- Home

- »

- Animal Health

- »

-

Pet Mobility Aids Market Size, Share, Industry Report, 2030GVR Report cover

![Pet Mobility Aids Market Size, Share & Trends Report]()

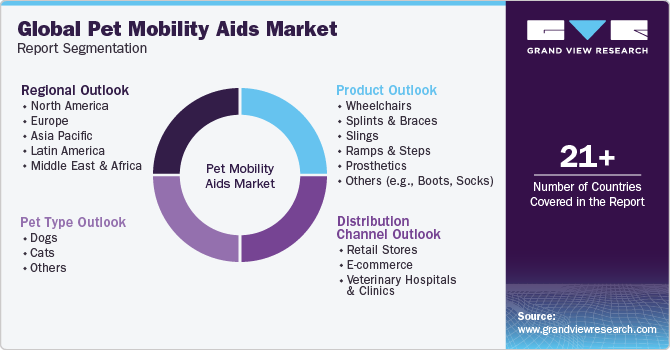

Pet Mobility Aids Market (2025 - 2030) Size, Share & Trends Analysis Report By Pet Type (Dogs, Cats, Others), By Product (Wheelchairs, Splints & Braces, Slings), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-164-3

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Mobility Aids Market Size & Trends

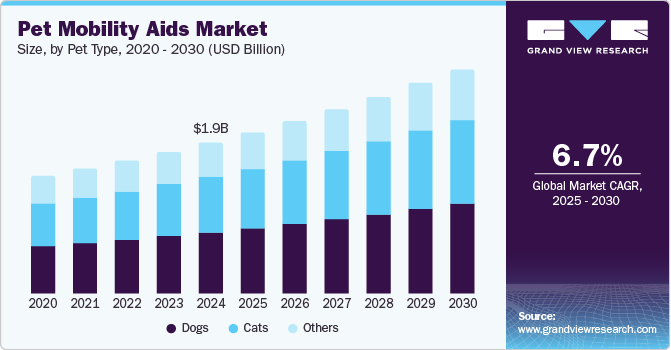

The global pet mobility aids market size was valued at USD 1.95 billion in 2024 and is projected to grow at a CAGR of 6.71% from 2024 to 2030. The increasing population, growing adoption of pet insurance policies, initiatives by key industry players, and increasing demand for customized mobility aids are some of the key drivers of this industry. For instance, in January 2024, Walkin' Pets announced the launch of an innovative product line of mobility solutions for companion animals. This exclusive launch was premiered at the Veterinary Meeting & Expos (VMX) in Florida at the Orange County Convention Center.

In addition, increasing demand for personalized and adjustable wheelchairs and carts for dogs & cats with varying disabilities and growing adoption of advanced technologies such as 3D printing and carbon fiber materials in manufacturing these aids contribute to the growth. Several players in the industry develop and provide advanced and more convenient mobility aids for companion animals. For instance, in October 2023, Sleepypod launched a harness for walking. It is designed for car use and provides a safe and secure way to transport the animals with mobility issues.

Ongoing advancements in veterinary medicine contribute to better diagnosis and treatment options for various health conditions, including those affecting mobility. This is encouraging the development and adoption of specialized movement aids. Additionally, increasing demand for customized solutions for pets, including tailored mobility aids that cater to specific conditions, contributes to the growth.

Furthermore, the availability of pet insurance plans that cover mobility aids, including wheelchairs, encourages owners to consider these solutions without the financial burden. For instance, in 2023, the U.S. witnessed a 17.1% growth in the total number of insured pets as compared with 2022. Also, the number of pets insured has grown by an average of 22.6% annually since 2020. This increase in insurance enrollment is attributed to increased hospital visits, as it offers financial convenience to the owners.

