- Home

- »

- Advanced Interior Materials

- »

-

Pneumatic Components Market Size, Industry Report, 2030GVR Report cover

![Pneumatic Components Market Size, Share & Trends Report]()

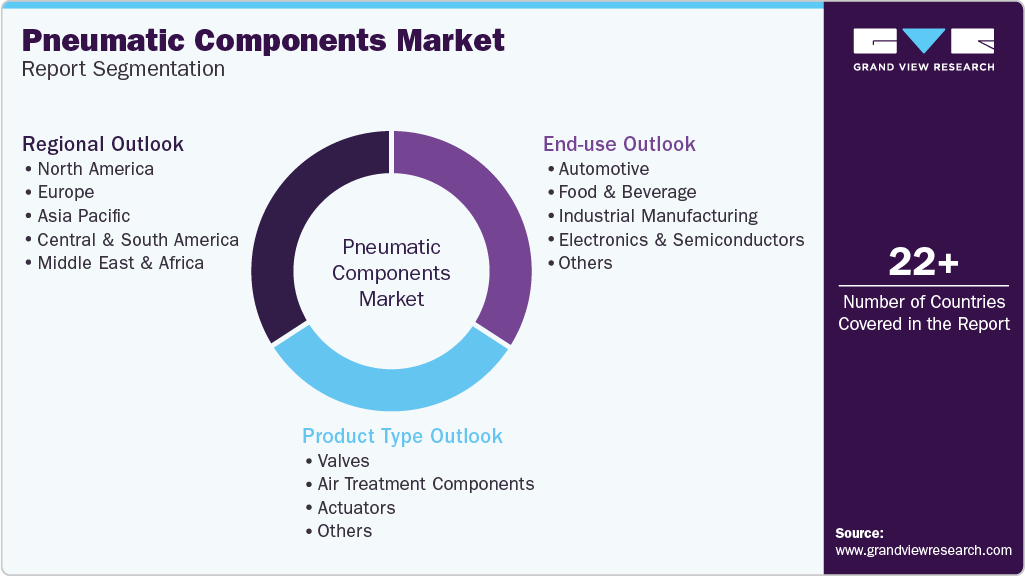

Pneumatic Components Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Valves, Actuators, Air Treatment Components), By End-use (Automotive, F&B, Industrial Manufacturing, Electronics & Semiconductors), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-592-2

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pneumatic Components Market Summary

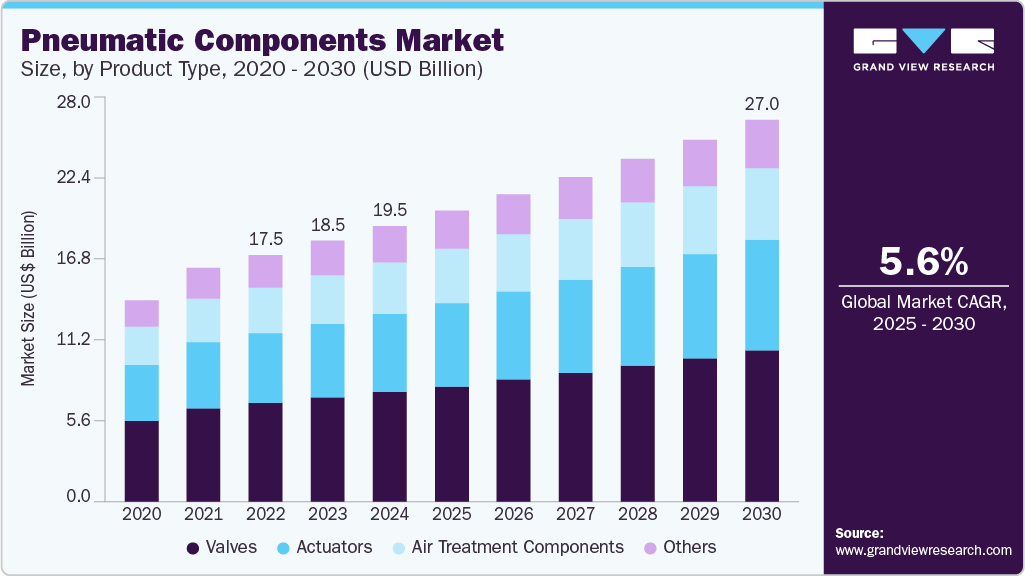

The global pneumatic components market size was estimated at USD 19.49 billion in 2024 and is anticipated to reach USD 27.02 billion by 2030, growing at a CAGR of 5.6% from 2025 to 2030, driven by their growing application across industries such as automotive, food and beverage, packaging, pharmaceuticals, and manufacturing.

