- Home

- »

- Medical Devices

- »

-

Ophthalmic Sutures Market Size And Share Report, 2030GVR Report cover

![Ophthalmic Sutures Market Size, Share & Trends Report]()

Ophthalmic Sutures Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Synthetic, Natural), By Absorption Capacity, By Application (Corneal Transplant Surgery, Cataract Surgery), By End-use (Hospitals, Ambulatory Surgical Centers), By Region, And Segment Forecast

- Report ID: GVR-3-68038-974-6

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ophthalmic Sutures Market Size & Trends

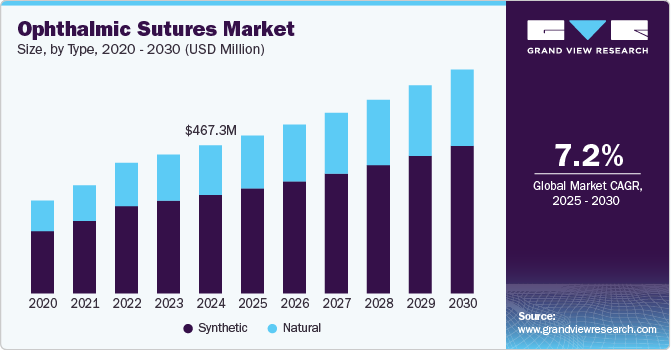

The global ophthalmic sutures market size was estimated at USD 467.3 million in 2024 and is projected to grow at a CAGR of 7.2% from 2025 to 2030. The market is being driven by the rising incidence of eye diseases and vision loss, which are major global health concerns affecting both physical and mental well-being. The American Academy of Ophthalmology forecasts that by 2050, approximately 7.32 million people in the U.S. will be affected by primary open-angle glaucoma (POAG), highlighting the growing need for ophthalmic surgical interventions and sutures.

As the global population ages, the incidence of eye disorders such as cataracts, glaucoma, and diabetic retinopathy is rising, which has created a growing demand for surgical interventions and medical devices, including ophthalmic sutures. These sutures are essential in eye surgeries to promote healing, minimize infection risks, and ensure the proper functioning of eye structures post-surgery. Vision impairment and blindness are among the leading causes of disability worldwide, affecting millions of people across different age groups. The World Health Organization (WHO) estimates that over 2.2 billion people globally suffer from some form of visual impairment, and many of these conditions can be managed or treated through surgery. For instance, cataracts, one of the most common causes of vision loss, are expected to affect more than 38 million people globally by 2030. This growing prevalence of eye diseases and the increasing need for corrective surgeries are key drivers of the ophthalmic sutures market.

Moreover, advancements in surgical techniques and suturing materials have contributed to the market’s expansion. Traditional sutures made of silk and nylon are being gradually replaced by newer, more advanced materials such as polyglycolic acid and polyglactin, which offer better biocompatibility and reduced post-operative complications. These innovations are crucial in improving patient outcomes and enhancing the effectiveness of eye surgeries, such as cataract removal and corneal transplants.

In addition to the rising demand for ophthalmic sutures due to increasing eye diseases, various public health campaigns and initiatives are raising awareness about the importance of regular eye exams and the need for timely interventions. The global "Vision 2020: The Right to Sight" initiative, led by the WHO and the International Agency for the Prevention of Blindness (IAPB), aims to eliminate avoidable blindness by the year 2020. While the goal date has passed, the campaign continues to promote eye health awareness and early detection, which indirectly contributes to the need for more ophthalmic surgeries and, by extension, sutures.

Furthermore, the ophthalmic sutures market is witnessing technological improvements with the development of minimally invasive procedures requiring precise and delicate techniques. These innovations in ophthalmic surgeries, including femtosecond laser-assisted cataract surgery and minimally invasive glaucoma surgery (MIGS), have increased the demand for specialized sutures that can provide secure wound closure without damaging delicate eye tissues.

