- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Pea Protein Market Size, Share And Growth Report, 2030GVR Report cover

![Pea Protein Market Size, Share & Trends Report]()

Pea Protein Market Size, Share & Trends Analysis Report By Product (Isolates, Concentrates), By Form (Dry, Wet), By Source, By Application (Food & Beverages, Animal Feed), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-458-1

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

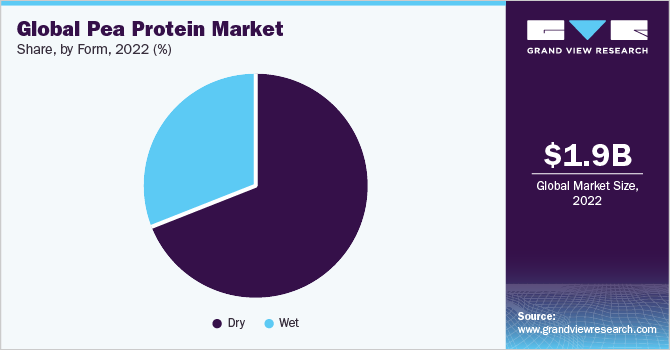

The global pea protein market size was valued at USD 1,904.2 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.0% from 2023 to 2030. The growth factors such as increasing demand for plant-based protein, health and fitness trends, and the growing vegan and vegetarian population are projected to augment demand over the forecast period. Furthermore, the versatility of pea protein and its ability to provide functional properties like emulsification, texture enhancement, and foaming has widened its market potential. Additionally, increasing product innovation, in terms of manufacturing, that performs specific functions, including energy balance, weight loss, muscle repair, and satiety, is expected to create immense market potential.

The protein is extracted from various types of pea varieties, including dry, green, and chickpeas, available in concentrates, textured, and isolates form. These products are derived from plant-based sources, making them ideal for consumers opting for vegan diets. In addition, they are non-toxic, non-allergic, and easily digestible with vast application potential in beverages, meat substitutes, dietary supplements, and bakery products. The rising importance of a flexitarian diet on account of increasing concerns about cardiological impacts associated with red meat consumption is expected to remain a favorable factor for market growth. Moreover, increasing awareness regarding the adverse effects of foods comprising gluten as well as lactose is expected to play a crucial role in promoting product demand over the forecast years.

Furthermore, the growing consumption of protein-fortified functional foods is anticipated to augment the product demand. Increasing demand for protein supplementation in food products has resulted in new product launches by food & beverage companies, which is foreseen to have a positive impact on market growth. In December 2021, Tiptoh, an innovative Belgian start-up, partnered with Olympia Dairy and SIG to introduce a new line of pea protein beverages to the Belgian market. The growing awareness about protein powder consumption for promoting bone health and muscle growth is also anticipated to augment market growth over the forecast period.

The price of pea protein plays a crucial role in driving the growth of the pea protein market. Its cost-effectiveness, competitive pricing compared to animal-based proteins, stable pricing, production efficiency, and affordability for consumers contribute to its increasing popularity and market expansion. Pea protein is generally more affordable compared to other plant-based protein sources such as soy or almond protein. Its cost-effectiveness makes it an attractive option for food manufacturers looking to incorporate protein into their products without significantly increasing production costs. Moreover, when compared to animal-based proteins such as whey or casein, pea protein offers competitive pricing.

Product Insights

Pea protein isolates dominated the market with a share of 49.8% in 2022. Isolates are widely used as nutritional supplements in meat products, energy drinks, fruit mixes, and bakery items as they exhibit good emulsification and non-allergic characteristics. Expansion of the sports nutrition industry in developed countries, including the U.S., Germany, and the UK, in light of new product launches by Cadbury and Amway in the energy mix segment, is expected to increase product demand. Similarly, in October 2022, Roquette introduced a line of organic pea protein isolates, catering to the demand for organic and plant-based options.

Pea protein concentrates are expected to grow at a CAGR of 11.6% from 2022 to 2030. Pea protein concentrates have several attributes, such as good emulsification and high digestibility, which drive their utilization in weight control and dietary supplement applications. Moreover, these concentrates are gradually incorporated into bakery products, such as cakes & pastries, for good flavoring and dry texture. A robust manufacturing base of bakery products in countries, such as Germany and France, due to proximity with equipment producers and easy access to wheat and rice as raw materials, is expected to increase the application of concentrates over the forecast years.

Textured pea protein plays a crucial role as a texturing agent in various food products, including meat products, baked goods, and confectionery items. Its fibrous content further enhances its potential application in energy powders and fruit juice mixes. Its sustainability, functionality, versatility, and nutritional profile make it a suitable ingredient for developing meat analogs or extenders.

Source Insights

Yellow split peas dominated the market with a revenue share of 76.8% in 2022. Yellow split peas have a high protein content, making them ideal for pea protein extraction. Additionally, they are widely available, ensuring a consistent supply. They also possess favorable functional properties and a neutral flavor, making them versatile for various food applications. Consumer familiarity and acceptance of yellow split peas contribute to their prominence in the market.

