- Home

- »

- Biotechnology

- »

-

Plasma Fractionation Market Size And Share Report, 2030GVR Report cover

![Plasma Fractionation Market Size, Share & Trends Report]()

Plasma Fractionation Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Immunoglobulins, Coagulation Factors), By Method (Chromatography, Centrifugation), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-962-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Plasma Fractionation Market Summary

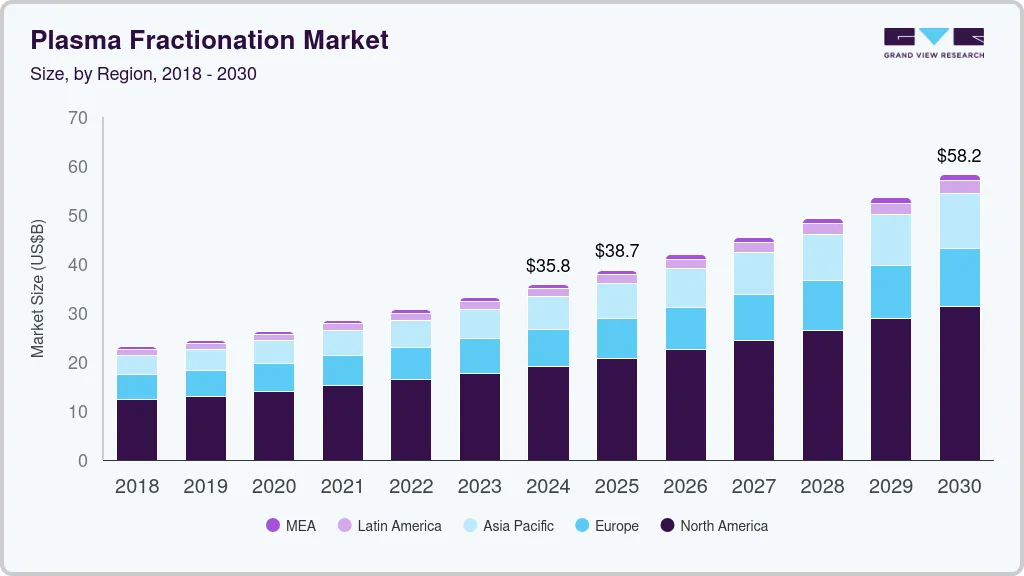

The global plasma fractionation market size was estimated at USD 35.79 billion in 2024 and is projected to reach USD 58.24 billion by 2030, growing at a CAGR of 8.5% from 2025 to 2030. The primary factor fueling the market growth is the increasing global population of elderly individuals, who are more prone to rare conditions requiring blood derivatives.

Key Market Trends & Insights

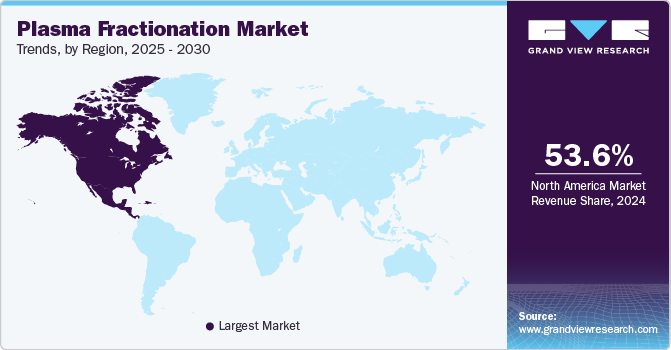

- North America plasma fractionation market dominated the global market and accounted for a 53.6% share in 2024.

- The plasma fractionation market in the U.S. is anticipated to grow over the forecast period.

- By product, the immunoglobulins segment dominated the market in terms of revenue share of 63.2% in 2024 and is anticipated to grow at the fastest CAGR of 9.1%.

- By method, the chromatography segment dominated the market and accounted for a 33.7% share in 2024.

