- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Poland Nutraceuticals Market Size, Industry Report, 2033GVR Report cover

![Poland Nutraceuticals Market Size, Share & Trends Report]()

Poland Nutraceuticals Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Dietary Supplements, Functional Food, Functional Beverages, Infant Formula), By Application, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-801-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Poland Nutraceuticals Market Summary

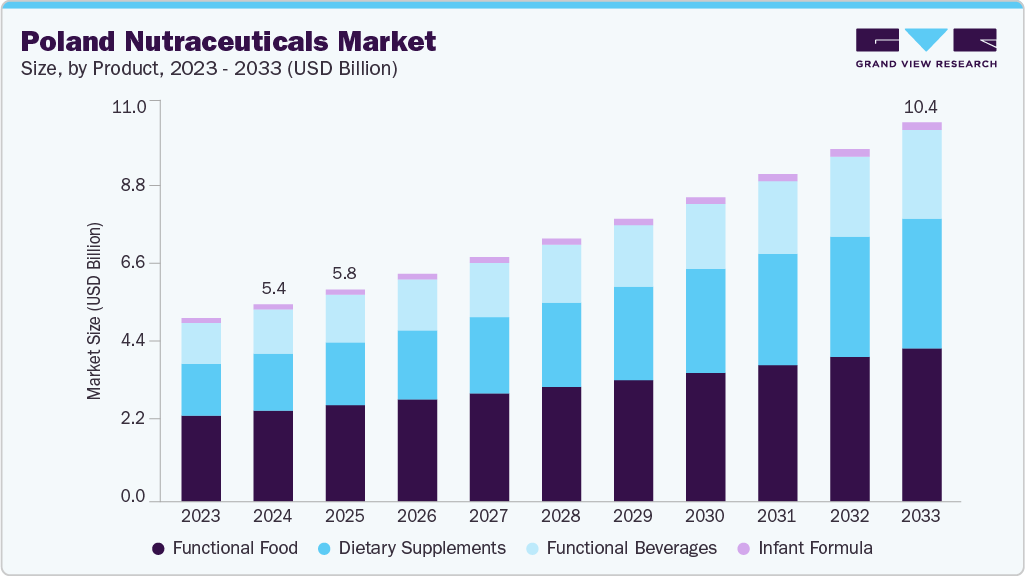

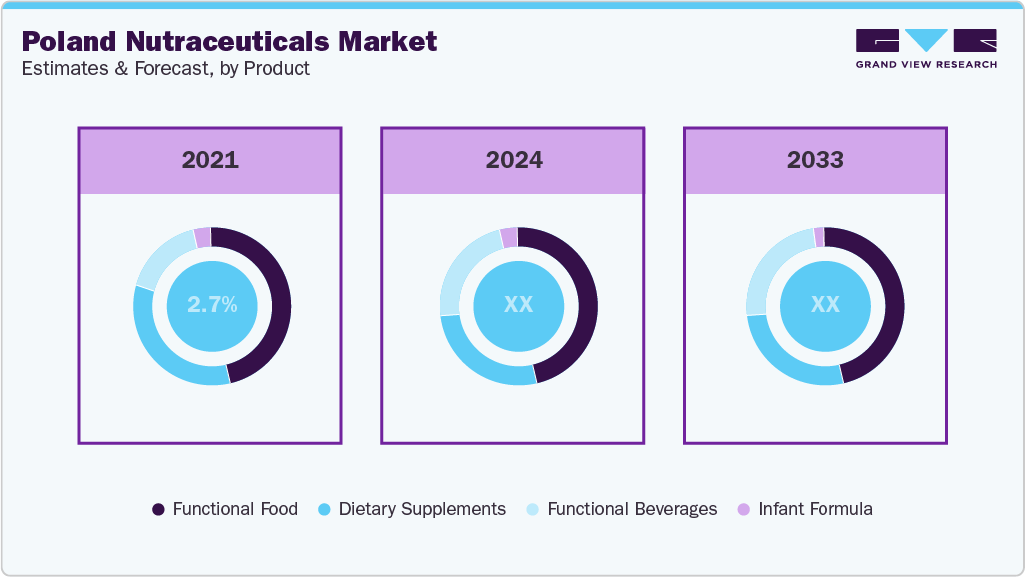

The Poland nutraceuticals market size was estimated at USD 5.40 billion in 2024 and is projected to reach USD 10.40 billion by 2033, growing at a CAGR of 7.5% from 2025 to 2033. The market is driven by rising health consciousness among consumers, leading to a surge in demand for functional and fortified foods.

