- Home

- »

- Plastics, Polymers & Resins

- »

-

Polymer Market for Waste Management Industry Report,2030GVR Report cover

![Polymer Market For Waste Management Size, Share & Trends Report]()

Polymer Market (2025 - 2030) For Waste Management Size, Share & Trends Analysis Report By Product (PVC, EVOH, HDPE, LDPE, EPDM, Others), By Region (North America, Europe, MEA, APAC), And Segment Forecasts

- Report ID: GVR-2-68038-809-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

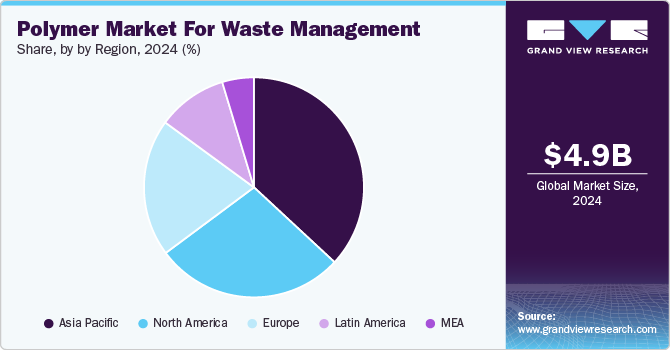

The global polymer market for waste management size was valued at USD 4.87 billion in 2024 and is expected to grow at a CAGR of 2.7% from 2025 to 2030. This growth is attributed to increasing environmental concerns regarding plastic waste and the critical need for effective waste management solutions. As governments and organizations worldwide implement stricter plastic usage and disposal regulations, the demand for innovative polymer solutions that facilitate recycling and waste reduction is expected to rise.

The growing emphasis on sustainability and circular economy practices has further driven the polymer market for waste management industry. Companies are increasingly focusing on developing biodegradable polymers and advanced recycling technologies that can transform plastic waste into reusable materials. For instance, some firms are investing in chemical recycling processes that break down plastics into their original monomers, allowing for the creation of new high-quality products without producing additional waste.

Urbanization and industrialization are accelerating plastic waste generation, necessitating improved waste management strategies. As cities expand and populations grow, the volume of plastic waste produced is increasing, prompting a need for efficient collection, sorting, and recycling systems. Implementing smart waste management technologies, such as AI-driven sorting systems, is an instance of how companies adapt to these challenges by enhancing operational efficiency.

The polymer market for waste management industry’s outlook is also influenced by rising consumer awareness regarding environmental issues and the demand for sustainable products. Consumers are increasingly seeking brands that prioritize eco-friendly practices, which in turn encourages manufacturers to adopt greener production methods. This shift in consumer behavior is driving innovation in polymer development and fostering collaboration among stakeholders to create comprehensive waste management solutions that align with sustainability goals.

Product Insights

HDPE segment dominated the market with the largest revenue share of 53.1% in 2024, driven by its excellent recyclability and versatility. With a sudden rise in environmental concerns, industries are increasingly adopting HDPE for sustainable packaging solutions, significantly driven by consumer demand for eco-friendly products. For instance, many companies are now using recycled HDPE in their packaging, reducing waste and lowering production costs. Furthermore, advancements in recycling technologies have improved the efficiency of HDPE recycling processes, making it a preferred choice for manufacturers aiming to meet stringent regulatory requirements and sustainability goals.

The EPDM segment is expected to grow at the fastest CAGR over the forecast period, driven by EPDM's resistance to extreme weather conditions, UV radiation, and chemicals. These benefits make EPDM an ideal choice for use in waste management systems, particularly in geomembranes and liners that prevent leakage in landfills and ponds. For instance, its application in landfill liners helps mitigate environmental contamination by effectively containing hazardous materials. In addition, the increasing demand for sustainable construction practices and renewable energy projects is further driving the growth of EPDM, as it is increasingly used in roofing membranes and solar panel encapsulation.

Regional Insights

The Asia Pacific polymer market for waste management market held the largest revenue share of 36.9% in 2024 due to rapid urbanization and industrial growth in the region. Countries such as China and India significantly contribute to plastic waste generation, driven by increasing population and consumption patterns. As urban centers expand, the demand for effective waste management solutions becomes critical, prompting governments to implement stricter regulations and initiatives. For instance, China has banned the import of plastic waste, compelling local industries to enhance recycling capabilities. In addition, the region's growing emphasis on sustainability and circular economy practices is driving investments in advanced recycling technologies and eco-friendly materials, further strengthening Asia Pacific's position in the polymer waste management market. This combination of regulatory support and rising environmental awareness positions Asia Pacific as a key player in addressing global plastic waste challenges.

China Polymer Market For Waste Management Trends

The China polymer market for waste management industry dominated Asia Pacific in 2024 with the largest revenue share due to stringent regulations and initiatives aimed at improving waste segregation and recycling practices, such as the ban on non-industrial plastic waste imports introduced in 2018. For instance, the Plastic Waste Reduction Project in Shaanxi, which received a USD 250 million investment, exemplifies the government’s commitment to tackling plastic pollution. In addition, advancements in recycling technologies and growing public awareness about environmental issues have further fueled demand for sustainable waste management practices.

