- Home

- »

- Plastics, Polymers & Resins

- »

-

Plastic Waste Management Market, Industry Report, 2030GVR Report cover

![Plastic Waste Management Market Size, Share & Trends Report]()

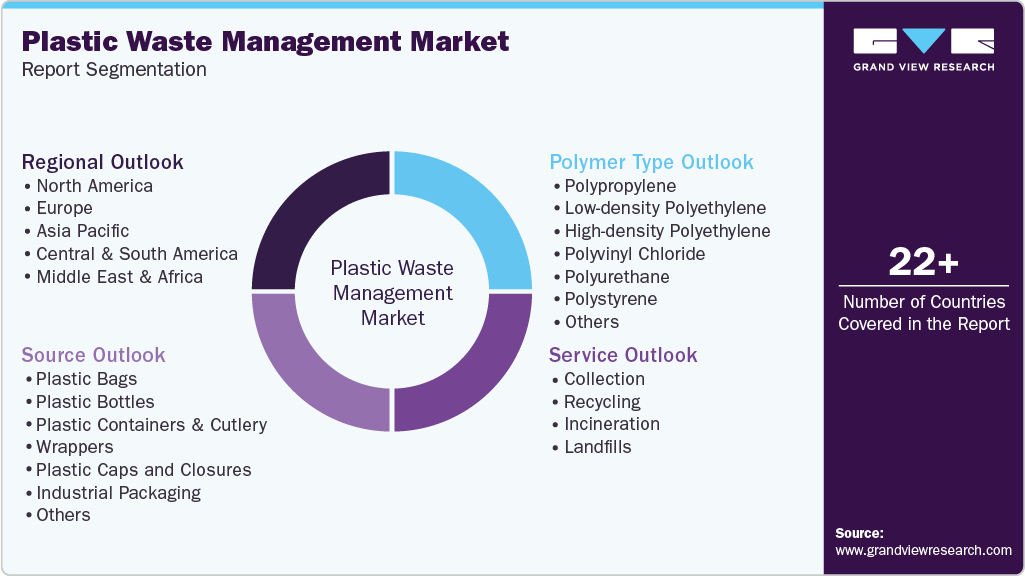

Plastic Waste Management Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Collection, Recycling, Incineration), By Polymer Type, By Source (Plastic Bags, Plastic Bottles, Wrappers), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-198-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Plastic Waste Management Market Summary

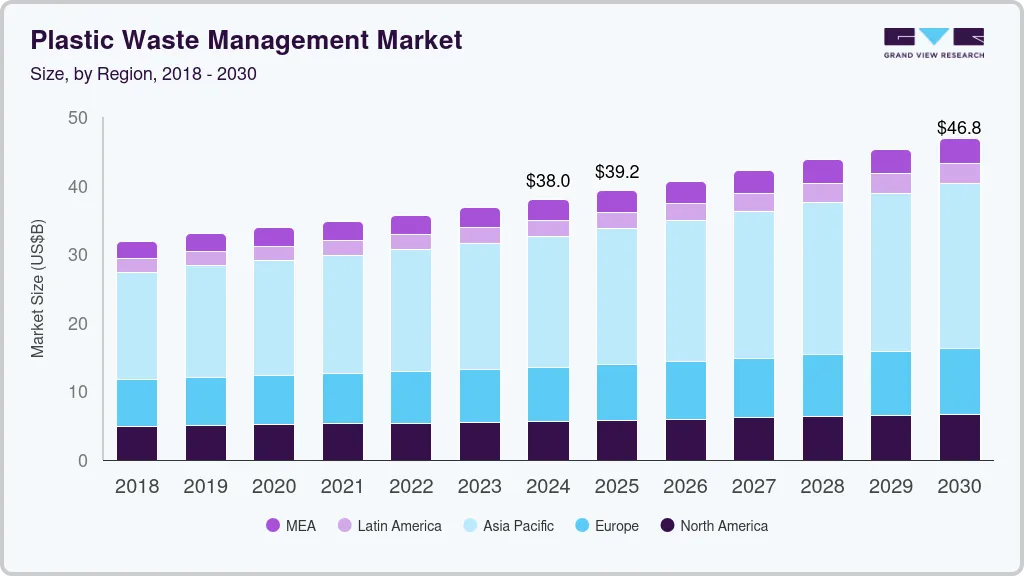

The global plastic waste management market size was valued at USD 37.95 billion in 2024 and is projected to reach USD 46.84 billion by 2030, at a CAGR of 3.6% from 2025 to 2030. Increasing concern about the environmental impact due to improper plastic waste management, rising industrialization, and growing urbanization are driving the overall plastic waste management industry.

