- Home

- »

- Medical Devices

- »

-

Osmometers Market Size, Share & Trends Report, 2025-2030GVR Report cover

![Osmometers Market Size, Share & Trends Report]()

Osmometers Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Freezing Point Osmometers, Vapour Pressure Osmometers, Membrane Osmometers), By Sampling Capacity, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-980-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

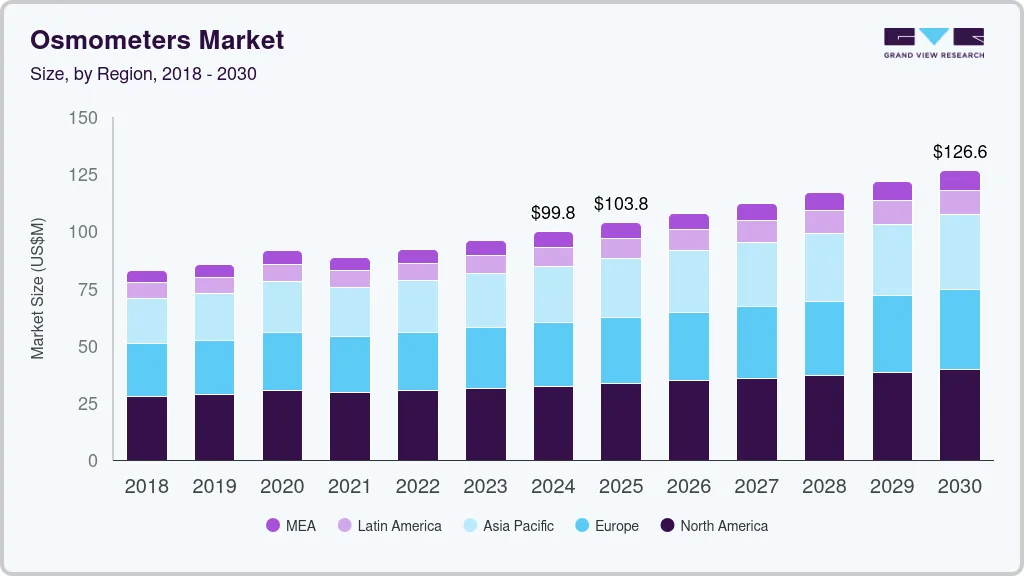

The global osmometers market size was valued at USD 99.8 million in 2024 and is expected to expand at a compound annual growth rate (CAGR) of 4.0% from 2025 to 2030. The growth of osmometers market is attributed to technological advancements, impact of COVID-19, and rise in the prevalence of electrolyte disorders such as Hyperchloremia, hyperkalemia, and hypernatremia. For instance , in January 2022, hyponatremia is the most prevalent electrolyte disorder, with a prevalence of 20.0% to 35.0% among hospitalized patients, according to the National Library of Medicine (NLM). Critical patients in the intensive care unit (ICU) and postoperative patients both have a high prevalence of hyponatremia. Osmometer usage has been greatly expedited as a result of such factors, propelling market expansion.

Osmometers are used in an extremely broad range of application areas, primarily for clinical treatment and studies. They are used to determine the solute content in a range of biological samples, including human tears and blood plasma. These measurements can offer a wealth of information that can help with prompt diagnosis of many illnesses at substantially lower medical expense.

However, it is becoming more common to utilize osmometers for quality assurance and control of different consumer products such as isotonic drinks which have been tested using freezing point osmometers to see if they adhere to legal requirements, sports beverages and non-alcoholic beer are other examples of this. Moreover, osmolality testing is actually a crucial step in determining the pathophysiology of many illnesses, including hyponatraemia, small-molecule poisoning, and even viral infections such as COVID -19 which is anticipated to boost the market growth.

Another factor has a positive impact on market growth is the outbreak of COVID-19, starting in the year 2020. As a result, the use of osmometers, to aid in patient care, has been greatly accelerated. In order to improve therapy and shorten hospital stays during the pandemic, proper medical management of COVID-19 patients is essential. Therefore, osmometers are used as a crucial test in the identification of electrolyte abnormalities, and for monitoring and managing COVID patients.

Long utilized in the treatment of electrolyte problems such as hyponatremia and hyperglycemia, which are defined by low blood salt and excessive blood sugar, respectively, osmolality is a quick, affordable, and reliable assessment. Numerous case studies of the patients with hyponatremia and hyperglycemia brought on by COVID-19 have been described by clinical researchers from the U.S. to the UK and Qatar.Moreover, according to a March 2020 report from "New Scientific Resource", the electrolyte disease hyponatremia is associated with COVID-19, which is anticipated to spur the market growth.

