- Home

- »

- Medical Devices

- »

-

Ophthalmic Supply Market Size, Share, Growth Report, 2030GVR Report cover

![Ophthalmic Supply Market Size, Share & Trends Report]()

Ophthalmic Supply Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Surgical Device, Diagnostic and Monitoring Devices, Vision Care Devices), By End-use (Hospitals and Eye Clinics, Academic and Research Laboratories), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-446-4

- Number of Report Pages: 95

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ophthalmic Supply Market Size & Trends

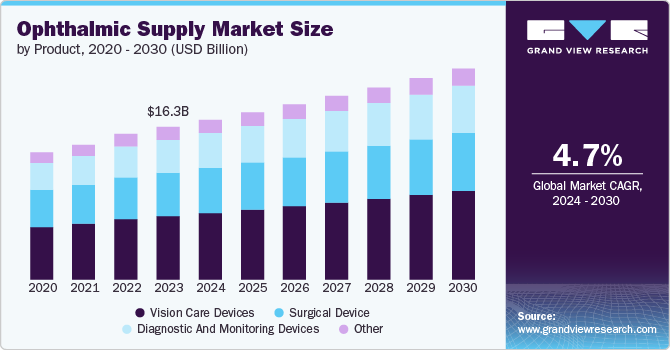

The global ophthalmic supply market size was estimated at USD 16.3 billion in 2023 and is projected to grow at a CAGR of 4.75% from 2024 to 2030. The market is driven by several key factors, including rising prevalence of eye diseases, technological advancements, increasing geriatric population, and growing awareness and access to eye care. According to the World Health Organization (WHO), approximately 2.2 billion individuals worldwide experience vision impairment, with at least 1 billion of these cases being preventable or unaddressed.

One of the key drivers for the market growth is technological advancements. Innovations such as optical coherence tomography (OCT) and advanced laser systems are revolutionizing diagnostics and treatments. Integrating artificial intelligence in diagnostic devices is enhancing accuracy and efficiency of eye disease management, further propelling market growth. For instance, in January 2024, German optics giant Carl Zeiss identified India as a crucial market for its AI-driven ophthalmic devices, driven by the alarming increase in diabetic retinopathy (DR) cases nationwide. Company's AI-powered solutions, which assist in early detection and management of DR, are gaining attention.

The growing geriatric population is another critical driver. As global population ages, incidence of age-related eye conditions like macular degeneration and presbyopia increases. According to WHO, by 2030, the number of people aged 60 and over will reach 1.4 billion; by 2050, those aged 80 and older will increase to 426 million. This demographic shift drives the demand for age-specific ophthalmic solutions and contributes to the market's expansion, as older adults require more frequent eye care and treatment options.

Market Concentration & Characteristics

Degree of innovation is high. Manufacturers are continually developing advanced technologies to improve diagnostic and surgical capabilities. Recent advancements include the development of minimally invasive surgical techniques, which are gaining traction due to their effectiveness and reduced recovery times. According to the National Centre for Biotechnology Information, smart contact lenses (SCLs) are wearable ophthalmic devices that enhance vision correction by incorporating electronic components such as sensors and microprocessors, enabling additional functionalities through integration with traditional soft contact lenses.

Mergers and acquisitions in the global market are at a medium. Strategic consolidations are common as companies aim to expand their technological capabilities and market reach. For instance, in September 2022, Théa Pharma finalized its acquisition of seven branded ophthalmic products from Akorn, broadening its eye care offerings in the U.S. market. The need for competitive advantage and integration of advanced technologies drives such activities.

The impact of regulations is high. Stringent regulatory frameworks in regions such as Europe and North America ensure that ophthalmic devices meet safety and efficacy standards before being marketed. The European Medical Device Regulation (MDR) introduced more rigorous requirements for clinical evaluations and post-market surveillance. Companies must navigate these regulatory landscapes carefully, which can influence their strategies for product development and market entry.