The other sources such as green peas, chickpeas, lentils, and fava beans are expected to grow at a CAGR of 10.2% from 2022 to 2030, driven by the need for product diversification, enhanced nutrition profiles, and flavor variations. They offer different amino acid compositions or micronutrient profiles, providing consumers with more options to meet their specific dietary requirements.

Application Insights

Food & beverages dominated the market with a revenue share of 39.6% in 2022, owing to the increasing consumer demand for plant-based and vegetarian/vegan options. Pea protein's functional properties, nutritional benefits, and versatility make it a preferred ingredient for enhancing the texture, stability, and nutritional profile of various food and beverage products. Pea proteins offer several functional benefits in bakery applications, including water holding, gelation, and increased browning, particularly in gluten-free applications.

Among various applications in the food and beverages industry, meat substitutes dominated the market in 2022. The functional properties of pea protein, including its ability to mimic the texture and mouthfeel of meat, make it a preferred choice for creating meat alternatives. Additionally, pea protein offers a complete amino acid profile, making it a valuable protein source in meat substitute formulations. Its neutral flavor allows for easy incorporation into various recipes and enables it to adapt to different flavor profiles. Pea protein offers good texturing properties that are expected to promote its application in the production of meat products, including mutton, chicken, lamb, and beef.

The personal care & cosmetics segment is expected to grow at a CAGR of 12.4% from 2022 to 2030 owing to the rising demand for natural and plant-based ingredients, vegan and cruelty-free product preferences, and the skin and hair benefits offered by pea protein. Consumers are increasingly seeking natural and plant-based ingredients in their personal care and cosmetics products. Pea protein, derived from plant sources, fits into the growing trend of clean and sustainable beauty. Its natural origin and perceived benefits make it an attractive ingredient for consumers.

Form Insights

Dry pea protein dominated the market with a revenue share of 67.3% in 2022, owing to the higher protein concentration, improved functionality, longer shelf life, and convenience in handling and storage. The dry processing methods used to produce pea protein concentrates and isolates result in a more concentrated protein product, making it desirable for manufacturers and consumers seeking efficient protein sources.

The powder form of dry pea protein allows for easy incorporation into various food applications without compromising texture or taste, and its low moisture content ensures longer shelf life and stability. Additionally, dry pea protein's convenience in handling and storage, along with its clean label appeal and alignment with the growing demand for plant-based protein alternatives, has contributed to its dominance in the market.

The wet pea protein is expected to grow at a CAGR of 11.2% from 2022 to 2030. Wet pea protein retains more of the natural properties and characteristics of whole peas, making it appealing to consumers seeking minimally processed and whole food options. Wet pea protein processing methods offer potential cost advantages compared to dry pea protein production. The wet process typically involves simpler extraction techniques, which lead to lower production costs. The establishment of Pésol Pea, as the first wet textured protein plant in Spain, in 2021, represents a significant development in the wet pea protein industry.

Regional Insights

The North American region dominated the market with a revenue share of 32.9% in 2022, due to high consumer demand for plant-based products, a strong food and beverage industry, and an abundant agricultural supply of yellow split peas. The survey conducted by Sprouts Farmers Market in 2021 indicates that the popularity of plant-based diets and meat alternatives is growing in the U.S., with almost half of Americans (47%) identifying as flexitarians and consuming more plant-based meals than meat.

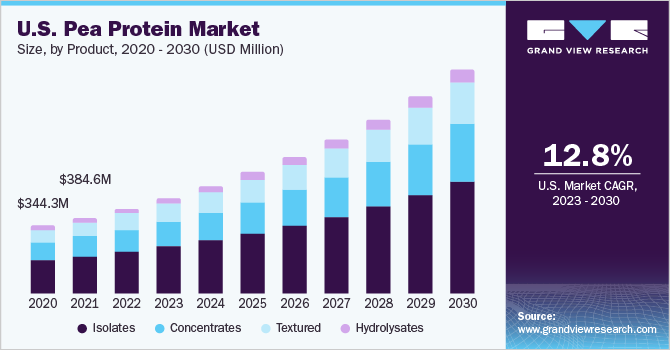

The U.S. pea protein market dominated the North American region with a revenue share of 68.6% in 2022. The large presence of market players such as Burcon; Nutri-Pea; and Roquette, among others, has contributed to the increased availability and improved quality of pea protein in the U.S. market. Furthermore, the launch of Benson Hill's advanced yellow pea breeding and commercialization program in August 2021 has further strengthened the U.S. pea protein industry. This initiative by Benson Hill, a Missouri-based food tech company, aims to drive expansion in the alternative protein sector by developing superior yellow pea varieties and bringing them to market.

The Asia Pacific pea protein industry is expected to grow at the fastest CAGR of 13.0% from 2022 to 2030, owing to the rising population and changing dietary preferences. The expanding food and beverage industry in China, India, and Australia has created opportunities for incorporating pea protein into a variety of products.

Furthermore, China pea protein market emerged as a dominant market in the Asia Pacific region with a revenue share of 25.0% in 2022, benefiting from a growing plant-based market and allergen challenges associated with mainstream ingredients. India pea protein industry is expected to grow at the fastest CAGR of 14.5% from 2022 to 2030, driven by high demand from the food & beverages sector, particularly in bakery and snacks.

