- Home

- »

- Plastics, Polymers & Resins

- »

-

Pet Food Packaging Market Size, Industry Report, 2030GVR Report cover

![Pet Food Packaging Market Size, Share & Trends Report]()

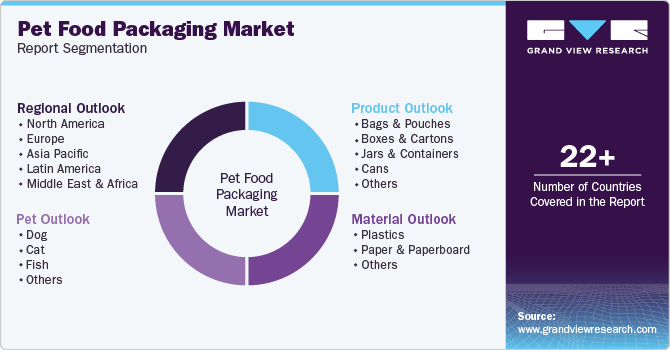

Pet Food Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Plastics, Paper & Paperboard), By Product (Bags & Pouches, Cans), By Pet (Dog, Cat, Fish), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-069-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Food Packaging Market Summary

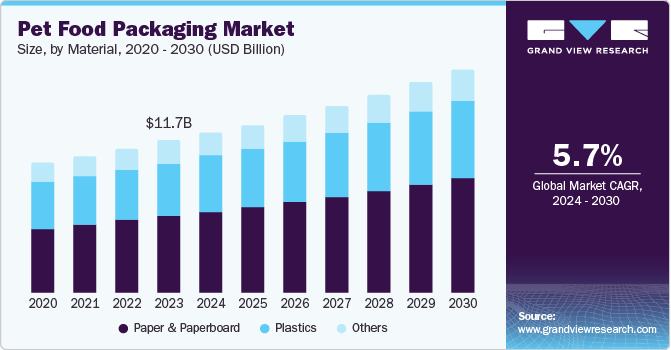

The global pet food packaging market size was valued at USD 11.66 billion in 2023 and is projected to reach USD 17.07 billion by 2030, growing at a CAGR of 5.7% from 2024 to 2030. The increasing disposable income is leading to an increase in pet adoption, resulting in high demand for pet food packaging.

Key Market Trends & Insights

- North America pet food packaging market dominated the market with a share of 36.0% in 2023.

- The U.S. pet food packaging market dominated the North America market in 2023.

- By material, the paper & paperboard segment accounted for the largest market share of 50.9% in 2023.

- By product, the bags & pouches segment accounted for the largest market share in 2023.

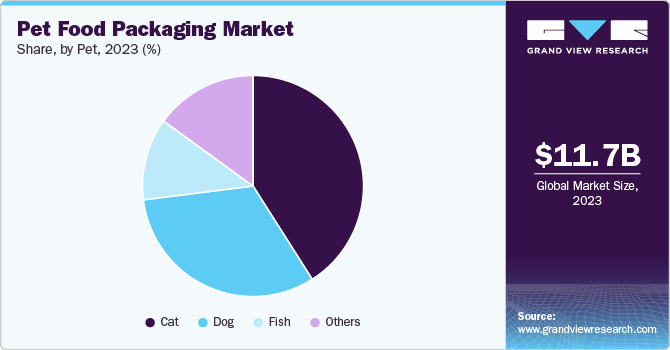

- By pet, the cat segment accounted for the largest market share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 11.66 Billion

- 2030 Projected Market Size: USD 17.07 Billion

- CAGR (2024-2030): 5.7%

- North America: Largest market in 2023

The shift towards urban lifestyle has increased the need for pet animals. The huge number of individuals are opting for pets as companions and members of the family.Furthermore, pet owners are increasingly recognizing the significance of their pets' health and nutrition. There is a high demand for good quality pet products, which also includes quality packaging. Pet owners are in search of customized products and packaging choices. Moreover, the creation of innovative materials, such as biodegradable and compostable plastics, is increasing the choices for packaging products for pets. Packaging designs are evolving to be more practical, incorporating elements such as resealable closures, tabs that are easy to open, and options for portion control.

