- Home

- »

- IT Services & Applications

- »

-

Outsourced Customer Care Services Market Report, 2030GVR Report cover

![Outsourced Customer Care Services Market Size, Share & Trends Report]()

Outsourced Customer Care Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Inbound Customer Services, Outbound Customer Services), By End-use (BFSI, Healthcare, Retail & E-commerce), By Region, And Segment Forecasts

- Report ID: 978-1-68038-082-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Outsourced Customer Care Services Market Summary

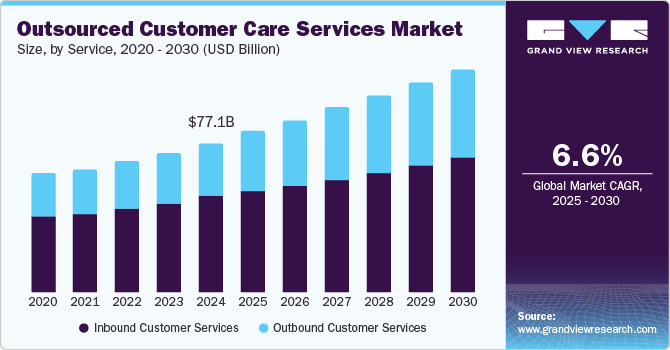

The global outsourced customer care services market size was estimated at USD 77.12 billion in 2024 and is projected to reach USD 113.18 billion by 2030, growing at a CAGR of 6.6% from 2025 to 2030. This growth is attributed to the pursuit of cost efficiency, which drives companies to outsource customer service functions.

Key Market Trends & Insights

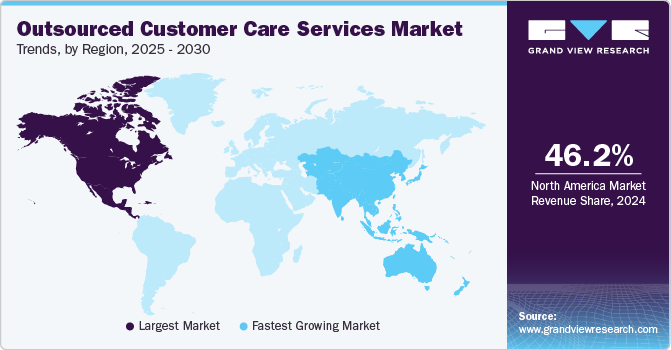

- The North America dominated the outsourced customer care services industry, holding the largest revenue share of 46.2% in 2024.

- The Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- Based on service, the inbound customer services segment dominated the global outsourced customer care services market with the largest revenue share of 62.6% in 2024.

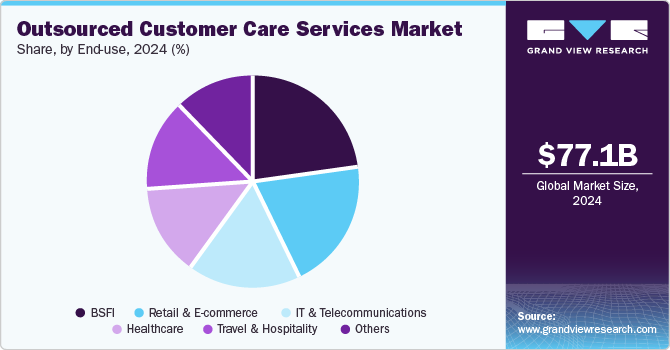

- Based on end-use, the BFSI accounted for the largest revenue share of the global outsourced customer care service market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 77.12 Billion

- 2030 Projected Market USD 113.18 Billion

- CAGR (2025-2030): 6.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Outsourcing minimizes expenses associated with hiring, training, and managing in-house customer service teams. By partnering with third-party service providers, companies achieve significant cost savings while maintaining service quality, particularly when using service centers in cost-effective regions such as Asia and Latin America. These regions offer competitive labor costs, enabling companies to direct resources toward core areas such as product innovation and marketing, ultimately boosting profitability and supporting market expansion.

Scalability is another significant advantage fueling the growth of the outsourced customer care services industry. Businesses often experience seasonal shifts in customer service demands, which can create challenges in workforce management. Outsourcing offers the flexibility needed to adjust service levels according to demand fluctuations. Third-party providers can rapidly scale up or down, enabling companies to meet heightened demand during peak periods, such as holiday seasons, without the expense and commitment of a permanent workforce. This ability to respond to demand surges while maintaining cost control is especially valuable in sectors such as e-commerce and retail, where demand volatility is common.

