- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Persulfates Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Persulfates Market Size, Share & Trends Report]()

Persulfates Market (2022 - 2030) Size, Share & Trends Analysis Report By Type (Ammonium, Sodium, Potassium), By End-use (Polymers, Electronics, Oil & Gas), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-999-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

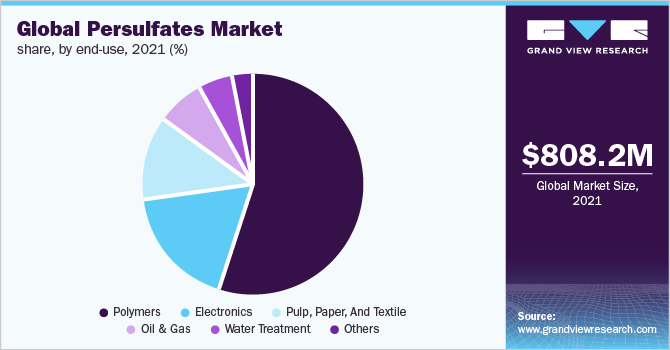

The global persulfates market size was valued at USD 808.16 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 3.5% from 2022 to 2030. This is attributed to the growing demand for persulfates from major end-use industries including polymers and the electronics industry. The polymer industry uses persulfates as initiators in the polymerization of synthetic rubber and latex. Sodium persulfate is considered an efficient microetchant to manufacture printed circuit boards in the electronics industry. Persulfates are used in several industrial processes as a key component. They are used in the preparation of acrylics, neoprene, polyvinyl chlorides, and polystyrenes. Persulfate initiation is utilized in preparing latex polymers for coatings, paints, and carpet backing. They can also be used as etchants for zinc, nickel, and titanium alloys. The product finds application in enhanced oil recovery, preparation of dispersants for toner formulations and ink jetting, water and soil remediation, and cobalt and nickel separation processes. In the cosmetics industry, the product is extensively used as a booster for hair bleaches and the oxidation of hair dyes.

Ammonium persulfate is produced by electrolyzing an aqueous solution of ammonium sulfate. Sodium persulfate is produced by reacting ammonium persulfate with caustic soda. The solution is then separated by cooling or vacuum concentration and then dried. Potassium persulfate is prepared by electrodeposition of a cold solution of potassium bisulfate in sulfuric acid at a higher current density. It can also be produced by reacting ammonium persulfate with potassium hydroxide.

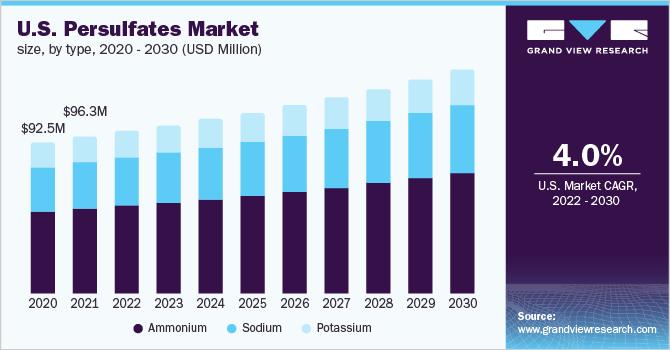

Type Insights

The ammonium segment dominated the market with a revenue share of over 50.0% in 2021. The growth is attributed to the wide range of applications of ammonium persulfate including the treatment of metal surfaces, manufacturing of semiconductors, and etching copper on printed circuit boards. Additionally, it is extensively used in wastewater treatment and as an initiator for the emulsion polymerization of acrylic monomers.

Ammonium persulfate (APS) finds application in several commercial applications. It is used for denim desizing and bleach activators in the textile industry. In the paper industry, it is used for de-inking and re-pulping. Moreover, APS is used as a reagent in molecular biology and biochemistry for the preparation of polyacrylamide gels.

Sodium persulfate emerged as the second-largest segment in 2021. The growth is attributed to the wide usage of the product as a detergent component and bleaching agent. It is a crucial component in the bleaching formulations in hair cosmetics. Moreover, sodium persulfate salt with high water-solubility is the most conventional among the three persulfates for in situ degradation of pollutants.

End-use Insights

The polymers segment dominated the market with a revenue share of over 50.0% in 2021. This is attributed to the application of all three persulfates as initiators in emulsion polymerization reactions for the preparation of polystyrenes, polyvinyl chlorides, neoprene, and acrylics. The product is also used as an initiator in concrete formulations and for the polymeric coating of graphite filaments.