Key Market Trends & Insights

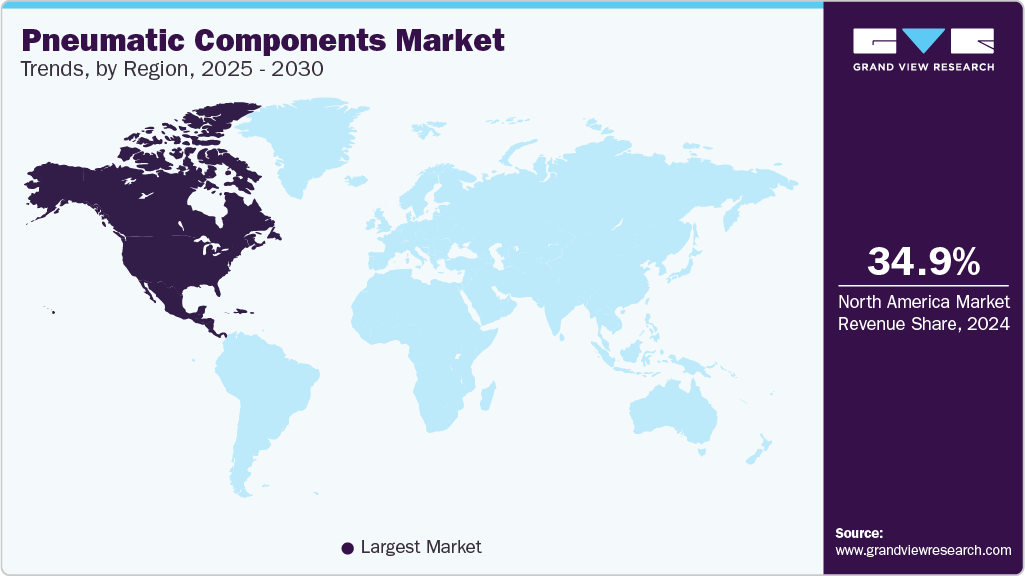

- North America dominated the market and accounted for the largest revenue share of about 34.9% in 2024.

- The U.S. leads the North American pneumatic components market.

- By product type, the valves segment accounted for the largest revenue share of 39.9% in 2024.

