- Home

- »

- Digital Media

- »

-

Online Poker Market Size & Share, Industry Report, 2030GVR Report cover

![Online Poker Market Size, Share & Trends Report]()

Online Poker Market (2025 - 2030) Size, Share & Trends Analysis Report By Game Type (Texas Hold’em, Omaha, 7-Card Stud), By Device (Desktop (PC), Smartphone), By Game Format, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-571-7

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Online Poker Market Summary

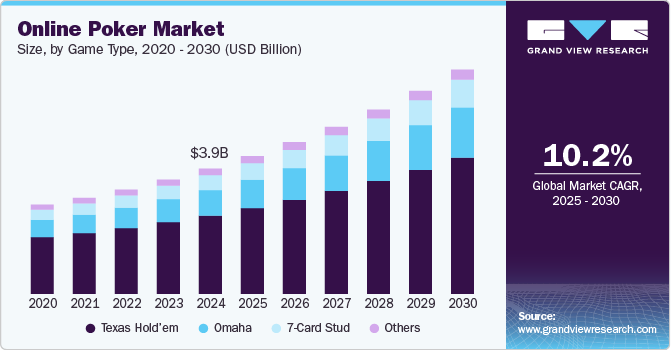

The global online poker market size was estimated at USD 3.86 billion in 2024 and is projected to reach USD 6.90 billion by 2030, growing at a CAGR of 10.2% from 2025 to 2030. The online poker industry is also experiencing significant growth through the integration of cross-platform interoperability, allowing users to seamlessly switch between devices without losing progress or access.

Key Market Trends & Insights

- The North America generated a significant revenue share, accounting for over 21% in 2024.

- The Asia Pacific region is expected to grow at the highest CAGR of over 11% from 2025 to 2030.

- Based on game type, the texas hold’em captured the highest market share of over 62% in 2024.

- Based on device, the desktop (PC) segment captured the highest market share in 2024.

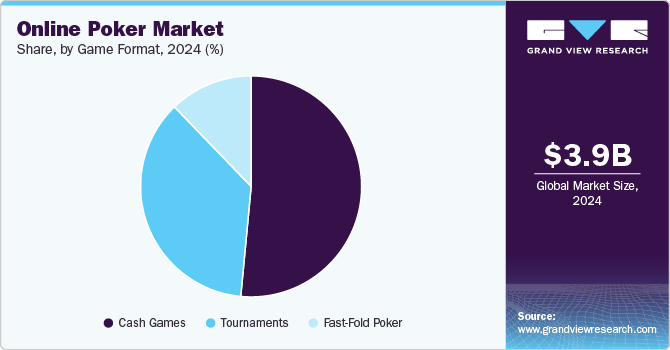

- Based on game format, the cash games segment captured the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.86 Billion

- 2030 Projected Market USD 6.90 Billion

- CAGR (2025-2030): 10.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Gamification features such as leaderboards, missions, and reward systems are increasingly adopted to enhance user engagement and retention.

Strategic collaborations between poker platforms and eSports organizations create hybrid formats to attract younger demographics. Virtual reality (VR) integration is also gaining traction, delivering a more immersive and interactive experience. In addition, cloud-based infrastructure facilitates scalable and secure platforms capable of supporting larger user bases with low latency. These developments underscore the sector’s adaptability and evolving role within the broader digital gaming landscape.

The surge in mobile device usage is driving the dominance of mobile poker applications, as players seek seamless gaming experiences on the go. Advanced UI/UX design, faster load speeds, and high-resolution gameplay have transformed smartphones and tablets into preferred poker platforms. Operators are increasingly adopting mobile-first strategies to attract digitally native younger demographics. Cross-platform integration ensures uninterrupted gameplay, enhancing user satisfaction and retention. This mobile shift is a key growth driver, especially in markets with high mobile internet penetration.

The online poker industry is rapidly expanding into high-potential regions such as Latin America, Africa, and Southeast Asia, where rising internet access and smartphone affordability are opening new demographics. Regulatory developments in countries like Brazil and India are formalizing the industry and encouraging licensed operators to enter. Platforms customize services with local languages, currencies, and payment gateways to meet regional expectations. This regional diversification drives new user acquisition and revenue streams, positioning emerging markets as pivotal to future industry growth.

Combining online qualifiers with live in-person finals, hybrid poker tournaments are gaining momentum across Europe and North America. This format enables broader participation while preserving the prestige of live championship events. Organizations like the World Series of Poker (WSOP) and World Poker Tour (WPT) now regularly integrate online stages into their major events to increase accessibility and engagement. Players benefit from lower entry costs and the opportunity to compete at a global level without immediate travel commitments. This trend is reshaping tournament dynamics and is likely to remain a long-term fixture post-pandemic.