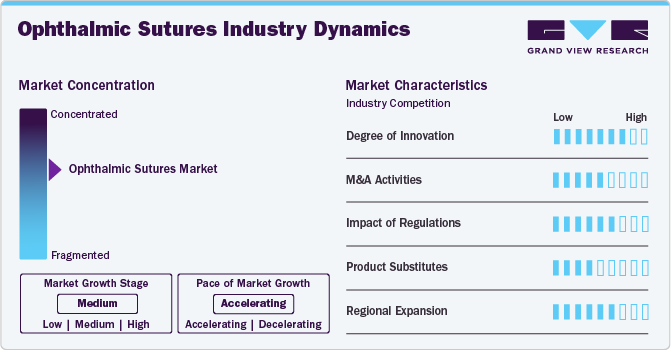

Market Concentration & Characteristics

The ophthalmic sutures industry is moderately concentrated, with a few leading companies such as Alcon Inc., B. Braun Melsungen, and Medtronic dominating the landscape. These players offer many ophthalmic suture products, including absorbable and non-absorbable options. Key market trends include the rise of minimally invasive surgeries and expanding healthcare access in emerging economies, contributing to the overall growth and diversification of the ophthalmic sutures industry.

The ophthalmic sutures industry is witnessing significant innovation, with recent advancements to improve surgical outcomes and reduce complications. One such breakthrough occurred in August 2021, when researchers at the Wilmer Eye Institute developed drug-loaded sutures. These ultrathin, nanometer-scale polymer sutures can deliver antibiotics directly to ocular wound sites for extended periods, addressing infection control challenges. Unlike traditional triclosan-coated sutures, which are limited to general surgery, these new drug-eluting sutures could revolutionize ophthalmic procedures, reducing the need for oral antibiotics, enhancing infection prevention, and potentially replacing the 12 million nylon sutures used globally in ocular surgeries annually.

Mergers and acquisitions (M&A) activity in the ophthalmic sutures industry has increased. In July 2021, GTCR, a leading private equity firm, announced that Corza Medical had acquired Katena Products, Inc., a prominent medical device company specializing in ophthalmic surgical products. Founded in 1975, Katena offers an extensive range of precision instruments and single-use devices used in cataract, glaucoma, and corneal surgeries. This acquisition strengthens Corza's ophthalmic portfolio, broadens its market reach, and enhances its infrastructure. It also represents Corza's first add-on acquisition following its 2021 merger with Surgical Specialties and TachoSil.

Regulations are crucial in shaping the ophthalmic sutures industry by ensuring product safety, efficacy, and quality. Strict standards set by regulatory bodies like the U.S. FDA, European Medicines Agency (EMA), and other national health authorities govern the approval, manufacturing, and marketing of ophthalmic sutures. These regulations require extensive clinical testing and compliance with quality control procedures to minimize infection risks and ensure patient safety. Additionally, evolving regulations related to new materials, such as drug-eluting sutures, drive innovation while maintaining high safety standards. Regulatory compliance is vital for market entry and sustained growth in the competitive ophthalmic sutures industry.

In the ophthalmic sutures industry, product substitutes are emerging as alternatives to traditional sutures, driven by advancements in surgical techniques and materials. For example, tissue adhesives and glue are increasingly used in certain eye surgeries as a substitute for sutures, offering benefits like reduced procedure time and a lower risk of infection. Additionally, laser-assisted surgeries are gaining popularity for procedures like cataract removal, where sutures may not be necessary. While sutures remain the gold standard for many ophthalmic surgeries, these alternatives are slowly gaining traction, particularly in minimally invasive and low-risk procedures, impacting the overall market dynamics.

Regional expansion in the ophthalmic sutures industry is being driven by increasing healthcare access, rising awareness of eye health, and growing demand for advanced eye surgeries. Emerging markets in Asia-Pacific, Latin America, and the Middle East are seeing rapid growth due to improving healthcare infrastructure, a rising aging population, and a higher prevalence of eye diseases. Companies are expanding their presence in these regions through strategic partnerships, acquisitions, and distribution networks.

Type Insights

The synthetic sutures segment of the ophthalmic sutures captured the largest market share of over 66.7% in 2024. The dominance of this segment is primarily due to the widespread use of synthetic sutures, driven by their ability to degrade through hydrolysis, resulting in reduced inflammation at the wound site. Made from materials like polyester, polypropylene, and polyamide, synthetic sutures offer enhanced durability, further contributing to their popularity in ophthalmic surgeries.

The natural sutures segment is anticipated to experience significant growth during the forecast period. This segment includes various types, such as collagen, surgical cotton, surgical silk, and surgical steel. The strong growth is mainly driven by the benefits of natural sutures, including excellent knot security, ease of handling, and high initial tensile strength. However, natural sutures may lead to tissue reactions and a higher risk of surgical site infections, which could potentially limit the segment's growth.