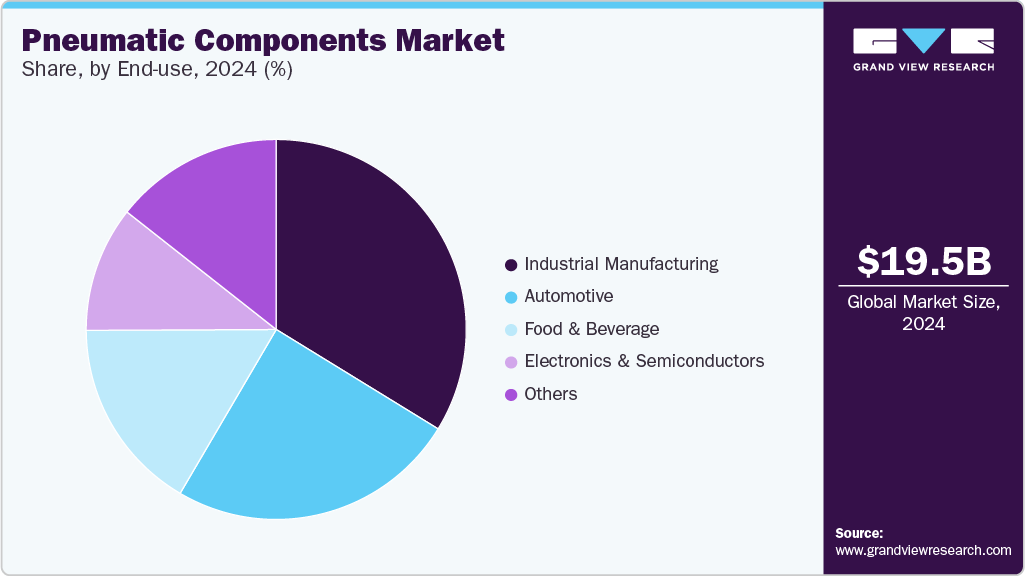

- By end-use, industrial manufacturing segment dominated the market and accounted for the largest revenue share of 33.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 19.49 Billion

- 2030 Projected Market Size: USD 27.02 Billion

- CAGR (2025-2030):5.6%

- North America: Largest market in 2024

These components such as valves, actuators, cylinders, and filters offer cost-effective, durable, and easy-to-maintain solutions for automation and process control. With the shift towards Industry 4.0 and increased focus on efficiency and automation, manufacturers are increasingly adopting pneumatic systems for their reliability and performance in high-speed operations.

Several factors are fueling the growth of the pneumatic component market. Firstly, the rise in industrial automation across both developed and emerging economies is a major driver. Secondly, the growth of end-user industries especially automotive and electronics demands faster and more efficient production processes. In addition, environmental regulations are pushing companies to adopt cleaner and more energy-efficient technologies, where pneumatic systems are preferred due to their minimal environmental footprint compared to hydraulic systems. Lastly, the lower upfront and maintenance costs of pneumatic systems make them attractive for small and medium-sized enterprises.

The market is witnessing significant innovation with the integration of smart technologies. Key advancements include the development of intelligent pneumatic systems with embedded sensors for real-time monitoring and predictive maintenance. IoT-enabled pneumatic components can now communicate system health, pressure levels, and operational efficiency to centralized control systems. Furthermore, manufacturers are focusing on energy-efficient designs and compact, modular components that offer flexibility and reduced air consumption. These innovations not only improve system performance but also align with the global trend toward sustainable manufacturing practices.

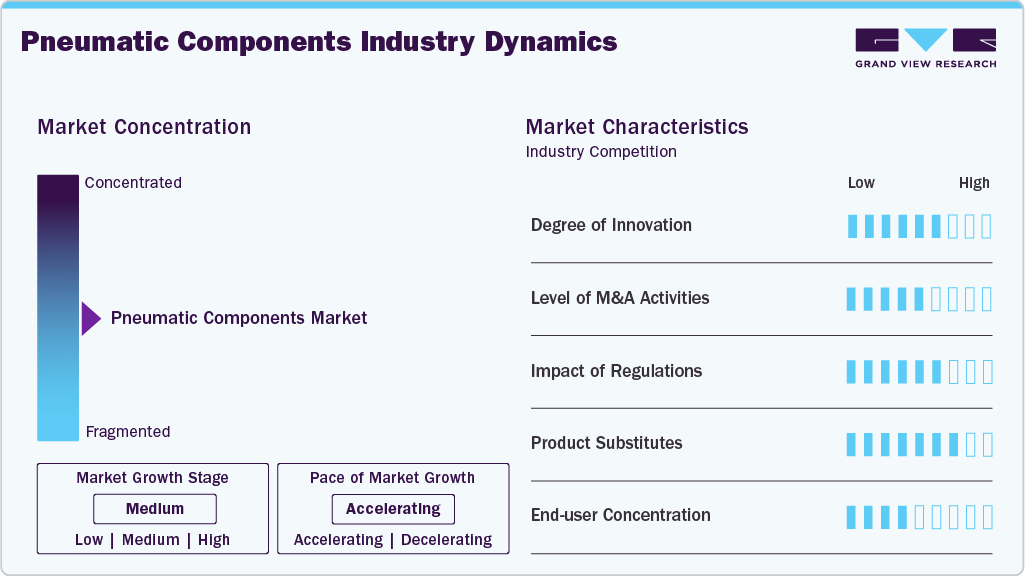

Market Concentration & Characteristics

The pneumatic component market is moderately concentrated, with a mix of established global players and regional manufacturers. Leading companies such as SMC Corporation, Festo, Parker Hannifin, and Emerson Electric dominate a significant share due to their extensive product portfolios, strong distribution networks, and continuous investment in R&D. However, the presence of numerous small and medium-sized enterprises in developing regions introduces competitive pricing and localized solutions, balancing the market dynamics. Despite the dominance of key players, technological advancements and niche application demands are allowing new entrants to carve out space in specific segments.