In addition, outsourcing provides access to advanced technologies and specialized expertise that can be costly and complex to develop internally. Many outsourcing providers invest heavily in state-of-the-art tools, such as AI-driven chatbots, data analytics, and customer relationship management (CRM) platforms, which enhance customer interaction quality and operational efficiency. By leveraging these tools, companies improve customer service and gain insights into customer behavior and preferences-insights that would otherwise require significant investments to acquire independently. This access to specialized technology and resources allows companies to offer a personalized, responsive customer experience, helping them stay competitive in an increasingly digital business landscape.

The outsourced customer service market's robust growth is driven by cost efficiency, operational flexibility, and access to advanced technology. By adopting outsourcing, companies can enhance service quality, adapt to fluctuating demand, and focus on core business areas, making it a strategic choice in today's fast-paced market environment.

Service Insights

The inbound customer services segment dominated the global outsourced customer care services market with the largest revenue share of 62.6% in 2024, driven by the growing importance of customer satisfaction and the need for quick, efficient support. Businesses are investing in inbound services to handle customer inquiries, issues, and support requests in real time, ensuring a positive experience. Increasingly complex products and services require skilled support teams to address technical queries and provide accurate information. In addition, advancements in technology, such as AI-driven call handling, enhance response speed and personalization, making inbound customer care a vital part of modern customer service strategies.

The outbound customer care service segment is expected to grow significantly during the forecast period. The increasing demand for proactive customer engagement, such as sales outreach, surveys, and follow-ups, is a key driver of this growth. Businesses are leveraging outbound services to generate leads, improve customer retention, and gather valuable feedback. The integration of advanced technologies, such as predictive dialing and automation, is enhancing the efficiency and reach of outbound services, enabling companies to connect with more customers in less time. The growing interest in AI and data analytics to optimize outreach strategies further fuels the expansion of this segment in the coming years.

End-use Insights

The BFSI accounted for the largest revenue share of the global outsourced customer care service market in 2024, driven by increasing digitization, cost optimization strategies, and the demand for scalable solutions. Outsourcing enables BFSI companies to leverage advanced technologies such as AI, blockchain, and data analytics to enhance customer experience, improve risk management, and streamline operations. In addition, cost efficiency remains a key driver, with companies outsourcing to regions such as Asia and Latin America to reduce operational expenses while maintaining service quality. The adoption of 24/7 customer support models ensures uninterrupted services for global financial clients, addressing critical needs such as fraud detection and real-time transaction support. Strict data protection regulations, including GDPR in Europe and HIPAA in the U.S., emphasize secure outsourcing practices, prompting BFSI companies to partner with compliant providers.

The healthcare sector is expected to demonstrate the highest growth in terms of CAGR over the forecast period. This growth is driven by the increasing demand for patient support services, telemedicine, insurance claims management, and healthcare IT solutions, all of which benefit from outsourced customer care services. For instance, in 2023, Teladoc Health, a leading telemedicine provider, outsourced customer care services to handle an increasing volume of patient inquiries and virtual consultation scheduling. By partnering with a third-party service provider, Teladoc ensured efficient management of patient queries and seamless integration of its telehealth platform, enhancing patient satisfaction and optimizing operational efficiency.

Regional Insights

North America dominated the outsourced customer care services industry, holding the largest revenue share of 46.2% in 2024. This can be attributed to the region’s strong technological infrastructure, continuous innovations in customer service solutions, and the increasing adoption of AI-driven support systems across various industries. Additionally, the presence of major outsourcing hubs and multinational companies in North America that have already adopted advanced customer care technologies has bolstered market growth.

U.S. Outsourced Customer Care Services Market Trends

The U.S. dominated the regional market, accounting for a substantial share due to high demand from sectors such as BFSI, retail, and telecommunications. The growing focus on enhancing customer experiences through personalized, multi-channel support services and a preference for cost-effective offshore solutions are key growth drivers for this market. Regulations such as The CCPA and HIPAA mandate strict data protection, driving secure outsourcing. USMCA enables cost-effective nearshoring while maintaining quality. FTC guidelines ensure service consistency, protect brands, and enhance satisfaction.

