- Home

- »

- Plastics, Polymers & Resins

- »

-

Plastics In Personal Protective Equipment Market Report 2030GVR Report cover

![Plastics In Personal Protective Equipment Market Size, Share & Trends Report]()

Plastics In Personal Protective Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Polyethylene (PE), Polypropylene (PP), Others), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-802-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plastics In PPE Market Size & Trends

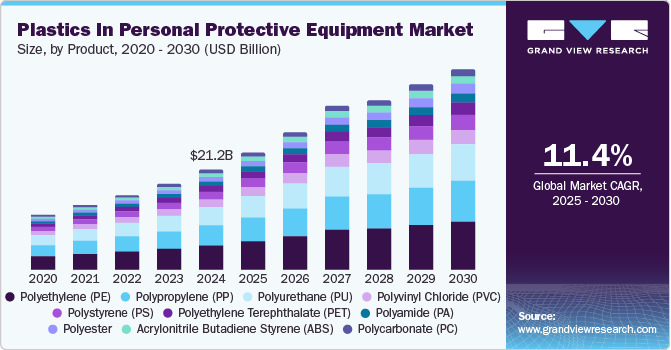

The global plastics in personal protective equipment market size was valued at USD 21.25 billion in 2024 and is projected to grow at a CAGR of 11.4% from 2025 to 2030. Constant technological advancements in raw materials, the increasing need for workplace safety and hygiene, and evolving regulatory standards by global authorities have helped drive market growth. The variety of available plastics and their different features and benefits have led to their large-scale utilization in the personal protective equipment (PPE) sector. These solutions are used widely in areas such as construction, chemicals, oil & gas, and mining, where the risk of exposure to harmful gases or chemicals is high and thus requires the availability of protective accessories.

The COVID-19 pandemic emerged as a major factor driving consumer awareness regarding protective equipment such as face masks and protective clothing, which boosted the use of plastics in the manufacturing process of PPE kits. As government mandates globally necessitated these solutions to prevent the spread of the virus, particularly outdoors, the plastics in the personal protective equipment industry witnessed significant expansion during this period. Increased focus on health security and preparedness has accelerated investments in manufacturing technologies that can produce large volumes of plastic-based solutions quickly and efficiently. PPE standards and regulations set by organizations such as the U.S. Food and Drug Administration (FDA), the Occupational Safety and Health Administration (OSHA), and the Centers for Disease Control and Prevention (CDC) require specific performance characteristics, for instance, barrier protection and fluid resistance, which plastics can meet effectively.

Plastics, particularly polymers such as polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC), impart excellent barrier properties to PPE, protecting the wearer from common contaminants, chemicals, and biological hazards. These materials are highly durable and resistant to wear, making them ideal for use in items, including gloves, masks, face shields, and protective gowns that must withstand continuous physical and environmental stress. Using plastics as a base material allows for the integration of various functionalities in these products. For example, face shields can be made from polycarbonate or PET (polyethylene terephthalate) for clarity and impact resistance, while nitrile, latex, or vinyl gloves provide flexibility and tactile sensitivity. Moreover, certain plastic materials can be embedded with antimicrobial agents, enhancing their ability to resist the growth of harmful microorganisms, which is important in specific applications such as medical gowns and gloves.

The increasing focus on sustainability among global corporations and rising awareness regarding the issues presented by single-use and disposable plastic products has helped shape industry developments. The improper disposal of PPE can introduce hazardous pollutants into ecosystems, including microplastics that pose a substantial risk to marine life and human health. Transitioning from conventional plastics to bioplastics represents a promising avenue for sustainable production. Bioplastics, derived from renewable resources such as plant cellulose, offer reduced carbon footprints and better biodegradability compared to traditional plastics. Partnerships between research institutes and manufacturers are expected to aid innovations in the plastics in the personal protective equipment industry. For instance, in April 2022, British PPE manufacturer Globus Group announced a partnership with Imperial College Healthcare to recycle face masks into new medical solutions for the National Health Service (NHS).

Product Insights

The polyethylene (PE) segment accounted for the largest revenue share of 24.5% in the global plastics in personal protective equipment industry in 2024. The demand for polyethylene (PE) has been influenced by various factors, including the material's unique properties, its versatility, and the evolving needs of industries and healthcare systems for protective accessories. Polyethylene is a widely used plastic in PPE due to its cost-effectiveness, durability, chemical resistance, and ease of processing. Moreover, it is a lightweight material, which results in items made from PE, such as gloves, gowns, and aprons being more comfortable for extended wear. Polyethylene is also resistant to fluids, making it an ideal material for creating protective barriers against bodily fluids, blood-borne pathogens, and other contaminants. Increasing sustainability concerns are expected to lead to the development of recyclable & bio-based polyethylene alternatives, aiding segment growth.