While pneumatic components are widely used for their simplicity and cost-effectiveness, they face competition from alternative technologies such as electric actuators, hydraulic systems, and electromechanical drives. Electric actuators, in particular, are gaining popularity due to their precision, energy efficiency, and better control in complex automation tasks. Hydraulic systems, although more expensive and maintenance-intensive, are preferred in applications requiring higher force and load-bearing capacity. The choice between these technologies often depends on factors such as application requirements, energy efficiency goals, cost constraints, and environmental considerations.

Product Type Insights

The valves segment led the market and accounted for the largest revenue share of 39.9% in 2024, due to their central role in controlling air flow, pressure, and direction within pneumatic systems. They are essential for regulating system performance and ensuring precise operation in a wide range of industrial applications, from assembly lines to packaging systems. Their versatility, relatively low cost, and critical function in system automation make them a high-demand component. In addition, the continuous need for maintenance and replacement of valves in existing systems contributes to their strong market share.

Actuators are experiencing the fastest growth in the pneumatic component market because of the surging demand for automation and motion control across industries. As companies seek to improve operational efficiency and reduce manual intervention, pneumatic actuators are increasingly used in robotics, manufacturing lines, and material handling systems. Their ability to convert compressed air into mechanical motion makes them ideal for precise, repetitive tasks, particularly in automotive, electronics, and food processing industries. Technological advancements such as compact designs, smart sensors, and energy-efficient models are further accelerating their adoption.

End-use Insights

The industrial manufacturing segment dominated the market and accounted for the largest revenue share of 33.8% in 2024, due to the rapid adoption of automation and smart factory technologies. As manufacturers strive to improve productivity, reduce downtime, and ensure consistent quality, pneumatic systems offer an efficient and economical solution for tasks such as material handling, clamping, pressing, and assembly. The expansion of industries such as electronics, machinery, and consumer goods especially in emerging economies is further accelerating demand. In addition, the integration of IoT and Industry 4.0 practices is driving the need for advanced pneumatic components with real-time monitoring and control capabilities.

The food and beverage segment is emerging as fastest growing in the pneumatic components market due to the industry's increasing focus on automation, hygiene, and efficiency. Pneumatic systems are highly suitable for food processing environments because they operate without electrical sparks, reducing fire risks and ensuring safe usage around flammable materials and liquids. In addition, pneumatic components require minimal lubrication, which helps maintain cleanliness and prevents contamination-an essential factor in food handling.

Regional Insights

North America Pneumatic Components Market Trends

North America dominated the market and accounted for the largest revenue share of about 34.9% in 2024. It is a technologically advanced and innovation-driven market, characterized by early adoption of smart manufacturing practices and high standards for energy efficiency and safety. The market growth is supported by widespread implementation of industrial IoT (IIoT), increasing use of collaborative robots, and retrofitting of older manufacturing facilities. Pneumatic components are widely used in automotive, aerospace, food & beverage, and pharmaceuticals industries where clean, reliable, and precise motion control is critical. The rising emphasis on reshoring manufacturing and enhancing domestic production capabilities post-pandemic further strengthens the market. In addition, North America is seeing increased demand for integrated pneumatic systems with real-time diagnostics and predictive maintenance features.

