- Home

- »

- Animal Health

- »

-

Phytogenic Feed Additives Market Size, Industry Report 2030GVR Report cover

![Phytogenic Feed Additives Market Size, Share & Trends Report]()

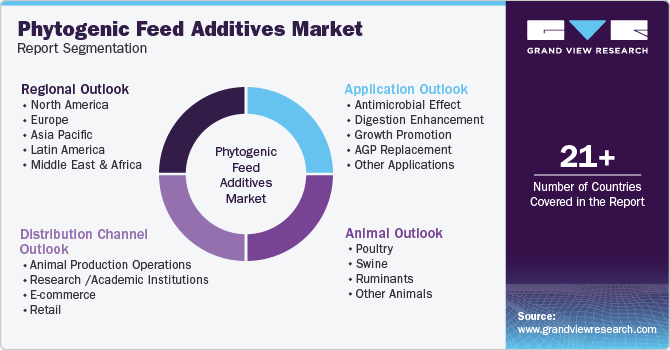

Phytogenic Feed Additives Market (2025 - 2030) Size, Share & Trends Analysis Report By Animal (Poultry, Swine, Ruminants), By Application (Antimicrobial Effect, Digestion Enhancement), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-520-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Phytogenic Feed Additives Market Summary

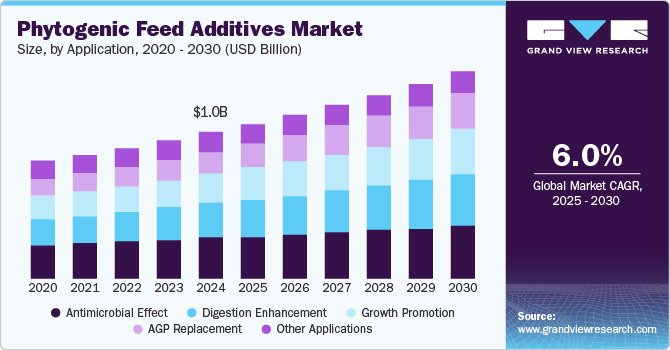

The global phytogenic feed additives market size was estimated at USD 1,047.9 million in 2024 and is projected to reach USD 1,484.7 million by 2030, growing at a CAGR of 6.04% from 2025 to 2030. Some key factors driving market growth include the application of phytogenuc feed additives as an antibiotic replacement, the acceleration of R&D initiatives, growing awareness about the benefits of PFAs, and the growing consumer demand for natural and sustainable food products.

Key Market Trends & Insights

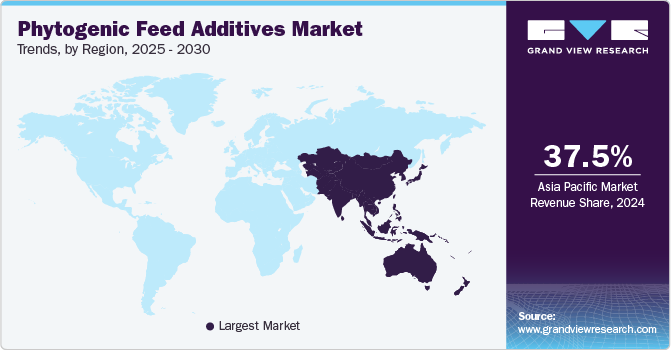

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, China is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, poultry accounted for a revenue of USD 492.6 million in 2024.

- Other animals is the most lucrative animal segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1,047.9 Million

- 2030 Projected Market Size: USD 1,484.7 Million

- CAGR (2025-2030): 6.04%

- Asia Pacific: Largest market in 2024

Phytogenic feed additives (PFAs) are natural, plant-derived compounds that are combined with the diets of primarily animals like poultry, ruminants, and swine. The aim is to enhance performance, immunity, and overall health, offering antimicrobial, antioxidant, and digestion-enhancing benefits. They're mainly used as antibiotic growth promoter substitutes, improving intestinal health, productivity, and food security.

The most dominant driving factor for this market is the increasing in-depth R&D initiatives by various scientists and research organizations. These activities are directed toward testing and researching novel phytogenic substances for multiple applications, such as growth promotion, antibiotic alternatives, improving animal product quality, and gaining antimicrobial effects. The substances under research include fruit pulp, guava, black pepper, turmeric, spices, etc., across animal species such as fish, poultry, and rabbit, among others.