The polyester segment is expected to grow at the highest CAGR from 2025 to 2030. Increasing awareness regarding product benefits such as its durability, versatility, resistance to wear and tear, and ability to be easily engineered for specific protective properties have made it a preferred material in the plastics in PPE industry. These properties have made it a preferred material for protective equipment that needs to withstand heavy wear and repeated use, such as protective clothing, coveralls, gowns, and aprons. Polyester also offers good resistance to chemical exposure, making it suitable for use in environments where workers are exposed to harsh chemicals or biohazards. Innovations in bio-based polyester, such as materials produced from renewable sources (plant-based feedstocks such as sugarcane or corn), offer an eco-friendly alternative to conventional polyester made from petrochemical resources.

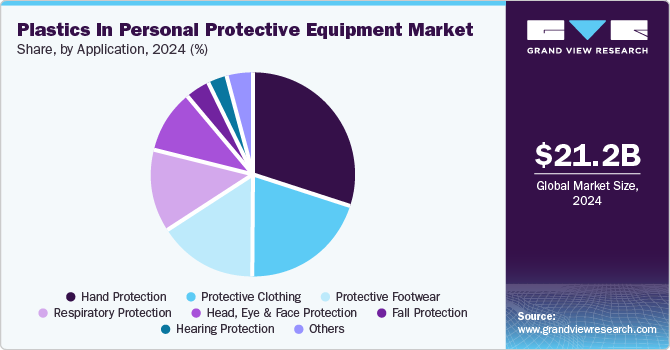

Application Insights

The hand protection segment accounted for a leading revenue share in the market in 2024. The demand for plastic-based PPE for hand protection, particularly gloves, has experienced significant growth due to healthcare requirements, industrial growth, safety regulations, and the increased importance of hygiene during the COVID-19 pandemic. For instance, latex, nitrile, and PVC gloves protect against pathogens, bacteria, and viruses, making them indispensable in medical institutions such as hospitals and clinics. Continued advancements in the food processing industry and the need to adhere to various food safety regulations have steadily increased the utilization of these protective accessories. Utilizing nanotechnology, self-disinfecting coatings, or reinforced materials has led to the development of high-performance gloves for intensive industrial and medical environments, aiding segment expansion.

The respiratory protection segment is expected to grow at the highest CAGR during the forecast period in the plastics in personal protective equipment industry. Increasing sales of face masks and protective face shields among general consumers and their continued widespread use in industrial settings contribute to the extensive use of plastics in making respiratory protective equipment. Key plastics used in respiratory protection accessories include polypropylene (PP), polycarbonate (PC), polyethylene (PE), and polyvinyl chloride (PVC), which provide a balance of durability, comfort, and protection. High-risk industries such as construction, mining, chemicals, oil & gas, and pharmaceutical manufacturing have regulations requiring workers to wear these types of PPE to prevent inhalation of toxic chemicals, dust, fumes, and other airborne hazards. This has led to a steady demand for respiratory PPE, such as N95 respirators, half-mask respirators, and full-face respirators.

Regional Insights

The Asia Pacific plastics in personal protective equipment market accounted for the largest global revenue share of 48.5% in 2024. The steadily growing regional population and fast pace of industrialization in economies such as India, China, and South Korea have created a significant demand for PPE, leading to the expansion of the plastics industry. Moreover, many countries are facing the issue of severe air pollution, with cities such as New Delhi and Gurugram (India), Lahore (Pakistan), and Dhaka (Bangladesh) seeing consistently hazardous Air Quality Index (AQI) levels. As a result, consumers have been compelled to use face masks and respirators, creating growth opportunities for manufacturers to incorporate high-quality and durable plastics in their solutions.

China Plastics in Personal Protective Equipment Market Trends

China plastics in personal protective equipment market accounted for a dominant revenue share in the regional market in 2024 and is expected to maintain its position in the coming years. The demand for plastics in PPE has significantly increased in recent years, driven primarily by stringent regulations due to the COVID-19 pandemic, as the economy was one of the worst-affected regions globally. Moreover, the country's rapid industrialization and comprehensive government worker and public safety regulations have enabled industry advancements through product innovations. China is one of the leading global producers and consumers of PPE, thus playing a vital role in both domestic consumption and global supply chains.

North America Plastics in Personal Protective Equipment Market Trends

North America plastics in personal protective equipment market accounted for a substantial revenue share in the global industry in 2024. Plastics such as polyethylene (PE), polyvinyl chloride (PVC), polypropylene (PP), and polycarbonate are widely used in manufacturing various types of PPE due to their cost-effectiveness, performance, and ability to meet safety standards. Furthermore, an increasing push toward recycling and the use of bioplastics in PPE manufacturing have led to a range of innovative developments in this industry in the U.S. and Canada. Recycled plastics, such as recycled polyethylene (rPE) and recycled polypropylene (rPP), are being used to reduce the environmental impact of plastic-based PPE. The extensive use of 3D printing technology to produce large batches of personal protective equipment has further enabled market expansion in this region.

The U.S. plastics in personal protective equipment market accounted for the largest revenue share in the regional market in 2024. Advancements in the material sciences segment, stringent regulatory environment concerning worker safety, and constantly evolving manufacturing practices have resulted in a steady growth of this industry. The U.S. was one of the worst-affected economies during the pandemic, leading to large-scale production of PPE kits across states to protect both citizens and healthcare workers. In recent years, several states and federal agencies have adopted strategies to stockpile PPE for future emergencies. Plastics remain an essential requirement in these strategies due to their low cost and effective performance in protecting against contaminants. Regulatory bodies such as the OSHA and the CDC have set strict standards for PPE used in workplaces and healthcare settings, which has helped shape the market positively.

