- Home

- »

- Pharmaceuticals

- »

-

Pain Management Drugs Market Size, Industry Report, 2033GVR Report cover

![Pain Management Drugs Market Size, Share & Trends Report]()

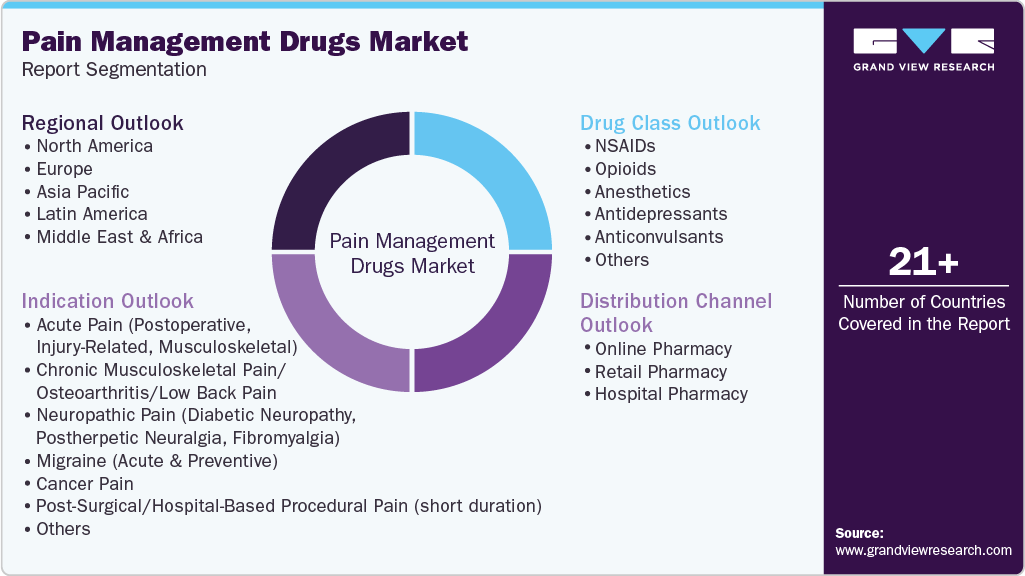

Pain Management Drugs Market (2025 - 2033) Size, Share & Trends Analysis Report By Drug Class (NSAIDs, Opioids, Anesthetics, Antidepressants, Anticonvulsants), By Indication (Acute Pain, Neuropathic Pain), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-779-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pain Management Drugs Market Summary

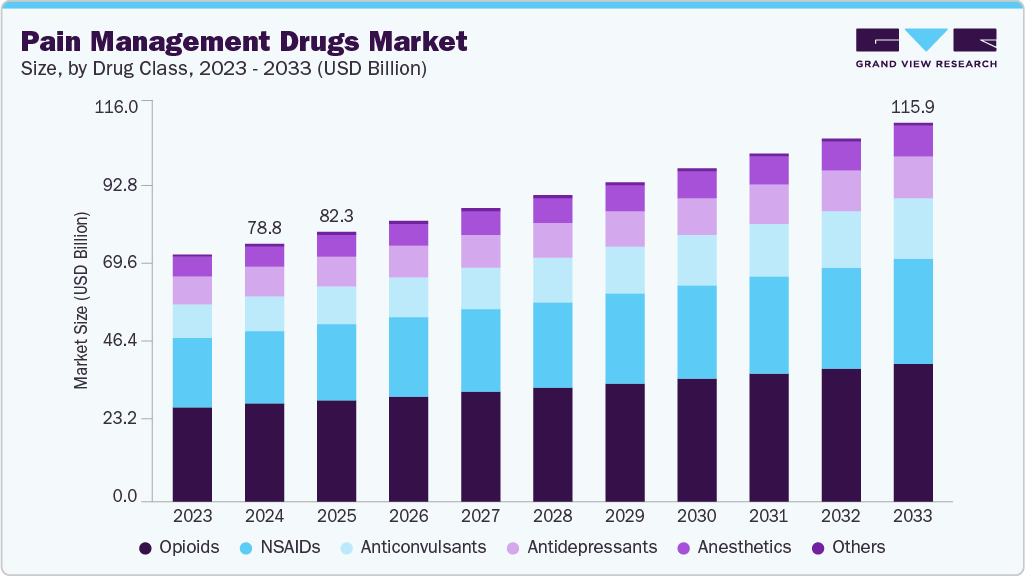

The global pain management drugs market size was estimated at USD 78.84 billion in 2024 and is projected to reach USD 115.92 billion by 2033, growing at a CAGR of 4.38% from 2025 to 2033. The rising prevalence of chronic pain conditions across aging and lifestyle-affected populations drives the growth of the global pain management drugs market.

