- Home

- »

- Distribution & Utilities

- »

-

Offshore Wind Market Size & Trends, Industry Report, 2030GVR Report cover

![Offshore Wind Market Size, Share & Trends Report]()

Offshore Wind Market (2025 - 2030) Size, Share & Trends Analysis Report By Installation (Biofuel, Hydrogen Fuel, Power to Liquid Fuel, Gas-to-Liquid), By Capacity (Up to 3 MW, 3 MW to 5 MW, Above 5 MW), By Water Depth, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-136-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Offshore Wind Market Summary

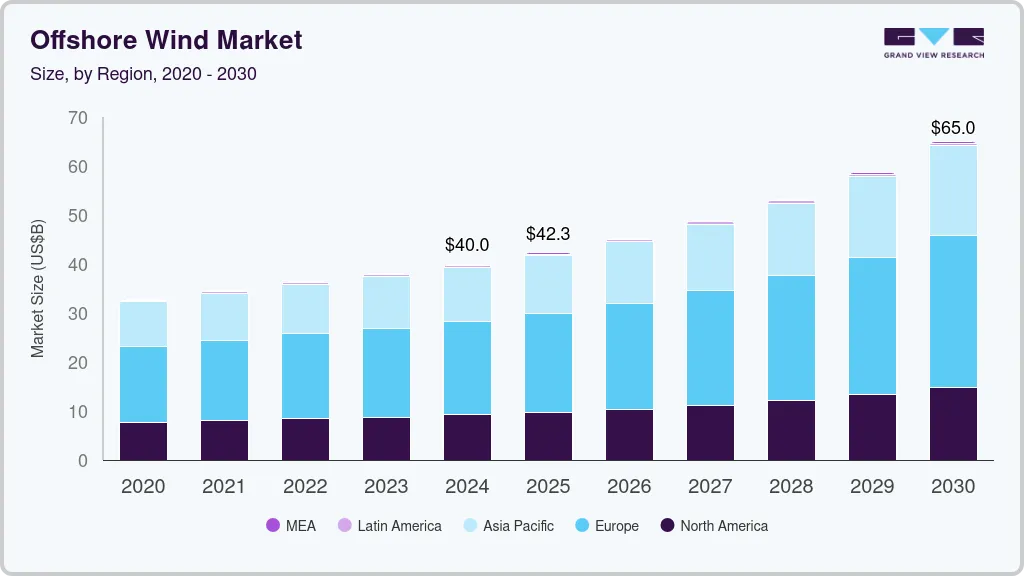

The global offshore wind market size was estimated at USD 39.97 billion in 2024 and is projected to reach USD 65.04 billion by 2030, growing at a CAGR of 8.9% from 2025 to 2030. The market is expected to expand due to growing interest in decreasing the global carbon footprint and increased demand for renewable energy sources.

Key Market Trends & Insights

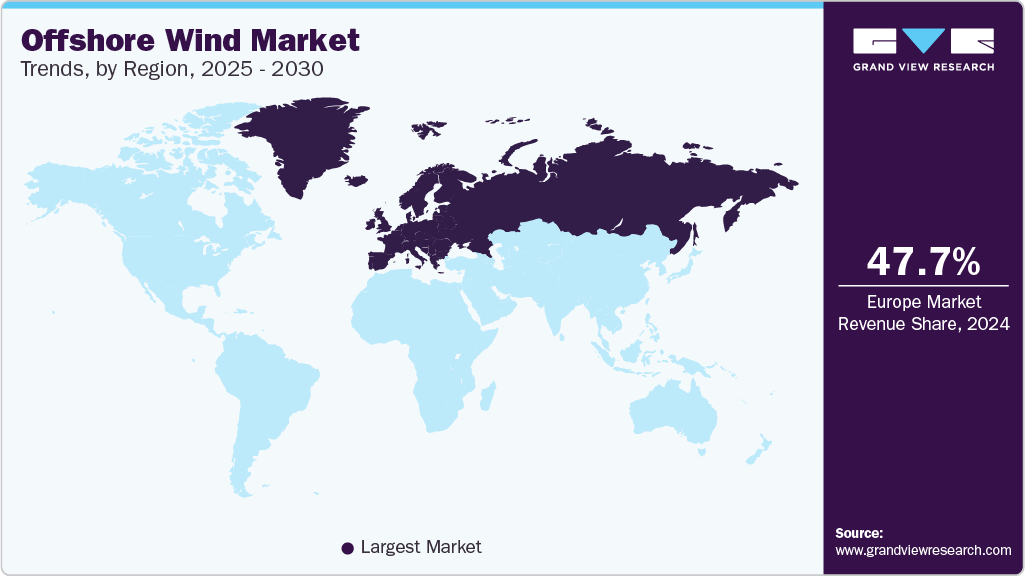

- Europe dominated the offshore wind market with the largest revenue share of 47.71% in 2024.