Application Insights

The cataract surgery segment dominated the market with a market share of 39.5% in 2024. This growth is primarily driven by the rising incidence of visual impairment due to cataracts. Over the past decade, cataract surgery techniques and technologies have advanced significantly, making it the most commonly performed ophthalmic surgery in many developed nations. Additionally, both government and private initiatives are expected to boost segment growth further. For example, the HelpMeSee initiative aims to eliminate cataract-related blindness in regions across Africa, Asia, and South America. The U.S.-based nonprofit has partnered with over 300 surgical centers in less than ten years by training surgical specialists and developing advanced technologies.

The corneal transplantation surgery segment is projected to experience the fastest growth during the forecast period, driven by the rising incidence of corneal thinning, which leads to scarring and irregular corneal shape. The primary indications for corneal transplants include endothelial corneal dystrophy and keratoconus. Corneal transplantation is a highly effective treatment for various severe corneal conditions, with the goal of restoring transparency. Advances in technology and improvements in ophthalmic surgical techniques have contributed to the increasing number of corneal transplants performed.

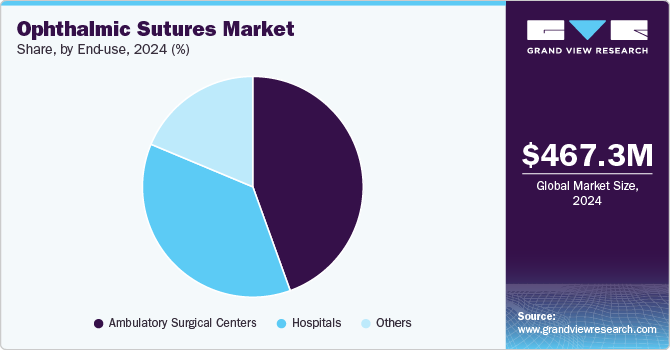

End-use Insights

The ambulatory surgical centers segment accounted for the largest share of 44.5% in 2024 owing to the increasing number of surgeries being performed in these centers. Most ophthalmic surgeries are performed on an outpatient basis and do not require a hospital stay. Ophthalmologists in the U.S. perform more than 90% of such surgeries in ambulatory surgery centers, annually. Every year, approximately 3.8 million outpatient cataract surgeries are performed in the U.S.

The hospitals segment is anticipated to experience significant growth, projected at a compound annual growth rate (CAGR) over the forecast period in the ophthalmic sutures market. This growth is driven by the increasing number of eye surgeries performed in hospitals, particularly with the rise in conditions such as cataracts, glaucoma, and diabetic retinopathy. Hospitals are the primary settings for complex ophthalmic procedures, with specialized surgical teams and advanced equipment available. Furthermore, the growing demand for minimally invasive surgeries and improved patient outcomes in hospital settings is expected to further propel the adoption of ophthalmic sutures in this segment.

Absorption Capacity Insights

The non-absorbable sutures segment captured the majority of market share at 59.4% in the ophthalmic sutures market in 2024. Non-absorbable sutures are commonly made from synthetic materials like polypropylene, nylon, and polyester, or natural materials such as silk and linen. These sutures provide long-lasting mechanical strength and are less likely to become infected due to their smooth surfaces that resist adhesion. They can be permanently implanted and, if necessary, removed after a few days to minimize the risk of post-operative infections. However, a notable drawback is that they can loosen at the knots due to a lack of grip, which may impact patient preference.

The absorbable ophthalmic sutures segment is projected to grow at a fastest CAGR during the forecast period. This robust growth is primarily driven by the sutures' ability to provide short-term wound support until healing progresses. These sutures degrade naturally and retain tensile strength for up to 60 days. Additionally, they are cost-effective, as they dissolve within the body over time, eliminating the need for removal surgery, which further enhances their appeal in ophthalmic procedures.

