- Home

- »

- Pharmaceuticals

- »

-

North America Sports Nutrition Market Size Report, 2028GVR Report cover

![North America Sports Nutrition Market Size, Share & Trends Report]()

North America Sports Nutrition Market Size, Share & Trends Analysis Report By Product Type (Sports Supplements, Sports Drinks), By Application, By Formulation, By Consumer Group, By Distribution Channel, By Country, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-366-6

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Healthcare

Report Overview

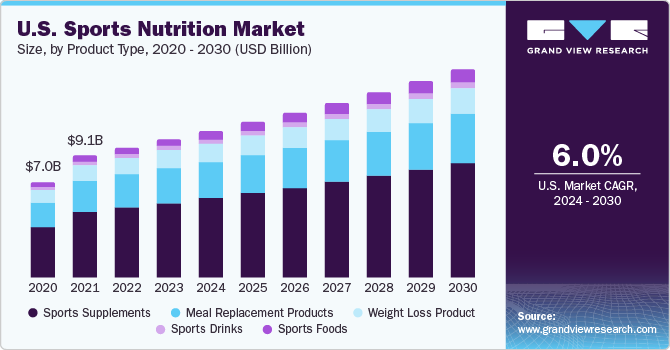

The North America sports nutrition market size was valued at USD 12.6 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 8.4% from 2021 to 2028. Increasing awareness about the health benefits of consuming sports nutrition products among bodybuilders and athletes is driving the market growth. Moreover, the increasing number of gym-goers and active lifestyle consumers’ adoption of sports nutrition products is further supporting market growth potential. Demand for sports nutrition products is growing rapidly from core users and active lifestyle consumers in North America. Light users consumed sports nutrition products specifically targeting muscle support, energy, weight management, and healthy snacking. Core users or heavy users are focused on sports supplements required for muscle building, strength performance, endurance, and recovery.

Consumers involved in strength training are major consumers of whey proteins, branched-chain amino acids, essential amino acids, and protein products. According to a survey of the U.S. college athletes published by the National Institutes of Health in 2021, 41.7% of the users were consuming protein products, 28.6% were consuming shots and energy drinks, creatinine by 14%, amino acids by 12.1%, and caffeine-containing multivitamins by 5.7%. Moreover, women were less likely to consume performance-enhancing products according to the same survey. According to a youth risk behavior survey conducted among high school students in the U.S. by the Centers for Disease Control and Prevention, 11% of the high school students drank sports drinks at least one time a day in 2019 in the U.S.

Awareness of health and fitness is increasing participation in sports and fitness activities. In addition, consumers are adopting various supplements to maintain health and wellbeing. The International Health, Racquet & Sportsclub Association (IHRSA), a Boston-based commercial health clubs trade association, reported a 27% rise in the number of health club members, from 58 million in 2010 to 73.6 million in 2019. According to the U.S. Bureau of Labor Statistics, 19.3% of the population in the U.S. was involved in exercise and sports activities each day in 2019. In addition, California, Georgia, Colorado, Illinois, Massachusetts, Maryland, Nebraska, Oregon, New York, South Carolina, Virginia, West Virginia, and Texas are some of the states where participation in sports and physical activity is increasing. All these parameters are fueling the growth of sports nutrition products in North America. For instance,

The spread of COVID-19 negatively impacted the sports nutrition market. Sales of sports nutrition products declined rapidly in 2020 as consumers were focused on buying essential products. Moreover, temporary closures of gyms & fitness centers owing COVID-19 associated lockdowns drastically declined consumption of sports nutrition products. However, the re-opening of gyms and fitness centers along with increasing consumer awareness on health is estimated to drive sales of sports nutrition products in 2020.

Many retailers are adopting various strategies to increase the adoption of sports nutrition products and thereby driving market growth. For instance, in January 2020, The Vitamin Shoppe partnered with LA Fitness and opened The Vitamin Shoppe locations inside LA Fitness health clubs. It created a new distribution channel for Vitamin Shoppe to sell its sport nutrition products. In July 2019, Amazon and MuscleTech collaborated to deliver MuscleTech Prime Series, a new and exclusive line of private-label sports nutrition products. In July 2020, Walmart partnered with health and wellness brand Optimega to make drinkable omega-3 supplements available through Walmart.com.

