- Home

- »

- Automotive & Transportation

- »

-

Off-road Vehicle Braking System Market Size Report, 2033GVR Report cover

![Off-road Vehicle Braking System Market Size, Share & Trends Report]()

Off-road Vehicle Braking System Market (2025 - 2033) Size, Share & Trends Analysis Report By Vehicle Type (All-Terrain Vehicles, Utility Task Vehicles), By Brake Type, By Component Material, By Brake System Operations, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-686-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Off-road Vehicle Braking System Market Summary

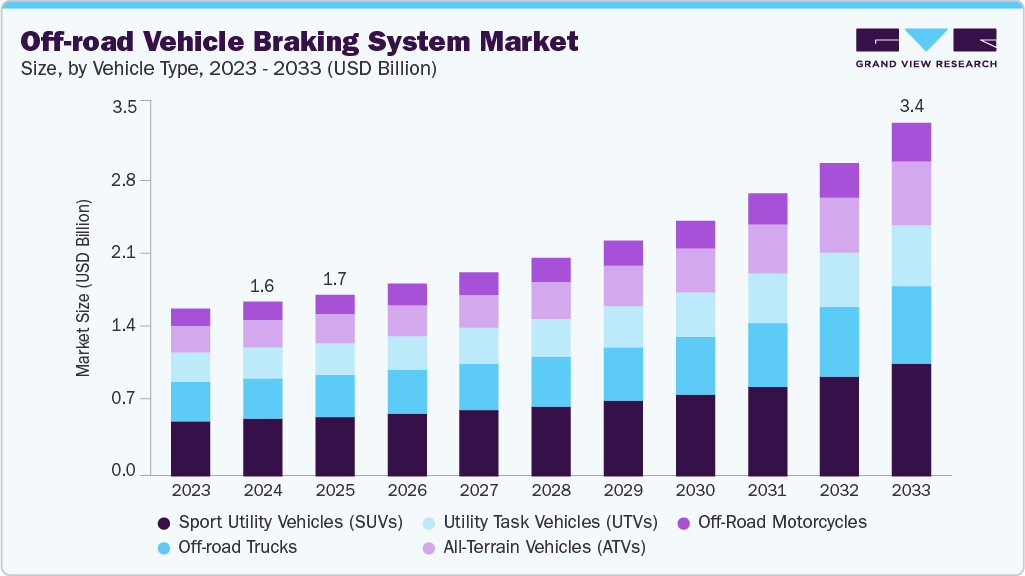

The global off-road vehicle braking system market size is estimated at USD 1.57 billion in 2024 and is projected to reach USD 3.43 billion by 2033, growing at a CAGR of 9.5% from 2025 to 2033. The rising adoption of electric and hybrid off-road vehicles is significantly reshaping the braking system landscape.

Key Market Trends & Insights

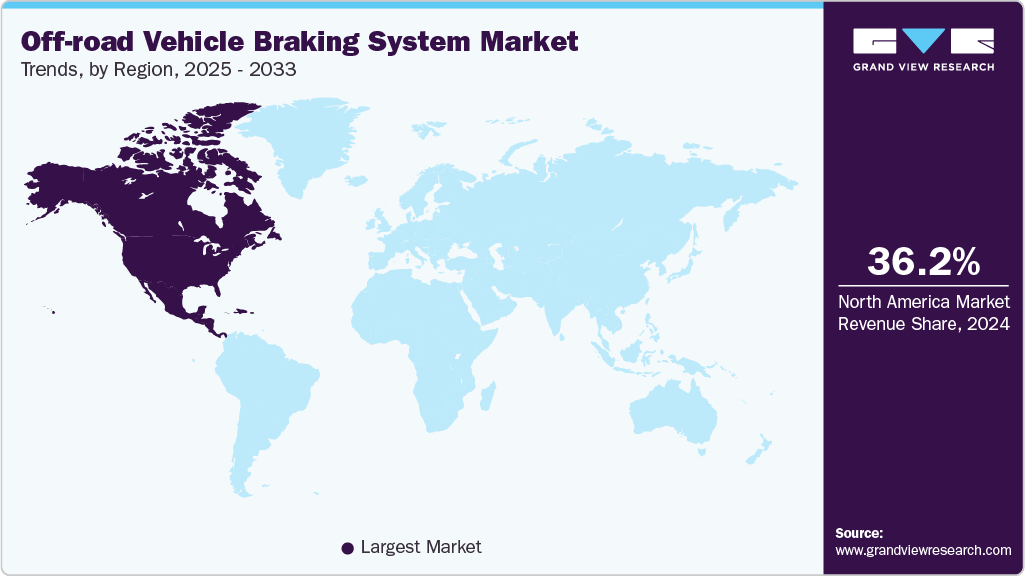

- North America dominated the off-road vehicle braking system market with the largest revenue share of 36.2% in 2024.

