- Home

- »

- Digital Media

- »

-

Online Casino Market Size & Share, Industry Report, 2030GVR Report cover

![Online Casino Market Size, Share & Trends Report]()

Online Casino Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (iSlots, iTable, iDealer), By Device (Desktop, Mobile, Others), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-478-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Online Casino Market Summary

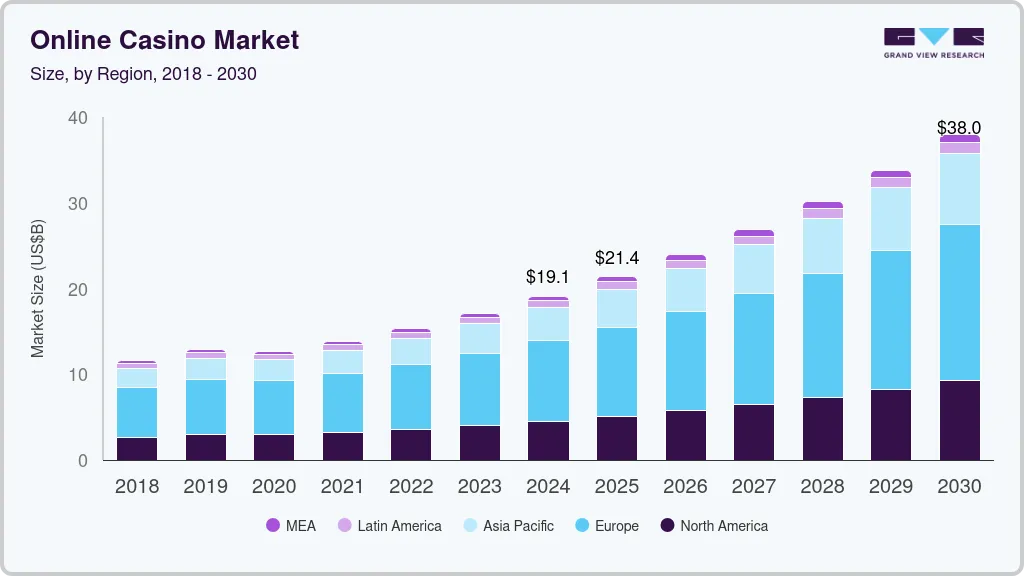

The global online casino market size was estimated at USD 19.11 billion in 2024 and is projected to reach USD 38.00 billion by 2030, growing at a CAGR of 12.2% from 2025 to 2030. The market growth is primarily driven by the increasing penetration of smartphones and high-speed internet, which has expanded access to digital gambling platforms.

Key Market Trends & Insights

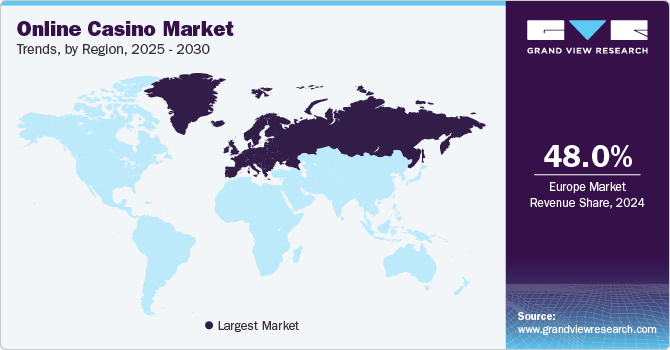

- Europe online casino industry accounted for the largest revenue share of around 48% in 2024.

- The UK online casino industry is among the most mature and tightly regulated in Europe.

- By type, the iSlots segment captured the largest revenue share of over 65% within the online casino industry in 2024.

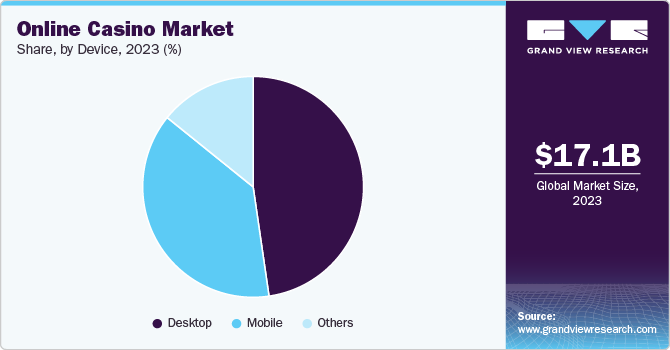

- By device, The desktop segment held the largest revenue share across the online casino industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 19.11 Billion

- 2030 Projected Market Size: USD 38.00 Billion

- CAGR (2025-2030): 12.2%

- Europe: Largest market in 2024

In addition, the liberalization of gambling laws in many countries and the rise of secure digital payment options have further accelerated the market growth. The convenience of remote gambling, combined with the availability of a wide variety of games such as slots, poker, and roulette, continues to attract a growing consumer base.