COVID-19 North America Sports Nutrition Market Impact: 34.2% decline in revenue growth

Pandemic Impact

Post-COVID-19 Outlook

The North America Sports Nutrition market declined by 34.2% from 2019 to 2020. As per earlier projections, the market was expected to be over USD 19.0 billion in 2020.

In 2021, the market will witness an increase by 35.7% from 2020, owing to the increasing penetration of sports supplements among active lifestyle users.

The spread of the COVID-19 pandemic resulted in the closures of gyms, fitness centers, and sports training academies, and thereby declining the market.

COVID-19 pandemic increased awareness on health and wellbeing. Post pandemic, consumers will continue adopting sports supplements for maintenance of health.

Consumers were focused on purchasing essential goods and reduced/discontinued adopting non-essential products, including sports nutrition.

Increasing investments in the North American sports nutrition industry along with various strategic initiatives undertaken by key stakeholders is estimated to increase the adoption of sports nutrition in North America.

In addition, sports nutrition brands are adopting various strategies to increase their adoption among consumers. For instance, in March 2020, PepsiCo agreed to acquire Rockstar Energy Beverages for USD 3.9 billion. The acquisition was aimed at enhancing its presence in the fast-expanding beverage category. In August 2021, Gelita AG presented its products for sports nutrition applications at SupplySide East and included gelatins for soft gel, hard-capsule, or gummy delivery systems.

Product Insights

By product, sports supplements account for the largest revenue share of 62.7% in 2020. It is due to high consumer demand for proteins, such as whey protein, egg protein, soy protein, pea protein, lentil protein, hemp protein, casein protein, quinoa, and whey proteins. The adoption of herbal and vegan supplements among consumers is rapidly increasing.

However, the sports food segment is expected to expand at the fastest CAGR over the forecast period. It is attributed to the growing consumption of protein bars and energy bars. Moreover, innovative sports foods with different flavors and ingredients are introduced in the market thereby supporting consumption. For instance, in June 2018, Clif Bar expanded its product portfolio with the launch of two new energy bars in the market—Clif Fruit Smoothie Filled Energy Bar and Clif Sweet & Salty Energy Bar. Both these bars are available in different flavors, including strawberry banana, caramel toffee with sea salt, and peanut butter.

Application Insights

The post-workout segment held the highest revenue share of 39.6% in 2020. It is attributed to the availability of a variety of post-workout supplements and increasing awareness of the benefits of post-workout supplements. Increasing awareness on health is resulting in the adoption of various activities for physical fitness. It, in turn, is driving demand for post-workout supplements to aid in recovery and replenishment of nutrients in the body post-physical activity.

However, other segments accounted for the fastest-growing application segment during the forecast period. Growing consumption of probiotics, meal replacement products, vitamins and mineral supplements, and during-workout supplements is contributing to the growth of this segment. Additionally, increasing instances of obesity are supporting segment growth. For instance, according to the Centers for Disease Control and Prevention (CDC), obesity prevalence in the U.S. was 42.4% in 2017-2018.

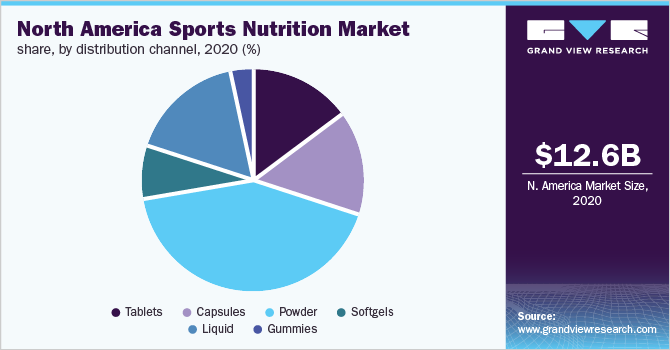

Formulation Insights

The powder segment held the highest market share of 41.9% in 2020 due to the high consumption of protein powders such as whey. High consumption of protein powders from athletes and gym-goers is driving market growth potential. The American Orthopedic Society for Sports Medicine recommends daily protein intake of 1.2 to 1.7 grams per kilogram of body weight, depending on the level of physical activity as well as athlete's rate of growth or healing. For instance, athletes under a critical growth period at or around puberty are required to increase their daily protein intake.