- The offshore wind market in U.S. is anticipated to grow at a significant CAGR over the forecast period.

- By capacity, the above 5 MW segment led the market with the largest revenue share of 43.69% in 2024.

- By installation, the fixed structure segment held the largest revenue share of 57.59% in 2024.

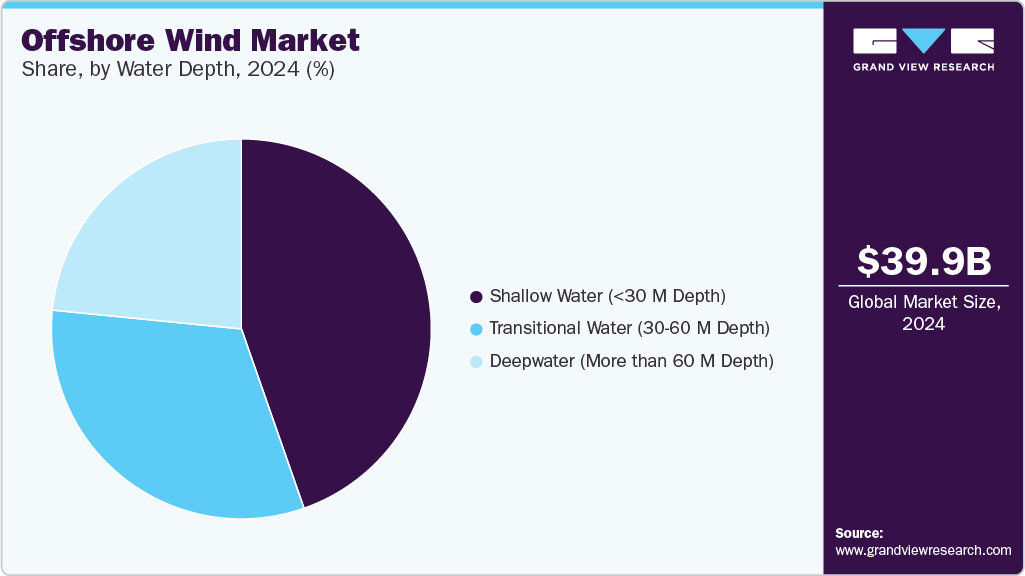

- By water depth, the shallow water (<30 M Depth) segment held the largest share of 44.65% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 39.97 Billion

- 2030 Projected Market Size: USD 65.04 Billion

- CAGR (2025-2030): 8.9%

- Europe: Largest market in 2024

The growing efforts of government bodies and electrical companies to reduce carbon emissions are the primary market drivers boosting market expansion. The offshore wind industry in the U.S. is predicted to experience significant growth in recent years, with several factors driving this expansion. The rise in the expansion of industrial industry, including wind power, owing to the growing need for a dependable, clean, affordable, and diverse electricity supply, is expected to boost the market growth in the country. For instance, the President of the United States announced a bold plan to install 30 gigawatt-hours (GW) of offshore wind by 2030, which would provide sustainable energy to 10 million homes, along with supporting 77,000 jobs, and encourage private investment throughout the supply chain.

Offshore wind is a substantial clean energy solution for large population centers seeking to get more of their power from clean sources, and lowering costs makes it more affordable.The country is predicted to drive demand for offshore wind, which is expected to propel the market growth in the coming years.

The increasing intervention of the U.S. Department of Energy’s Bioenergy Technologies and other organizations is projected to fuel the growth of the offshore wind industry in the U.S. over the forecast period. Moreover, the rise in continued research, development, demonstration, and deployment of technologies to eliminate impediments to the widespread installation of offshore wind in the country is likely to drive the market growth in the forecast period.