Furthermore, advancements in user interfaces and live dealer platforms are providing players worldwide with a more engaging and inclusive gambling experience.

A key trend shaping the online casino sector is the integration of live dealer games with live streaming technology. These features replicate the atmosphere of a physical casino, allowing players to interact with real-time dealers and fellow players. As consumer demand for social and interactive gaming rises, operators are investing in advanced video streaming, multiple camera angles, and real-time chat options. This trend is particularly pronounced among younger generations, who prioritize realism and social interaction in their online entertainment. The push towards gamification and blended gambling experiences is expected to continue as sites seek to improve user retention.

Another significant trend is the rapid adoption of blockchain and cryptocurrency technologies in online gambling. Operators are utilizing decentralized platforms and offering crypto-based payment options to enhance transparency, reduce transaction times, and build trust among users. The integration of smart contracts is also speeding up payout processes and ensuring fair play conditions. This shift is especially popular among technology-savvy players and in regions with stringent banking regulations. While regulatory uncertainties surrounding cryptocurrencies still exist in some areas, many online casinos are preparing for future demand and evolving regulatory landscapes in digital currency.

Major players in the online casino industry, such as Bet365, 888 Holdings, Entain Plc, and Kindred Group, are actively expanding their digital footprint through partnerships, acquisitions, and technological investments. They are focused on enhancing user experience with personalized content, advanced analytics, and AI-based recommendations. Strategic geographic expansion into newly regulated markets such as the U.S. and parts of Latin America is also a priority. Meanwhile, operators are strengthening their compliance frameworks to improve regulatory adherence and bolster responsible gaming initiatives, signaling a more organized and long-term approach to growth within the online gambling landscape.

Type Insights

The iSlots segment captured the largest revenue share of over 65% within the online casino industry in 2024. The dominance of iSlots can be attributed to their unique combination of traditional slot mechanics and interactive, story-driven gameplay. Unlike conventional slot machines, iSlots feature evolving narratives and skill-based elements, providing a more immersive experience that particularly appeals to younger audiences who prioritize engagement. In addition, the rising popularity of mobile gaming has made iSlots more accessible across various devices, enhancing user convenience. These factors contribute to significant growth in this segment and reinforce iSlots' leading position in the market.

The iDealer segment is expected to record a significant CAGR of nearly 13% from 2025 to 2030. This anticipated growth is fueled by a rising consumer preference for interactive and immersive gaming experiences that replicate the atmosphere of a live casino. iDealer platforms utilize live human dealers to conduct games in real time via high-definition video streaming, allowing players to engage in rapid, real-life interactions. Enhancements in mobile technology and streaming quality are expanding the reach of these experiences. Furthermore, the increasing demand for social and personalized gameplay further amplifies the appeal of the iDealer model to an expanding audience.

Device Insights

The desktop segment held the largest revenue share across the online casino industry in 2024. The desktop segment continues to offer better gaming experience due to their larger screens, enhanced graphics, and smoother gameplay, especially for complex or high-stakes games. Games such as live dealer casinos, poker, and advanced slot formats benefit from the processing power and screen real estate that desktops provide. In addition, many users prefer desktops for multitasking and secure financial transactions, particularly when managing multiple accounts or games. Although mobile usage is on the rise, desktops remain the preferred platform for experienced or high-investment players, maintaining their leadership in the market.

The mobile segment is estimated to record the fastest CAGR from 2025 to 2030, owing to the widespread availability of smartphones and mobile internet access. Mobile platforms offer unmatched convenience, allowing users to engage in casino gameplay on the go, whether casually or competitively. Continuous improvements in mobile app development, along with user-friendly web interfaces, have enhanced the overall performance of mobile gaming. The growing acceptance of mobile payment solutions such as e-wallets, QR code payments, and app-based purchases-has also simplified transactions. As mobile technology becomes increasingly powerful and affordable, this sector is poised to play a leading role in shaping the future of online gambling.

Regional Insights

The North America online casino industry is experiencing tremendous changes, fueled by the growth of online gambling, especially in the United States. The legalization of online sports betting and casinos in various states has created new revenue channels and encouraged conventional operators to invest in online platforms. Mobile gaming is also increasingly popular, particularly among young players who prefer convenience and interactive features. At the same time, land casinos are transforming into entertainment centers with dining, theater, and shopping experiences. Regulatory emphasis on responsible gaming and improved consumer protection is also influencing market dynamics, and North America is a prime region for innovation and expansion in the international casino market.