Key Market Trends & Insights

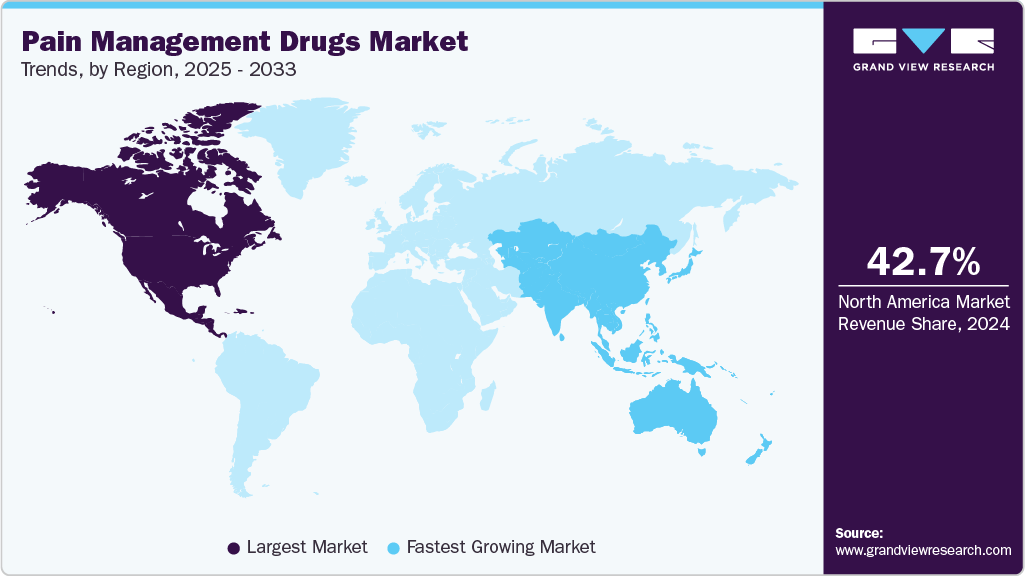

- North America pain management drugs market held the largest share of 42.73% of the global market in 2024.

- The pain management drugs industry in the U.S. is expected to grow significantly over the forecast period.

- By drug class, the opioids segment held the highest market share of 37.84% in 2024.

- By indication, the post-surgical / hospital-based procedural pain (short duration) segment held the highest market share in 2024.

