- Home

- »

- Next Generation Technologies

- »

-

Online Gambling Market Size & Trends Analysis Report, 2030GVR Report cover

![Online Gambling Market Size, Share & Trends Report]()

Online Gambling Market Size, Share & Trends Analysis Report By Type (Sports Betting, Casinos, Poker, Bingo), By Device (Desktop, Mobile), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-474-1

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Report Overview

The global online gambling market size was valued at USD 63.53 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11.7% from 2023 to 2030. The growing internet penetration and rise in the use of mobile phones among users for playing online games is increasing the demand for online gambling. For instance, in 2022, internet penetration in the U.S. was 92% of the country's total population. Furthermore, cultural and legalization approval, easy access to online gambling, celebrity endorsements, and corporate sponsorships are also helping market growth. For instance, in October 2022, Betsson AB acquired 80% shares in KickerTech Malta Limited, a B2B sportsbook operator. This acquisition helped Betsson to grow its B2B client base and provide additional scalable technology. The growing adoption of smartphones, along with the 5G internet technology, is driving the market's growth. For instance, in September 2022, the BetMGM subsidiary of Entain Plc. partnered with NBC Sports to provide weekly integrations on 2022 NFL season highlights on Football Night in America and other content across all the platforms of NBC Sports. Modern smartphones support augmented reality, machine learning, and artificial intelligence, which help developers create immersive and interactive gambling applications. Moreover, the availability of low-cost smartphones is expected to drive the market.

Advancements in the digital space are concurrent with the annual expansion of online casinos, and these improvements are intended to obtain the desired trust in the online gambling sector. For instance, virtual reality (VR) in gambling creates the simulation of surroundings; users can interact with them realistically with specific hardware. VR lets gamblers interact with other gamblers and dealers and offers a more realistic gambling experience, better sound quality, and a realistic game design. For instance, SLTM Ltd.'s SlotsMillion online casino offers a virtual reality mode.

Online casino developers focus on solutions that support and assist gamblers, ensure the authenticity of gambling activities, and prevent fraudulent activities. Various online gambling sites offer a free-play version of their games, which attracts new users. In-app or website advertisements are used to generate revenue in the free-to-play versions. For example, gambling websites and applications sell advertisement slots on their website and in-app. The growth and demand of the online gambling industry are significant, as users worldwide can play at any time at their convenience.

The adoption of blockchain technology has also impacted market growth significantly. In addition to regular payment modes, gambling applications, and websites have begun accepting payments via the blockchain. For instance, BitStarz is a bitcoin-based gambling platform with approximately 4 million regular players. The blockchain can ensure secure payments with transparency in gambling activity through blockchain ledgers. Gambling through cryptocurrency offers vast opportunities as they are fast and safe transactions. With fewer regulations and restrictions for cryptocurrency transactions, they are now widely used by users in online gambling.

Type Insights

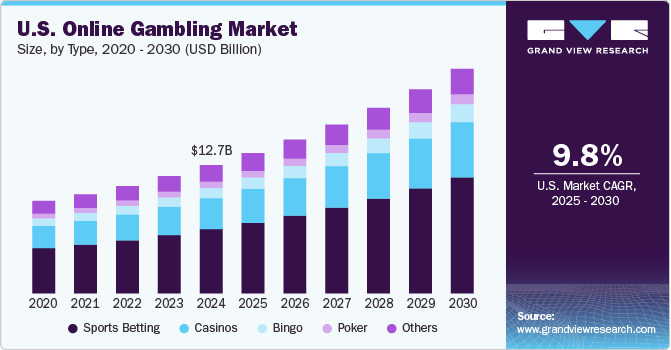

The online gambling market is segmented into poker, sports betting, bingo, and casinos. The sports betting segment dominated the market with a revenue share of approximately 49% in 2022. Moreover, the rise in popularity of sports betting gambling on games such as rugby and soccer, coupled with high internet penetration, has advanced the market growth. The partnerships between gambling software developers and private companies to produce user-friendly UI gaming solutions have expanded the market. For instance, in September 2022, Amazon.com, Inc. partnered with DraftKings Inc. to make it the exclusive sports betting application for soccer broadcast on Prime Video.

The casino's type segment is expected to grow at a significant CAGR over the forecast period from 2023 to 2030 due to the popularity of casino games such as blackjack, virtual slot machines, and more. The trend of quick casino games is a driving factor for this segment. For instance, the Lucky Block online casino website offers more than 100 live and interactive casino games. Additionally, the availability of customer support attracts users to play the games seamlessly.

Device Insights

In terms of devices, the desktop segment accounted for a significant revenue of around 48% in 2022. The desktop offers a large screen size compared to handheld devices and other devices that allow gamblers to enjoy the details and graphics of the game. Moreover, the performance features offered by desktops, such as audio quality, picture quality, and customizable storage capacity of desktops, provide an improved gaming experience. These factors have led to the growth of the desktop-type segment.

