- Home

- »

- Medical Devices

- »

-

Pharmaceutical Sample Services Market Size Report, 2030GVR Report cover

![Pharmaceutical Sample Services Market Size, Share & Trends Report]()

Pharmaceutical Sample Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Warehousing & Storage, Sample Fulfillment & Direct-to-Physician (DTP) Services), By Temperature, By Distribution Channel, By End-use, By Region

- Report ID: GVR-4-68040-526-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

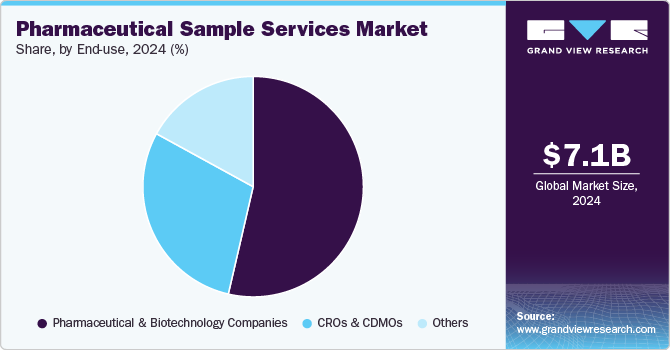

The global pharmaceutical sample services market size was estimated at USD 7.11 billion in 2024 and is projected to grow at a CAGR of 6.36% from 2025 to 2030. The market growth is primarily attributed to changing regulatory landscapes, technological advancements, and service demands. Sampling services focus on providing physicians with drug samples to increase product awareness and foster prescriptions, particularly for branded drugs. Further, the market growth is further driven by the increasing adoption of third-party logistics (3PL) solutions to streamline sample distribution, enhance regulatory compliance, and optimize supply chain efficiency. Key factors boosting market expansion include the rising demand for personalized medicine, advancements in cold chain logistics, and the growing penetration of e-pharmacies.

In the pharmaceutical industry, the supply chain and logistics support enhance that the processes from the manufacturers to the final consumer of the drugs are stored and transported at the right time, place, and quantity with acceptable quality and at low cost. In addition, most pharmaceutical companies have increasingly focused on outsourcing standard logistics management to prevent errors causing financial losses and damage to business brand value. This can be attributed to investments made for product development of pharmaceutical supply chains by all stakeholders, namely manufacturers, wholesalers, pharmacies, healthcare institutions, and transportation/ logistics providers, which are expected to drive the requirement for pharmaceutical sampling. In addition, by outsourcing functions to 3PL providers for pharmaceutical sampling, the pharmaceutical manufacturer can focus on their core competencies while optimizing their supply chains for efficiency & competitiveness.

Furthermore, the distribution of pharmaceutical products is subjected to various regulations and quality assurance standards to guarantee products stay safe, efficacy, and integrity throughout the distribution process. Thus, third-party logistics services are witnessing increasing requirements for pharmaceutical sampling as it plays a critical role in the pharmaceutical product supply chain. In addition, pharmaceutical sampling services offer cost efficiencies, provide access to industry expertise, the ability to quickly scale manufacturing up or down, and support to stay updated with regulatory changes, ensuring compliance. In addition, the 3PL pharmaceutical sampling supports products in reaching the market quickly with a smooth manufacturing process, reducing the risk in an unstable market. Therefore, 3PL pharmaceutical sampling services result in innovation, as companies can leverage brand-new strategies to minimize the contamination risk with lower operational expenses than in-house handling.

Opportunity Trends

The pharmaceutical sample services industry is witnessing lucrative growth opportunities in the near future. The key opportunity trends in the pharmaceutical sample services industry are as follows:

Growth in Asia-Pacific, Latin America, and the Middle East presents new distribution opportunities. Thus, increasing demand for localized 3PL providers and infrastructure development.

Integration of blockchain for sample authentication enhances transparency, security, and regulatory compliance in sample distribution, thereby reduces counterfeit risks and enhances traceability.