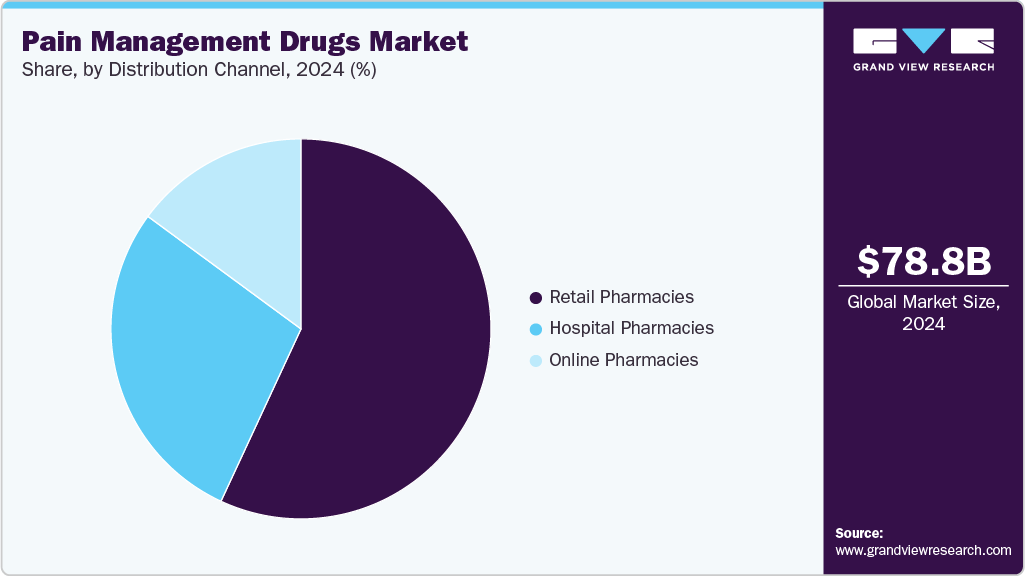

- By distribution channel, the retail pharmacy segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 78.84 Billion

- 2033 Projected Market Size: USD 115.92 Billion

- CAGR (2025-2033): 4.38%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Increasing cases of arthritis, cancer-related pain, lower back disorders, neuropathic pain, and post-surgical discomfort have intensified the demand for effective pharmacological interventions. The growing burden of musculoskeletal and neurological disorders has expanded the patient pool requiring long-term pain therapy. Healthcare providers are adopting advanced pain management approaches to enhance quality of life and reduce healthcare burden. In addition, the growing awareness of pain as a treatable clinical condition has supported early diagnosis and treatment. The rising number of surgical procedures globally further contributes to the higher consumption of analgesics and opioids, strengthening the need for targeted and multimodal pain management therapies.

The market expansion is further supported by continuous innovation in non-opioid pain medications and novel drug delivery technologies. For instance, in January 2025, TIME reported that the U.S. Food and Drug Administration (FDA) approved suzetrigine, marketed as Journavx by Vertex Pharmaceuticals, as the first new class of non-opioid pain medication in over 20 years. Suzetrigine is a 50 mg oral tablet taken twice daily and targets the Nav1.8 sodium channel, specific to pain neurons, thereby avoiding the addictive potential of opioids. In clinical trials involving patients recovering from bunionectomy and abdominoplasty surgeries, 83% and 61% of participants taking suzetrigine, respectively, reported at least a 30% reduction in pain, compared to 68% and 48% in the placebo groups. These results suggest that suzetrigine may offer a safer alternative to opioids for managing acute pain. Pharmaceutical companies also focus on developing safer formulations, while advancements in extended-release and transdermal drugs improve efficacy, convenience, and patient adherence.

Regulatory oversight continues to shape market trends. For instance, on March 12, 2025, the UK Medicines and Healthcare products Regulatory Agency (MHRA) and the Commission on Human Medicines (CHM) published a report detailing the removal of the post-operative pain indication from all modified-release opioids due to safety concerns, including persistent post-operative opioid use (PPOU) and opioid-induced ventilatory impairment (OIVI). PPOU occurred in 2% to 44% of patients treated with prolonged-release opioids, rising to 60% in those previously using these opioids, while OIVI incidence ranged from 0.4% to 41%. Consequently, the MHRA recommended that only immediate-release opioids be prescribed for short-term post-operative pain and encouraged smaller pack sizes to reduce over-prescription. Overall, growing R&D in non-addictive analgesics, personalized therapies, digital monitoring tools, and expanded healthcare access is fueling the sustained growth of the pain management drugs market globally.

Pipeline Analysis

NCT Number

Phases

Completion Date

NCT06994442

PHASE3

8/31/2029

NCT06649383

PHASE4

6/15/2029

NCT07158567

PHASE3

12/31/2031

NCT06835504

PHASE3

2/28/2029

NCT06576830

PHASE4

6/1/2029

NCT06626035

PHASE3

8/31/2029

NCT06626503

PHASE3

8/31/2029

NCT06810375

PHASE3

2/28/2029

NCT07153003

PHASE4

9/1/2031

NCT06525740

PHASE4

9/1/2029

NCT06878703

PHASE3

12/15/2029

Source: ClinicalTrials.gov

Opportunity Analysis for the Pain Management Drugs Market

Opportunity Area

Description

Latest Instance

Rising Chronic Pain Burden

Increasing prevalence of chronic pain conditions, including arthritis, lower back pain, neuropathic pain, and post-surgical pain, drives demand for effective pharmacological interventions.

