- Home

- »

- Distribution & Utilities

- »

-

Perovskite Solar Cell Market Size And Share Report, 2030GVR Report cover

![Perovskite Solar Cell Market Size, Share & Trends Report]()

Perovskite Solar Cell Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Flexible, Rigid), By Application (Smart Glass, Solar Panel), By Vertical (Aerospace & Defense, Industrial, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-404-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Perovskite Solar Cell Market Summary

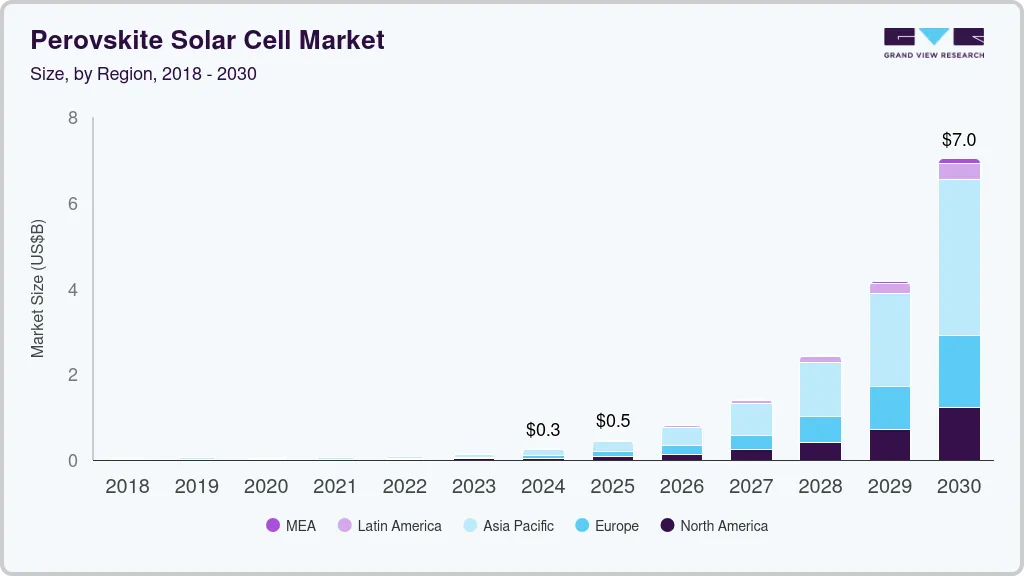

The global perovskite solar cell market size was estimated at USD 264.62 million in 2024 and is projected to reach USD 7021.18 million by 2030, growing at a CAGR of 72.18% from 2025 to 2030. Technological advancements have led to significant improvements in power conversion efficiency, with perovskite PV cells exceeding most thin-film technologies in small-area lab devices.