- By application, the neurology segment held the largest revenue share of 30.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 35.79 Billion

- 2030 Projected Market Size: USD 58.24 Billion

- CAGR (2025-2030): 8.5%

- North America: Largest market in 2024

The World Health Organization (WHO) projects that by 2030, the global population of people aged 60 and older will reach 1.4 billion, representing a 34% increase from 2019. This age group will account for 1 in every 6 people worldwide. Additionally, the rising use of immunoglobulins and alpha-1-antitrypsin across various medical fields worldwide is expected to further propel market expansion. Another key contributor to this growth is the global increase in blood collection facilities.

Plasma treatments, which include therapies like immunoglobulin treatments, coagulation factors, and albumin, are increasingly used to treat a wide range of medical conditions, including immune disorders, bleeding disorders, and respiratory diseases. As new applications for plasma-derived therapies emerge and research in this field advances, the market continues to expand.

The global demand for these treatments is also fueled by the growing focus on personalized medicine, where plasma therapies play a key role in managing rare and chronic diseases. As per the February 2024 report released by the CDC, roughly 129 million individuals in the U.S. are impacted by at least one significant chronic illness. These conditions necessitate more tailored treatment approaches, driving demand for biomarkers that can predict patient responses to therapies. This growth trend is further supported by technological advancements that enhance plasma collection, production, and storage processes, making treatments more accessible and cost-effective.

One of the most significant factors driving the market growth is the increasing prevalence of chronic diseases, particularly among the elderly population. According to the World Health Organization, by 2030, the number of people aged 60 or older is projected to reach 1.4 billion, significantly increasing the demand for treatments related to age-associated health issues. Older adults are more susceptible to conditions such as immune deficiencies, respiratory diseases, and bleeding disorders, which often require plasma-derived therapies like immunoglobulins and coagulation factors. As the global population continues to age, the demand for plasma treatments is expected to surge, especially in regions with rapidly aging populations, such as Europe, North America, and parts of Asia.

In addition, technological advancements and ongoing research in the field of plasma-derived products are also crucial factors influencing market growth. New and improved methods for plasma fractionation, collection, and purification are increasing the efficiency and safety of plasma treatments. This has led to the development of more targeted therapies, which are highly effective in treating specific conditions. For example, advancements in immunoglobulin therapy have allowed for more personalized treatment approaches, improving patient outcomes.

Moreover, innovations in recombinant technology provide alternatives to traditional plasma products, further expanding treatment options. As these technologies continue to evolve, they will likely play a significant role in driving the expansion of the plasma treatments market.

Furthermore, with a growing need for plasma-derived therapies, countries are investing in the development of more efficient blood and plasma collection centers. These facilities ensure a stable supply of plasma, which is essential for producing life-saving treatments. Governments and private organizations are also launching initiatives to encourage blood and plasma donations, addressing shortages and ensuring that plasma therapies remain accessible. The increase in collection centers, coupled with heightened public awareness about the importance of plasma donation, is boosting the availability of raw materials needed for plasma treatments, thereby supporting market growth.

Products Insights

The immunoglobulins segment dominated the market in terms of revenue share of 63.2% in 2024 and is anticipated to grow at the fastest CAGR of 9.1%. fueled by its widespread use in treating immune deficiencies, autoimmune diseases, and neurological disorders. The increasing prevalence of these conditions, particularly among aging populations, has significantly boosted demand for immunoglobulin therapies. According to a September 2023 report by the American Association for Cancer Research (AACR), intravenous immunoglobulin (IVIg) reduced the risk of severe infections by 90% in multiple myeloma patients receiving treatment with an anti-BCMA bispecific antibody.

In addition, advancements in plasma collection and fractionation technologies have improved the supply and safety of these products. Rising awareness of immunoglobulin therapies' effectiveness in managing chronic conditions, along with expanding healthcare access in emerging markets, is further propelling the segment's growth, making it one of the fastest-growing areas within the plasma treatments market.

The albumin segment is anticipated to experience robust CAGR from 2025 to 2030, driven by its expanding use in clinical trials for various medical conditions. Albumin is widely recognized for its therapeutic applications, such as treating shock, burns, and hypoalbuminemia. Ongoing clinical trials are exploring its effectiveness in new areas, including sepsis, liver cirrhosis, and acute respiratory distress syndrome (ARDS).