Market Concentration & Characteristics

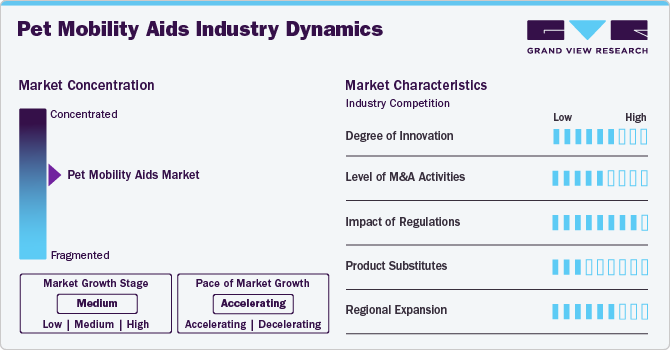

Industry growth stage is medium, and pace of the growth is accelerating. The Industry is characterized by a high degree of innovation due to rapid technological advancements driven by prosthetics advancements, customized solutions availability, and increasing pet spending.

The sector is also characterized by several merger and acquisition (M&A) activities by key players. This is due to several factors, including desire to gain access to advanced technologies and talent, need to consolidate in a rapidly growing sector, and demand for customized mobility-supporting products.

There are fewer direct product substitutes for these aids. However, a number of technologies can be used to achieve cost-effective solutions using patent-specific data. Pet owners may manually assist their pets by providing support, lifting them, or using slings to help them move around. This can serve as an immediate substitute for certain types of mobility aids.

The concentration of distribution channels can significantly affect industry accessibility, competitiveness, and overall industry dynamics. Companies offering unique and innovative solutions may have a competitive edge, affecting market concentration. Compliance with regulations may act as a barrier to entry and influence the concentration of companies within this space.

Pet Type Insights

Dogs hold largest share of market, accounting for 41.0% of the global revenue in 2024. This high percentage can be attributed to the increasing adoption of dogs as pets, the humanization of these companion animals, technological advancements, and rising disposable incomes. This growth is further fueled by an aging dog population, increasing awareness of movement aids, a diverse product range, expanding veterinary expertise, and a focus on preventive care. Furthermore, dogs are known to be common animals adopted for companionship and comfort. In 2024, according to the American Pet Products Association survey, 58 million U.S. households own at least one dog as a pet. Hence, medical issues like arthritis, degenerative myelopathy, intervertebral disc disease, canine hip dysplasia, and cruciate and knee injuries, accidents, and medical procedures are expected to rise.

Cats segment is expected to register the fastest CAGR during the forecast period. Rising humanization of pets and increase in the number of injuries such as broken bones, sprains, muscle strains, arthritis, and obesity in cats have significantly driven the segment’s growth. For instance, according to the article published in January 2024, the tibia is a cat's most frequent fracture site and comprises 18% of all fractures. Neurological disorders such as degenerative myelopathy, feline lower urinary tract disease (FLUTD), and cerebellar hypoplasia require mobility aids, thus contributing to the segment growth.

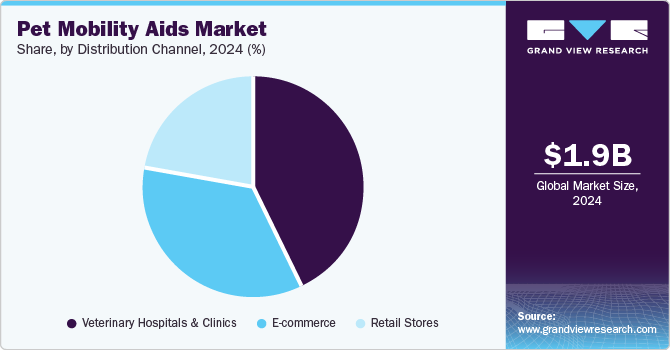

Distribution Channel Insights

The veterinary hospitals and clinics segment led the market in 2024. This growth can be attributed to the increasing awareness about animal healthcare and the rising adoption of pet insurance, which offers financial convenience to owners. These centers act as crucial distribution channels and recommendation places of mobility aids for locomotory issues in animals. Veterinarians provide expert guidance to parents in selecting suitable aids based on individual needs. Serving as points of purchase, these clinics enhance accessibility and promote awareness about the benefits of these aids.

