- Home

- »

- Clinical Diagnostics

- »

-

Oncology Companion Diagnostic Market Size Report 2030GVR Report cover

![Oncology Companion Diagnostic Market Size, Share & Trends Report]()

Oncology Companion Diagnostic Market (2025 - 2030) Size, Share & Trends Analysis Report By Product & Service, By Technology (PCR, IHC, NGS), By Disease Type (Breast Cancer), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-049-7

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Oncology Companion Diagnostic Market Summary

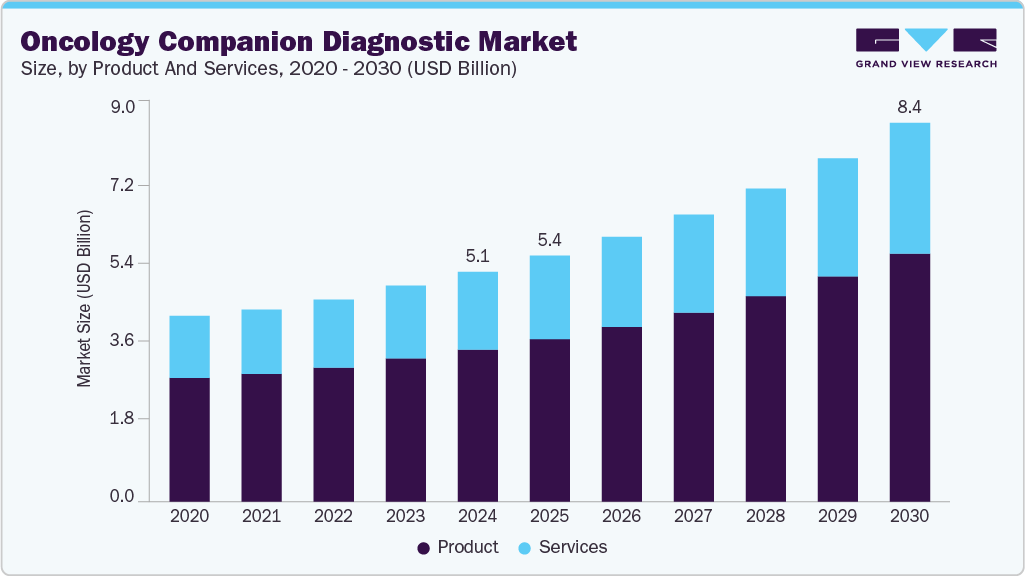

The global oncology companion diagnostic market size was estimated at USD 5.09 billion in 2024 and is projected to reach USD 8.38 billion by 2030, growing at a CAGR of 9.02% from 2025 to 2030. The growth of the market is attributed to the increasing prevalence of cancer, the growing adoption of companion diagnostics, and a rising emphasis on personalized medicine.

