- Home

- »

- Conventional Energy

- »

-

Pipeline Integrity Management Market, Industry Report, 2030GVR Report cover

![Pipeline Integrity Management Market Size, Share & Trends Report]()

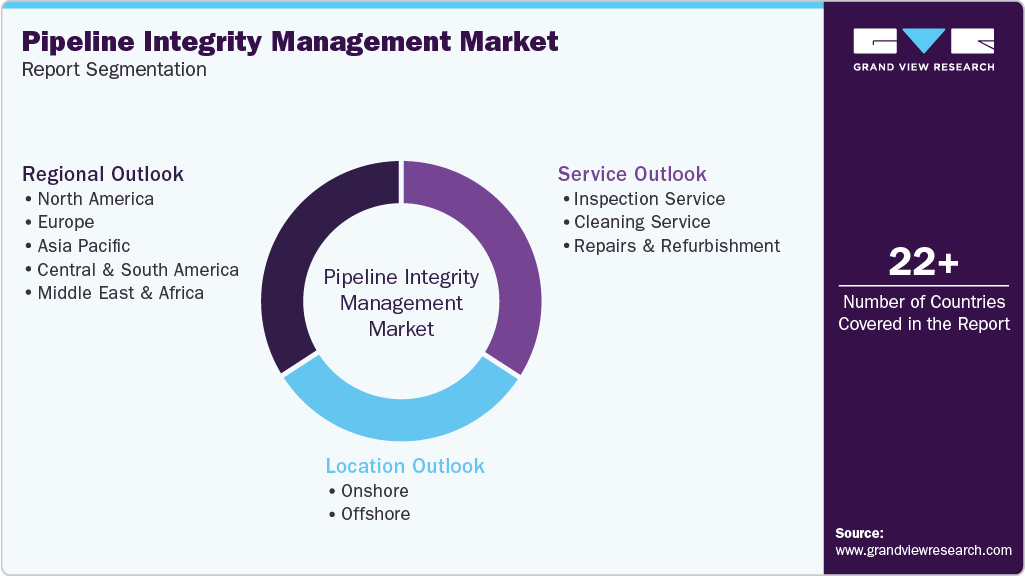

Pipeline Integrity Management Market (2025 - 2030) Size, Share & Trends Analysis Report By Location (Onshore, Offshore), By Service (Inspection Service, Cleaning Service, Repairs & Refurbishment), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-367-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pipeline Integrity Management Market Summary

The global pipeline integrity management market size was estimated at USD 2.27 billion in 2024 and is projected to reach USD 2.98 billion by 2030, growing at a CAGR of 4.7% from 2025 to 2030. Increasing demand for petroleum products such as LPG, LNG, petrol, and diesel is expected to fuel the need for pipeline integrity management services.

Key Market Trends & Insights

- North America pipeline integrity management market held the largest revenue share of 39.9% of the global industry in 2024.

- The U.S. pipeline integrity management market held the largest market in North America.

- Based on location, the onshore segment held the largest market revenue share of over 64.5% in 2024.

- By service, the inspection services segment held the largest market revenue share, over 60.0%, in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.27 Billion

- 2030 Projected Market Size: USD 2.98 Billion

- CAGR (2025-2030): 4.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The rising expansion of the oil & gas industry has increased the need to maintain pipeline infrastructure's safety and reliability. This has boosted the demand for pipeline integrity management (PIM) solutions to ensure the optimal functioning of pipelines.In addition, integrating advanced technologies in PIM solutions, including artificial intelligence (AI) and the Internet of Things (IoT), offers enhanced monitoring and predictive analysis capabilities. This will enable the identification of potential issues to mitigate risks, thereby further improving the efficiency of the pipeline infrastructure.

Technological advancements, smart pigging, and real-time monitoring systems are expected to improve integrity management solutions and services, making them more efficient and cost-effective. These advancements enable early detection of flaws and potential threats to pipeline safety, thereby preventing accidents and ensuring uninterrupted supply.

The high initial cost and complexity of implementing advanced pipeline integrity management systems and services are expected to hinder market growth over the coming year. Small and mid-sized companies find investing in these expensive technologies challenging, which can impact market growth. However, large companies have high capital expenditures, and thus, it is easy for them to implement such advanced systems.

The increasing environmental protection and pipeline regulations and standards will likely provide new opportunities for market participants. There is a growing demand for services and solutions that can help pipeline operators comply with these regulations, opening new avenues for market expansion. In addition, technologies that can work in harsh environmental conditions are expected to provide new sales avenues for market players.

