- Home

- »

- Specialty Polymers

- »

-

Polylysine Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Polylysine Market Size, Share & Trends Report]()

Polylysine Market (2022 - 2030) Size, Share & Trends Analysis Report By Application (Food & Beverage, Pharmaceutical, Personal Care & Cosmetics, Dietary Supplements), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-988-9

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

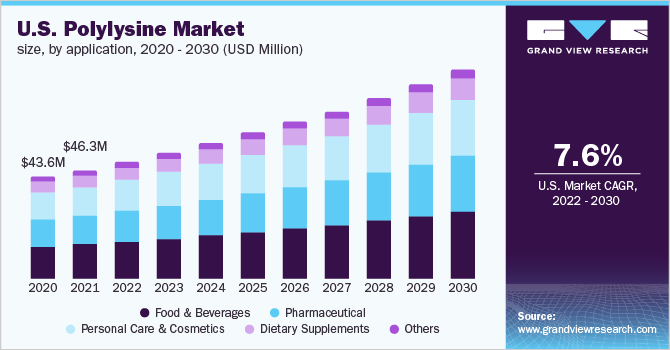

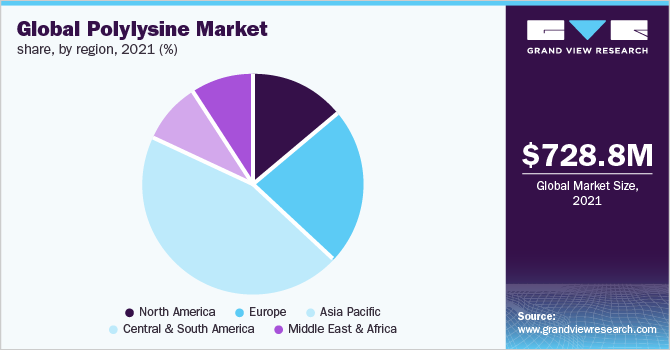

The global polylysine market was valued at USD 728.8 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.6% from 2022 to 2030. The increasing popularity of the product as a food preservative in packaged food items such as boiled rice, sushi, yogurt, soft drinks, bakery items, and confectionery products is expected to positively impact the market growth. Properties such as non-toxicity and broad-range antimicrobial effects are favoring the use of polylysine in the food industry. It also helps in extending the shelf life of food items.

The feed industry uses the product as a feed additive in feeds of multiple species as it is a natural antimicrobial agent. It is effective over an extensive range of pH values. In addition, it has excellent temperature stability and can be used to replace synthetic preservatives. Apart from the food & feed industry, it is used in the cosmetics and toiletries industry.

Polylysine is a naturally occurring homopolymer of lysine. It is commonly produced by the fermentation process. L-lysine and D-lysine are majorly used to produce polylysine and hence, act as raw materials along with other products such as agro-based corn powder, yeast extract, fish meal, and some bacteria. L-lysine and D-lysine undergo polymerization to yield polylysine. Streptomyces albulus is the most used bacteria in the production of polylysine.

In the past few years, there has been an increase in the use of polylysine as a natural food preservative in packaged food products. It is GRAS certified and safe to use in the food, feed, and cosmetics industries. Due to the increasing demand for personal care and cosmetics products, there has been a sharp increase in product demand. It is used in various soaps, sunscreen lotions, shampoos, and gels, and is known for its application in hair conditioners.

Demand for polylysine witnessed growth amidst COVID-19 as it can help curb the spread of the virus to some extent. Polymeric materials, such as polylysine, contain functional groups in their structures, which imparts antiviral properties. Polymers such as polylysine have showcased strong electrostatic interaction with the coronavirus, thus, preventing its replication in human beings.

Application Insights

Food & beverage dominated the industry with the highest revenue share of more than 32.0% in 2021. Its high share is attributable to its growing use as a food preservative in different food items across the regions, especially in China, Japan, and South Korea. The antimicrobial properties of the products facilitate their usage in the food & beverage industry.

In addition, it is used in soft drinks, yogurt, confectionaries, and other bakery products. It has been actively used to improve the quality and shelf life of numerous food products such as seafood, starch-based products, fruits & vegetables, and dairy products. Moreover, it is used as an effective polymer in packaging animal products such as pork, beef, and meat, due to its higher concentration and enhanced anti-microbial and non-toxic properties.

In the pharmaceutical industry, polylysine is used as a potent antiviral and antitumor adjuvant for humans, monkeys, and chimpanzees. It can also be used as an effective dietary agent and drug carrier owing to its properties such as high biocompatibility, non-toxicity, and high drug loading capacity. This is expected to have a positive impact on the overall market growth.