Key Market Trends & Insights

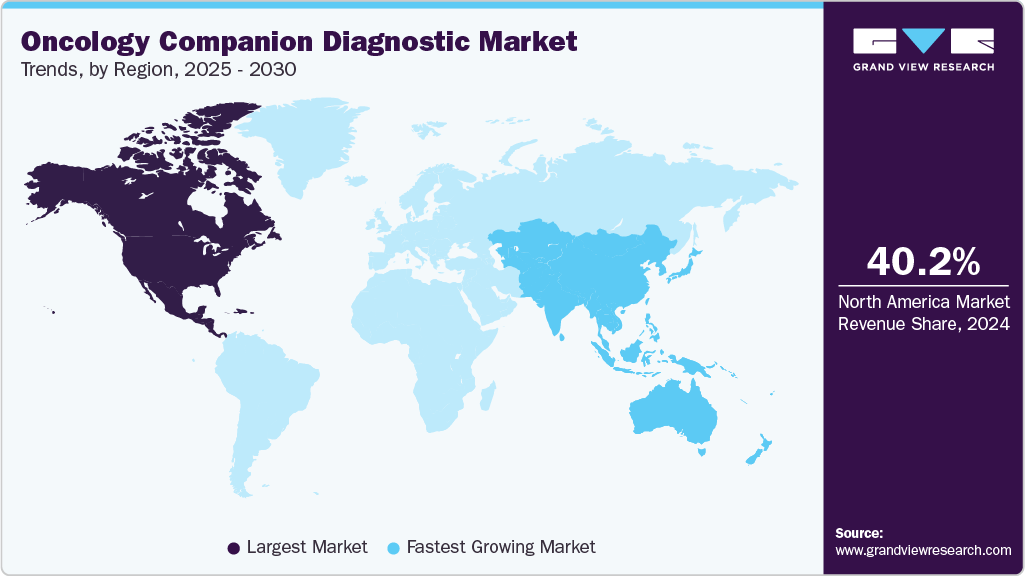

- North America dominated the market with the largest revenue share of 40.17 % in 2024.

- The U.S. oncology companion diagnostic market is expected to grow over the forecast period.

- By product & services, the products segment dominated the market with a share of 66.14% in 2024.

- By technology, the Polymerase Chain Reaction (PCR) segment dominated the market with a share of 28.03% in 2024.

- By disease the, non-small cell lung cancer segment dominated the market, with a share of 30.32% in 2024.

Market Size & Forecast

- 2024 Market Size: 5.09 Billion

- 2030 Estimated Market Size: 8.38 Billion

- CAGR: 9.02% (2025-2030)

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

According to the Pan American Health Organization (PAHO), around 20 million new cancer cases and 10 million deaths were expected in 2023, and the annual reported cases of cancer are likely to reach 30 million by 2050. As cancer rates rise, the need for early & accurate diagnostic tools becomes more critical to improve patient outcomes and manage healthcare costs effectively. Companion diagnostics can enhance the treatment effects of different diseases by providing doctors with clear clinical grounds for diagnosis & treatment, as well as proper management of patient resources and national insurance policies by reducing unnecessary treatment of costly targeted chemotherapy drugs. For instance, in April 2025, Inside Precision Medicine published an article discussing the significant role of companion diagnostics (CDx) in overcoming barriers to precision oncology. These diagnostics improve patient outcomes by guiding appropriate treatment and reducing healthcare costs by minimizing ineffective treatments. The development of CDx tests in parallel with targeted therapies has been shown to enhance the success rate of clinical trials, lowering research and development expenses for pharmaceutical companies. Due to the growing demand for targeted agents and the reduced cost of new drug development, this market is anticipated to witness lucrative growth over the forecast period.

The growing shift towards precision medicine in cancer care drives the demand for oncology companion diagnostics. As treatments increasingly rely on a patient’s unique biological, environmental, and lifestyle factors, the need for diagnostics that can accurately identify suitable candidates for targeted therapies is expanding. For instance, in September 2024, the U.S. FDA approved FoundationOne CDx and FoundationOne Liquid CDx as companion diagnostics for olaparib (Lynparza) combined with abiraterone and prednisone/prednisolone in BRCA-mutated metastatic castration-resistant prostate cancer (mCRPC). This approval enables identification of patients who may benefit from this combination therapy, addressing the critical need for first-line treatment options in this patient population. Companion diagnostics, particularly when paired with targeted therapies, enable early, effective treatment initiation, improving patient outcomes and reducing trial-and-error approaches.

The widespread adoption of Comprehensive Genomic Profiling (CGP) is further fueling the market demand. CGP provides detailed insights into complex tumor genomics, supporting better-informed decisions for therapies like immunotherapies and tumor-agnostic treatments. With CGP offering a broader, more comprehensive genomic analysis than smaller panels or single-gene tests, it has become a critical tool for guiding personalized treatment strategies. For instance, in March 2025, a study published in Precision Oncology evaluated the implementation of nationwide comprehensive genomic profiling (CGP) for advanced cancer patients in Belgium. The initiative achieved a 93% success rate across 12 hospitals, identifying actionable genetic markers in 81% of cases. A national molecular tumor board recommended treatment strategies for 69% of patients, with 23% receiving matched therapies. The study demonstrated the feasibility of decentralized CGP and highlighted its potential to advance precision oncology in the region. Hence, demand for companion diagnostics continues to rise, driven by their role in optimizing cancer treatment and improving patient outcomes.