In July 2023, Grifols completed participant recruitment for the PRECIOSA Phase 3 clinical trial. The study is evaluating the potential of long-term albumin therapy using Grifols' Albutein to extend survival in patients with decompensated cirrhosis and ascites, helping them live longer until a suitable liver transplant becomes available. Positive trial outcomes are expected to increase the adoption of albumin in these treatment areas, contributing to the segment's market expansion. Additionally, rising demand for albumin in drug delivery systems and critical care further supports its growing market presence.

Method Insights

The chromatography segment dominated the market and accounted for a 33.7% share in 2024. The utilization of industrial-scale chromatographic fractionation as well as purification techniques for plasma fractionation has increased recently. A new generation of therapeutic plasma products, particularly coagulation factors, protease inhibitors, and anticoagulants, have been developed. As a result, chromatography has made it possible to create new therapeutic items for treating patients who have acquired or congenital impairments in plasma protein levels. Thus, it will drive market growth.

The centrifugation segment is anticipated to grow at the highest CAGR of 9.3% from 2025 to 2030. Centrifugation is an essential step in getting high-quality blood supernatant. Additionally, it aids researchers in consistent blood separation and better clinical outcomes for patients. Thus, the increasing demand for centrifugation instruments would supplement the market growth.

Application Insights

The neurology segment held the largest revenue share of 30.0% in 2024, driven by the increasing recognition of plasma-derived therapies for neurological disorders. Conditions such as multiple sclerosis, Guillain-Barré syndrome, and chronic inflammatory demyelinating polyneuropathy are increasingly being treated with therapies like intravenous immunoglobulin (IVIg) and plasmapheresis. The rising incidence of these neurological disorders, coupled with advances in clinical research and the development of new treatment protocols, is fueling demand for plasma-derived products. Additionally, growing awareness among healthcare professionals regarding the efficacy of these therapies is further propelling the neurology segment’s expansion within the broader plasma treatments market.

The oncology segment is expected to grow at the fastest CAGR of 9.9% over the forecast period, due to the increasing use of plasma-derived therapies in cancer treatment. Intravenous immunoglobulin (IVIg) and other plasma products are being recognized for their role in managing complications associated with cancer and its treatments, such as infections and immune deficiencies. In addition, ongoing clinical trials are exploring the efficacy of these therapies in enhancing the immune response against tumors. The rising incidence of cancer globally and the growing emphasis on personalized medicine are further driving demand for plasma-derived treatments in oncology, contributing to the segment's robust market expansion.

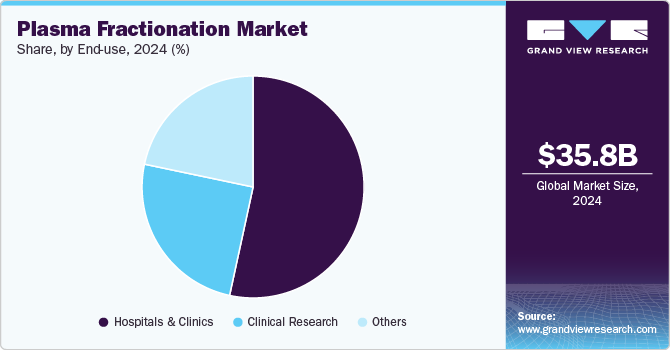

End-use Insights

The hospitals and clinics dominated the market with the largest revenue share of 53.4% in 2024 and are expected to grow at the fastest CAGR of 9.0% over the forecast period. This is driven by the increasing demand for plasma-derived therapies in various medical applications. These healthcare facilities are at the forefront of administering treatments like intravenous immunoglobulin (IVIg) and albumin, which are crucial for managing conditions such as immune disorders, liver diseases, and trauma cases. The rise in chronic illnesses and an aging population have led to higher patient admissions, further boosting the need for plasma treatments. Additionally, advancements in plasma collection and storage technologies are enhancing treatment accessibility in hospitals and clinics, supporting the segment's ongoing expansion.

