- Home

- »

- Advanced Interior Materials

- »

-

North America Plastic Injection Molding Machine Market, 2030GVR Report cover

![North America Plastic Injection Molding Machine Market Size, Share & Trends Report]()

North America Plastic Injection Molding Machine Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Hybrid, Electric), By End-use (Medical, Automotive), By Technological Sophistication, By Clamping Force, And Segment Forecasts

- Report ID: GVR-4-68040-035-2

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

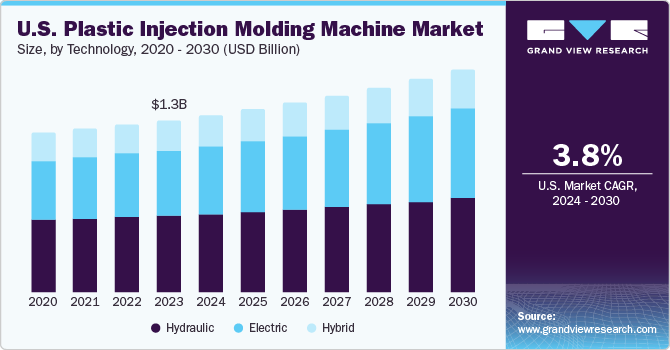

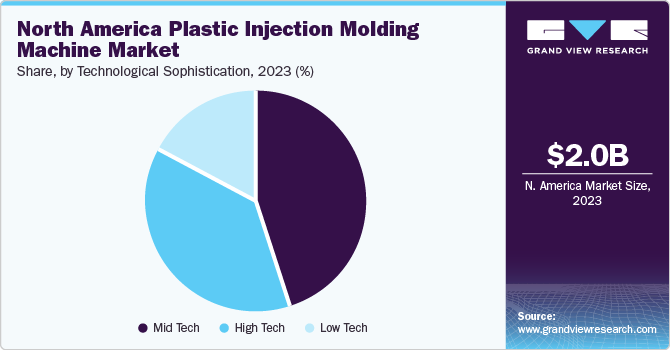

The North America plastic injection molding machine market size was estimated at USD 2,009.0 million in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 3.9% from 2024 to 2030. The industry is being driven by the increased demand for plastic injection molding equipment in end-use sectors including healthcare, consumer goods, automotive, electrical & electronics, packaging, and others. Plastic injection molding machines play a crucial role in the automotive industry, enabling the mass production of intricate and customized plastic components used in automobiles. These machines are widely used in the automotive sector for producing interior components, such as dashboards, door panels, and steering wheel components, as well as exterior parts, including bumpers and body panels.

The machines also offer advantages, such as rapid production cycles, cost-effectiveness, and the ability to work with a wide range of plastic materials, enabling the production of lightweight parts with high efficiency and cost-effectiveness. These machines also offer high design flexibility essential in modern automotive manufacturing. Rapid growth in demand for automotive components has boosted global automobile production, resulting in a high demand for plastic injection molded parts in the automotive industry.As the automotive industry continues to grow, driven by factors, such as increasing consumer demand, technological advancements, and a focus on sustainability, the demand for high-precision, efficient, and versatile plastic components within vehicles is also growing.

A hybrid injection molding machine combines the best of both hydraulic and electric injection molding machines. Hybrid machines offer high clamping force of hydraulic machines and high precision, energy efficiency, reduced noise, and repeatability of electric injection molding machines. Such machine attributes are reflected in high-quality manufacturing of thick- and thin-walled plastic parts. Furthermore, a hybrid injection molding machine enables the manufacturer to generate a quicker return on investment (ROI), make continuous modifications, and undertake various product design options. As per the International Organization of Motor Vehicle Manufacturers (OICA), vehicle sales in the U.S. declined from 2,512,780 units in 2019 to 1,926,795 units in 2020 due to COVID-19 lockdown measures.