Key Market Trends & Insights

- By product, the functional food segment held the largest market share of 46.1% in 2024.

- Based on application, the weight management & satiety segment held the largest market share in 2024.

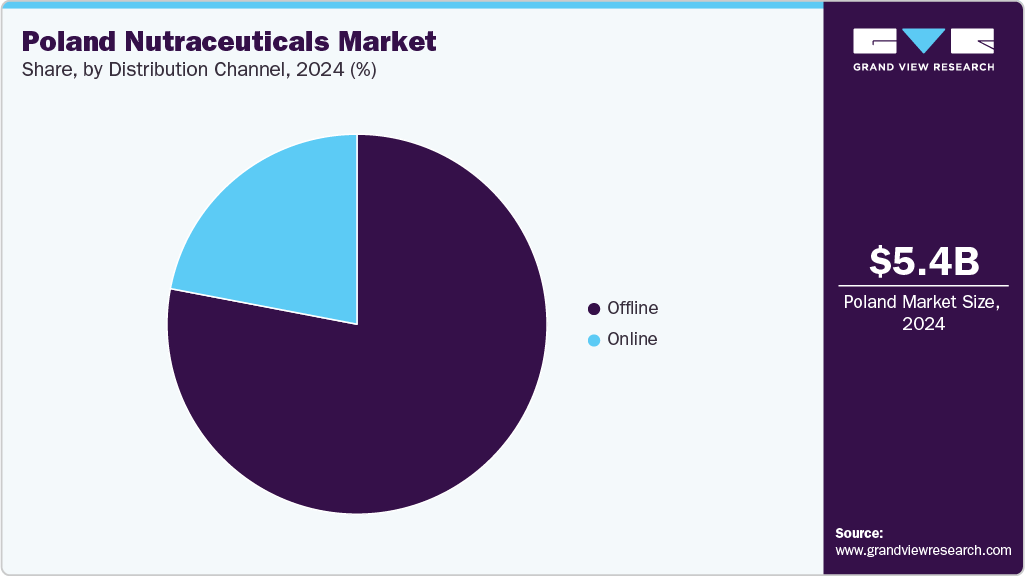

- By distribution channel, the offline segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.40 Billion

- 2033 Projected Market Size: USD 10.40 Billion

- CAGR (2025-2033): 7.5%

A strong focus on preventive healthcare further encourages the adoption of nutraceuticals as part of daily diet. Poland’s aging population, where individuals aged 65 and above accounted for nearly 20% of the population in 2024, is boosting the need for products that support healthy aging and disease prevention. Emerging health concerns drive the requirement for functional foods, dietary supplements, and weight management products. The increasing consciousness of the risk of obesity, including cardiovascular diseases, diabetes, and thyroid problems, is a positive aspect promoting preventive healthcare. For instance, according to World Obesity data for 2025, the projected prevalence rate of obesity among adults in Poland is 13.9% and overweight adults is 41.9%.

Urbanization in the country, busy lifestyles, and shifting dietary habits support this trend, as consumers increasingly prioritize overall wellness. Growth of this market is expected to be predominantly driven by products delivering long-term health benefits and aiding weight management. Innovations and strategic expansion are some of the major drivers of Poland nutraceuticals industry. Companies invest in new product launches, regulatory approvals, and partnerships to boost accessibility and consumer trust. The focus on premium, science-backed supplements further increases growth and competition among the market players. These factors are creating significant growth opportunities for the Poland nutraceuticals industry.

Consumer Insights

The Polish consumer insights show a major change in their attitudes toward nutritional supplements and health-oriented food consumption. The multicultural nature of the country, between the tourists and the natives, shapes their eating habits and lifestyle. According to an Assessment of Food Supplement Consumption in the Polish Population of Adults, approximately 44% of Polish adults used vitamin supplements during 2021. This indicates an increase in health awareness among consumers who want more nutritious diet and who are increasingly interested in reading nutritional values on labels before purchasing products. Education and increased awareness regarding wellness help in making consumers more conscious regarding their purchases. This also helps them evaluate products carefully to make healthier choices.

Consumers increasingly seek convenient, health-focused, and locally sourced products, leading to increased organic and natural food consumption. The growth in demand is supported by food delivery services and online ordering platforms, which enhance the accessibility of functional foods and dietary supplements.

