- Home

- »

- Consumer F&B

- »

-

Pet Food E-commerce Market Size, Industry Report, 2033GVR Report cover

![Pet Food E-commerce Market Size, Share & Trends Report]()

Pet Food E-commerce Market (2025 - 2033) Size, Share & Trends Analysis Report By Pet Type (Dogs, Cats), By Price Range (Economy, Mid-range, Premium), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-826-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Food E-commerce Market Summary

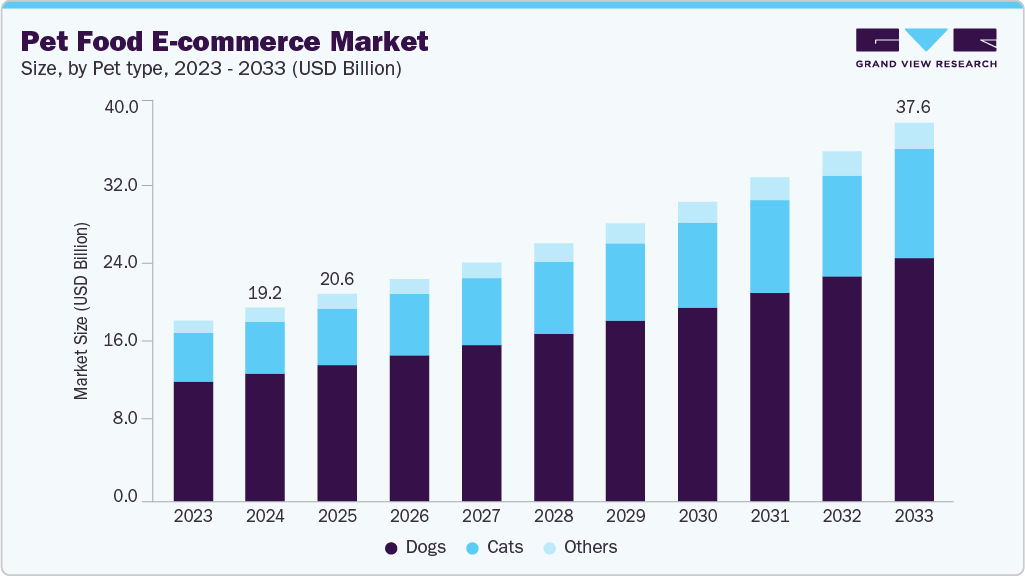

The global pet food e-commerce market size was estimated at USD 19.18 billion in 2024 and is projected to reach USD 37.56 billion in 2033, growing at a CAGR of 7.8% from 2025 to 2033. The rising pet humanization and demand for premium, health-focused diets, combined with the convenience of fast delivery, subscriptions, and seamless digital shopping, are some of the factors that are fueling the growth of the industry.

Key Market Trends & Insights

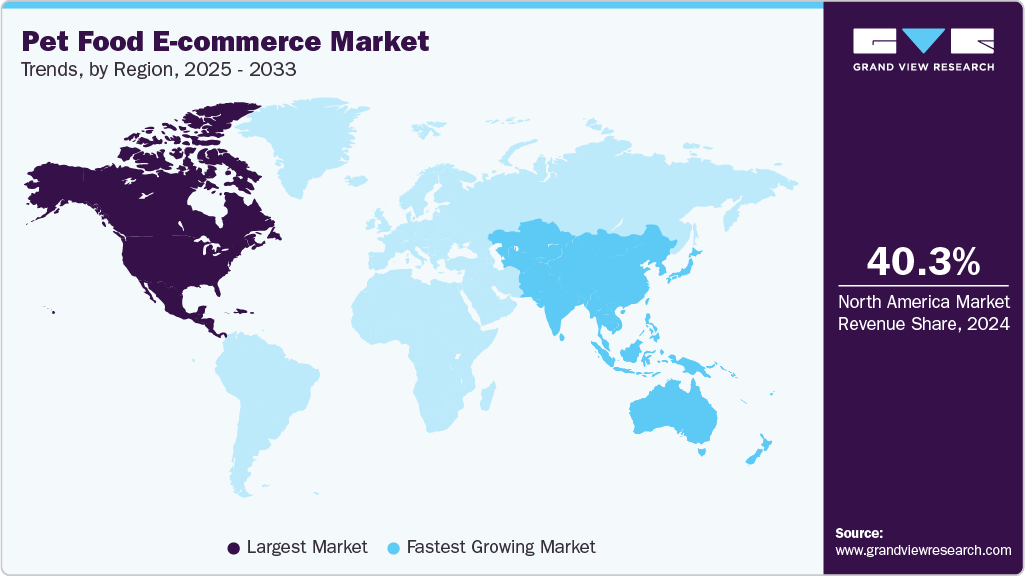

- The North American pet food e-commerce market captured a significant 40.25% of the global market share in 2024.