Over 1.5 billion people globally suffered from chronic pain in 2024, with musculoskeletal disorders accounting for 35% of cases.

Advancements in Non-Opioid Medications

Development of non-opioid analgesics and novel drug delivery systems improves safety, efficacy, and patient adherence, reducing reliance on opioids.

On January 30, 2025, FDA approved suzetrigine (Journavx) as the first new non-opioid pain drug in over 20 years; clinical trials showed 83% of bunionectomy patients and 61% of abdominoplasty patients experienced at least 30% pain reduction.

Strategic Collaborations

Partnerships between pharmaceutical companies and research organizations accelerate R&D for targeted pain therapies and combination therapies.

Vertex Pharmaceuticals collaborated with leading pain research institutes in 2024 to explore new molecular targets for chronic pain.

Regulatory and Safety Awareness

Regulatory actions to limit opioid overuse encourage safer pain management practices and stimulate demand for alternative therapies.

On 12 March 2025, MHRA removed post-operative pain indication from all modified-release opioids; PPOU incidence ranged 2-44%, rising to 60% in pre-op users, and OIVI incidence ranged 0.4-41%.

Digital Health Integration

Increasing use of digital tools for patient monitoring and pain assessment supports personalized treatment and long-term adherence.

Telehealth and mobile monitoring programs in the U.S. and Europe increased digital pain management adoption by 28% in 2024.

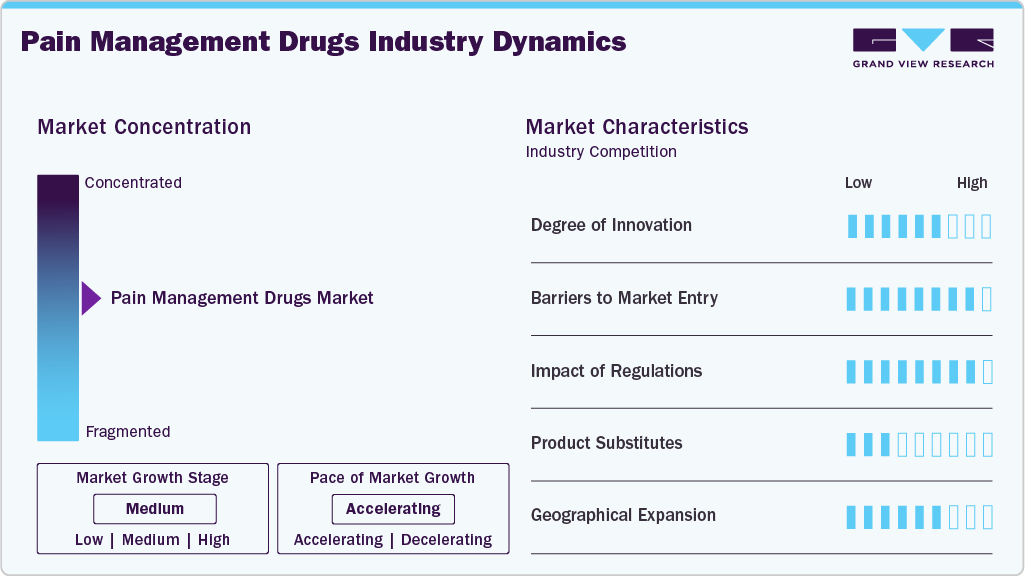

Market Concentration & Characteristics

The pain management drugs market exhibits moderate to high innovation, driven by the development of non-opioid therapies, extended-release formulations, and targeted treatments for neuropathic and chronic pain. Companies are increasingly investing in research to improve efficacy and reduce side effects. Biopharmaceutical advancements are enabling personalized pain therapies and combination treatments. Novel drug delivery systems, such as transdermal patches and injectable options, enhance patient compliance. Continuous innovation helps companies differentiate products and capture larger market shares.

The market has significant entry barriers due to high R&D costs, stringent clinical trial requirements, and complex regulatory approvals. Established brand loyalty and extensive distribution networks of leading players pose additional challenges. New entrants face hurdles in demonstrating safety and efficacy against well-established drugs. Intellectual property rights and patents create legal constraints for generic manufacturers. These factors collectively limit competition and maintain moderate industry concentration.

