- Home

- »

- IT Services & Applications

- »

-

Platform Engineering Services Market Size Report, 2030GVR Report cover

![Platform Engineering Services Market Size, Share & Trends Report]()

Platform Engineering Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Deployment, By Organization Size, By Service Type, By Vertical (BFSI, Manufacturing) By Region, And Segment Forecasts

- Report ID: GVR-4-68040-427-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Platform Engineering Services Market Summary

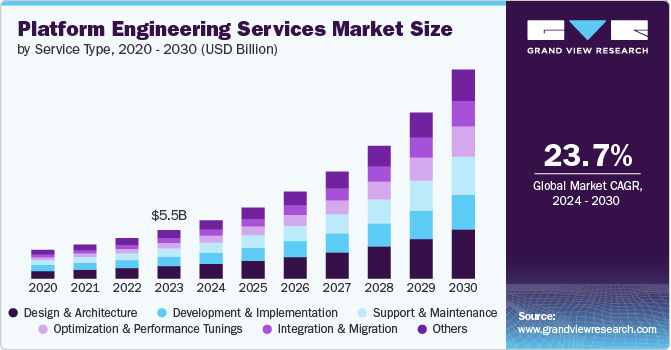

The global platform engineering services market size was estimated at USD 5,541.1 million in 2023 and is projected to reach USD 23,908.0 million by 2030, growing at a CAGR of 23.7% from 2024 to 2030. Platform engineering services are being increasingly adopted across various sectors such as BFSI, healthcare, retail, and manufacturing, driving market growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- In terms of segment, cloud accounted for a revenue of USD 5,541.1 million in 2023.

- Cloud is the most lucrative deployment segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 5,541.1 Million

- 2030 Projected Market Size: USD 23,908.0 Million

- CAGR (2024-2030): 23.7%

- North America: Largest market in 2023

Organizations are deploying applications across multiple cloud environments, necessitating advanced platform management and integration solutions. Moreover, businesses are increasingly migrating to cloud environments for better scalability, flexibility, and cost efficiency. The adoption of DevOps and CI/CD (Continuous Integration/Continuous Deployment) practices requires platforms that support automation, testing, and deployment pipelines.

Innovations such as 5G, edge computing, and blockchain are creating new opportunities and driving growth in platform engineering services. Advances in DevOps tools and automation are enhancing platform capabilities and driving demand. Growth in emerging markets is contributing to the expansion of the platform engineering services market as organizations in these regions adopt advanced technologies. Businesses are looking for ways to optimize costs and improve operational efficiency, which drives demand for advanced platform solutions.

Businesses are investing in platforms that offer personalized customer experiences and advanced analytics to drive engagement and retention. Integration of multiple customer touchpoints into a cohesive platform enhances user experience and drives demand. Adherence to regulations such as GDPR, HIPAA, and PCI-DSS drives the need for secure and compliant platform solutions. Increasing cyber threats and the need for data protection boost demand for secure platform engineering services.

Deployment Insights

The cloud segment led the market in 2023, accounting for over 68.0% share of the global revenue. Cloud platforms enable rapid deployment and scaling of applications, which supports agile development practices and quick adaptation to market changes. Moreover, various organizations are migrating from legacy systems to cloud-based solutions to improve efficiency and integrate new technologies. The adoption of multi-cloud and hybrid cloud environments is growing as businesses seek to leverage the strengths of different cloud providers and avoid vendor lock-in. Furthermore, the rise of cloud-native technologies, such as containers and micro services, drives the need for specialized platform engineering services to manage these environments.

The on-premises segment is anticipated to exhibit a significant CAGR over the forecast period. Organizations with specific security needs prefer on-premises solutions for greater control over security configurations and compliance. Various organizations have significant investments in existing on-premises infrastructure and applications. On-premises solutions facilitate integration with these legacy systems and allow for gradual modernization. For applications requiring low latency and high performance, on-premises solutions can provide the necessary speed and responsiveness by keeping data and applications close to end users.

Organization Size Insights

The large enterprises segment accounted for the largest market revenue share in 2023. Large enterprises often have complex IT environments with numerous systems, applications, and data sources that need to be integrated seamlessly. They require robust platform engineering solutions that can scale to handle large volumes of data and high transaction rates. Large enterprises are investing in modernizing legacy systems and adopting new technologies, which drives demand for advanced platform engineering services. The shift towards cloud computing, AI, machine learning, and IoT requires advanced platform solutions.