Europe Outsourced Customer Care Services Market Trends

Europe is one of the fastest-growing markets for outsourced customer care services in 2024, driven by the increasing digital transformation across sectors such as healthcare, BFSI, retail, and telecommunications. The demand for cost-effective, efficient customer support solutions and omnichannel service capabilities is accelerating growth. Countries such as Germany and the U.K. are leading this trend, with strong demand for multilingual support and specialized customer service solutions in retail and finance. The growing adoption of AI, chatbots, and automation is also contributing to the market's expansion in the region.

Asia Pacific Outsourced Customer Care Services Market Trends

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The rapid expansion of the e-commerce sector, along with the growing demand from industries such as BFSI, healthcare, and telecommunications, is driving the adoption of outsourced customer care solutions in the region. China, India, and South Korea are major contributors to this growth, with their large-scale outsourcing industries and a skilled workforce that supports cost-effective customer service solutions. The adoption of AI, chatbots, and automation in customer care services in these countries has significantly contributed to the region's dominance while rising consumer expectations for personalized and real-time support also fuel the market’s expansion.

India’s outsourcing market is projected to achieve the fastest CAGR during the forecast period, driven by its cost efficiency and a large pool of skilled, English-speaking professionals. The adoption of advanced technologies, including AI and CRM platforms, enhances service quality and operational efficiency. India’s time zone advantage facilitates 24/7 global support, making it a preferred destination for international businesses. Government initiatives, such as Digital India and IT Special Economic Zones (SEZs), provide tax incentives and robust infrastructure, further boosting the sector. The flexibility of India’s workforce enables companies to scale operations efficiently to meet fluctuating demand. Favorable policies, reduced costs, and cultural adaptability position India as a leading outsourcing destination, offering personalized, high-quality customer care solutions.

Key Outsourced Customer Care Services Company Insights

Some of the key companies in the outsourced customer care services industry include AEGIS Company; TD Synnex Corporation, Accenture; Expert Global; Amdocs. Major market participants have adopted strategies such as innovation, enhanced focus on research and development activities, expansions, portfolio enhancements, partnerships, and collaborations to address growing competition and rising technology adoption.

-

AEGIS Company is a global leader in business process outsourcing (BPO) and customer experience management. It offers a wide range of services, including contact center operations, customer support, and digital transformation solutions. The company specializes in industries such as BFSI, telecom, healthcare, and retail, providing innovative and customized outsourcing services. Aegis leverages advanced technologies such as automation and analytics to enhance operational efficiency and deliver superior customer experiences.

-

TD SYNNEX Corporation is a leading global distributor and solutions aggregator for the information technology (IT) ecosystem. It serves a broad range of customers, including resellers, retailers, service providers, and end-users. Its operations span hardware, software, cloud services, and advanced IT solutions such as cybersecurity, networking, and data analytics.

Key Outsourced Customer Care Services Companies:

The following are the leading companies in the outsourced customer care services market. These companies collectively hold the largest market share and dictate industry trends.

- AEGIS Company

- TD Synnex Corporation

- Accenture

- Expert Global

- Amdocs

- StarTek

- Concentrix Corporation

- Transcom

- Foundever

- Teleperformance SE

Recent Developments

-

In November 2024, TD SYNNEX announced new capabilities for its StreamOne cloud platform. It is expected to streamline operations for outsourced customer care service providers by integrating headless commerce and Professional Services Automation (PSA) connectors. Real-time reporting on infrastructure usage will improve billing and customer satisfaction. These innovations empower partners to enhance service delivery and meet the growing demand in the customer care market.

-

In August 2024, S&P Global and Accenture formed a strategic partnership. This collaboration will enhance the outsourced customer care services market by equipping 35,000 employees with generative AI skills to improve service delivery. The partnership will also provide advanced AI development and benchmarking tools, enabling financial institutions to manage customer inquiries more efficiently. This initiative will empower outsourced customer care providers to leverage AI technologies, enhancing their service offerings and responsiveness.

-

In July 2023, Amdocs announced the acquisition of TEOCO's service assurance business. This acquisition enhanced Amdocs’s next-generation OSS offerings by providing service, performance, and fault management capabilities.

Outsourced Customer Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 82.37 billion

Revenue forecast in 2030

USD 113.18 billion

Growth rate

CAGR of 6.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

AEGIS Company; TD Synnex Corporation; Accenture; Expert Global; Amdocs; StarTek; Concentrix Corporation; Transcom; Foundever; Teleperformance SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Outsourced Customer Care Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the outsourced customer services market report based on service, end-use, and region.

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Inbound Customer Services

-

Outbound Customer Services

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Healthcare

-

Retail and E-commerce

-

IT and Telecommunications

-

Travel and Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.