The Australia and New Zealand pea protein market is expected to grow at a CAGR of 13.3% from 2022 to 2030. According to a report from New Zealand Trade & Enterprise, a trade agency, published in 2023, New Zealand's market for pea protein is expected to grow significantly, expanding by tenfold in the next decade. Key sectors driving this growth include sports nutrition, infant formula, and plant-based dairy and meat alternatives. The increasing demand for plant-based protein sources, coupled with the country's focus on sustainable and clean-label products, is driving the growth of the New Zealand pea protein industry.

The Europe pea protein industry is expected to grow at a CAGR of 11.4% from 2022 to 2030 owing to the demand for plant-based proteins, a growing vegetarian and vegan population in countries like the UK and Germany, and health and wellness trends. The rise in the vegan and flexitarian population has led to a surge in the availability of pea protein-based products in the German pea protein industry. According to the USDA's Foreign Agricultural Service, Germany has the highest rate of vegetarianism compared to other European countries, with approximately 8 million people, which accounts for around 10% of the population, following a vegetarian diet. The UK pea protein industry is expected to grow at a CAGR of 11.4% from 2022 to 2030 owing to increasing availability and rising demand for plant-based alternatives.

Key Companies & Market Share Insights

The global pea protein industry is expected to witness moderate competition among companies owing to the presence of numerous players across the industry. Owing to changing consumer trends, numerous companies are expanding their product portfolio to gain a competitive edge in the market. Some of the key market players in the market are Burcon Nutrascience; Roquette Freres; Ingredion, Inc.; DuPont; and Nutri-Pea among others.

Manufacturers are increasingly engaged in R&D activities related to pea protein. They are also expanding their product lines through product launches, mergers, acquisitions, and partnerships to meet the growing demand for pea protein. For instance, in July 2022, Burcon NutraScience Corporation, a technology leader in plant-based proteins announced the launch of its latest protein ingredient, Peazazz C pea protein, through its joint venture company, Merit Functional Foods Corporation. Peazazz C is a distinct pea protein that offers a smooth and grit-free texture specifically designed for ready-to-drink beverages. Some prominent players in the global pea protein market include:

-

Burcon Nutrascience

-

Roquette Freres

-

The Scoular Company

-

DuPont

-

Cosucra Groupe Warcoing SA

-

Nutri-Pea

-

Shandong Jianyuan Group

-

Sotexpro SA

-

Ingredion, Inc.

-

Axiom Foods, Inc.

-

Fenchem, Inc.

-

Martin & Pleasance

-

The Green Labs LLC

Recent Development

-

In June 2023, Cosucra announced that it had received an investment of 45 million Euros from Wallonie Entreprendre, Sofiprotéol, and the SFPIM (Société Fédérale de Participations et d’Investissement). The investment would help the company realize its energy transition strategy and significantly increase its production capacity

-

In June 2023, Roquette announced the opening of a new Food Innovation Center at its Lestrem site in France. The facility will aid formulators with various capabilities, including R&D support, technical assistance, state-of-the-art equipment, and scale-up testing, with the aim to accelerate product launches

-

In May 2023, Burcon NutraScience announced the expansion of its protein development & innovation business through the provision of services such as pilot plant processing and scale-up validation for the company’s customers and partners. Burcon’s Winnipeg Technical Centre features 10,000 sq. ft of laboratory and pilot-scale production area that leverages advanced commercial processing equipment for complete product development

-

In March 2023, Nepra Foods announced a manufacturing & distribution partnership with Scoular for specialized plant-based products. Under this agreement, Nepra will provide its R&D team for the development of new products, with specialty ingredients involved from both companies. Scoular will further promote Nepra’s products through its strong supply chain network

-

In February 2023, Scoular unveiled ‘Scoular Food Innovation’, the new name for its food ingredient business that aims to reflect the company’s experience and expertise in supplying trending ingredients to address consumer demand in the food industry

-

In January 2023, Burcon NutraScience received a notice of allowance from the United States Patent and Trademark Office for a patent involving key features of the company’s ‘Peazazz’ pea protein. This development ensures that Merit Functional Foods, the licensee of the pea protein, will have protection and marketplace differentiation)

-

In January 2023, Roquette announced a significant investment in the Japan-based food tech startup DAIZ Inc., which specializes in developing technologies and processes to improve the flavor, texture, and nutritional profile of plant-based food items. DAIZ’s proprietary germination technology, the Ochiai Germination Method JP-5795679, was originally developed for soy and has been recently expanded to pea

-

In November 2022, Ingredion and InnovoPro signed an exclusive commercial distribution partnership, for distributing a chickpea protein concentrate in Canada and the U.S. The deal would result in the increased availability of chickpea protein that would help address rising consumer needs while allowing Ingredion to broaden its portfolio of plant-based ingredients