For instance, in an October 2024 article from the Brazilian Journal of Poultry Sciences, the researchers investigated the effect of Citrullus colocynthis fruit pulp (CCFP) in the place of antibiotic growth promoters (AGPs) in daily diets of broilers. Around 600 broiler chickens were fed with various combinations of CCFP/ AGP, and parameters like growth performance, blood biochemistry, and intestinal microbial count were measured. Results showed that a diet containing CCFP reduced feed intake but improved overall growth and helped maintain a healthy microbial balance. The study suggests phytogenic substances like CCFP may be a viable alternative to AGPs in the nutritional health of broilers.

Furthermore, a study from Nigeria explored use of turmeric as a potential alternative to antibiotics in poultry. This November 2023 research published in Translational Animal Science Journal found that curcumin can exhibit antimicrobial, anti-inflammatory, and immunomodulatory properties, enhancing growth performance and gut health while reducing the overall incidence of diseases. Turmeric is understood to enhance nutrient absorption, reduce oxidative stress, and improve egg production in laying hens.

In conclusion, this increasing focus on R&D initiatives to explore phytogenic substances for multiple animal applications is expected to significantly enhance animal health and productivity. Such activities promote sustainable practices in livestock management and, most importantly, foster innovation.

Another crucial factor positively impacting market growth is the increasing application of phytogenic feed additives (PFAs) to replace antibiotics. A January 2025 article published in MDPI investigated an oregano & thyme-based matrix-encapsulated phytogenic feed additive for its potential to replace antibiotics in animal feed. Results pointed towards benefits of PFAs like growth performance enhancement and improved gut health, concluding that PFAs are a viable replacement for antibiotic products.

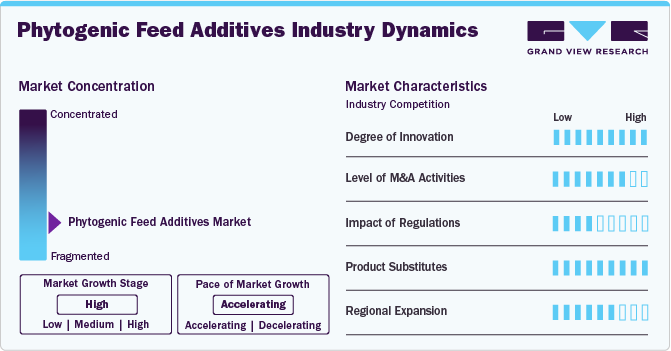

Market Concentration & Characteristics

The degree of innovation in this market is estimated to be very high owing to growing research initiatives and product launches employing a large variety of natural phytogenic substances. For instance, in July 2024, Dr. Eckel Animal Nutrition launched their proprietary phytogenic feed additive product, AntaPhyt, which contains natural substances like hops, licorice, and Arabic gum and can be used in poultry, swine, and ruminants.

The industry is experiencing a low to moderate level of M&A activities. Market competitors' main focus is to expand their product reach and increase profitability by acquiring domestic manufacturers from other countries. For instance, in September 2024, Anpario, a UK-based feed products company, acquired Bio-Vet Inc., a U.S.-based animal nutrition company.

The impact of regulations is anticipated to be low to moderate, with regulatory authorities occasionally providing necessary guideline updates to the existing regulation. For instance, in February 2025, the European Union (EU) updated guidelines for the use of microorganisms in animal feed. The regulatory body introduced new categories and emphasized their role as feed additives.

The industry has a high number of product substitutes; apart from a few leading products from companies like Cargill, DSM-Firmenich, ADM, and Kemin Industries, the majority of the other products available in the market are manufactured by domestic companies varying from country to country. This increases the variety of products available in the industry, ultimately boosting market competition.

The industry is experiencing a moderate-high impact of regional expansion. Industry participants are expanding their business by entering untapped or under-tapped countries. For example, Nuqo, a French company that manufactures animal nutrition products, announced entry into three new geographies in July 2024: India, Mexico, and Thailand.