North America Polymer Market For Waste Management Trends

The North America polymer market for waste management industry is expected to grow significantly over the forecast period due to increasing regulatory pressure and heightened environmental awareness. In order to reduce plastic waste, governments in the region are implementing stringent regulations, such as the U.S. federal strategy to phase out single-use plastics by 2035. This initiative is likely to drive demand for advanced recycling technologies and facilities capable of processing alternative materials, pushing companies to innovate and adapt their waste management strategies. For instance, Waste Management Inc. has invested in landfill gas-to-energy projects, capturing methane from landfills to produce renewable energy, reducing greenhouse gas emissions, and supporting energy sustainability. In addition, the growing public consciousness surrounding plastic pollution is prompting consumers and businesses to seek more sustainable practices.

The U.S polymer market for waste management Industry dominated North America in 2024 with the largest revenue share, increasing regulatory framework aimed at reducing plastic waste, which has led to greater investments in recycling infrastructure and technologies. For instance, the U.S. Environmental Protection Agency (EPA) has introduced initiatives to promote recycling and sustainable waste management practices, encouraging businesses to adopt eco-friendly materials. Rising public awareness about environmental issues has spurred consumer demand for sustainable products, prompting companies to innovate and enhance their waste management strategies. The growth of advanced recycling technologies, such as chemical recycling processes that convert waste back into raw materials, further supports the market expansion. For instance, companies such as Waste Management Inc. are investing in state-of-the-art recycling facilities to improve efficiency and reduce dependency on landfills.

Europe Polymer Market For Waste Management Trends

Europe polymer market for waste management is expected to grow significantly over the forecast period due to the European Union's implementation of ambitious waste reduction targets and recycling directives, compelling industries to adopt more efficient waste management practices. For instance, the EU's Circular Economy Action Plan aims to ensure that all plastic packaging is recyclable or reusable by 2030, driving investments in advanced recycling technologies. In addition, increasing public awareness regarding environmental issues is pushing companies to prioritize sustainable operations, leading to greater demand for eco-friendly polymer solutions.

Key Polymer Market For Waste Management Company Insights

Some key companies in the polymer market for waste management include Occidental Petroleum Corporation, Exxon Mobil Corporation, and Arkema. These companies leverage innovative strategies to enhance their competitive position, focusing on the development of advanced recycling technologies and sustainable practices. They prioritize eco-friendly materials and processes to address the increasing demand for responsible waste management solutions. By investing in research and partnerships, these firms aim to improve efficiency in waste processing and promote circular economy initiatives.

-

BASF focuses on innovative solutions to combat plastic waste through its ChemCycling project, which uses chemically recycled plastic waste as feedstock for producing high-performance materials. The company enhances recycling rates by developing both mechanical and chemical recycling technologies, allowing for the effective reutilization of mixed and uncleaned plastics.

-

Exxon Mobil Corporation is dedicated to adopting sustainable practices within the polymer market, particularly through its recycling and waste management efforts. The company seeks to develop solutions that minimize plastic waste and promote a circular economy, ensuring that valuable resources are conserved while addressing environmental challenges associated with plastic pollution.

Key Polymer Market For Waste Management Companies:

The following are the leading companies in the polymer market for waste management Industry. These companies collectively hold the largest market share and dictate industry trends.

- Bermüller & Co GmbH

- BASF

- KURARAY CO., LTD.

- Arkema

- DuPont de Nemours, Inc.

- Occidental Petroleum Corporation

- Formosa Plastics Corporation, U.S.A.

- CNPC

- Exxon Mobil Corporation

- Mitsui Chemicals, Inc.

- LyondellBasell Industries Holdings B.V.

- Eni S.p.A.

- Sumitomo Chemicals Co., Ltd.

Recent Developments

-

In June 2024, BASF showcased its milestones in its plastics journey at the Plastics Recycling Show Europe in Amsterdam. The company highlighted its innovative mechanical and chemical recycling solutions, including the ChemCycling process, which uses plastic waste as feedstock to produce high-performance materials. By focusing on sorting and cleaning processes, BASF aims to improve the quality of recyclates and significantly reduce plastic waste.

-

In March 2024, Arkema highlighted its commitment to sustainability within the polymer market for waste management. The company acquired Agiplast, a leader in high-performance thermoplastic recycling, in 2021 and developed over 15 certified grades through its Virtucycle custom recycling program. Arkema's state-of-the-art recycling center in Italy uses renewable electricity to mechanically recycle specialty polyamides and PVDF, positioning the company as a key player in promoting eco-design and reducing carbon footprint.

Polymer Market For Waste Management Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.07 billion

Revenue forecast in 2030

USD 5.79 billion

Growth Rate

CAGR of 2.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

January 2025

Quantitative units

Volume in Kilotons, Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Germany, UK, France, China, India, Brazil

Key companies profiled

Bermüller & Co GmbH; BASF; KURARAY CO., LTD.; Arkema; DuPont de Nemours, Inc.; Occidental Petroleum Corporation; Formosa Plastics Corporation, U.S.A.; CNPC; Exxon Mobil Corporation; Mitsui Chemicals, Inc.; LyondellBasell Industries Holdings B.V.; Eni S.p.A.; Sumitomo Chemicals Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polymer Market For Waste Management Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polymer market for waste management industry report based on product and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

EVOH

-

HDPE

-

LDPE

-

EPDM

-

PVC

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.