U.S. Pneumatic Components Market Trends

The U.S. leads the North American pneumatic components market with its strong base of high-tech and heavy manufacturing industries. The country's advanced infrastructure and significant investments in R&D contribute to the development and adoption of innovative pneumatic technologies. U.S. manufacturers are increasingly integrating smart sensors and controllers into pneumatic systems to improve operational visibility and efficiency. Key sectors such as automotive assembly, packaging, food processing, and life sciences are adopting pneumatic components for their durability and precision. Moreover, government support for domestic manufacturing and clean energy transitions is encouraging the use of energy-efficient pneumatic systems

Asia Pacific Pneumatic Components Market Trends

Asia Pacific is driven by its robust industrial ecosystem and accelerating pace of automation. Countries across the region, particularly China, India, Japan, and South Korea, are undergoing extensive industrialization, with rising demand for automation in manufacturing, electronics, packaging, and automotive sectors. The widespread availability of low-cost raw materials and skilled labor, combined with government initiatives such as “Make in India” and “Smart Manufacturing” in South Korea, are further driving growth. In addition, the rising trend of smart factories and Industry 4.0 integration is pushing demand for advanced, energy-efficient pneumatic solutions. This region benefits from both strong domestic consumption and export-oriented production, making it the dominant market globally.

China pneumatic components market is expected to grow as it is home to the world’s largest manufacturing base and a high concentration of end-user industries such as automotive, electronics, textiles, and heavy machinery-all of which rely heavily on pneumatic automation. The government's “Made in China 2025” policy promotes the adoption of advanced technologies, including smart pneumatic systems, across industrial sectors. As labor costs rise, Chinese manufacturers are increasingly investing in automation to maintain productivity and competitiveness. The ongoing expansion of high-speed railways, electric vehicle production, and semiconductor manufacturing also adds to the demand for precision pneumatic components.

Europe Pneumatic Components Market Trends

Europe is a mature but evolving market, characterized by a high level of technological sophistication and strong regulatory frameworks. European manufacturers prioritize sustainable and efficient production practices, which align with the development of eco-friendly and energy-saving pneumatic components. The region benefits from a highly skilled workforce and a strong presence of major pneumatic equipment manufacturers, such as Festo (Germany) and Norgren (UK). Demand is particularly high in industries such as pharmaceuticals, automotive, food and beverage, and packaging, where hygiene, precision, and automation are crucial. The European Green Deal and industrial decarbonization goals are also pushing companies to upgrade to more energy-efficient pneumatic systems.

Pneumatic components market in Germany is the industrial powerhouse of Europe, playing a pivotal role in the regional pneumatic components market. Known for its excellence in engineering and manufacturing, Germany has a deeply integrated supply chain involving automotive, robotics, and mechanical engineering sectors-all of which are heavy users of pneumatic systems. The country's leadership in implementing Industry 4.0 has led to widespread adoption of smart pneumatic components that can interact with digital control systems. German firms are also at the forefront of R&D, developing advanced solutions focused on energy savings, miniaturization, and system integration. High demand for precision, efficiency, and automation continues to drive growth in this market.

Central & South America Pneumatic Components Market Trends

Central & South America presents emerging opportunities for the pneumatic components market, particularly in Brazil, Mexico, and Argentina. These countries are seeing a gradual increase in automation across industries such as automotive, food processing, cement, and packaging. Economic reforms and trade agreements are encouraging foreign direct investment, which in turn is supporting industrial growth. While the market remains relatively underpenetrated, rising labor costs and the need for efficiency are pushing manufacturers to adopt pneumatic systems. Challenges such as political instability and infrastructure gaps still exist, but long-term prospects remain positive as regional industries modernize.

Middle East & Africa Pneumatic Components Market Trends

The Middle East & Africa region is slowly developing in the pneumatic components space, with industrial automation still at a nascent stage compared to other regions. However, there is growing interest in diversification beyond oil and gas, particularly in the Gulf Cooperation Council (GCC) countries. Governments are investing in logistics hubs, manufacturing zones, and food processing plants-industries where pneumatic systems are essential. South Africa and parts of North Africa are also showing signs of increased industrial activity. However, limited access to advanced technology, high initial investment requirements, and a shortage of technical expertise pose challenges to faster market growth. That said, infrastructure projects and industrialization initiatives are expected to gradually boost demand.

