- Home

- »

- Biotechnology

- »

-

Nucleic Acid Methylation Market Size, Industry Report, 2030GVR Report cover

![Nucleic Acid Methylation Market Size, Share & Trends Report]()

Nucleic Acid Methylation Market (2025 - 2030) Size, Share & Trends Analysis Report By Product & Services (Kits & Reagents, Enzymes), By Type (DNA Methylation, RNA Methylation), By Technology, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-524-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Nucleic Acid Methylation Market Summary

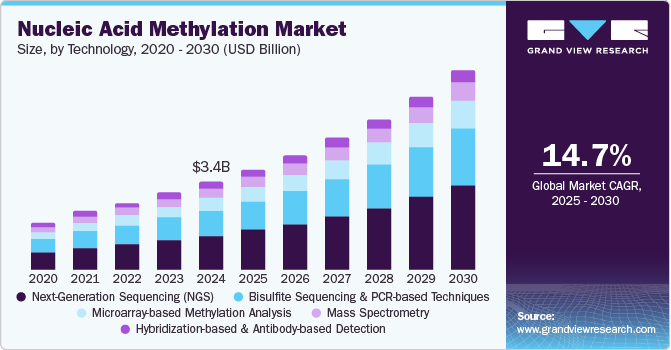

The global nucleic acid methylation market size was estimated at USD 3.43 billion in 2024 and is projected to reach USD 7.77 billion by 2030, growing at a CAGR of 14.69% from 2025 to 2030. The market is expected to grow due to the increasing use of methylation markers for early disease detection and the development of new drugs targeting m6A inhibitors for cancer and neurological disorders.

Key Market Trends & Insights

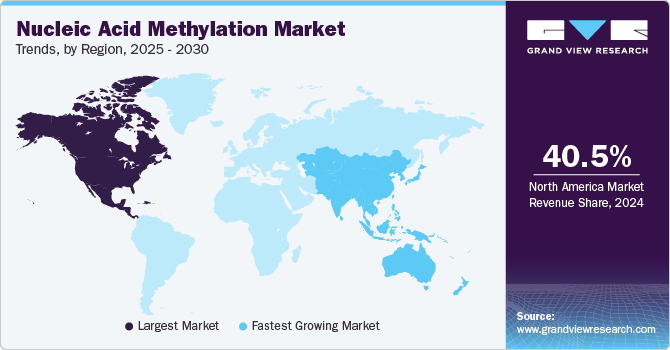

- The North America nucleic acid methylation industry led globally with a 40.46% share in 2024.

- The Asia Pacific nucleic acid methylation industry is expected to grow at the fastest CAGR of 16.56% from 2025 to 2030.

- Based on technology, the next-generation sequencing (NGS) segment led the market, holding a 39.67% share in 2024, and is expected to grow at the fastest CAGR of 15.82% in the coming years.

- Based on application, the drug discovery & personalized medicines segment dominated the market with a 51.48% share in 2024.

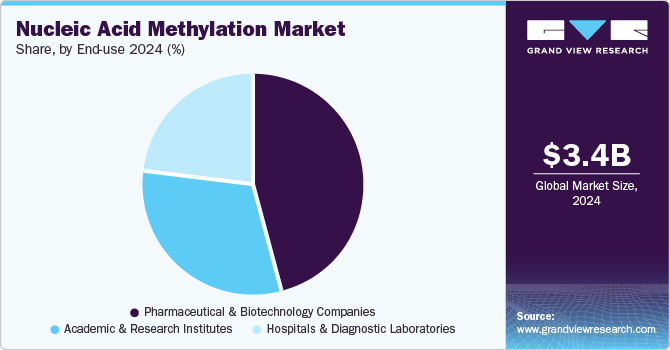

- Based on end-use, the pharmaceutical & biotechnology companies held the largest market share of 45.45% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.43 Billion

- 2030 Projected Market USD 7.77 Billion

- CAGR (2025-2030): 14.69%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, advancements in cost-effective sequencing and mass spectrometry, AI-driven data analysis, and increased research funding in precision medicine and oncology are further driving market demand.