Pea Protein Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2,121.4 million

Revenue forecast in 2030

USD 4.7 billion

Growth rate

CAGR of 12.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Volume in metric tons, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, form, source, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Netherlands; China; India; Japan; Australia & New Zealand; South Korea; Brazil; Argentina; South Africa

Key companies profiled

Burcon Nutrascience; Roquette Freres; The Scoular Company; DuPont; Cosucra Groupe Warcoing SA; Nutri-Pea; Shandong Jianyuan Group; Sotexpro SA; Ingredion, Inc.; Axiom Foods, Inc.; Fenchem, Inc.; Martin & Pleasance; The Green Labs LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pea Protein Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global pea protein market report based on product, form, source, application, and region:

-

Product Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

-

Isolates

-

Concentrates

-

Textured

-

Hydrolysates

-

-

Form Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

-

Dry

-

Wet

-

-

Source Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

-

Yellow Split Peas

-

Others

-

-

Application Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

-

Food & Beverages

-

Meat substitutes

-

Bakery goods

-

Dietary supplements

-

Beverages

-

Others

-

-

Personal Care & Cosmetics

-

Animal Feed

-

Others

-

-

Regional Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pea protein market size was estimated at USD 1,904.2 million in 2022 and is expected to reach USD 2,121.4 million in 2023.

b. The Pea protein market is expected to grow at a compound annual growth rate of 12.0% from 2022 to 2030 to reach USD 4.7 billion by 2030.

b. The North America region dominated the market with a revenue share of 32.9% in 2022, due to high consumer demand for plant-based products, a strong food and beverage industry, and abundant agricultural supply of yellow split peas.

b. Some of the key market players in the pea protein market are Burcon Nutrascience; Roquette Freres; The Scoular Company; DuPont; Cosucra Groupe Warcoing SA; Nutri-Pea; Shandong Jianyuan Group; Sotexpro SA; Ingredion, Inc.; Axiom Foods, Inc.; Fenchem, Inc.; Martin & Pleasance; The Green Labs LLC, among others.

b. The growth factors such as increasing demand for plant-based protein, health and fitness trends, and the growing vegan and vegetarian population are being projected to augment demand over the forecast period. Furthermore, the versatility of pea protein and its ability to provide functional properties like emulsification, texture enhancement, and foaming have widened its market potential

b. The U.S. pea protein market dominated the North America market with a revenue share of 68.6% in 2022. The large presence of market players such as Burcon, Nutri-Pea, and Roquette, among others have contributed to the increased availability and improved quality of pea protein in the U.S. market.

b. India pea protein market is expected to grow at a fastest CAGR of 14.5% from 2022 to 2030, driven by high demand from the food & beverages sector, particularly in bakery and snacks.

Table of Contents

Chapter 1 Pea Protein Market: Methodology and Scope

1.1 Market Segmentation & Scope

1.2 Research Methodology

1.3 Assumptions

1.4 InProductation Procurement

1.4.1 Purchased Database

1.4.2 GVR’s Internal Database

1.4.3 Secondary Sources

1.4.4 Third-Party Perspective

1.4.5 Primary Research

1.5 InProductation Analysis & Data Analysis Models

1.6 List of Data Sources

Chapter 2 Pea Protein Market: Executive Summary

2.1 Market Snapshot

2.2 Segment Snapshot

2.3 Competitive Landscape Snapshot

Chapter 3 Pea Protein Market: Industry Outlook

3.1 Market Lineage Outlook

3.1.1 Parent Market Outlook

3.1.2 Related/Ancillary Market Outlook

3.2 Penetration & Growth Prospect Mapping

3.3 Industry Value Chain Analysis

3.3.1 Raw Material Trends

3.3.2 Manufacturing Trends

3.3.3 Sales Channel Analysis

3.4 Technology Framework

3.5 Market Dynamics

3.5.1 Market Drivers Analysis

3.5.2 Market Restraints Analysis

3.5.3 Market Challenges

3.6 Business Environment Analysis

3.6.1 Porter’s Five Forces Analysis

3.6.2 PESTEL Analysis

3.7 Market Entry Strategies

Chapter 4 Pea Protein Market: Product Estimates & Trend Analysis

4.1 Product Movement Analysis & Market Share, 2022 & 2030

4.2 Pea Protein Market Estimates & Forecast, By Product (Metric Tons, USD Million)

4.3 Isolates

4.4 Concentrates

4.5 Textured

4.6 Hydrolysates

Chapter 5 Pea Protein Market: Form Estimates & Trend Analysis

5.1 Form Movement Analysis & Market Share, 2022 & 2030

5.2 Pea Protein Market Estimates & Forecast, By Form (Metric Tons, USD Million)

5.3 Dry

5.4 Wet

Chapter 6 Pea Protein Market: Source Estimates & Trend Analysis

6.1 Form Movement Analysis & Market Share, 2022 & 2030

6.2 Pea Protein Market Estimates & Forecast, By Form (Metric Tons, USD Million)

6.3 Yellow Split Peas

6.4 Others

Chapter 7 Pea Protein Market: Application Estimates & Trend Analysis

7.1 Application Movement Analysis & Market Share, 2022 & 2030

7.2 Pea Protein Market Estimates & Forecast, By Application (Metric Tons, USD Million)

7.3 Food & Beverages

7.3.1 Meat substitutes

7.3.2 Bakery goods

7.3.3 Dietary supplements

7.3.4 Beverages

7.3.5 Others

7.4 Personal Care & Cosmetics

7.5 Animal Feed

7.6 Others

Chapter 8 Pea Protein Market: Regional Estimates & Trend Analysis

8.1 Global Pea Protein Market: Regional Outlook

8.2 North America

8.2.1 North America Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.2.2 North America Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.2.3 U.S.