Drivers, Opportunities & Restraints

The global offshore wind industry is primarily driven by the growing emphasis on renewable energy to reduce carbon emissions and mitigate climate change. Governments across Europe, Asia, and North America are investing heavily in offshore wind projects to meet their net-zero targets. For instance, the European Union aims to increase its offshore wind capacity to 300 GW by 2050 as part of its Green Deal. Technological advancements, such as larger and more efficient turbines, are also enhancing the economic viability of offshore wind, reducing costs per megawatt. In addition, offshore wind farms benefit from higher and more consistent wind speeds compared to onshore installations, which significantly boosts energy output and efficiency.

The offshore wind industry offers numerous opportunities, particularly through the expansion of floating wind technology. Floating wind turbines enable the installation of wind farms in deeper waters where wind speeds are significantly higher. Countries like Japan and the U.S. are investing in pilot projects to leverage this technology. In addition, corporate power purchase agreements (PPAs) are emerging as a new avenue for financing offshore wind projects, as companies seek to meet sustainability goals. Innovations in energy storage, such as green hydrogen production through offshore wind power, are also gaining traction, offering a sustainable way to store excess energy and address intermittency issues.

Despite significant growth prospects, the offshore wind industry faces several challenges. High initial capital investments and complex installation procedures are major restraints, as offshore turbines require robust foundations and specialized vessels for deployment. Environmental concerns, such as the impact on marine life and underwater noise pollution, also pose challenges for obtaining regulatory approvals. Moreover, the maintenance of offshore wind farms is cost-intensive due to harsh marine conditions, which can lead to frequent equipment failures. Grid connectivity issues and a lack of infrastructure in emerging economies further hinder the market growth.

Capacity Insights

The above 5 MW segment led the market with the largest revenue share of 43.69% in 2024, due to advanced capacity and low cost. Higher power rating turbines are in high demand in order to make offshore wind power generation more energy-efficient and economically sustainable. Large-scale offshore wind projects benefit from economies of scale, making them more cost-effective in terms of power generation per megawatt-hour (MWh).

The expansion of offshore wind projects with capacities ranging from 3 MW to 5 MW represents a key component of the offshore wind industry. Offshore wind projects ranging from 3 MW to 5 MW provide a good blend of scale and flexibility. They are adaptable to diverse wind conditions and water depths, making them useful for a wide range of applications. These factors are likely to boost the segment demand in the coming years.

Installation Insights

The fixed structure segment led the market with the largest revenue share of 57.59% in 2024, due to a variety of factors, including ease of operation and cost-effectiveness. The growing desire for sustainable energy sources is a crucial driver driving industry expansion, and the fixed structure installation segment is likely to create significant revenue in the coming years.

The wind turbine technological advances segment is projected to grow at the fastest CAGR over the forecast period. The market is expanding due to the growing need for clean energy, and the fixed structure installation segment is likely to play a key role in most nations around the globe in achieving the renewable target.

Water Depth Insights

The shallow water (<30 M Depth) segment led the market with the largest revenue share of 44.65% in 2024. The presence of considerably less demanding weather and ease of maintenance makes it a suitable choice for the establishment of offshore wind farms.

Moreover, shallow water installations are less expensive than deep-water installations, making them a cost-effective choice for large population centers seeking to source more of their power from clean sources. The offshore wind industry is predicted to expand internationally as investments in renewable energy increase. This factor is expected to boost the shallow water installation industry.

Regional Insights

The offshore wind market in North America is expected to experience at a steady CAGR throughout the forecast period, driven by a combination of recovery efforts post-pandemic and the increasing focus on sustainability. A combination of supportive policies, technological advancements, and a growing demand for clean energy propels the North American market. Federal initiatives, such as the Inflation Reduction Act, have provided tax incentives and funding programs that bolster the sector.

U.S. Offshore Wind Market Trends

The offshore wind market in the U.S. is anticipated to grow at a significant CAGR during the forecast period. In addition, several U.S. states have set ambitious renewable energy targets, further stimulating investment and development in offshore wind projects. Technological innovations, including the development of larger and more efficient turbines, have enhanced the feasibility and cost-effectiveness of offshore wind energy. These advancements enable the harnessing of stronger and more reliable wind resources in deeper sea locations, expanding the potential for offshore wind deployment.

