- Home

- »

- Healthcare IT

- »

-

Operating Room Integration Market Size & Share Report, 2030GVR Report cover

![Operating Room Integration Market Size, Share & Trends Report]()

Operating Room Integration Market Size, Share & Trends Analysis Report By Component (Software, Services), By Device Type, By Application, By End Use (Hospitals, Ambulatory Surgical Centers), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-540-3

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global operating room integration market size was estimated at USD 1.86 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11.4% from 2023 to 2030. Increasing demand for technologically advanced Applications, a growing number of surgical procedures, congestion in Operating Rooms (OR), patient safety concerns in OR coupled with the surge in preference for Minimally Invasive Surgeries (MIS) are major factors primarily fueling the market growth. A decrease in the number of surgical procedures led to a decline in demand for devices and products required for respective procedures. For instance, Barco’s co-CEOs have recognized problems with the supply chain, producing value from technology, organizational structure, and R&D.

Longer intervals of peak loads in hospitals often produce an exponentially rising surgery waitlist of semi-urgent and non-urgent surgeries. The COVID-19 caused considerable wait times for patients standing by for surgery. A study published in the British Journal of Surgery showed that COVID-19 led to 28 million postponed or canceled surgeries globally in 2020 with millions of surgeries pushed into 2021. Thus, with thousands of patients facing delays in surgeries the necessity to enhance scheduling efficiencies has become more important. As a result, market players have introduced various technologies to cater to demand in the market for operating room integration. For instance, in June 2021, Getinge revealed that it released the “Torin” AI-based OR management system in the U.S.

Furthermore, the pandemic has pushed market players to operate in new ways, thus accelerating digitization. Operating rooms and surgical procedures changed in the following three ways in response to the pandemic-increased pre-surgical planning, video conferencing, and remote post-surgical patient engagement. Preoperative planning is already common in most areas of surgery. Shortly, there might be a better chance to take advantage of the preoperative phase of surgery, since preparations can be done with other clinicians in the office with negligible contact.

Improvements in AI technology can play a vital role in a complete plan to deal with these backlogs and can assist to enhance efficiency and decreasing costs for hospitals and surgery centers. In addition, the advent of advanced imaging as well as diagnostic technologies for OR, rising funding by the government to improve OR infrastructure or redevelopment projects in hospitals, an increasing need to curtail healthcare expenditure, and an increase in investments in OR equipment are some of the factors contributing to market growth. For instance, Okayama University Hospital installed a notable 20 new ORs, including one Hybrid OR. The hospital, located in Okayama, Japan, entered a partnership with Toshiba and Getinge for this key undertaking.

Improved patient outcomes with less invasive procedures are expected to drive the market for operating room integration. The adoption of a patient-centric approach for surgery further led to improved use of ORs in a more sophisticated way. These types of initiatives are anticipated to fuel market growth over the forecast period. Furthermore, an increasing number of MIS procedures and their benefits such as reduced hospital stays, rapid adoption of integrated systems to reduce complexity in OR is stimulating market growth. Increasing demand for improving surgical workflow in OR, and managing, sharing, and storing video-rich content across hospitals is also boosting the OR integration market growth.

Operating rooms are rapidly evolving. Advanced medical technologies and minimally invasive procedures have altered surgical procedures as well as the surgical setting. Continuous changes, improved convenience, and demand for increased productivity requires the surgical site to be highly competent and flexible. Thus, surgical displays are constantly being upgraded. Market players are also constantly working to upgrade products and address the demand. For instance, in July 2021, EMBITRON s.r.o. launched new 4K surgical displays in 27 inches and 32 inches screen sizes. This added to the company’s offerings. However, the lack of skilled surgeons in developing countries and the high cost of initial investment are factors restraining market growth. This high cost can be attributed to the high-priced integrated advanced technology that is being adopted in OR, especially in small size hospitals.

Component Insights

The software segment dominated the market in 2022, owing to various benefits associated with its use. These integrated software solutions offer seamless communication within various systems operational in OR to streamline surgical workflows and ensure ease of use and effective operation. In addition, companies are also marking their presence in the market for operating room integration by adopting attainment strategies to broaden their portfolio in the operating room integration space.

For instance, in 2017, Stryker's Endoscopy Division started a program named "OR of the Future''. The program uses holographic technology and allows customers to visualize how the company's surgical equipment and displays will operate in ORs. Such types of initiatives to promote integrated OR technologies are anticipated to boost the adoption of integrated ORs in the near future. The services segment is projected to register a CAGR of about 11% in the coming years. Growing demand for support and maintenance services, owing to cost-effectiveness, and well-trained and experienced technicians are expected to boost segment growth over the forecast period. In addition, service solutions assist customers in safeguarding their investment comprising on-site and remote support, maintenance, regular software updates, along with on-site training.