The emergence of e-commerce has simplified the process for pet owners to buy products over the internet. The rise of online shopping has led to an increased need for strong and secure packaging to protect products during shipping. The growing environmental awareness among customers is resulting in more sustainable packaging options. Governments are enacting more rigorous rules on packaging materials, which is leading to advancements in sustainable packaging.

The increasing consumer preference for convenience over cost has encouraged manufacturers of pet food packaging products to innovate their product offerings over the years. In this regard, the industry has been witnessing a steady demand for convenience and single-serve packaging in both pet treats and food.

Material Insights

The paper & paperboard segment accounted for the largest market share of 50.9% in 2023. Consumers' growing interest in eco-friendly and sustainable products, due to rising environmental concerns, is driving the segment growth. Paper & paperboard can be easily broken down by natural processes and reused, which makes them convenient to use. It provides numerous possibilities for customization, enabling brands to design unique packaging that stands out in retail displays.

The plastics segment is expected to register a significant CAGR during the forecast period. The lightweight packaging offered by plastics facilitates easy transportation and handling. Numerous plastic packages, such as pouches and bags, come with reclosable seals to maintain pet food freshness and prevent leaks. Producing plastics is usually more cost-effective than manufacturing materials such as glass or metal. It can be molded easily and shaped in different ways, helping to improve packaging efficiency and lower costs.

Product Insights

The bags & pouches segment accounted for the largest market share in 2023. Bags and pouches are available in a range of sizes to suit varying amounts of pet food. These packages are easily personalized with branding, product details, and appealing designs, improving product appeal and display on shelves. The lower production cost of this segment as compared to rigid packaging options like cans or jars is driving the segment growth. It frequently displays a modern and attractive aesthetic that draws in consumers.

The jars & containers segment is expected to register a significant CAGR during the forecast period. The improved protection against moisture, oxygen, and light offered by jars and containers is one of the key drivers attributed to the market growth. Consumers rely on packaging that maintains the quality of the food, especially for wet or high-end pet food. Jars and containers are practical for storing things and can be easily reused or recycled.

Pet Insights

The cat segment accounted for the largest market share in 2023. With the increase in urban population, cats are identified as low-maintenance pets. According to Forbes, the percentage of households in the U.S. who own cats increased by 4 percentage points, from 25% to 29%, between 2016 & 2022. Busy lifestyles and compact living quarters enhance the appeal of cats as pets. Pet owners are becoming increasingly conscious of their cats' dietary requirements, resulting in a growing desire for premium quality cat food. These are some of the major factors attributed to the segment growth. Various initiatives in the cat food space have increased the demand for convenient packaging globally. In November 2021, The Honest Kitchen announced the launch of the company’s 100% human grade cat portfolio. The new product line includes toppers, treats and foods.

The dog segment is expected to register the fastest CAGR during the forecast period. The increase in single-person households and postponement of starting families has led to an increased desire for pet adoption. According to Forbes, the percentage of U.S. households who own dogs between 2016 & 2022, increased by 6.1 percentage points, from 38.4% to 44.5%. The number of pet owners who view their dogs as part of the family is growing, resulting in a higher need for high-quality and custom packaging for pet food, such as treats and snacks. In August 2023, HelloFresh announced the launch of The Pets Table. It is the company’s new premium pet food brand and is developed in partnership with veterinarians. It is a subscription-based service offering human-grade air-dried and fresh recipes customized for the caloric requirements of each dog.

The others segment includes animals such as rabbits, guinea pigs, and reptiles, among other animals. This segment is likely to witness moderate growth in the foreseeable future as the adoption of the animals mentioned above is low as owners around the world predominantly prefer cats and dogs as their pets. The low adoption of these animals is expected to result in a drop in demand for their packaging products over the forecast period.