Online poker industry platforms are aggressively expanding into emerging markets such as India, Brazil, and South Africa, where digital access is rapidly improving. These regions offer high growth potential due to rising smartphone usage, growing middle classes, and evolving gambling regulations. Localized offerings-such as language support, regional payment gateways, and culturally relevant marketing-are crucial to capturing these audiences. Companies like Adda52 and Betsson Group are gaining early-mover advantages by adapting their strategies for local preferences. As regulatory frameworks become more favorable, these regions are expected to boost global market revenues significantly.

Game Type Insights

Texas Hold’em captured the highest market share of over 62% in 2024. The market is witnessing robust growth, with the Texas Hold’em segment continuing to dominate due to its widespread popularity and easy-to-understand gameplay. This variant attracts novice and professional players, contributing significantly to user engagement and platform revenues. The rise of mobile gaming and live dealer formats has further enhanced the appeal of Texas Hold’em, making it more accessible and interactive. Furthermore, integrating AI for fair play monitoring and personalized game recommendations reshapes player experiences. As regulations ease in several regions, the Texas Hold’em segment is expected to sustain its momentum, driving the expansion of the global online poker market.

Omaha is expected to witness the highest CAGR of over 12% from 2025 to 2030. The segment within the online poker industry is witnessing growing interest, especially in the Pot-Limit Omaha (PLO) variant, which attracts players due to its higher action and larger pots. Moreover, short-deck Omaha is gaining momentum, offering faster gameplay and a more volatile experience that appeals to thrill-seeking players. Online poker platforms are expanding their tournament offerings with Omaha-specific events, including progressive knockouts and multi-table formats, to meet the demand of this evolving segment. Advanced training tools and analytics, including solvers and coaching platforms tailored to Omaha, are helping players refine their strategies and improve their skills. As Omaha continues to gain traction, its growth is particularly notable in regions like Europe, where the game’s deeper strategic elements resonate with a wider player base.

Device Insights

The desktop (PC) segment captured the highest market share in 2024. The desktop (PC) segment remains a market dominant, particularly for serious and professional players who prefer larger screens and more advanced features. This platform allows players to access a full range of poker games, including multi-table tournaments, with enhanced graphics, detailed statistics, and real-time gameplay tracking. Desktop applications often offer better customization options, such as multiple tables and advanced player-tracking tools, which appeal to players seeking a high-level experience. In addition, many online poker rooms provide exclusive desktop promotions and loyalty rewards, further attracting dedicated players. Despite the rise of mobile gaming, the desktop platform remains the preferred choice for those prioritizing performance, control, and a more immersive poker experience.

The smartphone segment is expected to witness the highest CAGR from 2025 to 2030. This segment has rapidly transformed the online poker industry, with mobile gaming offering unparalleled convenience and accessibility. Players can now engage in poker games anytime, anywhere, significantly increasing the overall player base. Mobile platforms are increasingly optimized for seamless user experiences, featuring responsive designs, intuitive controls, and the ability to multitask between tables. Integrating features such as live dealer games, instant notifications, and one-click tournament registrations also fuels the growth of mobile poker apps. As smartphone technology advances, with improvements in processing power and internet connectivity, mobile poker is expected to keep expanding, attracting a more casual audience alongside traditional desktop players.

Game Format Insights

The cash games segment captured the highest market share in 2024. This market segment continues to be a core attraction for recreational and professional players, offering a flexible and strategic gaming experience. Unlike tournaments, where players must survive multiple stages to win, cash games allow for continuous play, allowing players to join and leave at their convenience. This flexibility has made cash games especially popular among players who prefer shorter, more intense gaming sessions. Platforms offer a wider variety of stakes and game types, including no-limit, pot-limit, and fixed-limit, catering to different skill levels and bankrolls. As more players seek non-committal, real-time action, the Cash Games segment is expected to remain a staple in the online poker ecosystem, with growing player interest in high-stakes games and innovative variations like fast-fold poker.

The fast-fold poker segment is expected to witness the highest CAGR from 2025 to 2030. Fast-fold poker is rapidly gaining popularity online, offering a fast-paced alternative to traditional cash games. This variant allows players to fold their hands instantly and move to a new table, eliminating the wait time between hands and enabling continuous play. The gameplay speed attracts players looking for quick action and higher hand volume, which is ideal for casual players and those seeking to maximize their time at the tables. Many online poker platforms have incorporated Fast-Fold Poker into their offerings, often with variations like "Zoom" or "Snap" poker, to cater to a wide range of player preferences. As demand for faster, more dynamic games increases, Fast-Fold Poker is expected to be a key driver in the future of online poker.