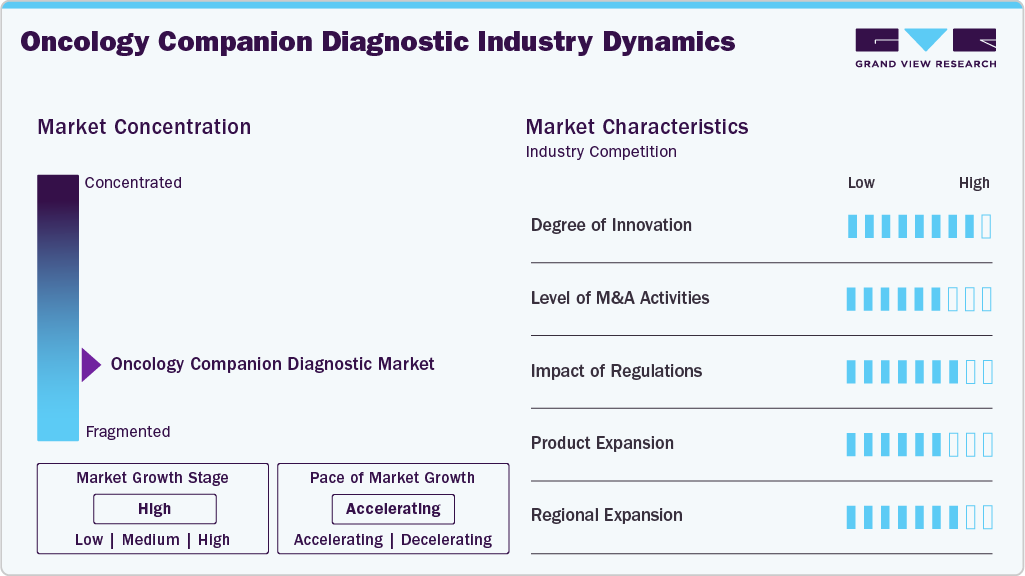

Market Concentration & Characteristics

The oncology companion diagnostics industry is characterized by a high degree of innovation, driven by rapid advancements in genomic technologies and the growing demand for personalized cancer treatment. As precision medicine becomes increasingly integrated into clinical practice, developers continuously enhance diagnostic tools to match the complexity of modern targeted therapies. For instance, in August 2024, the U.S. FDA approved Illumina's TruSight Oncology Comprehensive (TSO Comprehensive) test as a companion diagnostic for two targeted therapies: larotrectinib (Vitrakvi) for NTRK fusion-positive solid tumors and selpercatinib (Retevmo) for RET fusion-positive non-small cell lung cancer (NSCLC). This approval marks the first companion diagnostic claims for TSO Comprehensive, a pan-cancer test that profiles over 500 genes to identify actionable biomarkers across various tumor technologys.

Expanding global partnerships between leading academic medical centers and international healthcare organizations further contribute to the segment's growth. For instance, in December 2024, Guardant Health announced a collaboration with Boehringer Ingelheim to develop the Guardant360 CDx liquid biopsy as a companion diagnostic for detecting HER2 mutations in advanced lung cancer, primarily targeting U.S. and European markets. These collaborations aim to accelerate the development and deployment of advanced diagnostic solutions, improve global access to precision oncology, and support regulatory approvals across multiple regions. By leveraging combined expertise and resources, such partnerships enhance innovation and facilitate the integration of cutting-edge diagnostics into routine clinical care.