Asia Pacific Offshore Wind Market Trends

The offshore wind market in Asia Pacific is experiencing robust growth, driven by a confluence of factors. Foremost among these is the strong commitment of regional governments to renewable energy targets. Countries like China, Japan, South Korea, and Taiwan have implemented policies and incentives to promote offshore wind development, aiming to diversify their energy mix and reduce carbon emissions. This policy support has attracted significant investments from both domestic and international stakeholders, fostering an environment conducive to the expansion of offshore wind projects.

Technological advancements are also propelling the market forward. Innovations in turbine design, such as the development of larger and more efficient turbines, have enhanced the feasibility and cost-effectiveness of offshore wind energy. In addition, the region's extensive coastlines and favorable wind conditions provide an ideal setting for offshore wind farms. The combination of supportive policies, technological progress, and natural advantages positions the Asia-Pacific region as a significant player in the global offshore wind industry.

Europe Offshore Wind Market Trends

Europe dominated the offshore wind market with the largest revenue share of 47.71% in 2024, driven by ambitious climate policies, technological advancements, and regional cooperation. The European Union's Renewable Energy Directive, adopted in 2023, sets a target for renewables to comprise at least 42.5% of the energy mix by 2030, necessitating substantial increases in wind capacity. To support this, the European Commission introduced the European Wind Power Action Plan in October 2023, aiming to streamline wind energy deployment by expediting permitting processes and enhancing auction designs. Furthermore, collaborative initiatives like the North Seas Energy Cooperation foster integrated offshore energy grids, linking wind farms across northern Europe to optimize energy production and distribution.

Latin America Offshore Wind Market Trends

The offshore wind market in Latin America is poised for significant growth, driven by favorable natural conditions, supportive government policies, and increasing demand for renewable energy. Countries like Brazil and Colombia are at the forefront, leveraging their extensive coastlines and strong wind resources to develop offshore wind projects. Brazil, for instance, has initiated legislative processes to regulate offshore energy, aiming to allocate seabed areas for wind projects. At the same time, Colombia has attracted interest from multiple international and local companies for its offshore wind initiatives. These developments are part of broader national strategies to diversify energy sources and reduce carbon emissions.

Middle East & Africa Offshore Wind Market Trends

The offshore wind market in Middle East & Africa is gaining momentum, driven by a combination of abundant natural resources, strategic policy shifts, and technological advancements. Countries like Saudi Arabia, the United Arab Emirates (UAE), and Oman are exploring offshore wind projects to diversify their energy portfolios and reduce reliance on fossil fuels. The region's vast coastlines along the Red Sea and Arabian Gulf offer favorable wind conditions, making them ideal for offshore wind development. In addition, initiatives like Saudi Arabia's Vision 2030 and the UAE's renewable energy targets are fostering an environment conducive to renewable energy investments.

Key Offshore Wind Company Insights

The global offshore wind industry is a highly competitive market due to the presence of major industries across the region, as these companies are comparatively concentrated and fiercely competitive, along with acquisitions, mergers, and collaborations.

Key Offshore Wind Companies:

The following are the leading companies in the offshore wind market. These companies collectively hold the largest market share and dictate industry trends.

- General Electric

- Vestas

- Shanghai Electric Wind Power Equipment Co.

- Siemens Gamesa

- Doosan Heavy Industries and Construction

- Hitachi

- Rockwell Automation

- Nordex SE

- Hyundai Motor Group

- Schneider Electric

- Zhejiang Windey Co.

- Taiyuan Heavy Industry Co.

Recent Developments

For Instance, in February 2023, Siemens Gamesa announced its plan to develop a substantial offshore nacelle manufacturing facility in New York State. The facility will be built at the Port of Coeymans. It would represent a $500 million investment in the community and generate over 420 direct jobs.