- The U.S. remains the largest market in North America, accounting for 85.3% of the region’s total revenue in 2024.

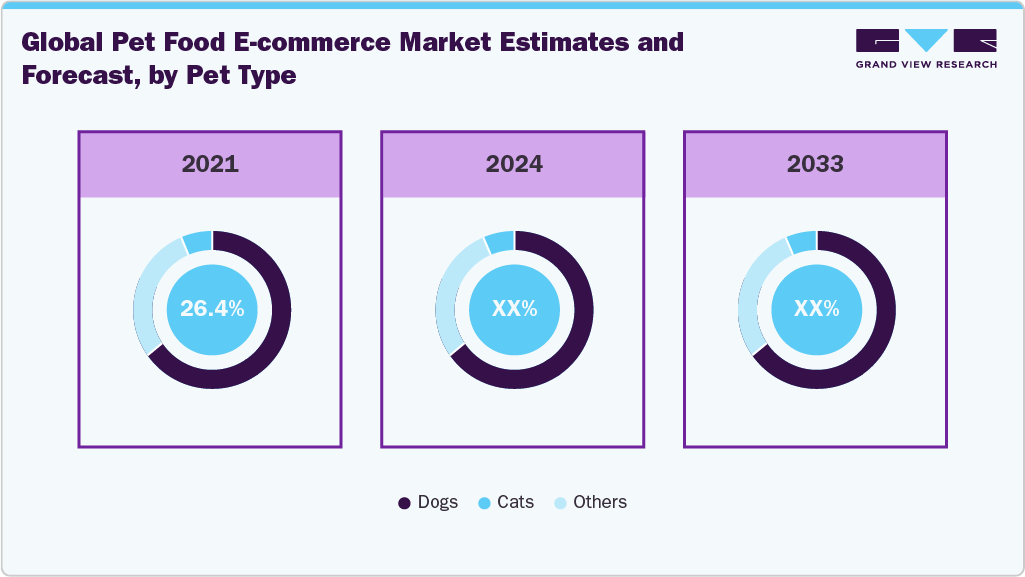

- By pet type, the dog food segment dominated the market and accounted for a revenue share of 66.4% in 2024.

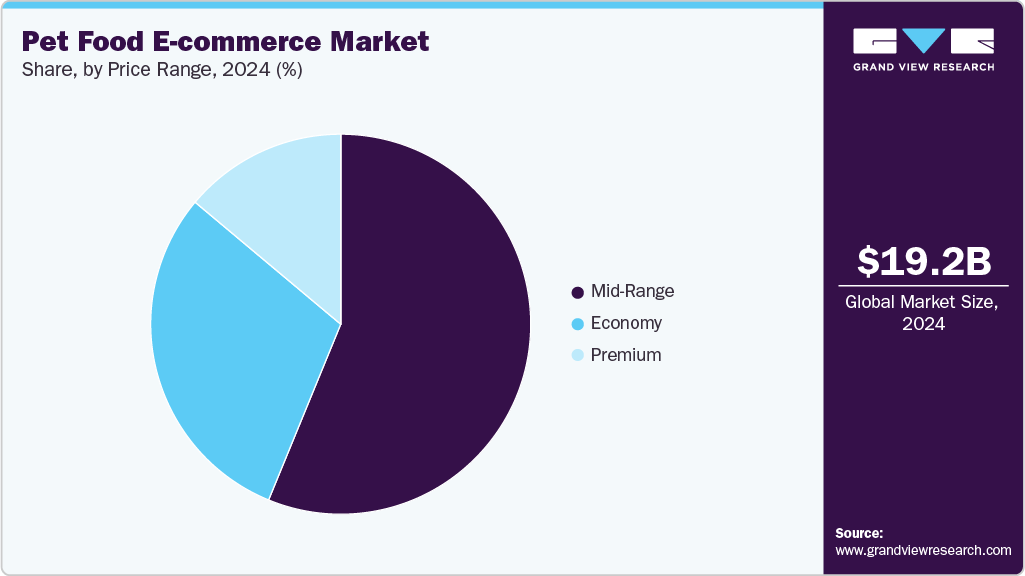

- By price range, mid-range pet food through e-commerce accounted for the largest revenue share of 56.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 19.18 Billion