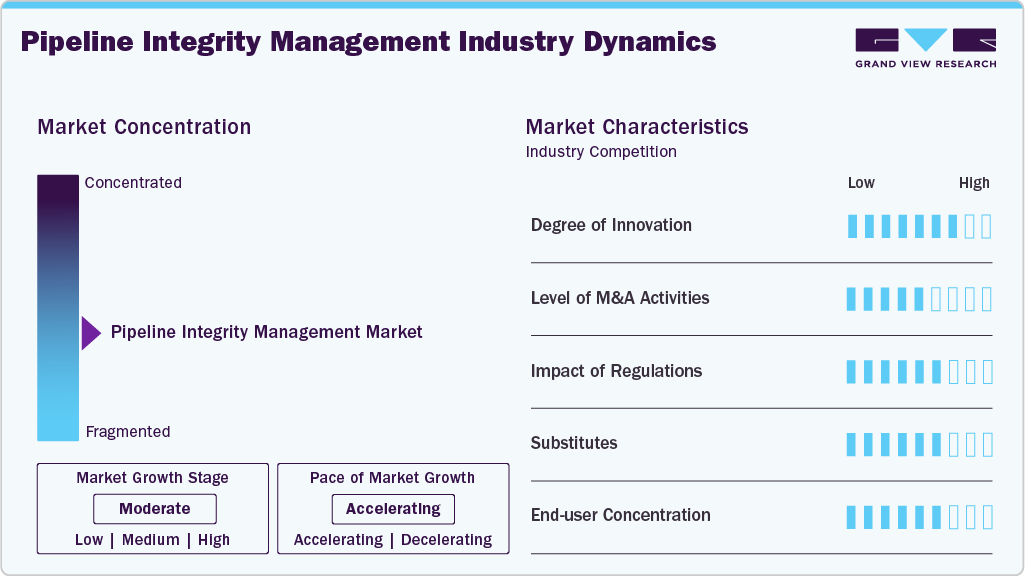

Market Concentration & Characteristics

The pipeline integrity management market is experiencing growth, driven by factors such as aging pipeline infrastructure, stricter regulatory requirements, heightened emphasis on safety and incident prevention, and the adoption of advanced data analytics and risk-based inspection methods. Cutting-edge innovations like digital twin technology, predictive maintenance, remote monitoring, and improved leak detection systems are becoming standard practices in the industry. In October 2024, Applus+ completed 904L Quick-Lock system installation for pipeline rehabilitation. It allows internal repairs without entry of human and is designed for demanding pipeline conditions.

Key technological advancements enhance real-time pipeline monitoring and support risk-based inspection approaches. Honeywell introduced its AI-based Gas Cloud Imaging system, which continuously monitors hazardous gas leaks, improving safety at oil, gas, and chemical facilities.

Key companies in the pipeline integrity management market are engaged in moderate merger and acquisition (M&A) activity to enhance their technological capabilities and broaden their service offerings. In August 2022, Baker Hughes agreed to acquire a subsidiary of Team, Inc, Quest Integrity. The acquisition includes the latter’s Furnace Tube Inspection (FTIS) and Invista technology. This acquisition aligns with Baker Hughes’ existing asset integrity offerings and is expected to support clients by ensuring the asset infrastructure is reliable and safe.

Location Insights

The onshore segment held the largest market revenue share of over 64.5% in 2024. The onshore segment deals with pipelines trailing land to transport oil, gas, and other substances. This segment faces unique challenges, including environmental conditions, land usage conflicts, and the need for meticulous monitoring and maintenance to prevent leaks or ruptures that could have significant environmental and safety impacts. Pipeline integrity management services can address these challenges by employing a combination of inspections, corrosion control, and leak detection technologies.

The offshore segment is expected to grow at the fastest CAGR over the forecast period. The segment mainly deals with pipelines located in marine environments, often used to connect production platforms with onshore facilities. Offshore pipelines are subjected to harsher conditions, including deep water pressures, corrosive saltwater environments, and extreme weather, posing unique challenges for pipeline integrity management. In such conditions, robust materials, advanced corrosion protection systems, and sophisticated monitoring and inspection techniques adapted for the marine context are emphasized.

Service Insights

The inspection services segment held the largest market revenue share, over 60.0%, in 2024. This segment includes identifying and assessing potential risks and damages to pipeline infrastructure. It has seen significant growth, driven by the need for regular inspections to ensure compliance with safety standards and extend the lifespan of pipeline assets.

The cleaning services segment is expected to grow at the fastest CAGR over the forecast period. The segment is vital in maintaining pipeline efficiency and safety. Regular cleaning helps prevent blockages and buildup that can lead to corrosion or leaks. The increasing awareness about the importance of pipeline hygiene is expected to benefit the market growth.

Repairs & refurbishment is expected to grow significantly over the forecast period. The segment includes restoration and enhancement of existing pipeline systems to meet current operational standards and safety requirements. The services in this segment include minor repairs to address specific damages and refurbishments that might involve replacing large sections of a pipeline or upgrading its material and technology to extend its service life. The growing need to maintain the continuous and safe operation of pipelines is expected to benefit market growth over the coming years.