AI & predictive analytics in supply chain optimization will enable real-time demand forecasting and route efficiency. This helps to reduces costs, improves delivery accuracy, and enhances inventory management.

Integration of blockchain for sample authentication enhances transparency, security, and regulatory compliance in sample distribution, thereby reduces counterfeit risks and enhances traceability.

Technology Landscape

The technology landscape in the global pharmaceutical sampling 3PL services market is evolving rapidly, driven by advancements in cold chain logistics, AI, IoT, and blockchain. Temperature-controlled storage and real-time monitoring systems ensure compliance with Good Distribution Practices (GDP), mitigating risks of sample degradation. AI-powered predictive analytics and machine learning enhance demand forecasting and optimize route planning, improving efficiency and reducing costs. Blockchain integration strengthens supply chain transparency, preventing counterfeit drugs and ensuring regulatory compliance. IoT-enabled smart packaging, including RFID and GPS tracking, enhances sample traceability and security. Automation in warehousing and distribution, using robotics and AI-driven inventory management, streamlines operations. In addition, drones and autonomous vehicles are emerging as potential solutions for last-mile delivery in remote regions. As cybersecurity concerns rise, data encryption and compliance with GDPR and HIPAA are becoming critical. Sustainability is also gaining traction, with eco-friendly packaging and green logistics initiatives determining the industry's future.

Moreover, growing technological advancement, growing focus on warehouse management, facilitating transparency throughout the supply chain, and increased focus on current good manufacturing practices (cGMP) are expected to drive the requirement for pharmaceutical sampling. Furthermore, with the increasing priorities of pharmaceutical companies, the pharmaceutical sample services support to ensure compliance, operational efficiency, and enhanced market reach, aligning with the strategic requirements of pharmaceutical companies. Some leading providers like Knipper Health, Cardinal Health, McKesson, and Kenco, among others, help pharmaceutical companies navigate the complexities of sample management while supporting marketing and regulatory objectives.

For instance, in May 2024, Kenco, a provider of 3PL, mentioned the partnership with QPharma, a cloud-based software company, to add pharmaceutical sample fulfillment to 3PL's life sciences division. Adding this sample distribution capability provides the 3PL with the ability to consolidate logistics vendors, boost its distribution speed and better control quality assurance audits. Similarly, in September 2024, MD Logistics mentioned the addition of 200,000 sq ft of temperature-controlled warehouse space by upgrading the largest in-network facility in Indiana. The addition of warehouses increases the need for cGMP-compliant, temperature-controlled facilities. This space will also include a 40,000 sq ft, 2-8C cooler to store the client's temperature-sensitive product. Such initiatives are expected to create new growth opportunities for pharmaceutical sampling.

Market Concentration & Characteristics

The market growth stage is medium, with an accelerating pace. The market is characterized by the level of M&A activities, degree of innovation, regulatory impact, service expansions, and regional expansions.

The pharmaceutical sampling 3PL market is witnessing significant innovation driven by digitalization, AI-driven logistics, and blockchain-based tracking solutions. Advanced cold chain technologies, IoT-enabled sensors, and predictive analytics enhance efficiency, ensuring real-time monitoring of pharmaceutical samples. Automation in warehousing and last-mile delivery, including drones and autonomous vehicles, is improving speed and cost-effectiveness. The integration of AI-powered demand forecasting and cloud-based logistics management systems is further optimizing operations, making innovation a key driver in improving service reliability and regulatory compliance.

Stringent global regulatory frameworks, including Good Distribution Practice (GDP) and Good Manufacturing Practice (GMP), significantly impact the pharmaceutical sampling 3PL services market. Compliance with FDA, EMA, and other regional guidelines imposes investment in secure and temperature-controlled supply chains. Regulations around data security, patient privacy, and anti-counterfeiting measures are driving the adoption of blockchain and IoT solutions. Frequent regulatory changes create operational complexities, requiring 3PL providers to continuously upgrade systems and processes to maintain compliance while ensuring seamless pharmaceutical sample distribution.

