- Home

- »

- Plastics, Polymers & Resins

- »

-

Packaging Wax Market Size, Share & Growth Report, 2030GVR Report cover

![Packaging Wax Market Size, Share & Trends Report]()

Packaging Wax Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Mineral Wax, Synthetic Wax, Natural Wax), By Packaging (Flexible, Rigid), By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-706-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Packaging Wax Market Size & Trends

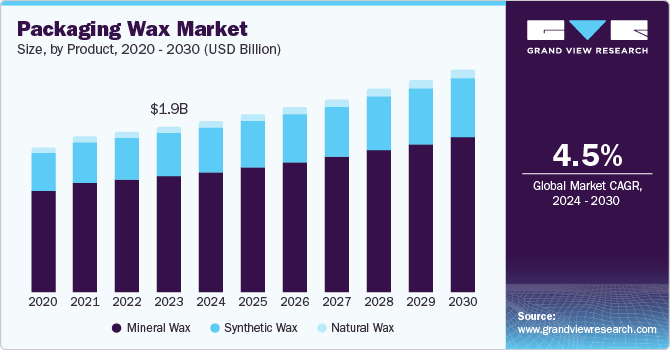

The global packaging wax market size was valued at USD 1.95 billion in 2023 and is projected to grow at a CAGR of 4.5% from 2024 to 2030. Packaging wax is moisture-resistant and has an aesthetic appeal in the packaging industry. Furthermore, the increase in demand for sustainable and eco-friendly packaging encourages manufacturers to adopt natural waxes derived from renewable resources, thereby enhancing market growth. In addition, e-commerce developments in the food and beverage sector and a growing focus on reducing plastic waste are further propelling the expansion of the industry.

The trend of premium and luxury packaging influences the global packaging wax market. As consumer preferences shift towards high-quality packaging, manufacturers prefer packaging wax to enhance product appearance and create a sophisticated look and feel. This trend is particularly evident in beauty, personal care, and high-end consumer goods, where the visual qualities of packaging are crucial for brand differentiation and consumer appeal.

In addition, technological advancements in wax formulation and production processes are contributing to market growth. The specialized wax blends and improved application techniques enhance the performance and versatility of packaging wax. These advancements allow better customization of packaging solutions, including adhesion, durability, and heat resistance which are essential to meet different industry requirements. This supports the expansion of the packaging wax market by offering more tailored and efficient solutions to various packaging needs.

Product Insights

Mineral wax dominated the market and accounted for a share of 70.3% in 2023 attributed to its low cost of production as they are derived from petroleum products and are less expensive to produce than plant-based materials. Additionally, their use in multiple applications allows manufacturers to use mineral wax in various sectors such as pharmaceuticals, cosmetics, food packaging, and industrial goods. Furthermore, their improved performance attributes and ability to withstand high temperatures without degrading make them ideal for applications that require heat resistance.

Synthetic wax is expected to register a substantial CAGR during the forecast period. This is attributed to the increasing demand for sustainable and eco-friendly packaging solutions across various industries. As consumers become environmentally conscious, manufacturers are shifting towards synthetic waxes that offer superior performance characteristics while minimizing environmental impact compared to traditional paraffin waxes. The technological advancements and innovation in synthetic wax formulations enhance their applicability in diverse packaging materials, further propelling market growth.

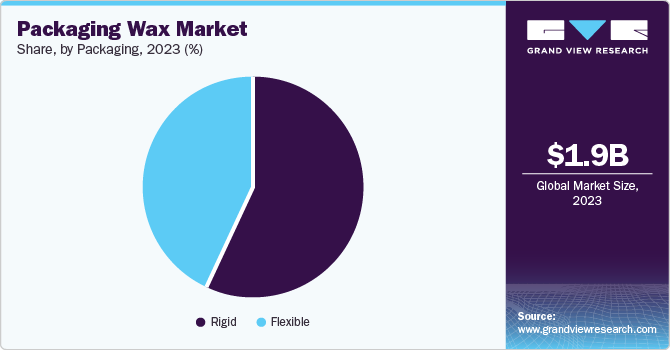

Packaging Insights

The rigid segment dominated the market with a share of 56.9% in 2023 due to the increasing demand for sustainable and durable packaging solutions, which are essential for preserving product integrity. Additionally, the growth of e-commerce has increased the demand for robust packaging that protects the products during shipping, herein manufacturers prefer rigid materials. Furthermore, advancements in wax formulations enhance barrier properties and compatibility with various substrates have made rigid packaging more appealing to industries such as food and beverages, cosmetics, and pharmaceuticals.

The flexible segment is projected to grow at a fast-growing CAGR over the forecast period due to its ability to provide lightweight and versatile packaging solutions that meet consumer preferences with convenience and sustainability. In addition, advances in flexible wax technology have improved its performance and recyclability, making it a more attractive option for various applications. Furthermore, the increasing demand for innovative and eco-friendly packaging options across industries is fueling the adoption of flexible wax materials.

Application Insights

The pharmaceutical segment dominated the market in 2023 due to the increasing demand for advanced drug delivery systems, which require high-quality packaging solutions to ensure product integrity and stability. Additionally, the rise in chronic diseases and an aging population have led to a surge in pharmaceutical production, necessitating efficient and reliable packaging materials that enhance shelf life and increase efficacy. Furthermore, stringent regulatory standards regarding pharmaceutical packaging safety and sustainability have driven manufacturers to adopt innovative wax-based solutions that meet these requirements.