COVID-19 has accelerated the growth of the market due to increased research on viral epigenetics, immune response, and long-term health effects. The pandemic highlighted the importance of epigenetic modifications in disease progression, leading to greater investments in methylation-based diagnostics and drug development. In addition, the demand for advanced sequencing, AI-driven data analysis, and precision medicine has surged, further driving market expansion. As a result, biotech firms and research institutions are increasingly adopting nucleic acid methylation technologies for infectious disease studies and broader healthcare applications.

In addition, the growing use of methylation markers for early disease detection is driving market growth. This is due to the rising demand for non-invasive diagnostics, better understanding of epigenetic biomarkers, and advancements in sequencing technology. These markers help detect diseases such as cancer and neurological disorders at an early stage, leading to more effective treatments and personalized medicine. As research and funding in this field increase, more biotech companies and healthcare providers are adopting methylation-based testing, further boosting market expansion.

Furthermore, the growing interest in epigenetics is driving demand for methylation-based studies. Researchers are increasingly exploring how epigenetic modifications influence gene expression and contribute to disease progression, particularly in cancer, neurological disorders, and autoimmune diseases. This has led to increased investment in understanding methylation patterns for early diagnosis, targeted therapies, and drug discovery. In addition, advancements in sequencing technologies and bioinformatics are making epigenetic research more accessible, encouraging biotech companies and healthcare institutions to expand their focus on this field, further accelerating market growth.

AI-Powered Advancements in DNA Methylation Techniques

The integration of artificial intelligence (AI) in DNA methylation techniques is transforming the way researchers analyze and interpret complex epigenetic data. AI-driven algorithms can quickly process large datasets, identify methylation patterns, and uncover potential biomarkers for early disease detection. This has significantly improved the accuracy and efficiency of DNA methylation analysis, making it a valuable tool for diagnosing diseases such as cancer, neurological disorders, and autoimmune conditions.

AI also enhances drug discovery and personalized medicine by predicting how methylation changes affect gene expression and treatment responses. By leveraging machine learning, researchers can develop targeted therapies based on individual epigenetic profiles, leading to more effective and customized treatments. In addition, AI-powered tools help streamline laboratory workflows, reducing manual errors and increasing data processing speed, which is essential for large-scale clinical research.

As AI technology continues to evolve, its role in DNA methylation studies is expected to grow. For instance, according to an article published in July 2024, Biology Methods & Protocols, researchers from Cambridge University and University College London have developed an AI system that can identify 13 types of cancer with 98.2% accuracy by analyzing DNA methylation patterns. This technology has the potential to revolutionize early cancer detection and treatment. With further training on diverse data and clinical testing, AI could soon assist doctors in screening and diagnosing cancer more effectively, leading to improved patient outcomes. Companies and research institutions are investing in AI-driven bioinformatics platforms to improve data.

AI-Powered DNA Methylation Analysis Across Diseases

Artificial intelligence (AI) transforms DNA methylation analysis, enabling faster, more accurate disease detection and biomarker discovery. Traditional methods for analyzing DNA methylation are time-consuming and complex, but AI-driven models enhance efficiency by identifying patterns across large datasets with high precision. This has significant implications for cancer diagnosis, neurological disorders, and aging research, where early detection is critical.

The table below highlights key studies showcasing AI's impact on DNA methylation analysis. These studies demonstrate AI’s ability to improve disease classification, early detection, and predictive modeling. For example, AI-powered models have achieved over 90% accuracy in cancer detection and have been successfully applied to lung cancer, Alzheimer’s disease, and breast cancer diagnostics. The increasing adoption of AI-driven DNA methylation tools is fueling market growth, with pharmaceutical and biotech companies investing in automated, high-throughput technologies.

