- Home

- »

- Plastics, Polymers & Resins

- »

-

North America Silicone Market Size, Industry Report, 2030GVR Report cover

![North America Silicone Market Size, Share & Trends Report]()

North America Silicone Market Size, Share & Trends Analysis By Product (Fluids, Gels, Resins, Elastomers), By End-use (Electronics, Construction), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-107-0

- Number of Report Pages: 164

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

North America Silicone Market Size & Trends

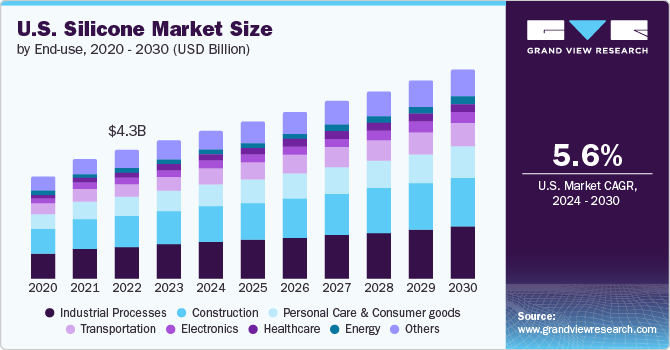

The North America silicone market size was estimated at USD 4.57 billion in 2023 and is expected to grow at a CAGR of 5.5% from 2024 to 2030. The market is poised for growth due to increasing demand across multiple industries, such as automotive, construction, electronics, healthcare, and consumer goods.

Silicone's remarkable versatility and extensive range of applications, including sealants, adhesives, coatings, and elastomers, have made it a highly sought-after material in various industries. Its unique properties, such as high temperature resistance, flexibility, and longevity, make it ideal for a wide array of uses, from construction and automotive to healthcare and electronics. The growing emphasis on sustainability has further boosted the demand for silicone, as its eco-friendly characteristics, such as recyclability, durability, and low toxicity, align with global environmental goals. This shift towards greener solutions is stimulating more industries to adopt silicone products, driving market growth.

Furthermore, technological advancements in silicone manufacturing processes are playing a crucial role in expanding the market. Innovations in product formulations and production techniques are enhancing silicone’s performance, making it suitable for even more demanding applications. These advancements are not only improving the material's properties but also enabling the development of new silicone-based products and solutions. As a result, the market is witnessing an influx of innovative silicone applications, opening new avenues for growth and expansion over the forecast period. This dynamic development is set to enhance silicone's market position, catering to a broader spectrum of industries and applications.

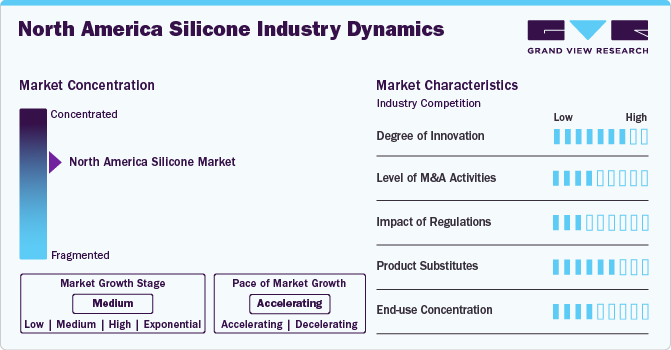

Market Concentration & Characteristics

The North America silicone market is consolidated in nature with the presence of key industry players such as CHT Group, Dow Inc., Elkem ASA, Evonik Industries, Gelest, Inc., and KCC Corporation, which dominate a significant market share. These companies often engage in aggressive marketing strategies, research and development initiatives, and mergers and acquisitions to strengthen their market position and expand their product offerings.

There are various product substitutes for silicone including materials such as polyurethane, rubber, and thermoplastics. Polyurethane is often used as a substitute due to its flexibility and resistance to wear and tear, whereas rubber is valued for its elasticity and cost-effectiveness. Thermoplastics, including materials such as polyethylene and polypropylene, are also popular substitutes due to their lightweight, moldable, and recyclable properties.

The global silicone market is characterized by a high degree of innovation, driven by continuous advancements in material science and manufacturing techniques. Companies are constantly developing new silicone formulations and applications to meet the evolving demands of various industries. For instance, in the healthcare sector, innovative silicone-based medical devices such as flexible, biocompatible implants and advanced wound care dressings have been developed, significantly improving patient outcomes and expanding the use of silicone in medical applications. This ongoing innovation ensures that silicone remains a versatile and essential material across multiple industries.