The e-commerce sector is projected to witness the highest growth rate over the forecast period. The e-commerce sector offers a convenient and comprehensive platform for these aids, featuring a wide variety of products. It allows pet owners to make informed choices through detailed product descriptions, reviews, and comparisons. With its global reach, e-commerce provides access to numerous brands and products, fostering competition. The added benefit of doorstep delivery makes it a preferred option, especially for those with limited access to physical stores. Consequently, many companies operate their own e-commerce platforms and collaborate with major platforms such as, Amazon, Flipkart, and Etsy, which host a diverse selection of products from various brands.

Product Insights

Wheelchairs accounted for the largest revenue share in 2024. Wheelchairs, address various mobility issues by providing support and assistance to animals with various mobility challenges. These devices are widely adopted due to their versatility, as they cater to various sizes and breeds. In addition, the presence of several medical issues, such as hip dysplasia, and degenerative myelopathy, need mobility assistance. Hence, companies are taking numerous business initiatives to reduce pain and help them regain mobility. For instance, in July 2023, Walkin' Pets helped a 12-year-old completely paralyzed dog regain its mobility using a wheelchair.

The Prosthetics segment is expected to register the fastest CAGR during the forecast period. The demand for prostheses is growing for animals who have lost limbs and help them reclaim their lives. Several players in the industry are developing new customized, lightweight prosthetics using advanced technologies such as AI, 3D scanning, 3D printing, and others, further accelerating the growth. For instance, according to the news published in October 2024, WIMBA, a Polish company, opened a new in-house 3D printing facility in its Kraków headquarters to accelerate veterinary orthotics & prosthetics.

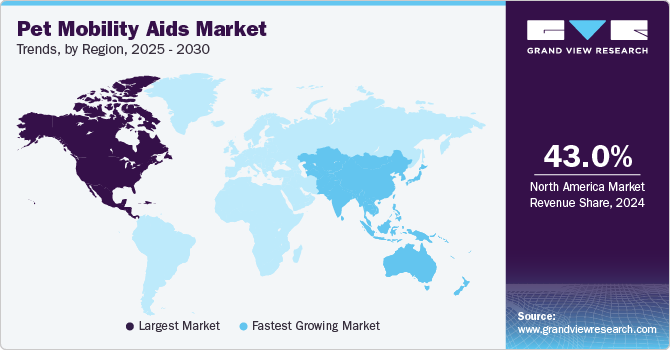

Regional Insights

North America pet mobility aids market dominated the market and accounted for a 43.04% share in 2024. The growth is driven by increasing pet ownership, heightened awareness among owners, advancements in veterinary care, a growing prevalence of health issues, the availability of health insurance, and the presence of leading manufacturers. Additionally, the strong presence of companies offering a wide range of products in the U.S. further supports the market's expansion. Key players such as Bionic Pets LLC, Animal Ortho Care, Walkin' Pets, Petsthetics, and Best Friend Mobility are actively engaging in various business initiatives to strengthen their position, thereby contributing to the growth in North America.

U.S. Pet Mobility Aids Market Trends

The U.S. pet mobility aids market held a significant share of the North America market in 2024. This growth is attributed to the advanced veterinary infrastructure and government support in researching and developing new ruminant vaccines. Moreover, the humanization of pets, where they are treated as family members, contributes to a growing willingness among pet owners to invest in products that improve the well-being of their pets, including mobility aids. For instance, according to the data published in August 2024 by the American Pet Products Association, 31% of cat owners use leashes, and 23% use harnesses for their pets to spend time outdoors. These numbers of parents using mobility aids have significantly increased since 2018, propelling the market growth.