Regulatory oversight strongly influences market dynamics by ensuring drug safety, efficacy, and quality. Approval processes from agencies such as the FDA, EMA, and other national authorities are rigorous and time-consuming. Compliance with labeling, manufacturing, and post-market surveillance standards is mandatory. Regulatory scrutiny also affects opioid prescribing and non-opioid drug adoption. Companies must continuously adapt strategies to meet evolving legal requirements, shaping product portfolios and market access.

Various non-pharmacological therapies, including physiotherapy, acupuncture, and cognitive-behavioral interventions, act as substitutes for pain medications. Within pharmaceuticals, alternative drug classes, such as biologics and topical agents, provide options for specific pain types. Over-the-counter analgesics compete with prescription drugs in mild to moderate pain management. Availability of generics reduces reliance on branded drugs. The presence of effective substitutes influences pricing, adoption rates, and overall market growth.

Market growth is increasingly driven by expansion into emerging economies with rising healthcare infrastructure and chronic disease prevalence. Developed markets continue to dominate due to established healthcare systems and higher per capita consumption. Regional differences in regulatory frameworks, reimbursement policies, and patient awareness influence expansion strategies. Companies are leveraging partnerships and local manufacturing to optimize market penetration. Global presence enhances competitive positioning and revenue diversification.

Drug Class Insights

The opioids segment dominated the market with the largest revenue share of 37.84% in 2024, driven by high effectiveness in managing moderate to severe acute and chronic pain. Widespread clinical adoption in post-surgical and cancer-related pain maintains steady demand, while fast-acting formulations enhance patient compliance. The growing prevalence of chronic pain supports sustained prescription volumes, and pharmaceutical companies continue innovating with extended-release and abuse-deterrent formulations. For instance, in June 2023, the California Department of Justice announced opioid settlements totaling USD 17.3 billion with CVS, Walgreens, Teva, and Allergan to fund treatment, prevention, and abatement programs. Strong brand recognition sustains market leadership and revenue contribution.

The anticonvulsants segment is projected to grow at the fastest CAGR of 6.09% over the forecast period, driven by expanding use in neuropathic pain and fibromyalgia management. Clinical evidence supports their effectiveness in diabetic neuropathy and postherpetic neuralgia, while increasing physician preference for non-opioid alternatives boosts adoption. Advances in formulation technology, including sustained-release capsules, enhance patient adherence and treatment outcomes. For instance, in July 2025, Medical Dialogues reported that Alembic Pharmaceuticals received final USFDA approval for its ANDA for Carbamazepine Extended-Release Tablets USP in 100 mg, 200 mg, and 400 mg strengths, equivalent to Novartis’s Tegretol-XR, with an estimated market size of USD 71 million for the twelve months ending March 2025. This approval added to Alembic’s 225 cumulative ANDA approvals, with the launch expected in the upcoming year. Awareness campaigns and combination therapies further strengthen market growth, positioning anticonvulsants as a high-growth segment globally.

Indication Insights

The post-surgical / hospital-based procedural pain (short duration) segment dominated the market with the largest revenue share of 34.06% in 2024, which can be attributed to the high volume of surgical procedures globally. Hospitals and clinics rely heavily on fast-acting analgesics to manage acute post-operative pain. Multi-modal pain management strategies increase consumption of both opioids and non-opioid drugs. For instance, in June 2023, PAIN Reports published a systematic review and meta-analysis estimating that the prevalence of moderate-to-severe postoperative pain after hospital discharge ranged from 31% to 58% across 27 studies, indicating that nearly one-third to more than half of patients experience significant pain following discharge. Patient recovery protocols emphasize effective pain control for faster rehabilitation. Widespread availability of injectable and intravenous formulations supports immediate relief. Collaboration between surgeons and anesthesiologists ensures optimal treatment selection. The segment’s strong clinical relevance and high drug utilization reinforce its leading market position.