- The off-road vehicle braking market in the U.S. accounted for the largest market revenue share in North America in 2024.

- By vehicle type, the sport utility vehicles (SUVs) segment led the market with the largest revenue share of 31.8% in 2024.

- By brake type, the disc brakes segment accounted for the largest market revenue share in 2024.

- By component material, the steel segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.57 Billion

- 2033 Projected Market Size: USD 3.43 Billion

- CAGR (2025-2033): 9.5%

- North America: Largest market in 2024

Manufacturers are increasingly integrating smart braking solutions such as regenerative braking, electromechanical brakes, and brake-by-wire systems. These advanced technologies improve control, efficiency, and safety on rugged terrains while aligning with global emissions reduction goals. As more UTV, SUVs, and off-road trucks go electric, the demand for precision-controlled and electronically-assisted braking systems is expected to surge.There is a global surge in demand for recreational off-road vehicles, driven by lifestyle shifts, off-road tourism, adventure sports, and increased disposable income in developed economies. North America continues to dominate this trend, with growing spillovers into Europe and Asia-Pacific. As end-users demand higher performance, safety, and comfort, braking systems are evolving accordingly. Vehicles such as sport UTVs, performance ATVs, and luxury off-road SUVs now come equipped with high-performance disc brakes, ABS, and traction control systems (TCS) designed to function efficiently on variable terrain - including mud, snow, sand, and rocky slopes. Furthermore, consumers now expect customizable or terrain-sensitive braking modes, integrating with broader vehicle control systems.

The growing global focus on off-road vehicle safety is pushing manufacturers toward compliance with increasingly stringent safety and emission regulations. Governments in the U.S., Canada, Europe, China, and Australia are introducing standards requiring features like Anti-lock Braking Systems (ABS), Electronic Stability Control (ESC), and rollover prevention systems in various classes of off-road vehicles including utility-focused models like agricultural tractors and construction loaders. In some jurisdictions, ABS is becoming mandatory even for motorcycles and ATVs beyond certain engine capacities. These mandates are not just improving operational safety, but are also encouraging widespread platform-level integration of advanced braking technologies across OEM portfolios.

As vehicle manufacturers strive to optimize fuel efficiency and battery range, the light weighting of vehicle systems, including braking components, has become a priority. This is especially critical in electric and hybrid off-road vehicles, where reducing unsprung mass directly impacts range, handling, and energy consumption. This is driving a shift from traditional cast-iron brake components toward aluminum alloys, carbon composites, and metal-ceramic hybrid materials. These materials offer high strength-to-weight ratios, superior heat dissipation, and enhanced wear resistance, key for extended off-road use. Furthermore, carbon-ceramic brakes, once exclusive to motorsports or premium automotive segments, are finding niche adoption in high-performance SUVs and tactical military vehicles due to their ability to maintain braking performance under extreme thermal loads.

Off-road braking systems are increasingly being tailored for commercial, industrial, and tactical use cases spanning agriculture, mining, construction, and defense. These sectors require braking solutions that can handle frequent heavy loads, high frictional heat, steep inclines, water crossings, and abrasive terrain, all while ensuring operator safety and minimal downtime. In agriculture, the shift from manual equipment to mechanized farming in regions like India, Brazil, and Sub-Saharan Africa is expanding the market for affordable, yet rugged hydraulic and pneumatic braking systems. In mining and extraction, off-road dumpers and haul trucks demand robust multi-stage braking systems including primary, secondary, and emergency brakes.