However, post-economic, the automotive industry recovered with sales reaching 1,563,060 units in 2021 and 1,751,736 units in 2022. The resurgence is attributed to factors, such as increased access to advanced EV technologies, a skilled workforce, advanced processing capabilities, and extensive R&D efforts. The market has witnessed a rise in the adoption of electric vehicles (EVs) propelled by favorable government regulations, tax incentives, and subsidies. The growing preference for EVs and rising demand for plastic injection-molded components in both traditional & EVs for various interior & exterior parts will drive market growth in the U.S.

In addition, plastic injection molding machines are integral to the medical industry, facilitating precise and scalable production of intricate plastic components used in various medical devices and equipment. These machines employ a sophisticated process wherein molten plastic is injected into a mold cavity, which enables the manufacturing of complex and customized parts with high precision. According to the U.S. Centers for Medicare & Medicaid Services 2023 Report, it is indicated that healthcare spending in the U.S. experienced a growth of 4.1% in 2022, totaling USD 4.5 trillion, equivalent to USD 13,493 per person. Moreover, health spending constituted 17.3% of the country's GDP during this period. Thus, the growing medical industry in the country is anticipated to drive product demand.

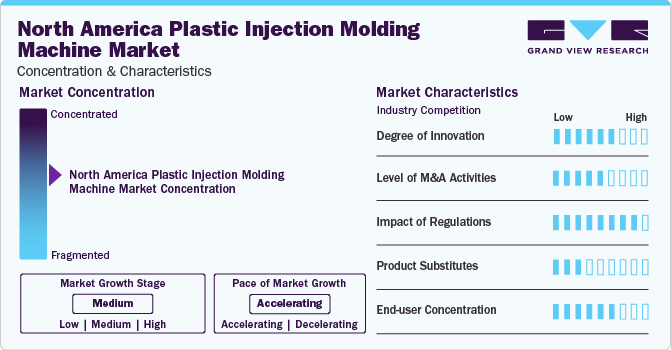

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. The plastic injection molding machine market is a dynamic and rapidly evolving sector, characterized by its pivotal role in manufacturing high-precision plastic components.One prominent characteristic of the market is the escalating demand for precision-engineered plastic parts.

Industries such as automotive, healthcare, and electronics require intricate components, driving the need for advanced injection molding machines capable of delivering high precision. Additionally, the trend toward product customization further intensifies the demand for versatile and adaptable machines that can cater to unique design specifications.

Continuous technological advancements play a crucial role in shaping the plastic injection molding machine market. Automation, digitalization, and Industry 4.0 technologies are increasingly integrated into these machines, enhancing operational efficiency, reducing production time, and minimizing errors. Smart manufacturing practices, real-time monitoring, and predictive maintenance contribute to overall competitiveness of manufacturers in this space.

The plastic injection molding machine market is characterized by a focus on mass production capabilities. Industries such as consumer goods and packaging rely on efficient and cost-effective manufacturing processes. Injection molding machines play a key role in achieving economies of scale, enabling manufacturers to produce large volumes of identical or similar components with high efficiency and cost-effectiveness.

Environmental consciousness is a driving force in the market, leading to a notable shift towards sustainable practices. Manufacturers are increasingly adopting eco-friendly materials and processes to reduce the environmental impact of plastic production. This includes the exploration of biodegradable polymers and recycling initiatives, aligning with global efforts to address plastic waste concerns.

Technology Insights

The hydraulic segment led the industry growth and accounted for 44.2% of global revenue share in 2023. As hydraulic systems can easily generate high pressure, these machines are mostly used in the manufacturing of plastic components with higher thickness & density. In the automotive industry, interior structures, such as dashboards and panels, are made of dense plastic. The adoption of plastic components in automotive systems helps reduce the weight of the system as well as makes it resistant to external factors, such as dust and corrosion. The use of plastic components also offers high design flexibility at a cheap rate.