Key Pneumatic Components Company Insights

Some of the key players operating in the market include SMC Corporation, Festo SE & Co. KG

-

SMC Corporation is a global leader in pneumatic technology, offering a vast range of products including valves, actuators, air preparation equipment, and automation solutions. Known for innovation and high-quality components, SMC serves industries like automotive, electronics, and food processing, helping improve efficiency and precision in automated systems worldwide.

-

Festo is a top-tier provider of pneumatic and electromechanical automation technology. The company is recognized for its advanced pneumatic actuators, valves, and control systems that support smart manufacturing and Industry 4.0 initiatives. Festo’s products are widely used in automotive, packaging, and process industries, emphasizing energy efficiency and digital integration.

Parker Hannifin Corporation., Emerson Electric Co. are some of the emerging market participants in pneumatic components market.

-

Parker Hannifin is a leading manufacturer of motion and control technologies, including a comprehensive portfolio of pneumatic components such as valves, cylinders, and air preparation units. Serving sectors from aerospace to industrial manufacturing, Parker focuses on durable, high-performance solutions that enhance automation and system reliability.

-

Emerson Electric Co. provides a broad range of pneumatic products through its brands such as Aventics, specializing in pneumatic valves, cylinders, and systems for industrial automation. Emerson emphasizes innovative design and integration capabilities to optimize manufacturing processes in industries including automotive, food and beverage, and pharmaceuticals.

Key Pneumatic Components Companies:

The following are the leading companies in the pneumatic components market. These companies collectively hold the largest market share and dictate industry trends.

- SMC Corporation.

- Festo SE & Co. KG

- Parker Hannifin Corporation.

- Emerson Electric Co.

- Norgren, Inc. (IMI, PIC)

- Bosch Rexroth AG

- Airtac International Group.

- JELPC (Ningbo Jiaerling Pneumatic Machinery Co., Ltd.)

- Zhaoqing Fangda pneumatic Co. Ltd

- Camozzi Group

Recent Developments

-

In April 2025, SMC Corporation announced the launch of 3-Port Solenoid Valve Modular Type/Residual Pressure Release Valve. This valve helps in saving space and reduces piping labor.

-

In March 2024, Festo introduced the ELGD-TB (tooth belt) and ELGD-BS (ball screw) axes, designed for high-load bearing and compact size. These axes are suitable for applications requiring high precision and repeatability.

Pneumatic Components Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 20.58 billion

Revenue forecast in 2030

USD 27.02 billion

Growth rate

CAGR of 5.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

SMC Corporation.; Festo SE & Co. KG; Parker Hannifin Corporation.; Emerson Electric Co.; Norgren, Inc. (IMI, PIC); Bosch Rexroth AG; Airtac International Group.; JELPC (Ningbo Jiaerling Pneumatic Machinery Co., Ltd.); Zhaoqing Fangda pneumatic Co. Ltd; Camozzi Group

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pneumatic Components Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pneumatic components market report based on product type, end-use, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Valves

-

Air Treatment Components

-

Actuators

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Food & Beverage

-

Industrial Manufacturing

-

Electronics & Semiconductors

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global pneumatic components market size was estimated at USD 19.49 billion in 2024 and is expected to reach USD 20.58 billion in 2025.

b. The global pneumatic components market is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2030 to reach USD 27.02 billion by 2030.

b. The valves segment led the market and accounted for the largest revenue share of 39.9% in 2024, driven by their critical role in controlling airflow and pressure in automated systems across industries like manufacturing, automotive, and process control.

b. SMC Corporation., Festo SE & Co. KG, Parker Hannifin Corporation., Emerson Electric Co., Norgren, Inc. (IMI, PIC), Bosch Rexroth AG, Airtac International Group, JELPC (Ningbo Jiaerling Pneumatic Machinery Co., Ltd.), Zhaoqing Fangda pneumatic Co. Ltd, and Camozzi Group are prominent companies in the pneumatic components market.

b. Key factors driving the pneumatic components market include rapid industrial automation, rising demand for energy-efficient systems, growth in end-use industries like automotive and electronics, and increasing adoption of Industry 4.0 technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.