- Home

- »

- Advanced Interior Materials

- »

-

Oxygen-free Copper Market Size And Share Report, 2030GVR Report cover

![Oxygen-free Copper Market Size, Share & Trends Report]()

Oxygen-free Copper Market (2024 - 2030) Size, Share & Trends Analysis Report By Grade (Cu-OF, Cu-OFE), By Product (Wires, Strips), By Application (Electrical & Electronics, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-228-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Oxygen-free Copper Market Size & Trends

The global oxygen-free copper market size was estimated at USD 21.54 billion in 2023 and it is projected to grow at a CAGR of 5.04% from 2024 to 2030. The market growth is expected to be driven by the increase of automotive and electrical & electronics industries. It is widely consumed in manufacturing of superconductors, semiconductors, and high-vacuum systems.

Oxygen-free copper is a highly conductive copper alloy that has been modified to contain minimal levels of oxygen, usually less than 0.001%. The demand for semiconductor applications is driving market growth. Furthermore, growing emphasis on application of high-quality materials in industries such as defense, aerospace, transportation, and electronics in developing economies like India, China, and Brazil is boosting oxygen-free copper industry.

Growing innovations in electronics technology are fueling steady demand for electrical and electronics products in the U.S., which is expected to have a positive impact on global market. The growth is attributed to a growing focus on renewable energy for energy generation, storage, and transmission. Solar Energy Industries Association reports that the U.S. has installed over 162.8 GW of solar power, which is sufficient to power 29.6 million homes. Solar market in U.S. has grown at an average rate of 24.0% per year over the last decade.

Oxygen-free copper is experiencing an increase in consumption due to its wide range of applications, including printed circuit boards, microwaves, vacuum seals, vacuum interrupters, vacuum tubes, vacuum capacitors, and waveguides for TV transmitters, radio, and magnetrons. The demand for oxygen-free copper is expected to increase in the coming years due to rapid growth of electronic devices such as mobile phones, smart devices, TV sets, and tablets worldwide. Due to growing demand for renewable energy, usage of oxygen-free copper has increased in various applications. Key industry players have adopted strategic initiatives to stay ahead in a competitive market.

Market Concentration & Characteristics

Market growth stage is medium, and pace of market growth is accelerating. The demand for oxygen-free copper is rising due to growing adoption of renewable energy in electrical and electronic applications. The industry is currently seeing a decently low level of merger and acquisition activities from the major players due to high level of market concentration. However, there is a growing trend towards partnerships and collaborations among emerging companies. These partnerships involve a shared commitment to work towards common objectives, utilizing each other's strengths and expertise for mutual benefit. This is due to various factors, including desire to maintain market share and the need in a highly competitive and growing market.

The market for oxygen-free copper is affected by various regulations and standards related to its production. This type of copper is widely used in electrical, electronic, and automotive applications and has no direct substitutes, resulting in a low threat of substitution. Due to its limited applications, such as electrical appliances, circuit boards, microwaves, and solar and alternative energy, end-user concentration in the industry is high.

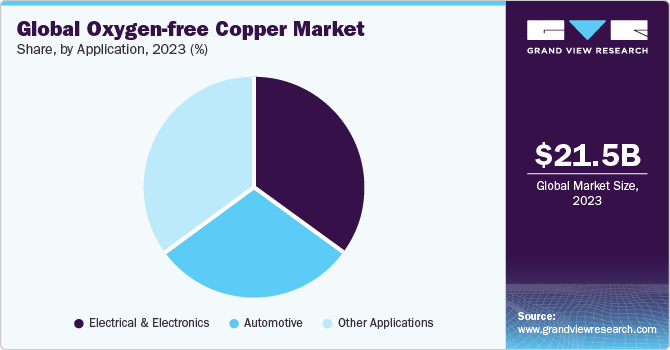

Application Insights

Based on application, the electrical & electronics segment led the market with the largest revenue share of over 34.70% in 2023. The increased adoption of automation, electronic devices, and smart gadgets has led to a rise in production of PCBs. This has resulted in a growing demand for oxygen-free copper, which is expected to continue in the forecast period.

It is used in manufacturing of copper anodes, busbars, coaxial cables, transmitter components, medical devices, tubes, waveguides, hollow conductors, and glass-to-metal seals, among others. Oxygen-free copper is preferred in certain applications due to its superior thermal conductivity and strength. OFC copper wires do not heat up as quickly as other metals such as aluminium due to their high thermal conductivity.