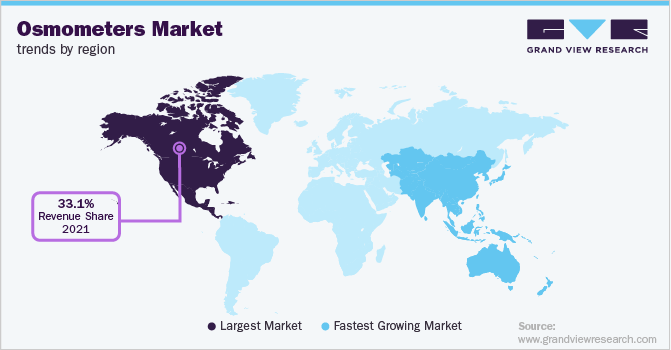

The U.S dominated the global market with the highest revenue share of 80.71% in 2021. This is due to the rise in prevalence of electrolyte disorders, technological advancements, and increasing demand for the advance testing methods. The growing demand for automation in clinical laboratory settings and a growth in R&D spending by pharmaceutical and biotech firms in the nation are likely to result in the realignment of the manufacturers strategies.

Global increase in the incidence of chronic diseases such as cancer, diabetes, and other autoimmune diseases are expected to drive the market growth. Moreover, factors such as adoption of sedentary & unhealthy lifestyles, smoking, antimicrobial resistance, and alcohol consumption are some of the other major factors, contributing to the rise in prevalence of non-communicable diseases. For instance, according to WHO in April 2021, Non-communicable diseases (NCDs) account for 71.0% of all fatalities globally, claiming the lives of 41 million people annually.

Type Insights

The freezing point (FP) osmometers segment dominated the market with a share of more than 72.58%, in 2021. Due to their effectiveness, freezing point osmometers are the most often used osmometers in a range of medical settings, including clinical chemistry, quality control labs, drug manufacturing, and pharmaceutical production. Additionally, freezing point osmometers have many benefits over other varieties, including quick and affordable measurements, industry-preferred FP technique performance, tiny sample size (ul), and suitability for diluted biological and aqueous solutions. Due to these factors, the segment is anticipated to expand during the forecast period.

A freezing point osmometer is often used in clinical laboratories for routine examination of the serum and urine osmolality values. Generally, the osmolality test, is frequently used to assist in measuring the body's water balance, offers a total concentration of the solutes present. The test also aids in the diagnosis of a wide range of therapeutic applications, such as the evaluation of renal function, examination of hyponatremia, toxic alcohol screening, and supervision of mannitol and other osmotically active pharmacological regimens. Additionally, it continues to be a source of profit for the testing laboratories because its operating costs per test are still far lower than the Medicare reimbursement rate.

The key market players are focusing on the launch of innovative products, technological advancements, and growth strategies. Which is likely to increase the demand of freezing point osmometers products in the near future. For instance, in June2022, the newest model in Advanced Instruments clinical series of freezing point osmometers, the Osmo MAX PRO automated osmometer, was revealed at the American Association for Clinical Chemistry trade show in Chicago. Automated barcode scanning prevents sample mix-ups and reduces transcription errors, direct sampling from primary tubes eliminates the need for sample cups, and other benefits of the device's improved productivity and streamlined osmolality testing procedure.

The membrane osmometers segment is expected to expand at the highest CAGR during the forecast period. Membrane osmometers offer good colioidat solution performance, no sample concentration restrictions, the ability to calculate the molecular weights of macromolecules, and theoretically limitless direct measurement of the osmotic pressure and solution osmolatity. As an alternative to freezing point and vapour pressure osmometers, rapid membrane osmometers are expected to spur additional market growth.

Althoughvapor pressure osmometers and freezing point osmometers are capable of quick and affordable observations, their utility is constrained by the fact that they are indirect techniques that rely on thermodynamic hypotheses. While solution osmolality and osmotic pressure can both be directly measured using membrane osmometry (MO), the traditional method is frequently labor-intensive and challenging to use. As a result, segment growth is anticipated.

Sampling Capacity Insights

The single-sample segment dominated the market with a share of more than over 67.79%, in 2021. Samples those are more challenging to freeze, such as cryo-preservatives used in RNA therapeutics, high concentration protein drug formulations, gene and cell therapy applications, buffer concentrates for in-line buffer dilutions, and others. These are becoming more complex and concentrated in bioproduction that are now easily measured with the advance technology, such as OsmoTECH XT single-sample osmometers.