8.2.3.1 U.S. Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.2.3.2 U.S. Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.2.4 Canada

8.2.4.1 Canada Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.2.4.2 Canada Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.2.5 Mexico

8.2.5.1 Mexico Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.2.5.2 Mexico Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.3 Europe

8.3.1 Europe Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.3.2 Europe Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.3.3 Germany

8.3.3.1 Germany Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.3.3.2 Germany Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.3.4 UK

8.3.4.1 UK Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.3.4.2 UK Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.3.5 France

8.3.5.1 France Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.3.5.2 France Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.3.6 Italy

8.3.6.1 Italy Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.3.6.2 Italy Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.3.7 Spain

8.3.7.1 Spain Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.3.7.2 Spain Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.3.8 Sweden

8.3.8.1 Sweden Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.3.8.2 Sweden Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.3.9 Netherlands

8.3.9.1 Netherlands Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.3.9.2 Netherlands Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.4 Asia Pacific

8.4.1 Asia Pacific Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.4.2 Asia Pacific Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.4.3 China

8.4.3.1 China Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.4.3.2 China Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.4.4 Japan

8.4.4.1 Japan Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.4.4.2 Japan Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.4.5 India

8.4.5.1 India Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.4.5.2 India Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.4.6 Australia & New Zealand

8.4.6.1 Australia & New Zealand Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.4.6.2 Australia & New Zealand Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.4.7 South Korea

8.4.7.1 South Korea Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.4.7.2 South Korea Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.5 Central & South America

8.5.1 Central & South America Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.5.2 Central & South America Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.5.3 Brazil

8.5.3.1 Brazil Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.5.3.2 Brazil Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.5.4 Argentina

8.5.4.1 Argentina Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.5.4.2 Argentina Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.6 Middle East & Africa

8.6.1 Middle East & Africa Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.6.2 Middle East & Africa Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.6.3 UAE

8.6.3.1 UAE Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.6.3.2 UAE Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.6.4 South Africa

8.6.4.1 South Africa Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.6.4.2 South Africa Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

Chapter 9 Competitive Landscape

9.1 Company/Competition Categorization (Key Innovators, Market Leaders, And Emerging Players)

9.2 Participants’ Overview

9.3 Financial Performance

9.4 Product Benchmarking

9.5 Company Market Share Analysis, 2022

9.6 Company Heat Map Analysis, 2022

9.7 Strategy Mapping

List of Tables

Table 1 Pea Protein Market Revenue Estimates and Forecasts, By Product, 2017 - 2030 (Metric Tons)

Table 2 Pea Protein Market Revenue Estimates and Forecasts, By Product, 2017 - 2030 (USD Million)

Table 3 Pea Protein Market Revenue Estimates and Forecasts, By Form, 2017 - 2030 (Metric Tons)

Table 4 Pea Protein Market Revenue Estimates and Forecasts, By Form, 2017 - 2030 (USD Million)

Table 5 Pea Protein Market Revenue Estimates and Forecasts, By Source, 2017 - 2030 (Metric Tons)

Table 6 Pea Protein Market Revenue Estimates and Forecasts, By Source, 2017 - 2030 (USD Million)

Table 7 Pea Protein Market Revenue Estimates and Forecasts, By Application, 2017 - 2030 (Metric Tons)

Table 8 Pea Protein Market Revenue Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

Table 9 Company Market Share, 2022

List of Figures

Fig. 1 Pea protein market segmentation & scope

Fig. 2 Information procurement

Fig. 3 Primary research pattern

Fig. 4 Primary research process

Fig. 5 Primary research approaches

Fig. 6 Pea protein market: Market snapshot

Fig. 7 Pea protein market: Segment outlook

Fig. 8 Pea protein market: Competitive Outlook

Fig. 9 Pea protein market: Penetration & growth prospect mapping

Fig. 10 Pea protein market: Value chain analysis

Fig. 11 Pea protein market: Porter’s analysis

Fig. 12 Pea protein market: PESTEL analysis

Fig. 13 Pea protein market, by product: Key takeaways

Fig. 14 Pea protein market, by product: Market share, 2022 & 2030

Fig. 15 Isolates Pea protein market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 16 Isolates Pea protein market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 17 Concentrates Pea protein market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 18 Concentrates Pea protein market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 19 Textured Pea protein market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 20 Textured Pea protein market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 21 Hydrolysates Pea protein market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 22 Hydrolysates Pea protein market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 23 Pea protein market, by form: Key takeaways

Fig. 24 Pea protein market, by form: Market share, 2022 & 2030

Fig. 25 Dry Pea protein market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 26 Dry Pea protein market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 27 Wet Pea protein market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 28 Wet Pea protein market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 29 Pea protein market, by source: Key takeaways