The SMEs segment is anticipated to exhibit the highest CAGR over the forecast period. SMEs benefit from platform engineering services that offer easy deployment and management, allowing them to focus on their core business rather than complex IT issues. SMEs are modernizing their IT infrastructure to improve efficiency and competitiveness, leading to growth in platform engineering services. SMEs seek cost-effective platform engineering solutions that provide high value without requiring significant capital investment, such as cloud-based platforms with pay-as-you-go models.

Service Type Insights

The design and architecture segment accounted for the largest market revenue share in 2023. As organizations adopt more complex IT systems and technologies, there is a growing need for robust design and architecture services to ensure seamless integration and interoperability. Designing scalable and flexible architectures is crucial for supporting the growth and evolving needs of businesses. Incorporating AI and machine learning into IT systems necessitates thoughtful design and architecture to integrate these technologies and leverage their capabilities.

The optimization and performance tunings segment is anticipated to exhibit the highest CAGR over the forecast period. Performance tuning is critical for real-time data processing and analytics applications to deliver timely insights and maintain operational efficiency. Implementing comprehensive performance monitoring tools helps identify bottlenecks and optimize system performance proactively. Automation of performance tuning processes helps in managing large-scale systems efficiently and reducing manual intervention. Optimizing performance ensures that applications and services are responsive and meet user expectations, which is crucial for customer satisfaction.

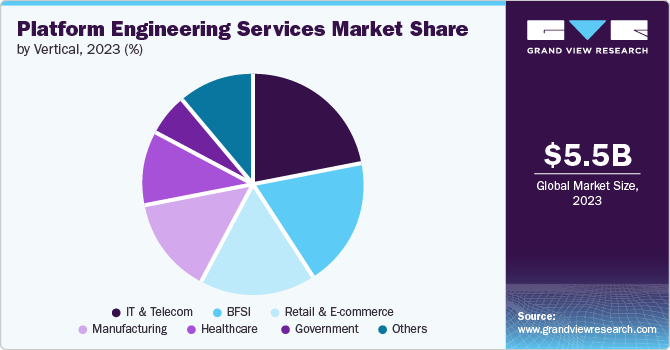

Vertical Insights

The IT & telecommunications segment accounted for the largest market revenue share in 2023. The modernization of IT infrastructure and telecom networks requires advanced platform engineering solutions to integrate new technologies and improve system capabilities. The advancements of 5G networks demands robust platform engineering to handle increased data traffic, support low-latency applications, and enable new services such as IoT and smart cities. The rise of edge computing necessitates platform solutions that can manage and optimize distributed computing resources closer to data sources. Network Functions Virtualization (NFV) and Software-Defined Networking (SDN) are transforming telecom infrastructure, requiring advanced platform engineering to design, deploy, and manage virtualized network functions and services.

The retail & e-commerce segment is anticipated to exhibit the highest CAGR over the forecast period. The expansion of e-commerce necessitates robust and scalable platform solutions to handle large volumes of transactions, manage product catalogs, and support online payment systems. Retailers are integrating online and offline channels to provide a seamless shopping experience, which requires advanced platform engineering to ensure consistency and connectivity across channels. Advanced platform solutions enable personalized shopping experiences through targeted recommendations, customized content, and personalized offers, enhancing customer engagement and loyalty.

Regional Insights

North America dominated with a revenue share of over 40.0% in 2023. North America is a prominent region for technological innovation, driving demand for advanced platform engineering services to support the latest technologies, such as AI, IoT, and blockchain. The region is at the forefront of cloud computing adoption, requiring sophisticated platform engineering services for cloud migration, management, and optimization.

U.S. Platform Engineering Services Market Trends

The U.S. platform engineering services market is anticipated to exhibit a significant CAGR over the forecast period. Companies in the U.S. are heavily investing in digital transformation initiatives to stay competitive. Application integration plays a crucial role in connecting new digital tools and platforms with existing IT infrastructure. Moreover, the increasing emphasis on data-driven decision-making and business intelligence requires robust integration solutions to consolidate data from diverse sources for comprehensive analysis and reporting.

Europe Platform Engineering Services Market Trends

The platform engineering services market in the Europe region is expected to witness significant growth over the forecast period. European enterprises are investing in digital transformation to modernize their IT infrastructure and integrate advanced technologies, driving demand for platform engineering services. Various countries in Europe have specific data protection and privacy laws that drive the demand for platforms that adhere to these regulations.