According to the data published by the U.S. Census Bureau in December 2023, new orders for manufactured durable goods in November 2023 increased by 5.4% as compared to October 2023. For November 2023, the total order valuation remained at USD 295.4 billion. Hence, with the growing demand for consumer durables & electronics, the demand for cost-efficient electric plastic injection molding machines is expected to increase over the forecast period in the U.S.

End-use Insights

The automotive end-use segment led the industry in 2023 owing to factors, such as material compatibility, high precision, repeatability, and surface finish. Furthermore, increasing demand for lightweight automotive components and rising automotive production are expected to propel the segment's growth.Moreover, plastic injection molding machines are used in the automotive industry for manufacturing exterior parts, such as door panels, car door trim, bumpers, trunk trims rear & front covering, floor rails, sensor holders, grilles, wheel arches, fenders, and mudguards.

Plastic injection molding is used in the medical industry for manufacturing small and complex items, such as dental implants, prosthetic replacements, endoscopic tools, tweezers, scissors, implantable components, orthopedics, and drug delivery equipment. According to the data published by the Canadian Institute for Health Information in November 2023, total health spending in Canada is predicted to reach USD 344.0 billion in 2023. This high health expenditure is expected to represent 12.1% of Canada’s GDP in 2023. In 2023, health spending was expected to rise by 2.8%, after a 1.5% rise in 2022. The rising demand for medical disposables and plastic consumption in healthcare applications during treatment and surgeries will support market growth.

Clamping Force Insights

The 100 to 400 metric tons segment led the industry in 2023. Plastic injection molding machines with clamping force ranging from 101 to 400 metric tons are used to manufacture medium-sized complex contoured parts. These machines are considered workhorses for the industry, owing to their ability to produce a diverse range of medium-sized parts across various industries. These machines are used to produce bottles & caps in the packaging industry. These machines are used to manufacture kitchenware, toys, and other small appliance parts in the consumer goods industry.

Increasing adoption of hybrid & electric machines for improved system effectiveness and efforts to reduce the carbon footprint are expected to drive segment's growth over the forecast period. Machines with less than 100 metric tons of clamping force are used to manufacture small electronics parts, medical components, and coverings of consumer goods. Changing consumer preferences are encouraging companies to develop small and precise products in the electronics and medical industries. This factor is considered an important driver for the incorporation of thin plastic components in the electronics industry.

Technological Sophistication Insights

The mid-tech segment led the industry in 2023. The mid-tech plastic molding machines are used in industries where sufficient precision is required with high-volume production. They are also used in small- and medium-scale businesses due to their cost-effective and reliable plastic component manufacturing. The plastic parts produced by these injection-molding machines have excellent surface finish and adequate dimensional accuracy.

Due to these attributes, big enterprises generally outsource plastic parts manufactured by medium-sized businesses. Low-tech plastic injection molding machines are used in industries that do not require high-precision and complex plastic parts. They are used in industries with high volume production, such as in the medical industry to manufacture syringes, catheters, and surgical instruments. The use of plastic injection molding lowers the risk of contamination and infection.

Country Insights

U.S. led the market and accounted for 80.5% of the global revenue share in 2023. Factors, such as easy access to new and advanced technologies in the EV industry, availability of a highly skilled workforce, presence of advanced processing capabilities, and expanded R&D projects have accelerated the adoption of Electric Vehicles (EVs) in the U.S.For instance, according to Atlas Public Policy, EV sales are projected to reach a historic high, constituting 9% of total passenger vehicle sales in the U.S. in 2023. This marks an increase from the 7.3% share observed in new car sales in 2022.

As per the Canadian Institute for Health Information, the total health expenditure in Canada reached USD 344 billion in 2023, equivalent to USD 8,740 per citizen of Canada, constituting 12.1% of the country's GDP. Notably, after a modest 1.5% growth in 2022, health spending recorded an increase of 2.8% in 2023. Concurrently, the medical sector is witnessing a heightened demand for plastic injection molding machines to efficiently manufacture intricate components for medical devices. These machines are integral to producing a diverse array of medical products, including syringes, vials, housings, and connectors, ensuring compliance with rigorous industry standards for quality and consistency.