The market is experiencing high merger and acquisition (M&A) activity as 3PL providers seek to expand capabilities and geographic reach. Leading logistics companies are acquiring niche players with expertise in pharmaceutical sampling, cold chain solutions, and digital logistics platforms. M&As also enable firms to strengthen compliance frameworks and technological capabilities. Strategic collaborations between pharmaceutical companies and 3PL providers are increasing to streamline supply chains, reduce costs, and enhance service differentiation in a competitive market landscape.

3PL providers are increasingly diversifying their service offerings to include specialized sampling logistics, temperature-sensitive storage, and direct-to-physician (DTP) delivery solutions. Value-added services, such as AI-driven demand forecasting, real-time tracking, and automated inventory management, are becoming industry standards. Companies are integrating digital tools for seamless supply chain visibility and optimizing last-mile delivery for faster distribution. The growing demand for personalized medicine and biologics is pushing service providers to enhance cold chain capabilities and develop innovative sample distribution models.

Rapid globalization is driving regional expansion in the pharmaceutical sample services industry, with providers expanding operations into emerging markets in Asia-Pacific, Latin America, and the Middle East. Growth in pharmaceutical R&D, rising patient access programs, and evolving healthcare infrastructure are increasing demand for efficient sample distribution. However, challenges such as varying regulatory landscapes, infrastructure gaps, and geopolitical risks remain.

Service Insights

Based on service, the warehouse & storage segment led the market with the largest revenue share of 37.12% in 2024. The segment growth is primarily due to increasing demand for temperature-controlled storage, regulatory compliance, and inventory management solutions. Advanced cold chain infrastructure, real-time monitoring technologies, and automated storage systems enhance sample integrity and security. Rising outsourcing trends among pharmaceutical companies and stringent GDP guidelines further bolster segment growth. In addition, smart warehousing solutions, including AI-driven inventory tracking and robotics, enhance efficiency, reducing storage costs and improving sample distribution accuracy.

The sample fulfillment & direct-to-physician (DTP) services segment is anticipated to witness at the fastest CAGR during the forecast period. The segment growth is driven by increasing demand for efficient physician-targeted drug distribution. The shift toward personalized medicine, regulatory emphasis on controlled sample distribution, and the rise of digital ordering platforms accelerate segment growth. Advanced logistics solutions, including temperature-controlled storage and AI-driven inventory management, enhance efficiency. Moreover, strategic collaborations between pharma companies and 3PL providers optimize last-mile delivery, ensuring compliance, traceability, and improved physician accessibility to new therapies.

Temperature Insights

Based on temperature, the ambient temperature segment accounted for the largest revenue share in 2024. The segment growth is driven by the high demand for temperature-stable drug samples, including tablets, capsules, and certain biologics. Stringent GDP regulations necessitate advanced storage and transportation solutions, accelerating product demand. Rising outsourcing by pharmaceutical firms to specialized 3PL providers enhances efficiency and cost-effectiveness. In addition, technological advancements in IoT-enabled monitoring and route optimization further strengthen the segment’s dominance, broadening compliance and seamless distribution across global markets.

The refrigerated temperature segment is anticipated to witness at the fastest CAGR during the forecast period. The segment is driven by the rising demand for temperature-sensitive biologics, vaccines, and specialty drugs. Strict GDP regulations and increasing investments in cold chain infrastructure are fueling growth. The expansion of biopharmaceutical R&D and personalized medicine further boosts the need for reliable refrigerated logistics, making it a critical growth driver in the pharmaceutical sample services industry.

Distribution Channel Insights

Based on the distribution channel, the contract sales organizations (CSOs) & field representatives segment accounted for the largest revenue share in 2024. The segment growth is owing to the outsourcing of sales and marketing operations by pharmaceutical companies. CSOs enhance physician engagement and sample distribution efficiency, ensuring compliance with evolving regulations. The rising adoption of data-driven sales strategies and CRM-integrated logistics solutions supports growth.