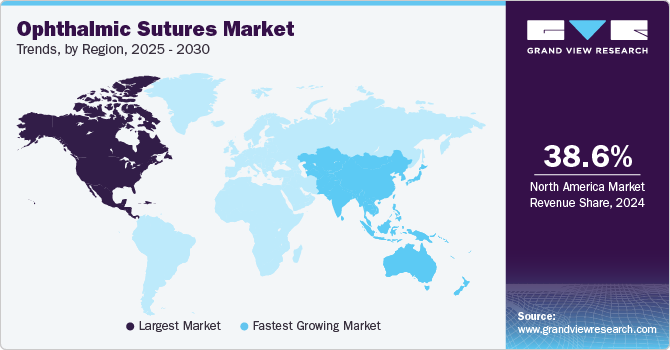

Regional Insights

The North America ophthalmic sutures market held the largest share of the global ophthalmic sutures market at 38.6% in 2024 driven by factors such as the high prevalence of eye diseases, including cataracts, glaucoma, and diabetic retinopathy. The region benefits from advanced healthcare infrastructure, a well-established healthcare system, and a high demand for surgical procedures. Furthermore, the rising aging population and increasing number of ophthalmic surgeries contribute significantly to market growth. Technological advancements in ophthalmic sutures, such as drug-eluting and biodegradable sutures, along with strong government healthcare support, further bolster the demand for ophthalmic sutures in North America, making it a key market globally.

U.S. Ophthalmic Sutures Market Trends

The U.S. ophthalmic sutures market accounted for the largest share of the North American market, highlighting its major influence on the region's overall landscape. According to the CDC data released in May 2024, around 12 million Americans aged 40 and older experience some form of vision impairment, including 1 million who are blind. Additionally, approximately 6.8% of children under 18 in the U.S. have a diagnosed eye or vision condition, with nearly 3% suffering from blindness or significant vision impairment, which persists even with corrective lenses.

Europe Ophthalmic Sutures Market Trends

The Europe ophthalmic sutures market is witnessing notable trends driven by advancements in surgical techniques and a growing aging population. The increasing prevalence of eye diseases, such as cataracts, glaucoma, and diabetic retinopathy, drives demand for ophthalmic surgeries. The shift toward minimally invasive procedures and adopting innovative sutures, such as drug-eluting and biodegradable types, further boosts market growth. Additionally, European healthcare systems' investment in advanced medical technologies and surgical equipment supports the uptake of high-quality ophthalmic sutures. Regulatory support for medical innovations and raising awareness of eye health are key factors driving European market expansion.

The UK ophthalmic sutures market is influenced by a demographic shift toward an aging population, technological innovations in diagnostics and treatments, increasing awareness of eye health, and regulatory changes ensuring quality standards & access to vision care services.

Ophthalmic sutures market in France is experiencing steady growth, driven by the country's significant investment in healthcare modernization. In 2024, France allocated approximately USD 2.7 billion to enhance surgical facilities and expand access to advanced medical technologies. This investment supports the adoption of innovative ophthalmic sutures, improving surgical outcomes and ensuring better patient safety. With an increasing demand for eye surgeries, especially cataract and glaucoma procedures, France’s healthcare improvements are fostering a favourable environment for the growth of the ophthalmic sutures market, positioning the country as a key player in Europe’s eye care sector.

The Germany ophthalmic sutures market is is expected to expand in the foreseeable future as people become more aware of potential issues linked to eye care, like infections or discomfort. This growing awareness has resulted in a stronger focus on ensuring the quality and dependability of vision correction products.

Asia Pacific Ophthalmic Sutures Market Trends

The ophthalmic sutures market in the Asia Pacific region is expected to grow fastest, driven by the rising prevalence of eye diseases like cataracts, glaucoma, and refractive errors, along with an aging population and workforce. Technological innovations and government efforts to enhance healthcare infrastructure also drive market expansion. Countries like India and China, with large populations and increasing cataract surgery rates, are critical contributors to this growth. However, challenges such as limited awareness and accessibility in rural areas may slow the market's overall expansion.

The China ophthalmic sutures market faced a setback in February 2024 when Covidien recalled 188 boxes of nonabsorbable nylon sutures due to a sterilization dosage exceeding the approved range. This recall was driven by concerns over compromised tensile strength, which could impact the sutures' effectiveness in ophthalmic procedures. However, the market remains resilient, bolstered by China's expanding healthcare infrastructure and rising demand for eye surgeries. With China's healthcare spending expected to exceed USD 1.2 trillion by 2025, the ophthalmic sutures market continues to grow, underscoring the critical need for rigorous quality control to maintain product reliability.