However, the gummies segment accounted for the fastest-growing formulation segment during the forecast period. Sports nutrition gummies are convenient, easy-to-use, and healthy alternatives to shakes, gels, or bars, and thereby driving the segment growth. Additionally, sports nutrition brands are offering innovative products to support market growth. For instance, Myoplex pre-workout gummies offered by Abbott can help increase stamina and performance throughout a challenging workout.

Consumer Group Insights

The adult segment held the highest revenue share of 68.4% in the global North America sports nutrition market in 2020. It is due to the higher adoption of supplements and preventative medicines and the presence of a large consumer pool in this age group. The rising instances of obesity, diabetes, and other lifestyle diseases along with increasing disposable income are fueling the market growth. According to the National Diabetes Statistics Report, in the U.S., 34.2 million people suffered from diabetes in 2018.

Moreover, the adult segment accounted for the fastest-growing consumer group segment during the forecast period due to the growing number of active lifestyle users and increasing adoption of fitness activities in North America. In 2017, Myprotein surveyed 1,350 Americans in the age group 18 to 65 years, which revealed that an average American adult spends nearly USD 155 per month on health and fitness. It was also found that Americans spend most of their money on supplementation, with average spending of USD 56 per month.

Consumer Group by Activity Insights

The light user segment held the highest market share of 72.4% in the global market in 2020. Increasing consumption of sports nutrition products to maintain health and well-being is a major factor responsible for high revenue share. Consumption of these products for weight management, healthy snacking, energy, and muscle support is rapidly growing among millennials. This in turn is driving consumption of various supplements.

Moreover, the light user segment also accounted for the fastest-growing segment during the forecast period. Lack of energy is a major problem faced by the millennials and, hence, they seek energy products, according to an article published in Nutrition Business Journal in 2019. Energy supplements, such as drinks, bars, powders, pills, & gels, enhance energy and endurance for exercise & sports, especially when there is a need for energy & electrolyte. Moreover, many senior citizens are looking for formulations that will help them gain strength and stay active longer.

Distribution Channel Insights

By distribution channel, the brick and mortar segment held the largest segment with a revenue share of 77.6% in 2020. It is owing to high consumer preference and trust for specialty and general discount stores over other channels. Moreover, brick & mortar distribution channel offers attractive discounts and loyalty programs to their customers. It, in turn, increases consumers’ preference for brick & mortar stores.

However, the online segment is expected to expand at the fastest CAGR over the forecast period. Increasing initiatives taken by an online platform and increasing penetration of e-commerce platforms is supporting segment growth. For instance, in September 2018, Amazon opened an online nutrition store as a title sponsor for the 2018 Ironman World Championship. This collaboration provided participants access to a vast selection of nutrition products.

Country Insights

In 2020, the U.S. accounted for the highest revenue share of 86.4% in the global market. It is attributed to growing awareness and adoption of sports foods and drinks, surging awareness on health, and increasing spending on supplements. According to a survey published by Optimum Nutrition in October 2020 in the U.S., 57% of the respondents were interested in learning about the benefits of supplements including vitamins and protein powder. Moreover, 55% of Americans were looking for supplements to have more energy, 53% to support immune health, 40% to support joint health, 37% to lose weight, 28% to build muscle, and 19% for after-exercise recovery.

However, Canada is anticipated to be the most lucrative region registering the fastest growth rate during the forecast period. Increasing awareness about health and fitness, increasing participation in gyms and fitness activities, and increasing disposable income are some of the parameters contributing to market growth. Additionally, factors such as the introduction of new products and favorable initiatives are taken by the government and key players are supporting market growth potential.