Regional Insights

North America pipeline integrity management market held the largest revenue share of 39.9% of the pipeline integrity management industry in 2024 and is expected to maintain its dominance during the forecast period. The North American market is characterized by its extensive network of oil and gas pipelines and a stringent regulatory environment. The region's focus on reducing environmental impact and preventing pipeline failures supports the continued adoption of pipeline integrity management (PIM) services. In addition, the rising crude oil production in the region is anticipated to fuel the PIM services.

U.S. Pipeline Integrity Management Market Trends

The U.S. pipeline integrity management market held the largest market in North America, expected to continue its dominance over the forecast period. The country's large infrastructure of pipelines transporting oil, gas, and chemicals requires comprehensive integrity management solutions to meet safety and operational efficiency standards.

Europe Pipeline Integrity Management Market Trends

The European pipeline integrity management market is expected to grow significantly over the forecast period. This growth is driven by strict EU regulations on pipeline safety and the region's commitment to environmental sustainability. European countries are investing in advanced PIM technologies and services to upgrade their aging pipeline infrastructure and mitigate risks.

Asia Pacific Pipeline Integrity Management Market Trends

The Asia Pacific pipeline integrity management market is predicted to grow at the fastest CAGR during the forecast period. This growth is driven by rapid industrialization, expanding oil and gas pipeline infrastructure, and increasing investments in advanced inspection and monitoring technologies to ensure pipeline safety and reliability. Government initiatives in countries like India and China to increase natural gas usage and upgrade aging infrastructure further support this market expansion.

The China pipeline integrity management market held the largest revenue share in 2024. China’s expanding oil and gas pipeline networks, with ambitious renewable energy targets and stringent safety regulations, are accelerating the adoption of advanced pipeline integrity solutions. Investments in modernization of pipeline infrastructure and increased focus on environmental protection drive demand for technologies that enhance pipeline safety and operational efficiency.

Key Pipeline Integrity Management Company Insights

Some key companies operating in the market include Baker Hughes Company.; Rosen Group, Emerson Electric Co.; IKM Gruppen AS. Major market players have been focusing on innovation, novel product launches, and adoption of advanced technologies.

-

Baker Hughes, a GE company, is one of the world's leading oil field services companies. The company has a presence in over 120 countries and provides products and services for oil and gas exploration, production, and refining. The company also provides digital solutions that assist in enhancing efficiency and productivity for its customers.

-

Rosen is a leading provider of integrity and inspection services for a wide range of industries, including oil and gas, petrochemical, and other energy sectors. The company was founded in 1981 and has operations in more than 120 countries.

Key Pipeline Integrity Management Companies:

The following are the leading companies in the pipeline integrity management market. These companies collectively hold the largest market share and dictate industry trends.

- Applus+

- Baker Hughes Company

- Emerson Electric Co.

- IKM Gruppen AS

- Lin Scan

- NDT Global

- Rosen Group

- Schneider Electric Group

- SGS S.A.

- T. D. Williamson, Inc.

Recent Developments

-

In April 2025, Applus+ launched a project in El Salvador using its DTI Trekscan ultrasonic in-line inspection tool to detect corrosion and deformations in transmission and distribution pipelines.

-

In July 2024, South Sudan and Ethiopia announced an agreement to construct a new pipeline connecting the Nile state in South Sudan and the Gambella region of Ethiopia. This will enable improved pipeline infrastructure in both countries.

-

In July 2024, the U.S. Department of Justice (DOJ) proposed modifications in the Lakehead pipeline system by Enbridge Energy. Under this proposal, the company would be required to fix the previously identified cracks. Earlier, in 2016, DOJ and Enbridge reached a settlement agreement associated with the Kalamazoo River oil spill.

Pipeline Integrity Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.37 billion

Revenue forecast in 2030

USD 2.98 billion

Growth rate

CAGR of 4.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Location, service, region

Regional scope

North America; Europe; Asia Pacific; Central & South America;Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Russia; China; India; Japan; South Korea; Brazil; GCC; South Africa

Key companies profiled

Applus; Baker Hughes Company.; Emerson Electric Co.; IKM Gruppen AS; Lin Scan; NDT Global, Rosen Group, Schneider Electric Group, SGS S.A., T. D. Williamson, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pipeline Integrity Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels as well as provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the pipeline integrity management market report on the basis of location, service, and region:

-

Location Outlook (Revenue, USD Billion, 2018 - 2030)

-

Onshore

-

Offshore

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Inspection Service

-

Cleaning Service

-

Repairs & Refurbishment

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

GCC

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.