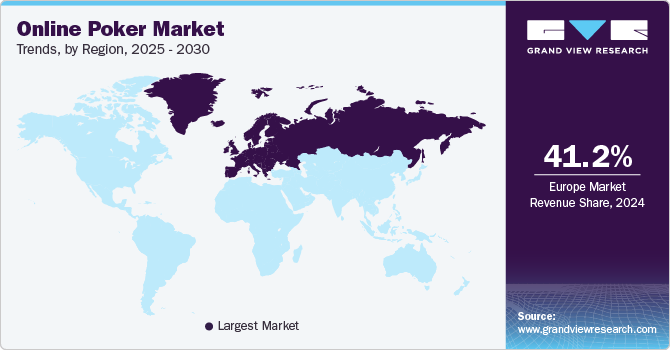

Regional Insights

The online poker market in North America generated a significant revenue share, accounting for over 21% in 2024. It is gaining momentum due to regulatory progress and growing consumer interest. Technological innovations like mobile poker apps and cryptocurrency integration make online platforms more accessible and secure. The U.S. is driving this growth, with increasing numbers of states legalizing and taxing online poker. As competition intensifies, operators invest in user experience and promotional strategies to retain players.

U.S. Online Poker Market Trends

The online poker market in the U.S. held a dominant position in 2024. In the U.S., online poker is rapidly expanding in states like New Jersey, Pennsylvania, and Michigan, where it's legalized and regulated. Operators are seeing increased player activity, driven by user-friendly platforms and secure payment options. Mobile gaming and multi-state player pooling are enhancing player engagement and liquidity. Regulatory clarity remains a key factor for nationwide market expansion.

Europe Online Poker Market Trends

The online poker market in Europe is mature and supported by clear regulations and high internet penetration. Countries like the UK, France, and Spain lead in terms of player volume and revenue. Integrating esports, live dealer games, and AI-driven poker tools creates a more dynamic and personalized experience. Cross-border gaming agreements are also helping boost prize pools and traffic.

The UK online poker market is one of the most regulated and stable markets globally. Players benefit from high consumer protection and access to a wide variety of platforms and poker variants. Mobile play, influencer partnerships, and innovative tournament formats are driving growth. Government policies on responsible gambling are also shaping player behavior and platform design.

The online poker market in Germany is evolving, with new regulations gradually opening the industry. The State Treaty on Gambling has provided a framework for licensed operators to offer services, albeit with strict controls. German players favor strategic gameplay, prompting platforms to offer analytics tools and training resources. Growth is expected as more states align with federal regulatory reforms.

Asia Pacific Online Poker Market Trends

The online poker market in the Asia Pacific region is expected to grow at the highest CAGR of over 11% from 2025 to 2030. The Asia Pacific region is experiencing growing interest in online poker, fueled by expanding internet access and smartphone penetration. Countries like Australia and the Philippines are emerging as poker hubs due to favorable regulatory environments. Localization and mobile-first strategies are key to attracting diverse player demographics. However, fragmented regulation across countries poses challenges to uniform market growth.

India online poker market is growing rapidly, driven by a young, mobile-savvy population and improved digital payment systems. Poker is gaining popularity as a skill-based game, attracting interest from both casual and serious players. State-specific regulations create a complex legal landscape, but this hasn't dampened investor or consumer enthusiasm. Operators are focusing on vernacular content and local tournaments to scale user engagement.

The online poker market in China remains largely restricted due to stringent government regulations. Despite the ban on real-money online poker, players access international platforms through VPNs and underground apps. The demand for skill-based, competitive games persists, especially among younger players. Unless legal reforms are introduced, the market will remain informal and have limited growth.

Middle East & Africa Online Poker Market Trends

The online poker market in the MEA region presents a mixed picture, with strong growth potential in Africa and tight restrictions in much of the Middle East. Mobile gaming is surging across Africa, especially in countries like Nigeria and Kenya, creating new opportunities. In conservative Middle Eastern markets, cultural and religious norms continue to limit legal adoption. Nonetheless, increased internet access is driving interest in poker-themed games and platforms.

South Africa online poker market is a bright spot in the MEA region, with a regulated market and growing demand for online poker. Mobile penetration and local payment solutions have made it easier for users to engage with platforms. Local tournaments and international operator entry are helping build a loyal player base. With a supportive regulatory environment, South Africa is poised to lead regional market expansion.

Key Online Poker Market Company Insights

Some key players operating in the market include Zynga Poker and PokerStars.

-

PokerStars is one of the most iconic online poker brands globally, known for its vast tournament offerings and professional-grade platform. It has hosted some of the largest online poker events in history, attracting millions of players across continents. With deep experience, strong regulatory compliance, and a feature-rich interface, PokerStars remains a gold standard in the industry.