U.S. Online Casino Market Trends

The U.S. online casino industry is expanding as more states implement regulatory regimes for online gambling. Consumer demand is increasing through the convenience of mobile play, the popularity of live dealer gaming, and better game design. Operators are shifting attention to enhancing user experience through customized interfaces, loyalty schemes, and convenient payment methods. Collaborations between casino brands and sports or media organizations are also serving to promote visibility and recruit new users. Although the regulatory environment continues to be patchy across states, incremental legislative change and heightened public acceptance of online gambling are creating a more favorable climate for sustained expansion.

Europe Online Casino Market Trends

Europe online casino industry accounted for the largest revenue share of around 48% in 2024. The continent features a highly developed regulatory system, with countries such as the United Kingdom, Italy, Germany, and Sweden operating mature licensing frameworks. High levels of participation in Internet casinos can be attributed to widespread digital payment usage, high Internet penetration rates, and consumer familiarity with digital betting sites. Companies such as Entain Plc, Betsson AB, and 888 Holdings Plc have established a strong presence in this market, supported by region-specific content and marketing strategies. The existence of multiple national regulators has also created a competitive environment, promoting product diversification and encouraging ethical gambling practices.

The UK online casino industry is among the most mature and tightly regulated in Europe. The UK Gambling Commission enforces stringent guidelines for licensing, advertising, and responsible gambling practices. Online casino participation is high, supported by a robust mobile infrastructure and a wide selection of games. Operators frequently update their platforms with personalized interfaces and offer diverse formats, including instant games, live tables, and themed slot series. Fast payouts, low deposit requirements, and loyalty incentives are commonly used to enhance user retention. Consumer trust is paramount, with an increasing focus on affordability checks and tools for self-regulation to promote safer gambling.

Germany online casinoindustry has undergone a significant transformation following regulatory reforms that permitted licensed private operators to enter the market. The introduction of a unified licensing framework has brought more structure to what a fragmented and partially restricted industry was previously. While strict limits on deposits, advertising, and game mechanics have posed operational challenges, these regulations aim to foster safer gambling environments. Consumers are increasingly adapting to legal platforms that offer verified content and clearer terms. There is a growing preference for mobile gaming, and demographic changes, particularly increased engagement from younger users and female players-are influencing how platforms present and market their content.

Asia Pacific Online Casino Market Trends

The Asia Pacific online casino industry is experiencing significant growth, driven by increasing internet access, widespread smartphone adoption, and a growing middle class with disposable income. China, India, and the Philippines are key contributors to this expansion. Despite varying regulatory environments across the region, the demand for online gambling sites continues to rise. Technological advancements, such as secure payment systems and engaging gaming experiences, have enhanced user interaction. However, the industry faces challenges such as regulatory uncertainties and concerns about responsible gambling behavior, creating the need for a balance between growth and regulation.

China online casino industry is highly restricted, with gambling activities largely prohibited aside from officially sanctioned state lotteries. Despite these restrictions, there is a substantial underground market driven by a cultural affinity for gambling and the widespread use of mobile technology. Many Chinese players access international online gambling sites, circumventing domestic laws. The introduction of cryptocurrencies and blockchain technology has facilitated anonymous transactions, complicating enforcement efforts. Authorities are intensifying enforcement against illegal online gambling operations, yet demand remains strong, fueled by deep-rooted cultural habits and the allure of gambling.

India online casino industry is on the rise, propelled by increasing internet access, the prevalence of smartphones, and a young population that enjoys online entertainment. The market features a diverse array of platforms offering games tailored to local preferences, such as Teen Patti and Andar Bahar. However, the regulatory landscape is complex, with laws varying significantly from one state to another; while some states have embraced online gambling, others have imposed bans. This fragmented legal environment poses challenges for operators. Nonetheless, the market's potential continues to attract investments, with localized content and payment innovations enhancing user engagement.

Key Online Casino Company Insights

Some of the key players operating in the market are 888 Holdings Plc, Bally’s Corporation, and Bet365 Group Ltd., among others.

-

888 Holdings Plc provides a range of online casino products on its 888casino site, including slots, table games such as roulette and blackjack, and live dealer games. Outside of its consumer services, 888 offers B2B solutions via its Dragonfish subsidiary, which allows third-party casino operators to operate branded online casinos based on its platform and game suite.

-

Bally's Corporation offers online casino products in certain regulated U.S. jurisdictions through its Bally Casino brand. The site offers a complete suite of casino content, such as video slots, card games, live tables, and proprietary branded titles. Bally's powers these products with the technology it gained from its acquisitions of Bet.Works and Gamesys, allowing it to have both front-end and back-end control of its online business.

-

Bet365 Group Ltd. has a full online casino platform featuring a wide selection of games, such as progressive jackpots, live dealer roulette, and branded slot content. The firm provides localized versions of its offerings in jurisdictions and is licensed in significant regulated markets. Bet365's platform is developed in-house, giving the firm control over product updates and ensuring compliance across jurisdictions.