Key Market Trends & Insights

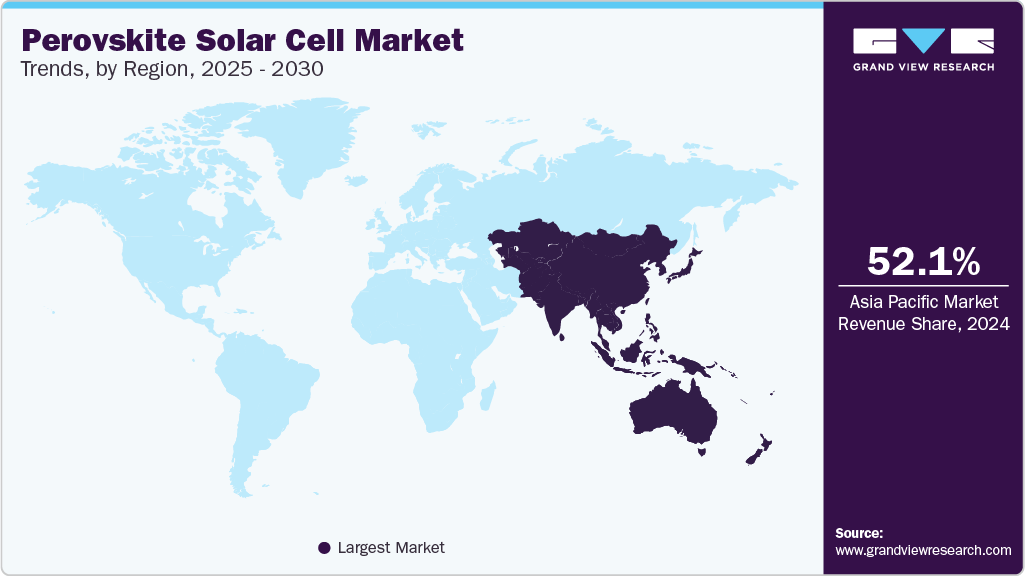

- The Asia Pacific perovskite solar cell market dominated the global industry with a revenue share of over 52.14% in 2024.

- The perovskite solar cell market in the U.S. is expected to grow at a significant CAGR over the forecast period.

- Based on product, the rigid segment held the largest revenue share of 69.79% in 2024.

- Based on vertical, the utility segment held the largest revenue share of 35.57% in 2024.

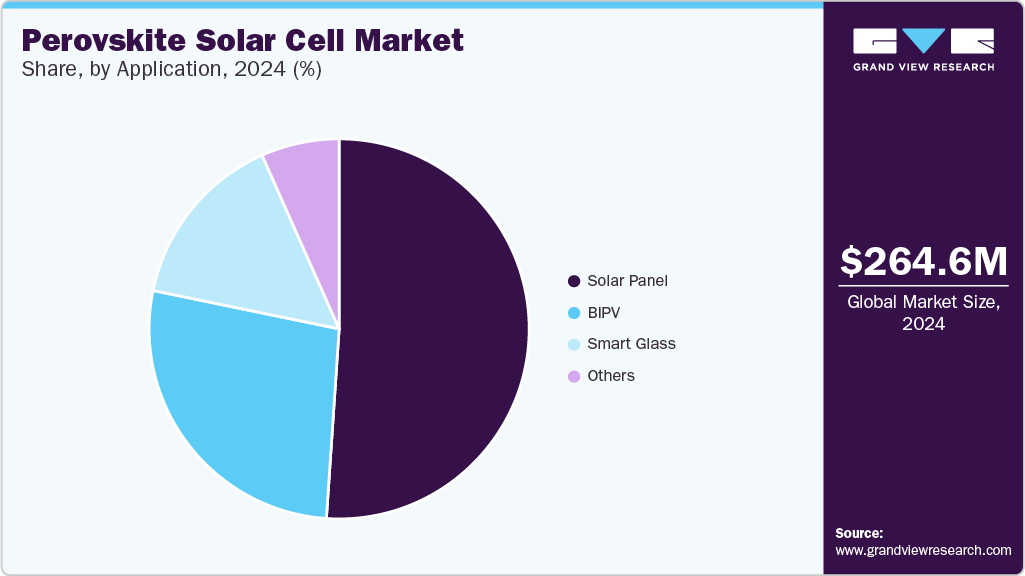

- By application, the solar panels segment held the largest revenue share of 51.07% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 264.62 Million

- 2030 Projected Market Size: USD 7021.18 Million

- CAGR (2025-2030): 72.18%

- Asia Pacific: Largest market in 2024

The ability to tune perovskites to respond to different colors in the solar spectrum by changing material composition is another advantage. The growth of the perovskite solar cell industry is driven by several key factors.

Technological advancements have led to significant improvements in power conversion efficiency, with perovskite PV cells exceeding 25% in lab devices. Perovskites also offer the potential for faster capacity expansion than silicon PV due to scalable fabrication approaches like sheet-to-sheet and roll-to-roll processing.

Drivers, Opportunities & Restraints

The perovskite solar cell industry is driven by the flexibility and sustainability of perovskite solar cells, which can be produced in various sizes and shapes, including flexible and transparent versions, making them suitable for diverse end-uses such as Building-Integrated Photovoltaics (BIPV), portable electronics, and clothing.