Table 1 AI-driven DNA methylation analysis: Key studies and market impact

Study

Disease Focus

AI Model Performance

Explainable AI of DNA Methylation-Based Brain Age Prediction

Aging

Developed an explainable AI model to predict brain age using DNA methylation data, aiding in understanding aging processes.

Application of Deep Learning in Cancer Epigenetics Through DNA Methylation Analysis

Cancer

Achieved an Area Under the Curve (AUC) and accuracy rate of 91.5%, with a sensitivity rate of 78.75% in cancer detection.

Artificial Intelligence and DNA Methylation Analysis of Circulating Tumor DNA in Lung Cancer Detection

Lung Cancer

High lung cancer detection rates were achieved using AI and DNA methylation analysis of circulating tumor DNA.

Artificial Intelligence and Circulating Cell-Free DNA Methylation Profiling: Mechanism and Detection of Alzheimer’s Disease

Alzheimer's Disease

AI combined with DNA methylation data from circulating cell-free DNA has shown excellent diagnostic accuracy for Alzheimer's disease.

Early Detection and Diagnosis of Cancer with Interpretable Machine Learning

Multiple Cancer Types

Using DNA methylome data, an interpretable machine-learning model classified 13 cancer types and non-cancer tissue samples.

Deep Embedded Refined Clustering Approach for Breast Cancer Distinction Based on DNA Methylation

Breast Cancer

Achieved an unsupervised clustering accuracy of 99.27% and an error rate of 0.73% on 137 breast tissue samples.

As AI continues to evolve, its integration with DNA methylation research will drive advancements in personalized medicine, early disease screening, and drug development, positioning AI-powered tools as a key driver in the epigenetics and molecular diagnostics market.

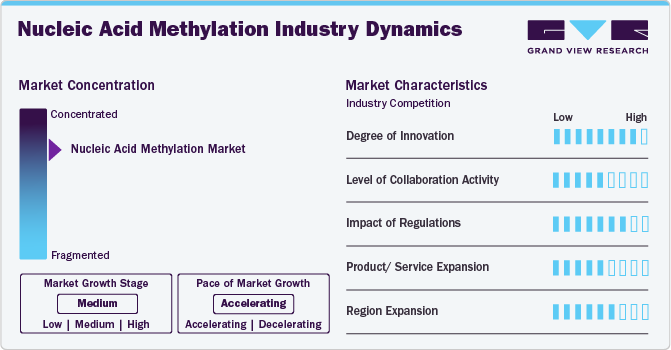

Market Concentration & Characteristics

The nucleic acid methylation industry is set for exponential growth, driven by the increasing use of methylation markers for early disease detection, advancements in sequencing and AI-driven data analysis, and rising investments in precision medicine. Growing research in epigenetics, drug discovery for cancer and neurological disorders, and the expanding role of methylation in non-invasive diagnostics fuel market demand.

The nucleic acid methylation industry is growing steadily, with moderate collaboration among industry players. Key drivers include advancements in sequencing technologies, increasing use of methylation markers for early disease detection, and rising investments in precision medicine. In addition, AI-driven data analysis, expanding applications in drug discovery for cancer and neurological disorders, and the growing focus on epigenetics research are fueling market demand. While industry collaborations are moderate, partnerships between biotech firms, research institutions, and healthcare providers are expected to accelerate innovation and market expansion. In November 2024, Wasatch BioLabs and Oxford Nanopore formed a partnership to accelerate the development and adoption of methylation sequencing for clinical use. This collaboration aims to enhance precision in DNA analysis, paving the way for improved disease detection and diagnosis.

Regulations have moderately influenced the nucleic acid methylation industry by setting standards for diagnostic accuracy, data privacy, and clinical validation of methylation-based tests. Regulatory guidelines ensure the reliability and safety of these technologies, impacting research, product development, and market entry timelines. While stringent approval processes can slow innovation, they also drive higher-quality advancements. As governments and health agencies recognize the potential of methylation-based diagnostics and therapies, evolving regulations may further shape market growth and adoption.