Vehicle Type Insights

The sport utility vehicles (SUVs) segment led the market with the largest revenue share of 31.75% in 2024, driven by the global surge in demand for versatile, high-performance vehicles capable of navigating both urban roads and rugged terrains. Modern SUVs, especially in the mid-size and premium categories, are increasingly equipped with advanced braking technologies such as Anti-Lock Braking Systems (ABS), Electronic Stability Control (ESC), and Traction Control Systems (TCS) to ensure superior control and safety in off-road conditions. With growing consumer preference for adventure travel and off-road exploration, particularly in North America, Europe, and parts of Asia-Pacific, OEMs are enhancing braking performance through disc-based systems, electromechanical brakes, and brake-by-wire integration.

The utility task vehicles (UTVs) segment is expected to grow at the fastest CAGR during the forecast period.These vehicles are valued for their compact design, load-carrying capacity, and ability to navigate challenging terrains, making them ideal for both work and leisure purposes. As UTV usage intensifies, there is a growing emphasis on equipping them with advanced braking systems that ensure safety, durability, and responsive handling in harsh conditions. Manufacturers are integrating features like hydraulic disc brakes, ABS, and electronic brake-force distribution (EBD) to enhance braking efficiency and prevent wheel lock on loose surfaces. The trend toward electrification of UTVs is also prompting the use of lightweight materials and electromechanical braking systems, improving overall energy efficiency and vehicle control.

Brake Type Insights

The hydraulic brakes segment accounted for the largest market revenue share in 2024, driven by its widespread application across Utility Task Vehicles (UTVs), all-terrain vehicles (ATVs), off-road trucks, and agricultural machinery. One of the key factors supporting its growth is the balance between performance, cost, and reliability that hydraulic systems offer. These brakes deliver consistent stopping power, are relatively easy to maintain, and perform well under varying load conditions, making them ideal for rugged, off-road environments. As demand rises for off-road vehicles in construction, farming, and recreational sectors, manufacturers are enhancing hydraulic systems with multi-piston calipers, dual hydraulic circuits, and integrated safety features like proportioning valves and hydraulic assist modules.

The drum brakes segment is expected to grow at the fastest CAGR during the forecast period.The drum brakes segment remains relevant in the off-road vehicle braking system industry, primarily due to its cost-effectiveness, mechanical simplicity, and durability in harsh operating environments. Drum brakes are commonly used in entry-level ATVs, UTVs, off-road motorcycles, and agricultural equipment, especially in price-sensitive markets across Asia, Latin America, and parts of Africa. Their enclosed design provides better protection against mud, dust, and debris, making them suitable for off-road conditions where exposure to elements is constant. In addition, advancements in friction material technology and enhanced drum designs are helping improve braking performance and reduce maintenance needs.

Component Material Insights

The steel segment accounted for the largest market revenue share in 2024, due to its proven strength, durability, and cost-effectiveness. It is widely used in manufacturing rotors, calipers, brackets, and backing plates across a broad spectrum of off-road vehicles including tractors, off-road trucks, UTVs, and heavy-duty construction equipment. Steel’s resistance to mechanical stress and high temperatures makes it ideal for rugged terrains and heavy-load operations, where reliability is critical. Its availability and ease of fabrication also contribute to its widespread use among OEMs and aftermarket suppliers.

The carbon composite segment is expected to register at the fastest CAGR during the forecast period.Carbon composite materials are rapidly emerging in the off-road vehicle braking system industry as demand grows for lightweight, high-performance braking solutions. These materials offer superior thermal resistance, low weight, and reduced brake fade, making them ideal for use in premium SUVs, electric off-road vehicles, and high-performance ATVs. Carbon composite rotors and pads contribute to better handling, improved energy efficiency, and enhanced stopping power-especially important in electric vehicles where every kilogram of weight matters. Although their adoption has been limited by higher production costs, advancements in composite manufacturing technologies and increased focus on sustainability and vehicle efficiency are expected to drive broader use.

Brake System Operations Insights

The manual brake systems segment accounted for the largest market revenue share in 2024.These systems are favored in price-sensitive and rural markets, where mechanical simplicity, ease of repair, and low maintenance costs are critical. Manual brakes are typically cable- or lever-operated and are well-suited for vehicles operating at lower speeds or lighter loads, where advanced electronic systems are not essential. Despite the growing shift toward automated and electronic braking technologies, manual systems remain relevant due to their robustness in harsh environments, including mud, dust, and debris-prone terrains. Moreover, in regions across Asia, Africa, and Latin America, where electrification and digital integration are still limited, manual braking systems offer a cost-effective and reliable solution for basic off-road mobility.