Which offers the widest range of osmolality measurement up to 4,000 mOsm/kg H2O, viscous sample, highly concentrated types that previously presented a hurdle to freezing point depression technology are now easily assessed.For instance, in September2020, the newest instrument in Advanced Instruments' lineup of biotech tools is the Osmo TECH XT single-sample micro-osmometer. Due to such advanced technology, the segment is anticipated to expand soon.

Moreover, in July 2018, Advanced Instruments has introduced the OsmoTECH single-sample micro-osmometer. OsmoTECH is simple to use, trustworthy, and easily incorporated into production workflows. The development of manufacturing processes, the creation of biological medicines, and the fabrication of injectable solutions, all use osmolality as a critical quality requirement. Due to these developments, the segment is anticipated to expand.

The multi-sample segment is expected to expand at the highest CAGR during the forecast period. Historically, osmolality testing is a test that many laboratories do infrequently. Due to this, the majority of laboratories have decided to employ single sample osmometers for standard testing. Although these systems have adequate testing capacity and performance, they take a lot of manual sample handling and technician time to finish. One reportable osmolality test may take up to 6 minutes of operator time to complete. The labor-intensive manual methods are mostly to blame for the increased likelihood of reporting inaccuracies.

However, due to the recent advancements, such as the development of new multi-sample osmometers for the laboratories doing osmolality testing, it is now possible to automate many parts of osmolality testing while offering a variety of automation benefits over single sample units. As opposed to single-sample osmometers, multi-sample osmometers provide a number of benefits, including integrated 2D barcode scanners, touch screen operation, and intuitive software control. Due to these factors, the multi-sample market is anticipated to expand in the next years.

Furthermore, the major market players are focusing on R&D activities to bring reliable and new products into the market, and they are also focusing on product launches. For instance, in August 2019, the newest instrument in Advanced Equipment' collection of biotech instruments, the Osmo TECH PRO multi-sample micro-osmometer, was unveiled. The Osmo TECH PRO offers the most possibilities for the data management and may be set up in many ways to evolve as the stages of R&D, preclinical testing, clinical testing, and GMP compliance advance.

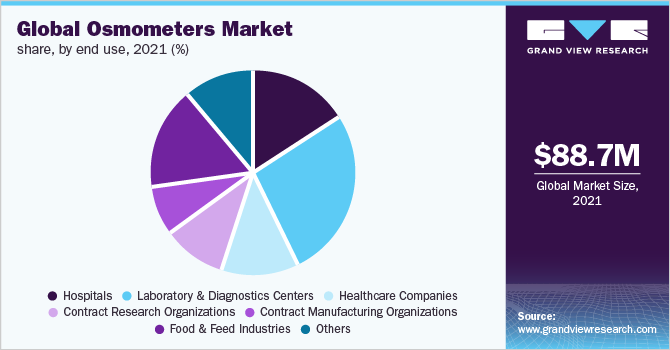

End-use Insights

The laboratory & diagnostics centers led the market and accounted for more than 26.49% share of the global revenue in 2021.This is due to the increased emphasis on the products that provide analytical performance and usability in these contexts. The expansion of the market will be fueled by an increase in the number of innovations and new product releases.

For instance, in May 2019, by using the new Advanced Instruments, LLC web-based Advanced QC Peer Group service, laboratories can assess the quality control of their osmometer urine and serum in real-time and on a monthly basis. The Advanced QC Peer Group programme was developed with the assistance of Advanced Instruments' clients. It enables laboratories to swiftly address issues by providing instantaneous and monthly reports that measure internal and external performance in real-time, which is projected to fuel segment expansion.

The healthcare companies segment is anticipated to witness the fastest growth during the forecast period. Osmometersare the faster data-driven method for a various applications in the biotechnology industry, including cell line development, cell therapies, gene therapies, personal care, vaccines, and others. Biopharmaceutical labs use routine osmolality testing in their processes during manufacturing and development of the biologic drugs while also having better control over the yield, titer, purity, and quality of their product.

In order to provide a quality check and process control in the research and production of biologics, osmometers are becoming increasingly prevalent within healthcare organizations. In the upcoming years, these companies will place a greater emphasis on developing high-quality treatments and increasing their efforts to produce precise patient results. Furthermore, a number of businesses are consistently expanding their portfolio to fulfil the needs of service providers due to the high consumer expectations regarding the diagnosis accuracy, speed, and procedural affordability of the devices, utilized in healthcare organizations.