The growth in electrical & electronics market has resulted in a flurry of activity amongst oxygen-free copper producers, who have been increasing their production capacities and setting up new plants. For instance, in February 2024, Incus GmbH, an Austria-based company, announced expansion of its material portfolio with addition of 99.9% copper material, which is an oxygen-free material to production stage. It utilizes lithography-based metal manufacturing (LMM) to additively manufacture copper pieces with exceptional surface aesthetics and high geometrical complexity.

Grade Insights

Based on grade, the Cu-OFE segment led the market with a revenue share of about 57.0% in 2023, and it is anticipated to grow at a significant CAGR during the forecast period, owing to excellent formability and can be welded and brazed, making it superior to other grades. It contains 99.99% of copper and 0.0005% of oxygen content. It is expected that technology upgrades will drive the market growth during the forecast period, with advantages of hard-pitch electrolytic copper (ETP) and phosphorus-deoxidized copper being offered.

It finds extensive applications in printed circuit board industry owing to its flexible and conductive applications. In addition, it is a preferred choice of raw material in production of high-frequency printed circuit boards due to its high quality.

Cu-OF grade of oxygen-free copper is highly suitable for application in very critical electrical, electronic and communication components. It contains 99.95% of copper and 0.001% of oxygen content and offers exceptional purity of copper. These materials are commonly used in circuit boards due to their ability to bond easily with an insulating layer and form a circuit pattern after etching. They can also be printed with a protective layer for added durability.

Product Insights

Based on product, the wires segment led the market with the largest revenue share of over 30.0% in 2023. Oxygen-free copper wires are commonly used in electrical and electronic industries. Manufacturers around the world use this type of copper to reduce the presence of voids within wire which can disrupt transmission process. It has several excellent characteristics including high conductivity, dimensional accuracy, ability to bend without cracking, and a long service life.

The strip segment is anticipated to grow at a significant CAGR over the forecast period. Copper strips are widely used in electrical equipment sector for manufacturing switchgear, power distribution systems, and transformers due to their high electrical conductivity and malleability, making them a cost-effective option compared to other substitutes.

Regional Insights

The oxygen-free copper market in North America is expected to witness a significant CAGR during the forecast period. North America is one of the key markets for automotive metals worldwide. U.S. dominates the demand in the region on account of early industrialization and adoption of new trends. Oxygen-free copper is highly used in the electric vehicles, thus the rise in electric vehicles demand in the region will boost the overall market growth.

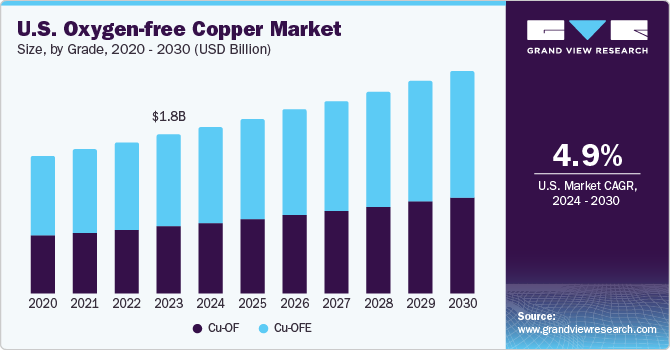

U.S. Oxygen-free Copper Market Trends

The oxygen-free copper market in U.S. is anticipated to witness a lucrative CAGR over the forecast period. Automotive players have been expanding their operations and acquiring companies. Several developments in automotive industry in the country support market growth in the U.S. For instance, in May 2023, Hyundai Motor Corp announced establishment of an automotive plant valued at USD 5.5 billion to assemble electric vehicles and batteries in Ellabell, Georgia in the U.S. The plant is expected to be commissioned by 2025. This if further anticipated to increase demand for oxygen-free copper applications.

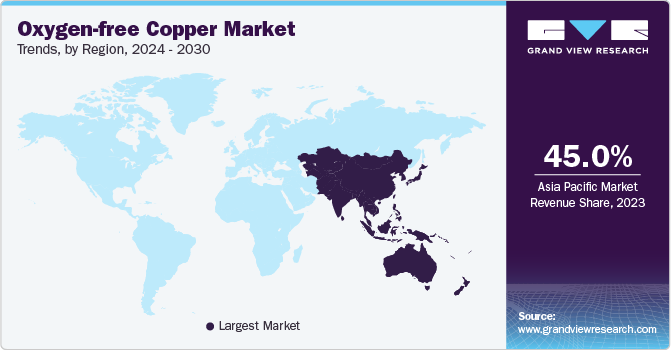

Asia Pacific Oxygen-free Copper Market Trends

Asia Pacific dominated the market with the revenue share of more than 45.0% in 2023. Oxygen-free copper is a type of copper that has several important properties, including high strength, corrosion resistance, chemical and thermal stability, and excellent electrical conductivity. The use of oxygen-free copper in various industries such as electronics, automobiles, aerospace, medical, and others is a major factor in market growth of Asia Pacific.