The cancer pain segment is projected to grow at a CAGR of 7.02% over the forecast period, due to rising prevalence of cancer and increasing patient focus on quality of life. Oncological pain management requires specialized, potent analgesics, boosting demand for both opioids and adjunct therapies. Advanced therapies targeting neuropathic and tumor-related pain are gaining traction. For instance, in April 2025, BreastCancer.org published an article detailing the use of non-narcotic analgesics in managing breast cancer-related pain, highlighting that over-the-counter medications like acetaminophen and non-steroidal anti-inflammatory drugs (NSAIDs) are commonly recommended for mild to moderate pain relief. Additionally, sodium channel blockers, such as Journavx, were approved in 2025 for treating moderate to severe short-term pain, with emphasis on consulting healthcare providers before starting treatment. Improved diagnostic practices enable earlier and more effective intervention. Combination therapy approaches enhance symptom control in complex cases. Growing awareness among patients and clinicians drives higher adoption of novel formulations. The segment’s clinical necessity and expanding patient pool contribute to robust market growth.

Distribution Channel Insights

The retail pharmacy segment dominated the market with the largest revenue share of 56.92% in 2024, which can be attributed to high accessibility and convenience for patients managing chronic and acute pain. Prescription analgesics and over-the-counter NSAIDs are widely available in retail outlets. Retail pharmacies offer personalized counseling and guidance on proper drug usage. Brand recognition and loyalty influence patient preference in retail channels. Refill and repeat prescriptions for chronic pain increase retail pharmacy sales volumes. Wide geographic presence of retail chains supports consistent market reach. The segment’s accessibility and consumer trust maintain its leading revenue contribution.

The online pharmacy segment is projected to grow at a fastest CAGR of 6.12% over the forecast period, due to increasing adoption of digital platforms for purchasing medications. Patients prefer home delivery for chronic pain therapies requiring repeated prescriptions. Online pharmacies provide convenience, competitive pricing, and broader product availability. Growth in telemedicine and remote consultation supports online sales of analgesics. E-commerce platforms facilitate quick access to both branded and generic drugs. Technology-enabled tracking and reminders improve adherence to treatment regimens. The segment’s digital integration and patient-centric convenience drive rapid growth in the market.

Regional Insights

North America held the largest share of the pain management drugs market in 2024, accounting for 42.73% of global revenue. High prevalence of chronic pain conditions among aging populations drives strong demand for analgesics and non-opioid therapies. Advanced healthcare infrastructure ensures widespread availability of prescription and specialty medications. Hospitals and outpatient clinics extensively utilize opioids, NSAIDs, and adjuvant therapies for effective pain control. Strong presence of leading pharmaceutical companies supports extensive product portfolios. Continuous clinical research fosters development of innovative formulations. The region’s mature healthcare system and established treatment protocols maintain market leadership.

U.S. Pain Management Drugs Market Trends

The U.S. remains the largest contributor to North America’s market share, with high per capita consumption of pain management drugs. Rising cases of musculoskeletal disorders and neuropathic pain increase prescription volumes. Advanced hospital networks and outpatient services enable rapid access to analgesics. Strong focus on specialty pain clinics supports growth of targeted therapies. Leading global players maintain significant market presence through branded and generic products. Patient awareness regarding pain management options enhances treatment adoption. The country’s advanced pharmaceutical R&D infrastructure sustains product innovation and market expansion.

Europe Pain Management Drugs Market Trends

Europe holds a significant share in the global pain management drugs market due to rising prevalence of chronic and acute pain conditions. Strong adoption of advanced therapies across hospitals and clinics drives market demand. The aging population increases the incidence of osteoarthritis and musculoskeletal disorders. Europe’s pharmaceutical sector invests in novel non-opioid analgesics and extended-release formulations. Wide access to retail and hospital pharmacies facilitates distribution. Increasing awareness of pain treatment options supports higher consumption. These factors collectively maintain Europe’s important position in the global market.

The UK pain management drugs market exhibits steady growth in pain management drugs, driven by a high incidence of chronic musculoskeletal and neuropathic pain. Hospitals and outpatient clinics adopt multimodal pain therapies for improved patient outcomes. Strong clinical guidelines support prescription of both opioid and non-opioid treatments. Retail pharmacies provide easy access to over-the-counter analgesics. Rising awareness among patients encourages timely management of post-surgical pain. Pharmaceutical companies actively launch novel formulations to address unmet pain needs. The UK’s developed healthcare network ensures consistent market demand.