Product Insights

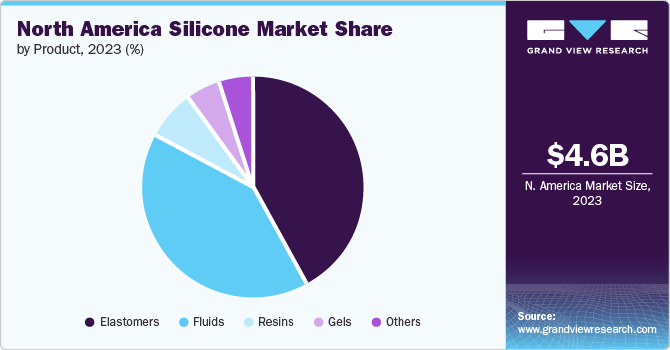

The fluid product segment led the market and accounted for a revenue share of over 45.0% in 2023. This growth can be attributed to its remarkable versatility and widespread utility. Silicone fluids exhibit a broad spectrum of viscosities, allowing them to serve a multitude of industries and applications. Their adaptability makes them a vital ingredient in a diverse range of products, including personal care items like shampoos and cosmetics, automotive fluids for lubrication and cooling, and various industrial applications. The exceptional thermal stability of silicone fluids makes them suitable for high-temperature environments, and their excellent electrical insulation properties add to their appeal in electronic and electrical applications.

Moreover, the fluid segment's dominance is reinforced by the reliability and trust that the industry places in silicone fluids. Their resistance to extreme temperatures, chemical inertness, and low toxicity make them a preferred choice in critical applications. Additionally, the ease of handling and formulation flexibility further bolster their popularity among manufacturers. As a result, the fluid product segment has firmly established itself as the go-to solution in the North America Silicone Market, meeting the diverse demands of different industries and solidifying its position as the primary driver of the market's growth.

The gel segment is expected to grow at a significant CAGR from 2024 to 2030. Silicone gels are known for their soft, flexible, and cushioning characteristics, making them ideal for use in medical devices, cosmetics, and personal care products. In the medical field, silicone gels are used for wound care, scar treatment, and implants, providing comfort and effective healing. In cosmetics, they are valued for their smooth texture and ability to enhance product performance, such as in skin care and hair care products.

End-use Insights

The industrial processes segment led the market and accounted for a significant revenue share in 2023. This is attributed to the remarkable properties of silicone that cater to a wide array of industrial applications. Silicone's unique characteristics, such as high thermal stability, excellent electrical insulation, and resistance to chemicals, make it highly sought after in various industrial settings. Silicone finds extensive use in industries like automotive, electronics, construction, and aerospace, where it serves as a crucial component in sealants, adhesives, lubricants, and coatings. Its ability to withstand extreme temperatures and harsh environments makes it invaluable in industrial processes, where reliability and performance are of utmost importance.

The electronics segment is expected to grow substantially from 2024 to 2030, driven by the material's excellent insulating and protective properties. Silicone is widely used in electronics for applications like sealants, adhesives, and coatings, which help protect delicate components from moisture, dust, and extreme temperatures. This makes silicone essential for the reliability and longevity of devices such as smartphones, computers, and automotive electronics.

Country Insights

U.S. Silicone Market Trends

U.S. silicone marketheld the largest revenue share of 89.5% in 2023. This can be attributed to its robust industrial and economic landscape. The U.S. is home to a diverse range of industries, such as automotive, electronics, healthcare, and construction, which are significant consumers of silicone-based products. Its strong manufacturing base and extensive research and development activities facilitate the widespread adoption of silicone in various applications. Moreover, the country's emphasis on innovation and technological advancements further bolsters its position as a key player in the silicone market.

Canada Silicone Market Trends

The silicone market in Canada is poised to grow significantly through the forecast period, fueled by the growing demand for high-performance materials in various industries such as automotive, construction, healthcare, and electronics fuels the market. Significant investments in clean technology and innovation, rising base metal exploration activities, and a growing personal care market are driving the demand for silicones in the country.

Mexico Silicone Market Trends

Mexico'ssilicone market is growing substantially. Mexico is expected to benefit from the rising construction spending and the growing inclination of consumers toward the utilization of sustainable and lightweight building materials. Moreover, continuous development in key growth areas such as medical devices, drug delivery, and specialty products for hair care is expected to boost product demand over the forecast period.