The electronic stability control (ESC) segment is expected to register at the fastest CAGR during the forecast period, driven by rising safety expectations and the increasing complexity of off-road driving environments. ESC systems are designed to improve vehicle stability by detecting and reducing loss of traction, making them especially valuable in off-road SUVs, high-performance UTVs, and electric 4x4 vehicles. As off-road vehicles are increasingly used for both recreational and commercial purposes across diverse terrains-such as gravel, mud, sand, and snow ESC helps maintain control during sharp turns, steep descents, and uneven surfaces. Regulatory pressure, particularly in North America and Europe, is also fueling the adoption of ESC as part of broader vehicle safety mandates. Moreover, the integration of ESC with other smart systems like Anti-Lock Braking Systems (ABS) and Traction Control Systems (TCS) enhances overall braking performance and vehicle control.

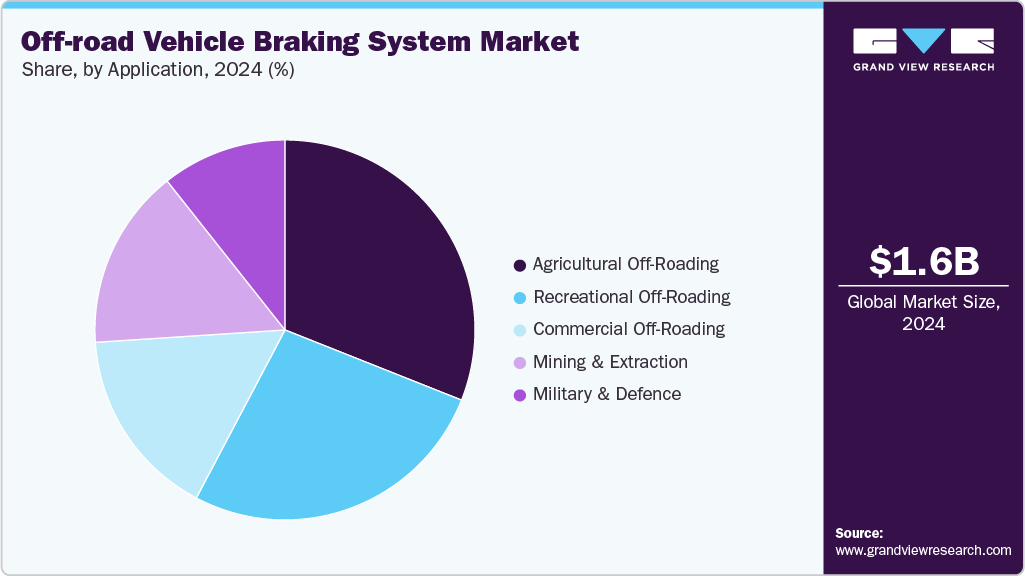

Application Insights

The agricultural off-roading segment accounted for the largest market revenue share in 2024.Tractors, harvesters, and other off-road farm machinery operate under heavy loads and variable terrain conditions, requiring robust, reliable, and easy-to-maintain braking systems. In regions such as Asia-Pacific, North America, and Latin America, large-scale farming and government-backed agricultural modernization programs are supporting sustained demand for hydraulic and drum brake systems that balance cost and durability. In addition, as farms become more automated and larger in scale, there is increasing adoption of disc brakes and electronically assisted braking systems in newer equipment to enhance safety and maneuverability. With the ongoing shift toward precision agriculture and more versatile machinery, brake system performance remains a key purchasing criterion for OEMs and end-users alike, solidifying agriculture’s position as the largest application area in this market.

The military and defence segment is expected to register at the fastest CAGR during the forecast period. Military-grade off-road vehicles, including armored personnel carriers, reconnaissance vehicles, and logistic support trucks, operate in extreme environments that demand advanced, fail-safe braking technologies. These vehicles require systems that offer high stopping power, heat resistance, electromagnetic shielding, and the ability to function under water, dust, and combat conditions. As defense agencies in countries such as the U.S., China, India, and NATO members focus on improving vehicle survivability and terrain adaptability, the integration of electronic stability control (ESC), ABS, and electromechanical braking systems is accelerating.