Fig. 30 Pea protein market, by source: Market share, 2022 & 2030

Fig. 31 Pea protein market estimates & forecasts, by yellow split peas, 2017 - 2030 (Metric Tons)

Fig. 32 Pea protein market estimates & forecasts, by yellow split peas 2017 - 2030 (USD Million)

Fig. 33 Pea protein market estimates & forecasts, by others, 2017 - 2030 (Metric Tons)

Fig. 34 Pea protein market estimates & forecasts, by others, 2017 - 2030 (USD Million)

Fig. 35 Pea protein market, by application: Key takeaways

Fig. 36 Pea protein market, by application: Market share, 2022 & 2030

Fig. 37 Pea protein market estimates & forecasts, by food & beverages, 2017 - 2030 (Metric Tons)

Fig. 38 Pea protein market estimates & forecasts, by food & beverages, 2017 - 2030 (USD Million)

Fig. 39 Pea protein market estimates & forecasts, by meat substitutes, 2017 - 2030 (Metric Tons)

Fig. 40 Pea protein market estimates & forecasts, by meat substitutes, 2017 - 2030 (USD Million)

Fig. 41 Pea protein market estimates & forecasts, by bakery goods, 2017 - 2030 (Metric Tons)

Fig. 42 Pea protein market estimates & forecasts, by bakery goods, 2017 - 2030 (USD Million)

Fig. 43 Pea protein market estimates & forecasts, by dietary supplements, 2017 - 2030 (Metric Tons)

Fig. 44 Pea protein market estimates & forecasts, by dietary supplements, 2017 - 2030 (USD Million)

Fig. 45 Pea protein market estimates & forecasts, by beverages, 2017 - 2030 (Metric Tons)

Fig. 46 Pea protein market estimates & forecasts, by beverages, 2017 - 2030 (USD Million)

Fig. 47 Pea protein market estimates & forecasts, by others, 2017 - 2030 (Metric Tons)

Fig. 48 Pea protein market estimates & forecasts, by others, 2017 - 2030 (USD Million)

Fig. 49 Pea protein market estimates & forecasts, by personal care & cosmetics, 2017 - 2030 (Metric Tons)

Fig. 50 Pea protein market estimates & forecasts, by personal care & cosmetics, 2017 - 2030 (USD Million)

Fig. 51 Pea protein market estimates & forecasts, by animal feed, 2017 - 2030 (Metric Tons)

Fig. 52 Pea protein market estimates & forecasts, by animal feed, 2017 - 2030 (USD Million)

Fig. 53 Pea protein market estimates & forecasts, by others, 2017 - 2030 (Metric Tons)

Fig. 54 Pea protein market estimates & forecasts, by others, 2017 - 2030 (USD Million)

Fig. 55 North America market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 56 North America market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 57 U.S. market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 58 U.S. market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 59 Canada market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 60 Canada market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 61 Mexico market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 62 Mexico market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 63 Europe market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 64 Europe market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 65 Germany market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 66 Germany market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 67 UK market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 68 UK market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 69 France market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 70 France market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 71 Italy market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 72 Italy market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 73 Spain market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 74 Spain market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 75 Sweden market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 76 Sweden market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 77 Netherlands market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 78 Netherlands market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 79 Asia Pacific market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 80 Asia Pacific market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 81 China market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 82 China market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 83 Japan market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 84 Japan market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 85 India market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 86 India market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 87 Australia & New Zealand market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 88 Australia & New Zealand market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 89 South Korea Zealand market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 90 South Korea market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 91 Central & South America market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 92 Central & South America market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 93 Brazil market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 94 Brazil market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 95 Argentina market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 96 Argentina market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 97 Middle East & Africa market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 98 Middle East & Africa market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 99 South Africa market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 100 South Africa market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 101 Pea protein market: Key Company/Competition Categorization

Fig. 102 Pea protein market: Company market share analysis (public companies)

Fig. 103 Company market position analysisWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Pea Protein Product Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Pea Protein Form Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

- Dry

- Wet

- Pea Protein Source Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

- Yellow Split Peas

- Others

- Pea Protein Application Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Pea Protein Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- North America Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- North America Pea Protein Market, by Form

- Dry

- Wet

- North America Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- North America Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- U.S.

- U.S. Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- U.S. Pea Protein Market, by Form

- Dry

- Wet

- U.S. Pea Protein Market, by Source

- Yellow Split Peas

- Others

- U.S. Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- U.S. Pea Protein Market, by Product

- Canada

- Canada Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Canada Pea Protein Market, by Form

- Dry

- Wet

- Canada Pea Protein Market, by Source

- Yellow Split Peas

- Others

- Canada Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Canada Pea Protein Market, by Product

- Mexico

- Mexico Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Mexico Pea Protein Market, by Form

- Dry

- Wet

- Mexico Pea Protein Market, by Source

- Yellow Split Peas

- Others

- Mexico Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- North America Pea Protein Market, by Product

- Europe

- Europe Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Europe Pea Protein Market, by Form

- Dry

- Wet

- Europe Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Europe Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Germany