The use of companion diagnostics often involves sensitive patient data, which must be handled according to privacy regulations and ethical considerations. Hence, maintaining compliance with evolving regulations and standards throughout the diagnostic device's lifecycle adds a layer of complexity. For instance, there are no dedicated guidelines or regulatory frameworks in India specifically for the approval and regulation of companion diagnostics.

Product expansion remains a moderate but strategic approach within the oncology companion diagnostics market, as companies aim to broaden their test offerings and extend their reach into new indications and geographic regions. For instance, in November 2024, the U.S. FDA approved the PATHWAY anti-HER2/neu (4B5) Rabbit Monoclonal Primary Antibody test as a companion diagnostic for zanidatamab-hrii (Ziihera) in patients with HER2-positive (IHC 3+) biliary tract cancer (BTC). This test aids in identifying patients eligible for treatment with Ziihera, marking it as the first and only FDA-approved companion diagnostic for this indication. The approval was supported by data from the phase 2b HERIZON-BTC-01 trial, demonstrating a 52% overall response rate with Ziihera in this patient population. These efforts are particularly important for addressing rare or hard-to-treat cancers, where precision diagnostics can significantly impact clinical outcomes.

The oncology companion diagnostics market is experiencing significant regional expansion, driven by increasing global adoption of precision medicine and growing investments in healthcare infrastructure. North America remains the leading market due to strong regulatory support, advanced research capabilities, and early adoption of innovative technologies. However, Asia-Pacific and Europe are rapidly emerging as high-growth regions. In Asia-Pacific, rising cancer incidence, expanding access to genomic testing, and supportive government initiatives are accelerating market growth. Regional expansion is further supported by strategic partnerships, clinical trial collaborations, and localization efforts by key market players aiming to meet region-specific needs and regulatory requirements.

Product & Services Insights

The products segment dominated the market with a share of 66.14% in 2024, driven by advancements in personalized medicine and the increasing prevalence of cancer. This segment includes various technologys of products, such as instruments, consumables, and software. These diagnostics help oncologists tailor treatment plans based on a patient's tumor's molecular profile, improving treatment efficacy and minimizing adverse effects. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) established guidelines to approve companion diagnostics, ensuring these tests are safe and effective before they reach the market. For instance, in August 2024, the U.S. FDA approved Illumina's TruSight Oncology Comprehensive (TSO Comprehensive) test as the first pan-cancer companion diagnostic. This vitro diagnostic (IVD) assay analyzes over 500 genes to identify actionable biomarkers in solid tumors, facilitating personalized treatment decisions. The TSO Comprehensive test utilizes next-generation sequencing and provides tumor mutational burden (TMB) scores, enhancing the likelihood of identifying clinically relevant biomarkers.

The services segment is expected to register the fastest CAGR during the forecast period. The growth of the service segment is expected to be driven by the presence of service providers such as Covance, LabCorp, and Q2 Solutions, which offer services for developing Companion Diagnostics (CDx). For instance, in June 2024, Foundation Medicine partnered with Repare Therapeutics in the United States to provide genomic profiling services for the MYTHIC Phase I/Ib study of lunresertib and to develop a companion diagnostic. This collaboration highlights the expanding role of service providers in advancing precision oncology and accelerating the development of personalized treatment strategies, further driving the growth of this market segment.

Technology Insights

The Polymerase Chain Reaction (PCR) segment dominated the market with a share of 28.03% in 2024. The real-time PCR assays available in the market offer high specificity and sensitivity, making them the go-to method for cancer diagnosis. Moreover, real-time PCR techniques are a favorable option for analyzing cancer markers. In clinical laboratories, real-time PCR offers benefits such as simultaneous analysis of multiple genes, low reagent costs, internal controls, and preservation of precious samples for tumor profiling. For instance, in September 2024, Qiagen launched the QIAcuityDx Digital PCR System in North America and Europe for clinical oncology diagnostics. The system offers precise DNA/RNA quantification, streamlining lab workflows and enabling liquid biopsy applications.