- 2033 Projected Market Size: USD 37.56 Billion

- CAGR (2025-2033): 7.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The expanding presence of D2C and personalized pet food brands further reinforces the shift toward online purchasing. Pet owners worldwide increasingly treat pets as family members, driving demand for high-quality, specialized, and health-focused nutrition. As consumers shift toward premium, organic, grain-free, and functional diets, they turn to e-commerce platforms for wider product availability than local retail stores can provide. This change is particularly strong among Millennials and Gen Z, who prioritize wellness ingredients, preventive care, and vet-recommended formulations that rely heavily on digital research and online reviews before purchasing.

Widespread penetration of smartphones, digital wallets, and mobile-first marketplaces has made online shopping seamless in both developed and emerging markets. Platforms such as Amazon, Chewy, Zooplus, JD.com, Tmall, Shopee, and Mercado Libre offer a superior user experience through secure payments, fast delivery, personalized recommendations, and easy reorder features. Improved logistics networks and last-mile delivery capabilities have also expanded the reach of online pet food delivery, making e-commerce the default channel for many urban households.

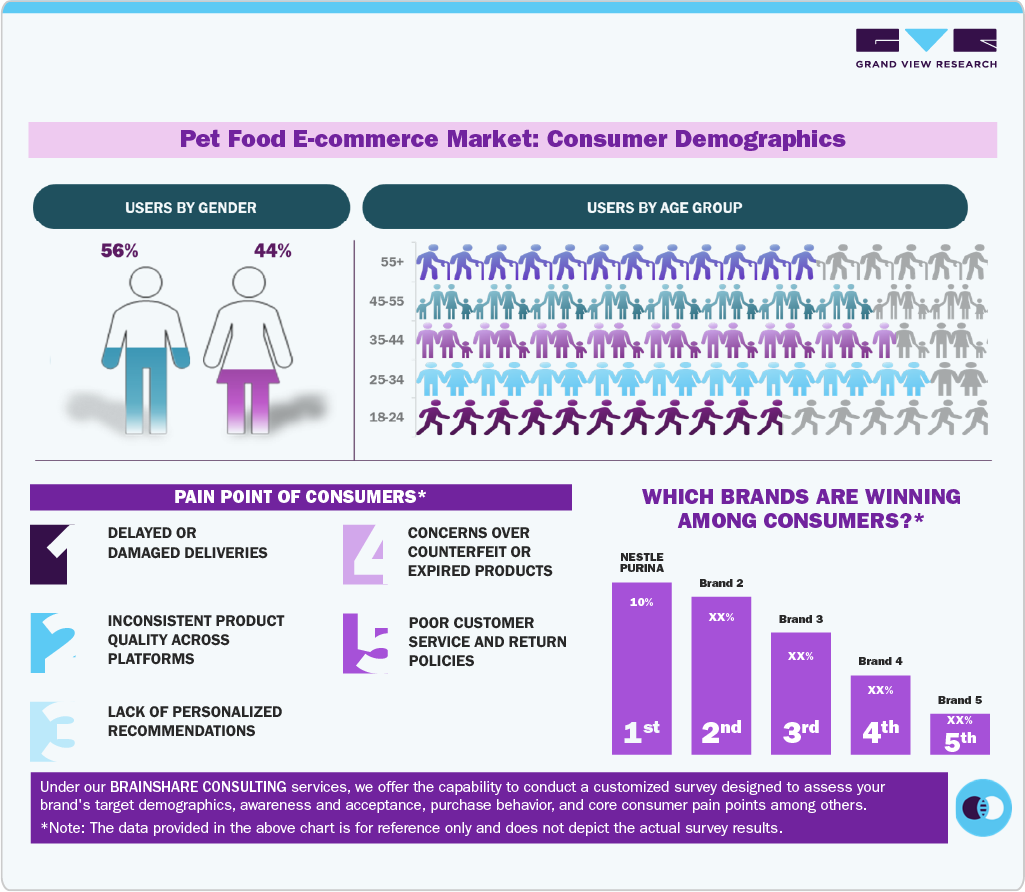

Consumer Insights for E-Commerce Pet Food

The global pet food e-commerce market is shaped by a diverse and expanding pet-owning population, with dogs and cats together representing the majority of household pets worldwide. While dog ownership remains slightly higher in North America, Latin America, and parts of Europe, cat ownership dominates in Western Europe and parts of Asia. This balanced distribution between dogs and cats creates steady demand across both product categories, driving innovation in breed-specific nutrition, functional diets, and life-stage-based formulations. As pet ownership rises globally-particularly among Millennials and Gen Z-consumer expectations around quality, transparency, and convenience continue to elevate market standards.

