water infrastructure projects in Yukon.

Numerous investments in several industries, especially energy-related projects, are further fueling product demand. For instance, the U.S. is trying to reduce carbon emissions, and to achieve this, the country is investing in renewable energy. In July 2021, the U.S. Senate passed a USD 550 billion clean energy investment bill, of which USD 73 billion is expected to be set aside for energy generation. Such trends are anticipated to augment the demand for iron castings in the power generation industry.

Moreover, the Mexican government is trying to boost the growth of industries, which is anticipated to propel product demand in the country over the forecast period. For instance, in May 2022, the government announced an allocation of USD 30 billion for infrastructure development in southeast Mexico. The investment is expected to help in the development of airports, railways, ports, and the modernization of customs offices in southeast Mexico. These projects are expected to be completed by 2024.

Key Companies & Market Share Insights

The North America iron casting market is highly competitive owing to the presence of various players, both emerging and established. Growing competition is compelling key market players to expand their businesses and improve their existing product portfolios.

For instance, in February 2022, the Metal7 Inc. division of the Quebec-based M7 Group acquired Minnesota-based Cast Corporation Foundry. This acquisition is anticipated to help Metal7 Inc. create high-value-added products and services for the mining industry and increase productivity while reducing the environmental footprint. Some of the prominent players in the North America iron casting market include: Some prominent players in the North America iron casting market include:

-

Alloy Castings Industries Ltd.

-

Cadillac Casting Inc.

-

CALMET

-

Decatur Foundry

-

Fusium

-

GREDE

-

Grupo Industrial Saltillo (GIS)

-

Hitachi Metals, Ltd.

-

Lemfco, Inc.

-

Metal Technologies, Inc.

-

Neenah Foundry

-

OSCO Industries, Inc.

-

US Castings

-

WAUPACA FOUNDRY, INC.

-

American Castings

-

The C.A. Lawton Company

-

Faircast Inc.

-

East Jordan

-

Golden’s Foundry and Machine

-

R.H. Sheppard Co. Inc.

-

BCI Solutions

North America Iron Casting Report Scope

Report Attribute

Details

Market size value in 2023

USD 16.79 billion

Revenue forecast in 2030

USD 24.89 billion

Growth rate

CAGR of 5.6% from 2023 to 2030

Market size volume in 2023

9,330.6 kilotons

Volume forecast in 2030

12,783.7 kilotons

Growth Rate

CAGR of 4.5% from 2023 to 2030

Base year for estimation

2023

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative Units

Volume in kilotons, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America

Country scope

U.S., Canada, Mexico

Key companies profiled

Cadillac Casting Inc.; CALMET; Decatur Foundry; Fusium; Grupo Industrial Saltillo (GIS); Hitachi Metals; Ltd.; GREDE; Lemfco, Inc; OSCO Industries, Inc; Neenah Foundry; US Castings; WAUPACA FOUNDRY; INC.; Alloy Casting Industries Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Iron Casting Market Report Segmentation

This report forecasts revenue and volume growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented North America iron casting report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Gray Cast Iron

-

Ductile Cast Iron

-

Malleable Cast Iron

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Automotive

-

Machinery & Tools

-

Pipes & Fittings

-

Railways

-

Power Generation

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. North America iron casting market size was estimated at USD 16.05 billion in 2022 and is expected to reach USD 16.79 billion in 2023.

b. The North America market is expected to grow at a compound annual growth rate of 5.6% from 2023 to 2030 to reach USD 24.89 billion by 2030.

b. Based on application, machinery & tool accounted for the largest revenue share of more than 35.0% in 2022 of the overall market. Rising demand for machine tools for increasing productivity is expected to fuel the growth of iron castings in the segment over the coming years.

b. Some of the key players operating in the North America iron casting market include CALMET, Decatur Foundry, Fusium, Hitachi Metals, Ltd, Grupo Industrial Saltillo (GIS), and GREDE.

b. Rising investment by governments across the region to upgrade their infrastructure is expected to propel the demand for iron castings in North America over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."