Electronics emerged as the second-largest segment and is anticipated to expand at the highest revenue-based CAGR of 4.0% over the forecast period. The growth is attributed to significant growth in the electronics industry across the globe owing to the miniaturization of electronic products. The product is used as a cleaning agent and etchant in the manufacturing of printed circuit boards.

The others segment includes soil remediation, adhesives, mining, cosmetics, and photography. Persulfates are used in the cobalt and nickel separation process in mining. In photography, the product is used in bleaching solutions, equipment cleaning, and solution regeneration. The formulations used in the cosmetics industry use persulfates to boost the performance of hair bleaching.

Regional Insights

Asia Pacific emerged as the dominant region and accounted for a revenue share of over 45.0% in 2021. The growth is attributed to the presence of a large number of plastic manufacturing industries in the countries such as China, Indonesia, and Malaysia. The plastic production industry in Thailand has grown rapidly in recent years and currently boasts around 5,000 operating companies.

China is the largest producer of plastics across the globe accounting for around one-third of the global plastic production. Around 90.87 million tons of plastic were consumed in China in 2020. The country has more than 17,000 plastic factories that are concentrated in the Eastern and Central South regions. Moreover, China has the presence of some of the biggest electronic manufacturing companies including Lenovo, BOE Technology, and Huawei.

North America is predicted to expand at a revenue-based CAGR of 3.6% over the forecast period. This is attributed to the presence of several market leaders in the plastic industry such as ExxonMobil chemical division and DoW Chemical in the U.S. The plastics industry is the third-largest manufacturing industry in the country. Some of the majorly produced polymers in the U.S. include high-density polyethylene, low-density polyethylene, and linear low-density polyethylene.

Key Companies & Market Share Insights

The competitive landscape of the market is characterized by the adoption of several strategic initiatives such as mergers, acquisitions, divestitures, and business expansions by major market players. For instance, FMC Corporation acquired RheinPerChemie GmbH from Unionchimica S.p.A. in 2011, which was acquired by Evonik Industries AG in 2020. In September 2022, Calibre Chemicals, an Indian specialty chemicals company acquired RheinPerChemie GmbH from Evonik. Some prominent players in the global persulfates market include:

-

Evonik Active Oxygens

-

RheinPerChemie

-

UI VR Persulfates (United Initiators)

-

MITSUBISHI GAS CHEMICAL COMPANY, INC.

-

Fujian ZhanHua Chemical Co., Ltd.

-

Ak-Kim

-

Yatai Electrochemistry Co. Ltd.

-

Hebei Jiheng Group

-

Fujian Jianou Yongsheng Industry

-

San Yuan Chemical Co., Ltd.

Persulfates Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 831.17 million

Revenue forecast in 2030

USD 1.10 billion

Growth Rate

CAGR of 3.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in tons, revenue in USD thousand/million, and CAGR from 2022 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Russia; Belgium; China; Japan; India; South Korea; Brazil; Argentina; Turkey; South Africa; Saudi Arabia

Key companies profiled

Evonik Active Oxygens; RheinPerChemie; UI VR Persulfates ; MITSUBISHI GAS CHEMICAL COMPANY, INC. ; Fujian ZhanHua Chemical Co., Ltd.; Ak-Kim; Yatai Electrochemistry Co. Ltd.; Hebei Jiheng Group; Fujian Jianou Yongsheng Industry; San Yuan Chemical Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Persulfates Market Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global persulfates market report on the basis of type, end-use, and region:

-

Type Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Ammonium

-

Sodium

-

Potassium

-

-

End-use Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Polymers

-

Electronics

-

Pulp, Paper, And Textile

-

Oil & Gas

-

Water Treatment

- Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Russia

-

Belgium

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Turkey

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the persulfates market include Evonik Active Oxygens, RheinPerChemie, UI VR Persulfates, MITSUBISHI GAS CHEMICAL COMPANY, INC., Fujian ZhanHua Chemical Co., Ltd. , Ak-Kim, Yatai Electrochemistry Co. Ltd., Hebei Jiheng Group, Fujian Jianou Yongsheng Industry, and San Yuan Chemical Co., Ltd

b. Key factors that are driving the market growth include the growing demand for persulfates from major end-use industries including polymers and the electronics industry.

b. The global persulfates market size was estimated at USD 808.16 million in 2021 and is expected to reach USD 831.17 million in 2022.

b. The global persulfates market is expected to grow at a compound annual growth rate of 3.5% from 2022 to 2030 to reach USD 1.10 billion by 2030.

b. Asia Pacific dominated the persulfates market with a share of 47.7% in 2021. This is attributable to the presence of a large number of plastic manufacturing industries in the countries such as China, Indonesia, Malaysia, and others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.