Product expansion in the market is high. Companies are launching new products to meet the diverse needs of eye care professionals and patients, introducing advanced surgical instruments and diagnostic devices, such as the latest generation of phacoemulsification devices for cataract surgery. In addition, the market is witnessing an increase in the development of specialized products targeting specific eye conditions, such as glaucoma and age-related macular degeneration. This ongoing product expansion is essential for addressing the rising prevalence of eye diseases and improving patient care.

This market is seeing medium levels of regional expansion, with companies targeting emerging markets and underserved regions to drive growth. Companies are increasing their presence in Asia Pacific and Latin America due to rising demand for advanced eye care solutions and improving healthcare infrastructure. Expansion efforts include establishing new distribution networks and partnerships. Companies also focus on market penetration in regions such as Africa and the Middle East, with a growing demand for ophthalmic services and technologies.

Product Insights

The vision care devices segment led the market with the largest revenue share of 41.5% in 2023, driven by the increasing prevalence of eye disorders and a growing aging population. Factors such as the rising incidence of myopia, presbyopia, and cataracts are propelling demand for corrective lenses and other vision care products. In addition, technological advancements, including the development of smart contact lenses and innovative eyewear, enhance the functionality and appeal of vision care products, further driving the market growth.

The diagnostic & monitoring devices segment is expected to grow at the fastest CAGR over the forecast period. Technological advancements and a heightened focus on early detection and management of eye diseases drive them. This segment includes refined equipment such as OCT scanners, fundus cameras, and tonometer, essential for accurately diagnosing and monitoring conditions such as glaucoma, retinal disorders, and macular degeneration. Key drivers of this growth include increasing prevalence of chronic eye conditions and demand for precise, real-time diagnostic capabilities.

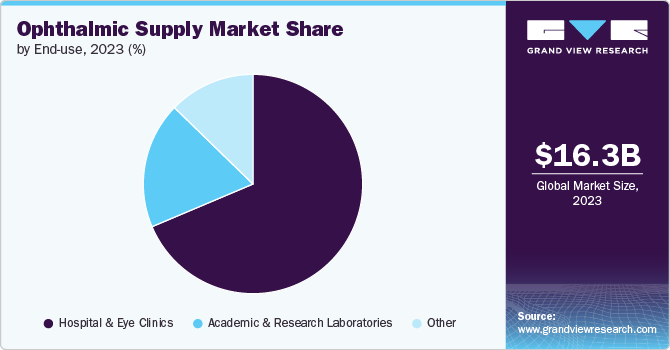

End-use Insights

Based on end use, the hospital and eye clinics segment led the market with the largest revenue share of 68.64% in 2023, due to several key drivers, including increasing prevalence of eye disorders, advancements in ophthalmic technologies, and a growing aging population that requires regular eye care. Hospitals and specialized eye clinics are equipped with advanced diagnostic and treatment facilities, which enhance patient outcomes and drive demand for ophthalmic supplies such as surgical instruments, diagnostic equipment, and therapeutic products.

The academic and research laboratories segment is anticipated to grow at the fastest CAGR during the forecast period, driven by increasing utilization of ophthalmic devices for research and development. This growth is largely fueled by rising investments in research initiatives to understand and treat various eye conditions, such as glaucoma and diabetic retinopathy. In addition, emergence of small-scale research firms in emerging markets, supported by government funding for innovative research, further propels this segment.

Regional Insights

North America dominated the ophthalmic supply market with the largest revenue share of 37.73% in 2023. North America is witnessing a dynamic shift driven by rapid technological advancements and a high demand for innovative solutions. The region benefits from significant investments in research and development, resulting in frequent product launches and cutting-edge technologies. Notably, prevalence of chronic eye diseases such as diabetic retinopathy and age-related macular degeneration is prompting increased adoption of advanced diagnostic tools and treatment methods.