The manufacturing sector in the region is currently experiencing rapid development, which can be attributed to increasing demand from various applications, availability of cheap labour, government initiatives, and foreign direct investment inflow. The market is expected to grow at a significant CAGR over the forecast period, due to investments in electric vehicle production, electronics sector, and energy projects. These investments will boost the consumption of oxygen-free copper in the region.

China oxygen-free copper market is largest copper producer and consumer in world. Increasing automotive production in China is expected to drive market growth over the forecast period. According to Ministry of Industry and Information Technology of China, it is the largest vehicle market in the world in terms of manufacturing output and sales. Domestic production of vehicles is projected to reach 35.0 million units by 2025. Growth in EV production in China is expected to drive consumption of copper-based products, including oxygen-free copper.

Europe Oxygen-free Copper Market Trends

Rising investment in the field of automotive production in Central European economies, particularly Bulgaria, and Poland, is expected to propel the market development over the forecast period.The presence of numerous sports car manufacturers in Europe is likely to augment the utilization of oxygen-free copper in cars over the coming years.

Germany oxygen-free copper market held prominent share in Europe in 2023. Germany is at the forefront of circuit board manufacturing. Expansion plans of key PCB producers have boosted market growth. For instance, in September 2023, Unimicron Germany GmbH announced an investment of EUR 12.0 million (~USD 12.9 million) to expand its production facilities to manufacture high-tech PCBs.

Central & South America Oxygen-free Copper Market Trends

The market growth in Central & South America is influenced by rising investments by automobile manufacturers and circuit board producers in the region. To achieve carbon emission goals, governments across the region have been directing their focus toward the adoption of EVs. For instance, in April 2022, the government of Chile announced its target of achieving 100% electricity-driven new vehicles in the country by 2035. Such measures undertaken by governments of different countries in the region are anticipated to positively impact the market growth.

Brazil oxygen-free copper market is anticipated to register the significant CAGR during the forecast period. Brazil's demand for copper is on the rise, primarily due to the growth of renewable energy industry. This industry is also benefiting oxygen-free copper industry. As of 2023, National Electric Energy Agency (Aneel) reported that almost 93.0% of country's electricity was generated from clean energy sources. To support economic growth, in August 2023, Government of Brazil announced its plans to invest USD 200.0 billion in infrastructure, energy, and transportation projects from 2024 to 2028 as a part of an initiative to enhance economic growth and employment opportunities and improve demand for the market.

Middle East & Africa Oxygen-free Copper Market Trends

Countries in the region are developing at a fast pace owing to rapid industrialization and urbanization. The MEA region has also seen a significant rise in the solar market in recent years, with several countries making great strides in deploying solar energy. The U.A.E. is a front-runner in solar energy investments, with the Mohammed bin Rashid Al Maktoum Solar Park being one of the world's largest solar parks with a capacity of 5,000 MW.

Saudi Arabia oxygen-free copper market holds prominence in Middle East. Countries in Middle East & Africa are developing at a fast pace owing to rapid industrialization and urbanization. Saudi Arabia has set ambitious renewable energy targets and is planning to install 58.7 GW of renewable energy capacity by 2030, with a significant focus on solar power. It has begun several projects, including Dumat Al Jandal and Sakaka solar power plants. The growing focus on renewable energy and promotion of solar energy projects on large scale is anticipated to boost the market growth.

Key Oxygen-free Copper Company Insights

Some of the key players operating in the market include Mitsubishi Materials Corporation, and Southwire Company, LLC.

-

Mitsubishi Materials Corporation is a diversified materials manufacturer. The company produces wide range of products including copper and copper alloy products. The oxygen-free copper category of products caters to various end-use industries such as telecommunication, electronics, and power transmission. It majorly focuses on advanced manufacturing techniques and technological innovations to manufacture high-quality oxygen-free products that meet stringent industry standards and customize specifications as per client requirements

-

Southwire Company, LLC is a leading U.S.-based wire and cable manufacturer. It specializes in wide range of products, including oxygen-free copper segment that revolves around continuous improvement, product quality, manufacturing processes, R&D, and offers superior conductivity, performance, and reliability

Wieland, and KME AG are some of emerging market participants.