Across regions, consumers are increasingly prioritizing pet health, nutrition, and wellness, propelling stronger demand for premium, natural, and specialized pet food products. Shoppers globally conduct extensive research online, comparing ingredient lists, nutritional claims, and brand credibility before making purchase decisions. Veterinary-approved, organic, grain-free, hypoallergenic, and functional diets designed for digestion, skin health, joint care, or weight management are growing in popularity. Younger demographics, especially digital-first Millennials and Gen Z pet owners, rely heavily on online reviews, social media content, KOLs/influencers, and community recommendations, reinforcing the role of digital ecosystems in shaping brand perception and buyer trust.

E-commerce has become a central purchasing channel for pet food globally, driven by the growing appeal of home delivery, subscription/auto-ship models, and the ability to access a wider assortment than traditional offline retail can offer. Online marketplaces such as Amazon, Chewy, Zooplus, JD.com, Tmall, Lazada, and Mercado Libre provide not only extensive product ranges but also competitive pricing, discount bundles, and loyalty programs that incentivize repeat purchases. Consumers frequently combine pet food orders with related categories such as treats, litter, supplements, and accessories, to reduce delivery costs and maximize value.

The study titled “Customer Satisfaction in the Pet Food Subscription‑based Online Services” examined customer satisfaction in pet food subscription services using text-mining of 28,786 reviews. The study found that e-service quality, healthy ingredients, packaging, and nutritional value significantly increase satisfaction and loyalty, while price does not moderate this relationship. For the pet food e-commerce market, this underscores the importance of premium quality, service reliability, and tailored nutrition in driving customer retention and growth, particularly in subscription models.

Pet Type Insights

The dog food segment in the pet food e-commerce industry dominated the market and accounted for a revenue share of 66.4% in 2024. Dog ownership is more widespread, with around 68 million households in North America owning dogs, compared to 49 million owning cats. In addition, dog owners tend to spend more on their pets, purchasing larger quantities of food more regularly. Younger generations, particularly Gen Z and millennials, are driving demand for premium, subscription-based dog food products. Survey data from platforms such as Yummypets indicates that dog owners are more inclined to opt for home-delivery services, further boosting the e-commerce market. Moreover, increased consumer confidence in online dog food purchases, facilitated by broader product ranges and competitive pricing, is reinforcing this shift, as noted by regulators and ministries such as New Zealand’s Ministry for Primary Industries.

The Cat food sell through e-commerce globally is anticipated to register the fastest CAGR of 8.6% from 2025 to 2033. This growth is driven by the increasing number of cat owners, particularly in urban areas, and the rising trend of pet humanization, where pets are considered family members. As pet owners seek higher-quality, specialized food options for their cats, e-commerce platforms provide a convenient way to access a wider variety of products. The ease of home delivery, subscription services, and the ability to compare prices and product reviews are also encouraging more consumers to choose online shopping for their cat food needs. Additionally, the growing availability of premium and health-focused cat food options online is further fueling the market's expansion.

Price Range Insights

Sales of mid-range pet food through e-commerce accounted for a market share of 56.2% in 2024. This trend reflects the growing preference among pet owners for affordable yet quality products that provide a balance between price and nutritional value. Mid-range pet food is increasingly popular as it meets the demands of a broad consumer base, offering high-quality ingredients without the premium price tag. E-commerce platforms have made it easier for consumers to access these products, thanks to convenient shopping experiences, competitive pricing, and the ability to compare brands and formulations. This segment's dominance in online sales highlights the shift toward value-conscious purchasing, with more pet owners turning to digital channels for their pet food needs

The sales of premium pet food through e-commerce are expected to grow at a CAGR of 8.2% from 2025 to 2033. The growing trend of pet humanization, where pets are increasingly seen as family members, drives the demand for higher-quality, health-oriented food. Consumers are more aware of the benefits of premium formulations, such as improved nutrition and functional health benefits, which boost spending on these products. E-commerce platforms provide a convenient and accessible channel for premium pet food, offering a wider selection, subscription models, and better exposure for niche brands that may not be widely available in physical stores. Moreover, the rise in pet ownership, particularly in urban areas with higher disposable incomes, further supports the growth of premium pet food sales online.