Key North America Plastic Injection Molding Machine Companies:

The following are the leading companies in the north america plastic injection molding machinet market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these north america plastic injection molding machine companies are analyzed to map the supply network.

- Arburg GmbH + Co KG

- Haitian International

- KraussMaffei

- Milacron, LLC

- Nissei Plastic Industrial Co., Ltd.

- ENGEL

- Chen Hsong Holdings Limited

- UBE Machinery Inc.

- Husky Technologies

- WITTMANN Technology GmbH

- The Japan Steel Works, Ltd.

Recent Developments

-

In December 2023, Husky Technologies opened a cutting-edge service center in Jeffersonville, Indiana. The facility provides a wide array of readily accessible OEM parts, demonstrating the company's dedication to its customers in the Americas region.

-

In November 2023, ARBURG expanded its global footprint with the inauguration of a new subsidiary in Vietnam. The primary objective was to enhance accessibility to ARBURG products and services for customers in Vietnam. The establishment of this subsidiary reflects the company's commitment to providing products and services with increased convenience, efficiency, and dependability.

-

In June 2023, Haitian International opened an advanced manufacturing facility in Mexico with the strategic objective of enhancing local production capacity, reducing delivery times, and delivering superior solutions to meet the technical needs of customers in North and South America. This marks another significant milestone in Haitian International's growth strategy with a total investment of approximately USD 50 million.

North America Plastic Injection Molding Machine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2,075.7 million

Revenue forecast in 2030

USD 2.61 billion

Growth Rate

CAGR of 3.9% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD million and volume units and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, end-use, clamping force, technological sophistication, country

Country scope

U.S.; Canada; Mexico

Key companies profiled

Arburg GmbH + Co KG; HAITIAN INTERNATIONAL; KraussMaffei; Milacron, LLC; Nissei Plastic Industrial Co., Ltd.; ENGEL; Chen Hsong Holdings Limited; UBE Machinery Inc.; Husky Technologies; WITTMANN Technology GmbH; The Japan Steel Works, Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Plastic Injection Molding Machine Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America plastic injection molding machine market report based on technology, clamping force, technological sophistication, and country.

-

Technology Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Hydraulic

-

Electric

-

Hybrid

-

-

End-use Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Goods

-

Packaging

-

Electronics

-

Medical

-

Others

-

-

Clamping Force Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

< 100 Metric Tons

-

101 to 400 Metric Tons

-

401 to 1000 Metric Tons

-

> 1000 Metric Tons

-

-

Technological Sophistication Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

High Tech

-

Mid Tech

-

Low Tech

-

-

Country Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. North America plastic injection molding machine market size was estimated at USD 2,009.0 million in 2023 and is expected to be USD 2,075.7 million in 2024.

b. The North America plastic injection molding machine market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.9% from 2024 to 2030 to reach USD 2.61 billion by 2030.

b. U.S. dominated the North America plastic injection molding machine market with a revenue share of 80.5% in 2023. Growing demand for on-the-go packaged products owing to increasing purchasing power and busy lifestyle in the U.S. is expected to have a positive impact on the packaging industry growth in the country, thereby driving up the demand for North America plastic injection molding machine.

b. Some of the key players operating in the North America plastic injection molding machine market include Arburg GmbH + Co KG, HAITIAN INTERNATIONAL, KraussMaffei, Milacron, LLC, NISSEI PLASTIC INDUSTRIAL CO., LTD., ENGEL, Chen Hsong Holdings Limited, UBE Machinery Inc., Husky Technologies, WITTMANN Technology GmbH, The Japan Steel Works, LTD.

b. The industry is being driven by the increased demand for plastic injection molding equipment in end-use sectors including healthcare, consumer goods, automotive, electrical & electronics, packaging, and others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.