The next-generation Sequencing (NGS) segment is expected to register the fastest CAGR during the forecast period. With the emergence of NGS in the past decade, cancer diagnostics have tremendously evolved. Advances in NGS technology have supported the development in various areas of cancer research. For instance, in January 2025, Tempus AI launched its FDA-approved xT CDx test nationwide in the U.S. This 648-gene next-generation sequencing assay offers comprehensive solid tumor profiling, including microsatellite instability status and companion diagnostic claims for colorectal cancer. The test utilizes a normal-matched approach, enhancing the identification of cancer-driving somatic variants. NGS analysis of tumor genomics, transcriptomics, and epigenomics drives biomarker discovery in cancer diagnostics & tumor stratification.The benefits of NGS technology include the detection of minor possible mutations, the combined detection of SNP & more extensive abnormalities, and a combination of high throughput, speed, & resolution. Owing to these benefits, the use of the NGS technique in cancer diagnosis is anticipated to increase.

Disease Type Insights

The non-small cell lung cancer segment dominated the market, with a share of 30.32% in 2024. The increasing number of Non-small Cell Lung Cancer (NSCLC) cases worldwide is a major driver for the companion diagnostics market. According to the American Cancer Society, NSCLC constitutes roughly 80% to 85% of all lung cancer diagnoses. This increasing prevalence underscores the urgent need for effective diagnostic tools to inform treatment decisions, thereby driving market growth. As the burden of NSCLC rises, the demand for CDx becomes critical in ensuring patients receive the most appropriate therapies. For instance, in November 2024, the U.S. FDA approved FoundationOne Liquid CDx as a companion diagnostic for TEPMETKO (tepotinib) in patients with MET exon 14 skipping alterations in non-small cell lung cancer. This approval enables a blood-based test to identify patients eligible for targeted therapy, enhancing precision medicine in oncology.

The breast cancer segment is expected to register the fastest CAGR of 9.65% during the forecast period, driven by advancements in diagnostic technologies and the growing integration of Artificial Intelligence (AI) in oncology. These innovations enhance the accuracy and speed of cancer detection, particularly in identifying actionable biomarkers for targeted therapies. For instance, in February 2025, the U.S. FDA approved the PATHWAY HER2 (4B5) test as a companion diagnostic for HER2-low metastatic breast cancer, enabling targeted treatment with T-DXd and advancing precision oncology strategies. Moreover, collaborations between pharmaceutical companies and diagnostic developers are fostering the creation of patient-centric diagnostic frameworks, improving the overall effectiveness of CDx and enhancing treatment outcomes in breast cancer care.