Advanced technologies in mobile phones have resulted in realistic gaming visuals in smartphones leading to increased access to online gambling through mobile phones. For instance, betting applications such as CricBaba, Sky Bet, bet365, and more can be accessed on iOS and Android smartphones. The wide availability of mobile phones at affordable prices and modern features such as improved graphics and expandable storage capacity contribute to the segment's growth. Mobile gambling has many advantages to users, such as remote playing, loyalty points, additional deposit options, and multiplayer gaming options.

Regional Insights

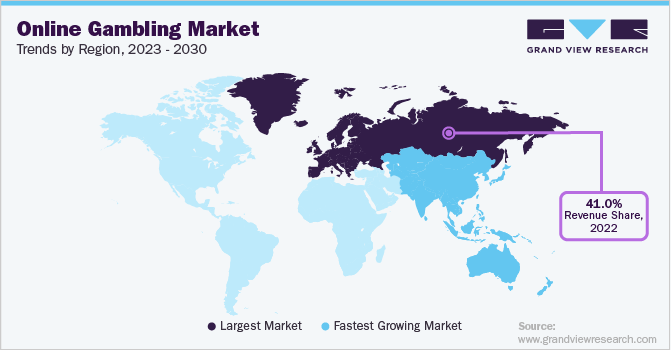

Europe dominated the market in 2022 with a market share of over 41%. The development can be attributed to the legalization of gambling in various European countries, including Italy, Spain, France, and Germany. Other drivers for the market growth include the availability of high-speed broadband internet, the rising popularity of online casinos, and the rising use of smartphones. For instance, in 2022, sports betting accounted for the largest share of online gambling, per a European Gaming & Betting Association study. Furthermore, the Gambling Act 2005 imposed by the UKGC (U.K. Gambling Commission) has enabled companies to promote their gambling websites, which also assisted in expanding the market in the region.

However, the increased use of internet services and modification of restrictions related to online gambling and betting is anticipated to promote the development of the market in the Asia Pacific over the forecast period. Furthermore, the adoption of bitcoins has contributed to the increase in cryptocurrency usage for gambling. Increase in spending on leisure activities, combined with the high economic growth of Asia Pacific is anticipated to fuel market growth throughout the forecast period. China, India, and Japan are APAC’s major revenue-generating countries.

Key Companies & Market Share Insights

Key players in the market are involved in partnerships and acquisitions to develop their offerings and attract new users. Moreover, the key market players are adding compatibility and support for new devices to lower the barrier of entry for new users. Utilizing technological advancements, companies have made it easy for new players to set up an account and begin gambling. Companies have also used different payment modes to make it even more convenient and easy for users to add funds to their accounts. Some of the prominent players in the online gambling market include:

-

888 Holdings Plc.

-

Bally’s Corporation

-

Bet 365 Group Ltd.

-

Betsson AB

-

Entain Plc.

-

FireKeepers

-

Flutter Entertainment Plc.

-

Churchill Downs Inc.

-

Kindred Group

-

Ladbrokes Coral Group Plc

-

Sky Betting & Gambling

-

Sportech Plc

-

The Stars Group Plc.

-

William Hills Limited

Online Gambling Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 70.64 billion

Revenue forecast in 2030

USD 153.57 billion

Growth rate

CAGR of 11.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, device, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; Japan; India; Brazil; Mexico; Turkey; South Africa

Key companies profiled

William Hill; Bet365; Fluter Entertainment Plc.; Betsson AB; Ladbrokes Coral Group PLC; The Stars Group Inc.; 888 Holdings PLC; Sky Betting and Gaming; Kindred Group PLC; Entain Plc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Online Gambling Market Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global online gambling market report based on type, device, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sports Betting

-

Casinos

-

iSlots

-

iTable

-

iDealer

-

Other iCasino Games

-

-

Poker

-

Bingo

-

Others

-

-

Device Outlook (Revenue, USD Billion, 2018 - 2030)

-

Desktop

-

Mobile

-

Others

-

- Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Turkey

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global online gambling market was estimated at USD 63.53 billion in 2022 and is expected to reach USD 70.64 billion in 2023.

b. The global online gambling market is expected to grow at a compound annual growth rate of 11.7% from 2023 to 2030 to reach USD 153.57 billion by 2030.

b. Europe dominated the online gambling market with a share of 41.10% in 2022. This is attributable to the legalization of gambling across European countries such as France, Germany, Spain, Malta, and Italy.

b. Some key players operating in the online gambling market include William Hill; Bet365; Paddy Power Betfair PLC; Betsson AB; Ladbrokes Coral Group PLC; The Stars Group Inc.; 888 Holdings PLC; Sky Betting and Gaming; Kindred Group PLC; GVC Holdings PLC.

b. Key factors driving the online gambling market growth include increasing investment in online gambling and the growing number of live casinos across the globe.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."