Regional Insights

North America dominated the off-road vehicle braking system market with the largest revenue share of 36.2% in 2024. This dominance is driven by a strong presence of agricultural mechanization, recreational off-roading, and military procurement. The U.S. remains a major contributor due to high demand across sectors such as farming, construction, mining, and tactical defense operations. Increasing popularity of off-road motorsports and adventure tourism, especially in the western U.S. and Canada, continues to support the adoption of high-performance braking systems, including ABS, ESC, and hydraulic disc brakes. Moreover, strong R&D investments from domestic OEMs and component suppliers, combined with growing electrification trends in off-road SUVs and UTVs, are further propelling market advancement.

U.S. Off-road Vehicle Braking System Market Trends

The off-road vehicle braking system market in the U.S. accounted for the largest market revenue share in North America in 2024.Equipment such as UTVs, tractors, and off-road trucks heavily relies on durable and responsive braking systems for performance and safety in rugged terrains. The rise of electric off-road vehicles has pushed OEMs to integrate lightweight composite materials and regenerative braking systems, especially in premium recreational and defense-focused vehicles.

Europe Off-road Vehicle Braking System Market Trends

The off-road vehicle braking system market in Europe was identified as a lucrative region in 2024. Countries such as Germany, France, the UK, and Italy are investing in next-generation off-road braking systems for applications ranging from agricultural machinery to off-road SUVs. The EU’s push for low-emission, electrified off-road vehicles is also contributing to the adoption of carbon composite and electromechanical brake systems.As off-road recreational tourism grows, especially in Nordic and Alpine regions, performance and safety requirements are pushing braking system innovation.

The UK off-road vehicle braking system market is anticipated to grow at the fastest CAGR during the forecast period, due to increasing use of UTVs and off-road vehicles in rural farming, military logistics, and environmental monitoring. Government incentives for sustainable agricultural equipment and investment in defense modernization are accelerating demand for advanced braking components.

Asia Pacific Off-road Vehicle Braking System Market Trends

The off-road vehicle braking system market in Asia Pacific accounted for the largest market revenue share in 2024.Countries like China, India, Japan, and Australia are key contributors to off-road vehicle production and usage. The growing popularity of recreational off-roading and eco-tourism, along with a surge in local vehicle manufacturing, has prompted wider adoption of hydraulic disc brakes, aluminum components, and ABS systems. Increasing government support for modernizing agricultural practices, especially in India and Southeast Asia, is further boosting demand for cost-effective yet durable braking technologies.

The China off-road vehicle braking system market held a substantial market share in Asia Pacific in 2024. The nation’s focus on farm automation, mining operations, and construction equipment has created steady demand for rugged, high-load-capacity braking systems.

The off-road vehicle braking system market in Japan held a significant share in 2024.The country’s technological leadership and emphasis on vehicle safety have accelerated the integration of advanced materials and semi-autonomous braking systems. In addition, with Japan preparing for international events and facing increased climate-related emergencies, there is heightened investment in reliable, high-precision braking solutions that can operate effectively in rugged and remote areas.

Key Off-road Vehicle Braking System Company Insights

Some of the key companies in the off-road vehicle braking system industry include ZF Friedrichshafen AG, Continental AG, Brembo S.p.A., Knorr-Bremse AG, and others.To gain a competitive edge and expand their market share, these companies are actively engaging in strategic initiatives such as mergers, acquisitions, and partnerships with OEMs, off-road vehicle manufacturers, and technology providers. Such collaborations enable firms to enhance their braking technologies by integrating advanced materials, electronic stability systems, and smart braking solutions tailored for off-road applications.

-

ZF Friedrichshafen AG is one of the prominent players in the off-road vehicle braking system industry, known for its comprehensive portfolio of brake technologies that serve agricultural, construction, mining, and military vehicle segments. Leveraging its acquisition of TRW and WABCO, ZF delivers hydraulic, pneumatic, and electronic braking systems tailored for heavy-duty off-road use. The company specializes in modular and intelligent braking solutions, including ABS for off-highway vehicles, electronic brake control (EBC) modules, and brake assist technologies that enhance vehicle stability across rugged terrains.

-

Continental AG stands out in the off-road vehicle braking system landscape through its focus on smart, integrated braking technologies suited for both recreational and utility off-road vehicles. The company offers a wide range of systems including hydraulic disc brakes, electronic stability control (ESC), anti-lock braking systems (ABS), and brake actuation modules that meet the specific needs of off-road environments. Continental is also pioneering innovations in brake-by-wire and terrain-adaptive braking systems, which allow for enhanced control and safety on varied surfaces such as mud, gravel, or snow.