The nucleic acid methylation industry has seen significant growth in product expansion, driven by advancements in sequencing technologies, increasing demand for methylation-based diagnostics, and the rising focus on personalized medicine. Companies are developing new kits, reagents, and software solutions to enhance methylation analysis, making it more accurate and accessible. In addition, AI-driven data analysis and automation are streamlining workflows, further boosting product innovation. As research in epigenetics expands, the market is expected to see continued diversification in product offerings. For instance, in November 2024, Ellis Bio, a spin-out from the University of Chicago, officially launched to advance epigenomics research. The company has introduced its SuperMethyl - Fast Kit, designed to enhance methylation analysis, making DNA methylation studies faster and more efficient for researchers and clinicians.

The nucleic acid methylation industry is expanding gradually across regions, driven by increasing research funding, growing adoption of precision medicine, and rising demand for early disease detection. North America and Europe lead the market due to strong biotech infrastructure and regulatory support, while Asia-Pacific is witnessing rapid growth fueled by expanding healthcare investments and technological advancements. As awareness of epigenetics and its role in disease management increases globally, the market is expected to gain traction across emerging regions.

Product & Services Insights

In 2024, the kits & reagents segment dominated the market with a 34.89% share, driven by high demand for DNA and RNA methylation analysis in research and diagnostics. The growing use of kits and reagents in epigenetics studies, cancer detection, and drug discovery has fueled this segment’s growth. In addition, advancements in sequencing technologies, increased adoption of methylation-based biomarkers, and the need for cost-effective, user-friendly laboratory solutions have further strengthened its market position. As research in precision medicine expands, demand for these products is expected to rise. In May 2024, QIAGEN launched a new library preparation kit to enhance nucleic acid methylation analysis, supporting multi-omic studies and driving advancements in precision medicine.

The services segment is expected to register the fastest CAGR of 16.82% from 2025 to 2030. This growth is driven by the increasing demand for specialized methylation analysis, bioinformatics solutions, and contract research services. Advancements in AI-driven data analysis, the growing adoption of precision medicine, and the need for cost-effective outsourcing in research and diagnostics are further fueling this growth. Expanding collaborations between biotech firms and academic institutions are also driving market expansion.

Type Insights

In 2024, the DNA methylation segment dominated the market share, driven by its critical role in disease diagnostics, biomarker discovery, and cancer research. The increasing use of DNA methylation in early disease detection, precision medicine, and drug development has fueled its growth. Advancements in sequencing technologies, rising investment in epigenetics research, and the growing adoption of methylation-based liquid biopsies have further strengthened this segment's market dominance.

The RNA methylation segment in the market is expected to grow at the fastest CAGR from 2025 to 2030. This growth is driven by increasing research on RNA modifications, particularly m6A methylation, and their role in gene regulation, cancer, and neurological disorders. Advances in sequencing technologies, growing interest in epitranscriptomics, and rising investments in RNA-based drug discovery are fueling demand. In addition, the expanding applications of RNA methylation in precision medicine and targeted therapies are accelerating market growth.

Technology Insights

In 2024, the next-generation sequencing (NGS) segment led the market, holding a 39.67% share, and is expected to grow at the fastest CAGR of 15.82% in the coming years. This growth is driven by the increasing adoption of NGS for high-throughput DNA and RNA methylation analysis in research and clinical diagnostics. Its precise, comprehensive methylation profiling ability has made it a preferred technology for cancer detection, epigenetic studies, and personalized medicine. Advancements in sequencing efficiency, decreasing costs, and integrating AI-driven bioinformatics further accelerate its market expansion.

The bisulfite sequencing & PCR-based techniques segment is also set for strong growth, driven by its widespread use in DNA methylation analysis, high sensitivity, and cost-effectiveness. Bisulfite sequencing remains a gold standard for methylation studies, enabling precise detection of methylation patterns at single-base resolution. PCR-based techniques, including methylation-specific PCR (MSP) and quantitative PCR, offer rapid and targeted analysis, making them essential for clinical diagnostics and research. Advancements in assay development and increasing demand for epigenetic biomarkers further fuel this segment’s growth.