The e-commerce & direct-to-consumer (DTC) models segment is expected to grow at the fastest CAGR over the forecast period. The segment's growth is primarily driven by the digitalization of healthcare and the rise of online pharmacies. Increasing patient preference for home delivery of drug samples and telehealth-driven prescriptions fuels demand. Advanced last-mile logistics, AI-powered fulfillment centers, and automated cold chain solutions enhance efficiency. Regulatory-compliant e-sampling programs further streamline distribution, making DTC models a key channel for expanding pharmaceutical reach while improving patient access and engagement.

End-use Insights

Based on end use, the market is segmented into pharmaceutical & biotechnology companies, CROs & CDMOs, and others. The pharmaceutical & biotechnology companies segment held the largest market share in the pharmaceutical sample services industry in 2024. The segment growth is due to expanding drug pipelines and increased R&D investments. These companies rely on third-party logistics (3PL) providers for efficient, compliant, and scalable sample distribution to healthcare professionals and patients. The growing demand for specialty drugs, biologics, and personalized therapies necessitates secure cold chain logistics and real-time tracking solutions. As pharma companies shift towards outsourced distribution models, 3PL partnerships are becoming essential for optimizing supply chain efficiency and market penetration.

The CROs & CDMOs segment is anticipated to witness at a lucrative CAGR over the forecast period. The high segment growth is owing to the outsourcing of clinical trials and drug development. As biopharma companies accelerate early-stage research and global clinical studies, the need for efficient sample logistics is rising. 3PL providers support regulatory-compliant storage, handling, and distribution of investigational drugs, expanding cold chain integrity and real-time tracking. Growing demand for personalized medicine and biologics manufacturing further drives 3PL adoption in this segment, enabling seamless supply chain operations and faster market entry for new therapies.

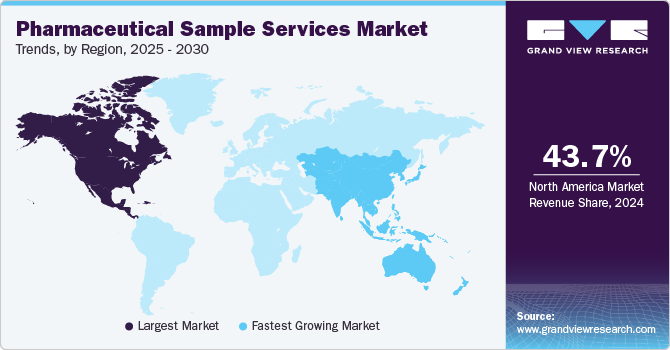

Regional Insights

North America pharmaceutical sample services market dominated the global market with the largest revenue share of 43.66% in 2024. The regional market demand is driven by strong biopharmaceutical R&D, a well-established regulatory framework, and the widespread adoption of specialty drugs. The presence of leading 3PL providers, coupled with advanced cold chain infrastructure, ensures seamless sample distribution. Growth in direct-to-physician (DTP) models and e-pharmacy channels further accelerates market expansion. In addition, stringent compliance requirements and increasing outsourcing of logistics by pharma companies continue to boost demand for technology-driven, GDP-compliant 3PL solutions across the region.

U.S. Pharmaceutical Sample Services Market Trends

The pharmaceutical sample services market in the U.S. is driven by a high volume of drug launches, stringent FDA regulations, and the expansion of specialty pharmaceuticals. The increasing adoption of direct-to-physician and direct-to-patient distribution models is fueling demand for secure, GDP-compliant logistics solutions. Advanced cold chain infrastructure, AI-driven inventory management, and digital tracking systems enhance supply chain efficiency. In addition, the rise of e-pharmacies and telehealth accelerates pharmaceutical sampling, making the U.S. a key hub for innovative 3PL partnerships and technological advancements in the sector.

The Canada pharmaceutical sample services market is attributed to expanding due to rising biopharmaceutical R&D, stringent Health Canada regulations, and increasing specialty drug distribution. Growth in cold chain logistics supports the handling of temperature-sensitive samples, while the adoption of digital tracking solutions enhances supply chain transparency. The expansion of e-pharmacies and direct-to-patient models is further driving demand for efficient 3PL networks.