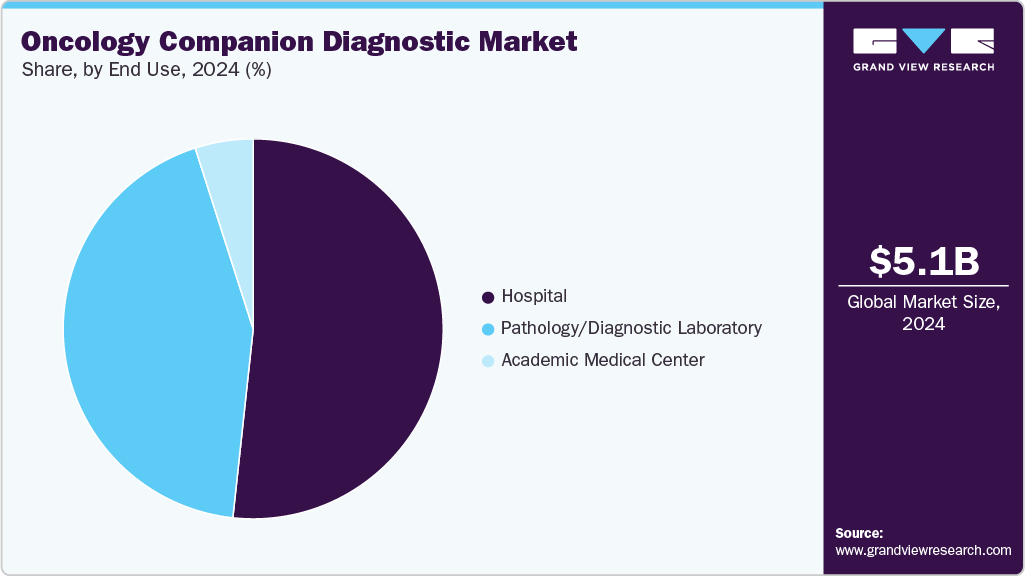

End Use Insights

The hospital segment dominated the oncology companion diagnostic market, with a share of 51.71% in 2024. Hospitals typically have a wide array of cancer diagnostic tests. Due to the high prevalence of cancer and an aging population, hospitals have witnessed an increase in the use of diagnostic products for cancer over the past few years. With the growing adoption, hospitals are increasingly embracing advancements in diagnostics. The evolution of hospital laboratories plays a vital role in meeting the changing demands of patients. For instance, in May 2025, NHS Forth Valley launched a Rapid Cancer Diagnostic Service (RCDS) in Scotland to expedite cancer diagnosis for patients with non-specific symptoms. This initiative aimed to reduce uncertainty, enhance patient experience, and improve cancer outcomes by quickly ruling out cancer or initiating timely treatment. The service involved collaboration among healthcare professionals and utilized coordinated testing and assessments.

The pathology/diagnostic laboratory segment is anticipated to grow fastest over the forecast period. The pathology/diagnostic laboratory is crucial in the oncology companion diagnostic market. These labs are responsible for developing and implementing tests that help identify specific biomarkers in cancer patients, enabling the selection of appropriate targeted therapies. They work closely with pharmaceutical companies, healthcare providers, and patients to ensure accurate test results & effective treatment decisions. The establishment of advanced laboratories dedicated to companion diagnostic development is a significant driver of the market's pathology/diagnostic labs segment. For instance, in July 2024, Danaher Corporation launched two CLIA and CAP-certified labs in the UK and the U.S. to accelerate the development of Companion and Complementary Diagnostics, enhancing global precision medicine capabilities and partnerships.

Regional Insights

North America dominated the market with the largest revenue share of 40.17 % in 2024. The region's dominance is attributed to advanced healthcare infrastructure and substantial healthcare expenditure in North America, which drives the widespread adoption of diagnostic technologies. Moreover, leading research institutions and biotechnology firms are dedicated to developing innovative diagnostic methods. Along with a robust regulatory framework that ensures timely approval and commercialization of new diagnostic tools, these factors are anticipated to significantly fuel the country's oncology companion diagnostic industry over the forecast period.

U.S. Oncology Companion Diagnostic Market Trends

The U.S. oncology companion diagnostic market is expected to grow over the forecast period due to the high cancer prevalence in the country and consequent rapid adoption of advanced companion diagnostics. For instance, in September 2024, Nanostics and Protean BioDiagnostics launched CDX Prostate in the U.S. This AI-powered blood test assesses aggressive prostate cancer risk, aiding informed biopsy decisions. Through Protean's CLIA-certified lab in Orlando, Florida, it enhances clinical decision-making for men with elevated PSA levels or abnormal DRE results. Moreover, significant technological advancements, increasing FDA approvals for tests, and rising competition among biotechnology companies are projected to boost the market over the forecast period.

Europe Oncology Companion Diagnostic Market Trends

Europe accounted for a significant share of the global oncology companion diagnostic market. This can be attributed to developed economies like Germany, Spain, the UK, France, and Italy. These countries have advanced infrastructure, which is anticipated to boost clinical research prospects in the region significantly. Moreover, a well-established and evolving regulatory environment further supports innovation and market growth in companion diagnostics. For instance, in April 2025, Agilent Technologies received European IVDR certification for its PD-L1 IHC 22C3 pharmDx assay. This companion diagnostic aids in identifying patients with gastric or gastroesophageal junction (GEJ) adenocarcinoma who may be eligible for pembrolizumab (Keytruda) treatment. The assay is approved for use with the Agilent Autostainer Link 48 advanced staining solution and is the only IVDR-certified companion diagnostic for this indication in Europe.