Betsson AB, Entain Plc, and Flutter Entertainment Plc are some of the emerging market participants in the global online casino industry.

-

Betsson AB operates online casinos under several regional brands, such as Betsson, Betsafe, and CasinoEuro. Its products include classic casino games, live dealer offerings, and slots from a large number of third-party studios. The company also licenses its technology platform to third-party operators, offering turnkey solutions for online gaming in regulated jurisdictions.

-

Entain Plc offers online casino services through a portfolio of brands, including PartyCasino, Bwin, Ladbrokes, and Coral. It delivers a broad portfolio of content from random number generator (RNG) slots and tables to engaging live dealer rooms. Entain has its technology platform, and as a result, it is capable of facilitating product customization, compliance management, and cross-brand integration.

-

Flutter Entertainment Plc provides online casino services to a number of consumer-facing brands, such as PokerStars, Sky Vegas, Betfair, and Paddy Power. Its platforms consist of proprietary slot titles, live dealer content, and game-show-style formats. Flutter's operations are spread across Europe, North America, and Australia, backed by central technology services and regional compliance frameworks.

Key Online Casino Companies:

The following are the leading companies in the online casino market. These companies collectively hold the largest market share and dictate industry trends.

- 888 Holdings Plc.

- Bally’s Corporation

- Bet 365 Group Ltd.

- Betsson AB

- Entain Plc

- Firekeepers

- Flutter Entertainment Plc

- Churchill Downs Inc.

- Kindred Group

- Ladbrokes Coral Group Plc

- Sky Betting & Gambling

- Sportech Plc

- The Stars Group Plc

Recent Developments

-

In September 2024, Flutter Entertainment Plc acquired Snaitech S.p.A., an omni-channel operator in Italy, from a subsidiary of Playtech plc for an enterprise value of USD 2.6 billion. This strategic move is part of the company's goal to strengthen its position in international markets.

-

In June 2024, a subsidiary of Betsson AB obtained local licenses for the newly regulated online casino and sports betting market in Peru. In addition to these new licenses, the company also holds licenses in two other countries in the region: Argentina and Colombia.

-

In March 2024, Bally’s Corporation launched its iGaming platform, an online casino experience in Rhode Island. This platform allows customers to play table games and slot games anywhere in the state, using either a desktop or an iOS mobile app. The product launch followed a four-day technical trial that involved selected guests who were invited to experience the new online gaming program.

-

In October 2024, La Française des Jeux (FDJ), the operator of the French national lottery, revealed that it had agreed to buy Kindred Group Plc for around USD 2.7 billion. The transaction was intended to reinforce FDJ's footprint in the European online gaming markets.

Online Casino Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.36 billion

Revenue forecast in 2030

USD 38.00 billion

Growth Rate

CAGR of 12.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, device, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Italy; Spain; Sweden; China; Australia; India; Australia; New Zealand; Brazil; Türkiye; South Africa

Key companies profiled

evoke plc; Bally’s Corporation; Bet 365 Group Ltd.; Betsson AB; Entain Plc; Firekeepers; Flutter Entertainment Plc; Churchill Downs Inc.; Kindred Group; Ladbrokes Coral Group Plc; Sky Betting & Gambling; Sportech Plc; The Stars Group Plc

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Online Casino Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analysis of the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global online casino market report based on type, device, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

iSlots

-

iTable

-

iDealer

-

Others

-

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Desktop

-

Mobile

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Australia

-

New Zealand

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Türkiye

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global online casino market size was estimated at USD 19.11 billion in 2024 and is expected to reach USD 21.36 billion in 2025.

b. The global online casino market is expected to grow at a compound annual growth rate of 12.2% from 2025 to 2030 to reach USD 38.0 billion by 2030.

b. The iSlots segment captured the largest revenue share of over 65% within the online casino market in 2024. The unique combination of traditional slot gameplay and interactive storylines is driving the demand for iSlots, driving the segmental growth. Unlike standard slot machines, iSlots provide a more engaging experience by integrating skill-based elements and narratives that evolve as the game progresses. This interactive feature appeals to a broader audience, particularly younger players who enjoy immersive and dynamic gaming experiences.

b. Some of the key players operating in the online casino market include 888 Holdings Plc; Bally’s Corporation; Bet 365 Group Ltd.; Betsson AB; Entain Plc; Firekeepers; Flutter Entertainment Plc; Churchill Downs Inc.; Kindred Group; Ladbrokes Coral Group Plc; Sky Betting & Gambling; Sportech Plc; and The Stars Group Plc

b. Market growth is being fueled by technological progress, regulatory developments, and shifting consumer behavior. The broad adoption of mobile technology has enhanced accessibility, allowing users to engage with online casinos more easily and conveniently. Additionally, the legalization and regulation of online gambling across multiple regions have opened up new avenues for market expansion

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.