- Home

- »

- Medical Devices

- »

-

Nutraceutical Contract Manufacturing Services Market Report, 2030GVR Report cover

![Nutraceutical Contract Manufacturing Services Market Size, Share & Trends Report]()

Nutraceutical Contract Manufacturing Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Dietary Supplements, Functional Food & Beverages), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-043-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Nutraceutical Contract Manufacturing Services Market Summary

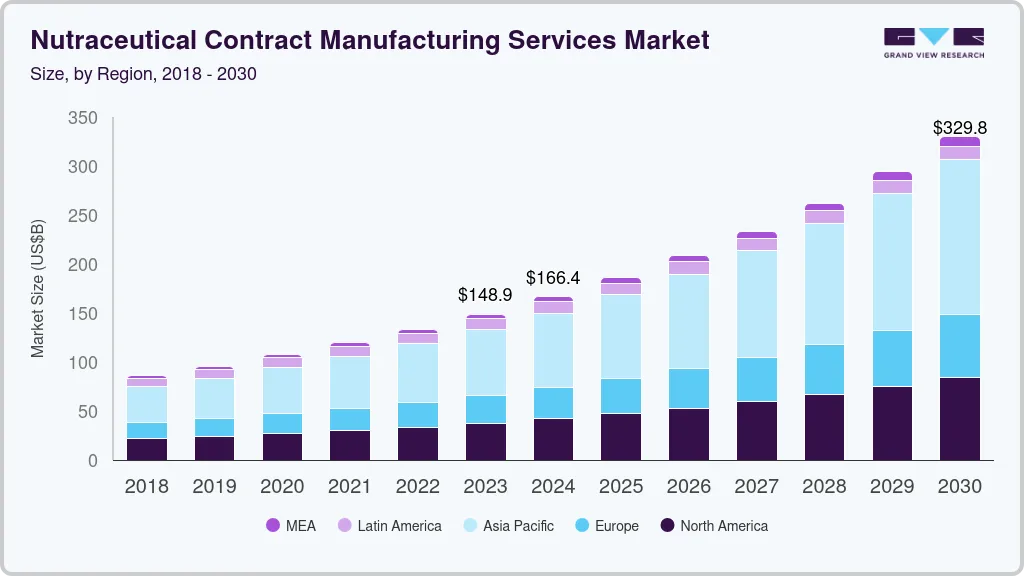

The global nutraceutical contract manufacturing services market size was estimated at USD 148.85 billion in 2023 and is projected to reach USD 329.84 billion by 2030, growing at a CAGR of 12.0% from 2024 to 2030. With increasing benefits from CMOs in the nutraceutical sector, such as lower overhead costs, better shipping options, and thorough lab testing, the market is expected to expand over the forecast period.

Key Market Trends & Insights

- North America dominated the market with a revenue share of 34.23% in 2022.

- Asia Pacific is anticipated to register a lucrative CAGR of about 13.92% over the forecast period.

- By product, the contract manufacturing services for the functional food and beverages segment dominated the market with a 64.40% revenue share in 2022.

- By dietary supplements by dosage form, the tablets segment dominated the dietary supplements market by dosage form, with a 24.48% revenue share in 2022.

Market Size & Forecast

- 2023 Market Size: USD 148.85 Billion

- 2030 Projected Market Size: USD 329.84 Billion

- CAGR (2024-2030): 12.0%

- North America: Largest market in 2022

Furthermore, the market is encouraged by the improved reliability and affordable production of CMOs. For instance, based on information offered on the website by Akums Drugs & Pharmaceuticals Ltd., one of the notable third-party contract manufacturing units in India, growth with minimal investment, effectiveness in expense and managerial staff, and operational & efficiency enhancement are benefits of working with third-party contract manufacturers.

Factors such as the increasing health consciousness among consumers, the availability of advanced technologies, and the rising number of contract manufacturing companies in various significant regions are expected to drive the growth of the overall nutraceutical contract manufacturing market.

The COVID-19 pandemic significantly disrupted raw material supplies, which coincided with the massive demands for dietary supplements positioned to support the immune system. For instance, according to an article published by the National Library of Medicine in December 2021, the sales of dietary supplements in the U.S. increased by 44% in the six weeks preceding 5th April 2020. The same source stated that the sales of multivitamins spiked by 51% in March 2020, reaching 120 billion units in the U.S. alone. Similarly, the sales of vitamins increased by 63% in the U.K. and around 40% to 60% in France during the pandemic, compared to 2019.