Key Market Trends & Insights

- The plastic waste management market of Asia Pacific led the global market and accounted for the largest share of 50.1% and fastest growth over forecast period.

- China plastic waste management market held the largest revenue share of the Asia Pacific market in 2024.

- By service, the landfills segment dominated the market and accounted for 44.7% in 2024.

- By polymer type, the polypropylene (PP) segment dominated the market in 2024 and is expected to witness the fastest growth over the forecast period.

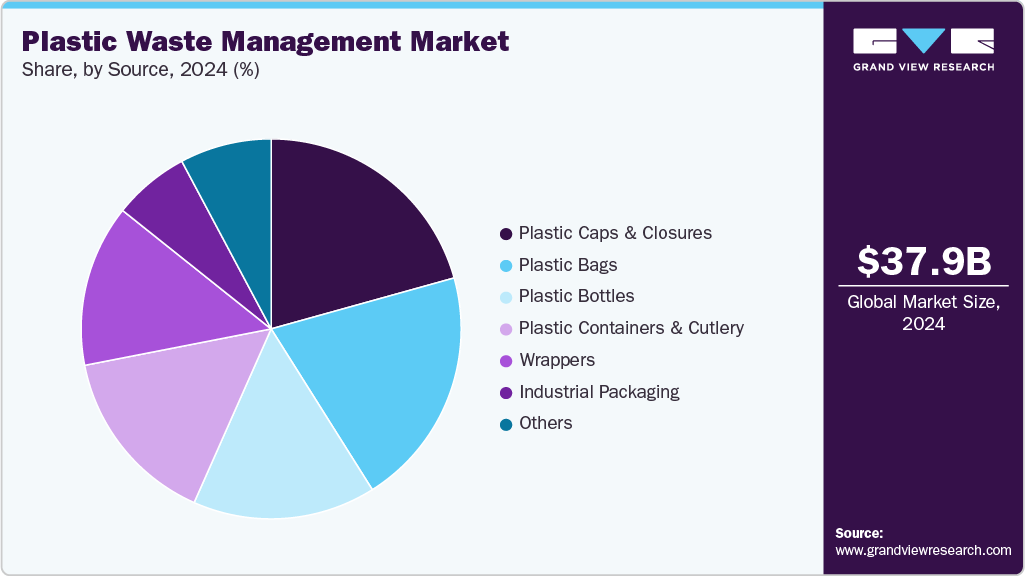

- By source, the plastic caps & closures segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 37.95 Billion

- 2030 Projected Market Size: USD 46.84 Billion

- CAGR (2025-2030): 3.6%

- Asia Pacific: Largest market in 2024

With increased environmental awareness among governments, corporate organizations, industries, and consumers, there is a growing emphasis on minimizing the environmental footprint of plastic waste. Furthermore, the growing demand for sustainable plastic disposable methods by plastic packaging manufacturers is encouraging overall market growth. Growing investments by the governments, especially from Western countries including the U.S. and the UK, to strengthen their recycling infrastructure, is a key factor pushing the demand for plastic waste management.

This investment translates into the upgradation and expansion of recycling infrastructure. For instance, in September 2023, the U.S. Environmental Protection Agency (EPA) announced a significant investment of over USD 100 million from President Biden's Investing in America program. This funding was designated to enhance recycling facilities and waste management operations nationwide, marking the Environmental Protection Agency's most significant investment in recycling in over 30 years. In addition, rising government focus on addressing the challenges of plastic pollution and supporting sustainable solutions is also driving the market's growth. For instance, in October 2024, the U.S. government announced funding for a public-private partnership named End Plastic Pollution International Collaborative (EPPIC). The PPP aims to strengthen international efforts to combat plastic pollution. Such initiatives and funding are proving vital for advancing sustainable waste management efforts.