The personal care segment is projected to grow at the fastest CAGR of 5.0% over the forecast period. This can be attributed to the rising consumer demand for premium packaging that enhances product appeal and functionality. In addition, advances in wax technology have enabled the development of packaging solutions that offer superior protection and extended shelf life for personal care products. Furthermore, the growing emphasis on sustainability and eco-friendly packaging options drives the adoption of innovative wax materials in the personal care sector.

Regional Insights

North America packaging wax market registered a significant growth in 2023 due to the region's strong demand for high-quality, sustainable packaging solutions driven by stringent regulatory standards and consumer preferences. The rise of e-commerce and increased focus on eco-friendly packaging options has further fueled market expansion, as companies are seeking advanced wax materials to enhance product protection and meet environmental goals.

Asia Pacific Packaging Wax Market Trends

Asia Pacific packaging wax dominated the market in 2023 with a revenue share of 59.6% and is also expected to witness a CAGR of 4.7% over the forecast period due to rapid industrialization and a booming consumer goods sector that has increased demand for effective packaging solutions. The region's strong manufacturing base and growing e-commerce industry have driven the need for diverse and innovative packaging materials. Additionally, the rise in disposable income and urbanization have spurred consumer demand for packaged products, further boosting the market for packaging wax in the region.

The China packaging wax market dominated in Asia Pacific with a share of 32.4% in 2023 due to the country’s rapid industrial growth and expansion in the consumer goods sector, driving significant demand for advanced packaging solutions. China's robust manufacturing infrastructure and increasing e-commerce activities have further fueled the need for versatile and protective packaging materials. Additionally, the rise in disposable incomes and changing consumer preferences towards premium and innovative packaged products have contributed to the substantial growth in China’s packaging wax market.

Europe Packaging Wax Market Trends

Europe packaging wax market is anticipated to witness significant growth in the forecast period. This is attributed to the increase in consumer and regulatory pressures for sustainable and recyclable packaging solutions. Additionally, the region's focus on innovation and quality in packaging, coupled with rising demand across various industries such as food and personal care is driving the adoption of advanced wax materials.

Key Packaging Wax Company Insights

Some key companies in the industry include China Petrochemical Corporation, CNPC, HF Sinclair Corporation, BP p.l.c., NIPPON SEIRO CO., LTD, and others. Vendors in the market are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers, acquisitions, and partnerships with other major companies.

-

China Petrochemical Corporation, commonly known as Sinopec, is a state-owned oil and petrochemical enterprise based in China, known for its operations in refining, chemical production, and distribution. Sinopec provides a range of high-quality wax products used in various applications, including food packaging, pharmaceuticals, and personal care products, leveraging its advanced petrochemical technologies and production capabilities.

-

Dow is a global materials science company, known for its innovations in chemicals, plastics, and advanced materials. Dow provides a range of high-performance waxes and additives that enhance packaging durability, flexibility, and sustainability, catering to diverse applications in food, beverage, and consumer goods packaging.

Key Packaging Wax Companies:

The following are the leading companies in the packaging wax market. These companies collectively hold the largest market share and dictate industry trends.

- China Petrochemical Corporation

- CNPC

- HF Sinclair Corporation

- BP p.l.c.

- NIPPON SEIRO CO., LTD

- Baker Hughes Company

- Exxon Mobil Corporation

- Sasol Limited

- The International Group, Inc.

- Evonik Industries AG

- BASF

- Dow

- Honeywell International Inc.

- Royal Dutch Shell P.L.C

- Mitsui Chemicals, Inc.

Recent Developments

-

In August 2024, Sasol Chemicals launched SASOLWAX LC100, an industrial wax with a 35% reduction in carbon footprint, aimed at improving sustainability in packaging adhesives while maintaining high performance. This move reflects the company's commitment to environment-friendly practices and aims at reducing overall greenhouse gas emissions in the packaging industry.

-

In April 2024, BASF launched a new line of sustainable solutions for the packaging industry, including a range of products designed to enhance recyclability and reduce environmental impact. The company’s innovations focus on improving the performance and sustainability of packaging materials, aligning with global eco-friendly solutions and trends. This initiative underscores BASF's commitment to advancing sustainability in the packaging sector while meeting the evolving needs of customers and regulatory requirements.

Packaging Wax Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.02 billion

Revenue forecast in 2030

USD 2.63 billion

Growth Rate

CAGR of 4.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, packaging, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

China Petrochemical Corporation; CNPC; HF Sinclair Corporation; BP p.l.c.; NIPPON SEIRO CO.; LTD; Baker Hughes Company; Exxon Mobil Corporation; Sasol Limited; The International Group; Inc.; Evonik Industries AG; BASF; Dow; Honeywell International Inc.; Royal Dutch Shell P.L.C; Mitsui Chemicals; Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Packaging Wax Market Report Segmentation

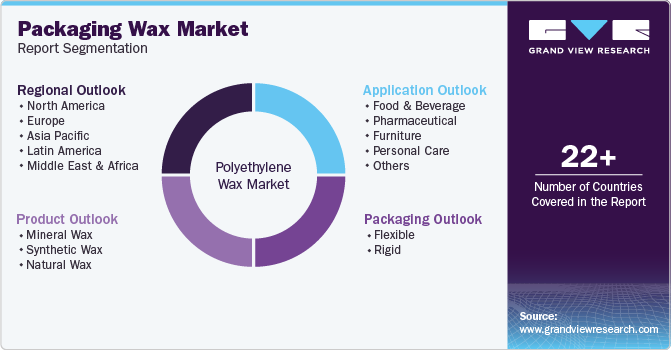

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global packaging wax market report based on product, packaging, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Mineral Wax

-

Synthetic Wax

-

Natural Wax

-

-

Packaging Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Flexible

-

Rigid

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Pharmaceutical

-

Furniture

-

Personal Care

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.