Additionally, the development of region-specific pharmaceutical and food industries is expected to further fuel the growth of the nutraceutical contract manufacturing services market. For instance, in June 2022, Star Combo Pharma, a manufacturer and distributor of health, nutritional, and beauty products, announced the opening of its new 7,000-square-meter manufacturing facility in New South Wales, Australia. The facility will provide 30,000 square meters of total manufacturing floor space and has been procured for a total bid of USD 7.5 billion.

Moreover, nutraceutical contract manufacturers have been expanding their service offerings to meet the evolving needs of the industry and their clients. Increasing collaborations between nutraceutical companies and contract manufacturers have led to strategic partnerships that foster innovation, improve operational efficiency, and drive growth. Some contract manufacturers have established dedicated R&D facilities to support their clients' product innovation efforts. They invest in R&D and ingredient testing to stay at the forefront of nutraceutical advancements. By offering R&D support, contract manufacturers enable their clients to leverage their expertise and bring new, science-backed products to the market.

Product Insights

The contract manufacturing services for the functional food and beverages segment dominated the market with a 64.40% revenue share in 2022. The segment refers to packaged food and beverages (e.g., antioxidant-rich cereals and beverages) containing added nutrients and/or health ingredients, wherein enhancements are intended to produce a nutritional benefit. As more and more consumers increasingly focus on their health and well-being, it is anticipated to propel the demand for functional foods and beverages that offer specific health benefits. This is because functional foods and beverages make for an effective means of delivering nutrients and bioactive compounds, including minerals, antioxidants, vitamins, plant extracts, fiber, prebiotics, and probiotics.

The dietary supplement market has been steadily growing, driven by increasing consumer awareness regarding health & wellness, changing dietary preferences, and a desire for preventive healthcare. This market expansion has led to a higher demand for manufacturing services to meet the growing need for dietary supplements. Contract manufacturers offer scalability and flexibility in production to brand owners, thus increasing the uptake of these services. They have the capacity to handle varying production volumes, accommodating fluctuations in demand without the need for significant capital investments from brand owners.

Dietary Supplements by Dosage Form Insights

The tablets segment dominated the dietary supplements market by dosage form, with a 24.48% revenue share in 2022. Tablets are the most popular dosage form for nutraceuticals. They offer convenience, ease of use, and precise dosage control. Market trends indicate high demand for tablets due to their familiarity, portability, and longer shelf life. Brand owners are increasingly outsourcing the manufacturing of tablets to Contract Manufacturing Organizations (CMOs) owing to associated benefits such as cost-effectiveness, expertise & technology, scalability, flexibility, and risk mitigation.

CMOs possess extensive knowledge, expertise, and advanced technologies in formulation development, production, and quality assurance. They are equipped with state-of-the-art facilities, regulatory compliance experience, and a skilled workforce dedicated to efficiently manufacturing tablets and adhering to industry standards.

The gummies segment is anticipated to register a lucrative CAGR of about 14.66% over the forecast period. Nutraceutical gummies and chews have gained popularity, especially among children and individuals who dislike swallowing pills. They offer a pleasant taste and are often formulated to resemble candies. The market for gummies and chews is growing rapidly, driven by the increasing demand for nutraceuticals in more palatable forms. Consumers are seeking personalized and customized nutraceutical products that cater to their specific needs. Contract manufacturers are responding to this trend by offering a wide range of customization options, including ingredient selection, dosage forms, and packaging, to meet individual/regional consumer preferences.

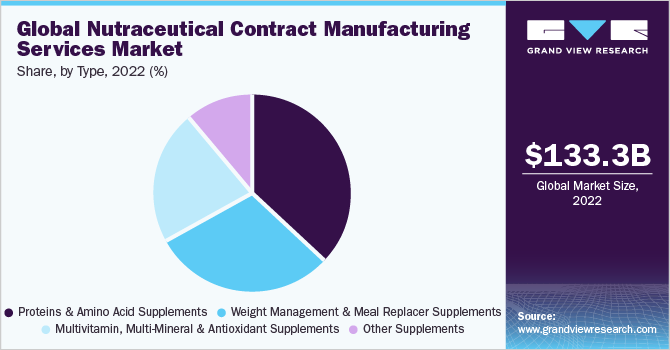

Dietary Supplements by Type Insights

The proteins & amino acid supplements segment dominated the dietary supplements market in terms of type, with a 35.8% revenue share in 2022. There is a growing awareness of the importance of maintaining a healthy lifestyle and physical fitness. Consumers, including athletes, fitness enthusiasts, and health-conscious individuals, are seeking protein and amino acid supplements to support their fitness goals, muscle recovery, and overall well-being. The desire to optimize athletic performance and achieve desired body composition is driving the demand for proteins and amino acid supplements. The demand for vegan and plant-based protein supplements is growing due to various factors, including ethical considerations, environmental concerns, and dietary preferences.