The UK oncology companion diagnostic market is growing primarily due to the presence of advanced healthcare infrastructure. Strategic collaborations and the introduction of innovative products are expected to drive market growth in the UK.

The France oncology companion diagnostic market is expected to grow over the forecast period. Companies and research institutes are entering several unique partnerships to offer in-house CDx genomic testing for cancer patients in the country. For instance, in September 2023, Roche France, Foundation Medicine, and the Institute Gustave Roussy partnered to introduce in-house liquid biopsy genomic testing for advanced cancer patients in France. The initiative also strives to establish a national network of centers to facilitate equitable access to precision oncology nationwide, significantly enhancing market growth by improving diagnostic precision and personalized treatment options.

The German oncology companion diagnostic market is expected to grow significantly, driven by the rising cancer incidence and the growing adoption of personalized medicine. This increasing demand for CDx products is anticipated to accelerate over the forecast period, fueled by advancements in clinical research, improved diagnostic capabilities, and the need for targeted therapies. Moreover, Germany's strong healthcare infrastructure and regulatory support will further expand the industry.

Asia Pacific Oncology Companion Diagnostic Market Trends

The Asia-Pacific market is expected to witness the fastest CAGR of 12.71% over the projected period, driven by healthcare reforms, enhanced infrastructure, a growing population, and an increasing number of local companies entering the market. With a large population and high cancer prevalence, the region is a significant focus for oncology advancements. According to Global Cancer Statistics 2022, nearly half of all global cancer cases and approximately 56.1% of cancer deaths in 2022 were reported in Asia. Moreover, market entry by local companies is likely to drive the demand for companion diagnostics. The high cancer prevalence and incidence underscore the need for effective diagnostic solutions, making the region a key oncology companion diagnostics market.

The oncology companion diagnostic market in China is expected to grow over the forecast period due to lifestyle changes, dietary habits, and an aging population. These diagnostics are crucial in identifying patients most likely to benefit from specific therapeutic agents, particularly in oncology. Companies are developing new therapies to treat oncology CDx.For instance, in May 2024, Burning Rock Biotech Limited collaborated with Bayer to develop next-generation sequencing (NGS)-based companion diagnostic assays (CDx) to enhance personalized cancer treatment, further expanding the oncology companion diagnostic industry in the country.

The Japan oncology companion diagnostic market is expected to experience significant growth during the forecast period, fueled by substantial government investments to reduce cancer incidence. According to data published by the World Economic Forum in 2023, Japan’s aging population, with more than 10% of its people now aged 80 or older, further highlights the need for advanced diagnostic solutions to address the growing cancer burden.

Latin America Oncology Companion Diagnostic Market Trends

The Latin American oncology companion diagnostic market has emerged as a promising region, experiencing significant growth in precision medicine technology, such as oncology companion diagnostics. This expansion is driven by various initiatives aimed at boosting research and development. Moreover, collaborations among pharmaceutical companies, diagnostics firms, and service providers are improving access to cutting-edge precision medicine technologies across the region.

The Brazil oncology companion diagnostic market is expected to grow over the forecast period. The market is evolving with advancements in genetic testing technologies and a growing emphasis on precision medicine, driven by collaborations between global innovators and local healthcare providers. For instance, in January 2024, SOPHiA GENETICS announced a partnership with Bioma4me, a Brazil-based company specializing in genetic sequencing for precision medicine. This partnership aims to streamline data analysis, reduce turnaround times, and provide affordable, high-precision genetic testing to the Brazilian population. The collaboration underscores a commitment to advancing personalized medicine and expanding access to cutting-edge oncology companion diagnostic technology in Latin America.