- Germany Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Germany Pea Protein Market, by Form

- Dry

- Wet

- Germany Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Germany Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Germany Pea Protein Market, by Product

- U.K

- U.K Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- U.K Pea Protein Market, by Form

- Dry

- Wet

- U.K Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- U.K Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- U.K Pea Protein Market, by Product

- France

- France Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- France Pea Protein Market, by Form

- Dry

- Wet

- France Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- France Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- France Pea Protein Market, by Product

- Italy

- Italy Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Italy Pea Protein Market, by Form

- Dry

- Wet

- Italy Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Italy Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Italy Pea Protein Market, by Product

- Spain

- Spain Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Spain Pea Protein Market, by Form

- Dry

- Wet

- Spain Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Spain Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Spain Pea Protein Market, by Product

- Sweden

- Sweden Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Sweden Pea Protein Market, by Form

- Dry

- Wet

- Sweden Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Sweden Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Sweden Pea Protein Market, by Product

- Netherlands

- Netherlands Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Netherlands Pea Protein Market, by Form

- Dry

- Wet

- Netherlands Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Netherlands Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Netherlands Pea Protein Market, by Product

- Europe Pea Protein Market, by Product

- Asia Pacific

- Asia Pacific Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Asia Pacific Pea Protein Market, by Form

- Dry

- Wet

- Asia Pacific Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Asia Pacific Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- China

- China Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- China Pea Protein Market, by Form

- Dry

- Wet

- China Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- China Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- China Pea Protein Market, by Product

- India

- India Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- India Pea Protein Market, by Form

- Dry

- Wet

- India Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- India Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- India Pea Protein Market, by Product

- Japan

- Japan Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Japan Pea Protein Market, by Form

- Dry

- Wet

- Japan Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Japan Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Japan Pea Protein Market, by Product

- Australia & New Zealand

- Australia & New Zealand Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Australia & New Zealand Protein Market, by Form

- Dry

- Wet

- Australia & New Zealand Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Australia & New Zealand Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Australia & New Zealand Pea Protein Market, by Product

- South Korea

- South Korea Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- South Korea Pea Protein Market, by Form

- Dry

- Wet

- South Korea Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- South Korea Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- South Korea Pea Protein Market, by Product

- Asia Pacific Pea Protein Market, by Product

- Central & South America

- Central & South America Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Central & South America Pea Protein Market, by Form

- Dry

- Wet

- Central & South America Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Central & South America Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Brazil

- Brazil Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Brazil Pea Protein Market, by Form

- Dry

- Wet

- Brazil Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Brazil Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Brazil Pea Protein Market, by Product

- Argentina

- Argentina Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Argentina Pea Protein Market, by Form

- Dry

- Wet

- Argentina Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Argentina Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Argentina Pea Protein Market, by Product

- Central & South America Pea Protein Market, by Product

- Middle East & Africa

- Middle East & Africa Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Middle East & Africa Pea Protein Market, by Form

- Dry

- Wet

- Middle East & Africa Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Middle East & Africa Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- South Africa

- South Africa Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- South Africa Pea Protein Market, by Form

- Dry

- Wet

- South Africa Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- South Africa Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- South Africa Pea Protein Market, by Product

- Middle East & Africa Pea Protein Market, by Product

- North America

Pea Protein Market Dynamics

Driver: Growing Preference For High-Protein Diet

The consumption of a high-protein diet among consumers and rising health awareness are estimated to drive market growth. Rising incidences of chronic illnesses due to changing lifestyles and growing fitness trends, particularly among the millennial population are projected to boost protein intake. With increasingly busier lifestyles, consumers are unable to consume a nutritionally rich complete diet regularly, which prompts them to seek nutrients from packaged food products. The competition within packaged food products has increased significantly during the past few years. To outpace the competition, manufacturers are increasingly incorporating functional ingredients into their products to increase the protein content of the product, thereby attracting health-conscious consumers and fitness enthusiasts. These factors are estimated to drive market growth over the forecast period.

Driver: Rising Popularity of Meat Substitutes

Meat substitutes, also known as meat analogs, offer nearly similar aesthetic characteristics such as flavor, texture, and appearance as well as nutritional characteristics as that of traditional meat products. These substitutes are often made from soy-based products such as tofu and tempeh. The growing vegan population globally is anticipated to drive market growth. Moreover, animal cruelty and rising impact of social media regarding veganism are among the few other factors leading to the growth of the vegan population. Processed food manufacturers are increasingly utilizing ingredients that are sourced from plants to cater to the vegan population, which, in turn, is expected to fuel the growth of the pea protein market.

Restraint: High Penetration of Animal Protein Ingredients

The demand for animal protein among consumers is high which is estimated to harm market growth. The animal protein ingredients industry is also strengthened by the presence of dominant market participants, including GELITA AG, Omega Protein Corporation, and Bovogen Biologicals Pty Ltd among others.

What Does This Report Include?