The rising importance of circular economic strategies is fueling the need for plastic waste management services worldwide. Such strategies encourage the repurpose and recycling of plastic, which decreases waste and saves natural resources. For instance, in November 2024, the United States Environmental Protection Agency announced the “National Strategy to Prevent Plastic Pollution.” The strategy explores and outlines opportunities to prevent communities from generating plastic waste and addresses how businesses, government agencies, communities, and non-profits can take action to prevent plastic pollution. Globally, corporations and organizations are embracing circular economic models, investing in sophisticated recycling technologies to efficiently reclaim, categorize, and process plastic waste. This movement towards circular economics is propelled by dependence on limited resources and the incorporation of sustainable development goals, thereby creating a sustainable value chain for recyclable plastic.

Moreover, improvements in living standards, especially in developed and emerging economies, have also increased the use of plastic in packaging. Thus, plastic pollution poses a severe threat to the environment and human and animal life. According to news published in January 2024, microplastics in the U.S. food and water supply contribute up to USD 250 billion yearly to the health crisis in the U.S. Moreover, poor management of plastic waste, especially in developing countries, is the primary source of plastic pollution. Thus, increasing plastics production coupled with growing concerns pertaining to plastic waste treatment is expected to offer new avenues for the plastic waste management industry, thereby driving the overall market growth over the forecast period.

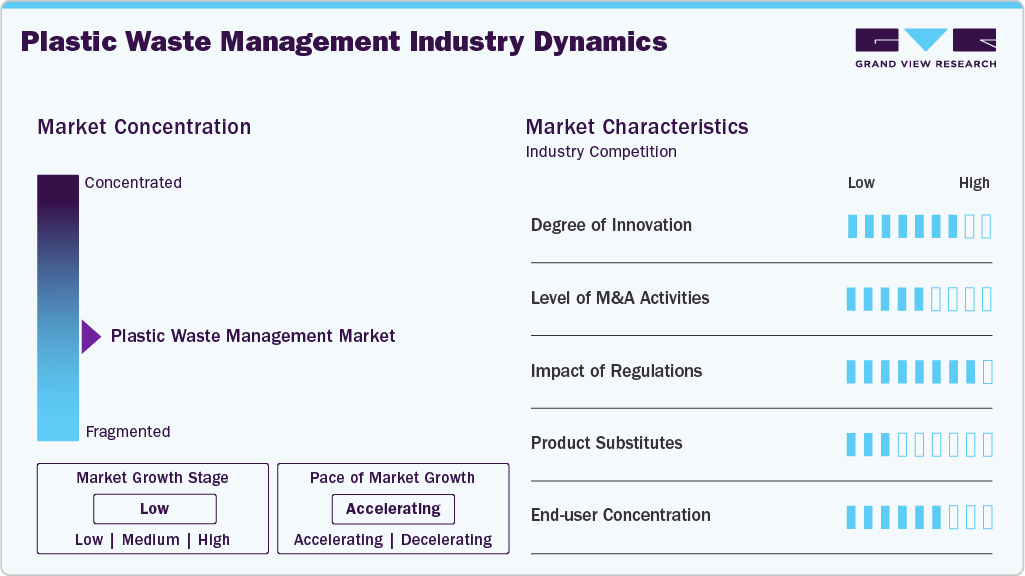

Market Concentration & Characteristics

The market growth stage of plastic waste management is medium, and the pace of the market growth is accelerating. The market is characterized by a high degree of competition owing to the various cost-efficient technologies adopted by the market players to improve their plastic waste management capability. Further, emerging economies witnessed a rapid growth in investment in plastic recycling infrastructure, thereby driving the competition between the market players.

The market is also characterized by a high degree of new service launches, which results in the development of plastic waste management. For instance, the 500-tonne-per-year showcase plant in Monthey, Switzerland, was introduced in April 2025 by the DePoly sustainable PET-to-raw-material recycling firm. At this facility, waste PET and polyester will be transformed into virgin-grade raw materials without the use of fossil fuels. Such new service launches can lead to increased market penetration for a market player by entering into new segments and expanding its customer base.

The market is moderately fragmented, dominated by few major players, including Veolia Environment S.A., Republic Services Inc., and Biffa PLC. However, some smaller companies are also competing in space at the country/regional level. The key players' strategies most often involve acquisitions and regional expansion.

Regulations such as the Plastic Bags Directive in Europe and the Resource Conservation and Recovery Act (RCRA) in the U.S. significantly impact the plastic waste management market. In addition, environmental requirements such as recycling targets and landfill diversion mandates incentivize businesses and local governments to invest in recycling infrastructure. All such factors are encouraging more companies to participate in the overall plastic waste management industry.