Europe Pet Mobility Aids Market Trends

The Europe pet mobility aids market is driven by the increasing pet population and humanization of pets. For instance, according to the data published in October 2024, FEDIAF and GlobalPETS revealed that Europe is home to around 352 million pets across a variety of species, mainly dominated by cats and dogs. The count of cat and dog population is nearly 129 million and 106 million, respectively. These numbers demonstrate that pets are an integral part of many European families. With the increase in this population, there is also an increase in the demand for tools that make their lives easier, which include different mobility aids.

The UK pet mobility aids market is expected to show significant growth due to various strategic initiatives taking place to bolster it. For instance, in November 2023, Paw Prosper acquired UK-based wheelchair company K9 Carts. With this acquisition, Paw Prosper strengthened its mobility aids portfolio for companion animals and also expanded its distribution network in the country. As a result, the market is expected to grow further, supported by enhanced distribution and brand visibility.

The Germany pet mobility aids market is experiencing significant growth, mainly due to the rising prevalence of chronic conditions such as arthritis, hip dysplasia, and neurological disorders in pets. Technological advancements in mobility devices and the growing humanization of pets encourage owners to invest in solutions that enhance their quality of life. Additionally, the expansion of e-commerce platforms such as “Zooplus.de” in Germany facilitates better access to these products, contributing to market growth.

Asia Pacific Pet Mobility Aids Market Trends

Asia Pacific pet mobility aids market is anticipated to witness the fastest growth during the forecast period. The growing popularity of pet ownership, rising disposable incomes, and shift in lifestyles in countries such as, China, Japan, and India are fueling demand for pet products and services. Increasing awareness about health and a focus on improving care are driving the adoption of these products in the region. Additionally, there is a growing emphasis on enhancing pets' quality of life, including addressing mobility challenges. The emergence of startups and companies in India specializing in these solutions further supports the growth. Combined with the expanding pet care industry and a rise in veterinary services and product availability, the market is expected to grow during the forecast period.

The China aids market is growing at a lucrative rate and held a significant share in 2024. The advancements in technology, combined with increasing awareness of pet healthcare and rising ownership, are key drivers in China. For instance, according to the news published in September 2024, KEXCELLED, along with IN Pet Supplements, launched its innovative 3D-printed prosthetics project for dogs & cats, "Running Again," at the 26th Pet Fair Asia, held at Shanghai New International Expo Center. Under this initiative, the company aims to provide custom prostheses to those who have lost limbs. They would also provide ongoing behavioral guidance and joint nutrition for better results in the movement, contributing to market growth.

Latin America Pet Mobility Aids Market Trends

The Latin America pet mobility aids market exhibits high growth potential, driven by the region's large and expanding pet population and increasing emphasis on disease prevention. For instance, as of 2024, Argentina has around 10.0 million dogs in the country. These factors significantly drive the demand for mobility aids, particularly as awareness of pet healthcare grows. The aging and disabled pet demographic creates opportunities for products like wheelchairs, harnesses, and prosthetics. Rising urbanization and pet humanization trends further encourage owners to invest in solutions that improve their pets' quality of life.

The Brazil exhibits high growth potential during the forecast period. This growth is mainly driven by the country's high pet ownership rates, with a large population of aging and special-needs pets creating a demand for mobility solutions. Brazil ranks among the top nations globally in pet ownership, with increased awareness among pet owners about improving pets' quality of life. Advancements in veterinary care and an expanding middle-class population also contribute to the growth, as more pet owners seek tailored products like wheelchairs, prosthetics, and slings to address their pets' mobility challenges.

Middle East and Africa Pet Mobility Aids Market Trends

The MEA market growth is driven by the increasing focus on pet healthcare, government investments, collaborations, and launch of innovative products to support the regional economy. Additionally, increasing disposable income in tier 1, tier 2 cities in the region, increases the adoption of mobility aids for pets and thus, contributing to market growth.