-

Wieland is a key emerging oxygen-free copper manufacturing player offering tailored solutions specific to client requirements. It offers a wide range of products, such as tubes, bars, and sheets that are made via oxygen-free copper process. These products are primarily used in applications of electrical engineering, aerospace, and telecommunication

-

KME AG is an emerging copper and copper alloy company headquartered in Germany. The product portfolio of the company includes wires, strips, sheets, and rods. These products find application in end-use industries that require superior thermal properties, making it an excellent application in electrical wiring, power transmission, and electric components. It focuses on technological advancements to maintain competitive advantage over other oxygen-free copper manufacturers

Key Oxygen-free Copper Companies:

The following are the leading companies in the oxygen-free copper market. These companies collectively hold the largest market share and dictate industry trends.

- Copper Braid Products

- Cupori

- Hitachi Metals Neomaterial, Ltd.

- Hussey Copper

- Metrod Holdings Berhad

- Mitsubishi Materials Corporation

- Sam Dong

- Southwire Company, LLC

- Wieland

- Zheijang Libo Holding Group Co., Ltd.

Recent Developments

-

In December 2023,U.S.-based C4V, a LiB company entered into a MoU with Hindalco Industries for collaboration in development and anode-copper to cater to growing EV industry in the U.S

-

In November 2023, Redwood Materials plans to further backward integrate and produce copper cathodes, and this plant is expected to become operational in 2025

-

In November 2023, South Korea-based SK Nexilis, started manufacturing of ultrathin oxygen-free coppers (4 microns) in its new facility in Malaysia. This plant has a capacity of 57.0 kilotons per annum and was built with an investment of KRW 900.0 billion (~USD 690.0 million). It consists of world’s largest production lines of oxygen-free coppers in the world

Oxygen-free Copper Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 22.68 billion

Revenue forecast in 2030

USD 30.46 billion

Growth rate

CAGR of 5.04% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grade, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Mitsubishi Materials Corporation; Southwire Company; LLC; Copper Braid Products; Hitachi Metals Neomaterial, Ltd; Metrod Holdings Berhad; Sam Dong; Wieland; Cupori; Zheijang Libo Holding Group Co., Ltd.; Hussey Copper

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

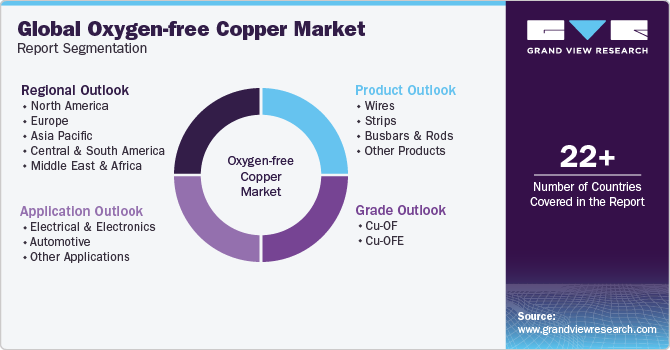

Global Oxygen-free Copper Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the oxygen-free copper market report based on grade, product, application, and region:

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Cu-OF

-

Cu-OFE

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Wires

-

Strips

-

Busbars & Rods

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Electrical & Electronics

-

Automotive

-

Other Applications

-

-

Region Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global oxygen-free copper market size was estimated at USD 21.54 billion in 2023 and is expected to reach USD 22.68 billion in 2024.

b. The global oxygen-free copper market is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030 to reach USD 30.46 billion by 2030.

b. Wires dominated the oxygen-free copper market with a share of over 30.0% in 2023, owing to its excellent characteristics including high conductivity, dimensional accuracy, ability to bend without cracking, and a long service life.

b. Some of the key players operating in the oxygen-free copper market include Mitsubishi Materials Corporation, Southwire Company, LLC, Copper Braid Products, Hitachi Metals Neomaterial, Ltd, Metrod Holdings Berhad, Sam Dong, Wieland, Cupori, Zheijang Libo Holding Group Co., Ltd., and Hussey Copper.

b. The key factors that are driving the oxygen-free copper market include increasing growth of automotive and electrical & electronics industries. It is widely consumed in manufacturing superconductors, semiconductors, and high-vacuum systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.