The clinical research segment is expected to grow at significant CAGR from 2025 to 2030, driven by increasing investments in the development of innovative plasma-derived therapies. Ongoing clinical trials are crucial for exploring the efficacy and safety of products like intravenous immunoglobulin (IVIg), albumin, and clotting factors for various medical conditions. As researchers focus on expanding the indications for these therapies, the demand for robust clinical data continues to rise. Furthermore, collaboration between pharmaceutical companies and research institutions is fostering innovation, enhancing the pipeline of plasma treatments. This focus on clinical research not only supports regulatory approvals but also drives market growth as new therapies become available.

Regional Insights

North America plasma fractionation market dominated the global market and accounted for a 53.6% share in 2024. This is a result of increased awareness and numerous advantages of plasma among North American citizens and an increase in the occurrence of respiratory disorders. In addition, the presence of significant players, an increase in the number of plasma collection facilities, a rise in the consumption of immunoglobulin, and the ability to supply plasma owing to the viability of plasma collections & distribution all support the expansion of the regional market.

U.S. Plasma Fractionation Market Trends

The plasma fractionation market in the U.S. is anticipated to grow over the forecast period, by driven by the increasing demand for plasma-derived therapies, such as immunoglobulins and clotting factors. Factors such as a rising prevalence of chronic diseases, advancements in plasma collection technologies, and a growing aging population contribute to this trend. Additionally, the expansion of blood donation centers and enhanced public awareness of plasma donation further support market growth. The focus on personalized medicine and the development of new therapeutic applications also plays a crucial role in driving the U.S. plasma fractionation market forward.

Europe Plasma Fractionation Market Trends

The Europe plasma fractionation market is anticipated to experience the fastest growth during the forecast period, driven by the rising prevalence of chronic diseases, particularly cardiovascular diseases (CVDs). According to the European Society of Cardiology, around 45% of individuals over 65 are affected by CVDs, which pose substantial health challenges. In 2022, nearly 4 million people in Europe died from CVDs, emphasizing the urgent need for effective treatments. This growing demand for plasma-derived therapies is fueling market expansion across the region.

The plasma fractionation market in the UK fueled by increased investments in plasma collection and processing facilities. Rising demand for plasma-derived therapies, particularly for chronic diseases and immunological disorders, is driving this expansion. Government support and initiatives aimed at enhancing blood donation rates further contribute to the market's growth, ensuring a stable supply of plasma for therapeutic use.

Germany plasma fractionation market is expected to grow over the forecast period, driven by the rising demand for plasma-derived therapies to treat various chronic and autoimmune diseases. Increasing investments in research and development, alongside advancements in plasma processing technologies, are enhancing product availability. Additionally, a robust healthcare infrastructure and a growing emphasis on personalized medicine further contribute to the market's expansion in Germany.

Asia Pacific Plasma Fractionation Market Trends

The plasma fractionation market in Asia Pacific is experiencing significant growth driven by several factors, driven by the rising prevalence of chronic diseases and increasing healthcare expenditures. Growing awareness of plasma-derived therapies, such as immunoglobulins and clotting factors, is further fueling demand. In addition, expanding blood collection centers and improved healthcare infrastructure in countries like China and India enhance access to these therapies. Government initiatives to promote plasma donation are also contributing to the market’s robust expansion in the region.

China plasma fractionation market driven by an increasing demand for plasma-derived therapies and advancements in healthcare infrastructure. Rising prevalence of chronic diseases and the aging population are significant factors propelling market expansion. Government initiatives promoting blood donation and investments in plasma collection facilities are further enhancing the availability of plasma products. As a result, China is becoming a key player in the global plasma fractionation market.

Latin America Plasma Fractionation Market Trends

The plasma fractionation market in the Latin America is driven by increasing healthcare investments and rising demand for plasma-derived therapies. Factors such as a growing population, higher prevalence of chronic diseases, and improved blood collection infrastructure are contributing to the expansion of this market across the region.