Regional Insights

The North American pet food e-commerce market captured a significant 40.25% of the global market share in 2024. The market is mainly driven by pet humanization and demand for premium diets, ingredient transparency, and subscription-based auto-replenishment, with platforms like Chewy, marketplaces including Amazon, and D2C fresh meal brand The Farmer’s Dog benefiting from advanced logistics networks and strong digital buyer penetration across urban and rural households.

U.S. Pet Food E-commerce Market

The U.S. remains the largest market in North America, accounting for 85.3% of the region’s total revenue in 2024. The growth in the U.S. market is driven by driven by high purchasing power, dense retailer-to-consumer logistics infrastructure, and strong penetration of app-based subscriptions in both dry kibble and fresh meal categories. Consumers increasingly seek hyper-convenient delivery of brands such as Royal Canin, Hill’s, Blue Buffalo, and fresh food subscriptions like The Farmer’s Dog.

Europe Pet Food E-commerce Market

The pet food e-commerce market in Europe held a significant market share of 27.7% in the global market The European market is being shaped by preference for quality ingredients, regulatory alignment on nutritional claims, and greater purchase consideration for sustainable, recyclable, and low-carbon packaging formats. Countries such as the United Kingdom, Germany, France, Italy, Poland, and the Nordics lead platform adoption for pet food delivery.

The Germany pet food e-commerce market expected to grow at a CAGR of 7.0% from 2025 to 2033. Consumers value domestic and global brands like Royal Canin and Zooplus-enabled large scale purchases of dry and wet pet diets. Growth rationale for Germany is supported by strong electronics and consumer internet adoption, and high preference for durable nutrition optimized for dogs and cats

Asia Pacific Pet Food E-commerce Market

The Asia Pacific pet food e-commerce market is projected to grow at the fastest CAGR of 8.8% from 2025 to 2033. The market is driven by a rapid rise in companion animal ownership-led largely by small dogs and indoor cats-along with increasing digital payments adoption through UPI, Alipay, and wallet ecosystems, higher repeat purchase and subscription uptake, and expanding cold-chain logistics that enable fresh and frozen pet meal deliveries; platforms such as Chewy’s regional alternatives including Zooplus-style marketplaces, local private labels, and international brands like Royal Canin are benefiting from demand for affordable, ingredient-transparent, and protein-rich diet bundles, widened SKU availability, and stronger last-mile fulfillment coverage across China, India, Japan, South Korea, Southeast Asia, and Australia, which is improving accessibility, order frequency, and average cart value for online pet nutrition purchases in the region.