The rise of smart technologies and the Internet of Things (IoT) also opens avenues for perovskite applications in energy-efficient systems. Furthermore, advancements in manufacturing techniques, such as roll-to-roll processing, promise to enhance scalability and reduce costs, making perovskite solar cells more accessible for widespread adoption. Overall, the combination of technological advancements, market demand for sustainable solutions, and versatile applications positions the perovskite solar cell market for significant growth and innovation in the near future.

The perovskite solar cell industry faces several significant restraints that could impede its growth and widespread adoption. One of the primary challenges is the stability and durability of perovskite materials, which are known to degrade quickly when exposed to moisture and heat. This instability raises concerns about the long-term performance of perovskite solar cells in real-world conditions.

Product Insights

Based on product, the rigid segment held the largest revenue share of 69.79% in 2024. The rigid perovskite solar cell market is propelled by a growing need for durable, high-efficiency solar technologies that can be deployed in fixed installations like rooftop and ground-mounted solar systems. These cells are particularly attractive in utility-scale applications due to their superior power conversion efficiencies, which have surpassed 25% in laboratory settings. Moreover, the ability to fine-tune the composition of rigid perovskite materials allows them to harness a broader spectrum of sunlight, further improving performance and energy yield.

On the other hand, the demand for flexible perovskite solar cells is rising rapidly, fueled by the push for portable, lightweight solar technologies. These cells are particularly beneficial for use in curved or irregular surfaces, such as wearable electronics, vehicle exteriors, or building-integrated photovoltaics (BIPV). Their adaptability makes them ideal for sectors where traditional rigid panels cannot be installed effectively. As innovations continue to improve their stability and efficiency, flexible perovskite solar cells are expected to play a crucial role in expanding solar adoption across new use cases.

Vertical Insights

Based on vertical, the utility segment held the largest revenue share of 35.57% in 2024. The utility perovskite solar cell market is primarily driven by increasing demand for clean, large-scale power generation. With global pressure shifting from fossil fuels to renewable sources, utility companies are turning to perovskite technologies due to their high-power conversion efficiencies and cost-effective production methods. Continued technological advancements have significantly improved the stability and lifespan of these cells, making them viable for long-duration deployment in utility-scale solar farms. Furthermore, the tunable nature of perovskite materials allows operators to optimize energy capture across a broad solar spectrum, enhancing overall system performance.

Meanwhile, the residential perovskite solar cell market is gaining momentum thanks to rising consumer interest in sustainable living and energy independence. Homeowners are increasingly drawn to the affordability and efficiency of perovskite cells, which offer a cost-effective alternative to traditional silicon panels. Though typically more rigid in large-scale setups, perovskite solar cells can also be engineered for lightweight and aesthetically integrated residential installations, such as rooftops or facades. As home energy storage and net metering programs expand, residential users are incentivized to adopt perovskite-based solar technologies.

Application Insights

Based on application, solar panels held the largest revenue share of 51.07% in 2024. The rising global demand for high-efficiency, cost-effective renewable energy solutions drives the solar panel perovskite solar cell market. Perovskite-based solar panels offer significant advantages over traditional silicon panels, including lower production costs, tunable band gaps for enhanced energy capture, and lightweight designs that simplify installation. These characteristics make them an attractive option for residential and commercial energy systems. As advancements continue to improve their durability and scalability, perovskite solar panels are increasingly positioned as a disruptive force in the photovoltaic industry.

The BIPV (Building-Integrated Photovoltaics) perovskite solar cell market is driven by the increasing demand for sustainable building solutions that combine energy generation with aesthetic design. Perovskite solar cells offer high efficiency and lower production costs, making them ideal for integration into building materials such as facades, windows, and roofs. Their lightweight and flexible nature allows for innovative architectural applications, enhancing energy efficiency while reducing reliance on traditional energy sources. Additionally, the dual functionality of BIPV systems-serving both as structural elements and power generators-enables significant cost savings on materials and energy, further propelling market growth.

Regional Insights

North America perovskite solar cell market is driven by increasing demand for renewable energy solutions and advancements in solar technology. The region's strong focus on reducing carbon emissions and enhancing energy efficiency supports the adoption of perovskite solar cells, known for their high efficiency and lower production costs. Additionally, ongoing research and development efforts are improving the stability and performance of these cells, making them more attractive for utility-scale and residential applications. Supportive government policies and incentives further bolster market growth.