Application Insights

In 2024, the drug discovery & personalized medicines segment dominated the market with a 51.48% share. This growth is driven by the increasing use of methylation biomarkers in targeted drug development and precision medicine. DNA and RNA methylation play a crucial role in understanding disease mechanisms, leading to the development of epigenetic therapies for cancer, neurological disorders, and autoimmune diseases. Advancements in sequencing technologies, AI-driven data analysis, and rising investments in personalized treatment approaches further fuel this segment's dominance.

The clinical diagnostics segment in the market is expected to grow at the fastest CAGR from 2025 to 2030, driven by its increasing role in early disease detection, cancer screening, and non-invasive liquid biopsies. Methylation-based diagnostic tests are gaining traction due to their high sensitivity and specificity in identifying epigenetic changes linked to various diseases. Advancements in sequencing technologies, rising adoption of precision medicine, and growing regulatory approvals for methylation-based biomarkers further accelerate market growth.

End-use Insights

In 2024, pharmaceutical & biotechnology companies held the largest market share of 45.45%, driven by their extensive investment in drug discovery, biomarker research, and precision medicine. These companies leverage DNA and RNA methylation technologies to develop targeted therapies for cancer, neurological disorders, and other diseases. Advancements in sequencing, AI-driven data analysis, and strategic collaborations with research institutions further strengthen their market position and drive continued growth.

Meanwhile, the hospitals & diagnostic laboratories segment is expected to grow the fastest in the coming years, driven by the increasing adoption of methylation-based tests for early disease detection, cancer screening, and personalized treatment planning. Growing awareness of epigenetic biomarkers, advancements in non-invasive liquid biopsy techniques, and the integration of next-generation sequencing (NGS) in clinical diagnostics fuel this growth. In addition, rising healthcare investments and regulatory approvals for methylation-based diagnostics are further accelerating market expansion.

Competitive Scenario Insights

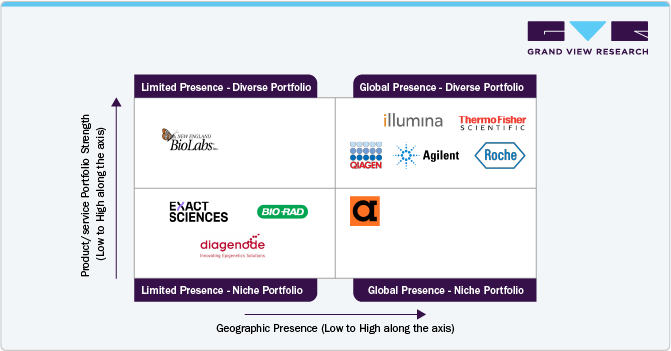

The nucleic acid methylation industry is highly competitive, driven by major biotech firms like Thermo Fisher Scientific, Illumina, QIAGEN, and Agilent Technologies, which lead in NGS, PCR-based detection, and methylation analysis tools. Strategic partnerships, acquisitions, and R&D fuel market expansion, particularly in personalized medicine and early disease detection. Emerging Asia-Pacific and Middle East players offer cost-effective solutions while academic institutions advance RNA methylation research. With regulatory approvals, AI-driven tools, and automation, the market is evolving rapidly, leading to increased consolidation and innovation in epigenetics research and clinical applications.

The nucleic acid methylation industry is highly competitive, with market leaders driving innovation, emerging players expanding clinical applications, and disruptors pioneering AI-driven and real-time methylation analysis, shaping the future of epigenetics and precision medicine.

Established players such as Thermo Fisher Scientific, Illumina, and QIAGEN dominate the market with comprehensive product portfolios covering NGS, PCR-based methylation detection, and mass spectrometry. These companies leverage strong distribution networks, R&D investments, and strategic acquisitions to maintain their competitive edge.