Animal Insights

The poultry segment held a significant share of around 44% in 2024. This can be attributed to factors like the everyday use of PFAs in improving the quality of poultry products like eggs and meat and the constant research initiatives to explore the effect of novel phytogenic substances. Furthermore, compared to other animals, poultry benefit from shorter production cycles. This enables feed additives, including phytogenic, antibiotics, probiotics, and growth promoters, to yield rapid and visible results regarding growth promotion, weight gain, digestion enhancement, disease prevention, and feed conversion efficiency. Furthermore, other factors, such as rising demand for poultry products and growing antibiotic resistance, prompt producers to adopt natural alternatives.

The other animal segment, aquaculture, rabbit, game, companion animals, etc., is anticipated to grow at the fastest CAGR from 2025 to 2030. This can be attributed to the increasing demand for feed additives due to the growing adoption of modern farming practices and the growing awareness about the importance of animal health & nutrition. Additionally, increasing R&D and product launches can be attributed to this segment gaining growth momentum despite being a relatively new area of operation. For example, in April 2024, Skretting (Nutreco) announced India's launch of its photogenic feed additive product, Armis, for use in shrimp farming.

Application Insights

By application, the antimicrobial effect held the highest share in 2024. The producers favor the antimicrobial effect of these natural plant-based products as they serve as a very effective and natural alternative to antibiotics for controlling pathogenic bacteria in animals. They support immune function, promote digestive health, and gradually reduce antibiotic dependency, improving overall nutritional growth. Additionally, amidst growing demand for sustainable farming practices, the natural origin of these products makes them crucial options in modern animal production.

AGP replacement segment is expected grow at the highest rate over the forecast period. Amidst the growing concerns over increasing antibiotic resistance, PFAs are proving viable alternatives supporting benefits like immune function and gut health improvement. Other driving factors include growing consumer demand for antibiotic-free products, and the need for enhanced animal health and performance. These products offer a sustainable and natural alternative that improves gut health and feed efficiency.

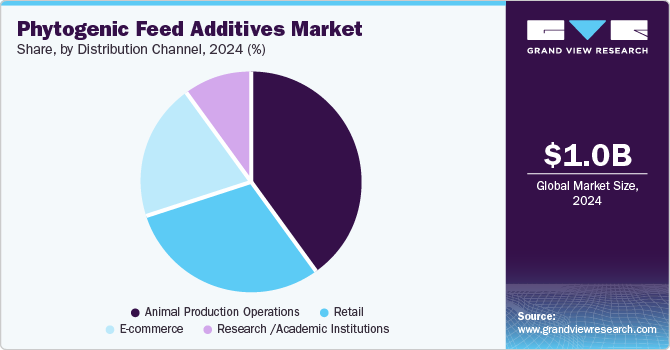

End Use Insights

The animal production operations segment led the phytogenic feed additives industry in 2024 in terms of revenue share. This segment includes poultry production, growing-finishing operations, aquaculture producers or suppliers, swine production, breeder farms, feed mills, ruminant farms, etc. These facilities prioritize animal health, performance, and sustainability. Hence, the demand for PFAs is highest at these operations as they mainly procure this product directly from manufacturers through establishing partnerships, negotiating long-term contracts, and leveraging their production scale for better pricing. Continuous education on the benefits of PFAs further supports their adoption across various animal production sectors.

The e-commerce segment is expected to grow at the highest rate of over 7.05% over the forecast period. This segment is expected to disrupt the market by improving the accessibility and efficiency of the PFA procurement processes. These digital platforms facilitate direct connections between producers and manufacturers, enabling better pricing, tailored solutions, and quicker responses to market demands, ultimately transforming traditional supply chains.

Regional Insights

The growing demand for meat products in North America, particularly in the U.S., is driving the market for phytogenic feed additives, including phytogenic options, as producers seek to maintain high meat quality standards. In Canada, extensive feed production capabilities in areas like Alberta enhance the demand for specialized additives. In contrast, Mexico, a major feed producer focusing on poultry, displays significant opportunities for phytogenic feed additive suppliers. Overall, rising health consciousness and increasing meat consumption across the region are expected to bolster the market for phytogenic feed additives in the coming years.