Offshore Wind Market Report Scope

Report Attribute

Details

Market size volume in 2025

USD 42.29 billion

Volume forecast in 2030

USD 65.04 billion

Growth rate

CAGR of 8.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in MW, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume forecast, company ranking, competitive landscape, growth factors, and trends

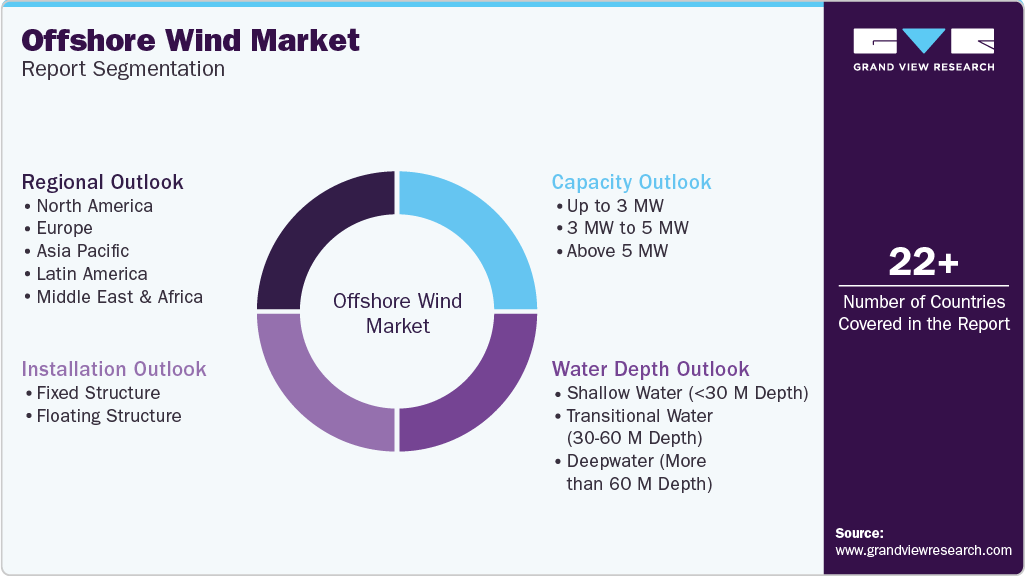

Segments covered

Installation, capacity, water depth, region

Region scope

North America; Europe; Asia Pacific; Latin America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; The Netherlands; China; India; Japan; South Korea; Australia; Malaysia; Singapore; Thailand; Vietnam; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

General Electric; Vestas; Shanghai Electric Wind Power Equipment Co.; Siemens Gamesa; Doosan Heavy Industries and Construction; Hitachi; Rockwell Automation; Nordex SE; Hyundai Motor Group; Schneider Electric; Zhejiang Windey Co.; Taiyuan Heavy Industry Co.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Offshore Wind Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. Forthis study, Grand View Research has segmented the global offshore wind market report based on installation, capacity, water depth, and region:

-

Installation Outlook (Volume, MW; Revenue, USD Billion, 2018 - 2030)

-

Fixed Structure

-

Floating Structure

-

-

Capacity Outlook (Volume, MW; Revenue, USD Billion, 2018 - 2030)

-

Up to 3 MW

-

3 MW to 5 MW

-

Above 5 MW

-

-

Water Depth Outlook (Volume, MW;Revenue, USD Billion, 2018 - 2030)

-

Shallow Water (<30 M Depth)

-

Transitional Water (30-60 M Depth)

-

Deepwater (More than 60 M Depth)

-

-

Regional Outlook (Volume, MW; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Malaysia

-

Singapore

-

Thailand

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global offshore wind market size was estimated at USD 39.37 billion in 2024 and is expected to reach USD 42.29 billion in 2025.

b. The global offshore wind market is expected to grow at a compound annual growth rate of 8.99% from 2025 to 2030 to reach USD 65.04 billion by 2030.

b. The above 5 MW capacity segment dominated the offshore wind market with a share of 43.69% in 2024. Higher power rating turbines are in high demand in order to make offshore wind power generation more energy-efficient and economically sustainable.

b. Some of the key players operating in the offshore wind market include General Electric, Vestas, Shanghai Electric Wind Power Equipment Co., Siemens Gamesa, Doosan Heavy Industries and Construction, Hitachi, Rockwell Automation, Nordex SE, Hyundai Motor Group, Schneider Electric, Zhejiang Windey Co., Taiyuan Heavy Industry Co.

b. The market is expected to expand due to growing interest in decreasing the global carbon footprint and increased demand for renewable energy sources. The growing efforts of government bodies and electrical companies to reduce carbon emissions are the primary market drivers boosting market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.