The Germany pain management drugs market contributes significantly to Europe’s market share, with high adoption of prescription analgesics in hospitals and outpatient care. Chronic low back pain and osteoarthritis are major drivers of drug utilization. Advanced drug delivery technologies enhance patient compliance and therapeutic efficacy. Presence of leading global and domestic pharmaceutical players supports market growth. Hospitals implement evidence-based pain management strategies, increasing demand for specialized medications. Awareness campaigns targeting neuropathic and cancer-related pain boost product consumption. Germany’s mature healthcare infrastructure sustains robust market performance.

The France pain management drugs market demonstrates steady market expansion with growing use of opioids, NSAIDs, and anticonvulsants for chronic and acute pain. Rising incidence of post-surgical and cancer-related pain increases demand in hospital and outpatient settings. Retail pharmacies play a crucial role in providing easy access to pain management therapies. Increasing adoption of novel formulations enhances patient adherence and therapeutic outcomes. Pharmaceutical companies invest in product differentiation to strengthen brand presence. Awareness of neuropathic pain management supports broader utilization. France’s advanced healthcare system ensures consistent market growth.

Asia Pacific Pain Management Drugs Market Trends

Asia Pacific is projected to grow at the fastest CAGR of 4.38% during the forecast period due to rising prevalence of chronic pain conditions and increasing healthcare access. Expanding urban population and lifestyle-related disorders drive higher analgesic consumption. Growing adoption of prescription and specialty pain drugs supports market expansion. Hospitals and retail pharmacies are rapidly increasing availability of advanced therapies. Rising awareness among patients and clinicians improves treatment adoption rates. Expansion of multinational pharmaceutical companies strengthens regional market penetration. Technological advancements in drug delivery enhance patient compliance and therapeutic outcomes.

The Japan pain management drugs market shows strong growth with increasing demand for pain management drugs in aging populations. Chronic musculoskeletal and neuropathic pain drive significant prescription volumes. Hospitals and clinics focus on multimodal approaches, integrating opioids, NSAIDs, and anticonvulsants. High penetration of retail pharmacies ensures widespread access to both branded and generic products. Innovative drug delivery systems, including patches and extended-release formulations, improve patient adherence. Awareness of post-surgical and cancer-related pain management supports therapy adoption. Japan’s developed healthcare system facilitates consistent market expansion.

The China pain management drugs market exhibits rapid growth due to increasing prevalence of chronic pain and rising patient awareness. Expanding healthcare infrastructure improves access to prescription and specialty analgesics. Hospitals and retail outlets are increasingly stocking non-opioid and opioid therapies. Rising incidence of post-operative and cancer-related pain drives demand for targeted formulations. Pharmaceutical companies are introducing novel and generic products to strengthen market presence. Growth in telemedicine and online pharmacy channels enhances convenience and adherence. These factors position China as a high-growth market within Asia Pacific.

Latin America Pain Management Drugs Market Trends

Latin America shows moderate growth in pain management drugs, driven by rising incidence of musculoskeletal and neuropathic pain. Hospitals and retail pharmacies are expanding access to prescription analgesics. Awareness regarding chronic pain management is gradually increasing among patients. Opioids, NSAIDs, and adjuvant therapies are widely used in clinical settings. Emerging generic drug manufacturers strengthen affordability and accessibility. Adoption of modern pain management practices improves treatment outcomes. These trends support steady expansion of the market across the region.

The Brazil pain management drugs market dominates Latin America’s market due to higher healthcare access and growing patient awareness. Increasing prevalence of osteoarthritis, lower back pain, and post-surgical pain drives analgesic demand. Hospitals implement multimodal pain management strategies to improve recovery. Retail and online pharmacy channels provide broad access to branded and generic products. Pharmaceutical companies focus on product innovation and expansion into regional markets. Rising adoption of non-opioid alternatives enhances therapeutic options. Brazil’s improving healthcare infrastructure sustains long-term market growth.

Middle East & Africa Pain Management Drugs Market Trends

MEA demonstrates gradual market growth, driven by increasing healthcare infrastructure and awareness of pain management therapies. Hospitals and clinics are adopting advanced analgesics for chronic and acute pain. Rising prevalence of musculoskeletal disorders and cancer-related pain contributes to higher drug utilization. Retail and hospital pharmacies enhance accessibility of pain medications. Regional players are expanding product portfolios and distribution networks. Adoption of non-opioid and combination therapies supports diversified treatment options. Overall, market expansion is supported by improving healthcare access and clinical adoption.