Key Companies & Market Share Insights

Growing mergers and acquisitions, collaborations, flavor differentiation are among the key strategies adopted by these companies for gaining a competitive edge in the market. For instance, in August 2018, BODYARMOR and The Coca-Cola Company announced an agreement, wherein Coca-Cola acquired a minority ownership stake in BODYARMOR. The acquisition is aimed at creating values for both the companies by enabling BODYARMOR to gain access to Coca-Cola’s bottling system and allowing Coca-Cola to expand its ownership stake in BODYARMOR in the future. Some prominent players in the North America sports nutrition market include:

-

Inovate Health Sciences

-

Abbott

-

Quest Nutrition

-

PepsiCo; Clif Bar

-

the Coca Cola Company

-

MusclePharm

-

The Bountiful Company

-

Post Holdings

-

BA Sports Nutrition

-

Cardiff Sports Nutrition

North America Sports Nutrition Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 19.6 billion

Revenue forecast in 2028

USD 34.5 billion

Growth Rate

CAGR of 8.4% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, formulation, consumer group, distribution channel, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico; Puerto Rico; Cuba

Key companies profiled

Inovate Health Sciences; Abbott; Quest Nutrition; PepsiCo; Clif Bar; the Coca Cola Company; MusclePharm; The Bountiful Company; Post Holdings; BA Sports Nutrition; Cardiff Sports Nutrition

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For this study, Grand View Research, Inc. has segmented the North America sports nutrition market based on product type, application, formulation, consumer group, distribution channel, and country:

-

Product Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Sports Supplements

-

Protein Supplements

-

Animal-based

-

Whey

-

Casein

-

Egg

-

Fish

-

Others

-

-

Plant-based

-

Soy

-

Spirulina

-

Pumpkin Seed

-

Hemp

-

Rice

-

Pea

-

Others

-

-

Vitamins

-

Minerals

-

Amino Acids

-

Probiotics

-

Omega-3 Fatty Acids

-

Carbohydrates

-

Detox Supplements

-

Electrolytes

-

Others

-

-

Sports Drinks

-

Isotonic

-

Hypotonic

-

Hypertonic

-

-

Sports Foods

-

Protein Bars

-

Energy Bars

-

Protein Gels

-

-

Meal Replacement Products

-

Weight Loss Product

-

-

Application Outlook (Revenue, USD Million, 2016 - 2028)

-

Pre-workout

-

Post-workout

-

Weight Loss

-

Others

-

-

Formulation Outlook (Revenue, USD Million, 2016 - 2028)

-

Tablets

-

Capsules

-

Powder

-

Softgels

-

Liquid

-

Gummies

-

-

Consumer Group Outlook (Revenue, USD Million, 2016 - 2028)

-

Children

-

Adult

-

Geriatric

-

-

Consumer Group by Activity Outlook (Revenue, USD Million, 2016 - 2028)

-

Heavy Users

-

Light Users

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

-

Bricks and mortar

-

Specialty Stores

-

Small Retail Stores

-

Fitness Institutes

-

Grocery Stores

-

General Discount Stores

-

Discount Clothing Retailers

-

-

E-commerce

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Puerto Rico

-

Cuba

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market for sports nutrition in North America growth include rapid urbanization coupled with the increase in disposable income & healthcare expenditure, increase in the number of sports and fitness enthusiasts, rising demand for various kinds of sports supplements, protein & energy bars, and energy drinks coupled with easy availability and accessibility to sports nutrition products across online and offline distribution channels.

b. In 2020, the powder segment dominated the North America sports nutrition market and held the largest revenue share of 41.9%.

b. In 2020, the adult consumer segment dominated the North America sports nutrition market and held the largest revenue share of 68.4% and is anticipated to register the fastest growth rate during the forecast period.

b. The North America sports nutrition market size was estimated at USD 12.6 billion in 2020 and is expected to reach USD 19.6 billion in 2021.

b. The North America sports nutrition market is expected to grow at a compound annual growth rate of 8.4% from 2021 to 2028 to reach USD 34.5 billion by 2028.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."