The Saudi Arabia market growth is anticipated to grow at a moderate CAGR during the forecast period in the MEA region. This growth is attributed to the expansion of veterinary services and rehabilitation facilities provides better support and accessibility for mobility aid products. The Ministry of Environment, Water, and Agriculture sponsored the third Saudi Pet and Vet Expo in October 2024. This expo comprises 120 exhibitors from over 16 countries to present various veterinary products and services, including these movement aid products. Such projects increase the awareness about new products and support adoption leading to market growth.

Key Pet Mobility Aids Company Insights

The market is highly competitive due to several strategic initiatives, such as new product launches, mergers and acquisitions, and regional expansion, undertaken by key market players to increase their global footprints. Companies are diversifying their product portfolios to address a broader range of applications.

Key Pet Mobility Aids Companies:

The following are the leading companies in the pet mobility aids market. These companies collectively hold the largest market share and dictate industry trends.

- Petco Animal Supplies, Inc.

- Chewy, Inc.

- Walkin' Pets

- Bionic Pets

- Animal Ortho Care (AOC)

- K-9 Orthotics & Prosthetics Inc.

- Petmate (Doskocil Manufacturing Company, Inc.)

- PetSafe (Radio Systems Corporation)

- WIMBA

- Paw Prosper

- OrthoVet LLC

Recent Developments

-

In November 2024, Paw Prosper acquired K9 Mobility to strengthen its presence in Europe through a dedicated E-commerce platform. This acquisition will help consumers with easy access, leading to increased adoption of pet mobility aids.

-

In October 2023, Sleepypod, a pet products company, launched a harness for walking and anxiety relief.

-

In June 2023, LOVEPLUSPET, a company specializing in pet accessories, launched its advanced leg braces. These leg braces help dogs with arthritis in the back and front legs.

Pet Mobility Aids Market Report Scope

Report Attribute

Details

The market size value in 2025

USD 2.08 billion

The revenue forecast in 2030

USD 2.88 billion

Growth rate

CAGR of 6.71% from 2025 to 2030

Actual data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD Billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Pet Type, Product, Distribution Channel, Region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Denmark, Sweden, Norway, Japan; China; India; Australia; South Korea; Thailand, Brazil; Argentina; South Africa; Saudi Arabia; UAE, Kuwait

Key companies profiled

Petco Animal Supplies, Inc., Chewy, Inc., Walkin' Pets, Bionic Pets, Animal Ortho Care (AOC), K-9 Orthotics &, Prosthetics Inc., Petmate (Doskocil Manufacturing Company, Inc.), PetSafe (Radio Systems Corporation), WIMBA, Paw Prosper, OrthoVet LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Pet Mobility Aids Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global pet mobility aids market on the basis of pet type, product, distribution channel, and region.

-

Pet Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wheelchairs

-

Splints & Braces

-

Slings

-

Ramps & Steps

-

Prosthetics

-

Others (e.g., boots, socks)

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail Stores

-

E-commerce

-

Veterinary Hospitals & Clinics

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pet mobility aids market size was estimated at USD 1.95 billion in 2024 and is expected to reach USD 2.08 billion in 2025.

b. The global pet mobility aids market is expected to grow at a compound annual growth rate of 6.71% from 2025 to 2030 to reach USD 2.88 billion by 2030.

b. North America dominated the pet mobility aids market with a share of 43.04% in 2024. The growth is attributed to rising pet ownership rates, increased awareness among pet owners, advanced veterinary care facilities, a rising incidence of pet health issues, the presence of leading pet mobility aids manufacturers, and rising awareness of pet health insurance.

b. Some key players operating in the pet mobility aids market include Petco Animal Supplies, Inc.; Chewy, Inc.; Walkin' Pets; Doggon' Wheels, LLC; My Pet's Brace; K-9 Cart; Petmate (Doskocil Manufacturing Company, Inc.); PetSafe (Radio Systems Corporation); Animal Ortho Care; Dutch Dog Design LLC

b. Key factors that are driving the market growth include increasing pet population, growing adoption of pet insurance policies, initiatives by key market players, and increasing demand for customized mobility aids.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.