The Saudi Arabia pain management drugs market represents the leading MEA market with growing demand for pain management drugs. Hospitals and outpatient clinics are increasingly utilizing opioids, NSAIDs, and anticonvulsants. Rising prevalence of post-operative and cancer-related pain drives prescription volumes. Retail pharmacies expand access to over-the-counter analgesics for mild to moderate pain. Healthcare providers are adopting multimodal approaches for improved patient outcomes. Awareness of chronic and neuropathic pain management supports therapy uptake. The country’s modern healthcare infrastructure ensures consistent market growth.

Key Pain Management Drugs Company Insights

Key players in the pain management drugs market include Teva Pharmaceutical, Pfizer, Abbott, Mallinckrodt, Endo International, GlaxoSmithKline, AstraZeneca, Depomed, Merck, and Novartis, each contributing through diverse portfolios and global reach. Teva leads with generic and specialty analgesics, while Pfizer drives growth with Lyrica for neuropathic pain. Abbott focuses on innovative delivery systems, and Mallinckrodt emphasizes hospital-centric opioids. Endo, GSK, AstraZeneca, Depomed, Merck, and Novartis expand adoption through novel formulations, non-opioid therapies, and extended-release options. Strategic partnerships, clinical development, and distribution networks strengthen their market presence. Together, these companies drive innovation, enhance accessibility, and shape the global pain management drugs landscape.

Key Pain Management Drugs Companies:

The following are the leading companies in the pain management drugs market. These companies collectively hold the largest market share and dictate industry trends.

- Teva Pharmaceutical

- Pfizer

- Abbott

- Mallinckrodt Pharmaceuticals

- Endo International

- GlaxoSmithKline

- AstraZeneca

- Depomed

- Merck

- Novartis

Recent Developments

-

In August 2025, Teva Pharmaceuticals announced that the U.S. FDA approved AJOVY (fremanezumab-vfrm) for preventing episodic migraine in children and adolescents aged 6-17 years weighing 45 kg (99 lbs) or more. AJOVY became the first CGRP antagonist approved for both pediatric and adult migraine prevention. Approximately 1 in 10 U.S. children and adolescents suffer from migraine, highlighting the significance of this monthly, in-office, or at-home treatment.

-

In May 2025, AstraZeneca exited neuroscience research, removing experimental drugs for Alzheimer’s, migraine, and pain from its pipeline. The company refocused on core areas, including cancer and cardiovascular diseases, which generated nearly USD 51 billion in sales. By 2030, it aims for USD 80 billion annual revenue and 20 new drug launches.

-

In March 2024, Endo International received U.S. Bankruptcy Court approval for its restructuring plan and opioid settlements. The company planned to transfer over 95% ownership to lenders, pay up to USD 465 million over ten years, and settle USD 7-8 billion in claims related to opioid litigation and debts.

Pain Management Drugs Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 82.29 billion

Revenue forecast in 2033

USD 115.92 billion

Growth rate

CAGR of 4.38% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Drug class, indication, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

Teva Pharmaceutical; Pfizer; Abbott; Mallinckrodt Pharmaceuticals; Endo International; GlaxoSmithKline; AstraZeneca; Depomed; Merck; Novartis

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pain Management Drugs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global pain management drugs market report based on drug class, indication, distribution channel and region:

-

Drug Class Outlook (Revenue, USD Million, 2021 - 2033)

-

NSAIDs

-

Opioids

-

Anesthetics

-

Antidepressants

-

Anticonvulsants

-

Others

-

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Acute Pain (Postoperative, Injury-Related, Musculoskeletal)

-

Chronic Musculoskeletal Pain / Osteoarthritis / Low Back Pain

-

Neuropathic Pain (Diabetic Neuropathy, Postherpetic Neuralgia, Fibromyalgia)

-

Migraine (Acute & Preventive)

-

Cancer Pain

-

Post-Surgical / Hospital-Based Procedural Pain (short duration)

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Online Pharmacy

-

Retail Pharmacy

-

Hospital Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.