-

Zynga Poker is a social gaming leader that offers a casual and entertaining poker experience without real-money betting. It thrives on in-game currency, player engagement, and social interaction, often through Facebook and mobile platforms. It remains the top destination for casual players worldwide with millions of daily users.

PokerBaazi and BLITZ POKER are some of the emerging participants in the market.

-

PokerBaazi, under Baazi Games, is becoming a dominant force in India’s skill-based poker landscape. With an emphasis on local content, player education, and regular high-stakes tournaments, it caters to both beginners and pros. Its strong community-driven model and legal clarity have helped build trust and user retention in a competitive market.

-

BLITZ POKER is a new-age poker platform in India, backed by i3 Interactive and celebrity influencers like Dan Bilzerian. It focuses on blending real-money poker with a gamified, social experience tailored for young, digital-savvy users. The brand is rapidly building momentum by offering sleek design, fast gameplay, and aggressive marketing.

Key Online Poker Companies:

The following are the leading companies in the online poker market. These companies collectively hold the largest market share and dictate industry trends.

- Americas Cardroom

- Baazi Games

- BetOnline

- BLITZ POKER

- Ignition

- MPL (Mobile Premier League)

- Playtika

- Pocket52

- PokerStars

- Tencent

- True Poker

- Zynga Inc.

Recent Developments

-

In March 2025, OneVerse Gaming, a metaverse and gaming technology company, announced a strategic partnership with online poker platform Poker Dangal to enhance its real-money gaming portfolio. This collaboration allows OneVerse users to access Poker Dangal's offerings, including free and paid online poker tournaments, thereby expanding OneVerse's gaming ecosystem. The partnership aims to strengthen OneVerse's position in India's gaming industry and provide Poker Dangal with broader audience reach and accelerated growth opportunities.

-

In February 2025, Playtech partnered with Pari Mutuel Urbain (PMU) to provide its advanced poker network services in France. PMU will join Playtech’s iPoker.EU network, gaining access to a broad portfolio of poker formats, including Twister Poker, cash games, and tournaments. This alliance strengthens Playtech’s role in the growing French poker market and enhances PMU’s player engagement through gamified features and advanced platform capabilities.

Online Poker Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.24 billion

Revenue forecast in 2030

USD 6.90 billion

Growth rate

CAGR of 10.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Game model, device, game format, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; Brazil; Turkey; South Africa

Key companies profiled

Americas Cardroom; Baazi Games; BetOnline; BLITZ POKER; Ignition; MPL (Mobile Premier League); Playtika; Pocket52; PokerStars; Tencent; True Poker; Zynga Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Online Poker Market Report Segmentation

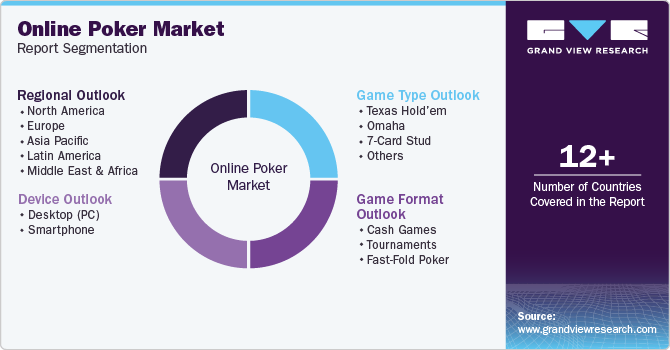

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global online poker market report based on game type, device, game format, and region:

-

Game Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Texas Hold’em

-

Omaha

-

7-Card Stud

-

Others

-

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Desktop (PC)

-

Smartphone

-

-

Game Format Outlook (Revenue, USD Million, 2018 - 2030)

-

Cash Games

-

Tournaments

-

Fast-Fold Poker

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Turkey

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global online poker market size was estimated at USD 3.86 billion in 2024 and is expected to reach USD 4.24 billion in 2025.

b. The global online poker market is expected to grow at a compound annual growth rate of 10.2% from 2025 to 2030 to reach USD 6.90 billion by 2030.

b. North America dominated the online poker market with a share of over 21.0% in 2024. The online poker market in North America is gaining momentum due to regulatory progress and growing consumer interest. Technological innovations like mobile poker apps and cryptocurrency integration are making online platforms more accessible and secure.

b. Some key players operating in the online poker market include Americas Cardroom, Baazi Games, BetOnline, BLITZ POKER, Ignition, MPL (Mobile Premier League), Playtika, Pocket52, PokerStars, Tencent, True Poker, and Zynga Inc.

b. Key factors that are driving the market growth include the rising popularity of online gambling, technological advancements in gaming platforms, and increasing legalization and regulatory support across various regions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.