Europe Pharmaceutical Sample Services Market Trends

The pharmaceutical sample services market in Europe is driven by stringent GDP regulations, increasing biopharmaceutical innovation, and rising demand for specialty drug distribution. The expansion of clinical trials and outsourcing by pharma companies accelerates 3PL adoption. In addition, the growth of e-pharmacies and direct-to-patient delivery models fuels demand for efficient last-mile logistics. Strategic public-private partnerships and increasing investments in digital supply chain solutions further enhance market expansion across the region.

The UK pharmaceutical sample services market is growing due to stringent Medicines and Healthcare products Regulatory Agency (MHRA) regulations, ensuring GDP-compliant distribution. Increased biopharma investments, the rise of specialty drugs, and the expansion of direct-to-physician models are key drivers. Brexit-induced regulatory shifts have reshaped supply chain strategies, increasing demand for third-party logistics expertise. In addition, the growth of e-pharmacies and evolving NHS pharmaceutical distribution policies continue to shape the market’s expansion and operational efficiency.

The pharmaceutical sample services market in Germany is expanding due to stringent EU GDP regulations, enhancing secure and efficient sample distribution. The country’s strong biopharma manufacturing base and high clinical trial activity drive demand for specialized logistics solutions. Digital supply chain integration, backed by Germany’s advanced automation and AI-driven logistics infrastructure, enhances efficiency. In addition, the rise of biosimilars and precision medicine is fueling demand for temperature-controlled distribution. Regulatory emphasis on eco-friendly logistics, including sustainable packaging and low-emission transport, is further shaping market growth.

Asia Pacific Pharmaceutical Sample Services Market Trends

The pharmaceutical sample services market in Asia Pacific is estimated to grow at the fastest CAGR over the forecast period. The regional growth is primarily attributed to driven by expanding biopharma R&D, rising clinical trials, and increasing healthcare access. Governments are strengthening regulatory frameworks, such as China’s NMPA and India’s CDSCO, to enhance GDP compliance and sample traceability. Growing investments in cold chain logistics and AI-powered supply chain solutions support efficient distribution. In addition, the expansion of domestic pharma manufacturing and e-commerce-driven drug sampling is accelerating demand for specialized 3PL services across emerging markets like China, India, and Southeast Asia.

The Japan pharmaceutical sample services market accounted for the largest market revenue share in Asia Pacific in 2024, owing to driven by strict Pharmaceuticals and Medical Devices Agency (PMDA) regulations, broadening high-quality and compliant distribution. The country’s aging population and rising demand for innovative therapies are fueling pharmaceutical sampling needs. Advanced robotic automation in logistics and AI-driven demand forecasting enhance efficiency. In addition, Japan’s focus on Good Manufacturing Practice (GMP) integration in 3PL services and sustainable cold chain logistics is fostering growth, while the expansion of digital health platforms accelerates direct-to-physician sample distribution.

The pharmaceutical sample services market in China is anticipated to grow at a significant CAGR during the forecast period, owing to expanding rapidly due to National Medical Products Administration (NMPA) reforms, enforcing stricter GDP standards and digital traceability. The rise of domestic biopharma innovation and government-backed healthcare expansion is driving demand for specialized logistics. Investments in smart warehousing, blockchain-enabled tracking, and AI-driven route optimization enhance supply chain efficiency.

The India pharmaceutical sample services market is expanding rapidly, driven by Central Drugs Standard Control Organization (CDSCO) regulations, enhancing GDP compliance and quality assurance in sample distribution. Growth in generic drug manufacturing and government-led healthcare initiatives is increasing demand for efficient logistics. The rise of temperature-controlled storage hubs, automation in warehousing, and blockchain-based track-and-trace systems is improving supply chain transparency. In addition, India’s fast-growing e-pharmacy sector and rural healthcare expansion are boosting the need for specialized 3PL distribution networks.