Ophthalmic sutures market in Japan is primarily driven by the high volume of cataract surgeries, which commonly require ophthalmic sutures. Japan has one of the highest rates of cataract surgeries globally, contributing significantly to the demand for these products. Additionally, Japan invests heavily in healthcare, with the government allocating substantial funds toward advanced eye care services. In 2023, Japan’s healthcare expenditure reached over USD 400 billion, further supporting the growth of the ophthalmic sutures market. These factors combined make Japan a key market for ophthalmic sutures, fostering continued growth in the coming years.

Latin America Ophthalmic Sutures Market Trends

The Latin America ophthalmic sutures market is experiencing steady growth. The market is expected to grow at a CAGR of 5.9% from 2024 to 2030. Improving healthcare infrastructure, along with greater access to advanced surgical technologies, is fueling the demand for ophthalmic sutures in the region. Additionally, rising awareness of eye care and government initiatives to reduce vision impairment are contributing to market expansion. The growing number of ophthalmic surgeries and investments in medical devices further support the market’s positive trajectory.

Middle East & Africa Ophthalmic Sutures Market Trends

The Middle East and Africa ophthalmic sutures market is anticipated to witness robust growth over the forecast period, is driven by the increasing prevalence of eye diseases, especially in the aging population, and the government's focus on healthcare improvements. Moreover, the rise in disposable income and lifestyle changes, including increased screen time, contribute to heightened demand for vision care services and products.

Key Ophthalmic Sutures Company Insights

The competitive scenario in the ophthalmic sutures market is highly competitive, with key players such as Medtronic, Alcon Inc., and others. The major companies are undertaking various organic and inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Ophthalmic Sutures Companies:

The following are the leading companies in the ophthalmic sutures market. These companies collectively hold the largest market share and dictate industry trends.

- Accutome Inc.

- Asset Medical Sarl

- Alcon Inc.

- Aurolab

- B Braun Melsungen AG

- DemeTech Corporation

- FCI Ophthalmic Inc.

- Medtronic Plc

- Rumex International Co.

- Surgical Specialties Corp

- Teleflex Incorporated

- Unilever.

Recent Developments

-

In October 2024, Corza Medical launched its Onatec ophthalmic microsurgical sutures at the American Academy of Ophthalmology conference in Chicago. This new product line highlights Corza's commitment to innovation, offering high-quality, tailored solutions to meet the evolving needs of ophthalmic surgery and strengthening its position in the global eye care market.

-

In November 2022, Alcon completed the acquisition of Aerie Pharmaceuticals, Inc., to strengthen its position in the ophthalmic pharmaceutical market. The acquisition further aims to expand Alcon’s commercial products portfolio.

Ophthalmic Sutures Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 498.6 million

Revenue forecast in 2030

USD 706.5 million

Growth rate

CAGR of 7.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, absorption capacity, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Accutome, Inc.; Asset Medical Sarl; Alcon Inc.; Aurolab; B Braun Melsungen AG; DemeTech Corporation; FCI Ophthalmic Inc.; Medtronic Plc; Rumex International Co.; Surgical Specialties Corp; Teleflex Incorporated; Unigene

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ophthalmic Sutures Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ophthalmic sutures market based on type, absorption capacity, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural

-

Synthetic

-

-

Absorption Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Absorbable sutures

-

Non-absorbable sutures

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Corneal transplantation surgery

-

Cataract surgery

-

Vitrectomy surgery

-

Iridectomy surgery

-

Oculoplastic surgery

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory surgical centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ophthalmic sutures market size was estimated at USD 467.3 million in 2024 and is expected to reach USD 498.6 million in 2025.

b. The global ophthalmic sutures market is expected to grow at a compound annual growth rate of 7.2% from 2025 to 2030 to reach USD 706.5 million by 2030.

b. North America dominated the ophthalmic sutures market with a share of 38.6% in 2024. This is attributable to increasing number of ophthalmic surgical procedures being performed and advanced healthcare systems and infrastructure in the region.

b. Some key players operating in the ophthalmic sutures market include Accutome, Inc.; Assut Medical Sarl; Alcon Inc.; Aurolab; B Braun Melsungen AG; DemeTech Corporation; FCI Ophthalmic Inc.; Medtronic Plc; Rumex International Co.; Surgical Specialties Corp; Teleflex Incorporated; and Unilene.

b. Key factors that are driving the market growth include increasing incidence of various eye diseases and vision loss.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.