Regional Insights

North America dominated the market with the largest revenue share of more than 33.05% in 2021. A favorable reimbursement environment, the presence of prominent players, and considerable government investments in the development of cutting-edge medical devices are the factors contributing to the region's market growth. A higher number of possibilities are still available in North America, due to the region's high per-capita healthcare spending and rising need for the laboratory automation. For instance, the Centers for Medicare & Medicaid Services (CMS) predict that from 2018 to 2027, U.S. health spending would increase by 5.5% annually and will total USD 6.0 trillion.

Additionally, developed economies, high levels of disposable income, and the presence of skilled workers are some of the factors influencing the region's sizable market share. As a result, manufacturers are focusing on utilizing cutting-edge technology to not only create improved osmometers but also to upgrade and modernize existing machinery.

The Asia Pacific region is estimated to register the highest CAGR during the forecast period. The growing geriatric population, rising incidences of chronic disease, and augmented development of the advanced products are the factors expected to support the market growth. Furthermore, ongoing expansion of medical infrastructure, as well as increased government and private sector investments to promote the use of safer & more cost-effective healthcare solutions, are driving market growth.

According to National Health Commission, there were around 12,000 public hospitals and 21, 000 private hospitals in 2018, with approximately 12,600 for-profit and 20,500 non-profits institutions (excluding township and community hospitals). During the forecast period, this is expected to create considerable potential prospects for the osmometers market participants.

Key Companies & Market Share Insights

Osmometers makers are speeding up their efforts to get their products licenced so that mass production may begin. In addition, the market players are adopting various strategies, such as mergers & acquisitions, partnership, innovations and product launches such as introduction of osmometers products to strengthen their foothold in the market.For instance, in July 2021, ELITechGroup has announced the acquisition of GONOTEC, in the freezing point osmometer technology sector.

Through the strategic purchase of GONOTEC, the company's ability to service the global vitro diagnostics, biotech, food and beverage, environmental, pharmaceutical, chemical, and research industry segments would be increased, which is expected to enhance osmometers market growth in the near future. Some of the prominent players in the global osmometers market include:

-

Advanced Instruments

-

ELITechGroup Inc.

-

Precision Systems Inc.

-

ARKRAY Inc.

-

Nova Biomedical

-

ASTORI TECNICA

-

KNAUER Wissenschaftliche Gerete GmbH

-

ratiolab

-

Labtek Services Ltd.

Osmometers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 103.8 million

Revenue forecast in 2030

USD 126.6 million

Growth rate

CAGR of 4.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, sampling capacity, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, Mexico, Colombia, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Advanced Instruments, ELITech Group Inc., Precision Systems Inc., ARKRAY Inc., Nova Biomedical, ASTORI TECNICA, KNAUER Wissenschaftliche Gerete GmbH, Ratiolab, Labtek Services Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Osmometers Market Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Osmometers Market report based the type, sampling capacity, end use, and region:

-

Type Outlook (Revenue USD Million; 2018 - 2030)

-

Freezing Point Osmometers

-

Vapour Pressure Osmometers

-

Membrane Osmometers

-

-

Sampling Capacity Outlook (Revenue USD Million, 2018 - 2030)

-

Single-Sample

-

Multi-Sample

-

-

End-Use Outlook (Revenue USD Million, 2018 - 2030)

-

Hospitals

-

Laboratory & Diagnostics Centers

-

Healthcare Companies

-

Contract Research Organizations

-

Contract Manufacturing Organizations

-

Food and Feed Industries

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global osmometers market size was estimated at USD 88.70 million in 2021 and is expected to reach USD 92.24 million in 2022.

b. The global osmometers market is expected to grow at a compound annual growth rate of 4.03% from 2022 to 2030 to reach USD 126.58 million by 2030.

b. The freezing point osmometers segment dominated the market with a share of 72.58 in 2021, Due to their effectiveness, freezing point osmometers are the most often used osmometers in a range of medical settings, including clinical chemistry, quality control labs, drug manufacturing, and pharmaceutical production.

b. Some of the key players in the global osmometers market are Advanced Instruments, ELITechGroup Inc., Precision Systems Inc., ARKRAY Inc., Nova Biomedical, ASTORI TECNICA, KNAUER Wissenschaftliche Gerete GmbH, ratiolab, and Labtek Services Ltd

b. The growth of the osmometers market is attributed to technological advancements, the impact of COVID-19, rise in the prevalence of electrolyte disorders such as Hyperchloremia, hyperkalemia, and hypernatremia.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.