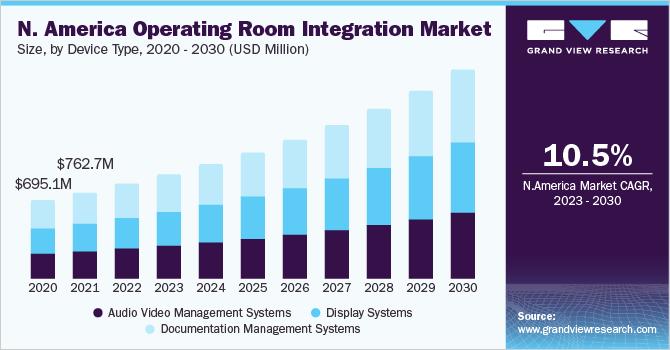

Device Type Insights

The documentation management systems segment accounted for the largest revenue share of over 35.0% in the market for operating room integration in 2022 owing to its wide applications in ORs. This system helps in managing all the records from various sources and presents them on a single platform to help surgeons with patients’ history and other necessary information during the surgery. Operating rooms are increasingly becoming complex and congested with the inclusion of a variety of equipment such as surgical lights, operating tables, and surgical displays. In basic ORs, individual devices are arranged which are pulled or pushed back according to their use, cords and cables are spread all over the room. This heightens the risk of tripping or pulling out the essential cord during surgery or damaging any equipment. Integrated operating rooms (I-ORs) help to curb this problem.

The Audio video management systems segment is expected to grow the fastest at a rate of about 11% over the forecast period. The high demand for MIS has spurred the implementation of I-ORs owing to its associated advantages such as safety. In addition, industry players are involved in continuous research and development activities for application innovation. For instance, in January 2021, ADLINK Technology, Inc. launched a series of medical-grade surgical monitors-the ASM (ADLINK Surgical Monitor) series to visualize videos and still images from multiple clinical imaging systems in ORs, ICUs, and emergency and examination rooms. The ASM series is available in sizes from 23.8 inches to 32 inches and can be customized as per the needs of medical device OEMs. These types of innovations are anticipated to boost their adoption over the forecast period.

Application Type Insights

The general surgery segment dominated the market for operating room integration and accounted for the largest revenue share of more than 30.0% in 2022. The increasing number of hospitals adopting MIS technology coupled with the rising number of chronic illnesses and requiring surgical procedures is further fueling the market growth. For instance, in the U.S. approximately half of the surgeries are done with MIS technology. The rising number of surgical interventions with the high number of MIS being carried out due to its several benefits such as reduced hospital stay, less painful features, and high focus on patient safety in OR are driving the demand. As this technology continues to grow along with telemedicine and robotic surgery becoming more common healthcare services, the I-ORs are expected to become an industry-standard in the coming years.

The orthopedic surgery segment is anticipated to witness a lucrative CAGR of 11.9% over the forecast period due to increasing demand for orthopedic procedures in the coming years. For instance, according to the American Academy of Orthopedic Surgeons 2018, total joint replacement is the most performed elective surgical procedure in the U.S. and by 2030, total knee replacement is expected to reach 189.0% i.e., 1.28 million procedures. Therefore, the rising number of orthopedic procedures demands an integrated OR to reduce the burden on surgeons and efficiently manage surgical workflow. Moreover, the increasing demand for advanced healthcare infrastructure, the high adoption rate of I-ORs due to the expanding pool of patients with chronic diseases is further boosting the market growth.

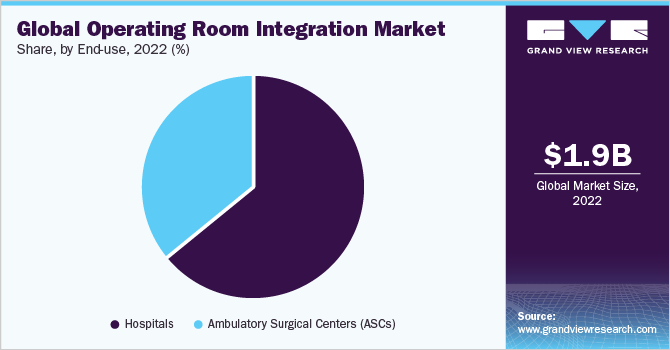

End-use Insights

The hospital segment dominated the market in 2021. This growth is owing to the high penetration of integrated ORs. With the large patient population being exposed to chronic diseases there is a need for I-ORs to reduce the burden on physicians and complexity so that they can efficiently manage their surgical workflow. Furthermore, ongoing technology innovations in medical devices attributing to the growing adoption of I-ORs over the forecast period.

The ambulatory surgical center segment is expected to witness an exponential growth rate of 11.9% over the forecast period. Ambulatory surgery is being increasingly performed in developed countries. The shortage of beds in hospitals and scarce economic resources are expected to boost the growth of this segment. However, the high initial and maintenance cost of integrated OR is hampering segment growth. The development of various medical devices that aid in performing minimally invasive surgeries is allowing physicians to carry out a greater number of surgical procedures on a day-care basis. The availability of technologically advanced I-ORs has contributed largely to the improvement of day-care surgery.