U.S. Ophthalmic Supply Market Trends

The ophthalmic supply market in the U.S. is characterized by continuous innovation and a strong focus on improving patient outcomes. The country developed and introduced new ophthalmic technologies, including advanced surgical instruments and diagnostic equipment. The high incidence of eye conditions such as cataracts and glaucoma fuels demand for innovative treatments and therapies. Furthermore, the U.S. market is active with mergers and acquisitions, as major players seek to strengthen their portfolios and leverage new technologies to stay competitive in a rapidly evolving industry. For instance, in July 2023, Vantage Surgical Solutions acquired Ophthalmic Surgical Solutions (OSS), a Kansas-based ophthalmic equipment and services provider.

Europe Ophthalmic Supply Market Trends

The ophthalmic supply market in Europe is experiencing significant growth driven by increasing consumer demand for advanced technologies and a rising prevalence of eye diseases. Government initiatives to improve access to eye care services and reduce disease burden further stimulate market expansion. For instance, due to the war in Ukraine, the charity OAEE is urgently seeking donations of new or gently used ophthalmic medical supplies for Lviv Hospital and St. Spiridon Hospital in Iasi, Romania, to assist displaced Ukrainian refugees.

The UK ophthalmic supply market focuses on addressing rising incidence of myopia and other vision impairments. According to a survey report, 41% of respondents reported that their child had previously been diagnosed with myopia, which is slightly higher than estimated prevalence of around one-third of children in the UK. The market is also witnessing increased product launches, such as introducing new refractive surgical devices that cater to this growing need.

The ophthalmic supply market in France is seeing growth fueled by technological advancements and an aging population. Introducing new ophthalmic drugs and devices, particularly for treating glaucoma and diabetic retinopathy, is becoming increasingly common. In addition, French government is promoting initiatives to enhance access to eye care services, which likely increase adoption of advanced ophthalmic technologies. As a result, the market is poised for continued growth, driven by both innovation and demographic changes.

Asia Pacific Ophthalmic Supply Market Trends

The ophthalmic supply market in Asia Pacific is experiencing rapid growth, driven by increasing urbanization and awareness of eye health. Rising rates of eye diseases, including myopia and diabetic retinopathy, are spurring demand for new diagnostic and therapeutic solutions. The region is witnessing a surge in innovative ophthalmic products, particularly in response to growing incidence of conditions such as age-related macular degeneration and diabetic retinopathy.

The Japan ophthalmic supply market is marked by a strong focus on research and development, leading to innovative product launches that cater to specific needs such as dry eye syndrome treatments. The country is witnessing increased partnerships between pharmaceutical companies and technology firms to develop smart contact lenses with integrated sensors. For instance, in December 2023, Kubota Vision Inc. formed a strategic alliance with AUROLAB, allowing the Indian ophthalmic consumables manufacturer exclusive rights to develop, produce, supply, and distribute Kubota Vision’s eyeMO device.

The ophthalmic supply market in China is anticipated to grow at the fastest CAGR during the forecast period. Rapid technological advancements and a surge in demand for high-quality eye care products characterize the market in China. The government’s initiatives to improve healthcare access increased investments in ophthalmology clinics and hospitals. Launching new diagnostic devices such as OCT systems transformed patient management. In addition, the market is witnessing increased investment in research and development, with local companies launching new products to cater to the population's growing needs.

Latin America Ophthalmic Supply Market Trends

The ophthalmic supply market in Latin America is witnessing a gradual expansion, driven by improvements in healthcare infrastructure and increased access to advanced eye care technologies. The region is seeing a rise in innovative product launches and the adoption of new diagnostic and therapeutic solutions. The growing prevalence of eye conditions such as cataracts and diabetic retinopathy drives higher demand for advanced ophthalmic treatments. Mergers and acquisitions are also becoming more prevalent as companies aim to strengthen their market presence and enhance their technological capabilities.

The Brazil ophthalmic supply market incorporates significant developments in technology and healthcare access. The country is experiencing increased activity in introducing new ophthalmic products and advanced surgical equipment. Rising rates of eye diseases, including glaucoma and cataracts, drive demand for innovative solutions. Strategic mergers and acquisitions are common as Brazilian and international companies seek to expand their reach and integrate cutting-edge technologies to meet the market's growing needs.