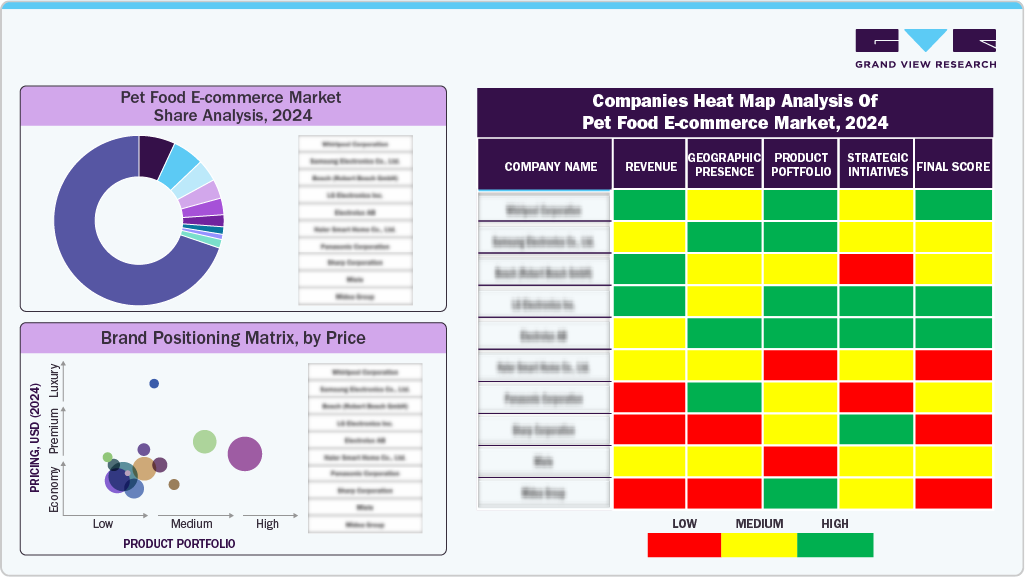

Key Pet Food E-Commerce Company Insights

The global pet food e-commerce market comprises a mix of international and domestic players competing to strengthen their presence in the country. Leading companies are focusing on expanding product portfolios, improving supply chain efficiency, and leveraging digital marketing to attract tech-savvy pet owners. Partnerships with major e-commerce platforms, such as Shopee and Lazada, have become crucial for reaching a vast consumer base.

Key Pet Food E-commerce Companies:

The following are the leading companies in the pet food e-commerce market. These companies collectively hold the largest Market share and dictate industry trends.

- Nestle Purina

- Mars, Incorporated

- Hill’s Pet Nutrition, Inc.

- General Mills Inc.

- Schell & Kampeter, Inc.

- Zooplus SE

- Charoen Pokphand Group

- The J.M. Smucker Company

- Chewy, Inc.

- Petto

Recent Developments

-

In November 2025, Reliance Consumer Products Limited has entered India’s pet‑care market by launching a new brand, Waggies, offering science‑backed pet nutrition at prices positioned 20‑50% below existing premium players.

-

In June 2025, General Mills expanded its Blue Buffalo brand into the fresh pet food category with the launch of its “Love Made Fresh” line. Additionally, General Mills is introducing its recently acquired European premium pet food brand, Edgard & Cooper, to the U.S. market through an exclusive partnership with PetSmart. These moves reflect the company's strategic push to tap into the growing premium pet food market.

-

In February 2025, Meatly launched the world's first cultivated pet food, "Chick Bites," in collaboration with plant-based brand THE PACK, offering a sustainable, nutritious alternative to traditional dog treats. Made from cultivated meat produced from a single chicken cell sample, it provides all the essential nutrients while being kinder to animals and the environment. Pets at Home is the first retailer to sell this innovative pet food, marking a significant step in the sustainable pet food market.

Pet Food E-commerce Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 20.56 billion

Revenue Forecast in 2033

USD 37.56 billion

Growth rate

CAGR of 7.8% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Pet type, price range, region

Regions covered

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Countries covered

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Nestle Purina; Mars, Incorporated; Hill’s Pet Nutrition, Inc.; General Mills Inc.; Schell & Kampeter, Inc.; Betagro Pet; Charoen Pokphand Group; The J.M. Smucker Company; Chewy, Inc.; Petto

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Food E-commerce Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the Global pet food e-commerce market based on pet type, price range, and region.

-

Pet Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Dogs

-

Dry Food

-

Wet Food

-

Snacks/Treats

-

-

Cats

-

Dry Food

-

Wet Food

-

Snacks/Treats

-

-

Others

-

Dry Food

-

Wet Food

-

Snacks/Treats

-

-

-

Price Range Outlook (Revenue, USD Million, 2021 - 2033)

-

Economy

-

Mid-Range

-

Premium

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

- Brazil

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pet food e-commerce market size was valued at USD 19.18 billion in 2024 and and is expected to reach USD 20.56 billion in 2025.

b. The global pet food e-commerce market is expected to grow at a compounded growth rate of 7.8% from 2025 to 2033 to reach USD 37.56 billion by 2033.

b. The dog food segment in the global e-commerce pet food industry dominated the market and accounted for a revenue share of 66.4% in 2024. Younger generations, particularly Gen Z and millennials, are driving demand for premium, subscription-based dog food products. Survey data from platforms such as Yummypets indicates that dog owners are more inclined to opt for home-delivery services, further boosting the e-commerce market

b. Some key players operating in the market include TNestle Purina; Mars, Incorporated; Hill’s Pet Nutrition, Inc.; General Mills Inc.; Schell & Kampeter, Inc.; Zooplus SE; Charoen Pokphand Group; The J.M. Smucker Company; Chewy, Inc.; Petto.

b. The pet food e-commerce market is driven by the rising pet humanization and demand for premium, health-focused diets, combined with the convenience of fast delivery, subscriptions, and seamless digital shopping.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.