Regional Insights

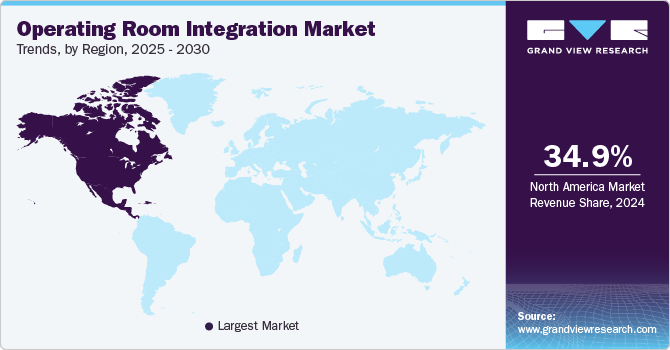

North America dominated the market and accounted for the largest revenue share of over 45.0% in 2022. Dominance can be attributed to the increasing demand for surgical automation. Major factors attributed to the market growth are the rise in demand for efficient healthcare services, an increase in the need to reduce healthcare expenditure, and effective EHR implementation by healthcare organizations. Furthermore, the presence of established players in the market, technologically advanced HCIT, and funding to improve OR infrastructure is other factors propelling the market growth.

In the Asia Pacific, the market for operating room integration is anticipated to witness the highest CAGR over the forecast period. The market is driven by a rising pool of patient populations suffering from chronic disorders that require surgical interventions, increasing demand for sophisticated medical devices in hospitals, a rising number of MIS procedures, and rapidly improving healthcare infrastructure. In August 2020, the Indian government introduced National Digital Health Mission, a complete digital health ecosystem. Such initiatives can contribute to overall market growth.

Key Companies & Market Share Insights

The industry is fragmented with a large number of players operating in this sector. The key players are focusing on implementing new strategies such as regional expansion, mergers, and acquisitions, improving their application portfolio through innovation, partnerships, and distribution agreements to increase their revenue share and mark their presence in the market. For instance, in April 2021, Barco launched surgical teleconferencing, telementoring, and teleassistance solution called NexxisLive as a secure cloud-based platform for ORs. While, in April 2021, caresyntax’s digital surgery platform was selected as part of a pilot program by the American Board of Surgery to enhance surgeon certifications with video-based assessments.

Likewise in January 2020, Caresyntax announced the installation of 16 digital ORs in Calvary Adelaide Hospital in South Australia with its digital OR integration platform, PRIME365. These types of initiatives are attributing to the increasing penetration of I-ORs in the coming years. Furthermore, Innovations like these by the established market players focused on introducing integrated OR platform globally is likely to propel market growth. Some of the prominent players in the operating room integration market include:

-

Braiblab AG

-

Barco

-

Dragerwerk AG & Co. KGaA

-

Steris Plc.

-

KARL STORZ SE & CO. KG

-

Olympus

-

Care Syntax

-

Arthrex, Inc.

-

Stryker Corporation

-

Olympus Corporation

-

Getinge AB

-

ALVO Medical

-

Skytron, LLC,

-

Merivaara

-

TRILUX Medical GmbH & Co. KG

-

Caresyntax

-

Sony Corporation

-

Richard Wolf GmbH

-

FUJIFILM Holdings Corporation

-

Ditec Medical

-

Doricon Medical Systems

-

Hill-Rom Holdings, Inc.

-

EIZO GmbH

-

OPExPARK

-

ISIS-Surgimedia,

-

Meditek

-

Zimmer Biomet Holdings, Inc.

Operating Room Integration Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.06 billion

Revenue forecast in 2030

USD 4.38 billion

Growth rate

CAGR of 11.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, device type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; Singapore; Brazil; Mexico; Argentina; UAE; South Africa

Key companies profiled

Stryker; Braiblab AG; Barco; Dragerwerk AG & Co. KGaA; Steris; KARL STORZ SE & CO. KG; Getinge AB; Olympus; Care Syntax; Arthrex, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Operating Room Integration Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global operating room integration market report on the basis of component, device type, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Services

-

-

Device Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Audio Video Management System

-

Display System

-

Documentation Management System

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

General Surgery

-

Orthopedic Surgery

-

Neurosurgery

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Hospitals

-

Ambulatory Surgery Centers

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global operating room integration market size was estimated at USD 1.86 billion in 2022 and is expected to reach USD 2.06 billion in 2023.

b. The global operating room integration market is expected to grow at a compound annual growth rate of 11.4% from 2023 to 2030 to reach USD 4.38 billion by 2030.

b. North America dominated the operating room integration market with a share of over 45% in 2022. This is attributable to the rise in demand for efficient healthcare services, an increase in the need to reduce healthcare expenditure, and effective EHR implementation by healthcare organizations.

b. Some key players operating in the operating room integration market include Steris, Getinge Ab, Barco, Merivaara, Stryker and emerging players are inclusive of Caresyntax, and Trilux GmbH.

b. Key factors that are driving the operating room integration market growth include the increasing number of minimally invasive surgeries, funding to improve operating room (OR) infrastructure, and rising congestion in the OR.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."