It is also used in the personal care industry for a variety of applications such as hair care, skin care, oral care, make-up, and sun care among others owing to its anti-aging properties. There was a significant rise in the personal care & cosmetics industry due to increased awareness about personal hygiene and cleanliness, which has led to a spike in demand for the product in personal care & cosmetics applications.

Regional Insights

Asia Pacific region dominated the polylysine market in 2021, with the highest revenue share of approximately 45.0%. This is attributed to various factors such as the rising population, increasing income, and expanding food & feed industry in the region. The region is leading the global polylysine market, in terms of production and consumption. The majority of the product manufacturers are from the countries like China, Japan, India, and Singapore.

China is one of the leading manufacturers of polylysine due to the presence of multiple manufacturing companies, which operate in both regional as well as global markets. In recent years, there has been a surge in demand for the product in Asia Pacific region, especially in China. The Chinese market offers lower-priced polylysine products as compared to other regions like Europe, to capture the maximum global market share.

The market in Europe is known for its cosmetics and personal care industries owing to the presence of multinational manufacturers such as Unilever, L’Oreal, Avon Products, and Reckitt Benckiser Group PLC, among others. The cosmetics and personal care industry is expected to boom in the region due to its rising demand among customers and rising awareness about the use of natural beauty products. It finds application in the cosmetics and personal care industry due to its non-toxicity and naturally sourced properties. It is used in the production of soaps, gels, sunscreens, shampoos, hair conditioners, masks, sprays, moisturizers, and liquid foundations.

North America polylysine market is driven by the growth of various end-use industries such as food, cosmetics, feed, and pharmaceutical among others. The rising application scope of the product in the manufacturing of pharmaceutical products is attributed to its properties such as non-toxicity, safe for human consumption, naturally sourced, anti-viral, anti-microbial, and anti-tumor. In addition, it is used as a drug carrier, gene carrier, Nanoparticle, liposome, and coating material. Rising demand for the product from the pharmaceutical and food industries coupled with the presence of major manufacturers is expected to fuel the market growth in the region.

Key Companies & Market Share Insights

The polylysine market is consolidated in nature with few manufacturers having the maximum share in the market space. The competition in industry is highly dependent on the demand for the product from different regions, product portfolio, global reach of the manufacturers, and R&D activities.

The competitors in the market try to gain a competitive advantage over others by expanding their global presence, price control, and strengthening product portfolios. In order to build up the global presence of the manufacturers follow typically create diverse types of contracts such as partnerships and joint ventures. For instance, Sino Lion USA has signed partnerships and joint ventures with multiple manufacturers from China and operates independently or jointly with Chinese partner companies.

Some of the prominent players in the global Polylysine Market include:

-

Chisso Co.

-

Okuna Chemical Industries Co.

-

SunBio Co.

-

JNC Corporation

-

Nanjing Shine king Biotech

-

Chengdu Jinkai Biology

-

Zhengzhou Bainafo Bioengineering

-

Yiming Biological

-

Siveele

-

Lion King Biotechnology

Polylysine Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 788.6 million

Revenue forecast in 2030

USD 1.4 billion

Growth rate

CAGR of 7.6% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in Tons, Revenue in USD Million, CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany ; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Chisso Co.; Okuna Chemical Industries Co.; SunBio Co.; JNC Corporation; Nanjing Shineking Biotech; Chengdu Jinkai Biology; Zhengzhou Bainafo Bioengineering; Yiming Biological; Siveele; Lion King Biotechnology

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polylysine Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polylysine market report based on the application, and region:

-

Application Outlook (Revenue, USD Million; Volume, Tons; 2018 - 2030)

-

Food & Beverages

-

Pharmaceutical

-

Personal Care & Cosmetics

-

Dietary Supplements

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Tons; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global polylysine market size was estimated at USD 728.8 million in 2021 and is expected to reach USD 788.6 million in 2022.

b. The global polylysine market is expected to grow at a compound annual growth rate of 7.6% from 2022 to 2030 to reach USD 1.4 billion by 2030.

b. Asia Pacific dominated the polylysine market with a share of 45.3% in 2021. This is attributable to various factors such as rising population, increasing income, and expanding food & feed industry in the region.

b. Some key players operating in the polylysine market include Chisso Co., Okuna Chemical Industries Co., SunBio Co., JNC Corporation, Nanjing Shineking Biotech, Chengdu Jinkai Biology, Zhengzhou Bainafo Bioengineering, Yiming Biological, Siveele, Lion King Biotechnology.

b. Key factors that are driving the polylysine market growth include the increasing prevalence of the product as a food preservative in packaged food items such as boiled rice, sushi, yogurt, soft drinks, bakery items, and confectionery products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.