Regional Insights

North America pet food packaging market dominated the market with a share of 36.0% in 2023. The region is experiencing a growth in pet food production and demand due to an increase in flavored and nutritious options, leading to market expansion. The region has the biggest portion, attributed to its high rates of pet ownership, thriving pet care sector, and significant consumer expenditure on pet items. These are some of the major factors attributed to the growth of pet food packaging market.

U.S. Pet Food Packaging Market Trends

The U.S. pet food packaging market dominated the North America market in 2023 due to the number of households owning pets and being open to purchasing premium pet care items, such as specialized and health-focused pet foods. Moreover, the market growth is being driven by the continued transition to packaging solutions that are more innovative, sustainable, and convenient, including recyclable materials and smart packaging technologies that improve user experience and product safety.

Europe Pet Food Packaging Market Trends

Europe pet food packaging market identified as a lucrative region in 2023 due to the growing need for packaging that communicates the unique benefits of specialized diets to address specific health needs, such as allergies or sensitivities, which is driven by increasing demand. The European Union has put in place more stringent rules on pet food safety and labeling, causing a rise in the need for packaging that meets the new regulations.

The UK pet food packaging market is expected to grow rapidly in the coming years. The growing number of elderly people has resulted in an increase in pet adoptions aimed at enhancing the mental and physical well-being of the pet owners. The rising number of pet owners in the area has boosted the need for pet food, leading to the growth of the region.

Asia Pacific Pet Food Packaging Market Trends

Asia Pacific pet food packaging market is anticipated to witness significant growth in the coming years. The increasing younger population and the trend of treating pets as family members, combined with China being one of the countries with the largest number of pets, are fueling the region's growth. The growing preference of consumers for easy packaging that is convenient, ensures freshness, and prevents spills is driving the market growth.

The China pet food packaging market is expected to grow rapidly in the coming years. The increasing disposable income of pet owners to spend on their pets due to rising Chinese economy is one of the key factors driving the market growth. This shift has led to an increase in demand for premium pet food and packaging choices, as pet owners are now open to spending more on high-quality products for their beloved pets.

Key Pet Food Packaging Company Insights

Some key companies in the pet food packaging market include Mondi, Amcor Plc, Sonoco Products Company, Crown, and others. Key players have deployed various strategies to stay abreast of the competition in the industry. Prominent among such strategies are mergers & acquisitions, product differentiation, and capacity expansion. Furthermore, these companies have established long-term supply agreements with pet food makers to ensure a steady demand for their product offerings.

-

Mondi is a global packaging and paper group that offers a variety of environmentally friendly packaging and paper options.Packaging options comprise of corrugated packaging, flexible packaging, industrial bags, labels, and release liners. Types of paper products comprise uncoated fine paper, coated fine paper, and recycled paper.

Key Pet Food Packaging Companies:

The following are the leading companies in the pet food packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Mondi

- Amcor Plc

- Sonoco Products Company

- Huhtamaki Oyj

- Berry Global Inc.

- Contantia Flexibles

- Crown

- Smurfit Kappa

- Transcontinental Inc.

- Winpak Ltd

- Sealed Air

- Silgan Holdings Inc.

Recent Developments

-

In August 2024, Mondi launched additions to the company’s sustainable pre-made plastic bags portfolio. The new line, FlexiBag Reinforced, is recyclable packaging, mono-polyethylene-based with enhanced properties such as sealability, stiffness and puncture-resistance.

Pet Food Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.24 billion

Revenue forecast in 2030

USD 17.07 billion

Growth rate

CAGR of 5.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, pet, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia; Thailand; Indonesia; Malaysia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Mondi; Amcor Plc; Sonoco Products Company; Huhtamaki Oyj; Berry Global Inc.; Constantia Flexibles; Crown; Smurfit Kappa; Transcontinental Inc. ; Winpak Ltd; Sealed Air; Silgan Holdings Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Food Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet food packaging market report based on material, product, pet, and region.

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Plastics

-

Paper & Paperboard

-

Others

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Bags & Pouches

-

Boxes & Cartons

-

Jars & Containers

-

Cans

-

Others

-

-

Pet Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dog

-

Cat

-

Fish

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

Indonesia

-

Malaysia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.