Vitamins, minerals, and antioxidants are essential nutrients supporting various bodily functions and contributing to overall well-being. As a result, consumers are turning to supplements to fill potential nutrient gaps and support their health goals. The increasing prevalence of dietary deficiencies due to inadequate nutrient intake or specific dietary restrictions is a key factor driving the market for multivitamins, multi-minerals, and antioxidant supplements.

Regional Insights

North America dominated the market with a revenue share of 34.23% in 2022. The region has a well-established nutraceutical industry, with numerous contract manufacturing companies offering services to brands and businesses. These companies have the necessary infrastructure, regulatory knowledge, and quality standards to ensure the safe and efficient production of nutraceutical products.

Preference for natural and organic products among consumers to support health and wellness is rising in North America. Nutraceuticals provide an alternative to traditional pharmaceuticals and are perceived as a more natural approach to maintaining good health. This growing demand is driving the need for contract manufacturers to produce a wide range of nutraceutical products in the region.

Asia Pacific is anticipated to register a lucrative CAGR of about 13.92% over the forecast period. The strong growth in the region is due to the rising demand for nutraceutical products from various countries, such as China, India, Japan, South Korea, and Australia. Increasing awareness about health and wellness, changing lifestyles, and a growing aging population are driving the demand for dietary supplements, functional foods, and other nutraceutical products. Consequently, this is improving the need for contract manufacturing services to meet production requirements.

Key Companies & Market Share Insights

The market is fragmented and competitive owing to the presence of several small to large market players. These companies offer nutraceutical contract manufacturing services spanning multiple segments, including dietary supplements, functional foods, and beverages. In addition, market players implement strategic initiatives such as mergers & acquisitions, partnerships, and collaborations to support their growth objectives. For instance, in May 2023, Nutralab Canada Corp. introduced its 2nd generation of nutritional powder supplement manufacturing & packaging process to serve the demand better. Some of the prominent players in the global nutraceutical contract manufacturing services market include:

-

Ashland

-

Glanbia plc

-

Herbalife International of America, Inc

-

Biotrex Nutraceuticals

-

Martínez Nieto

-

Menadiona

-

NUTRASCIENCE LABS

-

NUTRIVO

-

American Health Foundations, Inc.

-

Gemini Pharmaceuticals

-

Biovencer Healthcare Pvt Ltd

-

Rain Nutrience

Nutraceutical Contract Manufacturing Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 166.43 billion

Revenue forecast in 2030

USD 329.84 billion

Growth rate

CAGR of 12.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Ashland; Glanbia plc; Herbalife International of America, Inc; Biotrex Nutraceuticals; Martínez Nieto; Menadiona; NUTRASCIENCE LABS; NUTRIVO; American Health Foundations, Inc.; Gemini Pharmaceuticals; Biovencer Healthcare Pvt Ltd; Rain Nutrience

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nutraceutical Contract Manufacturing Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global nutraceutical contract manufacturing services market report on the basis of product and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dietary Supplements

-

By Type

-

Proteins & Amino Acid Supplements

-

Weight Management and Meal Replacer Supplements

-

Multivitamin, Multi-Mineral, and Antioxidant Supplements

-

Other Supplements

-

-

By Dosage Form

-

Tablets

-

Capsules

-

Liquid Oral

-

Powder In Sachet/Jar

-

Gummies

-

Energy Bars

-

Other Suitable Forms

-

-

-

Functional Food and Beverages

-

- Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global nutraceutical contract manufacturing services market size was estimated at USD 133.34 billion in 2022 and is expected to reach USD 148.85 billion in 2023.

b. The global nutraceutical contract manufacturing services market is expected to grow at a compound annual growth rate of 12.04% from 2023 to 2030 to reach USD 329.84 billion by 2030.

b. Asia Pacific dominated the nutraceutical contract manufacturing services market and accounted for the largest revenue share of over 40% in 2022. This is attributable to its strong demand from various countries such as China, India, Japan, South Korea, and Australia.

b. Some key players operating in the nutraceutical contract manufacturing services market include Ashland Glanbia plc; Herbalife International of America, Inc; Biotrex Nutraceuticals; Martínez Nieto; Menadiona; NUTRASCIENCE LABS; NUTRIVO; American Health Foundations, INC.; Gemini Pharmaceutical; Biovencer Healthcare Pvt Ltd; Rain Nutrience

b. Key factors that are driving the nutraceutical contract manufacturing services market growth include increasing demand for nutraceutical products, and increased reliability and cost-effective production offered by CMOs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.