Fast-growing firms like Diagenode (acquired by Hologic), Abcam, and Exact Sciences are gaining traction with cost-effective kits, specialized reagents, and expanding research applications. These companies focus on epigenetics-driven diagnostics and expanding methylation analysis into clinical settings, particularly cancer and neurodegenerative disease research.

Cutting-edge startups and biotech firms such as New England Biolabs (NEB), Oxford Nanopore Technologies, and Zymo Research are pioneering novel enzyme-based methylation detection, AI-driven bioinformatics tools, and direct RNA methylation analysis. Their focus on high-throughput, real-time, and automation-friendly technologies is reshaping the industry driving advancements in personalized medicine and early disease detection.

Regional Insights

In 2024, the North America nucleic acid methylation industry led globally with a 40.46% share, driven by strong investment in biomedical research, advanced healthcare infrastructure, and the widespread adoption of precision medicine. The region benefits from a high concentration of pharmaceutical and biotechnology companies, extensive funding for epigenetics research, and early adoption of next-generation sequencing (NGS) technologies. In addition, increasing regulatory approvals for methylation-based diagnostics and the growing use of liquid biopsy tests further drive market growth in North America.

U.S. Nucleic Acid Methylation Market Trends

The U.S. nucleic acid methylation industry is growing rapidly due to strong investments in epigenetics research, advanced sequencing technologies, and increasing adoption of precision medicine. Demand for methylation-based diagnostics in cancer and neurological disorders further fuels growth. In addition, regulatory support and expanding collaborations between biotech firms and research institutions are driving market expansion.

Europe Nucleic Acid Methylation Market Trends

Europe nucleic acid methylation industry is driven by strong government funding and increasing research in epigenetics. The region is witnessing the growing adoption of precision medicine and next-generation sequencing (NGS) technologies. Rising demand for early disease detection, especially in cancer and neurological disorders, is fueling market expansion. Collaborations between pharmaceutical firms, research institutions, and healthcare providers boost innovation. In addition, favorable regulatory policies support the development of methylation-based diagnostics and therapies.

The UK nucleic acid methylation industry is expanding due to increasing epigenetics research and precision medicine investments. Growing adoption of methylation-based diagnostics for cancer and neurological disorders is driving demand. In addition, advancements in sequencing technologies and strong collaborations between biotech firms, academic institutions, and healthcare providers fuel market growth.

Germany's nucleic acid methylation industry is growing rapidly due to strong government funding for biomedical research, increasing adoption of precision medicine, and advancements in sequencing technologies. The rising demand for methylation-based diagnostics in cancer and neurodegenerative diseases drives market expansion. In addition, collaborations between pharmaceutical companies, research institutes, and healthcare providers accelerate innovation and commercialization.

Asia Pacific Nucleic Acid Methylation Market Trends

The Asia Pacific nucleic acid methylation industry is expected to grow at the fastest CAGR of 16.56% from 2025 to 2030, driven by increasing government funding for epigenetics research and rising healthcare investments. The growing prevalence of cancer and neurological disorders is fueling demand for methylation-based diagnostics and precision medicine. Advancements in next-generation sequencing (NGS) and AI-driven data analysis further accelerate market expansion. In addition, expanding biotechnology and pharmaceutical industries and increasing collaborations between research institutions and global companies are boosting innovation. Favorable regulatory policies and adopting non-invasive liquid biopsy techniques also contribute to growth.

China’s nucleic acid methylation industry is set for rapid growth, driven by strong government investments in genomics and precision medicine. The rising prevalence of cancer and neurological disorders is increasing demand for methylation-based diagnostics and targeted therapies. In addition, advancements in sequencing technologies, AI-driven bioinformatics, and expanding collaborations between biotech firms and research institutions fuel market expansion.

Japan’s nucleic acid methylation industry held a strong share in 2024, driven by advanced epigenetics and precision medicine research. The country's strong biotechnology sector and investments in next-generation sequencing (NGS) are fueling growth. In addition, the rising demand for methylation-based diagnostics in cancer and neurological diseases and government support for innovation is boosting market expansion.