Asia Pacific Platform Engineering Services Market Trends

The platform engineering services market in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period. Businesses in the Asia Pacific region are accelerating digital transformation initiatives to modernize their IT infrastructure and integrate advanced technologies, driving demand for platform engineering services. The shift towards cloud computing is significant in the region, requiring advanced platform solutions for cloud migration, management, and optimization.

Key Platform Engineering Services Company Insights

Key platform engineering services companies include Amazon Web Services, Cisco Systems, Inc., and Google. Companies active in the platform engineering services market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in August 2023, automotive engineering services company, collaborated with Microsoft, to introduce "EnGeneer”, leveraging Azure OpenAI Service and Generative AI technologies to propel engineering innovation throughout various industries. The EnGeneer aims to boost engineering lifecycle agility by creating platforms and tools that provide automation and support to engineers. This would increase productivity and quality with Generative AI.

Key Platform Engineering Services Companies:

The following are the leading companies in the platform engineering services market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services

- Cisco Systems, Inc.

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- Microsoft

- Oracle

- Red Hat, Inc.

- Salesforce, inc.

- SAP SE

Recent Developments

-

In May 2024, DXC Technology Company, IT technology company, collaborated with Dell Inc., to advance Enterprise Intelligence Services (EIS). This partnership represents a major advancement in utilizing advanced technologies such as AI, machine learning, data analytics, and intelligent automation to convert data into a more integrated perspective of the business.

-

In April 2024, Kyndryl Inc. partnered with Oracle, to help end use companies modernize and migrate their databases and applications. Kyndryl Inc.'s partnership with Oracle plays a pivotal role in speeding up the cloud journey for customers by offering globally managed cloud solutions. As a partner for delivering Oracle Cloud Infrastructure (OCI), Kyndryl provides comprehensive services that assist clients in optimizing their investments throughout the full spectrum of Oracle technologies, from applications to infrastructure.

-

In March 2024, Salesforce, Inc. announced the general availability of Pro Suite, a scalable, comprehensive solution designed to assist small businesses in initiating and expanding on the AI CRM. Fueled by Salesforce’s Einstein 1 Platform and Data Cloud, Pro Suite offers clients a single, and pre-configured solution to enhance their operations.

Platform Engineering Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.69 billion

Revenue forecast in 2030

USD 23.91 billion

Growth rate

CAGR of 23.7% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, organization size, service type, vertical, region

Regional scope

North America, Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Amazon Web Services; Cisco Systems, Inc.; Google; Hewlett Packard Enterprise Development LP; International Business Machines Corporation; Microsoft; Oracle; Red Hat, Inc.; Salesforce, Inc.; SAP SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Platform Engineering Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global platform engineering services market report based on deployment, organization size, service type, vertical, and region.

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

SMEs

-

-

Service Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Design And Architecture

-

Development And Implementation

-

Integration And Migration

-

Support And Maintenance

-

Optimization And Performance Tunings

-

Others

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

IT And Telecommunications

-

BFSI

-

Manufacturing

-

Retail And E-Commerce

-

Healthcare

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global platform engineering services market size was estimated at USD 5.54 billion in 2023 and is expected to reach USD 6.69 billion in 2024.

b. The global platform engineering services market is expected to grow at a compound annual growth rate of 23.7% from 2024 to 2030 to reach USD 23.91 billion by 2030.

b. North America dominated the platform engineering services market with a share of 40.3% in 2023. North America is a prominent region for technological innovation, driving demand for advanced platform engineering services to support the latest technologies, such as AI, IoT, and blockchain. The region is also at the forefront of cloud computing adoption, requiring sophisticated platform engineering services for cloud migration, management, and optimization.

b. Some key players operating in the platform engineering services market include Amazon Web Services, Cisco Systems, Inc., Google, Hewlett Packard Enterprise Development LP, International Business Machines Corporation, Microsoft, Oracle, Red Hat, Inc., Salesforce, inc., and SAP SE.

b. Platform engineering services are being increasingly adopted across various sectors such as BFSI, healthcare, retail, and manufacturing, driving market growth. Organizations are deploying applications across multiple cloud environments, necessitating advanced platform management and integration solutions. Moreover, businesses are increasingly migrating to cloud environments for better scalability, flexibility, and cost efficiency. The adoption of DevOps and CI/CD (Continuous Integration/Continuous Deployment) practices requires platforms that support automation, testing, and deployment pipelines.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.