Product Insights

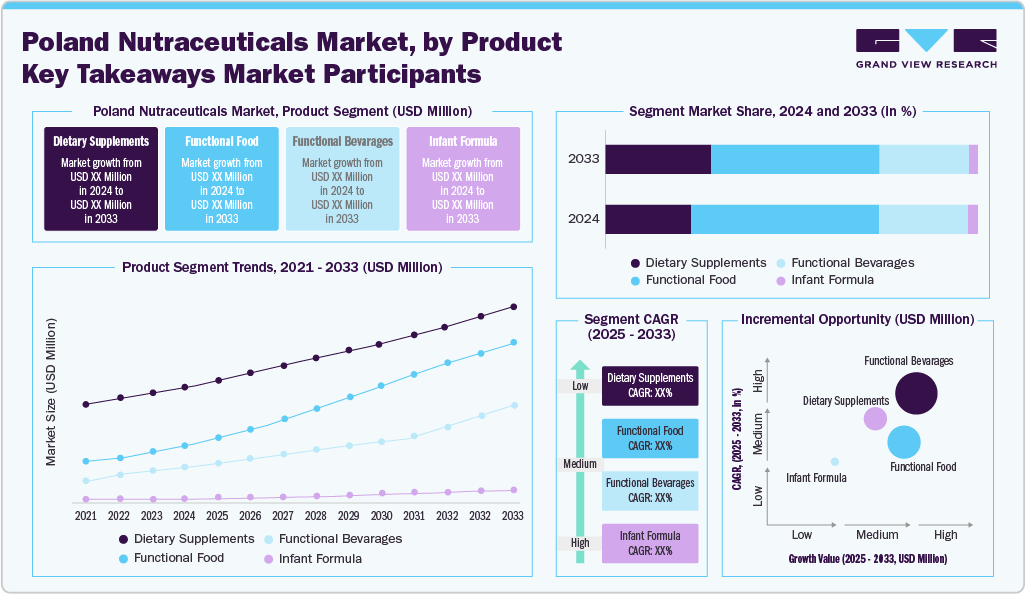

The functional food segment dominated the Poland nutraceuticals industry with the largest share of 46.1% in 2024. This is attributed to consumers increasingly demanding more health additives in their day-to-day food products. This category includes probiotic yogurts, bars with increased fiber content, and fortified cereals and drinks. The frequent integration of functional foods into daily diets makes them a high-volume channel. The dominance of this segment is fueled by the awareness of lower risk and easier adoption, as people consider them as enhancements to diet rather than supplements.

The dietary supplements segment is expected to grow at the fastest rate of 9.5% over the forecast period. This can be attributed to the rising awareness about preventive healthcare and targeted supplementation for nutrient deficiencies. As per a survey conducted in 2024, 78% of adult consumers in Poland use dietary supplements, with nearly 48% using them regularly. The growing interest of consumers in nutrients such as vitamins, minerals, and herbal products that address lifestyle-related conditions is further expected to favor the growth of this segment in the coming years. As consumers become more aware of micronutrient deficiencies, personalized blends and performance formulations are expected to support steady expansion of the segment.