Key Nucleic Acid Methylation Company Insights

Key players operating in the nucleic acid methylation industry are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling market growth.

Key Nucleic Acid Methylation Companies:

The following are the leading companies in the nucleic acid methylation market. These companies collectively hold the largest market share and dictate industry trends.

- New England Biolabs

- Thermo Fisher Scientific Inc.

- Illumina Inc.

- Abcam plc

- F. Hoffmann-La Roche Ltd

- Agilent Technologies Inc.

- Bio-Rad Laboratories, Inc.

- QIAGEN

- Exact Sciences Corporation

- Diagenode Diagnostics S.A.

Recent Developments

-

In February 2025, Alida Biosciences officially launched EpiPlex, the first platform to simultaneously detect and quantify multiple RNA modifications via short-read sequencing while also providing gene expression data. Combining the EpiPlex RNA Reagent Kit and EpiScout Analysis Suite, this comprehensive solution streamlines research into RNA modifications and their role in disease, aging, and development.

-

In January 2025, New England Biolabs launched EM-seq v2, an advanced enzyme-based alternative to bisulfite sequencing for 5mC and 5hmC detection. The updated kit minimizes DNA damage, supports a wider input range, and offers a faster, more efficient workflow for improved epigenetic analysis.

-

In May 2024, QIAGEN launched the QIAseq Multimodal DNA/RNA Library Kit, enabling seamless DNA and RNA library preparation for next-generation sequencing (NGS). The kit supports whole genome sequencing (WGS), whole transcriptome sequencing (WTS), and hybrid-capture-based target enrichment from a single sample, streamlining multiomic analysis.

Nucleic Acid Methylation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.91 billion

Revenue forecast in 2030

USD 7.77 billion

Growth rate

CAGR of 14.69% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, type, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

New England Biolabs; Thermo Fisher Scientific Inc.; Illumina Inc.; Abcam plc; F. Hoffmann-La Roche Ltd; Agilent Technologies Inc.; Bio-Rad Laboratories, Inc.; QIAGEN; Exact Sciences Corporation; Diagenode Diagnostics S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nucleic Acid Methylation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nucleic acid methylation market report based on product and services, type, technology, application, end-use, and region:

-

Product & Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Kits & Reagents

-

Enzymes

-

Services

-

Instruments & Software

-

Consumables

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

DNA Methylation

-

RNA Methylation

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Next-Generation Sequencing (NGS)

-

Bisulfite Sequencing & PCR-based Techniques

-

Microarray-based Methylation Analysis

-

Mass Spectrometry

-

Hybridization-based & Antibody-based Detection

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Discovery & Personalized Medicines

-

Clinical Diagnostics

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institutes

-

Hospitals & Diagnostic Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global nucleic acid methylation market size was estimated at USD 3.43 billion in 2024 and is expected to reach USD 3.91 billion in 2025.

b. The global nucleic acid methylation market is expected to grow at a compound annual growth rate of 14.69% from 2025 to 2030 to reach USD 7.77 billion by 2030.

b. North America dominated the nucleic acid methylation market with a share of 40.46% in 2024. This is driven by its advanced healthcare infrastructure, strong research funding, presence of key market players, and high adoption of epigenetics in disease diagnosis and treatment.

b. Some key players operating in the nucleic acid methylation market include New England Biolabs; Thermo Fisher Scientific Inc.; Illumina Inc.; Abcam plc; F. Hoffmann-La Roche Ltd; Agilent Technologies Inc.; Bio-Rad Laboratories, Inc.; QIAGEN; Exact Sciences Corporation; and Diagenode Diagnostics S.A.

b. Nucleic acid ethylation is driven by factors such as rising epigenetics research, increasing demand for biomarker discovery, advancements in sequencing technologies, growing prevalence of cancer and genetic disorders, expanding pharmaceutical applications, and government funding for epigenetic studies, fostering innovation in drug development and personalized medicine.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.