Middle East & Africa Ophthalmic Supply Market Trends

The ophthalmic supply market in Middle East & Africa is experiencing growth driven by the increasing prevalence of eye diseases such as cataracts and diabetic retinopathy. Innovations in minimally invasive surgical techniques and advanced diagnostic tools are gaining attention. In addition, the region saw a rise in partnerships between local companies and global players to enhance product offerings. The area is witnessing a surge in innovative product launches and adoption of new diagnostic and therapeutic solutions.

The Saudi Arabia ophthalmic supply market focuses on improving healthcare access and addressing burden of eye diseases. The country has seen a rise in prevalence of myopia, driving demand for ophthalmic devices and treatments. Innovations in diagnostic and surgical solutions are prominent, and strategic mergers and acquisitions are helping to enhance capabilities and reach of leading ophthalmic companies within the Saudi Arabian market.

Key Ophthalmic Supply Company Insights

Key companies are involved in various segments, such as surgical instruments, diagnostic equipment, and contact lenses, contributing to a competitive environment. Their market leadership is bolstered by continuous advancements in product offerings and strategic partnerships, allowing them to maintain a competitive edge. For instance, in February 2024, Kiora Pharmaceuticals Inc. formed a strategic partnership with Théa Open Innovation, a subsidiary of Laboratoires Théa, to further develop and commercialize the KIO-301 treatment for inherited retinal diseases.

Key Ophthalmic Supply Companies:

The following are the leading companies in the ophthalmic supply market. These companies collectively hold the largest market share and dictate industry trends.

- Bausch Health Companies, Inc.

- Alcon

- Carl Zeiss Meditec AG

- Johnson & Johnson Services, Inc.

- HOYA Corporation

- The Cooper Companies, Inc.

- EssilorLuxottica

- Canon Inc.

- Glaukos Corporation.

- TOPCON CORPORATION

Recent Developments

-

In April 2024, Carl Zeiss Meditec AG finalized its purchase of the Dutch Ophthalmic Research Center (D.O.R.C.) to influence ophthalmology market.

-

In June 2024, NIDEK introduced the RS-1 Glauvas Optical Coherence Tomography, a new device designed to enhance the diagnosis and management of glaucoma with advanced imaging capabilities.

-

In July 2023, Harrow acquired Santen's portfolio of branded ophthalmic products, expanding its offerings in the eye care market and enhancing its presence in ophthalmology.

Ophthalmic Supply Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 17.09 billion

Revenue forecast in 2030

USD 22.6 billion

Growth rate

CAGR of 4.75% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Bausch Health Companies, Inc.; Alcon; Carl Zeiss Meditec AG; Johnson & Johnson Services, Inc.; HOYA Corporation; The Cooper Companies, Inc.; EssilorLuxottica; Canon Inc.; Glaukos Corporation.; TOPCON CORPORATION

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ophthalmic Supply Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ophthalmic supply market report based on product, end-use and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical Device

-

Diagnostic and Monitoring Devices

-

Vision Care Devices

-

Other

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Eye Clinics

-

Academic and Research Laboratories

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ophthalmic supply market size was estimated at USD 16.3 billion in 2023 and is expected to reach USD 17.09 billion in 2024.

b. The global ophthalmic supply market is expected to witness a compound annual growth rate of 4.8% from 2024 to 2030, reaching USD 22.6 billion by 2030.

b. The vision care devices segment held the largest revenue share of 41.5% in the ophthalmic supply market in 2023 driven by increasing prevalence of eye disorders and a growing aging population.

b. Some of the prominent players in the global ophthalmic supplies market are Bausch Health Companies, Inc., Alcon, Carl Zeiss Meditec AG, Johnson & Johnson Services, Inc., HOYA Corporation, The Cooper Companies, Inc., EssilorLuxottica, Canon Inc., Glaukos Corporation

b. The market is driven by several key factors, including the rising prevalence of eye diseases, technological advancements, the increasing geriatric population, and growing awareness and access to eye care.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.