Middle East & Africa Plastics in Personal Protective Equipment Market Trends

The Middle East & Africa region is expected to grow at the fastest CAGR during the forecast period, aided by significant investments by regional governments in improving healthcare and industrial infrastructure. The growing importance of the healthcare sector has driven a strong demand for plastic-based medical PPE, such as surgical masks, gloves, and protective suits. The extensive presence of petrochemical and oil & gas facilities in this region has further boosted the utilization of protective gear and accessories such as chemical-resistant gloves, face shields, and coveralls. Polyethylene, polypropylene, and PVC are commonly used in these products due to their durability, chemical resistance, and affordability. The continued expansion of the construction sector due to the development of various high-rises and commercial complexes has driven the presence of plastic-based safety gear, such as helmets, safety goggles, gloves, and protective suits, in the market to ensure worker safety.

Saudi Arabia plastics in personal protective equipment market accounted for a substantial revenue share in the Middle East & Africa market in 2024, aided by increasing industrialization in the economy and initiation of various infrastructural projects. Saudi Arabia has been making significant investments in the healthcare segment, which aligns with its Vision 2030 goals to improve healthcare quality and increase the accessibility of healthcare services for its population. This has driven the demand for PPE, particularly solutions such as surgical masks, gloves, and protective clothing. Additionally, the fast pace of development of planned megaprojects such as Qiddiya and NEOM have boosted the construction industry and provided employment to several local and migrant workers. As a result, the need to ensure their safety and welfare has increased the demand for personal protective equipment such as safety goggles, gloves, helmets, and other fall protection equipment.

Key Plastics in Personal Protective Equipment Company Insights

Some major companies involved in the global plastics in personal protective equipment industry include BASF, SABIC, and Celanese Corporation, among others.

-

BASF is a multinational chemical producer that operates through six major segments, including materials, chemicals, industrial solutions, surface technologies, nutrition & care, and agricultural solutions. Through the materials segment, the company is involved in developing and manufacturing performance materials, polyamide raw materials, and monomers. BASF offers a range of products designed to make protective equipment; for instance, the Elastollan thermoplastic polyurethane (TPU) is used in safety footwear, such as the KAMU safety boots. Another notable offering is the Elastopan polyurethane that is used in various components of PPE, including protective gear that requires shock absorption and durability.

-

SABIC (Saudi Basic Industries Corporation) is a global chemical manufacturing company based in Riyadh, Saudi Arabia. The company manufactures and sells products through four major segments: petrochemicals, antinutrients, specialties, and metals. SABIC actively produces plastics for personal protective equipment (PPE), focusing on sustainability and incorporating innovative materials. For instance, it has developed specialized polypropylene melt-blown resins specifically for manufacturing face masks, with these materials complying with N95 standards.

Key Plastics In Personal Protective Equipment Companies:

The following are the leading companies in the plastics in personal protective equipment market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- SABIC

- Evonik Industries AG

- Sumitomo Chemical Co., Ltd.

- Arkema

- Celanese Corporation

- Eastman Chemical Company

- Chevron Phillips Chemical Company LLC

- Exxon Mobil Corporation

- Covestro AG

Recent Developments

-

In October 2023, SABIC announced its collaboration with INTELLINIUM, which involved the use of SABIC’S LNP STAT-LOY compound in PPE solutions that are ATEX-certified. LNP STAT-LOY addresses ATEX’s Intrinsic Safety electrical conductivity demands while offering a surface resistivity of 1 GΩ - 100 GΩ to adhere to ATEX directives. The compound further allows a high electrical signal transmission for embedded telecom technologies such as 4G NB-IoT, 4G LTE-M, LoRaWAN, GPS, Bluetooth, and Near Field Communication (NFC).

Plastics In Personal Protective Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 24.85 billion

Revenue forecast in 2030

USD 42.67 billion

Growth rate

CAGR of 11.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, China, Japan, India, Brazil, Saudi Arabia

Key companies profiled

BASF; SABIC; Evonik Industries AG; Sumitomo Chemical Co., Ltd.; Arkema; Celanese Corporation; Eastman Chemical Company; Chevron Phillips Chemical Company LLC; Exxon Mobil Corporation; Covestro AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastics In Personal Protective Equipment Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plastics in personal protective equipment market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyurethane (PU)

-

Polyvinyl Chloride (PVC)

-

Polyethylene Terephthalate (PET)

-

Polystyrene (PS)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Polycarbonate (PC)

-

Polyamide (PA)

-

Polysulfone (PSU)

-

Polyphenylsulfone (PPSU)

-

Acrylic

-

Polyester

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Head, Eye & Face Protection

-

Hearing Protection

-

Protective Clothing

-

Respiratory Protection

-

Protective Footwear

-

Fall Protection

-

Hand Protection

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

MEA

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.