Key Off-road Vehicle Braking System Companies:

The following are the leading companies in the off-road vehicle braking system market. These companies collectively hold the largest market share and dictate industry trends.

- ZF Friedrichshafen AG

- Continental AG

- Knorr-Bremse AG

- Brembo S.p.A.

- Aisin Corporation

- Wabtec Corporation

- Robert Bosch GmbH

- Mando Corporation

- Hitachi Astemo, Ltd.

- Alcon Components Ltd.

Recent Developments

-

In September 2024, Brembo showcased its full range of aftermarket braking solutions at Automechanika 2024, featuring five key product families designed for various vehicle types and customer needs. The lineup included Brembo Essential (entry-level), Prime (premium OE-quality parts), Beyond (sustainable and EV-compatible kits), Xtra (for customization), and Upgrade (for high-performance and track use). Brembo also introduced Carbon Ceramic Material (CCM) brake discs to the aftermarket, which were previously reserved for high-end supercars. The company expanded its Greenance Kit, which reduced emissions by up to 80%, and made it available for sedans. All offerings were supported through the Bremboparts App, which allowed users to find compatible products and locate nearby dealers.

-

In October 2023, Brembo unveiled its new aftermarket brake pads strategy at the 2023 AAPEX and SEMA shows in Las Vegas, showcasing the Copper-Free XTRA pad line in Low-Met and Ceramic NAO formulations. These pads, along with Brembo Max slotted and XTRA drilled discs, are designed to offer high-performance stopping power with reduced environmental impact. A new visual identity system was introduced to distinguish product families by color-coded shims and backing plates. The strategy was enabled through Brembo’s joint venture with Gold Phoenix, strengthening its aftermarket pad development and production capabilities.

Off-road Vehicle Braking System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.66 billion

Revenue forecast in 2033

USD 3.43 billion

Growth rate

CAGR of 9.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle Type, brake type, component material, brake system operations, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

ZF Friedrichshafen AG; Continental AG; Knorr-Bremse AG; Brembo S.p.A.; Aisin Corporation; Wabtec Corporation; Robert Bosch GmbH; Mando Corporation; Hitachi Astemo, Ltd.; Alcon Components Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Off-road Vehicle Braking System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global off-road vehicle braking system market report based on vehicle type, brake type, component material, brake system operations, application, and region.

-

Vehicle Type Outlook (Revenue, USD Million, 2021 - 2033)

-

All-Terrain Vehicles (ATVs)

-

Utility Task Vehicles (UTVs)

-

Off-road trucks

-

Off-Road Motorcycles

-

Sport Utility Vehicles (SUVs)

-

-

Brake Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Disc Brakes

-

Drum Brakes

-

Hydraulic Brakes

-

Pneumatic Brakes

-

Electromechanical Brakes

-

-

Component Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Steel

-

Aluminum

-

Carbon Composite

-

Cast-Iron

-

Metal-ceramic Composites

-

-

Brake System Operations Outlook (Revenue, USD Million, 2021 - 2033)

-

Manual Brake Systems

-

Automatic Brake Systems

-

Anti-lock Braking Systems (ABS)

-

Electronic Stability Control (ESC)

-

Traction Control Systems (TCS)

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Recreational Off-Roading

-

Commercial Off-Roading

-

Agricultural Off-Roading

-

Military and Defense

-

Mining and Extraction

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global off-road vehicle braking system market size was estimated at USD 1.57 billion in 2024 and is expected to reach USD 1.66 billion in 2025.

b. The global off-road vehicle braking system market size is expected to grow at a significant CAGR of 9.5% to reach USD 3.43 billion in 2033.

b. The North America market accounted for 36.2% largest share of the overall market in 2024. This dominance is driven by a strong presence of agricultural mechanization, recreational off-roading, and military procurement.

b. Some of the players in the off-road vehicle braking system market are ZF Friedrichshafen AG, Continental AG, Knorr-Bremse AG, Brembo S.p.A., Aisin Corporation, Wabtec Corporation, Robert Bosch GmbH, Mando Corporation, Hitachi Astemo, Ltd., and Alcon Components Ltd.

b. The growth of the market can be attributed to the rising demand for eco-friendly and smart mobility solutions which is driving the adoption of electric and connected golf carts across recreational and commercial sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.