Middle East and Africa Plasma Fractionation Market Trends

The Middle East and Africa plasma fractionation market fueled by rising healthcare investments and increasing awareness of plasma-derived therapies. In addition, government initiatives aimed at strengthening healthcare infrastructure are further supporting market development in the region.

The plasma fractionation market in Saudi Arabia is expanding due to strong government support and significant investments in healthcare infrastructure. Increased funding for research and development initiatives is fostering innovation in plasma-derived therapies. This commitment enhances the availability of plasma products and improves treatment options for various medical conditions in the country.

Key Plasma Fractionation Company Insights

Key players operating in the market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key Plasma Fractionation Companies:

The following are the leading companies in the plasma fractionation market. These companies collectively hold the largest market share and dictate industry trends.

- Grifols S.A.

- CSL Limited

- Takeda Pharmaceutical Company Limited

- Octapharma AG

- Kedrion S.p.A

- LFB S.A.

- Biotest AG

- Sanquin

- Bio Products Laboratory Ltd.

- Intas Pharmaceuticals Ltd

Recent Developments

-

In July 2024, Biotest AG announced that it has set the groundwork for an agreement with Kedrion for the complete commercialization and distribution of its immunoglobulin product, Yimmugo, in the U.S. This comes after the FDA granted Biologic License Application (BLA) approval for Yimmugo.

-

In January 2024, Takeda announced that the FDA approved Immune Globulin Infusion 10% solution as an intravenous immunoglobulin therapy for improving neuromuscular disability and impairment in adults with chronic inflammatory demyelinating polyneuropathy.

-

In August 2023, Shilpa Medicare Limited completed its Phase 1 clinical trial for recombinant human albumin 20%.

Plasma Fractionation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 38.71 billion

Revenue forecast in 2030

USD 58.24 billion

Growth rate

CAGR of 8.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, method, application, end-use, region

Regional scope

North America; Europe;, Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada;, Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Grifols S.A.; CSL Limited; Takeda Pharmaceutical Company Limited; Octapharma AG; Kedrion S.p.A; LFB S.A.; Biotest AG; Sanquin; Bio Products Laboratory Ltd.; Intas Pharmaceuticals Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plasma Fractionation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plasma fractionation market report based on product, method, application, end-use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Albumin

-

Immunoglobulins

-

Intravenous immunoglobulins

-

Subcutaneous immunoglobulins

-

Other immunoglobulins

-

-

Coagulation Factors

-

Factor VIII

-

Factor IX

-

VON WILLEBRAND factor

-

Prothrombin complex concentrates

-

Fibrinogen concentrates

-

Others

-

-

Protease inhibitors

-

Others

-

-

Method Outlook (Revenue, USD Billion, 2018 - 2030)

-

Centrifugation

-

Depth Filtration

-

Chromatography

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Neurology

-

Hematology

-

Oncology

-

Immunology

-

Pulmonology

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals & Clinics

-

Clinical Research

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global plasma fractionation market size was estimated at USD 35.80 billion in 2024 and is expected to reach USD 38.71 billion in 2025.

b. The global plasma fractionation market is expected to grow at a compound annual growth rate of 8.5% from 2025 to 2030 to reach USD 58.24 billion by 2030.

b. Immunoglobulins dominate the plasma fractionation market with a share of 63.2% in 2024. This is attributed to the extensive use of immunoglobulins for the administration, cure, and identification of metabolic disorders globally.

b. Some key players operating in the plasma fractionation market include Grifols S.A., CSL Limited, Takeda Pharmaceutical Company Limited, Octapharma AG, Kedrion S.p.A , LFB S.A., Biotest AG, Sanquin, Bio Products Laboratory Ltd., and Intas Pharmaceuticals Ltd.

b. Key factors that are driving the plasma fractionation market growth include the increasing number of rare diseases, increasing demand for plasma protein therapies, and the growing use of immunoglobulins in various therapeutic areas.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.