Key North America Silicone Company Insights

Key companies are adopting several organic and inorganic expansion strategies, such as mergers & acquisitions, new product launches, capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In January 2023, Dow Inc., one of the leading chemical producers, launched an innovative line of liquid silicone rubbers called SILASTIC SA 994X LSR series. This new range of rubbers boasts unique features including primer less adhesion, self-adhesive properties, and self-lubrication. Specifically designed for two-component injection molding with thermoplastic substrates, these liquid silicone rubbers are strategically targeted toward the mobility and transportation industries. The SILASTIC SA 994X LSR series provides manufacturers in these sectors with a reliable and efficient solution that simplifies the production process, enhances performance, and ensures long-lasting durability for various applications in the mobility and transportation sectors.

-

In September 2022, Elkem, a provider of advanced material solutions, announced the commencement of a new specialized plant for producing high-purity medical-grade silicones in York, S.C. The 18,000 sq. ft. site features ISO-certified Class 8 and Class 7 clean rooms designed to meet the stringent requirements of the Pharma and MedTech markets. This new facility serves as Elkem's global center of excellence for medical grade silicones, producing high consistency rubber (HCR), liquid silicone rubber (LSR), adhesives, silicone gels, and dispersions marketed under the Silbione Biomedical brand.

Key North America Silicone Companies:

- CHT Group

- Dow Inc.

- Elkem ASA

- Evonik Industries

- GELEST, INC.

- Jiangsu Mingzhu Silicone Rubber Material Co., Ltd.

- KCC CORPORATION

- Kaneka Corporation

- Momentive

- Shin-Etsu Chemical Co. Ltd

- Wacker Chemie AG

- HEXPOL AB.

- Silchem Inc.

- Specialty Silicone Products, Inc.

- Illinois Tool Works Inc.

- Abbvie Inc.

- CRI-SIL Silicone Technologies, LLC

North America Silicone Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.85 billion

Revenue forecast in 2030

USD 6.69 billion

Growth rate

CAGR of 5.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024-2030

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

CHT Group, Dow Inc., Elkem ASA, Evonik Industries, GELEST, INC., Jiangsu Mingzhu Silicone Rubber Material Co., Ltd., KCC CORPORATION, Kaneka Corporation, Momentive, Shin-Etsu Chemical Co. Ltd, Wacker Chemie AG, HEXPOL AB., Silchem Inc., Specialty Silicone Products, Inc., Illinois Tool Works Inc., Abbvie Inc., CRI-SIL Silicone Technologies, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Silicone Market Report Segmentation

This report forecasts revenue and volume growth at the regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America silicone market report based on product, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fluids

-

Straight Silicone Fluids

-

Modified Silicone Fluids

-

-

Gels

-

Resins

-

Elastomers

-

High Temperature Vulcanized

-

Liquid Silicone Rubber

-

Room Temperature Vulcanizaed (RTV)

-

-

Others

-

Adhesives

-

Emulsions

-

-

-

End use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Electronics

-

Transportation

-

Construction

-

Healthcare

-

Personal Care and Consumer goods

-

Energy

-

Industrial Processes

-

Others (Textiles)

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America silicone market size was estimated at USD 4.57 billion in 2023 and is expected to reach USD 4.85 billion in 2024.

b. The North America silicone market is expected to grow at a compound annual growth rate of 5.5% from 2024 to 2030 to reach USD 6.69 billion by 2030.

b. The fluid product segment dominated the North America silicone market with a revenue share of over 45.0% in 2023. This is primarily driven by its exceptional thermal stability, excellent electrical insulating properties, and its diverse applications across various industries, making it a preferred choice for numerous manufacturing processes and end-use industries such as electronics, transportation, construction, healthcare, personal care, and consumer goods, energy, industrial processes.

b. Some key players operating in the North America silicone market include CHT Group, Dow Inc., Elkem ASA, Evonik Industries, GELEST, INC., Jiangsu Mingzhu Silicone Rubber Material Co., Ltd., KCC CORPORATION, Kaneka Corporation, Momentive, Shin-Etsu Chemical Co. Ltd, Wacker Chemie AG, HEXPOL AB., Silchem Inc., Specialty Silicone Products, Inc., Illinois Tool Works Inc., Abbvie Inc., CRI-SIL Silicone Technologies, LLC.

b. Key factors that are driving the North America silicone market growth include growing construction activities that are pushing the demand for silicone.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."