U.S. Phytogenic Feed Additives Market Trends

The market growth in the country can be attributed to the involvement of researchers and other industry participants in developing novel products sourced from natural substances to improve animal health. For example, according to the February 2025 article published in WattPoultry, scientists from University of Delaware discovered a novel phytogenic feed additive to combat spread of low pathogenicity avian influenza (LPAI). In this research, a poultry population was fed algae, resulting in an increased immune response towards LPAI.

Europe Phytogenic Feed Additives Market Trends

The market growth in Europe can be characterized by leading industry players and researchers from the region engaged in activities like exploring novel products, product portfolio enhancement, and technological advancements. For instance, Evonik Industries Inc., a significant animal nutrition products manufacturer headquartered in Germany, in April 2023, launched two new units focusing on different aspects of poultry, ruminants, and swine nutritional health, amino acids, and specialty nutrition like phytogenic products.

The phytogenic feed additives market in Italy is set to experience lucrative growth due to the innovative research and developmental activities conducted by the country's research scientists. They continue exploring and attempting to develop plant-based feed additives for newer species of animals. For instance, according to a July 2023 study published in MDPI, researchers from multiple universities across Italy collaborated to examine the effects of phytogenic feed additives on rabbits. The study demonstrated the potential of these products in enhancing growth performance, improving feed efficiency, and promoting overall health in the study population. The study inferred that incorporating these natural additives positively influences rabbits' gut microbiota and immune response, resulting in better productivity and welfare in rabbit farming.

The phytogenic feed additives industry in Spain is growing at a healthy rate owing to lowered feed prices, reduced swine production costs, and surged pork exports from the country. Globally, Spain is the largest pork exporter after the U.S. and China and the largest exporter in the European Union. Provinces such as Lerida, Zaragoza, Huesca, Murcia, Segovia, and Barcelona are home to more than 50% of the Spanish pig population.

Asia Pacific Phytogenic Feed Additives Market Trends

Asia Pacific dominates the market with the revenue share of 37.46% in 2024 and is anticipated to witness a significant growth rate of over 6.58% over the forecast period. This dominance can be attributed to the growing penetration of phytogenic feed additive products as well as research activities in the South Asian countries of the region. Apart from prominent countries like India, China, Japan, and Australia, research activities have been on the rise in countries like Indonesia in recent years. These research activities focus on finding ways to improve the quality of animal products in the region by inculcating a variety of feed additives. For example, in 2023, researchers from Sam Ratulangi University in Indonesia studied the impact of black pepper flour (BPF) on the quality of eggs from brown laying hens over six weeks. Results indicated that using BPF significantly improved egg yolk weight, yolk index, and yolk color without considerably impacting overall egg quality. The research inferred that BPF can be safely included in laying hen diets without affecting egg quality.

The phytogenic feed additives market in India is growing at a very lucrative rate owing to the presence of the world's largest livestock population; subsequent opportunities this creates for domestic and international players to spread in this market. For instance, in May 2024, Nuqo, a global animal nutrition company, opened its business in India through Nuqo Animal Nutrition India Pvt. Ltd. The company is a pioneer in manufacturing products based on micro-encapsulation of metabolites from phytogenic sources. Moreover, domestic companies are heavily involved in researching traditional medicine's application in animal nutritional care. Companies like Indian Herb Specialties Pvt Ltd. are pioneers in integrating Ayurveda and veterinary health by producing groundbreaking research and developing products like phytogenic feeds.

Latin America Phytogenic Feed Additives Market Trends

Latin America is anticipated to witness a strong demand for phytogenic feed additives in the coming years, owing to the flourishing animal feed industry in Brazil, Argentina, and Chile. The surge in animal feed production in Argentina, Bolivia, Brazil, Paraguay, etc., is expected to play a significant role in fueling the market growth in the region over the forecast period. Argentina is the second-largest market for phytogenic feed additives in the area after Brazil. The country's market is projected to grow in the coming years owing to the recovering cattle and beef sector.

Brazil emerged as the largest phytogenic feed additives market in Latin America. The poultry segment holds the largest share of this market owing to the strong presence of poultry in Brazil in the global poultry industry. The country is the largest poultry market in the world, and it is growing significantly owing to the rebound in exports and domestic demand. Favorable feed cost is another major factor that positively impacts the growth of this feed additives market in Brazil.