Service Insights

The landfills segment dominated the market and accounted for 44.7% in 2024. The large share of the segment is attributed to the unavailability of incineration and recycling plants incapable of handling mixed & contaminated plastics. Besides, lower initial operational costs compared to advanced recycling or incineration, and insufficient infrastructure in many regions is also promoting plastic disposal at landfills. The landfill is the primary treatment method used for waste disposal management globally. Landfills are used to dispose of a variety of waste. Traditional landfills lack the capabilities to properly handle plastic waste. These landfills are either designed for the management of municipal solid waste or are used for the disposal management of commercial and institutional waste. In addition, high production of single-use plastic is fueling the segment's growth. In April 2023, the United Nations Environment Programme (UNEP) reported that the packaging industry is the largest contributor of single-use plastic waste globally. About 36% of all plastic is used for packaging, of which 85% end up in landfills, including single-use plastic food and drink containers. Such factors are expected to drive the growth of the plastic waste management industry.

The recycling segment is anticipated to witness a high growth rate of 5.2% over the forecast period. Stringent government policies, consistent rise in infrastructure for recycling plastic, and the need to reduce virgin plastic production are expected to drive the segment growth. Recycled plastic has a wide variety of applications in producing consumer products, including clothes, carpets, garbage bags, films, containers, and bottles. Moreover, the adoption of environmentally sustainable alternatives by different companies is fueling the demand for recycled plastic in the market. According to Unilever’s sustainability report, 57% of plastic packaging can be recycled, and 21% of its global product portfolio uses recycled plastic. This strategy helps them reduce the use of virgin plastic and greenhouse gas emissions. Furthermore, the rising circular economic initiatives and sustainability measures are driving the plastic recycling service.

Polymer Type Insights

The polypropylene (PP) segment dominated the market in 2024 and is expected to witness the fastest growth over the forecast period. The growth is attributed to its outstanding properties, including high chemical resistance, fatigue resistance, and weldability. PP is an easily available polymer at a low cost and can be adapted to numerous fabrication techniques, making it highly suitable for household and industrial applications. Widespread use across various applications, including packaging, automotive components, and consumer goods, is increasing demand for PP. Additionally, companies' increased focus on improving PP recycling is fueling the segment's growth. For instance, in June 2024, Georg Utz partnered with Braskem Wenew to advance circular chemically recycled polypropylene for food transport packaging. This collaboration aims to utilize post-consumer plastic waste to produce new, high-value materials, demonstrating a move toward more sustainable PP management.

The low-density polyethylene (LDPE) segment is anticipated to witness significant growth over the forecast period. The LDPE has a higher recycling ability compared to other polymer types. LDPE is extensively used to produce flexible and thin products, including container lids, shrink-wrap, bags, toys, stretch film, and squeezable bottles. In addition, the growth of the packaging industry, especially in e-commerce, has increased the volume of LDPE waste. According to the report/article published in July 2023 by BusinessWaste.co.uk, in the UK, approximately 20% of the 564 million plastic bags used annually are made of LDPE. Furthermore, recycled LDPE is used to produce floor tiles, garbage can liners, compost bins, furniture, paneling, and trash cans. With such diverse applications, LDPE waste is expected to be produced in considerable quantities, and its higher recycling ability is anticipated to help the segment to grow significantly.

Source Insights

The plastic caps & closures segment dominated the market in 2024. The growth is primarily attributed to the widespread usage and disposal of these items across various industries, including food and beverage, pharmaceuticals, and personal care, due to their cost-effectiveness, durability, and versatility. These qualities lead to their massive production and, consequently, to significant waste generation. Moreover, manufacturers focus on developing 100% recyclable mono-material caps and closures, fueling market growth. For instance, in May 2024, IMDvista and Origin Materials announced a partnership to establish the commercial-scale PET cap and closure manufacturing system, enhancing recyclability. These factors are driving the growth of the plastic waste management industry.

Plastic bottles have long been at the forefront of plastic waste management, largely due to high usage in beverage packaging and consumer products. However, this widespread use has led to significant environmental problems, as they constitute a substantial portion of the plastic waste in landfills and oceans because of their non-recyclability. According to an article published by GreenMatch in May 2024, approximately 500 billion bottles of plastic are consumed every year globally, with 35 billion empty water bottles being thrown away in the US alone, of which 12% of bottles are recycled. Efforts to manage this waste have included initiatives to improve recycling technologies, encourage the use of biodegradable alternatives, and implement policies to reduce single-use plastics.