Middle East and Africa Oncology Companion Diagnostic Market Trends

The Middle East and Africa oncology companion diagnostic market has been recognized as a high-potential region with considerable growth opportunities. However, most of the market remains underdeveloped, primarily due to the absence of organized cancer screening programs in many African countries, which limits early detection efforts. Addressing these gaps could unlock significant market potential and improve regional cancer outcomes.

The oncology companion diagnostic market in Saudi Arabia is expected to grow over the forecast period, attributed to the government's increasing involvement and rising awareness about the benefits of noninvasive diagnostic procedures. Moreover, the country's efforts to enhance healthcare infrastructure and the growing demand for precision medicine are expected to expand market.

Key Oncology Companion Diagnostics Company Insights

The global oncology companion diagnostic industry is highly competitive, with key players such as Agilent Technologies, Inc.; Illumina, Inc.; QIAGEN; Thermo Fisher Scientific Inc.; Foundation Medicine, Inc., focusing on enhancing the oncology companion diagnostics. These companies prioritize new product development, research & development (R&D) investments, and strategic mergers and acquisitions to strengthen their market position.

Key Oncology Companion Diagnostics Companies:

The following are the leading companies in the oncology companion diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Agilent Technologies, Inc.

- Illumina, Inc.

- QIAGEN

- Thermo Fisher Scientific Inc.

- Foundation Medicine, Inc.

- Myriad Genetics, Inc.

- F. Hoffmann-La Roche Ltd

- BIOMÉRIEUX

- Abbott

- Leica Biosystems Nussloch GmbH

- Guardant Health

- EntroGen, Inc.

Recent Developments

-

In May 2025, the U.S. FDA approved the VENTANA MET (SP44) RxDx Assay as a companion diagnostic for telisotuzumab vedotin (Emrelis) in non-small cell lung cancer (NSCLC). This immunohistochemistry-based test identifies patients with high c-MET protein overexpression, a key biomarker for selecting candidates for this targeted therapy. The approval was supported by data from the Phase 2 LUMINOSITY trial, which demonstrated a 35% overall response rate in patients with high c-MET expression treated with telisotuzumab vedotin.

-

In January 2025, the U.S. FDA approved FoundationOne CDx as the first and only companion diagnostic for OJEMDA (tovorafenib), a technology II RAF inhibitor, to treat pediatric patients aged six months and older with relapsed or refractory BRAF-altered low-grade glioma (pLGG). This approval enables clinicians to identify patients whose tumors harbor BRAF fusions, rearrangements, or BRAF V600 mutations, facilitating targeted therapy with tovorafenib. Previously, no FDA-approved treatments existed for tumors with BRAF fusions, which are present in approximately 80% of BRAF-altered pLGG cases.

Oncology Companion Diagnostic Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.44 billion

Revenue forecast in 2030

USD 8.38 billion

Growth Rate

CAGR of 9.02% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

June 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & services, technology, disease type, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Agilent Technologies Inc.; Illumina Inc.; QIAGEN; Thermo Fisher Scientific Inc.; Foundation Medicine Inc.; Myriad Genetics, Inc.; F. Hoffmann-La Roche Ltd.; BioMérieux; Abbott; Leica Biosystems Nussloch GmbH; Guardant Health, Inc.; EntroGen, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oncology Companion Diagnostic Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oncology companion diagnostic market report based on product & services, technology, disease type, end use, and region.

-

Product & Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Product

-

Instrument

-

Consumables

-

Software

-

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Polymerase Chain Reaction (PCR)

-

Next-generation Sequencing (NGS)

-

Immunohistochemistry (IHC)

-

In Situ Hybridization (ISH)/Fluorescence In Situ Hybridization (FISH)

-

Other Technologies

-

-

Disease Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Breast Cancer

-

Non-small Cell Lung Cancer

-

Colorectal Cancer

-

Leukemia

-

Melanoma

-

Prostate Cancer

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Pathology/Diagnostic Laboratory

-

Academic Medical Center

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.