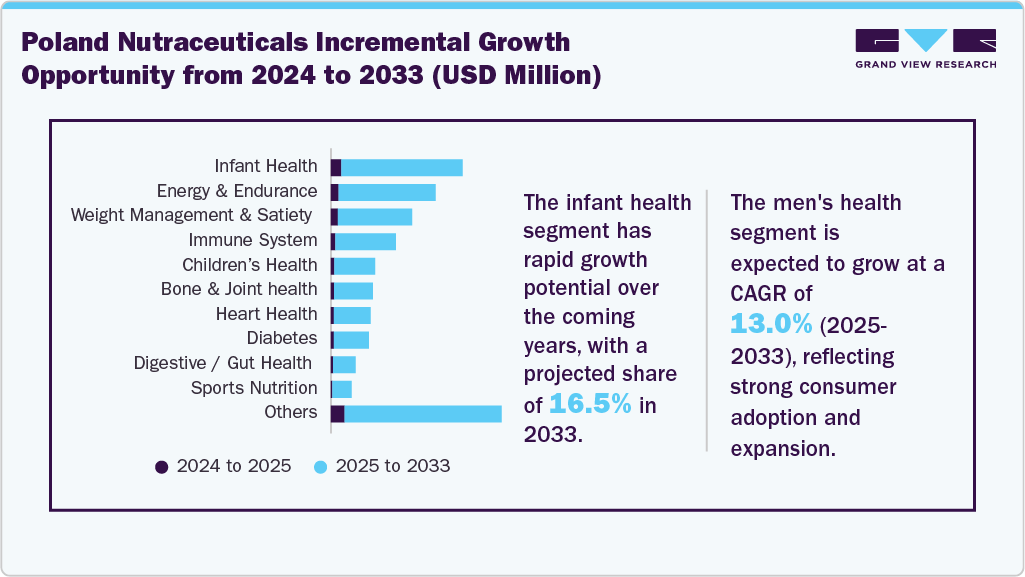

Application Insights

The weight management & satiety segment held the largest market share of the Poland nutraceuticals market in 2024. This can be attributed to the rising obesity rates and increasing health awareness. In 2025, according to the Health Status of the Polish Population report by the National Institute of Public Health, 26.4% of adult men and 24.1% of adult women in Poland are suffering from obesity and are overweight. These factors are contributing to the demand for dietary supplements targeted at weight management, appetite regulation, and metabolic support. Fat burners, appetite suppressants, and meal replacements have gained popularity among consumers in Poland seeking weight & overall health management.

The men’s health segment is projected to experience the fastest CAGR from 2025 to 2033. This can be attributed to the increasing awareness of health issues specific to men and rising focus on preventive healthcare. The 2025 Health Status of the Polish Population report highlights that 2.3% of adult men in Poland were affected by depression in 2023, which is lower than the European Union average but indicates a need for targeted health interventions. The growing trend of health concerns among men is leading to a surge in demand for supplements that support prostate health, testosterone levels, and overall vitality. Brands are responding by developing specialized products tailored to men's health requirements, contributing to the expansion of the segment.

Distribution Channel Insights

The offline distribution segment dominated the Poland nutraceuticals market in 2024. This is driven by consumers who prefer to physically examine products before buying. Pharmacies, drugstores, and supermarkets play a vital role in the growth of this segment and provide various types of dietary supplements, vitamins, and functional foods. Health stores selling specialized products can be considered as key contributors due to their staff offering expert advice and the wide selection of products available on shelves. For instance, various offline nutraceutical retail chains such as Rossmann and Super-Pharm have good accessibility and brand reputation. The offline channel delivers more personalized advice to frequent consumers and those who need personal consultation with pharmacists or store staff.

The online segment is anticipated to record the fastest CAGR from 2025 to 2033. The segment is driven by increasing internet penetration, smartphone adoption, and convenience offered by e-commerce. Online channels include multi-vendor e-commerce portals or online marketplaces like Allegro and Ceneo, and brand-specific online stores, where consumers can compare products, read reviews, and get detailed information regarding the nutritional value of the purchased products.

Key Poland Nutraceuticals Company Insights

Some key players in the Poland nutraceuticals industry include Amway Corp. and GSK plc.

Key Poland Nutraceuticals Companies:

- Amway Corp.

- Aflofarm

- GSK plc.

Poland Nutraceuticals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.81 billion

Revenue forecast in 2033

USD 10.40 billion

Growth rate

CAGR of 7.5% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, distribution channel

Key companies profiled

Amway Corp.; Aflofarm; GSK plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Poland Nutraceuticals Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Poland nutraceuticals market report based on product, application, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Dietary Supplements

-

Tablets

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Capsules

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Soft Gels

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Powders

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Gummies

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Liquid

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Others

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

-

Functional Food

-

Vegetable and Seed Oil

-

Sweet Biscuits, Snack Bars, and Fruit Snacks

-

Dairy

-

Baby Food

-

Breakfast Cereals

-

Others

-

-

Functional Beverages

-

Energy drink

-

Sports drink

-

Others (Functional dairy based beverages, kombucha, kefir, probiotic drinks, and functional water)

-

-

Infant Formula

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Allergy & Intolerance

-

Healthy Ageing

-

Bone & Joint health

-

Cancer Prevention

-

Children's Health

-

Cognitive Health

-

Diabetes

-

Digestive / Gut Health

-

Energy & Endurance

-

Eye Health

-

Heart Health

-

Immune System

-

Infant Health

-

Inflammation

-

Maternal Health

-

Men's Health

-

Nutricosmetics

-

Oral care

-

Personalized Nutrition

-

Post Pregnancy Health

-

Sexual Health

-

Skin Health

-

Sports Nutrition

-

Weight Management & Satiety

-

Women's Health

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Supermarkets & Hypermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Grocery Stores

-

Others

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.