MEA Phytogenic Feed Additives Market Trends

The overall MEA market is poised to show promising growth over the forecast period owing to the emergence of research initiatives in the region's low-middle-income countries (LMIC). Traditionally, countries like South Africa, Saudi Arabia, UAE, Kuwait, and others dominate the regional market regarding animal production, animal care products consumption, and R&D activities. However, LMICs have contributed to this in recent years by engaging in research activities. For instance, a February 2025 article published by researchers from Ethiopia, investigated the effects of herbal extracts on the growth performance, feed efficiency, and overall health of broiler chickens. The study inferred that incorporating these natural additives into daily diet significantly improved weight gain and feed conversion ratios while enhancing gut health and immune response.

Saudi Arabia is one of the major producers of poultry in the Middle East. The region's continuously growing population has resulted in a high consumption of meat and beef, thereby leading to a rise in demand for feed additives. This is expected to have a positive impact on the demand for animal feed additives in the coming years. The presence of various untapped markets, along with the growing livestock population, is projected to contribute to the growth of the market in the coming years.

Key Phytogenic Feed Additives Company Insights

Industry participants are actively involved in investing in activities like novel product research and development, expanding global presence and production capabilities, and forging collaborations with researchers, research institutions, and other market players.

Key Phytogenic Feed Additives Companies:

The following are the leading companies in the phytogenic feed additives market. These companies collectively hold the largest market share and dictate industry trends.

- Cargill, Inc.

- ADM

- Alltech, Inc.

- Kemin Industries, Inc.

- DSM-Firmenich

- Evonik Industries AG

- Nutreco (Selko)

- Adisseo

- DuPont (IFF)

- Natural Remedies

- Nuevo

Recent Developments

-

In January 2025, EW Nutrition, in an attempt to expand its global expertise in animal nutrition, announced the appointment of two new personnel, Nadia Yacoubi and Marie Galissot, to its headquarters in Germany. They will be helming the following departments: Phytogenic Products Manager & Category Manager Feed Quality Solutions.

-

In February 2024, Cargill’s Animal Nutrition & Health (ANH) business unit announced the launch of Micronutrition and Health Solutions (MHS), a business unit dedicated to offering feeding solutions for animals.

-

In April 2023, Kemin AquaScience, a division of Kemin Industries Inc., launched a novel natural phytogenic feed additive, Pathorol. This product enhances shrimp health and has been launched in multiple Asian countries.

Phytogenic Feed Additives Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.11 billion

Revenue Forecast in 2030

USD 1.48 billion

Growth rate

CAGR of 6.04% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Animal, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Spain; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Cargill, Inc.; ADM; Alltech, Inc.; Kemin Industries, Inc.; DSM-Firmenich; Evonik Industries AG; Nutreco (Selko); Adisseo; DuPont (IFF); Natural Remedies; Nuevo

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Phytogenic Feed Additives Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global phytogenic feed additives market report based on animal, application, distribution channel, and region:

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Poultry

-

Swine

-

Ruminants

-

Other Animals

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Antimicrobial Effect

-

Digestion Enhancement

-

Growth Promotion

-

AGP Replacement

-

Other Applications

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Animal Production Operations

-

Research /Academic Institutions

-

E-commerce

-

Retail

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global phytogenic feed additives market size was estimated at USD 1.05 billion in 2024 and is expected to reach USD 1.11 billion in 2025.

b. The global phytogenic feed additives market is expected to grow at a compound annual growth rate of 6.04% from 2025 to 2030 to reach USD 1.48 billion by 2030.

b. By application, the antimicrobial effect held the highest share in 2024. The producers favor the antimicrobial effect of these natural plant-based products as they serve as a very effective and natural alternative to antibiotics for controlling pathogenic bacteria in animals.

b. Some key players operating in the phytogenic feed additives market include Cargill, Inc., ADM, Alltech, Inc., Kemin Industries, Inc., DSM-Firmenich, Evonik Industries AG, Nutreco (Selko), Adisseo, DuPont (IFF), Natural Remedies, and Nuevo

b. Key factors that are driving the market growth include its application as an antibiotic replacement, the acceleration of R&D initiatives, growing awareness about the benefits of PFAs, and the growing consumer demand for natural and sustainable food products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.