This section will provide insights into the contents included in this pea protein market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Pea protein market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Pea protein market quantitative analysis

-

Market size, estimates, and forecast from 2017 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the pea protein market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for pea protein market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of pea protein market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Pea Protein Market Categorization:

The pea protein market was categorized into five segments, namely product (Isolates, Concentrates, Textured, Hydrolysates), form (Dry, Wet), source (Yellow Split Peas), application (Food & Beverages, Personal Care & Cosmetics, Animal Feed), region (North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa)

Segment Market Methodology:

The pea protein market was segmented into product, form, source, application, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The pea protein market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into eighteen countries, namely, the U.S.; Canada; Mexico; the UK; Germany; France; Italy; Spain; Sweden; Netherlands; China; India; Japan; Australia & New Zealand; South Korea; Brazil; Argentina; South Africa.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Pea protein market companies & financials:

The pea protein market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Burcon - Burcon was established in 1998 and is headquartered in Vancouver, Canada. It is engaged in the development of protein (plant-based) extraction and purification in Canada. The company produces a soy protein under the brand name CLARISOY, which finds application in dairy foods, coffee whiteners/creamers, and neutral (pH) beverages. It is a public company and trades on The Toronto Stock Exchange.

-

Roquette Frères - Roquette Frères was founded in 1933 and is headquartered in Lestrem, France. The company is involved in the production of starch and starch derivatives from corn, wheat, peas, and potatoes. These derivatives are used to manufacture ingredients for use in industries including pharmaceutical, food, paper, animal feed, textiles, and chemicals. It operates through six business segments, namely BioPharma, Pharma & Nutraceuticals, Cosmetics, Food & Nutrition, Animal Nutrition, and Industrial Markets.

-

The Scoular Company - The Scoular Company was founded in 1892 and is headquartered in Nebraska, U.S. It provides supply chain solutions to end-users and suppliers of grain, feed ingredients, and food ingredients. The company is engaged in the process of buying, storing, handling, processing, and selling ingredients and grain and also manages logistics and transport functions internationally. It is amongst the largest privately held companies in the U.S.

-

DuPont- DuPont was founded in 1802 and is headquartered in Wilmington, U.S. It operates as a global science and technology company. The company has various product lines including advanced printing solutions, adhesives, animal nutrition, biomaterials, clean technologies, construction materials, consumer products, dietary supplements, and others. It is a public company listed on The New York Stock Exchange.

-

Cosucra - COSUCRA was established in 1852 and is headquartered in Pecq, Belgium. The company is engaged in the manufacturing and distribution of food ingredients including chicory soluble fiber, pea protein isolate, and pea fiber. Its functional ingredients are widely utilized in dairy products, fruit juices, dietary supplements, meat & savory products, and animal feed. The company manufactures pea protein isolates containing protein composition from 88% to 90%. As of 2019, it had a presence in around 45 countries across Asia, Europe, North America, and South America with an employee strength of over 270.

-

Nutri-Pea -Nutri-Pea was established in 1997 and is headquartered in Manitoba, Canada. The company is engaged in manufacturing food ingredients from Canadian yellow peas. Its product portfolio comprises pea protein isolates, starch, and fiber products. Nutri-Pea utilizes wet milling as well as extraction processes for the production of protein ingredients. In the past few years, the company has received ISO 9001:2000, Kosher, Halal, and HACCP quality certifications for its production processes. As of 2019, it had a manufacturing facility spread across an area of 7,761 square feet and an employee strength of 50 people.

-

Shandong Jianyuan Group - Shandong Jianyuan Foods Co., Ltd. was founded in 2015 and is located in Zhaoyuan, China. The group is export oriented leading enterprise whose business covers R&D, manufacturing, planting, trade and other self-managerial import and export authority. The company is engaged in the production and distribution of vermicelli, rice noodles, pea proteins, fibers, and starch. The company operates as a subsidiary of Yantai Jincheng Food Co., Ltd. and had an employee strength of over 200. In the past few years, the company has received HACCP, ISO 9001, Kosher, Halal, and BRC quality certifications for its production processes.

-

SOTEXPRO - SOTEXPRO was established in 1995 and is headquartered in Bermericourt Marne, France. The company is a subsidiary of Gemef industries, a family-owned company since 1897, which has acquired a unique expertise in the field of pulses production and processing them into ingredients. The company is engaged in the manufacturing and distribution of functional ingredients for the food & beverage and animal feed industries.

-

Yantai Oriental Protein Tech, Co., Ltd. - Yantai Oriental Protein Tech Co., Ltd. was founded in 2008 and is headquartered in Zhaoyuan, China. Its product portfolio comprises pea fiber, pea protein isolates, pea protein concentrates, and pea starch. The company processes yellow peas into raw materials to manufacture finished goods. It manufactures protein extracts by applying advanced physical fractionation process using non-GMO peas from the U.S. and Canada.

-

PURIS - PURIS, formerly known as World Food Processing, was established in 1985 and is headquartered in Minneapolis, U.S. The company is engaged in the business of manufacturing and distribution of protein ingredients derived from corn, soy, and pea. As of 2019, the company had production facilities situated in Oskaloosa, Minnesota, and Wisconsin with accreditation for non-GMO certificates and employee strength of 100

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Pea Protein Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2022, historic information from 2017 to 2021, and forecast from 2023 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Pea Protein Market Report Assumptions:

-

The report provides market value for the base year 2022 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."