Key Pharmaceutical Sample Services Company Insights

The global pharmaceutical sample services industry is highly competitive, with key players focusing on strategic partnerships, technology integration, and regulatory compliance. Leading companies include DHL Supply Chain, UPS Healthcare, FedEx, Kuehne + Nagel, and SF Express, leveraging AI-driven logistics, cold chain expertise, and real-time tracking to enhance service efficiency. Market consolidation through M&As and regional expansions strengthens global reach. In addition, specialized 3PL providers catering to biopharma and clinical trial logistics are gaining traction, driving innovation in secure, compliant, and scalable pharmaceutical sample distribution.

Key Pharmaceutical Sample Services Companies:

The following are the leading companies in the pharmaceutical sample services market. These companies collectively hold the largest market share and dictate industry trends.

- Knipper Health

- Cardinal Health

- Cencora Inc.

- Eversana

- FedEx

- UPS Healthcare

- Ceva Logistics

- Kerry Logistics

- Medical Couriers

- XPO Logistics

Recent Developments

-

In November 2024, Kuehne+Nagel acquired a 51% stake in IMC Logistics, a leading U.S. marine drayage provider specializing in end-to-end transportation between seaports, rail hubs, and inland facilities. This move strengthened Kuehne+Nagel's access to North America's logistics network, offering enhanced flexibility amidst supply chain challenges.

-

In September 2024, DSV announced to acquire DB Schenker from Deutsche Bahn for €14.3 billion. This acquisition aims to enhance DSV's global network, expertise, and competitiveness, benefiting employees, customers, and investors.

-

In July 2024, CEVA Logistics, part of the CMA CGM Group, introduced a new organizational structure to streamline customer access to its global logistics capabilities. This new approach enhanced services across air, ocean, ground, and rail transport, contract logistics, finished vehicle logistics, project logistics, and customs solutions.

Pharmaceutical Sample Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.49 billion

Revenue forecast in 2030

USD 10.20 billion

Growth rate

CAGR of 6.36% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Service, temperature, distribution channel, end-use, region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Knipper Health; Cardinal Health; Cencora Inc.; Eversana; FedEx; UPS Healthcare; Ceva Logistics; Kerry Logistics; Medical Couriers; XPO Logistics

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Sample Services Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pharmaceutical sample services market report based on the service, temperature, distribution channel, end-use, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Warehousing & Storage

-

Transportation & Distribution

-

Sample Fulfillment & Direct-to-Physician (DTP) Services

-

Reverse Logistics Management

-

Others

-

-

Temperature Outlook (Revenue, USD Million, 2018 - 2030)

-

Ambient

-

Refrigerated

-

Frozen

-

Ultra-frozen/Deep-Frozen

-

Cryogenic

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Contract Sales Organizations (CSOs) & Field Reps

-

Retail & Hospital Pharmacies

-

E-commerce & Direct-to-Consumer (DTC) Models

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

CROs and CDMOs

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical sample services market size was estimated at USD 7.11 billion in 2024 and is expected to reach USD 7.49 billion in 2025.

b. The global pharmaceutical sample services outsourcing market is expected to grow at a compound annual growth rate of 6.36% from 2025 to 2030 to reach USD 10.20 billion by 2030.

b. North America dominated the pharmaceutical sample services market with a share of 43.66% in 2024. This is attributable to driven by strong biopharmaceutical R&D, a well-established regulatory framework, and the widespread adoption of specialty drugs. The presence of leading 3PL providers, coupled with advanced cold chain infrastructure, ensures seamless sample distribution.

b. Some of the key players operating in the pharmaceutical sample services market include Knipper Health, Cardinal Health, Cencora Inc., Eversana, FedEx, UPS Healthcare, Ceva Logistics, Kerry Logistics, Medical Couriers, and XPO Logistics

b. Key factors that are driving the market growth include driven by rising drug development, regulatory compliance needs, and digitalized distribution models. Increasing outsourcing by pharma and biotech firms boosts demand for specialized logistics solutions, including cold chain management, real-time tracking, and AI-driven supply chain optimization, ensuring efficient and compliant sample distribution worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.