Regional Insights

North America plastic waste management market is expected to grow at a consistent rate over the forecast period. Stringent environmental regulations characterize the plastic waste management market of North America. Moreover, the increasing consciousness regarding the impact of plastic waste on the environment among consumers, governments, and corporations is creating the need for plastic waste management. Similarly, innovations in waste management technologies, including advanced recycling and waste-to-energy solutions, are creating opportunities for market expansion. For instance, in April 2024, Canada's government announced an investment of over USD 3.3 million to support local organizations in combating plastic pollution, demonstrating its commitment to addressing plastic waste issues.

U.S. Plastic Waste Management Market Trends

The U.S. plastic waste management market accounted for the largest revenue share of the regional market in 2024. The market is significantly influenced by rules and mandates set by the state and federal governments, including policies such as the Extended Producer Responsibility (EPR) program. Additionally, the growing investment in waste management and recycling infrastructure presents a significant opportunity in the U.S. Significant investments are being made from both the public and private sectors to develop new technologies to tackle issues associated with plastic waste management.

Europe Plastic Waste Management Market Trends

Europe plastic waste management market is characterized by stringent government regulations implemented for plastic waste management. Moreover, the move towards circular economic frameworks in Europe, with a focus on plastic recycling, is propelling the market forward. In addition, the European Union is tackling the issue of single-use plastics through directives such as the Single-Use Plastics Directive, which aims to reduce the impact of certain plastic products on the environment, including the marine environment. Measures include bans on certain single-use plastic items, targets for separate collection of plastic bottles, and requirements for recycled content in plastic bottles.

The plastic waste management market in Germany accounts for the largest share of regional revenue and the highest CAGR over the forecast period. The need to manage plastic waste in Germany is influenced by the German government's adoption of a five-point plan to minimize plastic waste. Furthermore, advancements in innovation and technological development within the plastic waste management sector are propelling the market. Besides, continuous manufacturing processes and growing consumption of packaged products among consumers are also expected to help the growth of the plastic waste management industry in the country.

Asia Pacific Plastic Waste Management Market Trends

The plastic waste management market of Asia Pacific led the global market and accounted for the largest share of 50.1% and fastest growth over forecast period. The growth is attributed to the increasing industrial activities combined with strict regulations regarding disposal methods and the recycling of plastic waste. Continuous economic growth, together with the growing emphasis on reducing the ecological footprint of plastics in countries, is propelling the market significantly in the region.

China plastic waste management market held the largest revenue share of the Asia Pacific market in 2024. The Chinese government has embraced sustainability goals in response to the surge in plastic waste, a consequence of swift industrialization and urbanization. Additionally, China's efforts, including promoting a circular economy, encouraging recycling, and reducing reliance on landfills, are fueling the growth of the plastic waste management industry. The plastic waste management market of India is anticipated to grow at a significant CAGR over the forecast period due to government initiatives and regulations. For instance, the Ministry of Environment, Forest, and Climate Change (MoEFCC) announced the Plastic Waste Management Rules (2022) to manage plastic waste more sustainably by introducing the Extended Producer Responsibility (EPR) approach.

Central & South America Plastic Waste Management Market Trends

Central & South America plastic waste management market is expected to witness significant growth owing to the need for sustainable waste management solutions. The expansion of urban areas has led to increased plastic waste production, necessitating plastic waste management and recycling. The plastic waste management market of Brazil is projected to grow at a considerable CAGR over the forecast period, owing to stringent government regulations and resource conservation. The National Policy for Solid Waste Treatment and increasing public-private partnerships in waste management act as market drivers for plastic waste management in the country.

Middle East & Africa Plastic Waste Management Market Trends

The Middle East and Africa plastic waste management market is driven by the increase in industrial activities, expanding populations, and growth in urbanization. Increasing environmental consciousness and strict rules focused on reducing waste and safeguarding the environment fuel the need to manage plastic waste.

Key Plastic Waste Management Company Insights

Some of the key companies in the Plastic Waste Management market include Republic Services, Inc., Veolia Environnement S.A., and Biffa PLC. Companies are concentrating on growing their clientele to obtain a competitive advantage in the market. Thus, significant participants are undertaking several strategic actions, including alliances with other large corporations and mergers and acquisitions.