U.S. Perovskite Solar Cell Market Trends

The perovskite solar cell market in the U.S. is driven by a growing emphasis on renewable energy solutions and the need for efficient, cost-effective solar technology. The U.S. government’s supportive policies and incentives for clean energy adoption further stimulate market growth. Additionally, ongoing research and development efforts aim to enhance the stability and performance of perovskite solar cells, making them increasingly attractive for residential, commercial, and utility-scale applications.

Asia Pacific Perovskite Solar Cell Market Trends

The perovskite solar cell market in Asia Pacific dominated the global industry and accounted for the largest revenue share of over 52.14% in 2024. The demand for perovskite solar cells in the Asia Pacific region is significantly driven by the rapid urbanization and increasing energy needs of the population. This region hosts major manufacturing hubs, particularly in China, which is a leader in solar technology research and production. The growing emphasis on renewable energy sources, supported by government initiatives and investments, further propels market growth. Additionally, the high efficiency and lower production costs of perovskite solar cells compared to traditional silicon panels enhance their attractiveness for various applications, including residential and commercial use, thereby boosting overall demand in the region.

Europe Perovskite Solar Cell Market Trends

The perovskite solar cell market in Europe is driven by supportive government policies and ambitious renewable energy targets. The European Union aims to achieve at least 32% renewable energy in its energy mix by 2030, fostering growth in the solar sector. Additionally, the region's strong research and development ecosystem enhances innovation in perovskite technology, leading to improved efficiency and lower production costs. The increasing focus on sustainability and reducing carbon emissions further propels the adoption of perovskite solar cells across residential, commercial, and utility-scale applications, making Europe the largest market for this technology.

Germany perovskite solar cell market is significantly influenced by the country's strong commitment to renewable energy and sustainability initiatives. As one of the leading nations in solar energy adoption, Germany's focus on reducing carbon emissions aligns well with the advantages of perovskite technology, which offers high efficiency and lower production costs compared to traditional silicon solar cells.

The perovskite solar cell market in the UK is driven by a strong research and development ecosystem, with institutions like Oxford University leading advancements in perovskite technology. Additionally, the increasing focus on building-integrated photovoltaics (BIPV) and the growing popularity of smart home technologies create opportunities for the adoption of perovskite solar cells in residential and commercial applications. However, challenges related to material stability and the presence of lead in some perovskite formulations must be addressed to fully realize the market potential in the UK.

Latin America Perovskite Solar Cell Market Trends

The perovskite solar cell market in Latin America is driven by the region's abundant solar resources and the need for affordable, sustainable energy solutions. Countries like Brazil and Chile are investing in research and development to adapt perovskite technology to their local conditions.

Middle East & Africa Perovskite Solar Cell Market Trends

The perovskite solar cell market in the Middle East and Africa is growing, driven by the region's abundant solar resources and increasing energy needs. Countries like the UAE and South Africa are investing in renewable energy technologies to diversify their energy portfolios and reduce reliance on fossil fuels. Perovskite solar cells, known for their high efficiency and lower production costs, present a viable solution for addressing energy challenges in remote and off-grid areas.

Key Perovskite Solar Cell Market Companies Insights

Key players operating in the perovskite solar cell market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Perovskite Solar Cell Companies:

The following are the leading companies in the perovskite solar cell market. These companies collectively hold the largest market share and dictate industry trends.

- Alfa Aesar

- Dyenamo AB

- Energy Materials Corp,

- Fraunhofer ISE

- Frontier Energy Solution

- FrontMaterials Co. Ltd.

- FUJIFILM Wako Pure Chemical Corporation

- G24 Power Ltd.

- Greatcell Energy

- Microquanta Semiconductor Co., Ltd.

- Oxford PV

- Panasonic Corporation

Recent Developments

-

In June 2024, LONGi announced the achievement of a new world record efficiency of 30.1% for commercial M6 size silicon Perovskite Tandem Solar Cells at the 2024 Intersolar Europe in Munich, Germany.