-

Veolia Environments S.A. was incorporated in 1853 as Compagnie Générale des Eaux and is headquartered in Aubervilliers, France. It provides air quality management, waste management, and industrial cleaning services. The company offers its services through three business segments: water, waste, and energy. It provides various solutions, such as energy services for buildings, total waste management, desalination, cooling system management, landfill, biogas recovery, and drinking water production to municipal and industrial clients worldwide.

-

Biffa, an integrated waste management company, was established in 1912 and is headquartered in High Wycombe, UK. The company is involved in plastic containers & cutlery wrappers, plastic caps and closures, industrial packaging, municipal and household waste collection, and resources & energy services. It provides waste processing and treatment solutions across the UK and has over 8,000 employees. Services offered by the company through its business waste segment include glass recycling, plastic recycling, metal recycling, general waste collection, hazardous waste collection & treatment, unplanned waste removal, and asbestos waste removal.

Stericycle Progressive Waste Solutions Ltd. and Progressive Waste Solutions Ltd are some of the consistently growing market participants.

-

Stericycle was established in 1989 and is headquartered in Illinois, U.S. The company operates through four major business segments: waste services, communication services, brand protection services, and other specialty services & products. It offers waste services, including collection, transportation, and disposal of bio-hazardous, industrial hazardous, pharmaceutical, and household waste.

-

Progressive Waste Solutions Ltd. offers a wide range of waste management and recycling services tailored for businesses in hospitality, the private sector, health and fitness, hair and beauty, and construction and manufacturing. The Company also provides a range of waste containers for general waste and mixed recycling.

Key Plastic Waste Management Companies:

The following are the leading companies in the plastic waste management market. These companies collectively hold the largest market share and dictate industry trends.

- Veolia Environments S.A.

- SUEZ Environments Company

- Waste Management, Inc.

- Republic Services Inc.

- Waste Connections Inc

- Clean Harbors, Inc.

- Biffa PLC

- Covanta Holding Corporation

- Stericycle Inc.

- Remondis SE & Co. KG

- ADS Waste Holdings, Inc.

- Hawkvale Limited

- Hahn Plastics Limited

- Progressive Waste Solutions Ltd.

- United Plastic Recycling, Inc.

Recent Developments

-

In September 2024, LyondellBasell announced the launch of an advanced recycling facility in Germany. The facility will use proprietary LYB MoReTec technology to minimize plastic dust emissions during manufacturing.

-

In November 2023, Blue Polymers, LLC and Republic Services, Inc. collaborated for the first innovative plastics recycling complex in the U.S. This collaboration features the establishment of the Republic Services Polymer Center alongside Blue Polymers' cutting-edge polymer production facility. This project aims to promote the circularity of plastics and provide recycled materials for sustainable packaging and various other uses.

-

In January 2022, REMONDIS is collaborating with top retailers in Germany to recycle approximately 18 billion used drink containers annually, preventing them from being incinerated or discarded along roadsides. The deposit scheme's structure provides significant benefits for retailers.

Plastic Waste Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 39.24 billion

Revenue forecast in 2030

USD 46.84 billion

Growth Rate

CAGR of 3.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

May 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, polymer type, source, and region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Spain, Italy, China, Japan, India, Australia, South Korea, Brazil, Argentina, UAE, and Saudi Arabia.

Key companies profiled

Veolia Environments S.A.; SUEZ Environments Company; Waste Management, Inc.; Republic Services Inc.; Waste Connections Inc; Clean Harbors, Inc.; Biffa PLC; Covanta Holding Corporation; Stericycle Inc.; Remondis SE & Co. KG; ADS Waste Holdings, Inc.; Hawkvale Limited; Hahn Plastics Limited; Progressive Waste Solutions Ltd.; United Plastic Recycling, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastic Waste Management Market Report Segmentation

This report forecasts revenue growth at global levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plastic waste management market report based on service, polymer type, source, and region.

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Collection

-

Recycling

-

Incineration

-

Landfills

-

-

Polymer Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Polypropylene (PP)

-

Low-density polyethylene (LDPE)

-

High-density polyethylene (HDPE)

-

Polyvinyl chloride (PVC)

-

Polyurethane (PUR)

-

Polystyrene (PS)

-

Terephthalate (PET)

-

Others

-

-

Source Outlook (Revenue, USD Billion, 2018 - 2030)

-

Plastic Bags

-

Plastic Bottles

-

Plastic Containers & Cutlery

-

Wrappers

-

Plastic Caps and Closures

-

Industrial Packaging

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Spain

-

Italy

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.