-

As of April 2025, Panasonic continues its groundbreaking BIPV perovskite solar glass demonstration at Fujisawa Sustainable Smart Town, launched in August 2023. The project shows transparent, energy-generating glass integrated into building structures. Panasonic aims to commercialize the technology by 2026, with production ramp-up planned for late 2024.

Perovskite Solar Cell Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 463.98 million

Revenue forecast in 2030

USD 7.02 billion

Growth rate

CAGR of 72.18% from 2025 to 2030

Base year

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, vertical, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Russia; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Alfa Aesar, Dyenamo AB; Energy Materials Corp; Fraunhofer ISE; Frontier Energy Solution; FrontMaterials Co. Ltd.; FUJIFILM Wako Pure Chemical Corporation; G24 Power Ltd.; Greatcell Energy; Microquanta Semiconductor Co. Ltd.; Oxford PV; Panasonic Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

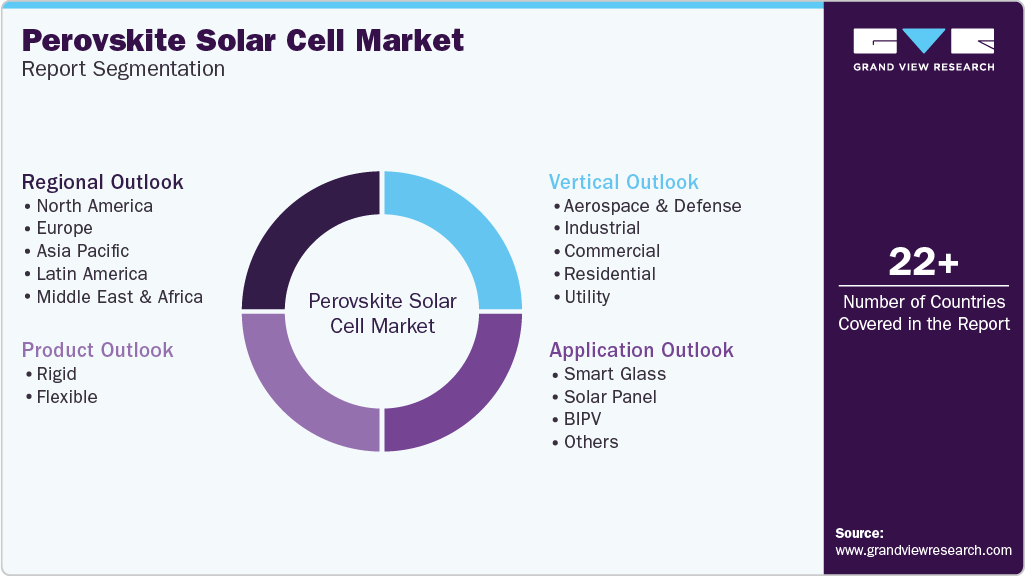

Global Perovskite Solar Cell Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global perovskite solar cell market report on the basis of product, vertical, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Rigid

-

Flexible

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Industrial

-

Commercial

-

Residential

-

Utility

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Smart Glass

-

Solar Panel

-

BIPV

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global perovskite solar cell market size was valued at USD 264.62 million in 2024 and is expected to reach USD 463.98 million in 2025.

b. The global perovskite solar cell market is expected to grow at a compound annual growth rate (CAGR) of 72.2% from 2025 to 2030 to reach USD 7.02 billion by 2030.

b. Based on Product, Flexible held the market with the largest revenue share of over 65.0% in 2024. The flexible perovskite solar cell market is driven by increasing demand for lightweight and flexible solar solutions, which allow for innovative applications in diverse sectors, including automotive, consumer electronics, and building-integrated photovoltaics (BIPV).

b. The perovskite solar cell market is a concentrated market with major companies such as Alfa Aesar, Dyenamo AB, Energy Materials Corp, Fraunhofer ISE, Frontier Energy Solution, FrontMaterials Co. Ltd.

b. Technological advancements have led to significant improvements in power conversion efficiency, with perovskite PV cells exceeding 25% in lab devices. The ability to tune perovskites to respond to different colors in the solar spectrum by changing material composition is another advantage.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.